Another month, another update. A few random comments.

Good Reads/Listens/Watches

- GoCurryCracker on getting a mortgage without labor income (link).

- A friend shared with me that the newest version of the Democrats’ multi-trillion dollar climate/social-spending bill no longer nixes the (mega) backdoor Roth (link1, link2).

- Who knows what the final version of the bill will be, but I found this to be somewhat comforting.

- I’ve started listening to archived Berkshire Hathaway meetings in podcast form going back to 1994 (link).

- Hat tip MyMoneyBlog (link).

- I (re)read the revised version of Bogle’s Little Book of Common Sense Investing (link).

- It is probably my favorite investing book. I hadn’t read the revised edition before.

- TLDR: Buy index funds.

- If you’ve already internalized that, then I suppose the book is redundant.

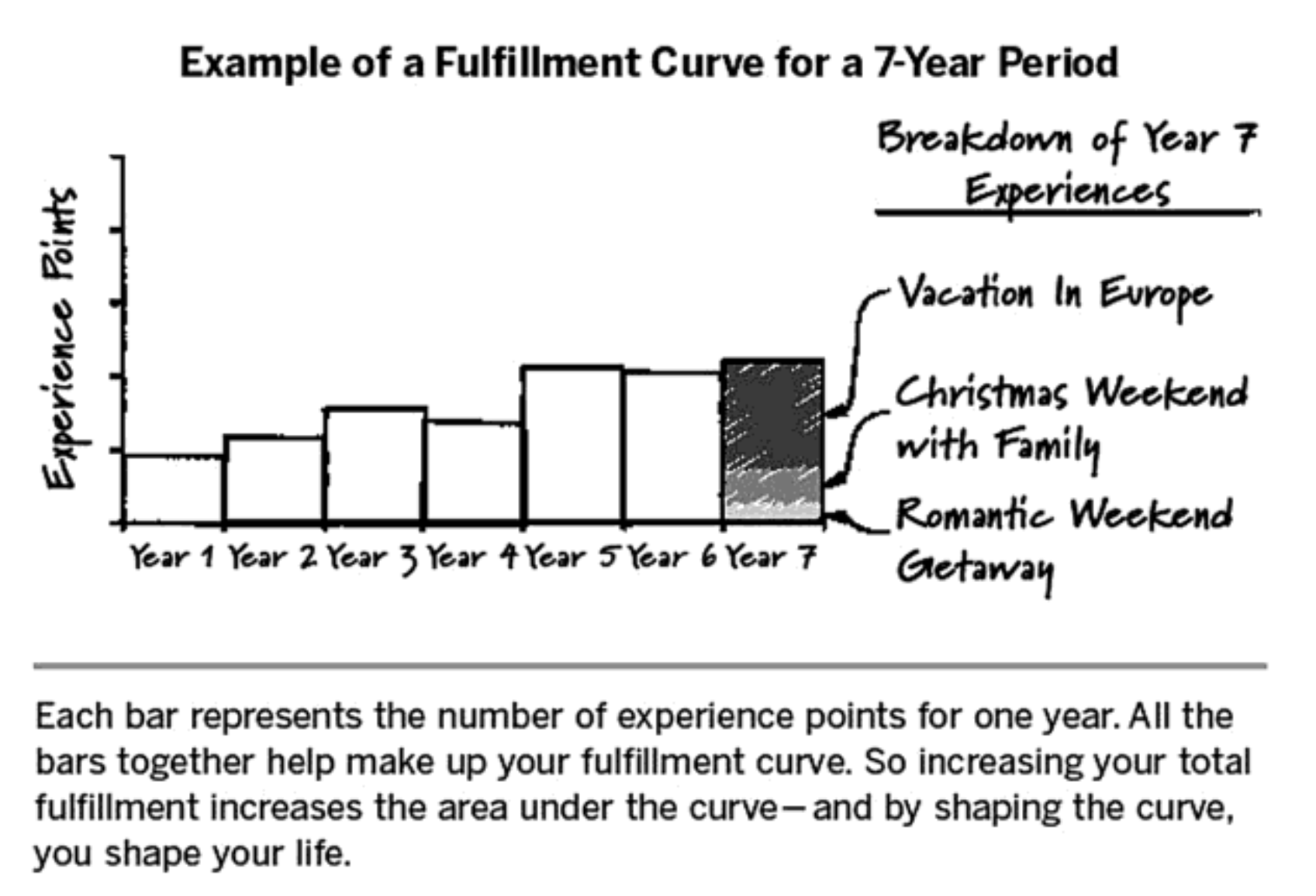

- I’ve gotten halfway through book Die With Zero (link).

- The book was recommended on a couple of Bogleheads threads.

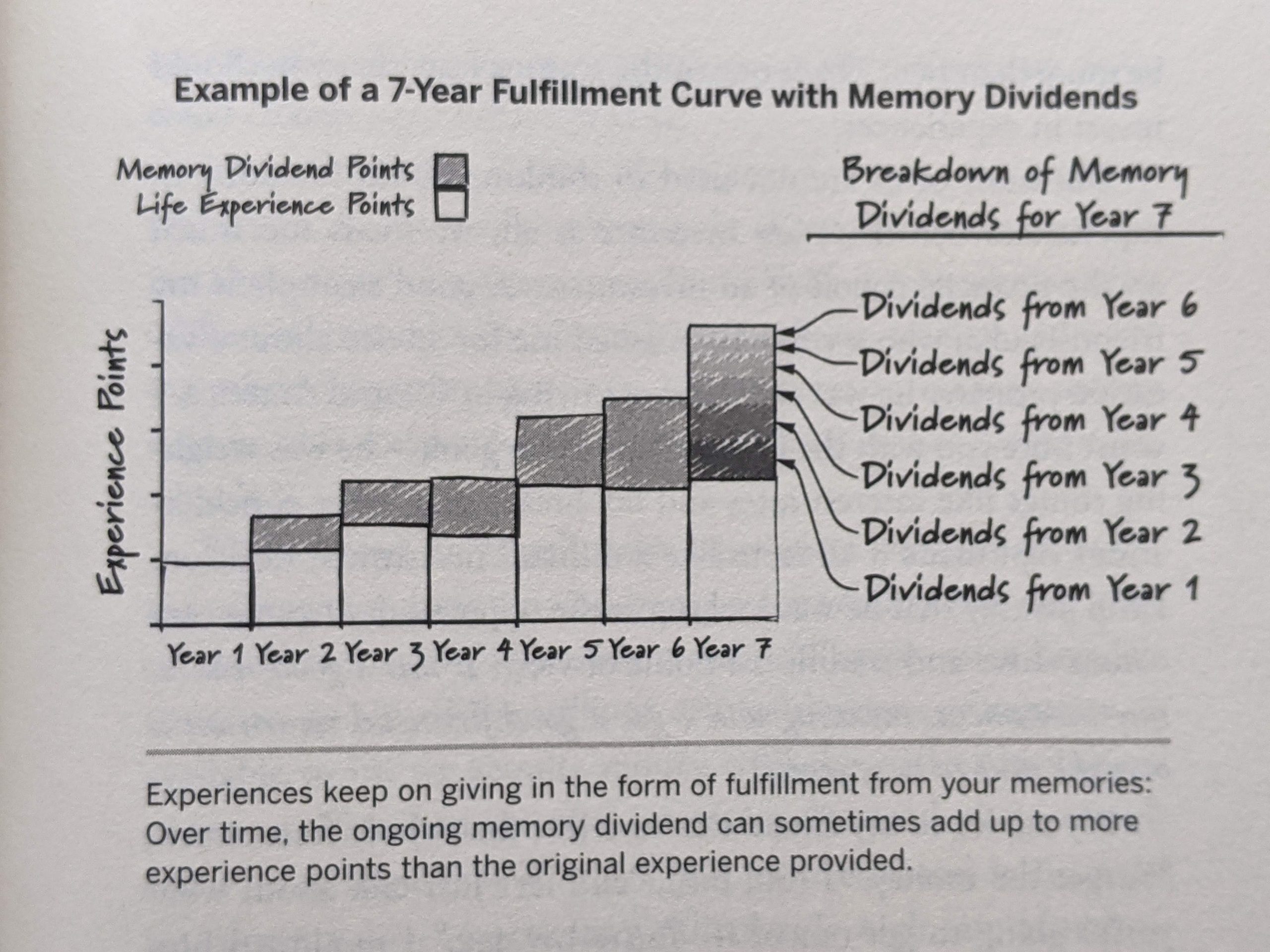

- My favorite part of the book is the second figure below.

- I’ve semi-jokingly asked my kids for money-spending proposals to enable me to die with zero. I’ve been unmoved by their proposals to date.

- I’m vaguely paranoid that I’ve irreparably harmed our children by living frugally. However, I think our kids are living a pretty good life. I’m fairly skeptical that >= doubling our household spending make our kids meaningfully happier or better-adjusted human beings.

- That said, I’d love to give them the experience of living abroad. My brother in law took a job in Germany six months ago. His kids are having the time of their lives.

- The author argues that rather than leaving money to heirs (or charities) at death, that you ought to give it away before you die. He argues that inheritances received in your 60’s don’t make much of a difference. I don’t disagree.

- That said, short of knowing the exact date you’re going to die, the mechanics of dying with zero are practically impossible. I suppose the only way of avoiding that scenario is fully annuitizing your retirement savings.

Life

- Mrs FP has been substitute teaching for about a year now. When she first hired on, she asked HR whether she was eligible to contribute to a 401k. HR answered “no.” This past month, I had the idea to ask again. This time, I went straight to the recordkeeper of the 401k. They answered “yes.” Woot.

- It is an almost universal truth, in my experience, that untrained HR people within firms will inadvertently and egregiously mislead employees about retirement plans.

- I have been harmed repeatedly by shoddy retirement advice from HR personnel throughout my life. You would think I would have learned my lesson by now, but I obviously haven’t!!!

- First time was as a young 20 something year old intern where an HR person at mega-corp advised me to not contribute to 401k, causing me to forfeit the 6% company match.

- The second time was as a late 20 something year old phd student where the HR person advised me to not contribute to the retirement plan. Only later did I realize I forfeited a 12% match on my phd stipend for 5 years. Doh!

- The third time was this incident with my wife’s current employer, where HR incorrectly told us that Mrs FP was ineligible for the 401k.

- The good news is that we can now avoid the 29% federal (includes 5% CTC phase-out) + 7% state = 36% MTR’s on her income by deferring 100% of it to a Trad 401k.

- Mrs FP and I took a quick trip to Banff paid entirely by a single 100k Chase Sapphire Preferred bonus (link).

- It was the off-season, so flights, rental car, and hotels were dirt-cheap. We lucked out with the weather.

- We still have 100k points left over from our second sign-up bonus. I guess we should use those eventually.

- Itinerary:

- Day 1:

- Bow Falls: 2/10.

- Hiked Tunnel Mountain: 6/10.

- Hiked Plain of Six Glaciers Trail at Lake Louise: 8.5/10.

- Day 2:

- Hiked Johnston Canyon to Ink Pots: 10/10.

- 1/4 mile past the ink pots was my favorite part of the hike. We hiked another 2.5 miles past the ink pots for a round-trip total of 13 miles or so that day.

- Day 3:

- Hiked Sulphur Mountain: 9.5/10.

- 2,500 feet of vert over 3.5 miles.

- Most people paid $55CAD/person to ride the gondola to the top, but we opted to huff it up there alongside the other (frugal) masochists.

- We were rewarded with quite reasonably priced hot-springs ($8/person) at the base of the hike on the way down.

- Stuffed our faces with Costco Poutine in Calgary. 9.5/10.

- It was my first time and I have been craving that bizarre concoction ever since.

- Stayed night at Calgary in-terminal Marriott and caught the first flight out.

- Hiked Sulphur Mountain: 9.5/10.

- Day 1:

- Despite being fully vaccinated, we ended up needing to take three Covid tests:

- One before we left the US.

- One at Calgary airport upon arrival (random screening).

- One before returning.

- The drug chain “Shoppers Drug Mart” administered $40CAD rapid-Covid tests for the return trip.

- We had to reserve our testing appointment about a month out.

- The drug chain “Shoppers Drug Mart” administered $40CAD rapid-Covid tests for the return trip.

- A colleague took me on a flight in his Diamond DA40 plane (link). It was fun.

Lake Louise.

The far end of Lake Louise.

Near the teahouse at Plain of Six Glaciers past Lake Louise.

Near the teahouse at Plain of Six Glaciers past Lake Louise.

Johnston Canyon. The hike through the canyon followed a neat walkway.

Johnston Canyon again.

Johnston Canyon again.

Ink pots past Johnston Canyon. I managed to capture the small bird in flight on the right.

1/4 mile past the ink pots. We at lunch on the bridge.

Top of Sulphur Mountain.

Corn nuts + unsalted sunflower feeds provided us sustenance.

Hot springs at the base of the sulfur mountain hike. $18.44 USD well spent, though it would have been a couple bucks cheaper if we had remembered to bring our swim suits.

The most beautiful scenery in all of Canada. Canada’s food court is better than the typical US food court. I am really jealous. Poutine was incredible. I am now addicted. Also, the $1.50 CAD hot dog = $1.21 USD. If that isn’t reason enough to move to Canada, I don’t know what is.

It took every bit of willpower I could muster to not buy this sweatshirt as an outward manifestation of my undying love for this establishment.

View from airplane ride with colleague. Costco, our house, and seemingly infinite cornfields on display. Suffice it to say that I don’t do much outdoor climbing or mountain biking locally. I chatted about the economics of plane ownership with him — it’s actually substantially cheaper than I would have thought. He paid $210k for his 4-passenger plane and incurs about $1.5k-$2k per month in maintenance, fuel, and storage costs. It consumes about $50/hr of fuel and cruises at 160mph.

View from airplane ride with colleague. Costco, our house, and seemingly infinite cornfields on display. Suffice it to say that I don’t do much outdoor climbing or mountain biking locally. I chatted about the economics of plane ownership with him — it’s actually substantially cheaper than I would have thought. He paid $210k for his 4-passenger plane and incurs about $1.5k-$2k per month in maintenance, fuel, and storage costs. It consumes about $50/hr of fuel and cruises at 160mph.

I took our annual Christmas card photo with a tripod. My Sony a7iii takes images at a rate of 10 frames per second. After shooting 1200 shots, we got a keeper.

Made Me Smile

- Dogs getting into trouble:

- Jason Gay’s WSJ article: She’s Playing College Golf. She’s 63. (link).

- Stranger gifts impoverished man a meal (link).

This Month’s Finances

I simplified the reporting a bit.

Also, I faced a bit of an accounting dilemma. Rather than report the redeemed CC points on the financial statement, I simply ignored it. This creates an inconsistency in how miles and cash-back points are accounted for. Oh well.

- The good:

- Still employed.

- Contributed 100% of Mrs FP’s substitute teaching pay to her 401k, helping to lower our federal tax liability by 29% and state by 7% of each dollar contributed.

- The bad/abnormal:

- Another $570 in payments (of $2k total) towards FC1’s upcoming band camp trip.

- $300 total in car registration fees for our two cars.

- There is a pretty steep depreciation-like curve for auto registration fees in our state. Since our cars are both over 10Y old, we get a lot of sympathy from our state in reduced fees.

- 2020 registration fees: $356

- 2019 registration fees: $398

- 2018 registration fees: $458

- There is a pretty steep depreciation-like curve for auto registration fees in our state. Since our cars are both over 10Y old, we get a lot of sympathy from our state in reduced fees.

- We spent more on “groceries” this month. I’m not sure why.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

The border crossing restrictions have definitely eased up! In May, we each had to take a test before and after crossing and then again half way through our mandatory 14 day quarantine. Luckily we were staying for 4 months or it wouldn’t have been worth it

It is really nice that they are finally loosening up the border restrictions. I’m glad you were able to cross as well. It was a bit of a pain for a short trip, but it luckily wasn’t too bad for us.

Hi Professor,

I am interested to know how you utilized the Chase Sapphire 100K points to cover the whole trip. Could you share the details, or make a short post?

Basically, 100k Chase = $1250 travel. Plus, Mrs FP got 20k bonus by referring me to my card. So we had 220k points to burn (plus whatever we accrued through getting to the $4k min spending requirement per card).

Here’s the Chase points we spent:

Category; Chase points; USD dollar equivalent

car; 10,072 points; $125.90

hotel; 22,780 points; $284.75

flights; 62,947 points; $786.84

total; 95,799 points; $1,197.49

I paid for the Marriott hotel in the Calgary airport out of pocket because I got a much better deal booking outside of Chase’s travel portal. This expenditure is not shown above.

I gamed the system a little bit. I could cancel hotel/car reservations at any time, so I checked back a few times after initially booking. If prices dropped, I’d cancel initial booking and rebook. I probably saved 40% on car/hotel with this strategy.

We hit up a Walmart in Calgary for corn nuts, sunflower seeds, and a few other odds and ends for lunch. I packed oatmeal on the airplane. We ate out for dinner. All-in food cost was probably a tiny bit north of $100.

$50 of gas at the Calgary Costco on our way back. $25 of airport parking back home.

Not too shabby. The cheapness of this trip, combined with the CC reward arbitrage, has motivated me to do a couples trip at least once every other year going forward. Life is too short not to not splurge a bit (die with zero), particularly if 95% is paid for by credit card shenanigans.

Totally agree with your “Life is too short not to splurge a bit.” Memories of special trips with my beloved late husband gave him great joy in his all too short life, and will continue to pay dividends in my own head and heart for the rest of my life.”

And …. can’t resist pointing out that the dividend stream from fond memories is tax-exempt, does not add to AGI/MAGI, a fact that would have tickled my late husband!

Dodecahedron,

Thanks for the words of wisdom! I appreciate the astute observation that the memory dividends are indeed tax-exempt!!!!

Love these updates! After seeing your photos, I’m definitely heading to Banff with my wife. Gorgeous.

Thank you for being so transparent with your investments, it’s a great benchmark for my own investing. I pretty much hold the same securities in roughly the same amounts as you, except all of my International allocation is in FZILX (because I’m a pathologically cheap).

My one big difference is that I’ve got about 20% of my portfolio resting in TIPS (FIPDX), mainly because I’m in my late 40s now and I’m following conventional allocation wisdom. I’m wondering if I’m being dumb, since interest rates can only go up from here. The average duration of FIPDX is about 6 years, so I’m a little worried that it’ll get hammered as soon as rates begin to inevitably rise.

Just curious – do you intend to stay 100% stock? Is there a projected age that you intend to move a portion to bonds, or are you waiting for rates to rise first?

We lucked out with weather. Late October in Banff could have definitely been disastrous. Luckily, it worked out great.

Another pathologically cheap person! You and I are kindred spirits. As of today, I don’t have access to FZILX in my workplace plans. However, that might change going forward so I might be joining you with 100% FZILX in my international holdings.

Given the inverse relationship between bonds and interest rates, I am not touching bonds with a 10 foot pole for the forseeable future. The yield of Vanguard’s Total US Bond Market fund is 1.5% as of today (avg duration 6.8 years).

I know stocks are risky, but owning a security yielding negative real presents its own kind of risk. As of today, I’m “betting” on stocks for the long-run.

I’m not sure how my views will evolve over time. Surely 100% stocks forever is unnecessarily reckless, particularly in the early stages of retirement when “sequence of return risk” is highest. BigERN has written much more extensively than me on the topic. Basically, he says 100% stocks until the beginning of retirement is not too crazy, then dial back stocks in the first several years of retirement, then scale up stocks slowly over time. At least that’s been my takeaway from reading his blog for years. That said, he’s way smarter than me so I cannot guarantee I’ve accurately synthetized his infinite posts on the topic.

I think there’s a false dichotomy between investing 100% in stocks and allocating some to AGG, which has a negative real yield. What about I bonds and STIP? What do you think of Campbell and Shiller’s research?

I don’t blame anyone for owning bonds.

Given current bond yields and the likely direction of interest rates, I personally don’t care to own bonds at the moment.

I agree that it needn’t be an all-or-nothing decision. But for me, 0% bonds is my current strategy.

Groceries maybe more expensive because of increasing inflation?

We spend an average of $1400/mo at Costco (food, staples like detergent, clothing, shoes, etc.). I’m not sure how we hit $2,100 this month, but it wasn’t pure inflation. It was likely due to us stocking up on clothing or detergent or something. My kids are growing up, but they didn’t increase their food consumption by 50% this month.

Or maybe it was bad accounting on my end. Not sure, but I’m optimistic it will return to the norm next month.

Did I miss it or have you not commented on crossing the 4% rule threshold? Seems like a big milestone. Congrats!

Thanks!

I don’t really believe in the 4% rule in today’s interest rate environment. Something like 3%-3.5% is probably a lot more prudent.

That said, the system of living below our means, investing in low-cost index funds, and enjoying the ride seems to be working reasonably well. I hope to continue for the foreseeable future. Life is good.

I enjoyed the pictures of Banff. I’ll have to get up there one of these days.

I’m a little mixed on the backdoor Roth news. Part of me was “well, I could shutdown the self-employed 401(k) and have a much simpler tax return”. But if it’s still in play, I’ll keep on keeping on.

It takes me about a minute or two to file the 8606 form each year with FreeTaxUSA for the backdoor Roth. I think it is time well spent.

I’ve never done a mega backdoor Roth, but I’m optimistic that it will be similarly easy to deal with.

Banff was great. It is located in a national park, but it is commercialized so you have all of the nice amenities.

How confident are you in FreeTaxUSA? I really struggled to find the correct checkbox to make a mega-back-door ROTH conversion not taxable on our 2020 taxes. Finally figured it out, but it was painful. Their ‘help’ topics were not especially helpful. But, like you know, the price is right.

I ask because this is our first year with household employees, so we have to complete Schedule H. I’d hate to increase the risk of an audit to save a few bucks on tax filing.

I’m 100% confident that reporting the conventional backdoor Roth is a breeze with FreeTaxUSA. I’ve done it annually for several years now.

Prior to your comment, I was rather confident that FreeTaxUSA would work just fine with a mega-backdroor Roth. However, your comment to the contrary is the first data point I’ve heard (in either direction), so my confidence in their ability do report the MBDR has been appropriately adjusted downward.

First step, I need to make the mega-backdoor Roth happen at my university (not an easy task). Second step, I need to figure out how to report it. Any suggestions/guides you can point me to, particularly with FreeTaxUSA?

I need to correct myself. I didn’t even use FreeTaxUSA last year. I believe it was because of my concerns with how it handled the MBDR. Maybe it can handle the MBDR, but I couldn’t figure it out.

I got MBDR to work on TaxAct. Sorry for the confusion.

All good.

If you haven’t seen the finance buff’s MBDR tax guides, they looks excellent:

https://thefinancebuff.com/mega-backdoor-roth-hr-block-tax-software.html

https://thefinancebuff.com/mega-backdoor-roth-freetaxusa.html

https://thefinancebuff.com/mega-backdoor-roth-in-turbotax.html

The finance buff is one of my favorite bloggers on the internet. I’ve learned so much from him.