Frustrating (but Important) Committee Work

I was asked by my university to serve on a committee to help select “an expert consultant” to tell us what is wrong with our 401a/403b/457 plans. If you haven’t had the joy of serving on an administrative university committee before, you’re missing out. It’s about 10 times more inefficient/frustrating as the least efficient meeting I attended while working as an engineer at Boeing…and I attended plenty of pointless meetings at there.

Committee work tends to be filled with faculty from broad swaths of the university. When dealing with cases of broad litigation or general misconduct, perhaps a broad range of opinions if warranted. However, when it comes to a dry, complex, and analytical topic like navigating the optimal retirement plan structure, the last thing in the world I want is a wide variety of uninformed opinions from the Music and History departments. I want a committee of only subject matter experts.

This is the second committee I’ve sat on at the university level. The first was to award the vendor to our HSA contract. My experience on both committees has reiterated a longstanding suspicion of mine — that HR benefits administrators at universities/corporations are systematically failing employees by making suboptimal benefits decisions. In both committees I’ve served on, I’ve been the only person with any background in finance/investing.

Yes, I find it infuriating that we can’t use the university’s existing in-house employees to perform this audit of our retirement plans, but perhaps there is some legal reason why we need to hire an external consultant. For the uninitiated, 401k plans are being sued on an almost daily basis. Just google “401k lawsuit” for examples. The vast majority of lawsuits arise from high fees in retirement plans or having inappropriate (or even too many) funds on the “menu.”

We haven’t hired this consultant yet, but it doesn’t take a rocket scientist to figure out glaring deficiencies in our current plan. It took me about 36 seconds to generate the below list:

- First, the good:

- We allow employees to choose between Fidelity & TIAA. I love that employees have the choice.

- (The minority of) Employees who know how to invest are able to to select index funds and pay as little as 0.015% for the right to buy a Fidelity Total Stock Market index.

- The “default” asset allocation — for those who don’t actively pick one — is a target date fund that is appropriately chosen based on the employee’s age.

- It’s well understood that most employees across the country simply stick with the default, even when that default is inappropriate (the default allocation in my Boeing 401k was cash if I can remember correctly back to 2006).

- Next, the bad:

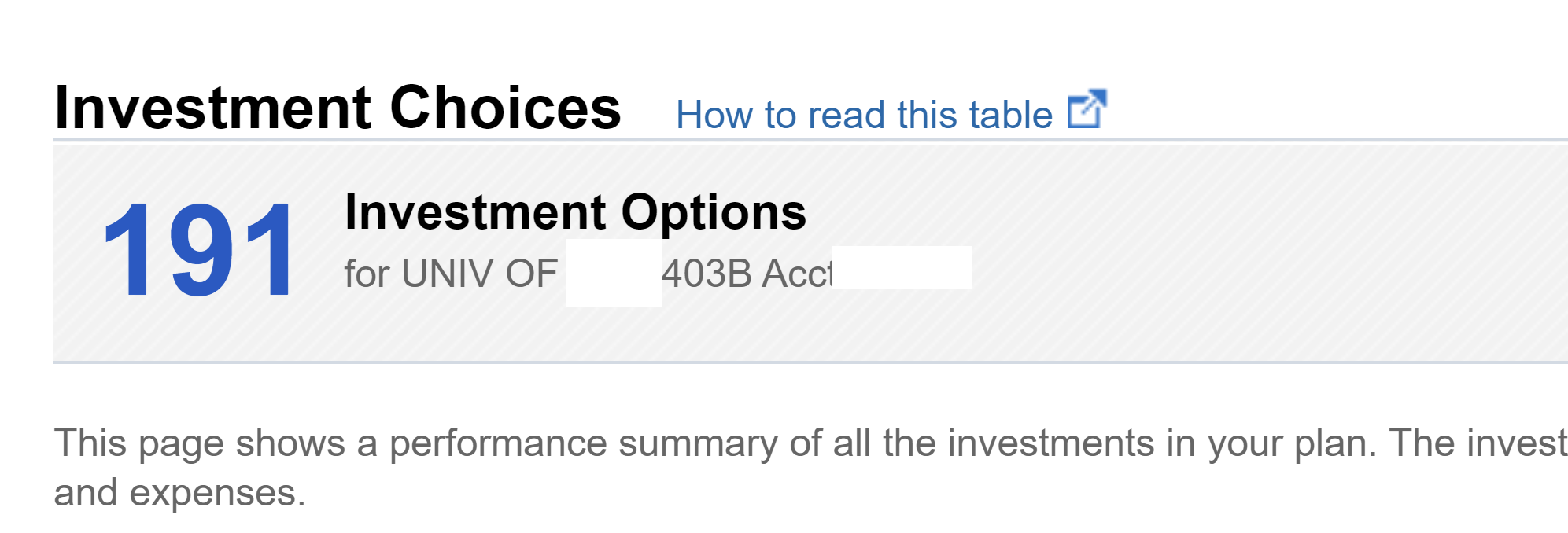

- At Fidelity alone, there are 191 funds on menu. This is asinine!!!!! How is an untrained employee supposed to navigate this insanity?

- Some funds have expense ratios as high as 1.31% (like this Fidelity Emerging Europe, Middle East, Africa Fund).

- At Fidelity, the Target Date Funds (TDFs) have expense ratios of 0.5%. This is especially egregious given that it’s the default fund and the university is therefore defaulting people into (relatively) high-cost funds.

- Since most employees stick to their employer’s default investment options, the selection of an appropriate “default” option is critical. Most HR systems fail to make the right call here.

- When I first joined the university, the Fidelity TDF cost about 0.65%. The subsequent reduction in fees is almost surely a result of the university’s assets growing to the point where we qualify for a new lower-cost share class. I’m (almost) sure of this because there haven’t been active renegotiations with Fidelity over this time period.

- Finally, the neutral / curious:

- Employees aren’t charged any other fees in their retirement accounts in addition to the underlying expense ratios of the funds. In other words, there are zero other administrative/recordkeeping fees explicitly charged to employees.

- At Boeing I was charged a quarterly 401k fee to cover the recordkeeping expenses. I hated the fee, but I know better understand that these fees have to come from somewhere. If not collected explicitly, it will be passed through to investors in the form of higher investing fees.

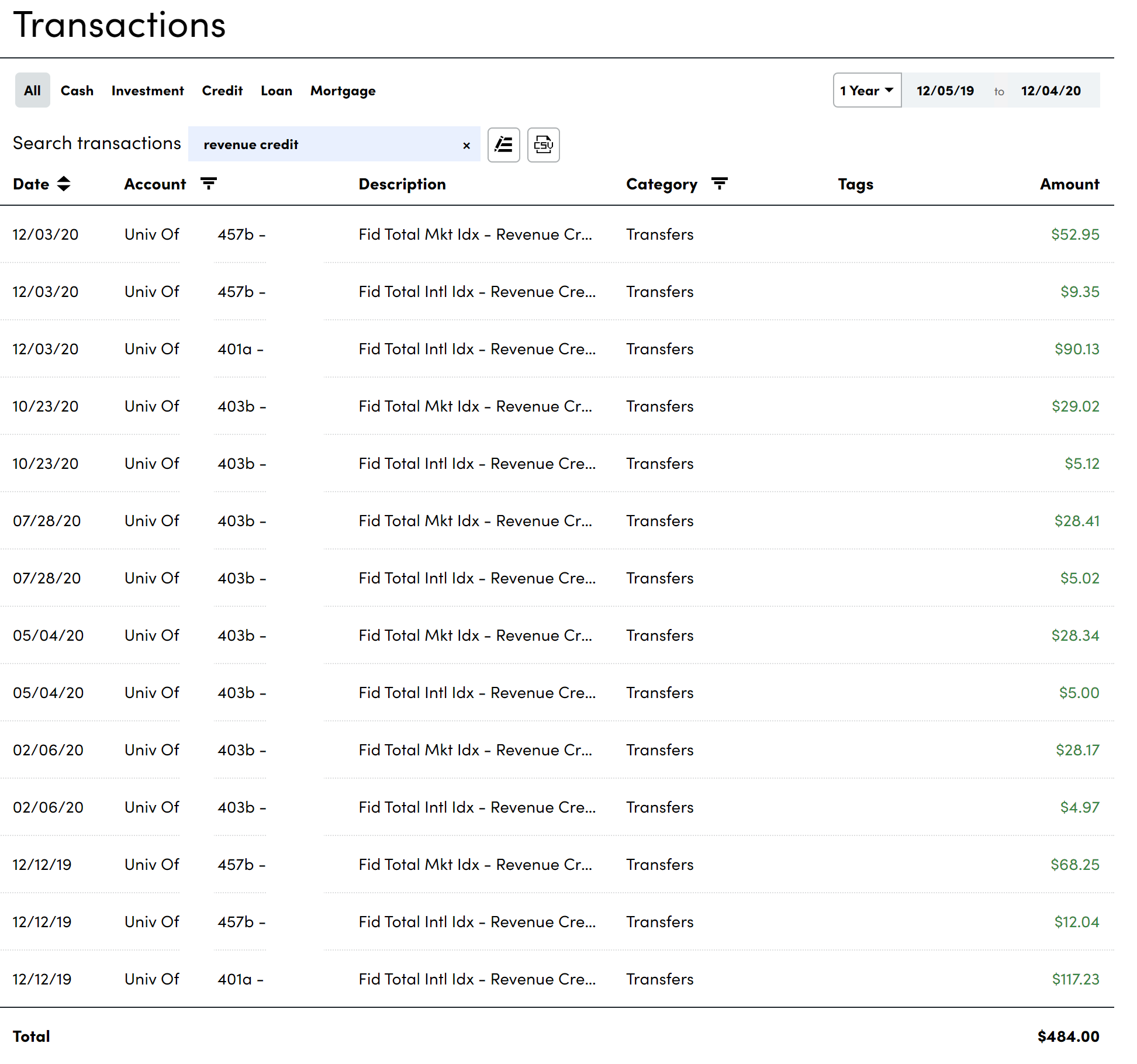

- In the event that the investing fees collected fall above above some secretive and pre-determined level, Fidelity/TIAA will reimburse some of these excess fees. These fees are reimbursed directly to investors in what is called a “Revenue Credit.” This Revenue Credit is distributed to employees based on the size of their retirement balances. Those with more money get more of this credit — completely independent of the fees they’ve paid.

- This creates a bizarre cross-subsidization where naïve investors investing in high cost funds (like the default TDF) end up subsidizing informed investors who are only paying 0.015%. The result of this cross-subsidization is that I pay less than 0% to invest.

- Here’s an example of how TIAA explains this Revenue Credit on another university’s website (link).

- Employees aren’t charged any other fees in their retirement accounts in addition to the underlying expense ratios of the funds. In other words, there are zero other administrative/recordkeeping fees explicitly charged to employees.

A Few Screenshots for the Curious

Over the past 12 months, Fidelity has disbursed $484 in “Revenue Credits” to my retirement accounts. All thanks to a bizarre cross-subsidization from naïve employees who are invested in high-cost funds. After accounting for this, my net retirement investing costs are definitively negative. I’m willing to bet that 95% of employees receiving these credits do not have the slightest idea that this is even happening in the background (that they are receiving these credits and/or what they mean).

The above is what I have access to at Fidelity in my 401a/403b/457. As an informed investor, I find this to be great. However, this is clearly going to be overwhelming to someone without appropriate training (i.e. 99% of the workforce)!!!!!!

The above is what I have access to at Fidelity in my 401a/403b/457. As an informed investor, I find this to be great. However, this is clearly going to be overwhelming to someone without appropriate training (i.e. 99% of the workforce)!!!!!!

If I Ran the World….

If I ran the world, I’d restructure our retirement plan that looked a lot like the US Government’s Thrift Savings Plan. In other words, I’d offer a very simple menu with:

- Cheap target date funds, and

- A handful of index funds

- The TSP only offers five funds to choose from.

- That’s quite the contrast from the 191 total funds available in my current plan!!!!

- Goodbye 1.31% ER mutual funds!!!!!!

From what I understand, the TSP accomplishes the above while only charging employees an all-in fee of 0.042% in fees.

I understand that there are economies of scale when managing almost $1T of assets in the TSP that are not available to the rest of us. As a result, the fees incurred by a university/corporation would necessarily be higher, but the general recipe of 1.) low costs, and 2.) a simple menu should serve as a relevant benchmark plan for the rest of us to follow. Further, offering an only-index-fee menu (alongside low-cost TDFs) would seem to immunize a company pretty well from future lawsuits. I honestly have no idea why any company would allow for actively managed funds to enter its menu given that we live in such a litigious society where employers are being sued daily for their crummy 401k’s.

Why my university needs to hire “an expert” consultant to conclude the above, I’m unsure. The scenario I’m more worried about, however, is that we hire a crappy consultant who will take us down the path of picking high cost actively managed funds. Given that there is nobody else on the committee with any finance training, I worry that any bad advice from a “consultant” will carry more weight than the opinion of a lowly, untenured assistant finance professor. It infuriates me.

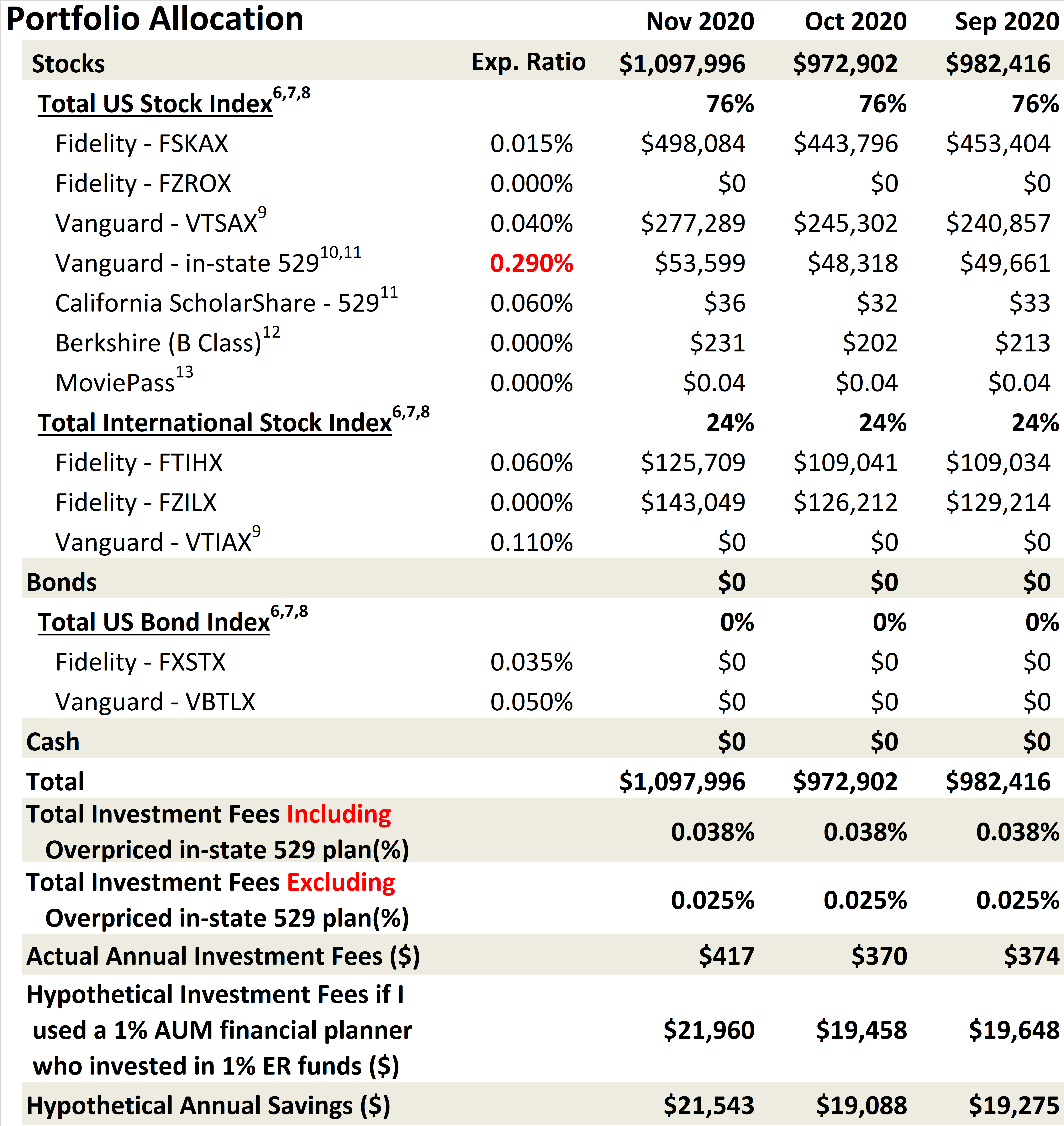

An Audit of My Investing Fees and How This Analysis Generalizes to my University System

Once a month, I calculate and share the investing fees I pay. I do this to highlight to others the importance of fees and how methodically I think about them. My hope is that others will be inspired to pay attention and perhaps make changes to their portfolio as a result.

I don’t adjust for the revenue credits in the above report. If I were to do so, it’d show I’m investing for less than zero.

It’s one thing to perform the above audit at a personal level. It’s another thing entirely to do the above audit on a University System level. The assets of our retirement system are in the billions of dollars. When you multiply these seemingly tiny expense ratios by billions of dollars of retirement assets, the result is quite a large number. However, when you multiply a big number by 0.015%, the result is a much smaller number. It’s really amazing to see a spreadsheet with these numbers explicitly broken down by funds that investors are actually invested in. Fidelity’s entire business model relies on people’s continued investing in high fee funds, like the TDFs. They surely would not be profitable if everyone invested in 0.015% funds. Vanguard manages to charge a mere 0.04% for some of their mutual funds. However, Vanguard can do so because it doesn’t have the vast infrastructure that Fidelity does. Fidelity has local offices in many cities and has a reputation for having excellent customer service. Consequently, Fidelity cannot break even with their index fund business like Vanguard can.

A Related Development / Victory

Lastly, in a related piece of news, my state recently lowered their 529 expenses from 0.31% to 0.12%. I emailed my state treasurer and legislators on a yearly basis for the past four years to complain about the high 529 fees. I started this tradition about a month after arriving to my state. It appears that someone finally listened (or perhaps it was dumb luck). As a result, countless families will now have more savings in their college savings accounts. Admittedly, a difference of a few thousand dollars over time is so subtle that the vast majority of families will have no idea that this seemingly inconsequential fee reduction was the reason why…..all because an angry schmuck pointed out the deficiency, got angry, and acted on his anger (or perhaps this was simply dumb luck).

Old 529 fees shown in left column. New 529 fees shown in right column.

Old 529 fees shown in left column. New 529 fees shown in right column.

That’s why I get so excited about this stuff. Because it matters. The “tyranny of compounded costs” matter. Because retirement and 529 plans are generally poorly run by people who have no business making such impactful decisions. Because investors are too uninformed to realize. Because nobody else seems to be screaming about this insanity.

If your 529 or retirement plan is hurting, consider taking action. Be the pain in the rear that I’ve been and complain to higher powers. Form a coalition to do increase your impact. Be mindful, however, that retirement plans are inherently costly to run, so if you are employed by a smaller company you are unlikely to enjoy the low costs that a multi-billion dollar retirement plan can command; you will have to lower your expectations accordingly.

A Copy of the Email I Sent my Treasurer

In the years since I first wrote this email, the numbers have changed slightly. My state’s 529 fee has decreased form 0.33% to around 0.3%. Similarly, California’s 529 plan fees fell from 0.1% to 0.06%. If you are unhappy with your 529 of 401k, perhaps it might serve as a template to follow as you contact your higher powers.

Dear State Treasurer & 529 Plan Manager,

I am an Assistant Professor of Finance at the University of XXXXX. I am a father of 5 children. I have a passion for savings and investing.

I’m writing in regards to the 0.33% program management fee that the XXX 529 plan charges. The marketing material of the XXX 529 plan seems to imply that this is competitive nationally. It’s frankly not.

The following table shows that XXX 529 plan has of the highest fees in the entire country. More importantly, it has substantially higher fees than the best plans. You can sort the table by fees by clicking on “Cost (ER)”. https://www.bogleheads.org/

Why do fees matter? Decades of academic research in finance have shown that investing fees are of the largest hindrances to investor wealth.

The California 529 plan has the lowest fee of 0.1% for investing in the total stock market index. The XXX plan charges 0.33% for an identical fund which tracks the same index. How does this seemingly small difference in fees effect returns?

If the stock market returns 7%, the California plan’s net return would be 7%-0.1%=6.9%, while the XXX plan’s net return would be 7%-0.33%=6.67%.

If I were to contribute $10k/year to each plan for 20 years, the ending balance for each plan would be:

California =FV(7%-0.1%,20,-10000,0) = $405,506

XXX =FV(7%-0.33%,20,-10000,0)=$

Difference in terminal value = $10,025

In 20 years, fees will have eroded $10,025 of value from the XXX’s 529 plan relative to California’s plan.

I understand that 529 plans are inherently costly to administer and that the 0.27% program management fee is intended to cover the operating costs of the plan. But I’m confused as to why it’s so much more costly to run XXX’s plan than California’s.

I see two viable solutions going forward to help XXX’s plan going forward.

Option #1: Lean down the XXX 529 plan’s services to become competitive with other states. I’d gladly take drastically reduced customer support (less junk paper mail, longer hold times, fewer hours to call in) in exchange for higher investor returns.

Option #2: Allow for XXX residents to deduct contributions to other state’s 529 plans, such as the California 529 plan, from their XXX state taxes. I understand that Arizona, Kansas, Minnesota, Missouri, Montana, and Pennsylvania do precisely this (https://www.savingforcollege.

I would be very interested in discussing the matter further in person if the opportunity allowed.

Thanks for your time,

FP

- Are you happy with your employer’s retirement plan?

- How much are you paying in fees? Are you charged fees on top of the underlying expense ratios of the funds?

- Have you found that investing fees are correlated with your employer’s size?

- Has anyone successfully lobbied to lower investing fees at their employer? If so, do you have any advice for others on how to accomplish this?

This is helpful. My (medium-sized private) university has TIAA and only has about 15 fund options with fees from 29 to 102 basis points. The target date funds average around 85 basis points and the broad equity and bond fund average around 35 basis points. And silly me, I previously thought TIAA cared about educators. Last fall — inspired by reading your blog actually — I went on a solo crusade for options with lower fees and thought I was getting some traction pre-pandemic. I brought some university leaders some rough calculations and hinted at their our retirement savings. But I think any momentum has stalled out now with all the attention (rightfully) on the pandemic, and I haven’t pushed given the situation. But I am still pretty unhappy with our options, given how much less I pay outside my university. Would definitely appreciate any advice for when I bring this up again. Do universities somehow benefit from the high fees?

It’s my understanding that employers don’t use retirement plans as profit centers. It’s more than likely to be the opposite.

The benefit to any employer in offering high fee funds is to pass the buck to you. In other words, all costs associated with managing a retirement plan are passed through to their employees in the form of high fee funds. I would assume that most frugal employers do this.

More generous employers will cover the administrative fees on their employee’s behalf. This will allow the administrators to offer lower-cost funds.

Alternatively, once you get enough assets under management, an employer will have the economies of scale to negotiate lower fees. I’m thankful to be currently employed by such an employer. Boeing similarly benefited from its size.

A further confounding factor is the incompetence of the people managing the HR systems that fail to appropriately look out for the wellbeing of their employees. Procurement / HR types make these contract decisions using “scorecards” in which completely subjective metrics receive equal weight to ones such as the expenses of the underlying funds. If I ran the world, the investment expenses would carry at least 90% of the weight when choosing a new retirement provider. These are systemic mistakes because the people in charge don’t understand the subtleties / complexities of the underlying contracts they are awarding.

As a test, ask your head of HR/procurement to tell you what percent of their wealth a person would sacrifice with a 1.015% fee over a 0.015% fee compounded over a 40 year investing horizon. Assume a 7% nominal pre-fee return. Assume a constant $1 contribution per year, though this is completely arbitrary and doesn’t matter for purposes of the calculation. The answer is 22.5% (=1-FV(7%-1.015%,40,-1)/FV(7%-0.015%,40,-1)) and can be easily calculated by anyone who has taken an intro to finance class covering the time value of money. You can paste the above equation into Excel to verify yourself and play around with the assumptions.

I’d argue that someone unable to perform the above calculation is unfit to run the HR benefits office of a university/corporation. I’d suspect that most in those positions would fail to do so, but this is admittedly pure conjecture and hopefully I’m wrong.

If you want to benchmark your retirement plan to that of other universities, simply turn to google. “University of XXXX 403b” will get you close enough. A few more mouse clicks and you’ll be able to poke around Fidelity/TIAA’s publicly available portals for each university with their corresponding menus and expense ratios. I’ve found it’s publicly available for most universities.

And 0.85% ER for a TDF is atrocious. TIAA charges us 0.45%, but are a bigger university system with more assets to leverage when negotiating those fees.

A number of retirement plans (including at universities) have been sued recently for, among other things, not being sufficiently vigilant about plan costs. Granted, many of the lawyers behind these are lawsuit trolls. If you can find examples comparable to your own university, then including articles about them in your communications would be sure to sharpen the attention of the administrators. They may not care if they’re costing your faculty thousands and thousands, but you can bet they don’t want to get sued!

Also, FP makes a good point that the numbers are more impressive and impactful if you compute costs for plan participants collectively. The effort of making a change is easier to justify if it you can show it saves millions in total vs. thousands per capita.

This “legal liability” angle is an interesting framing. It sounds a little abrasive, but employers around the country are getting sued for having crummy 401ks. Just google it for countless examples.

It is indeed amazing to see billions of dollars of assets multiplied by these expense ratio and the resultant fees. It’s a small fortune. And one avoidable by following the advice of Buffett & Bogle: keep it simple and keep your costs low. When looking at those investment losses in a spreadsheet, I envisioned all of the losses: fewer trips to see grandkids, less financial security, diminished opportunities for charitable giving. All because an HR system was negligent and allowed high fee funds on the menu without properly educating their employees.

My University limits the fidelity 403b options to maybe a dozen and I am lucky one option is fxaix at .02%. Our additional cash match fund options are massive, though, and I remember TIAA was all subpar (I pivoted to fidelity quickly after getting hired and starting to educate myself on $)

0.02% ER is great news. As is having a limited menu of about a dozen funds. How much do your target date funds cost? Do you pay any other account fees (like quarterly recordkeeping fees)?

Does your university allow you to do outside consulting? A friend who was a biology professor had a nice side business as an expert witness on genetic evidence in court cases. Perhaps it’s time for you to learn what this audit really consists of and set up a side business of performing these audits. You would want to see the report the auditor generates and have a Q&A session with the auditor about the report. Even if you can’t ever do this audit for conflict of interest reasons, you’ll be able to speak as one who performs these audits.

That’s a great suggestion! Most universities allow faculty to be expert consultants, especially post tenure.

I’ll pay special attention on the receiving end of this audit. I get the impression these consultants are not cheap. To the extent that they add value in driving down the costs of billions of assets under management, this would be money well spent. However, I’m unsure why my university couldn’t accomplish the same on our own without the help of this presumably expensive consultant. We obviously have the expertise in house. Anyone with an internet connection easy can do the external plan cost/menu benchmarking.

Collecting a few more letters after my name would probably help increase my credibility if I turned to consulting. It seems the CFA (Chartered Financial Analysist) designation carries a lot of weight in capacities like this.

The bigger problem would seem to be establishing credibility. One of the criteria for the current retirement plan consultant RFP is that they have consulted several similarly sized universities in the past few years. If everyone has similar requirements, then only the established players would ever have a chance of earning business.

If you decide to pursue this, Consider turning it into a research project. Then you can take a sabbatical and work at one or more of these companies that do the audits to learn the requirements and process.

I wonder how much “audit capture” there is. Do certain audit firms specialize in auditing companies that use certain providers? If they do, then they know what that provider gives to others and can try to get it at this company.

I agree that there are great synergies between this subject and potential research projects. I’ve already floated the idea past some coauthors and they seem excited at the prospect of the project.

It’s certainly an important and relatively understudied area, though there are certainly papers that have already looked at this topic: https://www.yalelawjournal.org/pdf/c.1476.Ayres-Curtis.1552_6gag5s3c.pdf

I work for a large tech firm. Out of the 20 options, I’m sticking with the S&P 500 index fund (.04% expenses) and the small/mid cap index fund (.06% expenses) which are the low cost index funds offered. Looks like they recently started offering an international fund offered at 0.12% expenses. Was frustrated that the only international option before was actively managed with a 0.44% fee and underperformed an index.

Sounds like you have some nice options, particularly now that you have a passive international option available.

In the collecting of these statistics from readers like you, I guess I don’t whether to attribute your low fees to: 1.) HR competently doing their job, 2.) your institution having huge assets under management to leverage lower fees, 3.) or your firm directly subsidizing the administrative costs and passing the low-cost investment savings to you.

Despite the above ambiguity, I still find it an interesting data collection exercise.

My current employer, with just over 200 employees, has a meh 401(k). 38 different investment options, including several index funds at .05% ER, but many active funds with ERs as high as .86% and target date funds around .29%. But what’s really pernicious is the .7% administrative fee (which was .75% last year), meaning the combined can be as high as 1.56%! North of $700/year for a 401(k) balance over $100k seems like a less than happy deal to me. When I started at the company, I quickly said “no thanks” to the “if you rollover your previous 401(k) accounts into our 401(k), our fees will get lower.”

I’ve thought about expressing to management my interest in the 401(k) details, but frankly I’m a bit skeptical. 401(k) participants are generally “interchangeables” (to borrow a term from The Dictator’s Handbook) and the power of the Wells Fargo advisor or expensive consultant on the account, the “influentials” to borrow yet another term from The Dictator’s Handbook, far outweighs my opinion. But, then again, I won’t know until I speak up.

Defaulting to 401(k) contributions to cash is practically criminal and surprising for a large company like Boeing. But then again, defaulting to target date funds with high expense ratios (in my opinion) is also less than ideal for employees.

The default of cash circa 2006 is not atypical based on my personal experience and based on a research project that I started. Unfortunately, the data provider (a large state public pension system) revoked access to the data after we’d written the paper out of fear of being sued.

These days, the default of target date funds are much more en vogue — even when these funds have ER’s in excess of 0.5%.

You made the right call not rolling over your 401k to your new employer. I’m not sure what to say on whether or not to speak up to management. At such a small firm, I’m not sure what a competitive fee structure is. Perhaps others will chime in to produce more data points. After writing this post, I came across this Bogleheads wiki article which seems a slightly more diplomatic version of the letter I repeatedly sent my 529 plan administrators: https://www.bogleheads.org/wiki/How_to_campaign_for_a_better_401(k)_plan#Approaching_your_company

Best of luck if you decide to pursue this!

You lost me at “This is the second committee I’ve sat on at the university level.” How the heck have you managed that? Have you not been there for four years yet?

I think I’ve been here 4.25 years.

I think the lesson learned is that, if you are a reasonably well-informed and well-intentioned squeaky wheel consistently proposing ways of helping over ten thousands of employees, then the higher ups are willing to listen and give you a seat at the table.

Don’t feel too discouraged.

What you describe sounds very similar to the situation of a colleague who sat on the counterpart committee at my own institution several years ago. Although the other members of the committee sound pretty similar to the other members of your commitee, what we wound up with in our 403b and 457b is terrific. A choice between Fidelity and TIAA, with a very streamlined set of curated low cost index fund selections at either place. The default options in Fidelity are the Fidelity Freedom Index Funds (with ERs of around 12 bp) and the default options at TIAA are their lifecycle funds (with ERs around 20 bp.) We have the liquid SRA TIAA (with 3% minimum) available.

For anyone who really wants to get fancier, there is a brokerage window that allows them to buy pretty much anything their heart* desires (individual stocks, other retail mutual funds) though they have to go through some additional paperwork hoops and pay some transaction fees, but for the lion’s share of us who don’t bother with that brokerage window, what remains is a simple and easy to navigate menu of solid choices and reasonable defaults.

*(Or their advisor’s heart, if they have one!)

Thanks for the words of encouragement! You’ve given me a glimmer of hope.

I’m glad to hear that you ended up with a great plan for yourself and the rest of the university, despite the general dysfunction of committees filled with non-subject-matter experts.

I’m hopeful that we’ll similarly end up with a great plan for everyone.

It’s a bit hard to convince people that these small fees matter and that we ought to pay attention to them. To an outsider, I’m sure I appear crazy.

revenue credits are noise and confuse people. but i should point out, even if those employees weren’t in high cost funds they/you would still be paying. the employer pays an agreed upon contract price. anything above that is refunded (to you). anything below is covered by the employer. even if everyone went to 0% funds, the employer has to pay the same amount. to them, so they don’t have much motive to move you into lower cost funds because they would have to cut other benefits to pay for the services. they want consultants for leverage, because cutting benefits looks bad

I’m sympathetic to the argument that the sum of employee benefits is a relatively fixed pot, so that any dollar of benefits going towards better retirement plans is a dollar less compensation in other areas (salary, healthcare, etc). It’s been my (limited and perhaps misinformed) experience, however, that sometimes these lower fees can be achieved without commensurate sacrifices if HR systems do their jobs properly.

I’m also cognizant that most employees couldn’t care less about retirement benefits. In other words, many would prefer a $1 increase in income to a $2 increase in retirement benefits. Under this framework, the optimal retirement benefits is near zero.

We are in complete agreement that revenue credits are not ideal, particularly as currently implemented. If my employer wanted to do so, they ought to reimburse in proportion to fees paid, not AUM, to avoid the regressive nature of their current system.

What is a reasonable administrative or management fee for a 401k plan? Our small group (30 participants) is being charged 0.4% annually, plus additional 0.4% if you elect to enter their “active” funds. Thoughts?

To be honest, I’m not really sure what is typical and/or appropriate for 401k fees. I’m pretty ignorant on broad trends, but I’ve had the fortune of working for larger employers that offer low-cost plans. It’s part of the reason why I asked this question to readers.

This document looks to answer your question might be covered pretty well on page 55 here: https://www.ici.org/pdf/20_ppr_dcplan_profile_401k.pdf

For a smaller plan, your fees don’t look terribly atypical. What are your all-in costs for an index fund?

If you search the bogleheads forum for “401k fees”, you’ll get several threads that discuss this as well.

Over the years, I noticed retirement plan fund lineups gradually improve, for various reasons (and I was fine with Fidelity’s “dizzying array” of 191 funds).

But when it comes to fees, there was a major backwards step.Firstly, I do like the model of having low cost funds, and then charging separate fees for the actual cost of running the plans. But there is the question of how these are structured. My 457 had a good structure, namely 0.15% of the first $60k, maxing out at $90 per year. Note that this demonstrates that there are expenses, but that they aren’t much.

By contrast, the 401a and 403b, which had had no explicit fee (they were getting it from funds) abruptly went to charging an uncapped 0.13% wrap fee. Since I have no pension and no social security, I have been forced to be very frugal and funnel all I could over many years into these plans. I got up to over $1M, so these fees were costing a fortune, and were far in excess of actual costs. Now I am using these funds to support a family on far less than someone with social security and a fat pension (that I was tricked out of signing up for). So it cannot be fairly said that the fee burden should be carried by those with larger balances, as that ignores the reasons why people may be forced to build those balances.

So anyone in a position to influence plan structures, keep in mind the issue of fee structure. The fee structure in my 457 plan (which I have kept) gets the balance right to fairly distribute cost payments over various balance sizes. A flat percentage places a huge fee burden (more than an order of magnitude of order in excess of real costs) on larger balances. (A flat dollar amount could hit smaller balances too hard, so a hybrid approach between the extremes of flat % and flat $ is what is called for.)

FP2,

I like your username! I a fellow FP in name and deed?

I agree entirely that a fixed % fee is problematic for the reasons you mention. A 0.13% fee on >$1M becomes non-trivial really quick. I like the $90 cap of your 457. That’s a pretty slick design because it doesn’t penalize the new employee with $10k in their account.

I’ve been doing a ton of benchmarking of university retirement plans over the past month or two. It seems to me that the following are best practices:

1.) Single recordkeeper to leverage economies of scale

2.) Transparent recordkeeping fee collection; gone are the days of hiding these fees in expense ratios. The fixed $/head seems to be more popular than %.

3.) Streamlined, low-cost menu

4.) Default allocation is a passive target-date fund

Here’s a copy of my benchmarking sheet if you’re interested: https://www.dropbox.com/s/2is4x61irr8qm3m/Harvard%20Stanford%20CMU%20TSP%20UC%20ND%20Penn%20Menu%20Comparison%20-%20Public.xlsx?dl=1

Stanford + University of California both offer the opportunity mega-backdoor Roth IRA. The links for that material is on the very last row of the spreadsheet.