First, a 40,000 ft overview of 2022:

- Life is flying by. FC1 is halfway through her sophomore year in high school and only a couple of years away from leaving us. Where did the time go!?!?!?

- I am grateful for good health and am cognizant of the fact any of us are one unlucky roll of the cosmic dice away from catastrophe. It’s easy to take good health (for myself and my family) for granted, but I try not to.

- I am slowly settling into the routine of middle age. I find myself inexplicably grunting when standing up or sitting down. My body doesn’t recover from physical activities quite as quickly as it used to.

- Earlier in life, my objectives were quite clear: work hard, get a good job, do well at my job, have some fun, and save a bit of money to achieve financial freedom. Following this recipe worked well, but after decades of having well-defined goals ahead of me, I find myself floundering a bit as of late. Given that I’ve ticked off a lot of previous long-term goals, I find myself cruising on auto-pilot these days. It is unfamiliar and a bit unsettling.

- My ~2 year involvement to redesign my employer’s workplace retirement plan that wrapped up at the end of 2022 was among the most satisfying things I’ve ever done professionally. Since the completion of this project, I’ve yet to sink my teeth into a subsequent project that I feel so passionately about.

- Despite living in flyover country that is oftentimes the butt of jokes, it is a great place to raise a family. Our kids are thriving here. Aside from the weather and less-than-ideal tax regime, life is easy and enjoyable.

- I’m enjoying the freedom (both time and monetary) that we’ve worked hard to accumulate over the past two decades.

Blog update next

Here are some historical state-of-the-blog posts:

2022 Blog Stats:

- 429 WordPress / email subscribers

- 12% growth from last year (382)

- 332 Feedly subscribers:

- 5% growth from last year (317)

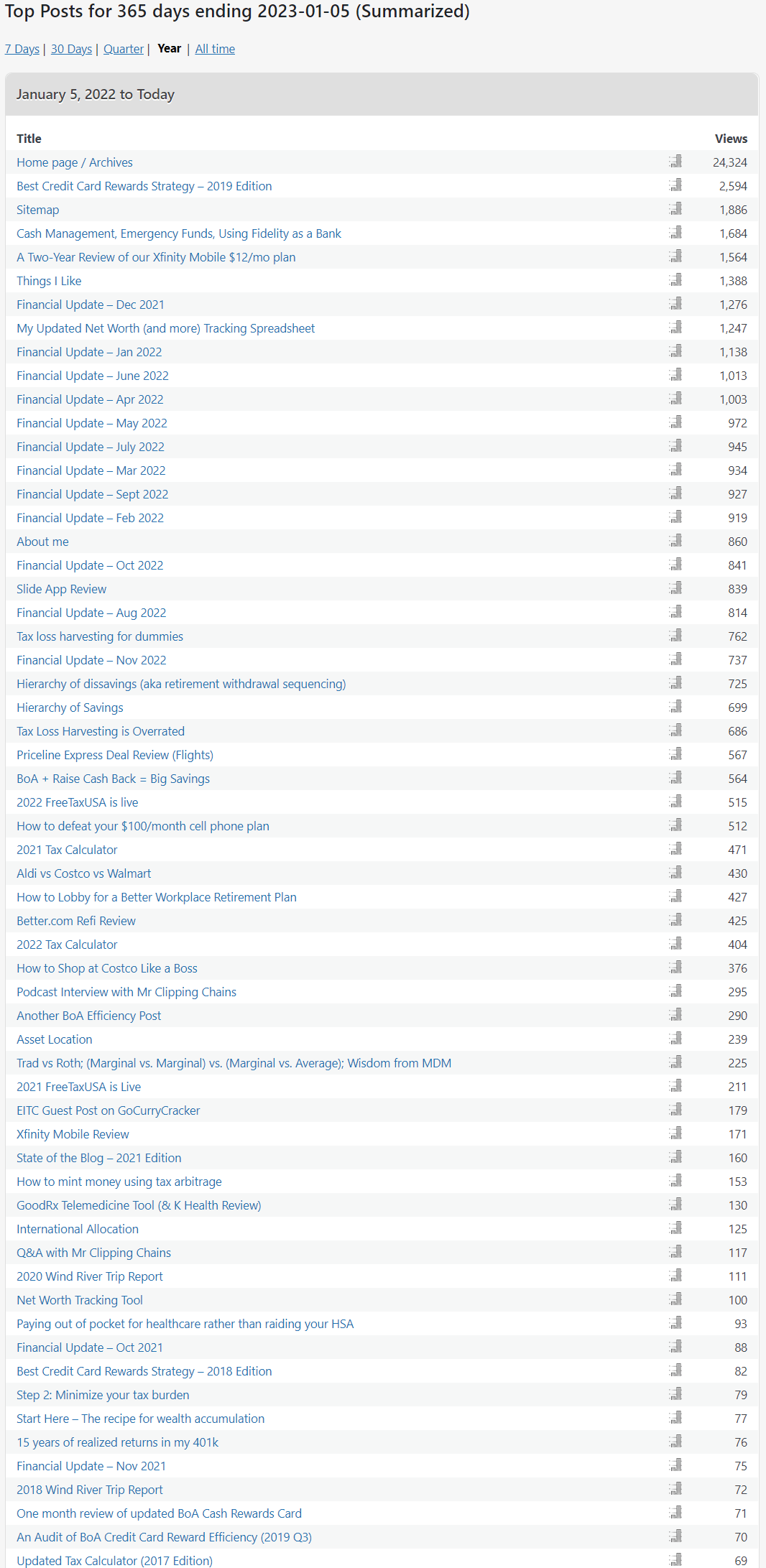

- 63,855 pageviews this year (30% less than 2021).

- 2021 pageviews: 92,017

- 2020 pageviews: 137,594.

- 2019 pageviews: 78,266.

- Posts/month: ~1.

- 2022 Profitability:

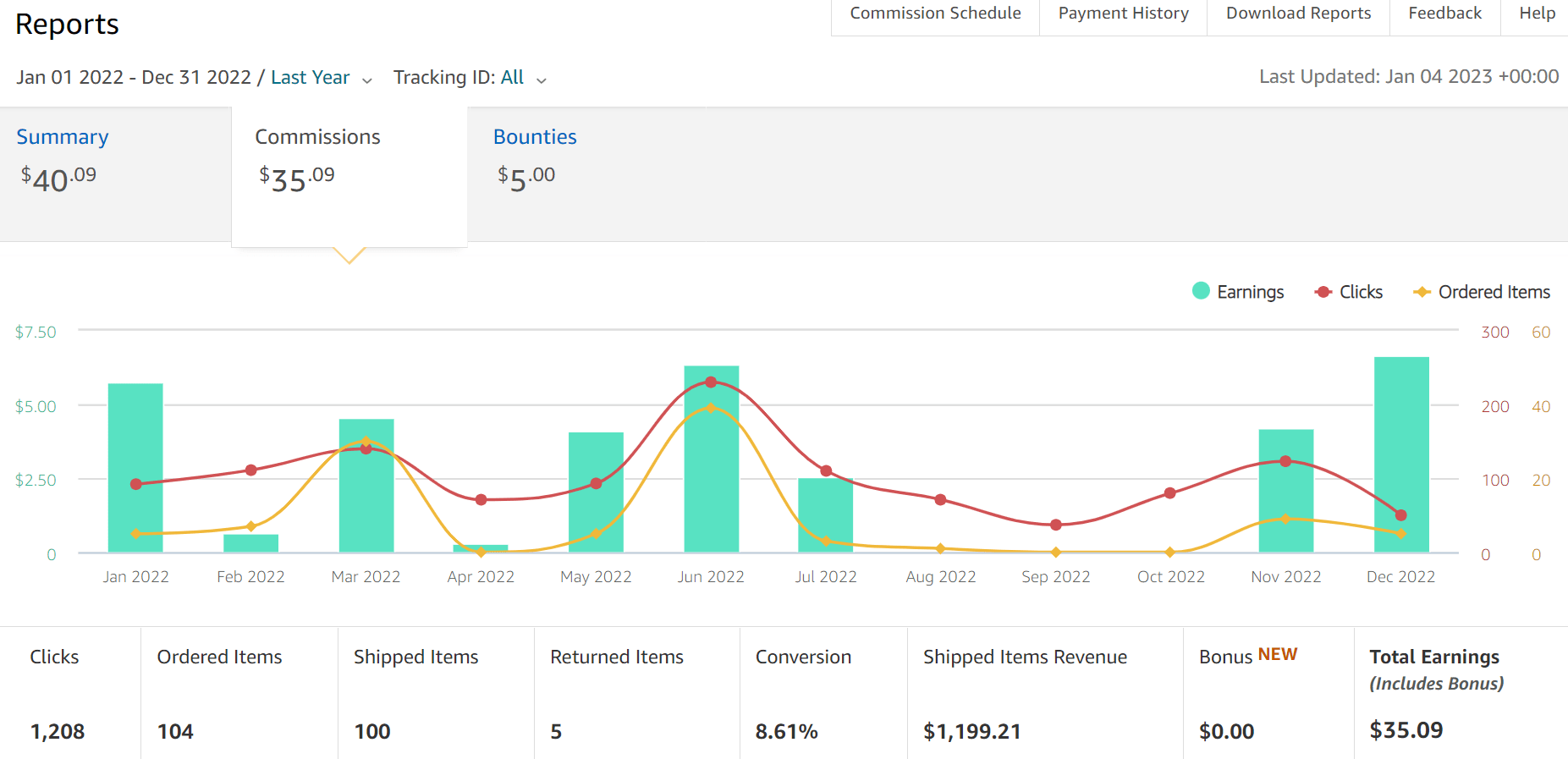

- Amazon affiliate revenue: $40.09

- Blog costs (digitalocean hosting + google domain): ($72.02+$12)*(1-5.25%) = $84.35

- $6-$7/mo VPS hosting at digitalocean (I’ve since downgraded to their $6/mo plan).

- $1/month for domain name at google domains

- 5.25% cash back for “online” category at BoA

- Profit (ignoring home internet costs, etc): loss of $44.26

- Profit/hr (assume 1 hr/post): negative $2/hr.

A few screenshots for the curious

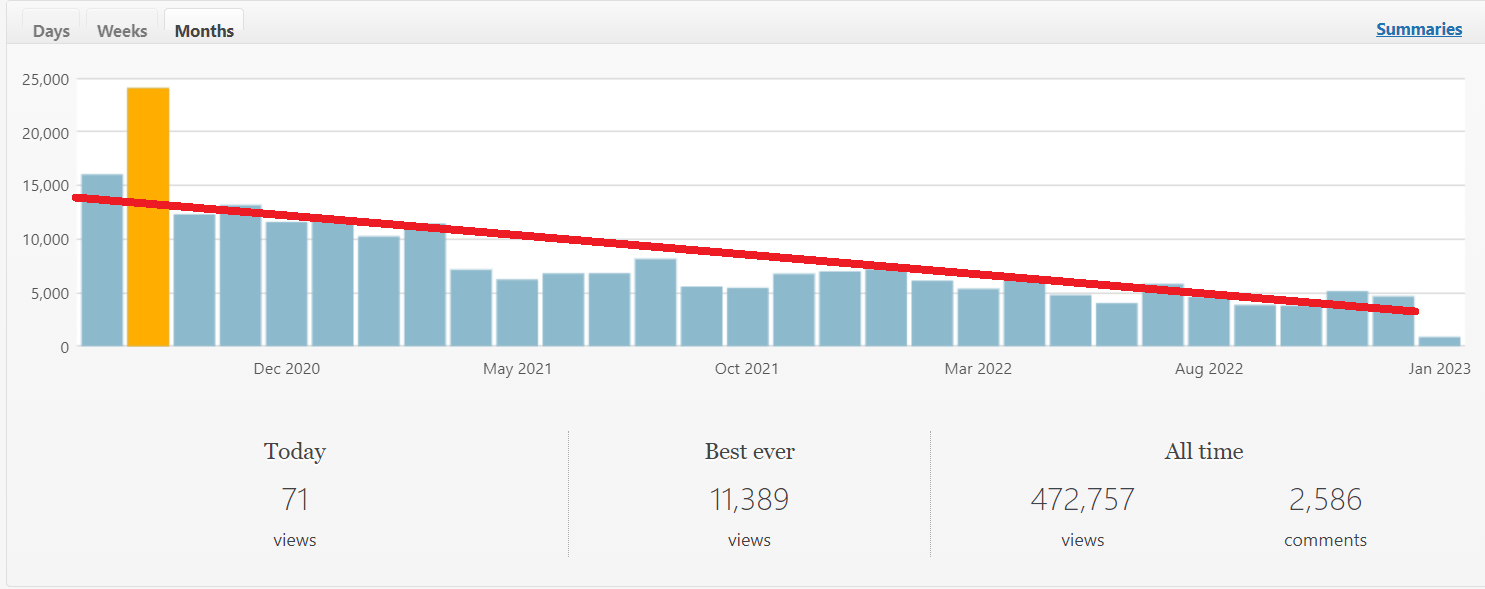

Monthly pageview counts over the past several years. I took the liberty of freehanding a trendline in MS Paint. Extrapolating, I’ll be at negative views in the not-too-distant future!

Monthly pageview counts over the past several years. I took the liberty of freehanding a trendline in MS Paint. Extrapolating, I’ll be at negative views in the not-too-distant future!

2022 Amazon affiliate income.

2022 pageviews.

2022 traffic sources.

2022 web hosting expenses at Digital Ocean.

Blogging conclusion:

- The blog is clearly in decline, both in terms of my output and readership.

- Admittedly, I don’t have much value to add any more.

- The recipe to accumulating wealth is profoundly simple:

- live below your means,

- be cognizant of taxes,

- invest the difference wisely (preferably in tax-efficient vehicles),

- and enjoy the ride the best you can.

- During interesting historical events (e.g. introduction of Trump tax cuts, weird >100% MTR stimulus phaseouts, etc), I sometimes have something interesting to say. But most of the time I don’t have anything profound to blog about. I’m a middle-aged dad living a normal life in the suburbs of flyover country.

- The recipe to accumulating wealth is profoundly simple:

- I’ve entertained the idea of changing platforms, like maybe starting a podcast or a YouTube channel. But I’m unsure whether it’d be worth the effort.

Reader poll:

- How was your 2022?

- What are you excited about in 2023?

- Any ideas on breathing life back into this blog (or alternative pursuit like podcast/YT channel)? Or do I mercifully put it out of its misery and bury it in the back yard?

Thanks for joining the ride with me in this random corner of the internet. It has certainly been an enjoyable ride.

FP –

As a middle aged dad that lives in the distant suburbs of a Northeast metropolis, I can relate. I think the key thing to do is really define what you want and get satisfaction from.

I like your blog, and I only regularly read 3 or 4, for a few reasons. First, I like the top part of your monthly updates with links to fun/interesting things, what is going on in your life and how you’re able to live a fun life while spending modestly. Second, you’re extremely knowledgeable and I like the creativity to “crack the code” of taxes, credit card rewards, cell phones, HSA plans, or whatever. Lastly, I think your writing voice is somewhat unique in that its both very logical and conversational.

To answer your questions:

– Financially 2022 was both a disaster and a huge success. My portfolio was down like everyone (I have a very Boglehead portfolio) but I had an incredible year earnings/savings wise with a windfall from a stock grant. Still my portfolio was down 10%. Personally, it was pretty good and one thing I started doing is tracking my fun activities (miles biked, days skiing, days at the beach, etc) as rigorously as my net worth.

– With my financials also sort of on autopilot, I’m excited about continuing to design my life into one that will progress into what I do post-work.

– As for the blog, I think it starts with what you want. Are you really looking to drive pageviews? Is it to make money? Or is it to have a conversation with a small niche of similar minded people? Once you answer these questions then perhaps can answer.

I come back regularly, so I clearly enjoy the blog. However, I can see how the numbers can put you into a spin.

M,

Thanks for stopping by and sharing the words of wisdom.

Glad to hear that 2022 treated you well financially, despite the abysmal stock market.

I’m not really sure what I’m trying to accomplish with this blog these days. When I started it, I was intending to share tricks to help people. But I seem to have exhausted those tricks and readership is down anyway, implying that I’m not helping many. Which begs the question, what is the point? I like engaging with readers, but this engagement has been low as of late. Perhaps that should be my strategy. To write in a manner to drive engagement? Not sure, but I appreciate the feedback.

-2022 was probably the hardest year of my life, but probably was also the most valuable in terms of personal growth. In the spring my wife was diagnosed with ovarian cancer and so, after a wonderful, blissful trip to Italy before we had any idea what was about to hit us, the rest of the year was spent dealing with her surgery and subsequent chemotherapy. It was physically demanding trying to keep working and helping with o it young kids and her treatments that brought her right to the edge. Thankfully treatment went well- no complications and we’re glad to be over, and her long term prognosis is pretty good as far as ovarian cancer goes.

-We are planning a ton of trips this year. It’s weird how going through something like that really makes you think about your priorities. We can afford them, and we still have a relatively high savings rate, but facing the possibility of losing your spouse in a couple years makes early retirement seem very lonely and meaningless. I have no regrets about living simply and frugally though- it certainly has enabled us to shift our money to what we value this year. I’m glad we weren’t locked into a larger mortgage and car payments.

-I’ve enjoyed the conversational style of your blog, and the bullet point style is unique and makes it easy to quickly read through. I wonder if most smaller blogs have had declining viewership the last few years. It’s a much less addictive medium and probably none of gen Z reads blogs. A youtube channel with long form videos would be a huge commitment. If you like doing videos and did shorts, like every bullet point was a tiktok or instagram short, you could probably build a following on one of those platforms, but it would depend on whether that’s what you want to do with your life. I bet there’s not much overlap between your current readers and those other platforms, btw. Middle aged dads aren’t big on those mediums, maybe more so on youtube though. If you wanted to put more content into the blog, posts on taxes, tax law changes, other ways to save a few bucks, might bring more traffic. Then again( it depends on what your underlying motivation is and whether that’s your goal.

Thanks for sharing some of your wisdom with us. Have a great year!

Benjamin,

I’m really sorry to hear about cancer diagnosis, but I’m glad to hear that the treatments and prognosis are good. I cannot imagine how scary/trying this past year must have been for you.

Best of luck to you on your upcoming trips in 2023! If your trips take you through middle america, please reach out. We’d love to host your family. It’s been a long time since we’ve chatted in person. I’m still embarrassed to have spent most of that era of life vomiting unsolicited tax/saving/investing advice to my unsuspecting friends. This blog has certainly provided the necessary relief valve on that dimension!

Take care,

FP

Your blogs are one of my favorites to read (I read many, but only subscribe to 3 blogs, you being one of them). Don’t let the blog reader views deter you – if you think of this as your journal, you have years of data and musings and it is nice to go back to to). You are one of the most intelligent people I have come across, obviously with finance but also with your stance on personal health and priorities. As a young 30s millennial living in DC, it is encouraging to see the different ways I can save based on your advice, despite living in a very high cost of living location. While we are pretty smart savers, my husband and I also joke that if we ever win the lottery, we would ask you to manage it [I say joke, but if it ever happens, I will be reaching out to you and will gladly fork over your cost].

Thank you for your amazing content. I always look forward to your monthly updates at the beginning of the month .

Thanks for stopping by and for the kind words Meighan. I certainly don’t claim to have all of the answers, but I’m of the opinion that we can (and should) learn a lot from each other.

If you happen to win the lottery, I’d recommend you do follow a Bogleheads three-fund portfolio: https://www.bogleheads.org/wiki/Three-fund_portfolio. I do this, although I’ve had zero bond allocation because of my relatively young age and the asinine bond pricing as of late. That’s the extent of the investing advice I could give, but it’s better than 99.9% of investing advice out there.

FP:

Yours is the only blog I read regularly. Yours is a unique voice. It also seems like the only one without ads and referral links.

i wonder how the above two replies hit you, whether they add fuel to the fire to continue in some way other than turning it off? Those replies were encouraging to me.

Do you want more readership, or more meaningful engagement with your reader community, or something else?

BTW, I’ve noticed you don’t always publish “on-time” like you used to (you don’t have it written within a few hours of the stroke of midnight on the 31st), and i’ve learned to not reach out and ask if you’re ok. Not because I don’t care about the content; rather I trust you are prioritizing.

– on the wrap up of your passion project: Do you feel as passionate about helping other institutions and/or their employees fix their plan offerings? If so, do you have the time, interest, and permission from the University to do some of that on the side?

On 2022:

– my father passed away this year. His life was a blessing to all of us, we’re much richer in all the ways that matter having known him and loved him, and he us. Thankful.

– our golden retriever passed away

– my “position was eliminated” in November. It was not unexpected, we are prepared, and we’ve entered a period of reflection and discernment about what’s next, where, and for what purpose.

– our family is just a few years ahead of yours, our first graduated college in May (now employed and saving), one in University will study abroad this spring (spending), and our youngest is a HS Senior. We’re savoring it…

You’re wise to pay attention to how time flies and the kids grow up. We snap our fingers, sleep a few winks and they start leaving for college… and we can’t turn it around.

Regardless of the direction you choose with the blog, please know that what you have shared with your community has been valued.

Rob,

Thanks for stopping by.

What do I want out of the blog? To help the most people I can. And declining readership is a proxy for the declining impact of the blog, which has me questioning whether I should pivot or something.

That said, it’s kind of a fun monthly ritual for me to settle up the financial statements, post a few pics, and share a few things I’ve done. I’m aware that these journaling activities are less valuable to the general public, but it’s all I’ve got most of the time. The comments on this post are certainly encouraging. It seems that a few of us personal finance weirdos have found each other in this obscure part of the internet. That’s pretty fun, but it’d be more fun if engagement were higher. I’m not sure how to promote that, but I’ll think about it.

I’d consider consulting other firms to clean up their plans, though admittedly I’m not as well versed on a few of the institutional details. As an example, navigating the complexities of the various TIAA annuity contracts is pretty complicated. But I’ve learned a lot though my employer’s plan redesign and am sure I could add a lot of value to firms. I was appalled to learn how commonplace it is for these consultants to give self-serving advice at the expense of plan participants (e.g. promoting complex, high-cost menus to guarantee the consultant future consulting income through monitoring).

Sorry to hear about your 2022 losses and I wish you the best sorting out your future. Please let me know the secret to life if/when you figure it out! Enjoy those kids!!!

I appreciate the work you’ve done over the years with this blog. I have no idea who you are but always enjoy some of the random links you share (before this morning, I never really thought to use a kayak in snow…but now I really want to try it out! & unfortunately I can never find that ricochet robots game you once recommended for families whenever I randomly look for it..) in addition to the personal financing/investing/etc. ideas over the years though, as you mention, the recipe to accumulating wealth is profoundly simple.

I have no idea what your goal is/was/will be with the blog or podcast/youtube, but I’m guessing it has to be an uphill climb to get traction in any format as a normal person that wants to live a life not obsessed with internet marketing, social media, etc. given how widespread blogs/podcasts/etc. have become. I’d say, do what you think is best for you and yours and enjoy the ride as long as your blessed with on this earth!

Thanks for stopping by! Snow kayaking indeed looks like a blast; it’s now on my bucket list!

It looks like the Ricochet Robots game is unfortunately out of print: https://smile.amazon.com/Z-Man-Games-ZMG-71330-Ricochet/dp/B00FNKYPYY/. Bummer. Games go in and out of print quite often, so hopefully it comes back in a few years.

Thanks for the feedback on podcast/YouTube. I think it’d indeed be an uphill battle for someone who couldn’t care less about marketing. Maybe I’ll just stick to the obsolete blogging platform.

I just wanted to echo all the positive comments. Your blog is excellent-please don’t burn it and bury it in the backyard.

Thanks for stopping by!

FP, you have saved me many thousands of dollars with the BAC credit card 5.25% method. I hope you keep writing to us. As far as a project, what about finishing your book ? I would definitely be a buyer, as well as some family members.

Thanks for stopping by. Glad to hear the 5.25% arbitrage is treating you well. We exploit the heck out of it!

I certainly lost motivation to finish that book, but perhaps I ought to give it another go. Thanks for the feedback!

FP,

I really enjoy your blog because 1) its an update on what is new with you and your family that wouldn’t be as regular or detailed if left to the occasional e-mail 2) it is a periodic dose of wisdom and common sense advice – mostly financial – but not always! I don’t have any great ideas for where to go next, but I would just suggest that if there is a way you can trim bits of the process/content that you don’t enjoy while keeping the parts that you do – do that! You’ve established a pattern for what the blog is, but I hope you don’t feel beholden to your readers to keep that pattern going in perpetuity.

Derek,

Great feedback. 1.) It’s indeed a great way for me to keep in touch with my friends from my distant past — particularly for someone who abstains from posting on social media platforms (though I certainly enjoy following your instagram feed!!!). 2.) I’m not sure that I deliver any wisdom; it’s mostly just incoherent rantings from a middle aged man.

Your idea of trimming what I dislike while keeping what I like is brilliant!

FP, I look forward to reading your monthly updates. You watch interesting programs and do interesting activities. It always gives me something to think about and consider doing myself. I am on the upper end of middle age and my children are all grown and left the nest. I am originally from not far from your location so I can relate to your comments about “flyover country”. Enjoy your children and figure out your next great adventure!

Thanks for stopping by KY Math! Hopefully 2023 treats you well!

Happy New Year! I agree with all of the posts. I also look forward to monthly updates and it always have some nuggets of useful information. I certainly understand the challenges involved in maintaining and keeping up with the word, but I appreciate your efforts and thank you for sharing the information.

Thanks Nazim! Glad to hear you find some of these incoherent thoughts helpful/useful.

FP, i really like your blog. If you did a podcast, I’d listen too. Just wanted to say

Thanks rob!

2022 was my first full year of retirement and there wasn’t a day when I wished I was still back at work. I was an EE and the job changed over the years from design work which I enjoyed to the drudgery of typing in lists of connections between digital components licensed from other vendors and hour upon hour of running validation tools. I’m still trying to figure out what to do with the increased amount of free time and probably frittered too much of it away reading online newspapers (Wapo, NYT, LA Times where I grew up, etc). So my goals for 2023 are to spend a few hours each day working towards some goals like learning a bit of Italian before a trip this Fall, use Posit Science training to hopefully maintain or improve cognitive performance, resume exercising regularly which I stopped doing a few months ago (not really sure why, just stopped), go on some bike rides.

I look forward to your monthly blog posts and hope you continue writing them. There are some good tips and also it is instructive to see the way you analyze things. I don’t have any tips for increasing readership but still hope you keep the blog going.

KR,

Great to hear that retirement is treating you well! I often describe my job as professor as the least bad job I can possibly think of, but your description of retirement sounds like it beats my current gig!

Best of like with that newfound time; riding bikes one of the most life-enriching activities I ever do (conditional on the obvious caveat of not getting run over by a car). Take care!!!

I read a few blogs occasionally, but this is the ONLY blog I subscribe to. I read it whenever I get the notification of new posts. I also reference this blog and several of your articles to numerous new grads / early career individuals that I mentor and share with. I love it and hope that you continue to post.

I like that you link out to other articles, books, and shows, etc. that you experience. There are many of those that I then read/watch, and I enjoy going down some of those rabbit holes. So all of it is great and helpful in my opinion.

Rod,

It’s an honor to be the only blog you subscribe to. I think the rational explanation for this is that there are about three of us bloggers left (so the chances of a reader being an “only subscriber” is quite high if you don’t know the other two blogs out there).

Glad to hear you find some of these incoherent thoughts helpful/amusing.

Your blog is amazing and a shine of light in the internet of clickbaits and forced engagement

Maybe you should try to collect donations, as simple as PayPal/Patreon/Crypto link. If people using your advise e.g. 5.25% cashback, could save several thousands, probably they would be willing to share some of it, especially if they want this blog to keep going. Book/course could be helpful too since it forces to structorize everything and dive deeper on the information hunt, but it’s not necessarily by any means, in an ideal world people would pay for what they get by themselves and not because they were tricked to do so (it’s hard to be an idealist)

And don’t feel discouraged by 2022 views downfall, it’s like stockmarket, some years are just going to be a downturn (probably related to stock market as well). Even if only couple people reads you and get value from it I think its worth continuing

Happy New Year!

Ivan, thanks for the constructive feedback. As far as monetization goes, I’m content losing $40/year on the blog in perpetuity. It’ll be my small (and insufficient) way of paying the universe back for all of the good karma I’ve received in my life. I like helping people, and hopefully this blog can continue to be an avenue to do so.

Happy new year to you as well!

Hello FP,

Im a new reader to your blog. I like what you have done in the blog. I like reading about the tax stuff you write and learn a lot from it. Also I like your financial update section a lot for 2 reasons, one for the Good Reads/Listens/Watches and two the life section. Both sections give me enough ideas\activities for me to follow\try\learn. I hope you continue to write in this blog. I believe 100% this blog is great and helpful and used by lot of people to improve their knowledge about the frugal living.

Thanks for the feedback!

I enjoy the blog and hope you continue it. Our interactions a while back helped me think through Rothification of my 403 and 457 contributions. Thank you for that.

The vast majority of blogs (or YT channels, etc.) are never financially viable. I agree with others that you should decide what you consider worth keeping.

As for passion and next steps, I am also a professor (multiple decades, at an R1, in a ranked department, having played the game) and can only speak from my experience. Each step up the ladder (promotion, tenure, etc.) will bring new challenges and opportunities. There are big decisions and small decisions. The job can be exciting and bleak – sometimes both at the same time.

Our kids are grown and out of the house now. I don’t regret not finding enough passion projects. I do understand now exactly how fast those days go by (of having the family at home).

In a nutshell, I wouldn’t worry too much about it. Enjoy these days.

Like I said, I can only speak from my own experience, but others have helped me navigate circumstances like those you describe. Let me know if I can elaborate.

Andy,

Thanks for stopping by and for sharing the words of wisdom. Academia is indeed simultaneously an exciting and bleak landscape. 5 years of grinding out a phd followed by 7 years of grinding out (hopefully soon) tenure/promotion has left me a little battered, but luckily still mentally sound. Whereas it has taken me at least 7 years to publish some academic articles (from inception to print), it’s nice to have this platform where I can get some thoughts down “on paper” and publish it in a matter of minutes. And it’s refreshing to write about things that are immediately helpful rather than esoteric.

Thanks again for taking the time to reach out and share your words of wisdom.

– FP

Good luck re P&T. It is indeed a struggle, albeit one with a defined clock. Associate is a different game. Full is wonderful and worth the work it takes to get there. Academia is changing, but hopefully some of the best parts remain for the next generation.

It is good to have different venues for writing, especially given the vagaries of Reviewer #2. I’ll add that I think it’s useful to have activities not related to your “day job”. I have friends who have sought to change the public space (as “public intellectuals”) and have succeeded. I would rather garden or hike. So it can be hard to find the right level of commitment to writing for the public space instead of for peer-review – especially so now that productivity is so measurable via h-indices, etc.

Best wishes for your path.

Academia can indeed be a bit of a grind, but I consider myself lucky to be here. It’s always nice hearing words of encouragement from those a few years ahead of me down this path. Thanks again for the words of encouragement!

I have been reading the blog for a while and find the financial related articles interesting. Your personal pictures and updates have been the cherry on top that add that unique voice that is enjoyable to read. While the financial tips don’t have to be mind-blowing or anything, it’s just interesting to read your perspective or thinking as a frugal person myself as well.

As a reader, some of the original articles like credit card rewards, who you bank with, etc. have been great and was what brought me to the site to begin with. I would say my constructive criticism would be there just needs to be new dedicated posts or updates to those topics. For example, the landscape and products available in terms of credit cards/banking have changed over the past year. It would be good to hear your thoughts to some of the new products and whether it has changed your thinking or consideration for your current setup. Or maybe there’s something out there that you’re not using that you find attractive that could fit well for someone else if you were not already entrenched with your current setup. Or lastly if there’s something you just don’t like, you should make a post about that as well. Another suggestion is to make a post about areas or topics people frequently comment on so the interaction becomes more focused on things people are interested about.

Also, I think you touched upon it with just one sentence in your December post…I also have the Bank of America premium rewards card. Have you considered the no annual fee version since can no longer resell the AA gift card? I think you may have commented on this before through some buried comment in one of the posts, but would probably be better as a post on its own even if it’s short.

Ron,

Great feedback. A few thoughts:

* I have indeed not circled back on topics that I’ve already covered in the past (why I bank with Fidelity, why I like the BoA eosystem, why I geek out on marginal tax rates) because I’ve already covered them. But I agree completely that it would be a good source of generating “new” content and reader engagement. This is a great suggestion.

* I’m not paying that close of attention to the broader landscape of financial products, but I think I’m paying close enough attention (through blogs I read and the Bogleheads forum) to realize that nothing has caught my eye to cause me to deviate from my systems. I’m open to being corrected here, but I really like the systems I have in place. The suggestion of blogging about stuff I don’t like is an interesting one.

* As far as the BoA premium rewards card goes, I’ve entertained the idea of downgrading it to the no annual fee version. However, I’ve decided not to do so for a few reasons. 1.) I like the lack of foreign transaction fee with the PR card. I’ve travelled internationally about 3 times in the past year and it’s nice not getting hit with FTF on every transaction, 2.) I like the 3.5% category for travel/dining. I realize that this is inferior to 5.25% of the CR card, but I don’t always walk around with every category card in my wallet, 3.) I’m optimistic that I can harvest some value from the $100 incidental credit. I fly United quite a bit and might very well try the United Travel Bank this year. Or I might try to sell the AA eGift card through another avenue. I thought I saw some discussion on Doctor of Credit thread about places to do so.

Thanks again for taking the time to give this feedback. I found it to be quite helpful.

– FP

FP,

First i would like to say thank you very much for gifting us your time and efforts to create this blog. I have learned so much over teh past year or so (honest truth) that it is fair to say my future self is indebted to you.

I enjoy the monthly updates and find them very useful for a a lot of reasons but here are a few: 1) I, too, am a climber and crave the outdoors (although much more less accomplished than you) so I enjoy your photos/updates and it is inspiring to see someone that has a large family finding time to climb and have adventures. I am married and in my 30s with no kids yet so its nice to see that it is possible. Especially coming from a REAL person not some YT/famous person. 2) I have found other blogs and podcasts (Revisionist History, Clipping Chains, etc) thanks to you! I really have enjoyed your monthly recommendations. You should listen to People I Mostly Admire if you havent already. 3) There are a lot of people out there that say what they are doing when investing, saving, living frugally, etc. But, so far, you are the only person that shows us that you are actually doing it by sharing your finances. I think it is one of the most useful things to see the ups and downs in your finances and it reminds me that financial independence is a long term game. Thank you very much for that.

I have also enjoyed your YT video on finance advise for your students. I only wish I had found it in my 20s. The draft of your book is another very valuable resource. How great it would be if we leaned those things in college. Sound, practical, simple (but not so easy to actually do) advise.

Im not sure what advice I’d give you but regardless of what you decide to do, know that we are reading and there are a lot of “Frugal Students” that like to read you. If you had a YT channel or podcast I would enjoy those as well. Even though you say “…..I’m a middle-aged dad living a normal life in the suburbs of flyover country”, I believe you do this in part to sincerely help people and show another way of doing things. I, personally, identify with being frugal and trying to spend money on things that really matter and make a difference in my life.

Thank you again very much and hope you continue!

E.

E,

Thanks for stopping by and sharing the kind words.

First off, People I Mostly Admire is unambiguously my favorite podcast!!!! I listened to the most recent episode today while running my dog. I’ve always found Steven Levitt to be the more interesting member of the Freakonomics duo (since I started reading/listening to them a decade ago) and I am completely enamored with his podcast format It’s so simple; just invite brilliant people from all walks of life and pick their brains in a conversational format.

When I started this blog, one of the intended value-adds was to document the journey TO financial independence, since it seemed to be an unmet need at the time (though surely I was missing some). MMM was interesting, but already sitting on piles of money. So was GCC, who I also love. But I thought the transparency might add value and show the boring monotony of stuffing the investment accounts — through thick and thin — month after month after month. When I started investing around 2005, I was gung-ho about it. However, when 2008 hit I was pretty shaken. I didn’t have a resource like this illustrating that volatility (and thus huge market declines) are simply a normal part of the game. After a large market decline, it’s always tempting to kick yourself for not timing the market perfectly….”if only I’d sold 13 months ago…”. But that type of market-timing behavior is a fool’s errand over the long term, and I certainly didn’t appreciate that fully in my 20’s. Hopefully my transparency can help communicate the normalcy of that process, among others (like the inevitable unexpected large expenses, etc.).

Thanks again for stopping by. Given the responses I see in this post, I’ll continue to keep this blog alive. I have a fun time with it, and I’ll give some thought on what I can do to make it more helpful/useful.

I just want to say that I appreciate your blog very much–glad to hear that you will keep it going. I am also a frugal professor (in a slightly less lucrative field) with four grown kids, all through college (with no debt–merit aid is your friend) and two now in grad school–you are right to be intentional about appreciating them while you have them at home. I confess that for a long time I have avoided thinking about investing–I grew up in a household where money was the source of a lot of unhappiness (my parents were both good at spending more money than they had and then blaming the other for their problems), which should have made me determined to master investing, but I found that thinking about money triggered a lot of anxiety. The one good thing was that I learned that I could avoid thinking too much about money by paying things quickly, so I’ve never had credit card debt, cars get bought with cash or paid off within a few years, our mortgage could be paid off tomorrow. However, I have very little real understanding of investments. I am trying to fix that but it’s a lot to master. I like your blog because it’s a window into the life of someone who has got their finances in order (and seems to enjoy the process).

Amy,

Thanks for stopping by, fellow frugal professor!

I try not to claim to have all of the answers about money, but I hope that I’ve shared some useful tidbits along the way. Almost all of my colleagues invest like me (low-cost index funds only, which is sometimes achievable within a passive-only target-date fund). But I think I’m fairly unique among my colleagues for thinking so deliberately about how to optimize for taxes (and certainly frugality).

Take care and don’t hesitate to reach out if you have questions.

FP – echoing others that this is such a helpful blog. We have a lot to learn from you still – for example about optimizing income and savings for college spending. Don’t leave us yet!

Glad to hear that you’ve found some of these rants helpful! Stay tuned for more, I suppose….

FP, please don’t quit. I hope you can find a way to transition from writing mostly about FI to writing about how to spend it well, if that’s of interest to you. I have found inspiration for interesting reading and activities on your blog, and I would love to see so much more. Like you, I’ve hit all my long-term objectives, financial and otherwise, and I find myself middle aged and floundering. I am bored and uninspired and jaded. Pulling oneself out of this slog by one’s bootstraps seems more difficult than reaching FI. All the advice on the internet seems generic as hell. Some fresh thoughts and specific examples would be much appreciated! I wonder, if you were to run a survey of your readers on what regular repeated activities they stumbled upon that increased their sense of well-being, meaning, connection, etc, what would replies be like? And what new long-term goals people make for themselves?

Thank you for creating this blog, it gave me much joy over the years. I hope your 2023 rocks and you stay on the safe side of all catastrophes.

Victoria,

Thanks for the kind note. Glad that I’m not the only one floundering in middle age. You’re exactly right! Pulling oneself out of the slog by one’s bootstraps indeed seems more difficult than the mechanical process of achieving FI.

I’ll keep the blog around as a small way of repaying the good karma I’ve received. I realize that blogs are a dying medium, but they have been my preferred medium of consuming information for a while (though my preferences, like everyone’s, are slowly transitioning to YouTube). I honestly don’t know where I’d be today without some of the impactful blogs I read about 20 years ago.

The reader poll is a good one, but I’m wondering if this is the appropriate forum? Seems like such a discussion would be more fitting at a place like Reddit or Bogleheads forum or MMM forum or something. But I agree that I should leverage the collective brainpower of this (small) community at this small site. We are small in number, but the readers certainly skew very educated and wealthy. I’ll give it some more thought.

Thanks again for the kind note and the good wishes on 2023. I wish you a healthy and prosperous 2023 as well!

Take care,

FP

Hello FP. I wanted to add my voice to the others here, and say I enjoy reading your blog, and look forward to reading it, and hope you keep it going. I enjoy the clarity, and detailed writing.

I have reached goals I set for myself. Something I never thought would actually happen, even though the spreadsheet said it would, and feel a little jaded and bored too now.

Like Victoria mentions above, a good future topic might be how to spend time and money post FI.

Thank you again for creating this blog, and wish you and your family a happy and long FI life

Sun,

Thanks for stopping by and sharing the kind words.

I guess it’s comforting to hear that I’m not alone in floundering a bit in life. I’ll keep the blog going and be sure to share when I uncover the secrets of the universe. Best of luck to you as well!

– FP