Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Bill Gates and Rashida Jones (Karen Filippelli from “The Office”) started a new podcast (link).

- I’m unsure how the two joined forces, but it has been pretty entertaining so far.

- In one episode they interviewed Raj Chetty (famous Harvard Economist) about inequality and in another they interviewed Yuval Harari (author of Sapiens) about why humans believe in lies.

- BoA is rumored to be close to cancelling their preferred rewards program, which I currently utilize to get 5.25% cash back on most credit card purchases. If it’s nixed, the max rewards would fall to 3% (link).

- It’s not particularly actionable for those of us already in the program. However, if you’re considering signing up, I’d probably hold off until we learn more.

- If they cancel the program, it won’t be the first time my heart has been broken; I’ll simply go back to the drawing board and reassess.

- The last time my heart was broken was around 2006 when Citi killed their Dividend American Express Card. It was a great companion to the Fidelity 2% card.

- The Citi Dividend American Express Card enables cardmembers to earn 5% cash back on purchases at supermarkets, drug stores and gas stations; 1% cash back on other purchases and eligible cash advances; and cash back on eligible balance transfers. Cardmembers also pay no annual fee.

- The last time my heart was broken was around 2006 when Citi killed their Dividend American Express Card. It was a great companion to the Fidelity 2% card.

- Interesting Journal of Finance paper on the abysmal performance of ~4,000 Canadian financial advisors and their ~500,000 clients (link).

- Within a large sample of Canadian advisors, we show that many advisors invest personally just as they direct their clients. In particular, they underdiversify, trade frequently, and favor expensive, actively managed mutual funds with high past returns. The portfolios that advisors hold themselves and the portfolios of their clients both underperform passive benchmarks by 3% per year. The client portfolios would have underperformed by 2.3% even if the advisors had provided their services free of charge. Advisors pursue similar strategies in their own portfolios even after they stop advising clients, which rules out the possibility that advisors hold expensive portfolios merely to convince clients to do the same.

- The novelty of this paper, of course, is that this sample of advisors was found to be just as incompetent managing their own money as they are managing their clients’ money — a finding which I never would have expected.

- The compounded effects of this are obviously catastrophic. Assume a real investment return of 5% without fees and 2% with fees. Assume $20k/year is invested for 40 years. In 40Y, the investor facing no fees has $2,415,995 (=FV(0.05,40,20000)) while the investor facing 3% fees has $1,208,040 (=FV(0.02,40,20000)). In other words, the no-fee DIY investor (or alternatively, a person choosing a competent fee-only advisor) has double the money having utilized low-cost index funds rather than trusting a supposed “expert.”

- This is the biggest paradox in all of investing. And it’s a paradox which makes me seem crazy when I tell it to people at dinner parties (yes, I’m that fun to hang out with….) — that they can predictably and decisively beat the supposed “experts” by simply keeping their costs rock bottom. I realize it sounds as crazy as telling people that performing their own heart surgeries with a mirror and pair of scissors will lead to superior outcomes to trusting a surgeon, but it’s true.

- Thought-provoking Mr Money Mustache article on the Direct Primary Care healthcare model (link).

- Through the map linked in the article, I learned my primary care physician is already a participant in a DCP plan. I’ll have to pick his brain on his experience next time I see him.

- The DPC model is certainly interesting, but it does nothing to insure against catastrophic events, which is the whole point of insurance in the first place. Given this reality (that MMM acknowledges), a DCP plan would surely have to be used in conjunction with something else.

- Reel Rock 14 is available for free on RedBull’s website. The following three videos contain the entirety of the 60-minute documentary about Tommy Caldwell & Alex Honnold’s pursuit of the nose speed record on El Capitan, Yosemite. It’s a fantastic documentary, just as enjoyable to me as Dawn Wall, Free Solo, and Meru:

Life

- Mrs FP started substitute teaching this past month and has already subbed for 4 of our 5 children. She has enjoyed the job and the kids have enjoyed having her as their teacher.

- I got a hole-in-one on a fairly challenging 307 ft disc golf hole, the second of my life (my first was in 1999). I got a hole-in-one in real golf in June of 2018 on a 160 yard par 3. Given my newfound lucky streak, I might have to buy a lotto ticket.

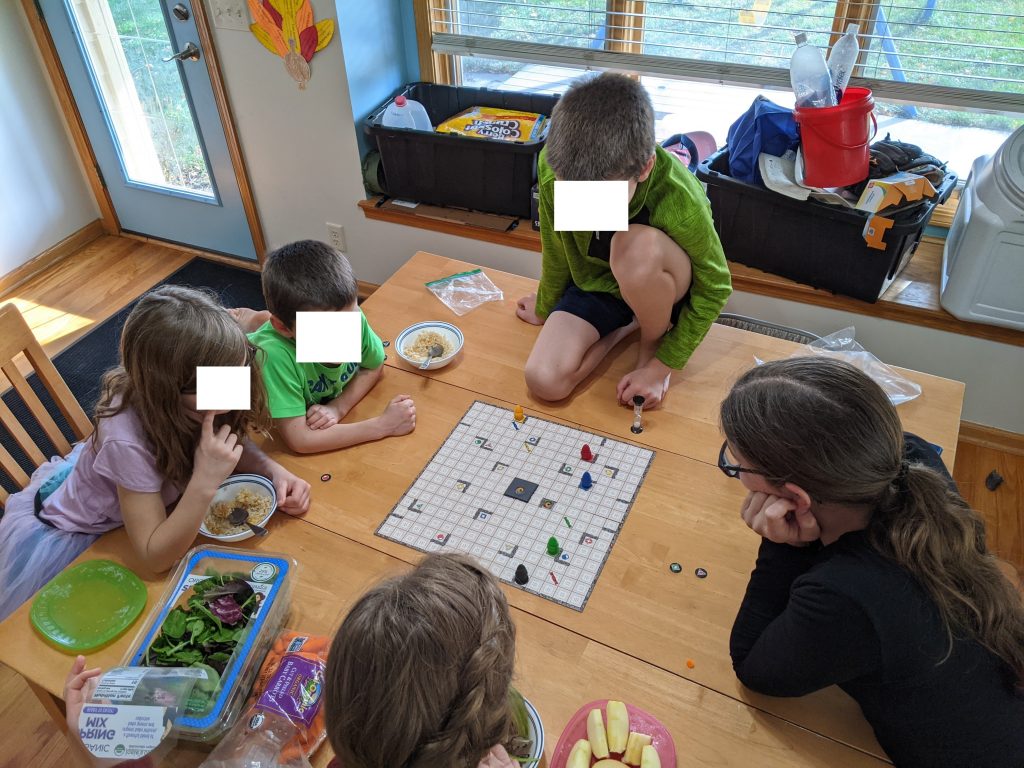

- We played a lot of Ricochet Robots over Thanksgiving break, a game I’ve played at least a thousand times. I had a friend in Seattle with over a thousand board games that introduced me to this game when I was an intern. I remember how challenging the game was — it made my brain ache — and I marveled that his 8-year-old-son walloped me so badly. Fifteen years later and a thousand games under my belt, the tradition is still going strong. I taught it to my oldest daughter when she was about five years old and we had a running tally of how many games each of us had won through the years. Now, the rest of the kids have caught the bug.

- I’ve taught this game to dozens of people in my life. About 95% of people end up loathing the game and 5% end up loving it.

A heated Ricochet Robots battle, in which all players are simultaneously trying to solve the same puzzle at the same time. The person who solves it in the fewest number of moves wins, with ties going to the first person to solve it.

I took this family portrait with a tripod. It’s almost impossible to get all seven of us to look at the camera at the same time, but the 10 frames per second bust mode certainly helps to increase the odds of that. The weather was unusually pleasant this month.

I took this family portrait with a tripod. It’s almost impossible to get all seven of us to look at the camera at the same time, but the 10 frames per second bust mode certainly helps to increase the odds of that. The weather was unusually pleasant this month.

Corn hole in the (former) corn field.

FC1 and a friend in the gym on auto-belays. The city has since tightened restrictions due to Covid.

Early morning drive to play frisbee golf. Beautiful sunrise.

My climbing partner bought me a pair of climbing pants on a recent excursion. They are my new favorite pants. I bought my second pair this past month. Walmart sells them in store or here. They are nice and stretchy which is nice for climbing/hiking/lounging/anything. I honestly don’t think I’ll purchase another type of pant for the rest of my life.

The water fountains at the climbing gym were apparently inspired by Silence of the Lambs.

I’m pretty cheap frugal. For the longest time I resisted buying Costco’s only ice cream because of the high price. It runs about 50% more expensive per ounce than ice cream at Walmart. After finally caving and buying the Costco ice cream, I now realize that it is heaven on Earth. I will never buy another type of ice cream. How’s that for lifestyle inflation?!?!? Never mind the fact that its superior taste is due to its higher fat content with the implication that each bite is shaving an extra hour out of my life expectancy.

Playing frisbee golf on Thanksgiving AM at 7:30am.

The scorecard from the “ace”, courtesy of the incredible (and free!) app called Udisc golf (link). The yardages are a bit off because we went from the more challenging set of tees. Thank goodness I didn’t choke and lose the round after the miracle shot.

The Thanksgiving miracle!!!

This Month’s Finances

- The good:

- Still employed…

- The bad/abnormal:

- $1,615 in medical/dental/drug bills.

- $189 for car insurance (2 cars).

- $37 for two disc golf discs.

- After recently blogging/bragging about how I hadn’t lost a disc in decades, karma got the best of me and I got one stuck at the top of a 40 ft pine tree. I climbed about 25 feet up but was unable to retrieve it. Luckily I didn’t fall to my death for a $15 piece of plastic. In my defense, it was my favorite disc.

Full version is downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads as well as the inability to buy partial shares. With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link).

- I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Nice ace! I’m going on almost a decade of playing without one. A couple of chain outs are all I have to claim.

I just got these pants from Costco: https://www.costco.com/weatherproof-vintage-men%e2%80%99s-pant.product.100600254.html. Very similar to the ones in your post.

They were on sale for $14.99 and they are down right amazing! I’m very hard on pants and tend to rip the crotch area, but these are stretchy and durable.

Bummer about the preferred rewards. I’ve been a member since your article convinced me of the merits. On the bright side, I’d love to move my assets back to Vanguard.

Thanks for the heads up on the Costco pants!!!! I guess the main difference between the two is that the Costco is 95% cotton (aka “the death fabric”) while the Walmart ones have no cotton (I’m pretty sure it’s nylon/spandex). I’m telling you, they are magical and have a cult following among climbers: https://www.mountainproject.com/forum/topic/119242176/best-cheap-pants-for-trad-climbing#ForumMessage-119244619

I agree about the upside of platinum honors going away is that the assets can be brought back to Vanguard and simplify my life slightly. Hopefully the program won’t get canned, but I’m not optimistic.

I love the Eddie Bauer Tech Pants from Costco. They replaced my expensive Prana climbing pants. Check them out if you haven’t already!

https://www.costco.com/eddie-bauer-men’s-tech-pant-.product.100653334.html

Thanks for the “beta”!!!!

Every month I check your movie pass value. What is the ticker symbol for that holding?

HMNY: https://www.marketwatch.com/investing/stock/hmny

I don’t understand how it’s trading above zero, but it has been interesting to keep on the books as a learning experiment.

I’m frankly shocked my brokerage account still registers this as a holding. I guess the non-zero stock price indicates there is a non-zero probability that it will be worth something greater than zero if the company emerges from bankruptcy?

I don’t know where you live, but a really fun frugal outdoor activity is orienteering. They give you a map and you run from point to point. https://orienteeringusa.org/ We have a local club where we live and they do a 16 week race series in the winter which works out to $3/race. We used to do them as a family, but my kids wanted to race by themselves and now even my five year old can read a map and navigate through the woods (with a grown-up tailing him, but he makes all the direction decisions). Find a local club close to you https://orienteeringusa.org/events/clubs/ or even permanent courses https://orienteeringusa.org/events/permanent-courses/. For DIY, you download an app and when you navigate to the correct point, it chimes. Other than a compass, no other specialized gear is required. My 5 year old doesn’t really use a compass yet, he just follows the trails on the map, but my 10 year old could navigate himself anywhere now with a good map and compass.

Very cool! I’ve sort of done orienteering in the past when I was involved with the boy scouts, but it’s been a long time. I’m directionally impaired, so this could be a really good activity for the family! Thanks for the suggestion!

I guess it reminds me of geocaching minus the GPS tech.

I agree it is a bummer about Preferred Rewards likely retreating, but it was really too good to be true as an indefinitely sustainable deal. It has been nice while it lasted (and those of us who purchase grocery gift cards online may be able to stretch it out a bit further than others), but I also agree that there is something to be said for consolidation.

If and when Preferred Rewards comes to an end, I will not, however, be consolidating at Vanguard (even though my assets currently in Merrill Edge custody are Vanguard ETFs.) I have read too many stories of declining customer service on BH (and have never been all that impressed by Vanguard customer service to begin with–they had sort of a mixed record when helping me with transitioning inherited assets after my husband’s death seven years ago.) I have been more consistently impressed with service at Schwab, which has a local brick and mortar branch, and currently plan to consolidate there. Schwab’s Donor Advised Fund also dominates Vanguard’s counterpart DAF.

Thanks for the thoughts on consolidating at Schwab vs Vanguard. I don’t have much personal experience with Schwab, but my folks have been happy campers for decades. Most of our assets are at workplace plans at Fidelity and I’ve been impressed with their customer service so far. If I had local access to Schwab or Fidelity, that would probably tilt the scales in one’s favor vs the other. However, there isn’t a Fidelity branch in my entire state. Schwab is similarly absent.

I’ve heard excellent reviews of Fidelity’s DAF but don’t know how it compares to Schwab’s.

One of the main advantages of holding ETFs over MFs, of course, is their portability. I’m currently in the MF camp, but I think I could be easily persuaded to switch to ETFs. Perhaps this whole ME/BoA demise will allow me to rethink this decision.

I have experience with DAFs at Fidelity, Schwab, and Vanguard. No difference between Fidelity DAF and Schwab DAF–both were very similar and both worked well. Vanguard, by contrast, had higher minimums and made me feel like they did not really want my DAF business.

However, Fidelity support on non-DAF stuff was decidedly subpar (most particularly, Fidelity unwillingness to disclose the FMV of my late husband’s brokerage account on date of death caused me extra legal expenses in settling his estate.)

Schwab on a variety of issues has been superb over the phone and via secure messages on their website. The brick-and-mortar office is a nice-to-know-its-there security blanket thing but has not actually been needed thus far. They went over-and-beyond in smoothly supporting assets into my name after husband’s death.

I also prefer MF to ETFs. If you are a MF fan, you should know that Schwab was perfectly happy to accept in-kind transfers of my Vanguard MFs and they have retained their Admiral class status while in Schwab’s custody.

At my age, I have very different concerns than you at your stage of life. Things like handling QCDs, RMDs, and POA if/when I become incapacitated and post-mortem asset transfer are important considerations. This recent thread on Bogleheads on VG repeatedly screwing up QCDs for many clients definitely made me resolve to stay away from VG as a custodian.

https://www.bogleheads.org/forum/viewtopic.php?f=2&t=328595

Thanks for the insightful comments on VG vs Fidelity vs Schwab! I hadn’t fully realized that VG was inferior on those dimensions.

I’ll definitely catalogue your advice in the back of my mind as I continue on through life and issues like QCDs become more important. I can understand why customer service and attention to details (e.g. appropriate handling of QCDs) would really differentiate brokerages at that point.

In the mean time, let’s hope the gravy train of BoA lasts a few more months…..

My Premium Reward card just renewed so I was hit with the $95 AF. Had I been more deliberate about it, perhaps I should have preemptively cancelled the card.

On a $/calorie basis, the Costco ice cream may not be that much more expensive than the Wal-mart ice cream, due to the higher fat content. You just have to keep that in mind when determining how many scoops to get. 🙂

Touché!

Just a general question I have had for a bit and was wondering what your thoughts were. What is the benefit of keeping your money in the Fidelity Total Market Index Fund (FSKAX) verse the Fidelity ZERO Total Market Index Fund (FZROX)? Wouldn’t those produce near identical results with the ZERO being better due to no expense?

Good question. I don’t have access to FZROX in my retirement accounts at my employer, so I’m forced to utilize the 0.015% ER FSKAX.

Odd question but if anyone can answer it would be you frugal professor :). Not sure if there is an exact answer to be honest.

If one was taking their 5% rewards from BOA and monthly investing it into VTI etf what would the % reward actually come out to long term?

Also,

what is a better option than BOA if they end the preferred rewards?

Money is fungible. Every single dollar invested (through after-tax labor income, dollar earned of tax-free CC rewards, dollar coupon utilized, or dollar not spent at a fast food joint) is worth $1*(1+R)^N in the future. Over the past 10Y, we’ve seen annualized stock returns of 13% for VTI. This magnificent (and unstainable) growth has amplified the returns to all of these endeavors (income, CC rewards, coupon clipping, or frugality). Every $1 invested in VTI 10Y ago (through after-tax income, CC rewards, coupon clipping, or plain old frugality) has grown to $3.39 today (=$1*1.13^10). In other words, 5.25% cash back received 10Y ago is the equivalent of 17.82% cash back thanks to compound interest (=5.25%*1.13^10). That’s a pretty neat way of thinking about things, though it’s not quite right because we’d want to adjust for inflation to make it truly apples-to-apples. Once we adjust for inflation, it’d look something like 5.25%*(1+(13%-2%))^10. Still, not too shabby.

In any regard, it’s pretty impressive but we’re admittedly cherry picking a 10Y bull run.

I have no idea what I’ll do when they end preferred rewards. Probably sulk in my basement for a month without showering while eating high-fat Kirkland Signature ice cream (thank goodness my new favorite pants are stretchy!). Or maybe I’ll simply consult google/bogleheads to figure out the next best thing. What that next-best thing is, I don’t know yet.

Thanks for the link to The Misguided Beliefs of Financial Advisors. I shared it with my neighbor and good friend, who is a successful Virginia based financial advisor who constantly harangues me about letting his firm manage my finances for me (…for 1% AUM). I love academic articles like this, because they make me feel so smug about the DIY approach. We had a good discussion about last night over beers. His conclusion? In a nutshell, Canadians advisors are clueless, and Americans know what they are doing. Ha!

Obviously we argued about this, but then I realized I was mirroring his same attitude in an oblique way myself. I maintain a similar Fidelity portfolio to yours, except for FZILX/FTIHX at a quarter of your overall value. I’m pretty much all-in on American companies, and feel like the larger multi-nationals offer global diversification. But when I thought about it, I realized I was thinking along the same lines as my neighbor. I only really trust American companies and American capital markets. As far as I can tell FZILX/FTIHX has significantly under-performed relative to FSKAX, and for a pretty long period of time. Just curious, do you know of any academic studies which proves that up to a quarter of your portfolio invested in international stocks would increase your returns over time? Something a lay person like me could get their minds wrapped around? Very much enjoying your blog! It’s one of my favorite destinations on the web.

Rick,

Great to hear from you. I’m a big fan of the DIY investing approach because 1% AUM fees will kill a portfolio over time. If you need advice above what bogleheads/blogs offer, then a fee only advisor would be much cheaper than 1% AUM over the long haul.

It’s great that your friend thought that Canadian advisors were clueless! I know one of the authors of the study fairly well and I sent him an email asking how the two firms signed off on releasing the data that would eventually incriminate them. He responded by saying that the firms were unhappy with the results but couldn’t do a thing because they had a pretty iron-clad data agreement already in place. That’s a great lesson learned for me because I’ve had projects scrapped because the provider got cold feet. If your friend is willing to share his client data for academic purposes to exonerate US advisors, please put me in touch with him!

Your second paragraph is referring to something researchers call the “(equity) home bias”, in which investors disproportionately weigh their portfolios to their home country as opposed to a global, market cap weighted portfolio. I don’t have any active research in this area, but a phd colleague of mine wrote a lot about it. Here are some articles on google scholar: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C28&q=equity+home+bias&btnG=

As of today, North America (presumably mostly the US) constitutes 60.1% of the total market cap of the world: https://investor.vanguard.com/mutual-funds/profile/portfolio/vtwax. A vanguard Target Retirement fund will follow this ratio completely with a 60/40 domestic/international split: https://investor.vanguard.com/mutual-funds/profile/portfolio/vfifx. If you dig into the equity holdings, you’ll find that 54.2%/(36.3%+54.2%)=60%.

I can think a few rational reasons to deviate from a world portfolio. Mainly, if your future expenses are likely to be in US dollars, it probably makes sense for you to hedge by holding a disproportionate weight in US firms. If the dollar strengthens relative to other currencies, you want to have a lot of your assets in dollars so that you are hedged appropriately. There is also a familiarity behavioral bias in that you trick yourself into thinking you understand US firms better because they are headquartered down the street.

Buffet says to hold 90% S&P & 10% short-term treasuries. I suppose I’m about halfway between Buffett & a zero-home-bias portfolio.

It’s true that US stocks have beaten the crap out of international stocks over the past decade. It’s especially painful given I have a decent amount of my portfolio in international. However, the poor performance is an ex-post realization that we couldn’t foresee a decade ago. As of today, as a result of the relatively high PE values of domestic vs international stocks, international stocks are appearing relatively cheap and will potentially be a better investment going forward.

P/E domestic is 25.4: https://investor.vanguard.com/mutual-funds/profile/portfolio/vtsax

P/E international is 17.3: https://investor.vanguard.com/mutual-funds/profile/portfolio/vtiax

More broadly, over the long haul, I can’t think of a good reason why the expected return on US firms ought to be higher than the expected return of international stocks. If anything, I would think it would go the other direction.

*** The normal caveat applies that I don’t give investing advice on this blog and I (seriously) have no idea what in the hell I’m talking about ****

FP don’t forget to ask Merrill Edge for a retention bonus!

I think I tried asking for one in the past and they didn’t budge. What’s the secret sauce I’m missing?

What a shame about the rumors of BofA ending the rewards bonus for platinum status. I just achieved this as a result of moving assets over to take advantage of a $1000 bonus for moving assets to Merril Edge

I’m similarly devastated. Sorry if I am the cause of your misery.

It sure was great while it lasted. Here’s to hoping that the rumor is false….

Hoping against hope the BOA rumors aren’t true. I’ve had BOA since I was 16, so I was lucky that their preferred rewards system ended up being the best out there for this period of time. And we’ve obtained 2 additional “Cash Rewards” cards in the past few months after I first read your post pointing out you can get multiple cards so as to avoid the $2,500 spending cap. If they don’t at a minimum keep the Premium Rewards at least 2% back on everything, I’ll have to look into switching to the Fidelity or Citi as my everyday card.

This morning, I redeemed $419.14 of tax-free BoA rewards. Granted, $110 of those rewards were passed through to a friend who bought a $2k camera that we wanted to help out.

I’ll similarly be devastated if they cancel the program, but it seems very likely that it’ll happen. I’d be content if they required $300k at ME or if they reduced the multiplier from 75% to 50%.

Those tax-free rewards really add up, especially when they are subsequently saved rather than spent on trinkets.

Yeah, 50% bonus would result in a 4.5% cash back for the 3% categories, which would still be better than most cards out there (so long as you can have multiple cards to spread the online shopping, dining and travel expenses).

I wish they had those water fountain cages back in the ’70s — there were always a couple of elementary school classmates who didn’t quite grasp how to drink from a fountain and would place their mouth right on the spigot!

No kidding!

Thanks for the recommendation of those pants. I picked up a couple pair and they are fantastic. WIth 96% nylon, they should outlast cotton pants by 2 to 1…and they are as comfortable as jogging pants!

Glad you liked them! I think they become more comfortable over time as they’ve been washed and worn in. I love the fact that they are non-cotton, so they dry out super quick.

Thanks for the Reel Rock 14 links. We enjoyed watching The Dawn Wall. I’ve never been into rock climbing, but I’ve found the documentaries very fascinating. Also, I’ll have to try those pants out.

I’m happy to have fulfilled my duty as “anonymous internet recommender of an assortment of things, from investment/tax strategies to ice cream/climbing movies/stretchy pants.”

I find well-done climbing documentaries to be incredibly entertaining. There is something about the climbing community that I find so appealing: their low-cost sustenance existence on the fringes of society (i.e. the “dirtbag” existence) and their love of the outdoors. Dawn Wall is among my favorites ever. As is Meru. Free Solo was meh. Here’s a few others if you are interested. All but the last are available with a free 7-day trial of “Outside” on Amazon:

* Stumped

* Queen Maude

* Sufferfest 1&2

* Safety third

* Free as can be

If you’re in the market for pants, Chris’ suggestion above looked great too (https://frugalprofessor.com/financial-update-nov-2020/#comment-1726). Eddie Bauer Tech Pants from Costco. I saw them in person over the weekend and was tempted to pull the trigger on yet another pair. They look to be a bit nicer than the Walmart Wranglers. I think they’re something like $15 after the current coupon.

Great recommendations. What I wouldn’t give for an inseam of 36″, though. #TallProblem

Agreed. The problem with being in the top 1% of height for women is that only 1% of the pants fit and arm sleeves are always too short. It’s a weird problem for a frugal person – I cant reliably find inexpensive options (bad), but I also can only buy a few styles (good) so I don’t spend much on clothes total, but the per piece price is probably more than others can find.

Since my wife has recently re-entered the workforce as a substitute teacher, she’s had to buy a few pieces of professional clothing.

Apparently it’s now in-style for women to wear pants that fall several inches above the ankle. Like capris, but longer: https://www.google.com/search?hl=en&tbm=isch&source=hp&biw=1280&bih=646&ei=-pjXX8GfK5H2tAWg-o2QDw&q=women+pants+above+ankle&oq=women+pants+above+ankle&gs_lcp=CgNpbWcQA1DQCVjQCWDpC2gAcAB4AIABRYgBRZIBATGYAQCgAQKgAQGqAQtnd3Mtd2l6LWltZ7ABAA&sclient=img&ved=0ahUKEwjBhJ6Q-M3tAhURO60KHSB9A_IQ4dUDCAc&uact=5

Perhaps David & Catherine can expand this trend to men and/or other articles of clothing: jackets that stop just past the elbow & above the belly button. The possibilities are endless!

I’m 6’3″ on a good day, have monkey arms, a long torso, and shorter legs. Getting pants that fit me isn’t usually a problem, but oftentimes jackets are a problem.