Giant Disclaimer

While I pretend to vaguely understand some aspects of frugality and the US tax code, I don’t pretend to be an investing guru. In fact, I’m pretty ignorant on the topic. So please take this post with a gain of salt.

Introduction

I’ve given some thought recently on the role of international holdings in my portfolio.

To date, I’ve held international funds in my portfolio for a few reasons:

- Diversification:

- Owning more firms can’t hurt, right?

- Vanguard’s total international index fund holds 7,420 stocks (link).

- Having exposures to more currencies can’t hurt, right?

- If the dollar weakens relative to other currencies, then owning foreign businesses could help offset the weakening of the dollar. This would help to increase the returns of a US investor in the event of a weakening dollar.

- This, of course, comes at a cost. If the dollar strengthens relative to other currencies, then holding foreign firms would reduce one’s investing returns.

- If the dollar weakens relative to other currencies, then owning foreign businesses could help offset the weakening of the dollar. This would help to increase the returns of a US investor in the event of a weakening dollar.

- If stock returns across countries are weekly correlated, then holding a mix of US + international stocks would serve to lower the volatility of ones portfolio.

- Owning more firms can’t hurt, right?

- Everyone else seems to be doing it:

- (Admittedly not the greatest of excuses….)

- For example., the equity component of Vanguard target date funds is split 60% domestic / 40% international.

- It seems arrogant to think I’m smarter than Vanguard.

- Today, international valuations are relatively attractive:

- International funds have a P/E ratio of 19.4 (link).

- The corresponding E/P ratio is 5.2%.

- Domestic funds have a P/E ratio of 28.1 (link).

- The corresponding E/P ratio is 3.6%.

- However, there are rational reasons for these ratios to vary across countries. It’s sensible for the P/E ratios in more stable countries to be higher than the P/E ratios in less stable countries.

- International funds have a P/E ratio of 19.4 (link).

- Corporate tax diversification:

- It seems to me that US stock returns are heavily dependent on corporate tax policy.

- If US corporate taxes are low (as they are now), this is good for investors in US firms as lower taxes result in higher net income. However, if future US corporate tax policy changes, this could adversely affect all firms in a domestic equity portfolio. This common factor to a single potential shock has me a little unsettled.

- By holding international stocks, an investor can mitigate this risk.

- I haven’t really heard of anyone else using the above as justification for holding international stocks, but it seems sensible to me. The US tax code one of the primary things all US firms have in common.

- If US corporate taxes are low (as they are now), this is good for investors in US firms as lower taxes result in higher net income. However, if future US corporate tax policy changes, this could adversely affect all firms in a domestic equity portfolio. This common factor to a single potential shock has me a little unsettled.

- It seems to me that US stock returns are heavily dependent on corporate tax policy.

However, I’ve recently questioned the wisdom of holding international stocks:

- Bogle & Buffett, both of whom I admire a lot, aren’t terribly keen on foreign stocks.

- Their basic argument is that many US firms are “multinationals”, meaning that they have significant revenues abroad. Consequently, you already own plenty of international diversification when you buy an S&P 500 or total domestic stock index fund.

- Further, they also seem skeptical of shareholder protection & government stability in other nations.

- Other nations, for example, might have less stable governments in which unscrupulous leaders baselessly deny election results and incite violent coups. This could never happen in the US…..

- Aswath Damodaran feels similarly (link).

- International funds have underperformed domestic funds by a wide margin.

- Over the past 10Y, here are the returns:

- Since 1996 (24.75Y), the (geometric) average returns are as follows (per my calcs):

- Domestic: 9.2%

- International: 5.3%

- Since past performance is the best indicator of future performance, we should expect domestic equities to outperform international equities by 3.9%/year forever. Common sense tells us that we should sell low (international) and buy high (domestic).

- That was blatant sarcasm. Admittedly, it was not the best of deliveries.

Relevant Screenshots

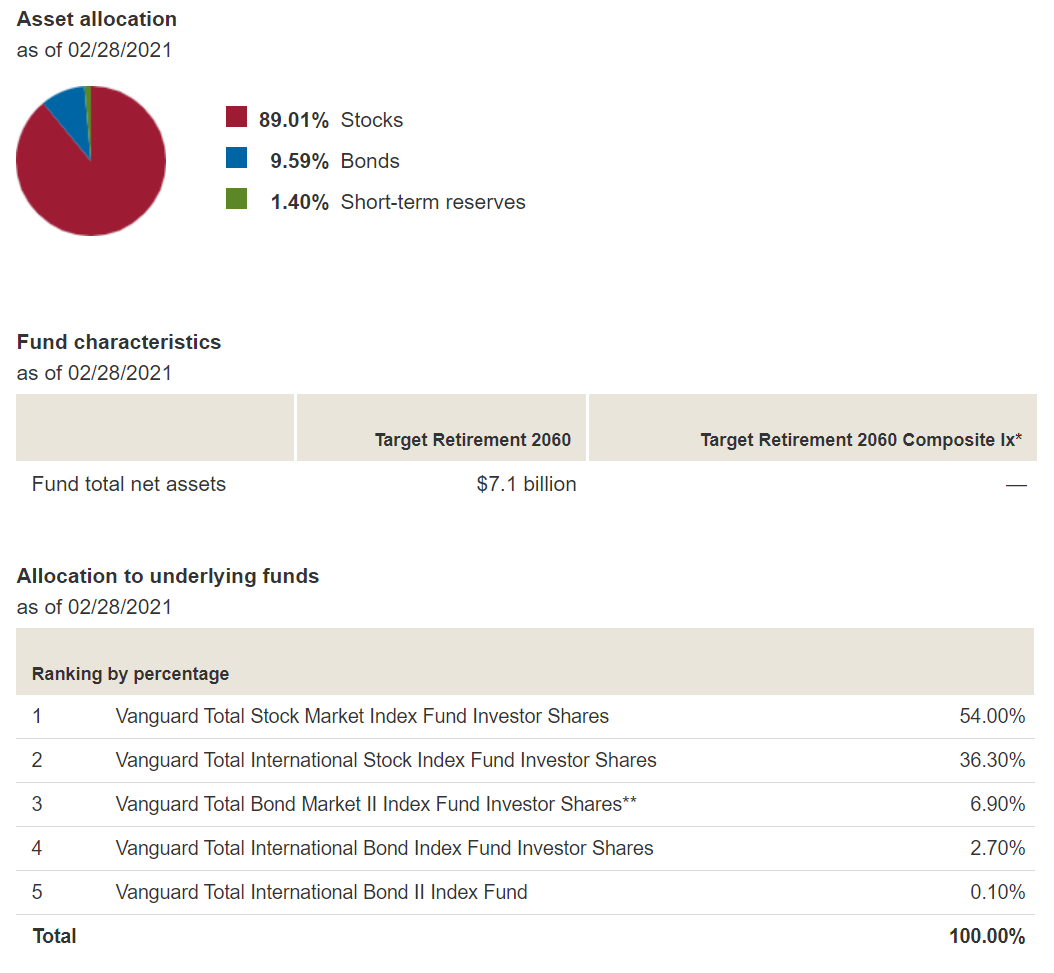

Here’s how Vanguard’s 2060 target retirement fund is allocated. There is a 60%/40% domestic/international split. International equity = (36.3%/(54%+36.3%)).

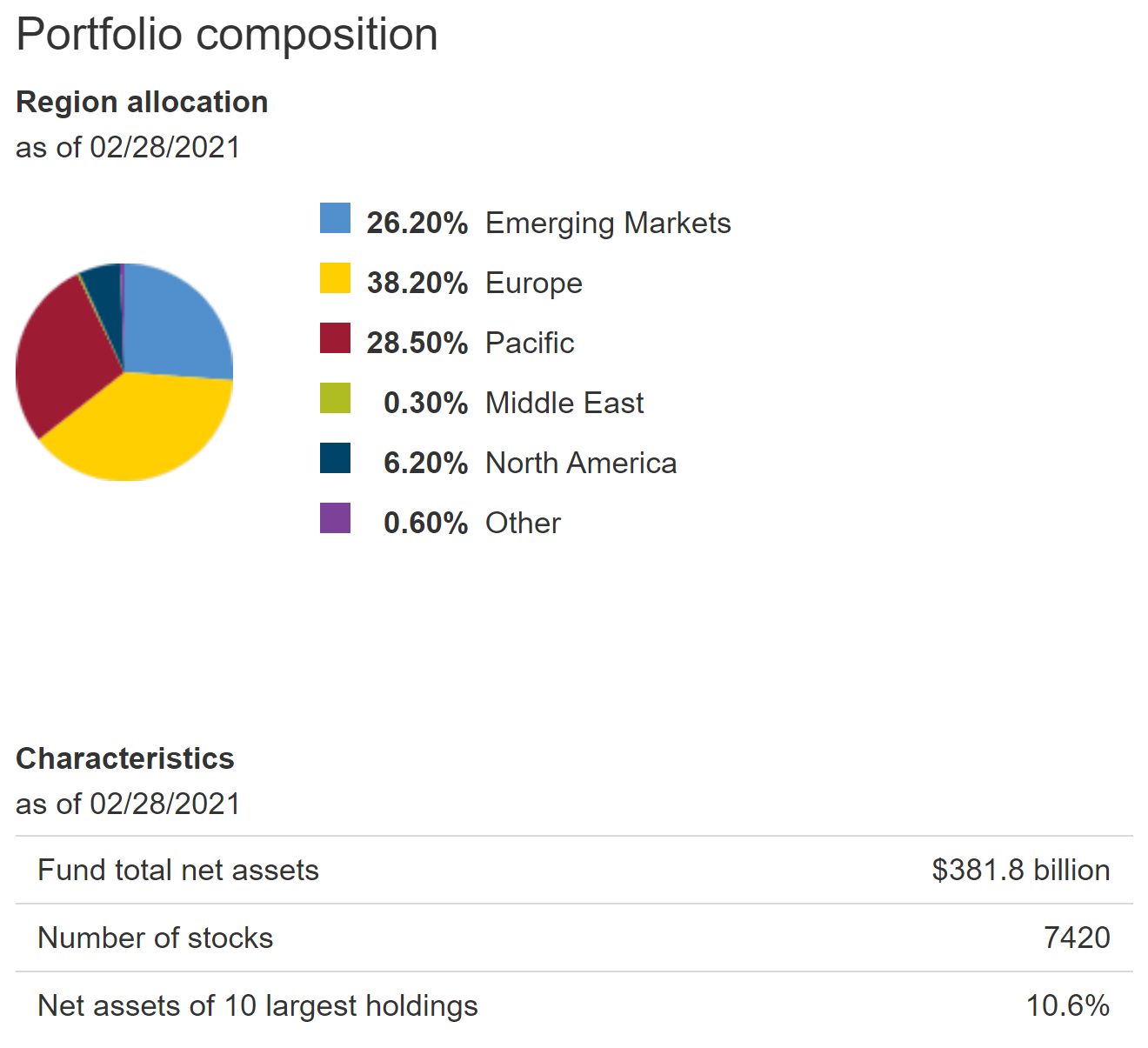

Here’s what you get when you buy Vanguard’s total international stock market index.

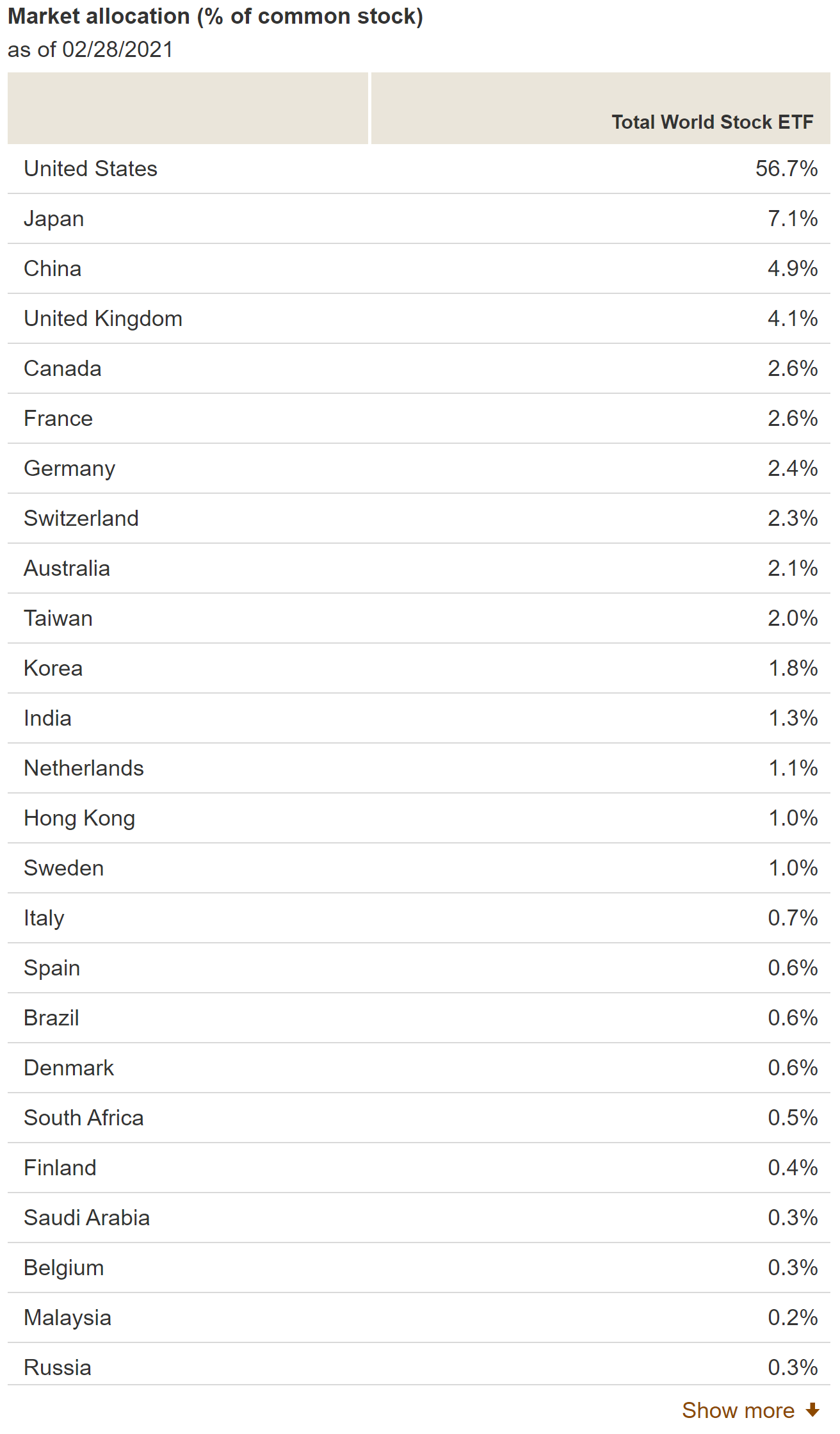

Here’s how the Vanguard total world fund is market-cap weighted across countries. The above implies that a portfolio of 56.7% domestic and 43.3% international would be free of any “home (country) bias.”

In-Class Activity

This past week in my intro to finance course, we discussed risk vs returns. It’s a fun topic to teach because we talk about:

- The benefits of diversification

- The efficient frontier

- Sharpe ratio (= excess return / volatility).

- Excess return is defined as the return in excess of the risk free rate.

During an in-class activity, I had my students play around with some data. Specifically, we played around with monthly returns for Vanguard’s total domestic & international funds from June 1996 to Feb 2021. I hadn’t personally played around with the data before, and I found the exercise to be pretty fascinating.

You can download my sheet here if you want to play around with it (link).

Plotting Monthly International (y-axis) vs Domestic (x-axis) Returns

For most of the analysis, I did it in three parts:

- Full sample (June 1996 – Feb 2021)

- First half (June 1996 – Sept 2008)

- Second half (Oct 2008 – Feb 2021).

What really stood out to me is the incredibly strong correlation between domestic and international stocks. I understood this to be true before playing around with the data, but I was pretty surprised by the analysis.

The correlation between domestic and international returns seems to be increasing over time, manifested by higher R^2 (78%) in the second half of the sample than the first (71%). This tightening of correlations makes a lot of sense. The world is becoming more interconnected. As multinationals increase their reach, it makes sense for domestic and international equities to be so highly correlated. This is the main Buffet/Bogle argument. They claim you get sufficient international diversification by holding only US firms.

Whole sample. Y axis is international returns. X axis is domestic returns.

Whole sample. Y axis is international returns. X axis is domestic returns.

Most recent half of sample. Y axis is international returns. X axis is domestic returns.

Older half of sample. Y axis is international returns. X axis is domestic returns.

Plotting the “Efficient Frontier”

We talked in class about the “efficient frontier.” I thought it would be fun to map out the risk vs return tradeoff for an investor who only invests in two assets: a total international and total domestic equity index fund. Here’s the analysis:

Here’s what the “efficient frontier” looks like for those two asset classes over the whole sample period. The bottom point is 100% international equities. Each point between these extremes is 10% more/less international equities. From June 1996-Feb 2021, holding between 20%-30% in international equity fund would have minimized one’s portfolio volatility over this time period. However, the objective of an investor is obviously not to minimize their volatility, but rather to maximize their excess returns / volatility (the Sharpe Ratio). When we zoom out the above chart, the next chart is produced. I’m simply changing the range of the X axis.

In this zoomed out chart, we clearly see that 20%-30% international allocations don’t maximize the Sharpe Ratio over the past 12.5 years. The 100% domestic fund obviously does that over this sample period. It’s the highest point on that chart. Return differential aside, what’s particularly striking to me in this chart is the fact that holding international stocks in one’s portfolio didn’t significantly reduce the portfolio’s volatility. This makes sense given the extremely high correlations we saw in the scatterplots above.

In this zoomed out chart, we clearly see that 20%-30% international allocations don’t maximize the Sharpe Ratio over the past 12.5 years. The 100% domestic fund obviously does that over this sample period. It’s the highest point on that chart. Return differential aside, what’s particularly striking to me in this chart is the fact that holding international stocks in one’s portfolio didn’t significantly reduce the portfolio’s volatility. This makes sense given the extremely high correlations we saw in the scatterplots above.

Here’s what the chart looks like for the most recent half of the sample. The bottom point is 100% international equities. Each point between these extremes is 10% more/less international equities.

Here’s what the chart looks like for the earlier half of the sample. The top point is 100% domestic equities. The bottom point is 100% international equities. Each point between these extremes is 10% more/less international equities.

Wrapping it up

While interesting, these backwards-looking efficient frontiers and scatterplots are not particularly informative to us in how to allocate going forward. Rather, they tell us how we should have optimally invested in the past. Armed with these plots and a time machine, I certainly would have made some different investing decisions in the past.

Nonetheless, I think the analysis is thought provoking. If nothing else, I hope to have convinced you that the diversification benefit (in terms of volatility reduction) from holding international stocks is small and getting smaller in an increasingly interconnected world.

Despite this, I still think you can rationally justify holding anywhere between 0% – 43.3% of international equity holdings going forward. If only we had a crystal ball to see which asset classes would outperform going forward….

Reader poll

What is your international / domestic split? Why?

Interesting analysis, and good to know as I have for while bought into the notion that international diversity can be achieved simply by owning domestic stocks. I am 100% in domestic stocks (VTI) for the reasons stated above.

Your approach & justification seems reasonable enough to me. Bogle & Buffett certainly agree.

100% S&P 500. Two reasons: simplicity and sufficiently diverse. I like keeping my portfolio simple and as hands-off as possible. A ham sandwich could manage my portfolio and still get the same long term market returns that are beating hedge funds and other professional money managers. When I pass away, I would like my portfolio to be simple enough that my heirs will not need to worry about managing the investments. Another point about simplicity is, as Bogle argued, why try to beat the market when you can just own the same market index against which everyone else measures their performance (e.g. Buffett’s annual shareholders letter shows annual returns of BRK compared to the S&P 500). With respect to sufficiently diverse, you stated the same argument above used by Buffett and Bogle that US firms already derive a growing percentage of international revenues to allow for diversification. There is no need to chase diversity when the S&P 500 increases its international diversity over time. Besides, no other international market can compare to the US market in terms of legal protections, regulations, market system, ease of access, and free exchange of information.

“Why try to beat the market” is an interesting statement. Which market? US or global? That’s the point of this post.

You are claiming that many use the domestic benchmark. That’s reasonable. I also think the global market is a reasonable benchmark.

I admire your desire to simplify. However, owning 2 tickers isn’t significantly more difficult/complex than owning one.

I agree with your legal protection argument. However, wouldn’t the lack of protections elsewhere depress prices and thus increase expected returns?

It’s all interesting stuff to think about. Hence the introspection over the past month. I certainly don’t claim to have all of the answers, but there is a lot to like about your approach. Especially the last 25Y of outperformance.

I’m 80/ 20 – for diversification. Didn’t the US under perform significantly 2000 – 2010?

The 2000-2010 period is certainly spanned by the data in my charts & Excel file. I didn’t test that subperiod specifically but it would be easy to verify.

With certainty, there will be periods of time where international outperforms domestic and vice versa.

Except China, it seems like in most of the countries, US companies are doing good business. US companies are acquiring good local companies left and right. So it seems that holding SP500 gives good exposure to international economies too. I have some international equities in my portfolio; I will hold on to them but I am not adding more.

Thanks for sharing your thoughts!

About 7 years ago, thinking international stock were undervalued relative to domestic stocks, I ramped up international holdings by contributing 100% of my 401k to international holdings and buying individuals ETFs/Stocks. Regression to the mean over time right? My target allocation was 30% international, with around 20% of the international holdings in emerging markets (Korea, Latin America, etc.) and the rest in developed (Europe, Japan). Needless to say, those contributions underperformed relative to domestic holdings. At the time, I was targeting 95% equities and 5% cash/bonds. I’ve read/observed similar conclusions to what you cite in this article and am now moving back to a 20% international holding mix mostly via future investments/contributions. I care more about volatility since I’m pretty close to calling it quits with work. I’m currently 17%/23%/60% bonds+cash/international/domestic. Bonds are ultra short term and municipal. If there’s big dip in the market, I plan to increase my equity position but move towards 20/80 international/domestic.

Thanks for sharing. It’s nice to understand what others are doing and why.

Phillip,

Thanks for sharing. Your strategy sounds reasonable to me. I too, find it interesting to see what others are doing and why.

If only that reversion to the mean would come…..

https://money.usnews.com/investing/stock-market-news/articles/japanese-stocks-that-warren-buffett-just-bought

Thanks!

Most of the biggest companies are global. So my thought process is to hold those biggest businesses without missing out on their growth prospects. Think of Nestle, Diageo, Samsung etc. They probably do most of their business in US. 30% of my equity is international. Just a number I am comfortable with.

Thanks for sharing your thoughts!

I’m 50-50. Because of the big difference in valuation, I feel like its a toss-up which is the better bet moving forward.

Thanks for sharing.

Many Bogleheads simply buy the total world index: https://investor.vanguard.com/mutual-funds/profile/vtwax. Its weighting is pretty close to 50/50 currently.

I’m 55/45 US-vs-Intl. The book Factfulness suggests that over the next century that population dynamics will see a shift of the global economy from Atlantic-centered (i.e. US/Europe strong) to being centered in the Indian Ocean (i.e. Africa/Asia). I suspect that US multinationals could face future headwinds that we didn’t see in the past.

Thanks for sharing! I think this is a sensible approach and justification. It seems you could accomplish this allocation using something like this: https://investor.vanguard.com/mutual-funds/profile/VTWAX. That’s be a pretty simple one-fund portfolio.

https://youtu.be/ZJzu_xItNkY

I guess this sums up all of us reading this blog…we know absolutely nothing. Hard pill to swallow but completely true!

Thanks for sharing!

In the context of professional money managers, I would agree that there are strong incentives not to diversify.

In the context of you and I, we have a big incentive to diversify. Buffett certainly advocates the passive index approach for us mere mortals.

But I agree. We don’t know nuttin’

As someone with a professional interest in tax policy, I have thought for years that diversification against adverse changes in domestic corporate tax policy was a good reason for holding some international.

Also since I am at stage of life where inflation protection is a primary reason for holding any equities at all, it seems prudent to have some international holdings in my equity allocation since adverse currency moves against the dollar could contribute to inflation.

On the other hand, I do find Bogle’s arguments that US stocks have better investor protections, transparency, etc. persuasively appealing.

So I follow his suggestion of holding *at most* 20% of equities in international.

Thanks for sharing your thoughts! Glad I’m not the only one who is hedging against unfavorable changes to US tax policy.

I agree that a good reason to hold stocks is to hedge against inflation risk. That’s one of the reasons I hold them as well.

Thanks for sharing the Bogle quote / rule of thumb. With the benefit of hindsight, his advice seems even wiser now.

My equity allocation is 70/30 domestic/international. I don’t have a good reason beyond what’s already been mentioned and copying Vanguard Target Date and the TSP Lifecycle Funds. It has been a bit painful waiting for that reversion to the mean. You’re not alone.

Glad I’m not the only one in agony about the persistent underperformance of international.

It’s always a lot easier to invest looking back than going forward…..

Do you think it’s short sighted to look at only the past 25 years? If you looked back longer aren’t international returns more similar to domestic returns?

I tried doing a similar analysis looking at several different allocations including subdividing more, but it was hard to find data before the 90s and I felt like my analysis was skewed by the fact that this was a period where large US companies dominated (which, if anything, means they could underperform in the future).

Agreed it’s myopic, but the recent data was easily downloadable in Yahoo finance for my in-class excel stuff.

The data in these articles span a longer time period:

* https://www.morningstar.com/articles/954560/revisiting-the-case-for-international

* https://www.vanguard.com/pdf/ISGGEB.pdf

What’s your international allocation? Why?