First, a note on asset ALlocation

I don’t pretend to know what the “right” asset allocation is. I think that anyone who claims to have this superpower is trying to fool you. I’m not smart enough to come up with a very sophisticated answer here, so I just guessed. I hope you are smarter than me and did something more sophisticated.

The only investing advice I feel remotely confident sharing is that I’m 51% confident that equities will outperform the 2.17% yield on treasuries over the coming 30Y (link). If true, stocks are paradoxically safer than bonds over this 30Y horizon. However, I’m admitting there is a 49% chance I’m wrong here.

I’ve maintained a roughly 70% domestic equity + 30% international equity allocation for a while because it seems reasonable enough to me. Since international equities have underperformed domestic equities, it’s easy to second-guess this strategy. Nonetheless I’m sticking to it….for now.

How to decide WHERE to place your assets (e.g. taxable brokerage vs tax-sheltered)

Whatever the asset allocation you decide, it’s important that you minimize your tax burden. Why? Because after-tax returns — not pre-tax returns — will pay for your future groceries. And who doesn’t want to have the privilege of affording a few more Costco hot dogs thanks to decades worth of deliberate tax planning?

The premise of minimizing ones taxes is presented in these two posts:

- https://frugalprofessor.com/hierarchy-of-savings/

- https://frugalprofessor.com/hierarchy-of-dissavings/

Assuming you can’t shelter all of your assets in tax-sheltered accounts (IRA/401k/401a/403b/457/HSA/529/etc), you will have to make a decision on where to place which assets. In general, you want to place tax-efficient investments in your taxable brokerage account and tax-inefficient investments inside of your tax-sheltered accounts.

There are ample resources out there discussing this concept, such as this great Bogleheads wiki article: https://www.bogleheads.org/wiki/Tax-efficient_fund_placement

What makes an asset tax efficient?

In the world of mutual funds, a few things:

- The fund pays relatively modest dividends (with the vast majority of gains accruing realized in a tax-deferred manner).

- The fund has a high ratio of qualified dividends (which are taxed at a lower rate) as a percentage of total dividends.

- The fund avoids capital gains distributions.

My preferred investment that I put in my taxable brokerage accounts is the Vanguard Total Stock Market Index Fund (VTSAX). Let’s see if it checks the above boxes:

- Dividend yield is currently 1.37%. ✓

- 96% of dividends are qualified. ✓

- No cap gains distributions. ✓

An alternative fund you might consider in a taxable account is the Vanguard S&P 500 index fund (VFIAX):

- Dividend yield: 1.50%. ✓

- 100% of dividends are qualified. ✓

- No cap gains distributions. ✓

If a dividend is qualified, it is taxed at preferential rates (15% federal + 7% state in my case). If a dividend is non-qualified, it is taxed at my ordinary income rate (24% federal + 7% state). Too bad my state is so greedy, eh?

Therefore, my “dividend tax drag” with VTSAX is 1.37%*96%*(15%+7%)+1.37%*(1-96%)*(24%+7%) = 0.306%. In simple terms, 0.306% of my wealth in a taxable brokerage account evaporates each year due to this “dividend tax drag.”

Let’s now compute the dividend tax drag for VFIAX: 1.50%*100%*(15%+7%) = 0.330%.

Despite the fact that 100% of VFIAX’s dividends are qualified, it still has a slightly higher dividend tax drag than VTSAX because it has a slightly higher dividend yield. But both are obviously good enough to put into a taxable brokerage account and are among the most tax-efficient investments available for a long-term investor.

It’s my understanding that the mutual funds offered by other brokerages (e.g. Fidelity and others) have less efficient qualified dividend ratios (e.g. here is a list of Fidelity’s most recent QDI numbers that shows the S&P500 & total stock market indices lagging VG’s QDI efficiency). Further, Vanguard has eliminated capital gains taxes in their MF’s through the use of their patented “heartbeat” trading methodology (Bloomberg link). Admittedly, you can avoid this capital gains distribution issue by simply buying ETFs which don’t have this problem (see the Bloomberg article)

If you were to recompute this dividend tax drag for other asset classes, it would be larger. Why?

- Bonds, in a non-zero interest rate environment, pay coupons which are taxed at ordinary income rates. From Fidelity:

- The income from taxable bond funds is generally taxed at the federal and state level at ordinary income tax rates in the year it was earned. Funds that exclusively hold U.S. Treasury bonds may be exempt from state taxes.

- There are infinite permutations here that I don’t care to go into (such as the preferential treatment of muni bonds, etc).

- The income from taxable bond funds is generally taxed at the federal and state level at ordinary income tax rates in the year it was earned. Funds that exclusively hold U.S. Treasury bonds may be exempt from state taxes.

- International stocks pay a slightly larger dividend (1.96% currently) and have a lower QDI ratio (72%). The foreign tax credit is not big enough to offset this tax burden.

- REITS, for example, require large distributions and the dividends do not count as qualified.

There are certainly more asset classes to consider, but since I prefer to keep my portfolio simple with broad asset classes, the above is all I invest in (minus the REITs).

Let’s say that your desired portfolio is 70% domestic and 30% international. Assume you have $50k in a taxable account and $50k in a a 401k/IRA/HSA. From what we learned above, we could achieve your desired outcome in a tax-efficient manner by putting $50k of VTSAX in your taxable and putting the remainder of your assets ($20k domestic equity + $30k international equity) in your tax-sheltered accounts.

The above is what I do.

I love the simplicity of it. Every penny of my taxable accounts ($307,629.07) is invested in a single mutual fund, VTSAX. For reasons discussed above, I think this is optimal; I’d recommend it.

A note on the (ideally) permanent nature of taxable brokerage investments

I had a discussion with some friends yesterday about some basic investing topics. Despite offering to help them with their investments (for free) years ago, they instead opted to utilize a 1% AUM advisor (with Ivy credentials) on a large balance. They are highly compensated medical professionals; in other words, unscrupulous financial salespeople view them as having huge bullseyes on their backs.

What occurred to me over that conversation is that my friends are stuck with crummy investments that former salespeople had duped them into buying decades ago. They remain in these high-cost funds because it would be prohibitively costly from a capital gains tax standpoint to clean up their positions.

In conclusion, only choose investments in your taxable brokerage account that you are wiling to hold until your death. I recommend a total US stock market fund or a S&P index fund. I can’t really foresee any scenario in which someone would regret either choice fifty years from now.

How to decide WHERE to place your assets (e.g. across financial institutions)

Something else you might consider when deciding where to place your funds across financial institutions is the idea of Comparative Advantage: https://en.wikipedia.org/wiki/Comparative_advantage.

The below numbers are bogus but serve to illustrate a point.

Assume you can invest in a taxable brokerage account at Firm A with the following costs:

- Domestic equity ER: 0.04%

- International equity ER: 0.11%

Assume you can invest in a tax-sheltered account through work at Firm B with the following costs:

- Domestic equity ER: 0.08%

- International equity ER: 0.12%

Answer the following questions. Which investing firm has the:

- Absolute advantage in domestic equity?

- Absolute advantage in international equity?

- Comparative advantage in domestic equity?

- Comparative advantage in international equity?

Here are the answers:

- Absolute advantage in domestic equity?

- => Firm A because 0.04% < 0.08%

- Absolute advantage in international equity? =

- => Firm A because 0.11% < 0.12%

- Comparative advantage in domestic equity?

- => Firm A because there is a 0.07% “domestic discount” at firm A vs a 0.04% “domestic discount” at firm B

- Comparative advantage in international equity?

- => Firm B because there is only a 0.04% “international penalty” at Firm B vs a 0.07% “international penalty” at firm A

Using comparative advantage logic, it would make sense to invest in international equities at Firm B and domestic equities in Firm A.

No matter how bad a particular brokerage is, it will always have a comparative advantage in something.

Mean-spirited economics professors joke that even their most problematic students have a comparative advantage in something. The joke, of course, is that even the most incompetent individual in the world is relatively less bad at doing something, no matter how inept they are.

Conditional on having to invest your money at an inferior institution (as is the case with a 401k, for example, in which case you can’t costlessly move elsewhere while employed), it makes sense to exploit the funds for which that firm has a comparative — not absolute — advantage.

The above logic is what drove my decision to hold international equity funds in Fidelity’s 0% ER total international stock fund (FZILX). Fidelity has a sizable comparative — and absolute — cost advantage in international equities.

So what do I personally do?

- 100% of my taxable is 0.04% ER VTSAX at Vanguard

- 100% of my IRAs and HSA is 0.00% ER FZILX (total international stock) at Fidelity

- My work funds are split between 0.015% ER FSKAX (total domestic stock) and 0.06% ER FTIHX (total international stock) at Fidelity

- 100% of my 529 is invested in a 0.12% ER domestic equity mutual fund (used to be 0.31%, but mercifully they lowered the fee recently).

The weighted average of all of these expense ratios is 0.0318%, a number which I automatically recalculate monthly on my financial statements. Per $1M invested, that results in $318/year of fees. It’s not bad, and in fact the lowest I could figure out how to accomplish given my personal constraints (e.g. I can’t invest in CA’s lower-cost 529 fund and still get my in-state 529 deduction, etc).

It’s even better when you consider the underlying tax efficiency of this system. The taxable is as tax efficient as it can be. The less tax-efficient assets are appropriately shielded in tax-sheltered accounts. Further, I’m fully adhering to the “hierarchy of savings” logic which maximizes the overall tax arbitrage benefits of our portfolio.

What about rebalancing?

Given the comparative advantage logic above, I’m perfectly content keeping my taxable account 100% domestic equities, my HSA & IRA accounts 100% international equities, and my 529 accounts as 100% domestic equities. That leaves all of the rebalancing effort in my workplace accounts (401a/403b/457).

It turns out to be a pretty fun algebra exercise to determine the fraction of my workplace plans that should be allocated to domestic vs international equities.

Let’s define X% be the % allocation to domestic equities in my workplace accounts. (1-X%), therefore, is my % allocation to international equities in my workplace accounts.

Given my situation (100% taxable & 529 is domestic equity), the rebalancing algebra in my workplace accounts works out like this:

% desired_portfolio_domestic_equity_allocation = (100%*taxable_brokerage_balance + 100%*529_balance + X%*workplace_balance) / (total_investment_balance)

Solving for X and getting rid of nuisance 100%

% desired_portfolio_domestic_equity_allocation*total_investment_balance = taxable_brokerage_balance + 529_balance + X%*workplace_balance

X% = (% desired_portfolio_domestic_equity_allocation*total_investment_balance – taxable_brokerage_balance – 529_balance) / workplace_balance

If I wanted to rebalance my portfolio to achieve a 70% domestic allocation, I’d plug that in below and the resultant X tells me what my desired re-allocation ought to be at Fidelity.

Let’s plug in some actual numbers using today’s balances:

X% = (70% * $1,270,782 – $307,380 – $69,415) / $715,078

X% = 71.71%

This is the % allocation to domestic equities that I’d put into my Fidelity workplace account to help me achieve my desired portfolio balance of 70% domestic exposure. Similarly, 100%-71.71%=28.29% is the fraction of my workplace portfolio that I’d allocate to international equities.

This covers rebalancing, which is adjusting your existing balances to reach your desired asset allocation.

If I wanted to maintain that ratio going forward, I would also change FUTURE contributions to help me stay at that desired asset allocation. You can easily adjust that in your 401k as well.

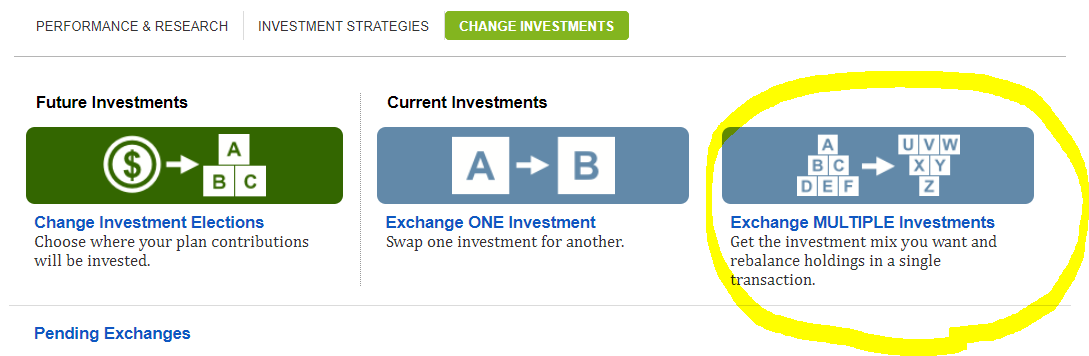

To rebalance existing balances at Fidelity, choose the highlighted option.

To rebalance existing balances at Fidelity, choose the highlighted option.

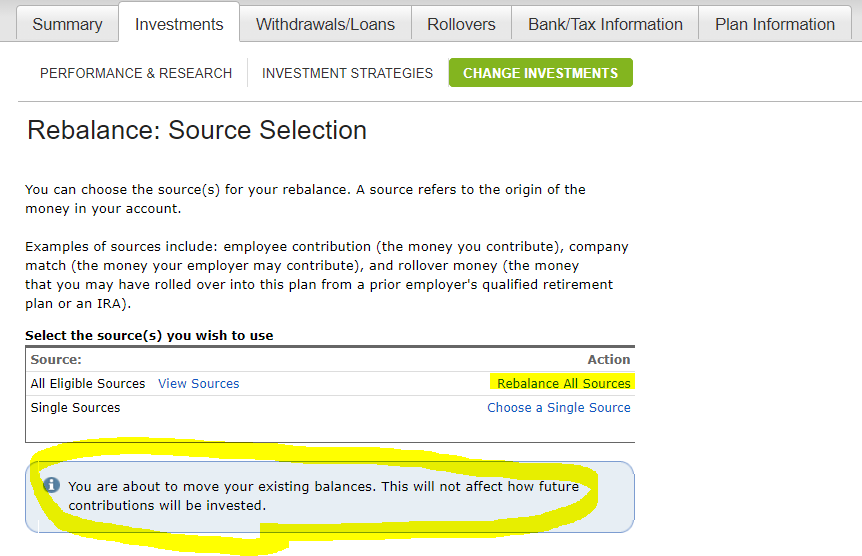

Note the bottom disclaimer on future contributions not being effected. To do that, we’d use the left-most option in the previous image.

Once we solve for X% with algebra, we put the corresponding values of X% and 1-X% in our right columns there.

Congrats, you’ve officially rebalanced to a few pennies of your optimal portfolio allocation in less than a few minutes using 7th grade algebra. Perhaps you now understand my skepticism when I hear rebalancing touted by human advisors and robo-advisors alike. It’s trivially easy and is just about the poorest excuse I can think of to justify 1% AUM fees.

Do I really believe in rebalancing?

Not particularly.

I’m fine if you rebalance monthly, annually, every other year, or never.

I’d probably recommend rebalancing if you ever deviated from 5-10% of your target allocation, but I think you’d be fooling yourself if you thought that more precision would drastically change your investing performance.

It seems to me that focusing on investing fees + optimizing your taxes + practicing good old frugality easily trump a misallocation of your target allocation by 5-10%. After all, my personal 70%/30% domestic/international split is a completely arbitrary guess, so there isn’t a terrible amount of harm in deviating from these arbitrary values.

Conclusion

Keep your investments simple and buy broad-based indices. Be particularly mindful of what investments you place inside of taxable accounts, because you’ll ideally not mess with these for decades. I’d recommend a domestic index fund (or ETF). If you decide to rebalance, do so with your tax-sheltered accounts.

Reader poll

I’m not particularly interested in hearing why you think REITs or Bitcoin or 30Y treasuries each ought to occupy 23.456% of your portfolio. I think such discussions are unfruitful because we’d be arguing about pure speculation.

I’m much more interested, however, in what the following:

- Conditional on deciding on an asset allocation, where/how do you maintain the asset allocation?

- What do you hold in taxable and why?

- Have you made any blunders that were costly to unwind in a taxable brokerage account?

- What brokerage firms do you select and why?

- Do you actively rebalance?

- If so, what are your rebalancing criteria (e.g. deviation 5% from target, etc)?

- Do you rebalance in a taxable account?

Am I missing anything?

Believe in American ingenuity. Invest broadly in U.S. Follow the 3 Fund scenario. Don’t get bogged down in details. Forget money schemes, tried a few=learned slow but sure investments are much better. No need to re-balance — except in extreme circumstances.

I read “The Richest Man in Babylon” at age 15. One suggestion was to invest 10% of gross income. I decided to invest 15 %- and except for a few early years – did so. How? Delayed gratification, worked my way through college (to Ph.D.) while supporting my mother, no credit card debt, paid off mortgage aggressively, bought two-year old cars & kept them for 10 years, always had a part-time job = it helped me achieve the 15% goal, married a sensible woman. Be grateful for what you have.

Read and re-read Mr. Jack Bogle’s “Common Sense…” book, watch him on You Tube.

I fear I drifted beyond your questions. Typical retired professor, I guess! Keep up the good work!

The Richest Man in Babylon remains one of my favorite books of all time. I read that in my early 20’s and it made a lasting impression on me.

Glad to see that I’m not the only professor who gets excited about this stuff. Thanks for stopping by!

I used to be all stock (roughly 65% domestic 35% international) but recently started taking on more short term and muni bond funds and cash since the CAPE is above 30. Yes, it’s timing the market whereas when I think valuations are high (e.g. 30+ CAPE), I’m holding on to close to 15% bonds/cash now. I recall a couple of blogs (Retirement Manifesto?, forgot the other) that showed CAPE is a reasonable metric to measure the overall market at least in the context of portfolio withdrawal rates. But I use this metric to help balance between stocks and bonds. I also have my “free” Fidelity advisor say that based on the efficiency frontier of stocks and bonds, going beyond 80/20 stock/bond ratios yields excess risk relative to risk adjusted returns of an all stock portfolio. So my tweak to your all equity portfolio incorporates a “rule” on when to introduce bonds. When CAPE is 20 or lower, I’ll likely be all in on equities, between 20-30 around 90 – 95% in equities and at 30+, closer to 85% equities. I’m closer to retirement though.

My browser didn’t let me finish my comment so here’s the rest …

I’ve made the same blunders of holding high distribution, high fee mutual funds in taxable funds that have appreciated quite a bit. So I’m now stuck with some high fee funds that I can’t unwind without some huge tax payments. 15, 20 and even 25 years ago, these funds had good expense ratios (around 0.7%) but over time, new products with better fees came out. So it wasn’t really so much a blunder but the best I could do at the time. The only real blunder was not paying attention to the re-investment of distributions back into these high fee funds for many years.

I use Fidelity and Vanguard mostly. My “free” Fidelity advisor has given me some good advice and their service is better than Vanguard. I only use Vanguard for admiral shares. I also recently started bouncing around from brokerage firm to brokerage firm (eTrade, TDAmeritrade, Schwab), transferring positions in-kind to pick up some sign-up promos but maintain enough at Fidelity and Vanguard to maintain my “status” levels.

I don’t actively rebalance too much. I mostly rebalance by changing future buys to eventually rebalance to my targets. It’s just easier to do this vs selling/buying to rebalance.

Thanks for stopping by Phillip!

I’m of the opinion that most “rules of thumb” which justify X% of bond allocation were derived before bond yields were negative after inflation. Consequently, I’m not eager to hold them, but I’m relatively young so I can afford the riskier equity-only portfolio.

The transfer-in-kind sign-up bonus game at different brokerages can be quite lucrative. I’m tempted to get another $1k at Merrill Edge by transferring $200k there. The unfortunate thing is that this is taxed at 31% for me. If I had $200k in IRAs to transfer, that would be ideal.

What do you mean by get another 1k at merrill edge?

If you’re an established ME customer, I’ve heard you can transfer more assets in to get more of those bonuses. Alternatively, I could transfer Vanguard assets to other brokerages and play the asset transfer bonus game: https://www.doctorofcredit.com/best-brokerage-bonuses-earn-up-to-3500/

Outside of a workplace defined benefit plan (which I consider fixed income) and two rural properties, I am all equities. Similar to you, my taxable brokerage is 100% VTI or VOO. My 401K houses international equities, large cap domestic and small cap domestic. My RRSP (Canadian 401K) has all Canadian equities (VCN). My HSA houses emerging markets.

My target allocation is 10% fixed income/cash, 50% US equities, 15% Canadian equities, 15% international equities and 10% emerging market equities. My portfolio will look a little different than most since I split my time between Canada and the US. I do rebalance, but in a very passive way. i.e. Every contribution goes to the asset class furthest below its target in whatever respective bucket I’m contributing to. I plan on continuing this method when I start withdrawing. I fancy that it keeps me buying low and selling high (at least relative to my own investments).

I like your asset allocation and your passive rebalancing approach. I’m not surprised I approve since you’re a lot smarter than me!

I do the 7th grade algebra twice a year to rebalance. I do it by date. but will also tweak a bit if I feel the market is irrationally beat up. I moved 5-10% from bonds to stocks back in late March 2020. I also do a 70/30 Domestic/International stock mix and keep around 30% in low risk fixed investments. I think Schwab, Fidelity, and Vanguard (if you want mutual funds) are tough to beat, but many companies allow free trades on ETF’s – so I work with whomever is convenient.

I always think in the back of my mind that someday index funds will have issues as they continue to gain popularity. I have considered moving to an equal weight index or making my own index without any expense ratio (since equal weight indexes have relatively high expense ratios). This would be easy now that many companies allow fractional ownership of ETFs. I would LOVE your comments on the following article regarding Michaels Burry’s thoughts about the systemic risk of everyone buying index funds and his call that it is/has created a bubble-

https://money.usnews.com/investing/funds/articles/do-index-funds-etfs-quietly-pose-a-systemic-risk-michael-burry-thinks-so

I agree that ETF’s are pretty much identical to mutual funds these days. The differences between them in practice are negligible.

Thanks for sharing the usnews article. It is certainly thought provoking.

A few months before his death, John Bogle wrote this article in the WSJ, warning the public of potential governance issues arising from concentration of index funds: https://www.wsj.com/articles/bogle-sounds-a-warning-on-index-funds-1543504551

I believe Bogle’s main argument is this: as index funds grow in popularity, the collective voting power of Vanguard/BlackRock/Etc grows too, squeezing out the voting power of active managers. This places undue power of a few investing firms to control publicly traded firms. Left unchecked, this disproportionate control might lead to bad governance outcomes. In the WSJ article, Bogle mentions several potential solutions to this problem.

I’m much more sympathetic to Bogle’s governance concerns than I am about Burry’s asset pricing concerns. I had an investing professor during my MBA who made a lasting impact on how I view this. He likened stock-picking to a free-throw contest. Imagine there are 100 random people entered into a free-throw contest. Imagine there is a monetary incentive to score the best. Rather than actively participating, you can simply ride the bench and instead take the score of anyone who remains in the contest. At first glance, it would seem that the bottom 50% of shooters would self-select to sit on the bench and simply take the average score of the remaining 50% of better shooters. But if you think harder, shooters in the 50-75% range would also have that same incentive once the bottom 50% have decided to sit out. And the logic continues until only Steph Curry is shooting free throws on behalf of the remaining 99 shooters. The rest of us free-ride on Steph’s greatness.

The analogy has stuck with me over 10 years later. To the extent that indexing is increasing in popularity, it’s analogous to people bowing out of a free-throw contest acknowledging that there are better people out there to pick stocks and help in “price discovery.” Perhaps Warren Buffett, George Soros, or Cliff Asness are the “Steph Curry’s” of the investing world. If you’re asking me whether I’m worried about these superstar investors being the only ones left to discover prices, I’m not worried at all. In fact, I think the market would be a lot better off if Robinhood-type investors simply left it to the pros. All Robinhood-type trading is simply short-term noise.

But my net worth is surely orders of magnitude less than Michael Burry, so what the hell do I know!?!?!?

“In conclusion, only choose investments in your taxable brokerage account that you are wiling to hold until your death.”

This may be hard for some to do. During my career I was maxing out the 401K but wanted to save more so the only other option was to fund my taxable account. As I neared retirement I wanted to back away from my aggressive holdings (100% equities) and just rebalancing my 401k/IRA couldn’t get me to where I wanted to be. In retrospect had I just remained in equities I would have been better off given the performance the recent years, but I still feel the decision to rebalance was the right one at the time.

If you desire a 50% allocation to bonds at/near retirement and your ratio of (taxable / total investments) > 50%, then I agree entirely that you would necessarily have to hold bonds in a taxable account. Sorry if I over-generalized. I’m guilty of that sometimes in my writing.

However, I get the sense that most ordinary people hold the majority of their retirement wealth in tax-sheltered accounts. For people of modest means, the $6k/year/person and $19.5k/year/person IRA and 401k contribution limits are hard to surpass. For such people the ratio of (taxable / total investments) will be low.

Good point on the dividends. I used to heavily contribute to (and still carry with no contributions) a Vanguard dividend index fund that tracked the S&P 500. It is a good fund, but it carries a slightly higher ER and spits off way too much in ordinary dividends. That suck is getting sold first!

Dividends are great….until you have to pay taxes on them.

A concur with “selling the suck” first! Hopefully you can sell at the 0% LTCG rate.

FP – I have been a long time reader of your content and enjoy the mix of facts and entertainment. The “labor and delivery” charges for the mer-babies (if that’s the correct term..?) on this past month’s update were particularly funny. Perhaps because it hit close to home as we have a fish tank in a child’s room that started with 6 tetras a few months ago and now has about 35 fish of varying sizes and ages…

I currently have a Roth, Rollover IRA, and HSA at Fidelity – I prefer to keep things simple and have everything under one roof (with the exception of my workplace 401k which I don’t have a say in). I have adopted a somewhat complex asset allocation strategy, but it has worked well for me so I am sticking to it. I keep the same allocation in each account separately, as I find it easier to maintain the allocation since I only have the means to contribute to the HSA and 401k currently. As Fidelity allows for fractional ETF trading, I find it very easy to use ETFs to maintain my allocation (which is tilted to smaller cap US and emerging markets): 34% US Large Cap, 16% US Mid Cap, 16% US Small Cap, 23% Intl Developed Markets, and 11% Emerging Markets.

I’m glad to hear that I’m not the only father who is horrified at the compounded growth of kid stuff. At the rate your fish are growing, I think you might need a dedicated backyard fish pool within the next six months….. Maybe I’ll be building one as well for the mer-children.

I like your keeping-in-one roof strategy and certainly don’t have anything disparaging to say about your asset allocation strategy. It certainly passes the “reasonable enough” sniff test from me, though that sniff test is admittedly not worth anything!

In a future world, I could imagine a world in which I convert my VTSAX holdings to VTI (the ETF counterpart) and transfer all assets to Fidelity to keep it simple.

If I’m in the 0% tax zone for qualified dividends (like most Americans, I am), is it better to hold international stocks in the taxable account? Almost all my assets are in IRAs and a 457 plan, but occasionally I hold an ETF in my Vanguard brokerage, and I’ve always chosen VEA over VTI due to the foreign tax credit. Is that optimal?

Ryan,

Great question. Due to the 0% MTR, it seems that you’re slightly better off holding international in your taxable due to the foreign tax credit:

* https://www.bogleheads.org/forum/viewtopic.php?p=4934574#p4934574

* https://www.bogleheads.org/forum/viewtopic.php?t=242137

The second link has a google doc that you can edit an play around with if you “save a copy.”

Thanks for the links! Great spreadsheet!

Hi – great article. For myself:

IRA/Old 401(k) – Vanguard – primarily VTSAX and the S&P500 Index fund and Total Bond fund

Taxable Account – Vanguard – VTSAX, S&P500 and the Total Intl Index fund

Current 401(k) – Fidelity – S&P500 index fund and Fidelity Bond Index Fund and Total INtl Fund

HSAs – Fidelity – S&P500 fund

Wife’s 403(b) – USAA – S&P500 Index fund

Wife’s 457 – Valic – actually get Vanguard VTSAX though this

(My wife is a teacher down here in Houston. They have 40 choices for 403(b) and 457 and only a couple providers are worth a darn and none of the providers that are worthwhile will offer both the 457 and the 403(b) – it is ridiculous. That being said – being able to utilize both 403(b) and 457 is awesome. And we do!)

Currently – any re-balancing done is done in either my IRA account or 401(k). I do that every year or so.

My worst step was very recent – when I realized – while reading this very blog – that I could have been setting up a new IRA every year, contributing to the max, and then converting to Roth IRA same day. Some days I really just feel like letting one of my kids grab my hand and then do the “why are you hitting yourself” game to me over and over. Actually – I am glad it happened because I am going to start doing this by setting up a new IRA this year. Better late than never!!

Sounds like you have a great investment set-up! Thanks for sharing!

I’m sorry to have triggered feelings of self loathing with the “why are you hitting yourself game” realization. But I’m happy that you’re able to do something about it!!!!

As a procedural question, when I do the backdoor Roth every year at Fidelity, I simply leave the old Trad IRA open with $0 balance. They ask that question each time, and I simply say “leave it open.” This might slightly simplify the process for you each year.

Best of luck!

Good analysis. 85% of our investments are in tax-advantaged accounts, but the taxable portion is all in one fund (VTIAX). The available international funds in the 401k’s had higher fees and/or were less diversified (comparative advantage goes to taxable). My IPS says that I should rebalance in tax-advantaged space 1x/year if allocation is off by more than 5%. In practice, I rebalance by dollar-cost averaging future contributions. The one reason I’ve contemplated adding another fund or two in taxable is for potential tax loss harvesting (assuming I could exploit the 0% region for LTCG). For now I’ve chosen simplicity.

85% in tax-advantaged is fantastic.

The nice thing about having VTSAX in taxable for me is that I can easily TLH to S&P 500 (+ extended market if desired). Since my tax-advantaged stuff is all with Fidelity and tracks slightly different indices, there is no risk of wash sales.

I’m sure there is some equivalent play with VTIAX => EAFE + emerging markets.

What is this strategy of tax loss harvesting with VTSAX you speak of? Can you help me understand this? Thanks!

https://www.bogleheads.org/wiki/Tax_loss_harvesting

https://frugalprofessor.com/tax-loss-harvesting-is-overrated/

Great thoughts about using the concept of comparative advantage to consider where you keep your assets. I hadn’t really thought too much about that and will have to think about how my current spread of assets fits into that. I haven’t really seen my taxable and tax-advantaged as one big pot, instead keeping them mentally separated.

I have a spreadsheet that keeps track of my asset allocation and tells me when any asset class is more than 20% out of variance with the expected allocation. Technically I rebalance when it hits that 20% mark and also every 18 months. I have no problem riding that 20% for a few weeks though, not really high pressure. I also don’t rebalance in my taxable account, but instead just put any new funds towards the side with the negative imbalance. I also use my charitable giving as opportunities to rebalance the taxable accounts.

I use Fidelity because of (a) previous employer 401k plans and (b) for the self-employed 401k options. I use Vanguard for most of my taxable accounts, but flit between the two for my covered calls. My current workplace 401k is at Principal, but if/when I leave my current job, I’ll immediately roll it into my self-employed 401k at Fidelity.

Glad to hear that the post gave you something to think about!

It sounds like your setup is working well. Do you have self-employed income or is this something you envision utilizing down the road?

– FP

We had a little bit of self-employment income for a couple of years a while back and we took advantage of the self-employed 401(k) to enable future backdoor Roth conversions by moving our deductible IRA contributions into the self-employed 401(k). It’s also been a good place to roll old workplace 401(k) funds instead of rolling them into my current workplace 401(k) with it’s .7% administration fee.

This makes a lot of sense. Do you have to file Form 5500 every year then? I’ve read it’s required for balances above $250k and that there are incredibly steep penalties assessed for not doing so in a timely manner. That part of solo 401k’s kind of terrifies me.

The total is creeping up on $250k, but I’ve been doing Form 5500EZ. It’s not bad and Fidelity provides all the information on how to file it. But if you have no traditional, deductible IRA money and no 401(k)/etc. that needs to be rolled out of where ever it is, you shouldn’t have to worry about setting one up.

We have our assets at Schwab, Vanguard, our employer’s 401ks, a NY 529, and two HSAs at Fidelity.

Schwab is our historical (25+ yr) account and we have a S&P500 mutual fund there, plus a few

legacy, individual stocks. Pre-2005, I thought I could pick stocks. Around 2005, I converted to

all index funds, started doing most of our investments at Vanguard (since then the fees were

much lower) and have never looked back.

A few years ago I corrected our portfolio by donating many of our high cap gains stocks to

our DAF (right before the Trump tax bill went in.)

While we max out our tax-deferred accounts, about 66% of our assets are in taxable accounts.

I have learned to detest dividends and cap gains, therefore I love VTSAX for the heartbeat

benefit (even over Schwab S&P500). I agree with buying something with “forever” being

the desired holding period….and have used deferred capital losses to reduce my taxable income

by $3k for every year since 2008.

My asset allocation has changed over the years. When I still had a mortgage, I had a firm rule

of no bonds. I viewed it as a left pocket/right pocket issue with considerable drag. Once my

mortgage was paid off, I slowly dipped my toe into Bond muni funds going up to 20% max of

the overall portfolio.

(see part 2)

Right now, we are past our FI number, and my asset allocation is a little more nuanced. I keep 0.25yrs of spend in cash/checking. I keep ~ 5 years spend in MuniBond in taxable index fund. I keep another 5 years of spend in bonds in IRA index funds. The remaining is stocks split 70/30 (US/Int). As I add assets, I’ll contribute to the one that is lowest from that target inmy magic spreadsheet.

I’ve made many mistakes. Individual stocks that always seem to underperform. Buying too much of our employer’s stock. Not realizing the holding period is forever. Having REITs intaxable (corrected during the pandemic drop last march!). The last one is not realizing how much better a Roth would be for me until very recently.

That said, I’ve also done a lot right, due to what I’ve learned from your site, and others. My529s have been awesome. Finding Vanguard and becoming a Boglehead. Pre-loading my DAF in 2018 with many years of donations. Going to Fidelity for HSAs. And a healthy dose of frugality (perhaps not as much as you though!)

Thank you for your site. I always get a laugh (whether the un-frugal dog or the Mer-man) and learn something from your exquisite spreadsheet skills. All the best!

M,

Thanks for stopping by! It sounds like you are in great financial shape! I’m glad to hear that there is someone else in the world who similarly loathes the drag on one’s portfolio from taxes. When you do the math on compound interest, even small drags can compound to huge losses (hence, the Vangaurd/passive/index/Bogle revolution).

Fortunately, it sounds like your mistakes are small in magnitude relative to your successes. It’s always nice when the mistake/success imbalance tips in success’ favor.

I’m glad to hear that some of my incoherent ramblings may have positively impacted you in some small way. Keep up the great work!

– FP

How have you used deferred capital losses to reduce your taxes by 3k each year? Can you explain? Thanks.

I mostly think that tax loss harvesting is overrated: https://frugalprofessor.com/tax-loss-harvesting-is-overrated/

That said, I did it last year and this year. I’ll come out slightly ahead for having done so, but it’s nothing to write home about.

A different stage of life and my asset location is more complicated and nuanced than yours, (Late 60s, widow, kids grownup and in their 30s.)

My needs and wants are modest. Charitable giving is by far the biggest line item in my spending since my husband’s death eight years ago.

At my age, I probably think about tax-efficient bequests a lot more than you probably do. Also RMDs, QCDs, IRMAA rules, senior property tax exemptions, and eventual long-term care. By the time you get to be my age, the rules for these may be quite different. Indeed, even at my age, I no longer think it is a foregone conclusion that the step-up in basis at death will be available to my heirs, and this has caused some rethinking of asset location. I also think ahead to the time when someone else may need to take over managing my financial life.

I am 30% equities and 70% fixed income. Also 50% taxable/20% tax-deferred/30% Roth.

Most of my equities are in taxable. Rebalancing takes the form of donating appreciated securities to my DAF when the markets get periodically frothy. I don’t plan to rebalance in other direction.

The lion’s share of my Roth is in TIPS but some equities there also. My tax-deferred is in TIAA Trad (liquid with 3% minimum).

I am still working (very part-time) purely because I find it rewarding and enjoyable. So I am still contributing to my Roth 403b and Roth IRA. Also doing some gradual opportunistic Roth conversions.

I itemize deductions (due to large charitable donations as well as maxed out $10K in SALT) so dividend drag and taxable interest are not a problem for me. I also have solar tax credits with carryforwards that have been eating up my remaining federal tax liability since 2017.

My tax-deferred is all in my 403b (invested in TIAA Trad liquid with 3% minimum.)

I am hoping to age in place if I need LTC and my HSA and tax deferred accounts are mentally earmarked for those purposes if and when needed. If not needed for LTC, they will eventually go to charity.

At my age, I am also thinking about Marie-Kondoing my financial life, to keep things simple for whoever has to pick up the pieces of managing my financial life after I am no longer competent to do so.

I already decided to stop holding international equities in taxable so there is no more fussing around with Form 1116 and Foreign Tax Credit. Once I hit QCD age, I will probably stop itemizing deductions and just give via QCDs.

Dodecahedron,

As usual, thanks for stopping by and sharing your wealth of knowledge. It sounds like you are executing your plan to perfection. I really admire your deliberate planning… and your use of Marie-Kondo as a verb!

I can’t resist pointing out that your dividend drag on VTSAX is actually slightly LESS than you calculated above. It turns out that the 4% of nonqualified VTSAX dividends are REIT dividends eligible for the 20% QBI deduction. So if your marginal federal tax rate on ordinary income is 24%, those REIT dividends would be taxed at .24*.8=19.2%.

Thanks for the clarification!!!!