Another month, another update. A few random comments.

Good Reads/Listens/Watches

- GoCurryCracker on Tax Loss Harvesting (link).

- I wrote a TLH article a few years back (link).

- Here are my takeaways from the GCC article:

- Due to wonky phase ins/outs of various credits (e.g. ACA subsidies), one’s marginal tax rate can be quite high. Therefore, the benefits deducting “only” $3k/year can be non-trivial.

- I still think TLH is mostly overrated, except for cases like GCC mentions (super high implied marginal tax rates due to phase ins/outs of various credits).

- Nonetheless, I’m still on track to realize ~$8k more of investment losses in the coming months, for a total of ~$12k during this bear market (4 years worth of TLH deductions).

- BoA is giving an extra 2% cash back on Nov 5 (BoA link, DoC discussion).

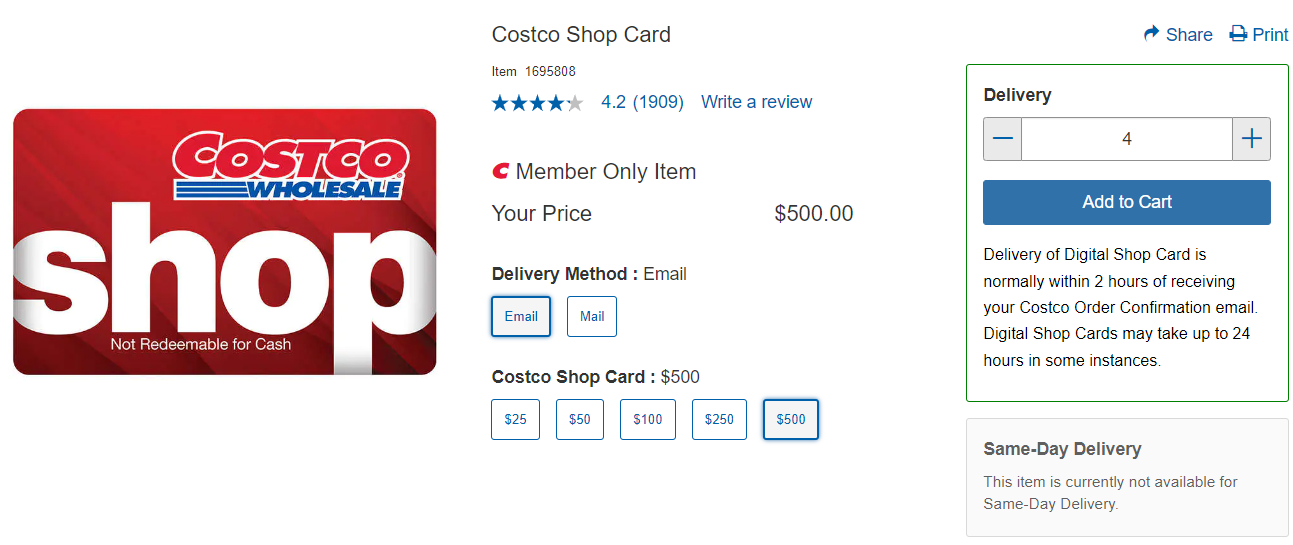

- I’m planning on buying $4-5k of of Costco eGift cards that day (across two different BoA CCs).

- I’ve bought tens of thousands of physical Costco GC’s over the past few years to get 5.25% cash back at BoA (2% executive stacks on top of that when swiped in store, excluding gas and food court transactions).

- The eGift card offering is brand new this month, with max purchase size of $500/eGift (or physical) card (though you can add multiple per order).

- The max purchase size of a physical gift card used to be $2k, but they reduced that recently as well.

- Here are the FAQ. Some noteworthy limitations of the eGift card:

- Costco Digital Shop Cards may be used to shop at any Costco location or online at Costco.com and Costco.ca. At this time, Digital Shop Cards cannot be redeemed at Self-Checkout, Food Court Kiosks or the Gas Stations.

- Can I transfer the balance of my Digital Shop Card to a physical Shop Card? Yes. You can take your Digital Shop Card to your local warehouse, where you can use it to purchase a physical Shop Card of the same value.

- So the above mitigates the limitation of the prior bullet.

- I did a $25 test eGift card transaction yesterday. Here’s what I learned:

- In my N=1 sample, It took 10 minutes from order placement to eGift card delivery.

- It took about 1 minute at the customer service desk to transfer the eGift card to a physical Costco Cash card.

- Combined, this would result in 9.25% cash back on eGift cards purchased on Nov 5:

- 5.25% base BoA rewards.

- 2% bonus BoA rewards.

- 2% executive when swiped in warehouse (excluding gas and food court).

- I should also try to pay utilities, etc. that day.

- I’m planning on buying $4-5k of of Costco eGift cards that day (across two different BoA CCs).

- Jason Gay, from the WSJ, on whether or not to become a “big candy” house on Halloween (link).

- I was very close to joining the “big candy” club this year, but I did the math. Big candy is 40% more per ounce than small candy at Costco (even considering the current $7/package “big candy” sale at Costco). Who would have thunk that?

- The logical solution: recreate the “big candy” effect more economically via multiple small candies. Win win, though admittedly multiple “small candies” are not as magical as a “big candy” score. +1 to the “big candy” camp.

- I was very close to joining the “big candy” club this year, but I did the math. Big candy is 40% more per ounce than small candy at Costco (even considering the current $7/package “big candy” sale at Costco). Who would have thunk that?

- I finished the first (and only) season of Welcome to Wrexam that I’d started last month. I really enjoyed it.

- I’ve dropped ~$10k below the $100k platinum honors status at Merrill Edge, so I’ll need to eventually replenish it with more funds to retain the status. Reader “FP2” left a detailed comment on this blog on how BoA handles this. I assume others would benefit from this thoughtful response as well (link).

Screenshot of BoA promo.

Screenshot of BoA promo.

It’s really happening. Digital Costco eGift cards are live.

It’s really happening. Digital Costco eGift cards are live.

Life

- Life was busy, as always, chasing our kids around the state.

- Both boys wrapped up flag football.

- FC1’s cross country team made it to the state meet. It was fun to cheer her on.

Fun with friends at a gym.

Our lackluster attempt at costumes this year, decided about 15 minutes before going out.

$5.99 Costco pumpkins, of course.

Candy histogram.

FC2’s stash. Not bad at all. Quite a few “big candies” in there, not to mention a Kirkland Signature microwave popcorn!

Cardboard heads at FC1’s cross country meet.

Cardboard heads at FC1’s cross country meet.

The cross country cheering squad.

Dubious double toilet at a restaurant we visited after the cross country meet.

This Month’s Finances

- The good:

- Still employed.

- The bad/abnormal:

- $395 airplane ticket for Mrs FP.

- $241 for a new router(s).

- Google is phasing out support for our perfectly functioning 6-year-old Asus Onhub router, which is a bummer. Nonetheless, I decided to go back to them again this time around. I bought a 4 pack at Costco for $450 (+ tax) to split with a friend. Despite purchasing 2, a single centrally located unit still works fine for our home.

- $194 for giant cardboard heads for the members of FC1’s varsity cross-country team. It was a fun splurge.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

That double toilet is hilarious!

It is terrifying!

In full disclosure, I didn’t see it personally. It was the women’s bathroom.

Thanks for the tip on the Costco digital gift cards! I also buy Costco shop cards using my BoA CCR card, but I was bummed that I couldn’t take advantage of the BoA extra 2% day, since the charge for physical shops cards always posts a week later.

Looks like I’ll be buying the digital gift cards this Saturday! I’m way too excited about this meager savings.

I’m glad I’m not the only one excited about this stuff. When I first learned about this promo, I shared your apprehensive about being able to perfectly time the physical GC timing.

These shenanigans add up for us. By buying Costco gift cards, we pocket an extra $350/year ($20k * 1.75%). This promo alone will net an extra ~$100. Not too shabby at all.

I was at Costco today and their self-serve kiosks were accepting the digital GC directly, which contradicts what they publish in their FAQ. Weird.