I’m married with 5 kids. My wife is a stay-at-home mother, though she taught elementary school for a year before putting her career on ice for a couple decades until the kids are older (maybe after they graduate high school?).

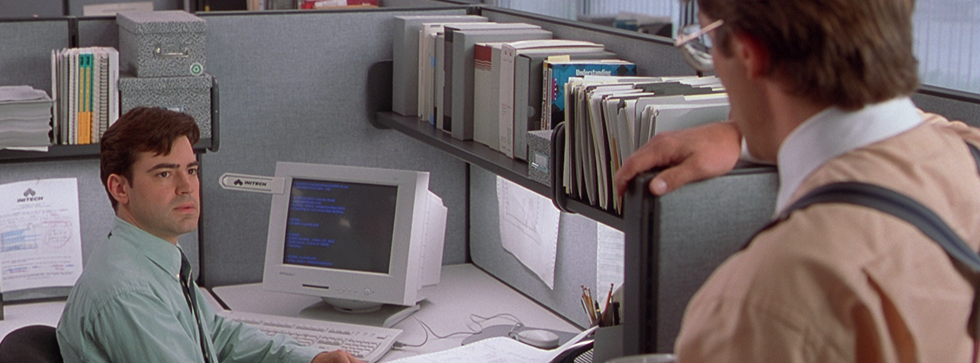

I spent 5 years getting an undergrad degree in mechanical engineering. I then spent 4 years at a Fortune 25 company doing grunt engineering work. I was surrounded by grey-haired people who had been doing the same thing for their entire careers. Convinced I would rather kill myself than rot in cubicle hell for the next 40 years, I plotted my exit. First, I tested the waters by temporarily leaving my well-paying job (I was making $90k/year when I left) to pursue an MBA while on educational leave. Emboldened by my positive experience outside of cubicle hell, I took the plunge into 5 more years of school. It was brutal, but miraculously our family survived.

Thus far, we’ve accumulated wealth the old-fashioned way with frugality. I haven’t tracked our net worth religiously to prior to starting the blog, but here’s a rough timeline of our income & net worth.

- Mid twenties.

- Earned $15k/year in income working as teacher’s assistant + random summer jobs before graduating.

- Finished our undergrad degrees.

- At graduation, our net worth was $10k ($0 debt).

- Took first job paying $56k/year.

- Late twenties.

- Got several raises and earned $90k/year before leaving on educational leave.

- Started & completed MBA.

- Net worth $100k ($0 debt).

- Early thirties.

- Took 5 years earning PhD, during which I earned $25k-$30k/year.

- Still managed to max out two IRAs each year thanks to the EITC.

- Took 5 years earning PhD, during which I earned $25k-$30k/year.

- Mid thirties.

- Completed twelfth year of college with net worth of $225k ($0 debt).

- Took job paying $200k/year.

- Bought first home for $400k with 20% down payment funded by Roth IRAs.

Our goal is to be financially independent in our mid-forties with ~$1.5M in investments (producing $45k/year in income in perpetuity at a 3% withdrawal rate). Let’s see how this goes, huh? It’s not as impressive as some of my blogging counterparts (Mr. Money Mustache, etc) who retired at 30, but with five kids and 12 years of college under my belt, I didn’t necessarily take the fastest path towards financial independence.

I created this blog to document our journey and illustrate how dumb-simple the process is. Hopefully someone will get use out of it.

Family photo about when I started the blog. October 2016.

Grinnell Glacier hike at Glacier National Park. July 2019.

Backpacking in the Wind Rivers, WY. I’ve backpacked there in 2018, 2019, 2020 (x2), and 2021 but the above was taken August 2020. Photo credit Jason Carr.

First multi-pitch trad climbing excursion. Johnny Vegas. Red Rocks, Vegas. December 2019.

Pretty good Costco haul. I can probably count on two hands how many times we’ve driven to Costco in the past 3 years.

Pretty good Costco haul. I can probably count on two hands how many times we’ve driven to Costco in the past 3 years.

The above is a 90-minute lecture I share with my students every year. Perhaps you may find it helpful.

Disclaimer:

This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Love the blog! I’m a mid-thirties attorney with five kids aged 2-9 and a stay at home wife who taught for a year (Montessori). We have a 2.875% mortgage, use many of the same frugal, investing, and life hacks, shop weekly at Costco, are generally in a pretty similar financial situation, and my first job paid $55k. I guess what I’m saying is that I can relate. I love MMM and GCC, but you are more relatable. The stuff that you do differently from me is great – I’ve got a handful of open links now to investigate further.

Some suggestions that may or may not be helpful. In the “Things I Like” page – a list of books (money or otherwise) would be great. Your links currently take you away from your site and to third-party sites. Perhaps you could set it up where when someone clicks on a third-party link, it opens in a new tab. I spotted a few typos. I’m far from a grammar nazi, but to maximize your appeal, it might help to clean those up. Keep up the great the work and thanks for sharing.

Quick edit – I saw the books list. I should have said more books and not necessarily money related.

P, thanks for the kind words! It’s like the twilight zone coming across another mid-thirties dude with 5 kids and a 2.875% mortgage. Glad to hear you like the blog. You’re certainly right that it has some typos. I’ll try to clean that up. Perhaps I can have Mrs. Frugal Professor to do the editing. Good point about the redirect on the links. My life hack for that is CNTRL+click in chrome, or even better if using a mouse (and chrome), click the link by pressing down on the middle mouse wheel button. But the better approach, as you suggest, is to not rely on my life hacks for readers clicking a link.

If there are life hacks I’m missing, let me know. I guess that’s one of the benefits of being so transparent in this blog. If I’m doing something idiotic, perhaps my (5) readers can help redirect me.

Totally random life hack for a large family: we do a family closet in our master bedroom. It’s a 5×5 Ikea shelf. Each kid gets a row (oldest gets top). Google “family closet” for examples of what this looks like. It makes folding laundry a dream.

I started off by getting Life‑Changing Magic of Tidying Up from the library for my wife. She’s the opposite of a pack rat and was pretty skeptical but agreed to at least quickly skim the book. Then, for the next couple days, she’s taking notes and talking about how she’s going to start doing things differently. I took all the kids to on a Saturday, and she spent a good chunk of the day going through the process in the book – blankets stacked sideways and empty shelves everywhere. Now that she’s sold on that concept, I’ll probably pitch the family closet and see if there’s any interest.

One more suggestion. A “contact me” link would be helpful. Keep up the great blog!

P, good to hear from you. I’m glad to hear that you found that book helpful. The woman is crazy (i.e. your socks have feelings), but at her core the message is of the most powerful and transformative messages I have read in a long time. In an effort of full disclosure, my house is a disaster and I have yet to find a way of implementing her methods entirely with 5 kids. However, I do find myself throwing stuff away without remorse now. And I also try to apply the same principals to time management, etc. Life is too short to not be surrounded by the people, things, and activities that bring you joy.

Good luck with your other endeavors. Thanks again for your suggestions on the blog. Hopefully I can figure out a way of making it more broadly appealing.

I don’t know how I found your blog, but I am SO glad I did! I couldn’t stop reading, your content is a wealth of information. I have a long way to go, but I hope to be debt-free by my 29th birthday (10 more months!) and put the 401k percentage that my employer matches. I learned so much about federal tax forms, and realize I may be giving the government “free money” with how much they take out of my paycheck. Now I’m going through my past forms to see what I can do differently next year. Truly appreciate all the work you put into this!

Happy to help. That’s what the blog is for; to help others avoid the pitfalls that I made in my 20s.

Great stuff! I’m highlighting one of your posts, Hierarchy of Saving, at http://www.moneyisnottaboo.com/2017/09/01/the-weekly-fav-5-five-great-financial-posts-you-should-check-out-2/ and wanted to Tweet about it, but can’t find you on Twitter.

I’ll be looking for more of your good stuff.

Keith, Thanks for reaching out. Twitter has always seemed redundant to RSS to me, so I have never gotten excited about it. With that said, I understand the rest of the world disagrees with me. Can you just tweet a URL to my post or is it cooler to tweet to my twitter which contains a URL to my post?

Thanks in advance for teaching an old guy new tricks. Here’s my twitter “handle”: https://twitter.com/Frugal_Prof

I recently started a blog and would like to use your wordpress theme. Can you tell me what theme it is (I assume you are using a free theme)? Let me know if I should have used a “contact me” button instead (I couldn’t find one).

I use GeneratePress. I think it was free. I tweaked it a bit to get it to look how I wanted.

Plugins I use:

Akismet Anti-Spam

Async JavaScript

Autoptimize

Easy Updates Manager

Jetpack by WordPress.com

Orbisius Child Theme Creator

RS FeedBurner

UpdraftPlus – Backup/Restore

WP Super Cache

Setting up WordPress was a pain to learn, but hopefully the above can point you in the right direction.

Thank you so much. This is invaluable advice. I’m new to this and want to learn something new (my background is accounting). I’ve enjoyed your blog immensely and will be linking to your Excel tools as well as your hierarchy of savings article. It blows my mind that most co-workers don’t even have a clue what to prioritize with their savings, so they end up spending it all.

Glad to hear that this was helpful to you. I’m happy to help.

Like you, I’ve worked with some smart people through my life. Engineering mega corp, phd, now professor guy. Like you, I marvel that people aren’t better versed in taxes. It’s by far my biggest line item in my budget. With a 45% effective marginal tax rate (thanks AMT 🙁 ) it’s a no brainer to shove money into pretax accounts. But many at my university don’t do it. I guess it’s because there is no margin in their budgets.

Will you be commenting on Cybercurrency ever? I’d be interested in your take on that.

Rich

Found your blog through Justin @ Root of Good. We’re just a little further ahead in our FI journey, but I thought I’d leave a comment because we are also a family of 5 and I am an engineer. We reached FI ($2.4m) this November with the sale of a company and I am planning to work through June 1.

I love your spreadsheet calculations. Looking forward to following you for years to come!

Fred, thanks for stopping by! FI @ $2.4M w/ 5 kids is impressive. Looking forward to learning all of your secrets from you on your blog.

Hi Mr Frugalprofessor,

I really do not mean to be rude, but how do you get a $200K/yr salary as a professor right out of graduate school? We are an academia family and know many others too. And most academia are paid peanuts right out of their PhD program and it would take many years to full professorship to maybe get a $200k/yr salary? From a financial point of view, it’s been painful being an academia family… and I am often thinking I would never encourage another person to go into academia because of the miserable pay and job insecurity before you get tenured.

I had come to your site hoping to learn more on how you managed financially with the typical poor pay for academias.

Kareen, your question is not rude at all. I happened to get a phd in the business school in a field that pays really well. If not for the decent pay, I probably would have stuck it out as an engineer. The pay bump was the only thing that turned the phd into a positive NPV project for me.

I wouldn’t wish a phd on my worst enemy. It almost cost me my sanity. 5 years of constant stress and anguish, fearing every day I’d get kicked out of the program in my early-mid thirties with 5 kids. Not my idea of happy times.

What I really hope to convey with my blog is that 1.) it pays to be frugal, 2.) it pays to understand and strategize around the tax code, and 3.) it pays to understand how to invest. By following these steps, we maintain a 70% net savings rate thanks to my income. If my income were halved tomorrow, we’d still save a good 40% of our income (thanks to progressive tax system). These strategies apply to people of any walks of life, from those making $10/hr to those making $10M/year.

Academics have incredible tools at their disposal from a tax standpoint. If you work for a public university, you can shelter insane amounts of money in supplemental retirement accounts (403b & 457), whereas normal people working in the private sector cannot do this. Hopefully you can find something useful from the blog.

Frugalprofessor, thank you for your reply. I wished I had known that B-school professors pay so much better. Many days I am literally in tears thinking of the stupid decision we made to give up our good paying jobs in pursuit of our academia dream. We exchanged good pay and job security for low pay (half prior pay check) and no job security and are we so much further out from FI then if we had just stuck to our boring jobs earlier on.

To further complicate the problem, we are resident aliens, meaning we are never sure if using 403b/401k will work for or against us (exit tax, foreign withholding tax etc) if we choose to return to our home country.

Looking back, we gained “intellectual freedom” at a huge cost.

Sorry to hear about the painful path. Academia is a tough place to be in, for sure.

A key principal of economics is the idea of the “sunk cost fallacy.” When you’re making decisions about your future, try to ignore the costs you’ve already expended in the past. For example, even with a phd if the non-academic path appears more lucrative & fulfilling, take the plunge despite the huge costs (emotional & financial) incurred to get to where you are. Easier said than done, for sure.

I wish you well on your path.

I’ve only just discovered your blog, and am already a big fan of Jim Collins and MMM. Yours suddenly struck a cord with me as a fellow academician (although I’m but based in the UK).

We don’t have the tenure system here, but salaries are generally lower, I only recently started making $84K having done eight years of training (including a fully funded PhD at Oxford) and have14 years of experience, so I can relate to Kareen! But what is really interesting is to hear everyone saying how tough academia is, just wanted to reassure you it’s no better over here.

Am looking forward to getting stuck into this, am about two years into investing and my aims for FIRE for the general stress reduction!

Welcome. My blog is admittedly US-centric given the emphasis on the importance of tax arbitrage in the US, but I hope you find something useful here.

You’ve already prompted me to work out how to optimise the tax I’m paying, so thanks!

I stumbled your blog and loved it! Just curious why would a tenured professor earning 200K a year would ever want to retire in the 40s 😉

Welcome to the blog!!!

Good question!!!!!!! First, I’m untenured. Second, I want to be financially independent in my 40s, not necessarily retired. There indeed is a lot to like about my current job. It’s the best job I’ve ever had.