I did an internship for Delta Airlines a little over 10 years ago in which I left my wife and 2 1/2 kids for 10 weeks to live with 5 single men in a filthy Atlanta home (story at the end of the post). I’ve lost touch with all but one of my former Atlanta roommates, who is (now) an Information Systems professor who follows this blog. I got this note from him yesterday:

I’ve been thinking it would be interesting to see a post from you that describes where income should come from (in order) when you retire. I guess the hierarchy would be different at different age ranges, and different income scenarios, state of residence, and would be based on today’s tax system. You could also mention how your investment portfolio might change in retirement.

My dad has been retired for a bit, and I’m sure several of your other readers will soon retire… could be interesting? Or maybe too complicated to be of any use… anyway, just an idea.

I’d been thinking about writing this exact post for years, so my friend’s email provided the requisite kick-in-the-pants to get some thoughts on “paper.”

My corollary Hierarchy of Savings post has been viewed 10,190 times and is the fifth most visited post on this site. I wrote that post in about 15 minutes. This one took a bit more thought since it’s slightly more complicated.

Hierarchy of dissavings (aka retirement withdrawal sequencing):

As people approach retirement, there will be a combination of retirement income sources and hopefully some non-zero retirement wealth.

The worst-case scenario is zero retirement wealth, zero home equity, zero pension, and only a meager Social Security income. I’m watching this scenario play out in real time before my eyes for a close family member. So far, they are keeping their head above water through the generosity of family members (e.g. their son is letting them stay in the son’s former home at a heavily subsidized rate after their prior home was foreclosed after living there for 20Y). But I worry about what happens when this generosity runs out or larger expenses arise. Without the generosity of their son, they would be in a world of hurt. This family member told me once that his retirement “plan” was “his children.” At least he was transparent about his intentions to sustain life on the charity of others….

Rant aside, here’s what a less distressed retirement ought to look like:

- Sources of income:

- Pensions (though these are becoming increasingly rare for all but federal employees)

- Social Security

- Sources of wealth (wealth is obviously different from income):

- Roth accounts:

- 401k/401a/457/403b

- IRA

- Trad accounts:

- 401k/401a/457/403b

- IRA

- Taxable brokerage accounts

- HSAs

- Liquid savings

- Home equity

- Roth accounts:

The challenge with retirement seems to be:

- To not run out of money

- To not die with too much money (bad for the deceased, good for heirs)

- To transform wealth into income streams

BigERN is a PhD economist (earned at the highly esteemed U of Minnesota) who has spent the better part of 4 years blogging about “safe withdrawal rates” (i.e. how much one can safely withdraw each year from their portfolio without running out of money). I’m surely oversimplifying his billion posts, but what I seem to have gleaned from them is that one can retire when the amount they require to live falls below some “safe withdrawal rate” (SWR). BigERN’s extensive analysis concludes that 4% is less safe, 3.5% is more safe, and 3% is even safer.

To make the math easy, let’s assume a 3.333% SWR and a $50k/year cost of living. That implies that a person would need a portfolio of $1.5M (=$50k/0.0333333) to sustain that standard of living for a long time. BigERN has a series of thoughtful posts on asset allocation for before and after retirement. However, I don’t recall that he’s written much about the bizarre zero interest rate environment we’re currently in (I could be wrong). No amount of Monte Carlo analysis using historical U.S. data would help us reasonably predict outcomes of today’s wonky interest rate environment.

For the purposes of this post, I’m going to assume that the retiree has done their homework and has: 1.) enough money to last them for life, and 2.) the “right” asset allocation. Consequently, I don’t have anything to add on these dimensions.

Rather, what I hope to cover in this post is how one would optimally sequence the withdrawals from their accounts to minimize their tax burden. By minimizing one’s tax burden in retirement, one can either: 1.) retire earlier with fewer assets, 2.) increase their consumption in retirement, or 3.) leave a larger inheritance to their heirs.

As an aside, I don’t seem to recall BigERN (or others) talking much about annuitizing assets. In practice, not many people annuitize their assets to transform their assets to guaranteed income streams. This lack of annuitization is known as the “annuitization puzzle” by academics and is written about here by Nobel Prize winner Richard Thaler and coauthors in the Journal of Economic Perspectives. My uninformed opinion of annuities is that they reek of opaqueness, high fees, and sleazy high-commissioned salespeople. I fully acknowledge, however, that my opinion might be unjustified….

Continuing with our example, let’s assume that the retiree doesn’t want to sell their home to “eat” their home equity. One way a person could “eat” their home equity is to utilize a reverse mortgage. However, these products can be predatory. For the purposes of this example, let’s assume that the retiree doesn’t want to utilize a reverse mortgage. Rather, they plan to leave the home equity to their heirs upon death.

Let’s also assume this person has no pension (as will be the case for most of us) and that the retiree is 45 years old so that Social Security is many years off. This makes the scenario more interesting in my opinion. The age could be increased to 60+ without much loss of generality. To make things interesting and the math easy, let’s assume that the distribution of assets roughly mimic my own (50% tax deferred, 25% tax exempt, 25% taxable). As an employee of a public university with access to a 401a, 403b, and a 457, I admit this is surely not a great assumption for the masses. However, it makes for a more interesting analysis than something more generic (e.g. 30% tax deferred and 70% taxable). Again, we’ll relax that assumption at the end.

Since I like bullet points, here’s where we are so far:

- Total investments: $1.5M

- Tax deferred: $750k

- Trad 401k/401a/403b/457

- Trad IRA

- Tax exempt: $375k

- Roth 401k/401a/403b/457

- Roth IRA

- HSA

- Taxable brokerage: $375k

- Tax deferred: $750k

- Other assumptions:

- Annual cost of living: $50k.

- Married (we can relax this later).

- We’ll use today’s tax structure as the baseline because who knows what it will look like in 50 years.

- Let’s assume that the cost basis of the brokerage account is $0. This is obviously over-conservative but serves to illustrate a point.

- Assume we’re retiring at age 45 to make the withdrawal strategy more challenging (e.g. we desire to avoid 10% early withdrawal penalties).

- An older retiree wouldn’t have to worry about avoiding early withdrawal fees, so I think the younger retiree scenario is more interesting to look at.

- Other considerations:

- If planning on optimizing for ACA subsidies, there is a delicate balance to tread. Optimizing for taxes might well push one over the dreaded “Obamacare subsidy cliff.”

- The Finance Buff talks about the cliff here (link).

- The math (and the financial reality of retirement) is easier if we move to a zero-income state tax in retirement (a-la the GOAT Tom Brady (FL) and the artist formerly known as the frugal engineer (WY)). Let’s assume that for this example.

- If planning on optimizing for ACA subsidies, there is a delicate balance to tread. Optimizing for taxes might well push one over the dreaded “Obamacare subsidy cliff.”

Here’s the foundation of what I’d do if I’m recently retired:

- First, roll over all retirement assets to IRAs:

- Roll over Trad 401k/401a/403b/457 to Trad IRA

- Roll over Roth 401k/401a/403b/457 to Roth IRA

- Pros to rolling over:

- Fidelity offers 0% fee funds with 0% administrative expenses. This will surely beat the investment selection of a 401k with high-fee investment options and high recordkeeping fees.

- Vanguard is not far behind.

- Once at Fidelity/Vanguard, general investing maintenance is super easy.

- Fidelity offers 0% fee funds with 0% administrative expenses. This will surely beat the investment selection of a 401k with high-fee investment options and high recordkeeping fees.

- Cons to rolling over:

- It’s my understanding that 401k/401a/403b/457 plans have better “asset protection” structures. That is, if you are sued, it’s slightly better to have money in a 401k/401a/403b/457 than an IRA (link).

- Surely carrying umbrella insurance would help to mitigate this risk.

- If you end up going back to work, having a non-zero Trad IRA balance would complicate any future backdoor-Roth contributions.

- If you are currently invested in a well-functioning 401k with institutional share classes, then you’d lose access to these lower-cost funds. However, given the lack of fees in IRAs in today’s environment (expense ratios + recordkeeping expenses), I think this disadvantage is moot.

- It’s my understanding that 401k/401a/403b/457 plans have better “asset protection” structures. That is, if you are sued, it’s slightly better to have money in a 401k/401a/403b/457 than an IRA (link).

Now, here’s how I’d withdraw my funds:

- The taxable brokerage account will presumably be throwing off dividends (unless invested in Berkshire Hathaway, for example). If invested in a domestic equity index fund, this will produce roughly $7,500/year in dividends (=2% div yield * $375k). Once the dividend is received, the tax “damage” has already occurred. Since we need $50k to live in this example, we may as well start eating that $7,500/year.

- I’d next begin a “Roth IRA conversion ladder”:

- I’d unambiguously convert up to the standard deduction ($24,800 in 2020) each year in Roth Conversions.

- If we are younger than 59.5, we can’t immediately “eat” this converted money. It must be “seasoned” for 5 years post-conversion.

- In year 1 through year 5, we have a consumption shortfall of $42,500 (=$50k annual consumption – $7,500 annual dividends).

- In year 6+, we’ll only have a consumption shortfall of $17,700 (=$50k annual consumption – $7,500 annual dividends – $24,800 “seasoned” Roth conversion from 5 years prior).

- To satisfy the above shortfalls, we’ll fund them in the following order:

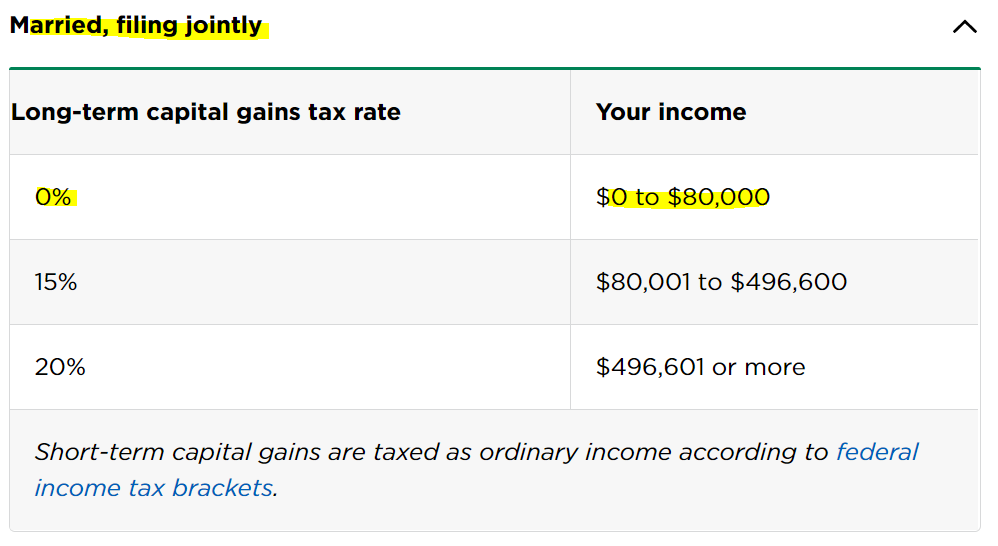

- First, we’ll exploit the 0% region of long-term capital gains. Based on today’s tax laws, we can realize up to $80,000/year in tax-free long-term capital gains + dividends (see picture below). Since our investments have already kicked off $7,500/year in dividends, that leaves us $72,500 (=$80,000 – $7,500) of tax-free capital gains per year.

- I realize we don’t need the full $73,300 to survive, but we’ll do so anyway to exploit the 0% region. Why would we do so? It’s free to do so and a great hedge against future tax law changes. If we don’t need the money, we IMMEDIATELY reinvest the money back into the market, with the now-higher cost basis. In our simplified example, the cost basis of our initial $375k was $0. In years 1-5, I compute a $42,500 shortfall to be funded by the taxable brokerage account. Since we just sold $73,300 of stock, this leaves $37,500 (=$80,000 – ($50,000 – $7,500)) to IMMEDIATELY reinvest in the market at the higher cost basis. If the tax code doesn’t change in the future, then the benefit to this “0% tax gain harvesting” is moot. However, if the future tax law changes eliminates this option, then these actions will lower our future tax burden through raising the cost basis of our shares.

- Once the brokerage account is exhausted (or if more tax-free liquidity is needed for emergencies or ACA cliff avoidance purposes), then I’d liquidate investments in the following order:

- Eating any HSA receipts (aka reimburse yourself for any accumulated healthcare expenses not already reimbursed).

- Once the HSA is already funded, there is no real additional advantage of maintaining a HSA balance over a Roth. In fact, HSAs are substantially less friendly from an estate planning perspective, particularly to non-spouse beneficiaries (link):

- In the event of a non-spouse HSA beneficiary:

- The HSA will cease to exist as an HSA as of the date of the owner’s death

- The HSA’s fair market value as of the owner’s date of death must be distributed to the beneficiary

- The distribution is fully taxable to the beneficiary (needs to be included in the income tax of the beneficiary) whether it’s a person or the decedent’s estate

- As a result of the above, it is optimal for a retiree to deplete their HSA before depleting any Roth money.

- You obviously can’t exceed the amount of accumulated previously unreimbursed expenses without incurring penalties and/or taxes.

- Once the HSA is already funded, there is no real additional advantage of maintaining a HSA balance over a Roth. In fact, HSAs are substantially less friendly from an estate planning perspective, particularly to non-spouse beneficiaries (link):

- Next, I’d eat any Roth principal

- This includes converted Roths after the 5-year seasoning period (aka the Roth Conversion Ladder).

- Any principal of Roth IRA contributions over one’s lifetime.

- If older than 59.5, then Roth interest can also be eaten.

- Eating any HSA receipts (aka reimburse yourself for any accumulated healthcare expenses not already reimbursed).

- First, we’ll exploit the 0% region of long-term capital gains. Based on today’s tax laws, we can realize up to $80,000/year in tax-free long-term capital gains + dividends (see picture below). Since our investments have already kicked off $7,500/year in dividends, that leaves us $72,500 (=$80,000 – $7,500) of tax-free capital gains per year.

2020 LTCG table from NerdWallet (link). Highlights are mine. Not shown in this table is the fact that qualified dividends are also subject to the same taxation as LTCG. However, I’ve confirmed this through TurboTax’s software.

As a result of doing the above year after year after year, the following will occur:

- Trad IRA balances will be slowly converted to Roth IRA without paying a penny in taxes.

- One could accelerate this conversion by converting in the 10% or 12% brackets, but this would limit the ability to exploit the 0% LTCG in the taxable brokerage account.

- Taxable brokerage accounts will slowly be depleted to zero tax-free.

- Eventually, Roth and HSA balances can be depleted to zero (obviously) tax-free.

- Eventually Social Security will be withdrawn, easing the need to liquidate assets.

What are some additional considerations?

- Avoiding the ACA cliff should rationally limit one’s eagerness to do Roth conversions and/or 0% capital gains harvesting.

- Future RMD concerns may induce people to accelerate the conversion of Trad to Roth.

- GoCurryCracker wrote about this here (link).

- Particularly if someone doesn’t have have large taxable brokerage balances with which to exploit the 0% LTCG region, I’d think hard about converting to the top of the 12% bracket if Trad balances are currently large.

- Since the cost basis of the taxable brokerage will be non-zero in reality, we can generate more liquidity than we generate in capital gains. For example, if our cost basis for a $10k withdrawal is $7k, then $10k of liquidity is generated through the realization of only $3k of LTCG.

- The taxation of Social Security hurts my head. I know it’s significantly more nuanced than non-Social Security income and I’ll eventually get around to learning that some day.

- I’ve gleaned from many personal finance websites (like OchoSinCoche’s post here) that it’s generally optimal to delay starting Social Security payments. To the extent that this is true, optimizing one’s taxes in retirement help someone delay Social Security.

- Non-zero state income taxes throw a wrinkle in the 0% LTCG capture strategy. However, I still think it’s rational. I think the main reason it wouldn’t make sense is if the individual is planning on leaving those assets to their heirs at death. In which case, there is no real benefit to incurring the non-zero state income tax burden now through capital gain harvesting since there is a tax-free (federal + state) step-up in cost basis at death.

What about alternative scenarios?

- If single?

- Divide numbers in our example by 2.

- If someone retires after 59.5?

- We no longer have to worry about the 5-year seasoning period of Roth conversions above because we can simply eat directly from our Trad accounts. However, Roth conversions could still be optimal as a way of reducing downstream RMD’s starting at age 72.

- What if someone has a $0 taxable balance at the beginning of retirement (only Trad + Roth)?

- Before Roth conversions are seasoned, then exiting Roth principal would have to be eaten to sustain life.

- This is basically the best case scenario, as it is less reliant on the generous (and probably temporary) 0% LTCG region.

- In a perfect world, my employer will open up the mega-backdoor Roth and I will have the entirety of our wealth in Roth + Trad accounts.

- Before Roth conversions are seasoned, then exiting Roth principal would have to be eaten to sustain life.

- What if someone has a massive taxable balance and $0 tax-sheltered money?

- Tax gain harvest to your heart’s content. If the tax laws don’t change (ha!!!), you can enjoy the massive region of 0% taxation.

- I basically write about this strategy in this related post.

- Tax gain harvest to your heart’s content. If the tax laws don’t change (ha!!!), you can enjoy the massive region of 0% taxation.

- What if someone wants to spend $200k/year in retirement?

- This is a great problem to have because it implies they have a boatload of money saved. This person will obviously need to pay more than $0 taxes in retirement.

- Having a paid off mortgage would lower cash flow requirements in retirement.

- This is a great problem to have because it implies they have a boatload of money saved. This person will obviously need to pay more than $0 taxes in retirement.

Wrapping it up

The above example perfectly exemplifies tax arbitrage in retirement:

- The sizable state “tax alpha” achieved by moving across state lines in retirement.

- In my case, I’d stand to gain 7% of “tax alpha” by simply moving.

- Thinking harder about it, I’d be transforming $0.93 to $1, which is a state tax “alpha” of 7.5% =(1/(1-0.07))

- In my case, I’d stand to gain 7% of “tax alpha” by simply moving.

- The sizable federal “tax alpha” (24% in my current case, but 37.5% a couple years back due to pre Trump AMT tax cuts) generated by saving your marginal tax rate when contributing to “Trad” accounts while working and doing tax-free (or <= 12%) Roth conversions in retirement.

- Thinking harder about it, the federal tax “alpha” is 31.6% (=1/(1-0.24)) under current tax code and 60% (=1/(1-0.375)) pre-Trump tax cuts.

So those are my thoughts based on the current tax code. I’d be curious to see if people can poke holes in what I wrote or offer improvements.

(Yet again…..) A completely orthogonal and unnecessary trip down memory lane,

The below trip down memory lane was prompted by the email from my Atlanta buddy yesterday. If you proceed, I offer no refunds on the ensuing few minutes of your life that you will never get back.

During my MBA, I did a ten-week summer internship in Delta’s procurement department. While some of my colleagues a few cubes over were given the high-profile job of helping to procure the “best” (i.e. cheapest) mustard packets or paper luggage tags, the entirety of my internship was dedicated to supporting the RFP and eventual award of a portion of our internal shipping contracts (for when Delta needed to ship stuff internally like spare airplane parts).

Given the short-natured terms of my employment, I didn’t think it would be logistically or economically prudent to move my entire family out to be with me (I was married with 2 1/2 kids at the time). As a result, I flew out to Delta’s headquarters to live in Atlanta by myself for those 10 weeks. One perk of working for Delta was the unlimited access to free standby flights. As a result, I was able to fly back to visit my wife and kids every weekend.

Through my church network, I connected with a group of 5 dudes renting a home on the North side of town who offered to rent me a room for $300/mo. It was reasonably close (1.4 miles) to Atlanta’s MARTA rail system (specifically the “Medical Station” stop). On my day of arrival, I walked the 1.4 miles to my new home (google map link). Having spent the vast majority of my life in non-humid environments, I vastly underestimated the amount of sweat I could produce over a 1.4 mile walk in Atlanta’s summer humidity. These were the pre-Uber/Lyft days and I simply couldn’t justify the expense of a taxi when my two legs worked fine.

It was a surreal experience being transported back into a bachelor pad (essentially erasing 10 years of life progression on my end). Granted, these were church-going folks, so it’s not like there were nightly keggers or raves at our place. However, the level of upkeep of the housing arrangement left much to be desired. For example, my bedroom was located adjacent to the kitchen. At night, I would hear rats enter our cupboards and gnaw on the food. I will never forget the sound of rats chewing on dried pasta about 15 feet from my pillow.

Google maps street view of the place. The red box was my room.

Another oddity of the new housing arrangement was that my roommates had somehow let the garbage service lapse a couple of weeks before my arrival with no plan to reinstate it. Consequently, I arrived to a few weeks of squalor built up in the home, much do the delight of my newfound four-legged rodent roommates.

The MARTA train would take me from the North side of Atlanta to the airport on the South side of town. From there, I would catch a 15-minute shuttle to Delta headquarters. It was 90-minutes one-way and about as fun as it sounds.

I remained car-less throughout the summer internship but I needed a better way of getting to and from the MARTA stop. To shorten my 1.4 mile commute from the house to the MARTA station, I ended up buying a bike from Walmart only to have it fall apart on me. Mercifully, there was an unclaimed bike that a former roommate had abandoned that I adopted as my own. The bike had a u-lock that was permanently attached to the frame (since nobody had the key), but I overcame it by simply taping the lock to the frame to prevent rattling and banging into my knee.

What a beauty!!!!! Unfortunately, I’d sweat quite a bit even on an easy 1.4 mile bike commute.

My least favorite memory of that summer (much worse than the rat infestation) is that 9 months after leaving the company, Delta harassed me over an alleged $885.42 overpayment mistake on their end (which I still dispute to this day). I’d already filed my taxes with the W2 they originally provided me, so they were implicitly asking me to revise my already-filed tax return. When I showed them the math of why they were wrong, the refused to budge. It was one of the more frustrating experiences of my life. Below are some screenshots of the correspondence. It is a bit cathartic sharing this completely orthogonal story of a Fortune 100 company threatening to send a former intern to collections 9-months after I left the company for a 3-figure sum. Fortunately, after weeks of battling them they “forgave” the discrepancy and stopped harassing me.

After asking for clarification on the $885.42 overpayment, Delta realized they needed to correct their correction because they’d forgotten to adjust for tax withholdings.

After asking for clarification on the $885.42 overpayment, Delta realized they needed to correct their correction because they’d forgotten to adjust for tax withholdings.

FP, I looked into annuities for a portion of asstes, but in this low interest enviroment they do not seem attractive. I decided to create my own “annuity” for that portion of the portfolio by investing about 75% in short term government bond low expense ratio ETF and the remainder in a few high dividend yield dividend aristocrats/kings like MO and T to increase the overall yield. I laughed when reading about the Atlanta heat. I live in the Augusta area and biking results in dripping wet shirts.

Agreed entirely that annuity rates must be abysmal these days. However, the historical lack of annuitization remains a puzzle to economists.

I have an even funnier/grosser sweat story from Atlanta. One day at work I was supposed to meet a supplier offsite about 2 miles from Delta headquarters. This created a bit of a logistical problem for me since I didn’t have a car. Luckily, I found an internal Delta shuttle that would get me close enough. For some reason, I missed my shuttle by a few minutes, meaning I would surely miss my appointment with the supplier. Given that it was only a couple miles away, I decided to jog there in my work clothes. I was about halfway there when a passerby took pity on me and offered a lift. When I got the the appointment in an air conditioned building, my body wouldn’t stop sweating. It was as if I had taken a shower in my work clothes. Suffice it to say, that was a low point in my life but it certainly puts a goofy grin on my face as I look back on the absurdity of the situation. Uber/Lyft certainly would have come in handy a few times in my life had it existed back then.

Why are annuities not attractive in a low interest rate environment? TIAA Traditional offered a minimum guaranteed interest rate of 3%. Shouldn’t that rate be particularly attritive in a low interest rate environment? I know that environment is gone now, but I only recently came across this article and am trying to understand the argument.

I think they are a good option for a lot of people. Especially those who are really risk averse. It seems that the academic literature is convinced more people should annuitize.

On the other hand, I prefer to be my own pension company to cut out the fees associated with middle men. The consequence of this decision is that I alone bear my longevity risk, as opposed to having it pooled among tens of thousands of pension plan participants. Same thing with market risk. But the upside is that my heirs will inherit whatever we don’t spend.

Who knows, maybe in a few years I’ll change my mind on the topic. I certainly am open to changing my mind down the road.

Eric-

Judging by your construction, you may be trying to replicate income annuities (immediate/deferred depending on fund placement and reinvestment preference). More recent product designs incorporate various options strategies to exchange a fixed rate of return for a greater potential return without sacrificing the downside protection offered by annuities. This concept broadly falls under the umbrella of Fixed Indexed Annuities (previously termed Equity Indexed Annuities) and may be a more attractive choice.

Nerd’s Eye View has a pretty good guide on this DIY:

https://www.kitces.com/blog/building-your-own-equity-indexed-annuity-or-structured-note-by-pairing-bonds-with-equity-index-options/

There are a few other bells and whistles not available with this approach (alternative indices, GMWB riders, exotic options, etc.) only available through an insurance carrier, but there are also definitive advantages to the DIY approach. You would not have to pay commission, surrender charges to access your own capital, and have infinite customization choices.

K,

Thank you for the info from Kitces. I read him but missed this article. I was originally looking at SPIAs and never considered using options. This really helps.

Eric

K,

Thanks for sharing the Kitces link! It’s an interesting idea. Are you currently implementing this strategy (or something similar)?

Somewhat relatedly, in the recent interview of Aswath Damodaran by Prof G, Aswath (the master) suggested that investors could achieve relatively cheap downside protection through use of put options: https://podcasts.google.com/feed/aHR0cHM6Ly9mZWVkcy5tZWdhcGhvbmUuZm0vV1dPNjY1NTg2OTIzNg/episode/OTkyYTFmNzAtNjFkYi0xMWViLTg4ZDQtZDM3NGQ0NTFlNDNh?sa=X&ved=0CAUQkfYCahcKEwjIkJex2sjuAhUAAAAAHQAAAAAQAQ

While a sensible strategy, I’m skeptical of adopt this strategy myself because 1.) the strategy requires ongoing maintenance (e.g. re-purchasing put options periodically, etc), and 2.) options are zero-sum in nature (admittedly similar to insurance). I understand that derivatives can still add hedging value in a zero-sum setting, but it makes me less interested in buying them. I’m of the mindset of self insuring (car, home, health, etc) to save on premiums, thereby transforming myself into a (hopefully profitable) insurance company where I invest my lower premiums to grow my portfolio. The same carries over to my personal investment portfolio. I self insure against adverse outcomes by recognizing that I can always work longer.

Your ATL experience reminds me of when I moved from south central PA (small college town the amish frequented on horse and buggy) to North Philly for grad school. I was offered a TA spot last minute and lined up a room within a week of the semester with a random undergrad student off facebook (~15 years ago) and few guys in a band, hopped on an Amtrak and taught myself the subway to find campus and the apartment a block away.

The band had the complete opposite life of me as a grad student; they would be up all night in the basement drinking and jamming and be piss ass drunk in the first floor living area as I was heading out to campus most days. The 10×10 room cost a fortune because it was a block from Temple with a police station and subway stop a few hundred yards away despite not having a functional kitchen (the band guys were supposed to be renovating it for the landlord…) and looking like an all around dump. Someone even busted the lock to my room and stole the computer I had a few days before I had lined up a truck to move my junk to a new apartment after my wife (then gf) graduated. She would take the train/subway to leave the amish paradise and live with me while doing her grad internship in philly- My brother in law jokes that he still thinks that place is where I grew up because he was in philly for an event once and picked us up in the ghetto

Life comes at you fast!

Thanks for the good laugh about your Philadelphia experience. It’s always fun to look back in life and appreciate how far we’ve come.

I hope I didn’t paint too bad of a picture about the Atlanta housing arrangement. After all, it was perfect for my needs (cheap, easy enough access to the train, short term rental, free bike, good roommates).

Super thorough, and I appreciate the summary.

Yeah, the ACA cliff is the thorn in our side. And not only the cliff, but we’ve budgeted based on an income assumption well below the cliff, closer the $40k. We made the mistake of getting a costlier silver plan that we probably don’t need (in hindsight)

If we generate income above $40k, even with just conversions, we owe Big Sam on back-payments on the ACA rate we were quoted. I think our plan of action is to go dividends + Roth conversions up to standard deduction + Cap Gains Harvest to $40k. Not much room. Thankfully we have a year of cash, a healthy brokerage account, and a decent amount of Roth IRA holdings, so we’re not too concerned on paying ourself first, this year. Next year we are getting a bronze plan for sure, which will considerably lower our healthcare rate and allow us more flexibility on income.

Thanks for the great comment!

Isn’t the huge ACA cliff at 400% FPL? Or is it another cliff you’re hoping to avoid?

2021 FPL looks to be $17,420 for a family of 2. $17,420×4 = $69,680. What am I missing?

Yes, so when you go through the process, the ACA rate isn’t subsidized at a flat rate below 400% FPL. So if we spend 40k or 50k, we’re still “on the cliff”, but the ACA plan with $50k spending costs more (less subsidized)…it’s tiered even “on the cliff”. This is our first year, so I could be mistaken, but when we put in higher incomes on the form, it spit back a higher monthly premium. Make sense?

I just played around with the 2020 Obamacare subsidy calculator from KFF: https://www.kff.org/interactive/subsidy-calculator/#state=ut&zip=84604&locale=utah&income-type=dollars&income=68961&employer-coverage=0&people=2&alternate-plan-family=&adult-count=2&adults%5B0%5D%5Bage%5D=21&adults%5B0%5D%5Btobacco%5D=0&adults%5B1%5D%5Bage%5D=21&adults%5B1%5D%5Btobacco%5D=0&child-count=0

You’re right. In UT, there’s a “slope” preceding the “cliff.”

* Income: $17,240 (100% FPL). Subsidy: Free Medicaid.

* Income: $34,480 (200% FPL). Subsidy: $5,128/year.

* Income: $51,720 (300% FPL). Subsidy: $2,292/year. Implicit marginal tax rate = 16% (=(5228-2292)/(51720-34480)).

* Income: $68,960 (400% FPL). Subsidy: $598/year. Implicit marginal tax rate = 10% (=(2292-598)/(68960-51720)).

* Income: $68,961 (400.01% FPL). Subsidy: %0/year. Implicit marginal tax rate = 59,800% (=(598-0)/(68961-68960)).

So there’s indeed a steep “cliff”, but the preceding “slope” makes the “cliff” much less big of a deal.

Given the above, you’re justified in not maxing out the 0% LTCG region each year. I’d have to think harder about what I’d do if I were you. It’s certainly more complicated once you throw in these competing considerations.

Great article. It wouldn’t impact many, and the benefit exist for only a 4.5 year window, but there is a 401k/403b IRS rule known as the “Rule of 55”, where employees can actually make penalty free (not tax free) withdraws from their 401k as long as their balance is left with their employer after they quit/retire at age of 55. This definitely provides some added security/flexibility for those who retire within this 55-59.5 age window and would be a good reason to NOT roll over your 401k, especially if you are lucky to have low cost plan. My understanding is once a 401k is rolled out, this benefit is lost.

Another tax strategy to consider for those who have acquired decent amounts of appreciated company issued stock over a career is 401k Net Unrealized Appreciation. This is a bit more complicated, but would be great for a future post!

Really enjoy the blog!!

D,

I appreciate the great comment. I’ve vaguely heard of this “rule of 55” on the Bogleheads forum, so thanks for the reminder of the implications. That definitely simplifies the complexity of unnecessary “seasoning” of Roth conversions.

Prior to your comment, I’d never heard of “Net Unrealized Appreciation.” The way my personal finance education has worked thus far is that I haven’t been formally taught anything. I only know stuff well once I encounter it. Through my years in poverty in grad school I learned the EITC well. Pre-Trump tax cuts I understood AMT well. I understand Roth vs Trad well because I dedicated an inordinate amount of time understanding the US tax code. But I’ve never been a position to receive company stock in my life, so I’m completely ignorant on how it works. Thanks to your suggestion, I’m going to learn more.

The blessing and curse of maintaining a personal finance blog is that many of “the regulars” are significantly smarter than me. The blessing is that I learn from people like yourself. The curse is that I look like a fool. On net, I’m happy to look like a fool to get closer to the truth.

One issue worth thinking about is COBRA. For at least 18mos after retirement (36 for those working for some employers in some states) you can keep your old health plan instead of using Obamacare. Whether this is worth it depends on the cost of COBRA and what your current plan offers compared to what you can get via Obamacare (in Calif to get the subsidy you must sign up for an “enhanced silver” plan). But while on COBRA the ACA cliff will not be a concern.

Also in addition to avoiding the ACA cliff, you have to be careful not to earn too little! According to https://www.healthforcalifornia.com/affordable-care-act “To qualify for financial assistance, you must have a household income that ranges between 100% – 400% of the Federal Poverty Level” and elsewhere on the site it says you may be put in Medicare instead of Obamacare if your income is below 138% of FPL.

Mike,

Thanks for the great feedback!

It’s my understanding that the majority of states have expanded Medicaid to 138% FPL: https://www.kff.org/medicaid/issue-brief/status-of-state-medicaid-expansion-decisions-interactive-map/

However, it’s also been my experience that Medicaid is superior to any other insurance I’ve ever had (while living below the poverty line in grad school). I don’t understand people’s visceral disgust of it, although I fully admit there is an ethical question surrounding living on the government’s dole when someone can afford to pay for an ACA plan.

Your experience with Medicaid does not generalize everywhere.

Medicaid is operated by the states and can vary widely in quality depending on your state. Unlike Medicare, which is fully financed by the federal government and uniform in benefits nationwide, states have to pick up a share of Medicaid costs. Some states are more generous than others. Payments to providers are so low in many places that it can be hard to find a provider, particularly a specialist.

Some states have not expanded Medicaid, e.g. Texas, so falling below 138% does not guarantee access to Medicaid. The non-expansion states have asset tests as well as income tests to qualify and it can be impossible for a childless non-disabled adult to qualify, regardless of poverty. There is a coverage gap in those states where you can be too poor to qualify to purchase an ACA plan but still not eligible for Medicaid.

Thanks for your comment! I’m sorry if I gave the impression that my positive Medicaid experience was generalizable. I acknowledge that it’s highly state-dependent.

Here’s a few data points that reiterate my positive experience:

* https://forum.mrmoneymustache.com/post-fire/fire-in-medicaid-expansion-state/msg2696300/?PHPSESSID=nupuu8kjojoam1hee0keqv4397#msg2696300

* https://forum.mrmoneymustache.com/welcome-to-the-forum/why-keep-income-above-medicaid-limits/msg2069305/#msg2069305

There are obviously plenty of counter-examples and “gotchas,” though.

For someone living in a “bad” Medicaid state, it wouldn’t be hard to avoid Medicaid by having their MAGI slightly exceed 138%. In the absence of “real” income, this could be accomplished via Roth conversions or realization of LTCG.

Thanks for the post. From the sounds of things, having Twitter and a moderate following at the time would have helped shame an image conscious Delta into dropping such a small mistake. Glad that it resolved well, but as a young student with a small family, I imagine it was pretty frustrating. Glad it worked out alright. Reminds me of my experience at Dumpster Fire Inc when they switched everyone from paid time off to flexible time off (aka, “take as much as vacation as you want, but not too much”) and used the absolutely most unfavorable calculations to cash out the accrued PTO. Talk about angering current employees.

Also, thanks for the shout out.

Your story about Dumpster Fire Inc sounds infuriating!

Prior to Delta, I’d never heard of an employer threatening to send an employee to collections for a 3-digit sum of money. I guess there’s a first for everything.

Delta Payroll harassment aside, I was very underwhelmed by what I saw in the procurement department. Delta was hell-bent on hitting “diversity” objectives with its suppliers to gain “brownie points” with the broader world/community. When our team awarded contracts to “diverse” suppliers, we’d get a lot of praise from the higher-ups. It created a system in which ethics were breached (sharing non-“diverse” RFP pricing responses with “diverse” RFP respondents to give them an unfair informational advantage in the process. Armed with this information, the “diverse” supplier would have to update their pricing to just below the non-“diverse” supplier’s to win our business. The ethics of this made me want to vomit, but given the incentive structure (award contracts to “diverse” suppliers at any cost), I’m not surprised with the outcome.

Also, my manager cussed and shouted at us like a drunken & angry sailor during group meetings. It was, by a large margin, the least professional environment I’ve ever worked in.

Hi FP,

Thanks for putting all this together. Can you confirm how much you can gain harvest? I thought you need to take into the Roth conversion dollars into account for this. You only deducted the dividend money. This might have to do with AGI or MAGI used to determine LTCG rates coming before standard deduction. Just want to confirm.

I just ran the following scenario through TurboTax’s 2020 software:

MFJ

0 kids

$24,800 Roth Conversion

$40,000 Qualified Dividends

$40,000 LTCG

Total federal tax liability = $0.

Thank you! That is a great way to verify!

A few more potential cons to rolling assets from an employer plan to IRAs.

Some of us have TIAA Trad in our 403b, which is a pretty attractive option for fixed income portion of the portfolio in many of its varieties, especially for those with older “vintages,” with a minimum of 3% even on some of the fully liquid contracts.

TIAA funds also have options to take distributions as annuities that compare quite favorably to the best commercially available SPIAs, particularly for women. (TIAA is not permitted to use gender as a factor in calculating annuity payments.)

Also, in some states public university 401k and 403b distributions get very generous state tax treatment (fully exempt in some cases) but if rolled to an IRA that state tax perk is lost.

Thanks so much for the comment! I agree that these are powerful reasons why one might keep money in a 401a/457/403b, though I suppose this wouldn’t generalize very well to conventional 401k holders, right?

Another very important reason to never roll a governmental 457 plan into an IRA is that the governmental version of these plans is not subject to the early withdrawal penalty, which is a huge benefit for early retirees! I’m planning to use regular withdrawals from my 457 to fund my early retirement lifestyle, while doing Roth conversions to fill up the rest of the 10% tax bracket. The benefit is that I don’t have to wait five years for my withdrawals to “season” in the Roth before I can “eat” them, because I can always “eat” directly out of my 457. Fresh slabs of 457 are even tastier than seasoned Roth!

Ryan,

Thank you for another great counterpoint!!!

I’m of the opinion that seasoned Roth’s taste almost as good as “fresh” 457’s, but I can see why people would prefer the simplicity of what you are proposing.

Can you elaborate on why you would roll over 457’s to IRAs => convert to Roth, instead of directly eating 457s early? What benefit is there to roth seasoning them besides centralizing accounts?

IRAs tend to have lower fees (e.g vanguard and fidelity). But if you have a low fee 457 plan then I agree entirely that withdrawing directly from a 457 makes sense.

Now that the ACA subsidy has passed with the stimulus bill in the senate (which from what I read caps the maximum you spend on ACA premiums to 8.5% of your income and gets rid of the cliff) seems like there there is less incentive to sell up to the $80000 capital gains tax cap if you don’t need that money to live? Every $100 you sell in your brokerage account that you don’t need you are expected to use $8.50 on ACA premiums which is effectively a 8.5% long term capital gains tax rate?

I’m not an expert in ACA phase-outs (>138% FPL & < 400% FPL), but it's my understanding that phase-outs existed before the current law. This is something I asked Mr Clipping Chains about in our recent Q&A. If you look at an ACA premium estimator, like KFF's, you can infer such phase-outs. In the presence of ACA phase-outs, this would indeed complicate things. However, I'm not convinced that it would make a significant difference in one's strategy regarding tax loss harvesting. That said, I'll keep my eye out on ACA implications with this bill thanks to your comment. It's always interesting to learn about the unintended consequences of legislation.

I like https://www.i-orp.com/Plans/index.html

I think it does a very good job of taking many things into account and it is free.

Very cool. Thanks for sharing!

Hey FP,

I’m interested in why your ideal is maxing the Roth IRA. Reading the article from GoCurryCracker here: https://www.gocurrycracker.com/roth-sucks/ , the basic tradeoff on using the Roth seems to be:

Pro:

-Saves on taxes

Cons:

-Significant loss of liquidity on the earnings, which are virtually impossible to get out prior to 59.5 (except for first-time home purchase, medical expenses, and education).

I’d like to hear your perspective on this. On the one hand, my first thought is that he does have a good point regarding the loss of liquidity.

I think the counterpoints would be as follows:

-GCC discounts the impact of state taxes. For someone w/ a high income living in a high-tax state, those taxes can be significant (e.g mine living in NYC are around 25%).

-Even contributing max to Roth, your earnings aren’t going to become a sizeable portion of it overnight. You’ll have the ability to take action if needed.

-The exclusions to getting money out are quite generous. Most people who are interested in FIRE are probably only really trying to fund their basic needs and probably the lives of their loved ones, which would be reflected by the home, education and medical exclusions.

That said, at some point you do need to monitor how much you have in Roth earnings, especailly if you’re young (e.g 35 or less), b/c you’re going to have a lot of trouble getting the earnings out to RE.

Super interested to hear why you’re pro-Roth and/or why you don’t have the same concerns about liquidity.

Like GCC, I prefer Trad to Roth while working (which is the point of the GCC article you linked to). Why? Because tax rates while working are usually higher than those during retirement.

Given my preference towards Trad, there really isn’t a liquidity concern. Even in the “illiquid” Trad 401k, money can easily be accessed within 5 years at any age with a Roth conversion ladder.

That said, it is looking like my employer is about to open the mega backdoor Roth, and I’ll take full advantage of it. I very much look forward to avoiding the dividend tax drag in the future. I look forward to 5+ decades of tax-free growth, including cap gains. It’ll open up >$40k/year of Roth space. I couldn’t be more excited. Even given your liquidity concerns you mention, that’s $400k of principal per decade I can access before 59.5 if needed.