I realize that blogging about my sheltered life is tone deaf in light of the unfathomable suffering in Ukraine right now.

But tradition (5.5 years strong) demands that I write something. So here we go…

Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Harvard economist Greg Mankiw on Ukraine:

- Mankiw discussing his Ukrainian heritage

- A couple of links

- I am blown away by Zelenskyy’s response to the invasion; I’ve never seen such inspiring leadership in my life.

- I enjoyed watching Charlie Munger’s interview at the Daily Journal annual meeting (link).

- I especially liked his thoughts on the dramatic increase in our standard of living over the past century. Despite these miraculous advancements, our tendency to fall victim to envy robs us of happiness (link).

- I hope I’m 1/100th as sharp as he is at 98!

- After a couple year hiatus, the in-person Berkshire meeting is resuming on Saturday, April 30th. I’m planning on being there. One would hope Munger and Buffett will attend many more meetings to come, but the actuarial tables indicate that this might be overly optimistic.

- The Tinder Swindler (link).

- A Netflix documentary about an elaborate con using the Tinder dating app. I had low expectations going into it, but I thought the movie was very well done.

- A friend recommended the podcast Smartless to me (link).

- It is pretty entertaining. It’s the only “fun” podcast I listen to.

- Jason Bateman, Sean Hayes, and Will Arnett are the hosts.

- They have interviewed some pretty interesting guests (Jerry Seinfeld, Tom Hanks, etc).

- Fun read about a retired 60+ year-old couple who rode their bikes 3,800 miles across the country (WSJ link).

- It reinforced my desire to keep Great Divide Mountain Bike Route on my bucket list.

Life

- FC1 turned 15 and got her driver’s permit.

- After spending several hours practicing with her in the high school parking lot, I congratulated myself on keeping my composure. When we started practicing in our neighborhood, however, it became a lot more difficult to keep my composure. Heaven help me!

- We bought these “student driver” magnets from Amazon $9 to put on the car.

- I think it was $9 (+tax) well spent. Other drivers seem a bit more patient when they see the signage.

- The magnets seem a bit weak, but certainly adequate for driving in-town. I’m skeptical that they would stay attached on the freeway.

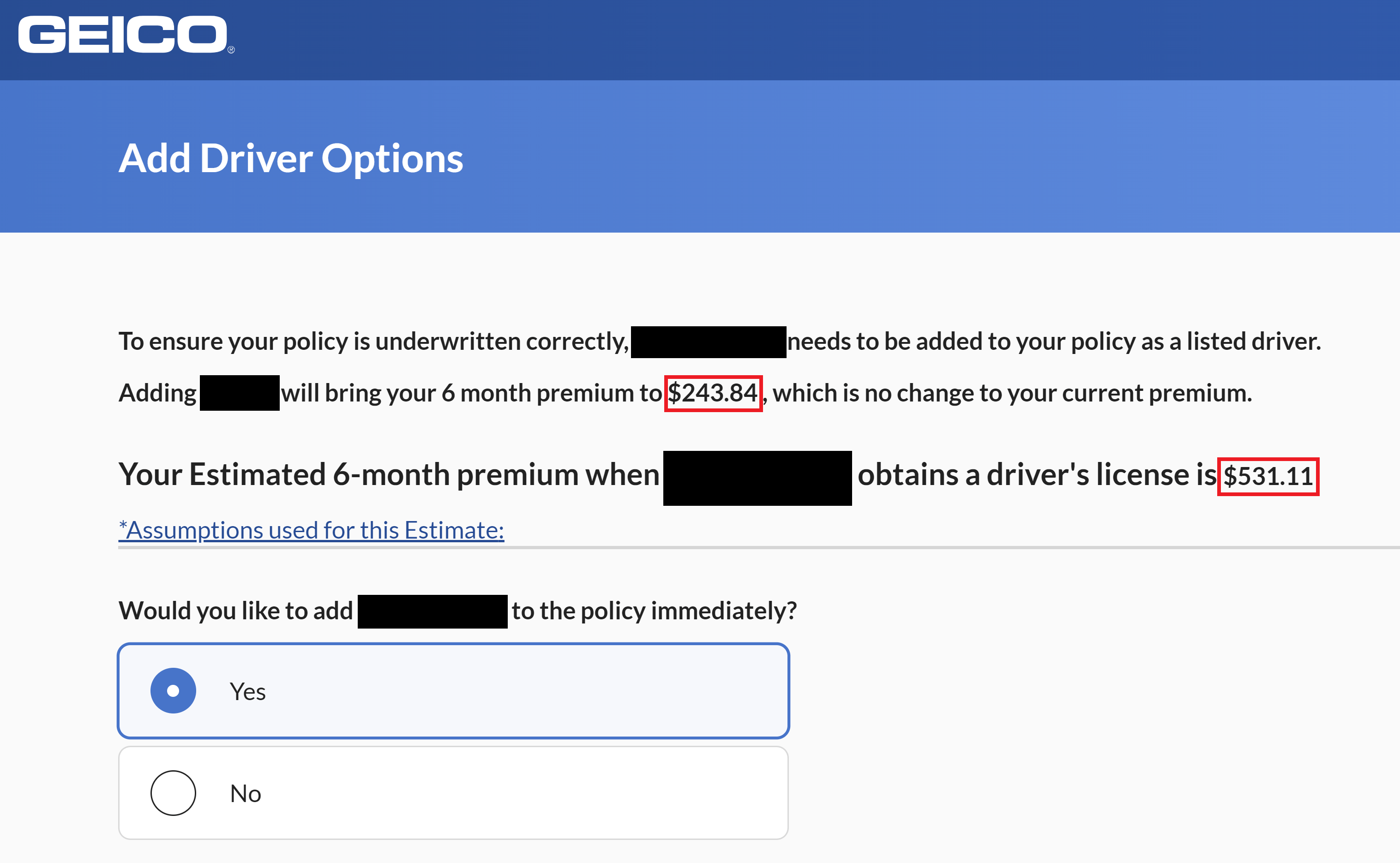

- I added FC1 to our Geico insurance. The price tag didn’t go up yet, but will go up by $574.54/year once she turns 16 (from $243.84*2/year to $531.11*2/year).

- No news yet on how this will affect my $1M umbrella policy.

- I competed in my second climbing competition at our university’s climbing gym. It was a blast. After battling a 5.12 route for an hour (and falling many times), I finally finished the route with seconds to spare. It was one of the highlights of my life.

FC1 has been dreaming of this moment for quite some time!!!

Adding FC1 to Geico. Ouch!

It got cold. Then warm. Then cold. Then warm….

Suffice it to say, I’ve never seen a bigger chew toy in my life. The thing was 4 inches in diameter and weighed ~8 lbs? I’m unsure what breed of dog this toy was intended for.

This Month’s Finances

With the recent market volatility, I decided to try my hand at some tax-loss harvesting (TLH’ing), despite doing the math and concluding that it is largely an unproductive endeavor. Early Feb 25, the markets were down ~2%. so I figured I’d give it a try. I submitted my order around noon. I had to teach the next few hours, but the markets rallied during that time to +1.74% for the day. This ~4% intraday price swing negated much of my anticipated benefit from TLH’ing. Oh well. A few thoughts:

- Lesson learned: submit TLH orders for mutual funds near the end of the day.

- TLH’ing with ETF’s would have obviously mitigated that issue entirely.

- That said, TLH’ing with mutual funds at Vanguard could not have been more simple. The exchange occurred at NAV. There was no timing issues to worry about.

- TLH’ing with ETF’s would have obviously mitigated that issue entirely.

- I TLH’d from the Vanguard Total Stock Market Index (VTSAX) to the Vanguard Large Cap Index Fund (VLCAX), which appears to track the Total Stock Market slightly better(?) than the S&P index.

- I’ll hold VLCAX for at least 31 days and reassess. If the price drops again, I’ll TLH back to VTSAX. Otherwise, I suppose I’ll hold onto it forever.

- For reporting purposes in my financial statements, however, I simply combine the two holdings into “VTSAX”. They are essentially the same fund anyway.

- When combined with some trades from last month, I’ve realized losses slightly in excess of $3k. Therefore, I’ll hit the max $3k deduction of losses against my ordinary income this year, with any remaining losses being carried forward to future years.

- This, of course, is not free money since the lowering of the cost basis will cause a larger tax burden down the road. That said, if my future tax rate on LTCG is 0% (a la GoCurryCracker), this could indeed present a small arbitrage opportunity. The net tax savings would be ~$930 (e.g. $3k*(24% federal+7% state)). Not gigantic by any means, but I’ll take it.

- The good:

- Still employed.

- The bad/abnormal:

- Nothing too unusual.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Best wishes to all concerned with FC1’s rite of passage. You and she can do this!

– MDM

Thanks for the well wishes MDM! We’ll certainly need it!!!!

When my boy got put on our auto insurance policy, it went up about $1100/yr (same 2 cars, good student discount) so you made out better than us. Let’s hope he dosen’t wreck the car or we’ll be totally screwed. My wife got these “New Driver” magnets. I caught my boy forgetting to stick that thing back on after he drove back from school one day. When I saw those magnets, I pretty much knew he would do this to avoid any ribbing from his classmates. I got a chuckle when I busted him for doing the magnet-off-magnet-on manuever.

$1,100/yr >> $575/yr. My condolences, but I hear that boys are more expensive to insure than girls. I was once a boy, and I think that is completely justified.

I too am hoping for no accidents. It would be an awful time to replace a car right now. Thankfully, we put relatively little mileage on our cars so they should both easily last another decade +.

Thanks for the warning on the magnet removal. I don’t know that I’ll have FC1 continue to use them after getting her license, but they sure have come in handy during the first few weeks of her driving. Other drivers are much more courteous when they see the stickers. Thank goodness.

Interestingly, daughter #3 just got her license and we got the email telling us how much extra she was going to be. Three cars, three kids all drivers (all girls 21,18, 16.5) plus two adults….the increase was $960 per year. I thought there might be some asymptote that we would hit…..but I think that the insurance company plans for all three of them will be in a car and (despite my driveway only being 60 feet long,) crash into each other on the driveway.

Ouch!!!!!

I had vaguely heard that premiums wouldn’t increase when subsequent kids are added to the policy. If your situation generalizes, it sounds like I was was misinformed.

One other comment/question related to your TLH. You seem to have way more transactions (buys) than I do and was curious about your approach. I would say that at best, I have two transactions per month in any fund (often none). I get paid biweekly. I have dividends go to cash (no auto reinvestment). Whenever I have a fair amount ($1-2k), I make a purchase. I do it into the index that is helping me to get to my allocation percentage.

Generally, the following triggers “buys” for me:

* Dividend reinvestment

* Paycheck

* Cashing out credit card rewards

* Any reimbursements (work expenses, insurance payouts, etc)

It takes me about 30 seconds to log into Vanguard and place a “buy” order, so it’s not a big time commitment, but I acknowledge that the benefits to my approach relative to yours are quite small.

I’m trying to fill up my IRA bucket for 2022. I remember you talked about how you made the mistake of contributing to a backdoor Roth instead of a trad. Do you remember which post was that? Thank you!

Not sure which post, but it happened last year. I assumed that Mrs FP and us made too much for her to contribute to a Trad IRA, but I was wrong. We made enough for her to make a partial contribution. Nonetheless, we ended up going 100% Roth for her that year, meaning we lost a small opportunity to defer.

This year, we are likely to be under the Roth IRA income cap, so we could make a “normal” Roth IRA contribution this year. However, we opted for the “backdoor” Roth to guard against the scenario where unexpected income puts us over the income threshold.

Hi Professor – do you know if the Chase referral award is considered taxable income? I’m trying to think back whether I received 15,000 points or $150. I didn’t receive a 1099 so I assume it is not taxable income.

It is my understanding that all credit card rewards (cash back, miles, points, sign-up bonuses) are tax-exempt for consumers. I believe it’s a nonsensical policy, but I think I’d read that it stems from the fact that CC rewards are a type of “rebate” or something (analogous to how you don’t report taxes when you use a coupon at the grocery store…?).

That was my understanding as well. Thank you.

FP- Hey old friend! Just a tip from one former west coast kid to another…It’s called the interstate; you’re not in *state of origin* anymore. 😉

Tell F1 congrats from me (F2 isn’t too far behind, right? Exciting!). B sends his condolences.

Heaven help me indeed with this driving thing. FC2 is 20 months or so behind FC1….