Another month, another update. A few random comments.

Good Reads/Listens/Watches

- NYT Podcast on how the much anticipated reduction in real estate agent fees has yet to materialize (link).

- Older Bogleheads on advice they’d give their 45-year old selves (link).

- WSJ on how to easily delete personal info (address, phone number, etc) from the internet (wsj article).

- Google’s free tool is here. You put your info in, then it searches for you on a variety of sites. If you wish to remove yourself from a site, it takes a single click on the Google site and Google handles the information removal request. It couldn’t be easier.

- A few more WSJ videos on Costco (Video 1, Video 2).

- Costco Founder Jim Sinegal, who famously told his successor “If you raise the [price of the] effing hot dog, I will kill you,” is my hero.

Life

- I’ve long aspired to have a minimalist wallet. About a year ago, I made the decision to ditch my physical Costco Citi card (which I previously used solely for entry and checkout) and simply use the Costco app instead. However, the app is somewhat clunky. This month, I learned on Reddit that I could load my Costco membership to my Google Wallet, which is much better. To do so: “+ Add to Wallet” => “Loyalty Card” => “Costco Wholesale” => Scan membership barcode from existing card. It has worked flawlessly for me so far (although I still have the app as a backup).

- Relatedly, the only physical credit card I carry is the 4% US Bank card these days. I love the simplicity of the setup. Too bad my state does not yet offer a digital driver’s license.

- In a deviation from my legendary cheapness, I spent $185 on professional coaching this month. First, we hired a private basketball coach (former D1 player & Italian pro) for FC3. I learned more about proper shooting technique by eavesdropping on that one hour session than I had in a lifetime of playing basketball. Second, I paid a personal trainer (who happens to be a climbing phenom) to get me and FC3 into shape. He schooled us on diet, stretching, and lifting technique. It was inspiring and was arguably some of the best money I’ve spent in a long time. I don’t know why I didn’t do this sooner. I’m now lifting 3x/week and doubling my protein intake, which was insufficient given my active lifestyle. Functional health and fitness are something we all seem to neglect because “we’re too busy” or “it’s too expensive” or “it’s too hard”, but at the end of the day our health is one of the few things that really matter.

- I learned about this $8/mo (tax inclusive) “Light” plan from US Mobile from my frugal brother. Unlimited calls/texts + 2gb of data. Seems pretty hard to beat unless you go really cheap with a minimal use Redpocket plan for $2.50/mo. If our family were smaller, I’d jump ship from our $20/mo Xfinity Mobile family plan.

At 14, FC3 is now taller than me. I am devastated.

FC3 dunked a men’s basketball for the first time this month. I did not dunk a basketball until later in life. I’ve been practicing with him quite often. I can still show him who’s boss, but surely not for long.

Shopping cart after meeting with trainer. I have no idea why I’m supposed to be eating hemp hearts, but I’m shoving them down my gullet nonetheless.

I cooked quinoa for the first time in a long time.

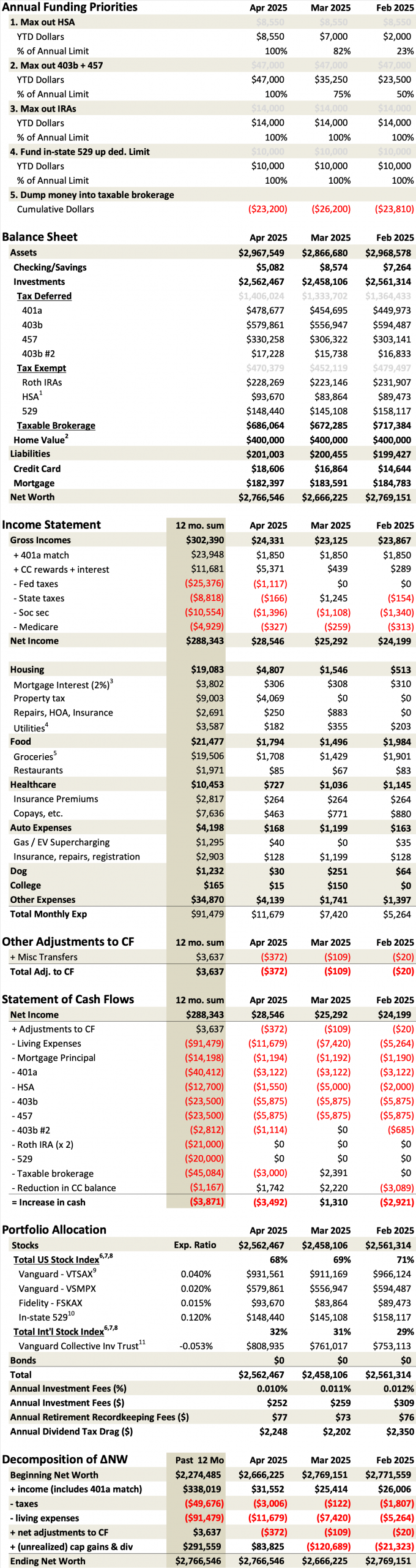

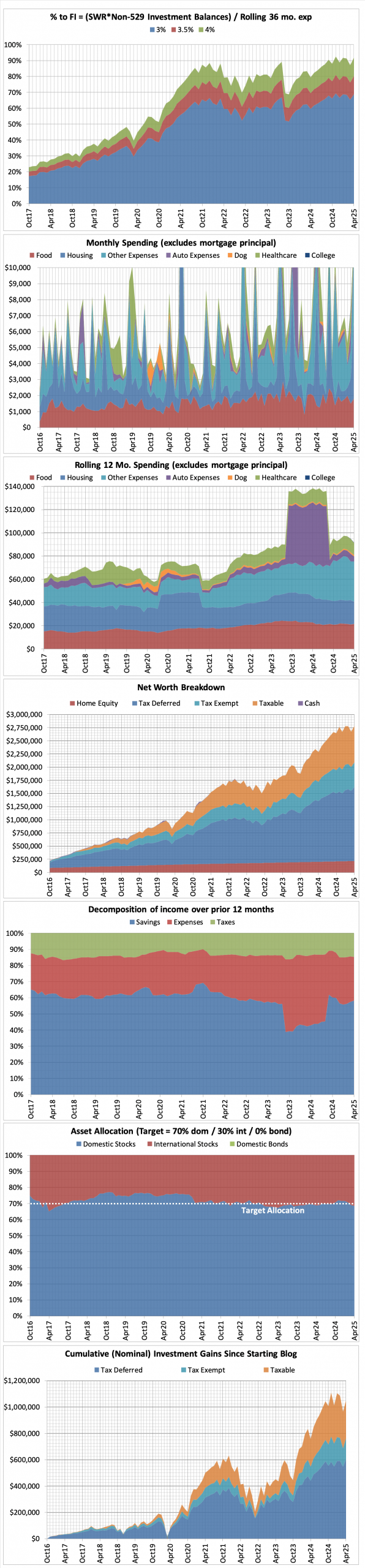

This Month’s Finances

I don’t know what to make of the markets/government/world, so I’m putting my head in the sand and staying the course. That strategy seems to have worked out reasonably well for me so far in life, and I’m hoping it will continue to do so going forward.

- The good:

- Still employed.

- With the exception of my 401a (which is funded every paycheck), all tax-advantaged accounts are fully funded (403b, 457b, backdoor Roths, HSA, and 529 up to state deduction limit). Liquidating $24k of brokerage assets on Jan 1 helped expedite that process. On to brokerage for the next 8 months…

- The 2 x $2.5k of (taxable) Wells Fargo bonuses finally hit. We’ve moved onto the 2 x $1k of Merrill Edge bonuses (and to renew our platinum honors status for the year).

- I received news that some of our Vanguard funds at work will be lowering their expense ratios, saving me $80 per year in fees.

- The bad/abnormal:

- $4,100 property tax payment.

- $950 for 4 x Pixel 9a phones for the family, with the younger kids inheriting the still-functional older devices. We hopped on a Visible Wireless deal, with the caveat that they’ll be locked for two months.

- $950 for a 15″ MacBook Air for FC1.

- $630 for show choir summer camp.

- $346 in contact lenses from Portugal for one of the kids.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Can you say more about the contact lenses from Portugal? I feel like I spend way too much money there.

When querying for my daughter’s (expensive custom) contacts recently, one of the google hits that came up was from a Portuguese company called Interlenses (https://www.interlenses.com/biofinity-xr-toric-6.html?gQT=2). The all-in price was ~30% less than Costco’s (good) prices in the US.

I’m giving it a go. The lenses are custom made, so they usually take months to deliver. I suppose I’ll know in a few months whether I got duped or not. I’m optimistic that I won’t be.

I’ve been fairly open to international arbitrage lately:

* Renewing Costco membership in Canada to exploit the exchange rate differential (before US dollar plummeted)

* Dog meds from Australia, priced stuplidly cheaper than in the US (and available without Rx): https://www.pets-megastore.com.au/zoetis-pet-products/simparica-trio-green (58% cheaper than Costco’s US pricing)

* Buying products from Costco Canada online and having the package forwarded to US (for those products unavailable locally)

* And finally, I’m giving it a go with these contacts. If successful, I’ll probably do it for life.

Wow. I thought I was doing well with Mint Mobile at $15/mo.

I’m a weirdo that can’t not know the best deal. It’s a mental sickness.

Can you explain how you get the Merrill bonus again? It seem you have to open a new account? Did you close the old account prior?

In my experience, Merrill gives bonuses in a few flavors:

* Retention bonuses, where you threaten to move assets away and customer service will supposedly incentivize you to stay. I’ve never had luck with these bonuses, but several Bogleheads (including some readers of this blog) have done so.

* New account bonuses. No phone calls necessary. Just click the promo link and fund the new account (e.g. https://www.merrilledge.com/offers/pr1000).

The disadvantage of the second approach is that you start to accumulate brokerage accounts. This can be remedied by closing them after the bonus is paid off.

I imagine it’s super nice to have the 4% card, it did get nerfed as per the rumors. Crazy quick.

Great start on the protein, I see a lot of canned tuna and chicken – how do you manage to make them tasty or albeit not smell too bad?

I’m a fan of the 4% card and hoping that they just forget about us “grandfathered” people. I just made a life insurance payment on it today (which policy I should arguably cancel). I’m about to put 5 kids’ worth of college education (tuition + room & board) on it. I would pay property taxes on it, but I actually use my 4.5% USBAR card instead (tap to pay at county treasurer’s office).

On the protein front, I’m a relative novice. In my 20s I was much better about it when I was regularly weightlifting. Over the ensuing 20 years I lifted fewer weights and dabbled with veganism. I’ve converged on the “flexitarian” approach, but I admire those who can pull of veganism and get sufficient nourishment. As far as how to make the canned stuff taste less like death? No idea. I have a really high tolerance for unappetizing food and just shoving stuff down my gullet. But if you have suggestions, I’m all ears.

Would love to hear more about your training/experience! I’ve considered reaching out to a trainer recently as well. Did you go from truly zero lifting back to this new schedule? Does your trainer actually attend your sessions or just help you create routine and diet? What does your programming look like? As someone similar in age with busy family/work schedule, curious where are you squeezing in your gym time? I absolutely despise lifting at crack of dawn, but don’t see any other reasonable time window. I’ve managed to stay in relatively good shape over the years with short but super consistent daily calisthenics consisting of mainly pushups, pull ups, sit ups, air squats and some stretching, but have noticed for first time in life now in mid 40’s that my body is changing and that I’m just holding steady/flat at best. Your post might be the push for me to shell out a few bucks and get some help to get me out of decades long rut of purely maintenance exercise only. Any other sources for some good middle age motivation? As usual, appreciate your blog and look forward to your monthly posts!

I’d seen my trainer climbing at my gym for almost a decade. At the gym, he also did personal training for the most elite youth climbers. Recently, however, I saw him doing a training session with an average joe middle aged dude like myself. I happened to eavesdrop a bit and loved what I heard/saw, so I took the plunge.

It’s really expensive so I don’t know how often I’ll be scheduling these sessions. That said, I can easily see myself checking in quarterly at a minimum.

To answer your questions:

* My guy provided a roadmap on diet, stretching, technique, and exercises (just the basic ones…squat, deadlift, bench, pullups). Other than form checks, we didn’t work out in front of him.

* I’ve gone through several cycles of weight training vs not over my life. Recently, I’d been doing a decent amount of bodyweight exercises but felt like I’d plateaued. In hindsight, this could have been due to my inadequate protein intake (I also bike/run a lot).

* We bought a cheapo squat cage from Amazon about 15 years ago that I have in our basement. It’s certainly not fancy, but it does the job well enough. If I stick with this routine for a few more months, I’d happily splurge on a Rogue rack or something (which they have at my climbing gym and I love it).

* Given the location of the weights in my basement, the only real hurdle is willpower (of which I admittedly have a finite supply).

* In our mid 40s, we’re both in the same situation. We know what is coming — the inevitable physical decline of our bodies until death. We are healthier today than we will be at any point in our remaining lives. I suppose I’m just trying to “invest” in a bit of muscle mass (& skeletal strength) now to provide a bit more functional fitness down the road as my body inevitably declines.

As far as resources, I’m not sure what to say. Reader mike recommended KBoges (YouTube & forum) to me, which I found pretty motivating but haven’t fully embraced: https://frugalprofessor.com/financial-update-sept-2024/#comment-4639. There are several readers of this blog that are far more fit than me, so hopefully they can chime in.

I had a long winded ramble about health, exercise, etc. but it didn’t post unfortunately. Super cool as a life long exercise/health fanatic, former NCAA strength coach and possible future Kinesiology PhD student (thinking I may get a free degree from the unit I work in starting Spring 26…) to hear about your positive experience working with a trainer.

“When health is absent, wisdom cannot reveal itself, art cannot manifest, strength cannot fight, wealth becomes useless, and intelligence cannot be applied.” ― Herophilus

Study these books to learn a ton:

Fat Loss Forever – Layne Norton

The Renaissance Diet 2.0: Your Scientific Guide to Fat Loss, Muscle Gain, and Performance – Mike Israetel

Forever Strong – Gabrielle Lyon (also has a podcast if you listen to them)

Outlive – Peter Attia (also has a podcast, but a lot more deep into science/medicine)

Fat Loss Habits: The No Bullsh*t Guide to Losing Weight – Ben Carpenter

Everything Fat Loss: The Definitive No Bullsh*t Guide – Ben Carpenter

Get up (Why your chair is killing you and what you can do about it) by James Levine

Deskbound by kelly starrett – he also has a book ready to run that could be interesting if you really like running/want to run more

Born To Walk: The Broken Promises of the Running Boom, and How to Slow Down and Get Healthy—One Step at a Time Kindle Edition by Mark Sisson (Author), Brad Kearns (Author)

Spark: The Revolutionary New Science of Exercise and the Brain by John J. Ratey MD

Burn: New Research Blows the Lid Off How We Really Burn Calories, Lose Weight, and Stay Healthy by Herman Pontzer PhD

Starting Strength by Mark Rippetoe is also a great one if you want very effective and efficient strength training information and you could combine with practical programming to go a little deeper and be your own coach/trainer. Big thing is to do hard things, the more basic and hard it is the better (ex: pullups > pulldowns). I often joke that the fitness industry has made billions off catering to peoples built in evolutionary desires for magic and to avoid doing hard work (squats, etc.) — life was hard back when so we learned to conserve energy very well, which is horrible for public health given the modern food + technology environment and individual health unless you are wise/smart enough to go against the grain and….

Essentially, lift heavy things 2-3 times a week for ~30 minutes using full body bar bell lifts and bodyweight movements (generally avoid machines unless your hurt, want variety or to really bulk/pump up a specific muscle) and you’re good, walk 10-15k steps/day and do HIIT work 1-3x a week where your heart rate gets kicked very high and your even better. combing with 1g protein per pound of ideal bodyweight, a lot of fiber and invest 75$/year into macrofactor so you can track it easily and get a nice scale that tracks weight plus bodyfat and will synch to macrofactor and start weighing yourself daily so in the morning after you use bathroom but before food/water if possible and over time you will really know what your metabolism is like and how many calories to eat if you want to lean, maintain or gain.

Stress over protein, kcal and fibers, carbs/fat is really not important unless 1) you really love/thrive on one more than the other or 2) you can’t control yourself with one or the other and always overeat your calorie targets. Natural foods are best/ideal but part of eating is enjoyment so remember that and get lots of fruits/veggies and lean animal proteins. eggs + low/no fat cottage cheese and yogurt are amazing staples to eat daily too assuming your not lactose intolerant and don’t neglect your microbiome (sauerkraut and yogurt are really easy to DIY).

Jeff,

Thanks, as always, for the insightful health comments! It’s going to take a while to digest them.

I immediately headed to the comments to ask about the Portuguese contact lens solution but I see someone beat me to it. I tried to dabble in some international arbitrage re contacts a couple months ago but all the sites I found on reddit sent me to stores based in the UK and they all greyed out the option to ship to the US. I’m excited to try this one.

Good luck. The caveat is that my order hasn’t arrived yet, so I can’t personally vouch for them. That said, they seemed to have passed the sniff test. I’ll report if it’s a scam.

FP FYI chase 100k preferred offer plus 300 Rakuten bonus if you apply through there. Cant get easier.

Pretty tempting!

I’ve really been enjoying my Rep Fitness rack + Ares cable system. Pair that with some adjustable dumbells and a bench and you can do almost everything you’d like! Here’s my gym: https://www.reddit.com/r/homegym/comments/1dek0bh/rep_pr_5000_ares_home_gym_200_sq_ft/

The only changes I’d make if I’d do it now are buy the new Ares 2.0 cable system and new Rep Pepin adjustable dumbbells. All in I’m at ~$7,500. I grabbed a stationary bike too recently for some HIIT cardio.

Thanks for the recommendation! Looks like a great setup!

Love the updated. For the brokerage bonuses, do you typically transfer all the assets in kind from WF to Merrill and vice versa? Or do you just transfer enough to hit the desired bonus tier? Trying to do it from WF to US Bank, but I dislike both brokerages.

I transfer the requirement + some margin for volatility. For WF, I transferred ~$300k for the ~$250k requirement. By the skin of my teeth I didn’t drop below $250k.

Everything in-kind. I haven’t yet had a problem with cost basis transferring.

Impressive dunking. Did he need to work on his vehicle or is he a natural jumper?

He’s 6’3″, so I suppose that helps quite a bit. He does high jump for his 8th grade track team and can clear 5’2″, but one of his teammates is a freak of nature that can clear 5’8″ (or more?).

My WF sunk below 250k for a few weeks, so I did the 25k savings bonus too. I received my bonus.

Nice!

Do you use Google Sheets or another software tool to manage your finances?

How do you consolidate all the information? Do you enter it manually each month, or is there an automated way to pull it directly from different accounts?

https://frugalprofessor.com/my-updated-net-worth-and-more-tracking-spreadsheet/

Thank you!

Thank you for sharing. Ive completely moved to fidelity with CMA + bofa 5% cashback system , thanks to your posts!

Has anyone had success buying FRSXX on merrill edge? I keep getting error that this fund is not allowed for my account.

Welcome to the cult.