I bought our house a little over 4 years ago. At the time of purchase, we got a 15Y loan with a 2.875% interest rate. Given how low the rate was, I didn’t think that refinancing a mortgage refinancing was going to be viable.

I was mistaken.

There are several great Bogleheads threads on the topic (link1, link2) in which people are sharing their rates and experiences with different lenders. Suffice it to say, now is a great time to refinance for two reasons:

- Mortgage rates are at historic lows (15y, 30y).

- Importantly, Fannie & Freddie are going to implement a 0.5% “Adverse Market Refinance Fee” on refinances beginning December 1 in response to credit risk surrounding Covid-19 (link). Given that it takes 4-8 weeks to close a refinance, this means the process must be initiated soon to meet that cutoff and avoid the 0.5% fee.

- To put this fee into context, a 0.5% fee on a $250k loan balance = $1,250 in extra closing fees on Dec 1 relative to Nov 30 — a pretty stark difference.

Due to the glowing reviews of LenderFI on the Bogleheads forum, I gave them a try. Here was my experience:

- You can play around with their rates after filling out 30 seconds of info (no social / credit check).

- I had questions about waiving escrow + appraisal and called their customer service but they didn’t answer or return my calls until I submitted a formal application.

- I found their rates to be competitive, so I did a submitted application on 9/11 (and unfroze my credit at all three bureaus to do so).

- I was instantly conditionally approved.

- I called my assigned loan officer to inquire about waiving escrow + appraisal (I have a 50% LTV). He confirmed this was viable.

- My loan officer gave me closing costs over the phone that were about $1k less than what was approved on my online account. I’ve heard other Bogleheads confirm the same.

- The rates were similar for a 10Y vs 15Y, so the 15Y seemed like a no-brainer.

- Here were my quoted closing costs for a 15Y refi:

- 2.5%; $0 total closing costs ($1,100 lender credit offsets $1,100 third-party closing costs)

- 2.25%; $1,100 total closing costs ($0 lender fee + $1,100 third-party closing costs)

- 2.0%; $3,800 total closing costs ($2,700 lender fee + $1,100 third-party closing costs)

- 1.75%; $6,000 total closing costs ($4,900 lender fee + $1,100 third-party closing costs)

I opted for the 2.25% 15Y refi with $0 lender fees + $1,100 third-party closing costs. I locked in the rate over the phone and DocuSigned some paperwork to make it official. I am in the process of uploading paystubs, etc. right now. I hope the remainder of the process is as seamless as the initial application was.

I’m going to contact a few more lenders to see if they can beat my current offer. If so, great. If not, then I’m a happy camper anyway.

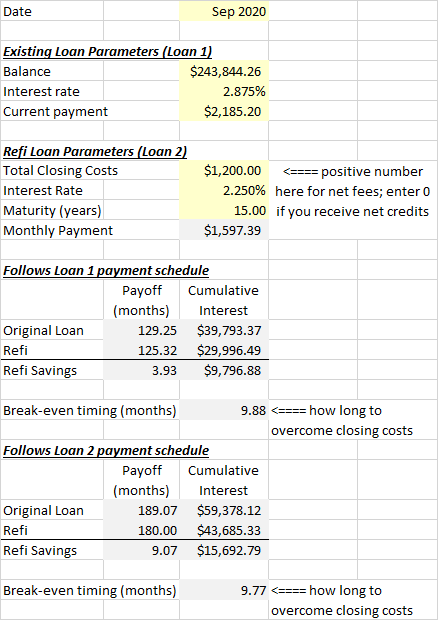

Since this is my first refinance ever, I was pretty ignorant to how the math worked. Naturally, I built a spreadsheet to assess my options and teach myself how it works.

You can download the model here (link).

Model notes:

- Assumptions:

- Any closing are subtracted from the original loan balance today to make an apples-to-apples comparison of what the original loan would look like if those closing costs were simply used to prepay the original mortgage.

- I didn’t make my model smart enough to handle net lender credits, so if that’s the case with your situation simply put $0 for closing costs (cell D10) and it’ll be close enough.

- Input Parameters:

- Yellow highlighted cells.

- Pretty simple and self explanatory.

- Output:

- Grey highlighted cells.

- I model two different scenarios:

- Original vs Refi that follows the original loan maturity (in my case 11Y left on a 15Y mortgage)

- I apply the original interest rate to the original trace and the refi interest rate to the refi trace.

- Original vs Refi that follows the new loan maturity (in my case 15Y mortgage)

- I apply the original interest rate to the original trace and the refi interest rate to the refi trace.

- Original vs Refi that follows the original loan maturity (in my case 11Y left on a 15Y mortgage)

- Break-even timing (in months)

- This calculates how long it takes for the monthly interest savings to cover the fixed costs of refinancing.

- Payoff timing (in months)

- This calculates how long it will take for the loan to be repaid in full under each scenario.

- Cumulative interest

- Calculates how much interest will be paid over the remaining life of the loan in each scenario.

Model inputs in yellow. Model outputs in grey.

Model inputs in yellow. Model outputs in grey.

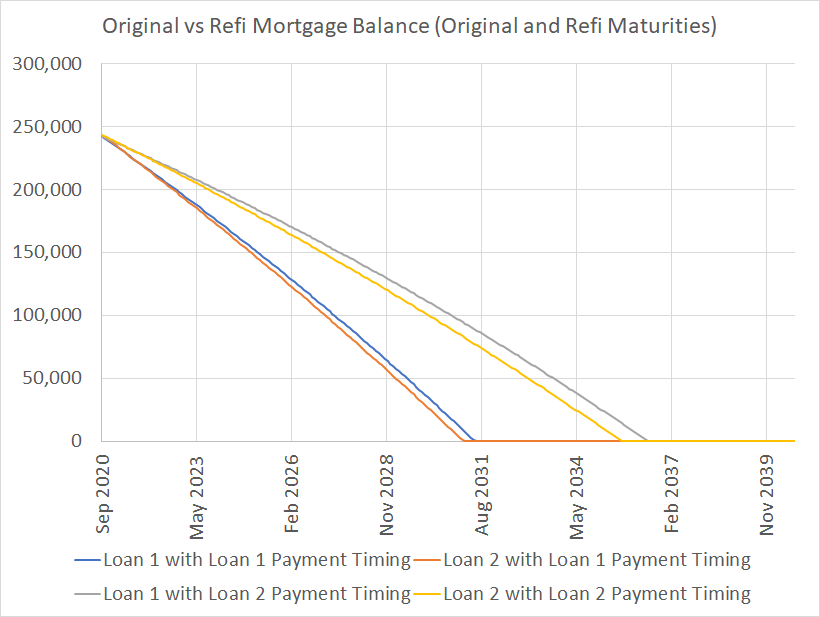

The blue and red traces keep the original payment amount ($2,185.20). The yellow and grey traces show the new payment amount ($1,597.39). I prepay the existing loan by the amount of the closing costs to make it an apples-to-apples comparison.

The blue and red traces keep the original payment amount ($2,185.20). The yellow and grey traces show the new payment amount ($1,597.39). I prepay the existing loan by the amount of the closing costs to make it an apples-to-apples comparison.

Happy refinancing…?

Edit 9/14/20

I’ve shopped the refi a few more places (LoanDepot, Better) and both have beaten the initial LenderFI loan estimate. With Better, I’ll be refinancing at 2.25% for 15Y with no closing costs (technically I’m walking away with $427).

The sequencing of loan estimates seems to matter a lot. From my experience, it seems that going to Better last is optimal because they beat the competing loan estimates by $100 even including a $550 appraisal, which was subsequently waived, meaning they actually beat the next best offer by $650. I write about this strategy here.

Edit 10/7/20

I wrote a formal review of Better.com here.

You are omitting the cost of your time in messing around with all of this. We refinanced several times back in the late 1980s and 1990s, when interest rates were dropping like a rock.

And there was less paperwork hassle then than today. None of this stuff like uploading paystubs, etc. There is a ton of fine print you need to be reading about subtle gotcha clauses. We always opted for the zero closing costs options, because we suspected (correctly) that we would be rinsing and repeating. Which we did.

If everybody and his brother decides to refinance *right now* to beat the new 50 bp fee going into effect Dec 1, there could be backups and bottlenecks from the title search vendor or some other necessary paperwork step. Delays in closings at crunch times are very common.

All this stress, time and energy for a ~10 year breakeven? Seems crazy to me. Have you considered the possibility that unpredictable life events (higher ed is a crazy business right now, online provision may become more and more dominant, etc.) that might make you want to move well before then.

A side-hustle (perhaps consulting job that also adds to your human capital?) seems like a more productive use of your time. Use the money from the side-hustle to pay down your mortgage faster.

Oops–speaking needing to read the fine print. I just realized your breakeven is ~10 months, not years! In that case, it *might* be worth doing.

This is my first rodeo, so perhaps I’ll be more sympathetic towards your waste-of-time argument once this thing closes.

My analysis concludes that I break even from the fixed expenses at 10 months and save about $10k-$15k in interest over the life of the loan depending on what payment schedule I follow (11Y vs 15Y). Seems like a decent return on invested time (a few hours?).

Regarding side hussles, I’m not sure how I’d pursue that but perhaps ought to think more seriously about it. More broadly, I’m genuinely interested in coming up with financial solutions that apply not just to me, but for any person with a mortgage that is considering refinancing. It takes 20 minutes to write a blog post once a model is built, so it seems like a decent investment to share knowledge with the masses (or more accurately, the 5 followers of this blog). Or maybe I’m full of myself.

Now that the caffeine has hit my bloodstream, I agree this is a good use of your time, both personally and from a social welfare point of view, since you will be learning something from the process and sharing with others. (Positive externalities for the win!)

Back when we bought our first home (early 1980s), prevailing rates on 30-year fixed rate mortgages were insane (18% plus a point) but teaser-rate one-year ARMs (some with negative amortization were all the rage.) You really had to read the fine print. We were sophisticated (two econ PhDs) and we did read the fine print. It was the Wild West. There were good deals to be had if you knew what you were doing, especially if you knew you were likely to be living elsewhere in a few years or if the seller had an assumable mortgage (which many did back then.)

My lifetime has been Alice-in-Wonderland as far as mortgage rates (or interest rates more generally) go. I never dreamed I would see interest rates like these in my lifetime. My parents’ mortgage on their first home back in the 1950s was a VA GI Bill deal for 4% thirty year fixed. As mortgage rates took off in the 70s (when I was in college & grad school) and early 80s (when we were in market for our first home), it was inconceivable that they could go this low. (Or that a former student I taught back then would become prominent for his early advocacy that negative interest rates should be taken seriously.)

https://blog.supplysideliberal.com/post/140196195627/negative-interest-rate-policy-as-conventional

http://www.freddiemac.com/pmms/pmms30.htm

The history of mortgage interest rates that you’ve observed is indeed incredible. I vaguely recall my parents trying to buy their first home in the early 80’s and seeing rates similar to what you are describing – 15% or so.

Thanks for sending the Miles Kimball blog link! I haven’t read too much of his stuff but he’s obviously brilliant and fun to read.

Just curious, but why did you choose to refinance versus paying off your mortgage in cash? My husband and I are looking to own a home next summer and am curious to know your thoughts. PS: I love your blog! I have learned so much and only wish I knew this stuff in college.

At any given time, I have about $1k in cash, so I’m not currently in the position to pay off a mortgage early from a cash standpoint.

I could, however, liquidate my taxable brokerage account and pay off the mortgage. The downside of this approach is that I’d incur non-trivial capital gains taxes through selling appreciated securities (index funds).

On the other hand, I could divert future investments to paying off the mortgage. At that point, it becomes a math problem. Do I think that my investments will beat 2.25%? Despite the really high valuation level of stocks, I’m of the opinion that over the next several decades that stocks will return at least 3% or so, meaning that I’ll still come out ahead on an after-tax basis. Admittedly this is a riskier strategy but one that I’m comfortable taking.

There is a lot to be said for just paying off the mortgage much sooner rather than later at your stage of life. College financial aid formulas treat home equity far more favorable than other types of assets. With as many children as you have, this is a non-negligible consideration even at your income level.

I appreciate the feedback!!!! This is definitely something to seriously consider….

Are you going to invest the proceeds? With what asset allocation?

It’s not a cash-out refi, so there are no proceeds if that’s what you’re asking.

My AA (100% equities) is not changing as a result of refinancing to a lower interest rate.

I’ve worked for this company and they treat their employees horribly. Hopefully a competing offer will win your business. Have you tried Costco?

Sorry to hear about the crummy work environment. For what it’s worth, another lender beat their offer today so it looks like I won’t be utilizing them.

I briefly tried Costco’s tool but it didn’t seem terribly competitive. Perhaps I’ll give it another try.

If I hadn’t already refinanced in March, I might be interested. Reduced my 30 year to 3% at the time. Rates are even better, but probably not going to do a refinance again. Doesn’t stop me from window shopping, though. LenderFI couldn’t find any options for me, which was a little weird.

Glad to hear that you got a good rate in March. I’m new to this game, but it’s pretty fun.

LoanDepot ended up beating the LenderFI offer once I showed them the initial loan estimate. It’s a silly game we’re playing, not unlike buying a vehicle from a dealer. Lots of haggling, it seems….

I think you’re my financial doppelganger. On 9/11 I locked in 2.375 on my mortgage that was at 2.875. Closing costs are less than $500. never understood why people think it takes so much time to refinance their mortgage. I collected all my documents in 10 minutes and secure sent them to the processor. 10 minutes and a half hour meeting is not a lot of time. The appraisal was electronic so all I have to do now is sign some paperwork in a month or so. I did it primarily to lower my cash flow, and also save on rate. Having a lower payment saves me a lot of money to put into retirement accounts and HSAs to lower my income enough to maximize the earned income tax credit! We are a one-part time income family right now while raising our children so understanding taxes is paramount. It was all planned this way.

Hello my financial doppelganger!!!!

Thanks for sharing your refi experience. This is my first rodeo, so I’m flying blind. So far, it’s been really simple as you mentioned.

Lowering payments to maximize retirement contributions to minimize AGI to maximize the EITC sounds like a brilliant strategy. I should reach out via email to better understand your life strategy. It sounds really compelling!

Sure, shoot me an email, I’d love to chat! I considered myself FI 4 years ago at 39. I am a hardcore optimizer in almost all aspects, just like you. Love traveling and hiking/backpacking and have been to all 50 states. My mortgage that I am refinancing should not have a whole lot of games as it was an advertised rate at a credit union and I am at around 20% LTV.

Thanks for sharing the excel sheet. I live in Illinois and for some reason I am not able to find better than my current 3.25%, 30 year loan. About 200K balance left.

Happy to share the sheet. Hopefully you found it helpful.

I had luck with LoanDepot as well. If you read the Bogleheads thread I linked to, you’ll see that people are having good luck with dozens of lenders. LenderFI is one of the ones that was most commonly referenced, though.

I tried LenderFi and Better so far. LenderFi is showing me 3% for 30 years loan and 2.5% for 15 years loan plus closing costs. Better is worse and agent told me that this is due to my low balance. I haven’t heard from LoanDepot yet, but started getting calls from scammers! Hopefully this is just a coincidence. Does LoanDepot just connects agents with customers and does not process applications? How do you send your documents? I will be hesitant to email the documents.

I’m sorry about the calls from spammers! For what it’s worth, I haven’t gotten any spam calls so I’m hoping it’s just a coincidence.

I’ve been reaching out to LenderFI, Better, and LoanCabin. Initially Better was the least competitive, but they quickly became most competitive after showing competing Loan Estimates. What a weird game this is turning out to be…… They have me at a 15Y 2.25% refi at about $300 of total closing costs now, beating out the others by over $500 (this was helped by the waiving of the appraisal).

Hello Professor,

I very much enjoy your blog, thank you! It’s validating to find other people who obsesses over the minutiae of personal finance. I use your blog as substantiation to my wife that I’m not the only financial compulsive in the world.

I also have tremendous respect for academics, so I’ve been following Professor Jack Guttentag’s site called the Mortgage Professor. If you’re not familiar with him, he teaches at Wharton and has established a site with an excellent online calculator and vetted lenders here: https://www.mtgprofessor.com/steps/listofsteps.html?s=1000&a=5

Plugging my current mortgage information in popped out three different lenders – all with extremely competitive rates, both 15 and 30 year.

I just refinance my 4% 30-year to a 2.5% 30-year with zero fees, waived appraisal, and $1790 of lender discounts. It will be zero out of pocket at closing time and the whole process was pretty painless.

Just curious – regarding your comments on the “math problem”…ie paying off mortgage vs refinancing. With 30-yr rates at 2.5%, why did you not go with the longer term? I understand that you’d pay more in overall interest at 30 years, but if you were disciplined about investing the cash flow difference between the 15-yr and 30-yr term, wouldn’t you come out way ahead (assuming a reasonable market return of 4%, even accounting for inflation)? Would love to know your thoughts – feeling a little guilty about going for the 30yr.

Keep up the great blog!

Rick,

Your comment made me chuckle. I’m happy I can fulfill the role of “proof-of-existence-of-other-money-weirdos” to your wife. When I discovered this community online during my phd (mainly earlyretirmentextreme and mrmoneymustache), the most rewarding part for me was recognizing that there were other people in the world with brains wired like mine. I don’t think I’ve learned anything from either of their blogs, but my mind was blown that I was not alone in the world.

Thanks for the recommendation on the Mtg Professor’s website. I think I’ve been there before and he indeed has great advice. Unfortunately for me, when I fill out my info at the link you provided there aren’t any matching lenders that pop up. Perhaps my mortgage balance is too low?

Thanks to the negotiations the last few days, I too will be closing with net zero closing costs (or even ~$300 net credits with Better).

Since buying my home 4.3 years ago, I’ve been reasonably happy with the 15Y mortgage; it seems like a nice compromise between paying down a mortgage soon – but not too soon. I wouldn’t mind it disappearing, but I also don’t mind borrowing at 2.25% — an insanely low interest rate. But I’m sympathetic towards your argument to lengthen the maturity of the mortgage to 30Y, especially when it can be done at 2.5%. That frees up significant cash flow to throw at investments, helping to minimize “sequence of returns” risk.

Professor,

In regards to Better.com, which fees were you able to get them to reduce (or waive) in the loan estimate under “Services You Can Shop For”? Is is standard for them to beat the competition by $100?

I think they beat the competion by $100 when adding A + B + C + E.

I don’t think E varies across lenders, so the action is in A + B + C. For my quote, A + B + C with Better was $100 cheaper than the next-best offer.

However, Better’s A + B + C included a $550 appraisal which was subsequently waived and $1373 of Section C title fees. I found a local title company that will do Section C for $650, saving me another $723. So $100 + $550 + $723 = $1,373 better than the next best offer. I’ll be walking away from the refinance with $427 in pocket.

My Better breakdowns were:

A: 0

B: 64

C: 1373

Lender Credits: $1299

Did you get confirmation from Better to waive the appraisal in advance or was that only after you locked in your rate with them?

It was after the lock. It took about 30 seconds after swiping the credit card with the required $550 appraisal fee. Customer service confirmed the $550 would be reimbursed if appraisal wasn’t required.

Well I followed your instructions to a T and it works flawlessly! Better.com beat my best offer by $100. The best offer in terms of a rates was from LenderFi and Better added in enough credits to beat them by $100. When it was all said and done, I didn’t need an appraisal either. Thanks for the advice!

Glad it worked for you too! It seems like a great recipe and I’m confused why I hadn’t clearly seen it articulated in that thousand page Bogleheads thread. It seems like a pretty logical conclusion given how my experience worked out.

I took about 30 minutes to call local companies about title insurance and closing fees and got it down from $1373 to $720 for a savings of $653 relative to the default Better closing costs. A couple of days after communicating my preferred title/closing company to Better, they reflected it in my updated loan estimate. $653 is a pretty good return for 30 minutes of phone calls. I was amazed at how much the price varied across companies; some were more than double what my closing company charged!

Here’s where I’m at for closing costs:

A: $0

B: $614 (includes $550 appraisal which will surely be refunded as promised)

C: $720

E: $94

Lender credits: $1,299

Total closing costs after refunding appraisal = $0 + ($614-$550) + $720 + $94 – $1,299 = negative $421

Things are moving quickly. I locked on 9/14 and I’ve already moved through underwriting and title clearing and all that nonsense. I think the next step is final approval and signing some paperwork. It’ll be interesting to see how quickly the rest of this process goes.

I’m not sure I understand the benefits of your refinancing:

If I’m reading your spreadsheet correctly, your current mortgage has 129 months and $39.8k interest expense remaining and your refi will have 180 months and $43.7k interest. Although you get a lower rate and a lower monthly expense, you will be paying $1,200 closing cost in order to pay an extra $4k interest over the life of the loan.

Am I missing something? Seems like you’re better off not refinancing. Maybe you should analyze your current mortgage vs. a 10 year refi.

If you look at the section of the spreadsheet entitled “Follows Loan 1 payment schedule”, it shows that if I apply my original loan’s payment schedule of $2,185.20/month to my new loan (even though the new loan only requires $1,597.39/mo), then the refi’d loan will be paid off in 125.32 months, which is 3.93 months faster than the 129.25 months remaining on my original loan. IF I refi and continue making the larger-than-required payment of $2,185.20, then I’ll end up saving $9,796.88 in interest (after properly accounting for the refi closing costs).

That said, I was able to negotiate the closing costs down to about zero (if not a $400 net credit), so it’ll be even more favorable than the numbers I published in the post.

I hope that made sense. I agree it’s a little confusing.

The “Follows Loan 2 payment schedule” compares what would happen if I could simply adopt the refi loan’s payment of $1,597.39/mo to my exiting mortgage (which is clearly not possible, but is just provided for illustration purposes).

I had been thinking about refinancing and this post convinced me to look into it…sadly for me, I live in Florida, so it’s almost impossible to do a low/no cost refinance unless I choose a higher rate which will give me credits…but that’s not the point of refinancing.

Better Mortgage offered us multiple rates and the one we felt comfortable with was: 2.875%; 30 years; $8.5k closing costs…it would lower my monthly payment by $250 which would take me 2.8 years to recoup.

I was about to move forward with Better but decided to call the (local) bank where I have the mortgage and they offered me a Streamline Refinance: for $1.5k I can lower the current rate from 3.75% to 3.125% and I maintain the original term (no reset)…it’ll save me $140/month, which means I’ll recoup the cost in 10ish months.

The amazing thing is that I can do it as many times as I want during the term of the loan and it’ll cost me $1.5k each time! Oh and the best thing is that they just require a credit check, no paystubs, no tax returns, nada más.

Wow! That’s damn impressive!!!!!!!!! If all I had to do to lower my rate by 0.625% was to pay $1.5k, I’d do that 10 times and have the bank start to pay me interest for borrowing their money!!!!

I’m glad that you found out about that deal! I wonder how common it is. I’ve never heard of that before…..

The Streamline Refinance is a great idea. It greatly simplifies the paperwork hassles and should reduce the cost because your current lending institution already has the title insurance, etc.set up. Lots of little details involved in the transition should be smoother and easier. The current bank servicing your mortgage is motivated to try to retain your business if they can.

https://www.hud.gov/program_offices/housing/sfh/ins/streamline#:~:text=Streamline%20refinance%20refers%20to%20the,and%20non%2Dcredit%20qualifying%20options.

I’d never heard of the streamline refinance before this thread (again, I’m ignorant when it comes to most things related to owning homes). I appreciate you providing that link for me to learn more about it!

As a fellow professor, I wanted to drop a note about Better. I am in the refi process with them now and they just reached out to say it was denied (after being conditionally approved) as they thought my pay was variable and tied to the number of classes I teach. Not sure where they got that idea. Seems like we will be able to sort it out – I just sent them proof that I am tenured and salaried – but my experience so far is that they are not the most careful group. I have caught a few fairly minor errors already. (For example, they had ~$200 less than promised on the lender credits). Big fan of your blog!

Sorry to hear that you had a bad experience with them!!!! I guess I should consider myself lucky that it all went well.

Just wanted to say THANK YOU for sharing your Excel calculator! We have an $82k balance at 3.6% and hope to pay it off in the next year or two (to give us lifestyle flexibility), so my suspicions were that refinancing would not save us enough to be worth the hassle, which your calculator confirmed. Thanks for your generosity!

Happy to help! Glad to have saved you the hassle.

I have remembered reading this post a while back, and had remembered you built an excel model to help with the refi calcs. Any chance you still have this available? The link above appears to be broken and I’m looking to do some of my own scenario analysis.

Thanks for bringing this to my attention. I was doing some rearranging within Dropbox this past month and must have screwed up the link.

I think this is the file you were talking about: https://www.dropbox.com/scl/fi/lgevvbejgwb660onb9hvi/debt-repayment-calculator-refinance-calcs-public.xlsx?rlkey=bbo5o30juc65xu5i4rkclh0jm&dl=1

It’s kind of nostalgic to see that spreadsheet again three years later. From a quick glance at it, I seem to have done a decent job coding it at the time.