Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Everybody Lies (link).

- I discovered the book via the author’s interview with Steve Levitt (link).

- It’s as if Freakonomics and Google Trends made a baby.

- David @ OchoSinCoche published a book on 529s (link).

- I was a beta reader and found it to be a great resource.

Life

- We survived the craziness that the end of the school year brings.

- I did a 26-mile rim-to-rim hike in the grand canyon in a day (South to North).

- The logistics of the one-way rim-to-rim hike were challenging. It is a 4-hour drive from one rim to the other. We had two groups and swapped keys at the bottom.

- Perhaps next time I’ll do the rim-to-rim-to-rim…?

- Honnold did the 48-mile hike in 12 hours a year ago (link).

- Perhaps next time I’ll do the rim-to-rim-to-rim…?

- The bottom of the canyon was a bit of a slog. Hot and seemingly never ending.

- On a small detour to a waterfall, I came very close to unknowingly stepping on a large rattlesnake. After I almost stepped on it, it curled up and rattled like crazy. I can think of few worse places to get bitten by a rattlesnake.

- The logistics of the one-way rim-to-rim hike were challenging. It is a 4-hour drive from one rim to the other. We had two groups and swapped keys at the bottom.

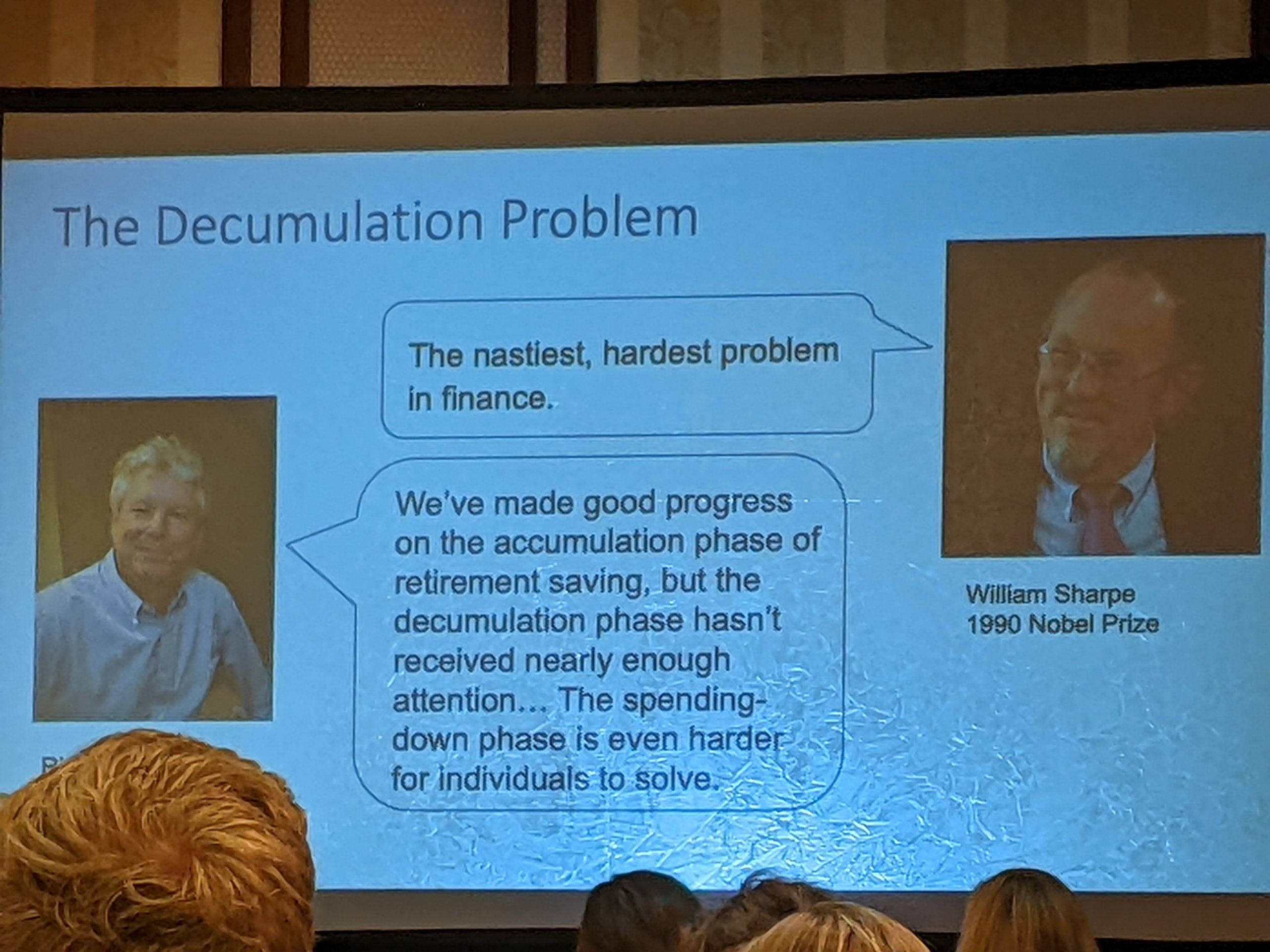

Thoughts on retirement decumulation from a few Nobel prize winners.

Flatirons in Boulder (#2 seen from #1).

Rancho San Antonio, Cupertino, CA. Total mileage was around 8 miles

We started hiking at sunrise at 5:30. I overheard a tourist on the phone describing the view as a “grand canyon.” No kidding!

We reached the Colorado River a few hours after leaving the South rim. The swim in the river was glorious.

Just a few minutes after almost stepping on the rattlesnake.

This Month’s Finances

I’ve officially tracked every penny that has flown through our hands in the past 12 months (and most pennies for the past 5.75 years). It has become a bit of an obsession getting the income statement, balance sheet, and statement of cash flows to jive each month. I’m unsure of the utility of the endeavor, but it has been a slightly enjoyable pursuit. There is an incredible amount of accountability and discipline that it imposes on me.

- The good:

- Still employed.

- Tax advantaged accounts are full (e.g. 403b, 457, IRA x 2, HSA, 529 (up to state deduction limit), so we’ve transitioned once again to our taxable brokerage account.

- The bad/abnormal:

- $2,545 in “Other expenses”:

- $685 in summer camps.

- $442 in Peru expenses.

- $195 zoo membership

- Several insurances were billed:

- $610 in annual home insurance fees.

- I increased my deductible from $10k to $25k for this renewal cycle (the max allowed by my mortgage servicer), more fully embracing the idea of self insurance.

- $244 in auto premiums (6 months for 2 cars).

- $147 for $1M umbrella policy.

- $610 in annual home insurance fees.

- $630 in gas (the average for the rest of the year was $150).

- A single fill in CA was $110. That was a first for me.

- $2,302 in doctor, drug, and dentist payments.

- Thank goodness we have hit our deductible and almost our OOP max. We have 7 months left to enjoy “free” healthcare. Time to schedule visits with specialists (allergists, asthma, etc.).

- The drug arbitrage was less fruitful this year because a few of our meds changed their coupons. Oh well.

- $2,545 in “Other expenses”:

As usual, I don’t have anything profound to say about the state of the world right now. Inflation is slightly painful, but there is a whole lot of discretionary fat in most of our budgets. I don’t pretend to know the perfect asset allocation, but I trust that saving a large percentage of our paychecks each month in tax-advantaged accounts will serve us well down the road. I remain comfortable with our 100% equity allocation, particularly with bond yields so low (e.g. 3% for BND). It seems inevitable to me that investors in all asset classes will have to accept lower returns going forward given the currently high valuations (e.g. VTSAX trading at a 19.4 P/E).

As always, I’m convinced the only source of guaranteed “alpha” to be had is through tax optimization. This seems particularly relevant during inflationary times since capital gains in taxable accounts are computed on nominal, not inflation-adjusted, terms.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Thanks for the shoutout and thanks for being a beta reader! For folks that would rather read it through Apple Books, it’s available here: http://books.apple.com/us/book/id6442923969 You can even download a 15 page sample.

Thanks for sharing the updated links!

Time to rename the blog to Spendy Professor – quite a recent increase in outflows. My rule of thumb is once my Other/Misc category gets bigger than everything else, it is time to add a new category…. Travel, Insurance, LaserTag…

I’ve had similar thoughts on renaming the blog…perhaps SpendthriftProfessor or WastefulProfessor?

I like the idea of splitting up the “other expenses”, but I also love the simplicity of the single category that captures pretty much all of our discretionary spend. It’d be nice to have a category for “kids”, but that is so hopelessly ambiguous. When FC1 goes to college in a few years, I’m sure I’ll introduce a “college” line item.

The laser tag expense 1-2 months back was indeed painful. The “old” FP wouldn’t have signed off on that. The “new” FP begrudgingly did so….

Love the spreadsheet; however I use google sheets instead of Excel and can get the charts to work. If anyone has any tips, please do share. Thank you!

I’m pretty frugal, but I have personally found google sheets to be an inferior substitute to Excel. However, I think the recurring annual Excel license fee is a scam. Sorry I can’t be of more assistance.

@FrugalProfessor,

With inflation at 40 year highs and real estate prices soaring, I think you probably need to increase the value of your house.

I’m okay keeping the home at book value for the time being. I don’t want to count the chickens before they hatch (or something like that).

That said, we’ve had anemic home price appreciation in the midwest relative to the coasts and mountain west, which is a bummer. I was thinking I would be reasonably well hedged against broader US home price appreciation as a newly minted homeowner, but I am clearly not perfectly hedged here in the midwest. The mountain west (a next potential destination for us) is becoming prohibitively expensive….

If I possessed a time machine, I’d go back in time, lever up, and buy property in CA or the mountain west (e.g. Boise, SLC, etc).