Disclaimer

This blog isn’t profit-driven — I don’t receive money from credit card referrals, and there are no affiliate links here. I write because I enjoy analyzing these topics, so the thoughts below reflect my genuine opinions, unclouded by profit motives.

Background

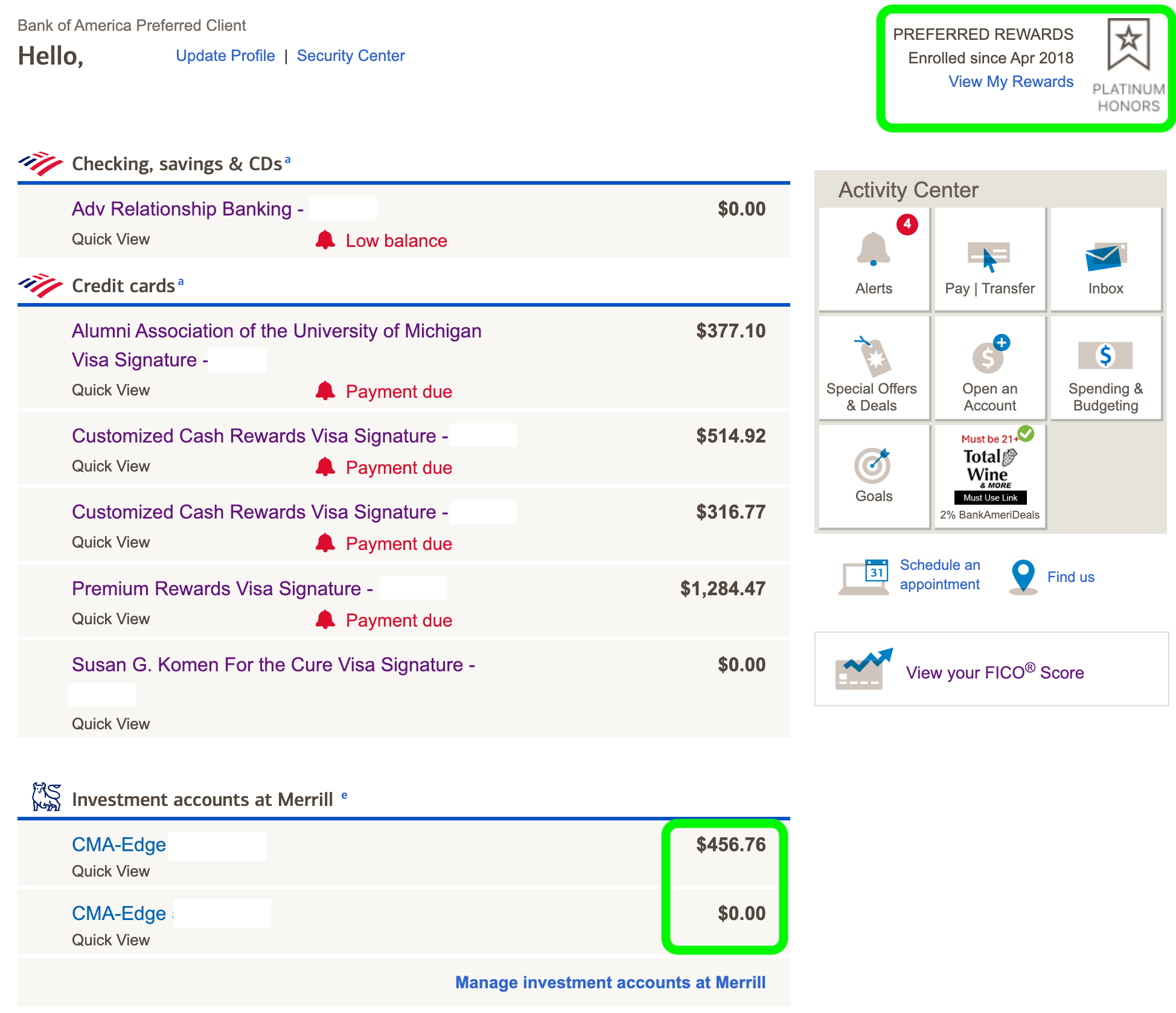

I’ve been a long-time user of Bank of America credit cards, particularly the Customized Cash Rewards and Premium Rewards cards, though it’s been several years since my last update (see previous posts: link1, link2, link3). My wife and I collectively hold one Premium Rewards card and seven Customized Cash Rewards cards, so I’ve gathered plenty of insights over nearly a decade of using these as my daily drivers.

Executive Summary

- BoA cards are only worthwhile if you qualify for the “platinum honors” status of their Preferred Rewards program, which requires at least $100k in assets with BoA/Merrill Edge. With this, you get a 75% boost on credit card rewards, meaning the Customized Cash Rewards earns 5.25% on your selected category and the Premium Rewards card earns 2.625% (general) or 3.5% (travel/dining).

- You won’t incur opportunity costs on this $100k since it can remain fully invested, and there are no account fees.

- Without at least $50k or $100k in assets parked with Merrill, BoA’s offerings lose competitiveness. In that case, you’re likely better off with options like the US Bank Altitude Reserve (USBAR), which provides 4.5% cash back on mobile wallet purchases with no asset requirements.

- BoA’s website is outdated and surprisingly difficult to navigate, with setting up autopay being especially frustrating. But given the 5.25% cash-back, I (barely) tolerate these issues. Merrill Edge is also lackluster, and I only keep the minimum required assets there. While the 5.25% / 2.625% / 3.5% rewards used to be a great deal, US Bank’s Altitude Reserve and their upcoming 4% card are competitive alternatives today.

- I have the USBAR and much prefer dealing with US Bank to BoA. Setting up autopay with USBAR was intuitive and straightforward, avoiding the hassle that BoA makes unavoidable.

- That said, the main limitation of the Customized Cash Rewards card is that the elevated 5.25% rewards cap at $2,500 per quarter. However, this can be bypassed with multiple cards and involving a spouse or “player 2.”

- BoA’s customer service, on the few occasions I’ve used it, has been poor (long hold times, etc.).

The rest of this post assumes you’ll transfer the $100k to Merrill to get the 75% rewards boost. Without it, BoA’s cards fall short. If you’re using BoA cards without the premium rewards program, just divide each cash-back in this post by 1.75 (e.g. 5.25%/1.75 = 3%).

The Mechanics of the Premium Rewards Program

To qualify for the Preferred Rewards program and the associated 75% rewards boost, you need:

- A BoA Checking Account:

- I use the “Advanced Relationship Banking” option, which has no fees if you maintain over $20k with BoA/Merrill Edge.

- $100k Three-Month Average Combined Balance with BoA/Merrill Edge:

- You can hold this balance in a brokerage account or an IRA.

- If you have a joint Merrill brokerage account with a spouse, each spouse will qualify for “platinum honors” (the 75% rewards boost) status with a single $100k (rather than requiring $100k each).

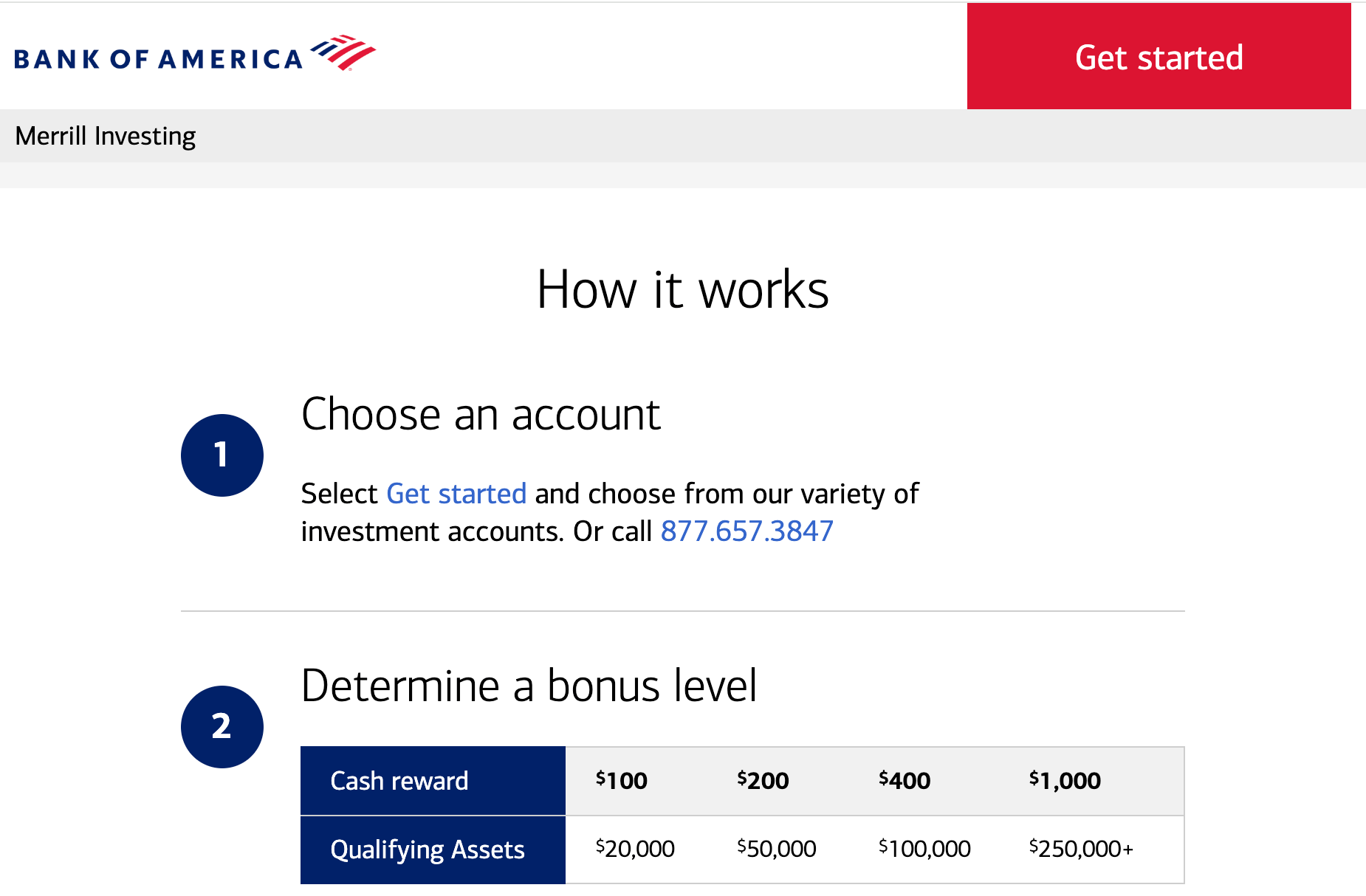

The balance is calculated as a three-month rolling average, checked once annually on your Preferred Rewards anniversary date. For example, my anniversary is in April, so I transfer $300k for that month, which meets the average requirement (since $0 + $0 + $300k / 3 = $100k), and then move funds back out the following months. Merrill occasionally offers transfer bonuses up to $1k per $250k, which can help offset the hassle. If you miss the renewal date, BoA checks the average again three months after (July, in my case).

I’ve already moved the money out of Merrill. I’ll bring back $300k in either April 2025 or July 2025.

I’ve already moved the money out of Merrill. I’ll bring back $300k in either April 2025 or July 2025.

As of today, Merrill is offering $1k for a $250k transfer, but check Doctor of Credit for current offers.

Details on the Customized Cash Rewards Card

My wife and I hold seven Customized Cash Rewards cards combined. Here’s the summary:

- $0 annual fee.

- No real perks to the card besides the generous cash back.

- 3% foreign transaction fee.

- 3.5% on grocery/wholesale. Dollars spent here count towards the $2.5k/quarter quota.

- You designate a single category as your 5.25% category:

- Online Shopping

- Gas & EV Charging

- Dining

- Drug Stores

- Home Improvement

- Travel

- You can change the category once per calendar month. It is easy to do so.

- The “online” category is the most versatile and is what makes this card valuable. You’ll earn 5.25% cash back at major retailers like Amazon, eBay, Costco.com, Walmart.com, and Delta.com.

- Costco.com eGift cards can be converted to physical gift cards in-store, allowing you to earn 5.25% cash back on in-store and gas purchases. Convert eGift card to physical gift card at the front desk. If they get stuck, tell them to hit F12 a few times.

- If you load the card into Walmart Pay, in-store purchases usually code as “online.” However, this hasn’t been as reliable recently; a workaround is to buy online gift cards.

- Online payments for property tax, doctors, federal tax do NOT count as “online” shopping. You’ll only get the 1.75% here.

- Categories are not mutually exclusive — Delta.com would get you 5.25% if you chose either online or travel as your category.

- If you spend in any other category or if you exceed the $2.5k/quarter of “category” or grocery/wholesale spending, the 5.25% rewards reverts to 1.75%.

- Merchandize returns (or cancelled flights) count against our $2.5k/quarter quota on the Customized Cash Rewards Card. Kind of annoying.

- You can defeat the $2.5k/quarter cap 5.25% space by opening up more Customized Cash Rewards cards over time. I have 4. My wife has 3. Combined, that’s $17.5k/quarter of potential 5.25% space, or $70k/year.

- We don’t use it all, but some quarters we get closer than not.

- Here’s a list of 5.25% “affiliate card” options that will help you defeat the $2.5k/quarter cap (link).

- Note that the URLs in the github are broken but you can simply google the card’s name to get to the proper URL.

- BoA does a crappy job telling you where you are in the accrual of the $2.5k spending per quarter. If you think about it, they have every incentive to hide this information from you to minimize the amount of 5.25% rewards they have to pay. To get around this, I export Personal Capital transactions into a pivot table to analyze. It takes about 30 seconds for me to do. Just remember that merchandize returns (or cancelled flights) count against your quota.

Details on the Premium Rewards Card

- $95 annual fee.

- $100 annual airline incidental credit (triggered with purchase of $100 AA Gift Card or $100 United Travel Bank).

- 0% Foreign Transaction Fees.

- $100 Global Entry / TSA PreCheck credit every 4 years.

- No spending caps to worry about.

- 2.625% baseline rewards.

- 3.5% travel/dining.

While the Premium Rewards card used to occupy a pivotal role in my wallet for non-category spend, I seldom use it anymore since USBAR’s 4.5% cash back on mobile wallet purchases is better (by a non-trivial ~2%). However, the Premium Rewards card’s travel credit makes it essentially free, and it’s useful for purchases where mobile pay isn’t an option (e.g. online payment for car registration, online payments to doctors, etc).

You can see above that I’ve fully utilized the $100 travel credit this year. It’s easy to do each Jan 1 by buying the $100 AA gift card or $100 United Travel credit (or incurring >$100/yr of incidental travel expenses like baggage fees, etc). After receiving the $100 credit, this card becomes a negative $5 annual fee card (=$95-$100).

Details on the Unlimited Cash Rewards Card

I’ve never owned this card because it seems inferior to the Premium Rewards card. That said, here are the highlights:

- $0 annual fee.

- No real perks to the card besides the cash back.

- 3% foreign transaction fee.

- 2.625% on all purchases.

A Few Gotcha’s With BoA’s Autopay System

BoA’s autopay system is notoriously flawed. Not only is setup complicated, but it fails to adjust for refunds issued after the statement closes, so you’ll need to adjust payment amounts manually. For instance, after returning a large purchase and canceling autopay on my $0 balance, BoA still charged me a late fee for missing a minimum payment.

The Finance Buff has a tutorial here on how to set up autopay (here). I cannot believe this requires a tutorial.

A Few Other Details

- You have non-cash back options (travel, gift card, etc) but the cash redemption is obviously the best.

- I redeem to my BoA checking account then sweep to my real checking account at Fidelity.

- BoA used to charge a fee for ACH pushes, which was terrible (I simply pulled from BoA to avoid). Luckily they have removed this fee a few years back.

Conclusion

- In summary, the BoA system offers strong rewards for those willing to navigate its quirks and keep assets with Merrill. However, for new users, options like the 4.5% USBAR or upcoming 4% cash back card offer similar rewards without the headache of dealing with BoA/Merrill.

- Given that I’ve already incurred the “cost” of setting up the BoA system, I’ll stick with it for the foreseeable future. Once in place, it’s hard to turn down the gravy-train of 5.25% cash back. The extra effort for the 5.25% relative to 4.5% or 4% probably isn’t worth it for most people, unless you are a masochist who enjoys the pain of dealing with BoA/Merrill.

- While these credit card games can be fun to play, you can earn orders of magnitude more by embracing frugality, investing wisely, and optimizing your taxes. You can download my draft “book” here which contains everything I know about the tax code. Poke around the blog a bit if you want to hear more of my rantings, or head over to Bogleheads — the best source of financial information on the internet.

Very well written! I’ve been very happy with this system for about 5 years now. I also recently signed up for a USBAR, and I do plan on also signing up for the Smartly card (and subsequently sign up for US Bank’s brokerage) for the 4% cash back.

My eventual credit card setup goal will be:

US Bank Altitude Reserve for all things Apple Pay (4.5%)

BoA Cash Rewards cards for all things online (5.25%)

US Bank Smartly card for everything else (4%, and we still don’t know if there’s a catch yet). This would be the one physical credit card I carry around.

Let’s see if this dream comes true!

Zack,

Glad to hear that you are enjoying the BoA system as well.

My optimal CC setup going forward largely mirrors yours, though I’m considering dropping the Altitude Reserve for the 4% card for the sake of simplicity. It just doesn’t seem that the 0.5% spread is worth the hassle of maintaining the AR, but perhaps I’ll reconsider over the coming months…

If I mirror your proposed setup, it would certainly maximize cash back at the “cost” of a little bit more complexity…

BofA CCR is fantastic for that 5.25% cashback on online purchases — it’s tough to beat. I’m currently using the UCR for my 2.62% catch-all, but I’m excited to potentially replace it with the USB 4% card and product change that to CCR.

For a completely fee-free setup, need $250K in their brokerage, otherwise, there’s that $50 annual fee. Even with assets over $100K, cashback is 4% but will have to deal with the fee.

I reached out to their investments team for clarification since the website doesn’t provide much detail beyond the “no fee for assets over $250K” point. I’m curious if it’ll work similarly to BofA, where you need to maintain those asset thresholds for a certain number of months each year to qualify for the 4% and avoid fees.

If you decide to go for the USB 4% card, I’d love to hear your thoughts! Someone on Reddit posted a helpful TL;DR about avoiding fees with the current information published: https://www.reddit.com/r/CreditCards/comments/1fzi3rq/upcoming_us_bank_smartly_visa_signature_card/

Looking forward to the next Optimal CC Cashback Setup Review post 😉

Glad you’re enjoying the 5.25% card. It’s hard to beat.

I’m similarly interested in the upcoming 4% card and will hopefully be able to get it at release. I have the assets ready to transfer.

Stay tuned for a review…

btw, my questions to their “Annual Fee” email address I was provided from Twitter ([email protected]):

* Does the account need to be >250k for x/12 months in a year to be considered for this? If so, how many?

* Is this automated or do I have to reach out to someone to waive this fee?

Never got a reply :/

Thanks for sharing!

I think we’ll learn a lot more in the coming weeks…

I’ll add that one doesn’t necessarily need to maintain the BoA Premium Rewards card, there is the no annual fee Unlimited Cash card option too. I would argue if you can make use of the $100 airline credit the Premium Rewards is the better option (effectively negates the annual fee) and it gives you 3.5% on dining/travel as well as no Foreign Transaction Fees. Unlimited Cash has foreign transaction fees.

With my two new US Bank cards (4.5% & 4%), I’m on the cusp of downgrading my Premium Rewards card to my 8th Customized Cash Rewards card. Rumor has it that the downgraded card has special features like no FTF. Would be awesome to get 5.25% without FTF. I’ll let you know how the experiment goes.

No rotating 5x cards such as Chase Freedom (Flex)?

5.25% @ BoA > 5% @ Chase, so I obviously do BoA whenever possible.

Further, the 4.5% Altitude Reserve and the 4% Smartly card make the hassle of the rotating 5% category unappealing to me.

I have a Chase Freedom Flex in the sock drawer. It has lived untouched in the sock drawer for many years.

Your loss, transferring to United, Hyatt, and Southwest has earned me considerably more than 5% cash over the years

How much more? 2x (e.g. 10%)? If so, I could get interested I suppose.

Can you review USBank Smartly credit card at some point? Their USBAR is not longer open to application 🙁

Will do

I would do the same thing.

It depends. At a minimum you can get 1.3 cents/point with Southwest. With Hyatt, it’s closer to 2 cents/point. When booking business class travel, I’ve received 8 cents/point, but that’s not real, as most people wouldn’t pay the cash price. Hyatt is a solid choice though.

@FP,

One thing you and the commentors are not considering is sign up bonuses. The US Bank Smartly (4% card) is great if you are converting from an existing product, but if the choice is a Chase Ink card or a US Bank Smartly card with a new application; it will take a long time to make up that 75-90k sign up bonus you could’ve received.

Would a Roth IRA with >$100k be qualifying for the platinum honors status?

How do you keep track of which cards for which category?

5.25% sounds enticing, but the prospect of dealing with ME/BofA sounds terrible and based off your “Gotcha” stories sounds like a major deterrent.

Yes, $100k of tooth would work at ME.

5.25% (tax free) is with the upfront hassle for me. The online category is incredibly generous.

It’s not too bad to keep track of cards/categories.

Other than the transfer bonus, is there a reason you don’t park your $100k at BoA/ME permanently?

I used to park 100K at Merrill edge permanently, but then I started persuing the bonus transfer game.

It’s simpler to leave it put.