I’ve spent a good chunk of the past couple of years helping to redesign our university system’s ~$5B retirement plan. This post summarizes what I learned.

While my setting was a multi-billion dollar university retirement plan, surely many of the lessons learned will also be relevant to any 401k plan by even the smallest of companies.

A summary of best practices:

If I had to summarize the best practices for any retirement plan, it would be:

- A transparent recordkeeping fee — separate from the expense ratios of the underlying investments.

- Almost all universities are converging on a fixed $/head fee.

- Large plans can negotiate this fee to be around $25/head/year.

- A simple, low cost menu. Preferably 100% passive.

- Importantly, the “default” investment choice should be a passive target-date-fund.

- The availability of a “brokerage window” for those employees who want more complexity to what is offered through a streamlined menu.

- However, the merits of this plan design feature are more ambiguous since it could lead to excessive risk taking among (potentially financially unsophisticated) plan participants.

- For years, the ~$750B US Government’s Thrift Savings Plan (TSP) offered a streamlined, 100% passive menu without a “brokerage window.” However, they introduced this option in June of 2022.

- In other words, there is plenty of precedent for a streamlined menu to exist without the “brokerage window” option.

- That said, the trend is for plans to include this feature.

- In other words, there is plenty of precedent for a streamlined menu to exist without the “brokerage window” option.

Most retirement plans are awful:

How so?

- They offer high-cost investments

- Many plans have funds that charge > 1% in fees

- They charge high/opaque “recordkeeping” fees

- They are unnecessarily complex

- Some plans offer >250 of investment choices, which is clearly asinine.

The (obvious) problem with lousy retirement plans is that an individual cannot avoid the bad plan if they want to fully reap the tax benefits that are only achievable through workplace retirement plans (e.g. $20,500 401k contribution limit in 2022, deductibility of Trad 401k even when income is above Trad IRA deductibility limit, etc).

I don’t believe that the presence of low-cost index funds is sufficient to designate a plan as “good,” although it’s admittedly “good enough” for informed individuals like you and me. But why do employers deliberately place landmines (undiversified, high-cost funds) on a menu and hope that their untrained employees successfully avoid these mines? Why not just construct a well-designed mine-free menu? Unfortunately, the vast majority of 401k plans are a metaphorical minefield of undiversified, high-fee funds.

WHY are retirement plans so bad?

I’ve given some thought on this one, and the following is the best I can come up with:

- They are designed by HR professionals with little-to-no finance training.

- The retirement plan consultants, who HR hires, fail to provide unbiased advice.

- Recordkeepers and mutual fund families have the obvious incentive to fleece their customers through high fees.

The problem with retirement plan consultants:

As part of our due diligence, our university (like any other) hired a consulting firm to help. Early on in this process, I was naively optimistic that we’d receive helpful advice from our consultants. Instead, I have come to believe that these consulting firms have severe conflicts of interest. What are the conflicts of interest?

- When recommending a menu, our consultant proposed a 50/50 mix of active/passive funds.

- I believe the recommendation to construct a menu with 50% actively managed funds is wrong and self-serving.

- Why wrong? Because the data suggest that passive investments beat active investments.

- Why self-serving? Because an active menu requires constant oversight, tinkering, and fund replacement. In other words, an active menu guarantees the consultant future consulting revenue in perpetuity as it helps to remove underperforming funds in the future.

- If the funds were so great, why would there be a need to remove underperforming funds? These were the same funds that previously were deemed to be overperforming (on a forward-looking basis).

- I believe the recommendation to construct a menu with 50% actively managed funds is wrong and self-serving.

- If our consultant had instead recommended a 100% passive menu, they have consulted themselves out of future consulting revenue, since a passive menu is essentially maintenance free in perpetuity.

What are some examples of exemplary plans?

- Thrift Savings Plan (which has ~$750B in assets):

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 2 fixed income funds

- US Gov’t

- Broad US Bond

- 3 stock funds

- S&P 500

- Extended Market Index (e.g. mid+small cap)

- Int’l Stock

- 2 fixed income funds

- They offer a self-directed brokerage plan for those wanting more complexity.

- What I dislike about their plan:

- Even though the expenses are extremely low on their funds (e.g. 0.001% for a S&P index), they charge a ~0.042% on all investments, so the cheapest stock fund is 0.043% all-in.

- I prefer $/head recordkeeping fees, rather than a ~0.042% surcharge on all investments.

- Their (new) brokerage window is very high fee.

- I don’t think there is much value in splitting US stocks into S&P + extended market.

- Even though the expenses are extremely low on their funds (e.g. 0.001% for a S&P index), they charge a ~0.042% on all investments, so the cheapest stock fund is 0.043% all-in.

- What I like about their plan:

- Harvard

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 2 fixed income funds

- Vanguard Total US Bond

- Schwab TIPS

- 3 stock funds

- Vanguard Total US Stock

- Vanguard FTSE Social

- Vanguard Total Int’l Stock

- 2 fixed income funds

- They charge a modest fixed $/head recordkeeping expense.

- They offer a self-directed brokerage plan for those wanting more complexity.

- What I dislike about their plan:

- They offer two (relatively) high-cost CREF Variable Annuities (CREF Stock & CREF Money Market) that should be removed from the menu entirely.

- I’m not enamored with the ESG investing trend, so I would have deferred that option to the brokerage window.

- What I like about their plan:

- Stanford

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 3 fixed income funds

- Vanguard Total US Bond

- Vanguard TIPS

- Vanguard Total Int’l Bond

- 3 stock funds

- Vanguard Total US Stock

- Vanguard Total Int’l Stock

- Vanguard FTSE Social

- 3 fixed income funds

- They charge a modest fixed $/head recordkeeping expense.

- They offer a self-directed brokerage plan for those wanting more complexity

- No variable annuities from TIAA. Just the TIAA Traditional.

- What I dislike about their plan:

- I’m not enamored with the ESG investing trend, so I would have deferred that option to the brokerage window.

- What I like about their plan:

- Yale

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 2 fixed income funds

- Vanguard Total US Bond

- Vanguard TIPS

- 3 stock funds

- Vanguard Total US Stock

- Vanguard Developed Market

- Vanguard Emerging Market

- 1 real estate fund

- Vanguard REIT

- 2 fixed income funds

- They offer a self-directed brokerage plan for those wanting more complexity

- What I dislike about their plan:

- They offer two (relatively) high-cost CREF Variable Annuities (CREF Global Equities & CREF Social Choice) that should be removed from the menu entirely.

- What I like about their plan:

- Delaware

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 1 fixed income funds

- Vanguard Total US Bond

- 4 stock funds

- Vanguard S&P 500

- Vanguard Extended Market

- Vanguard Developed Markets

- Vanguard Emerging Markets

- 1 fixed income funds

- They charge a modest fixed $/head recordkeeping expense.

- They offer a self-directed brokerage plan for those wanting more complexity

- No variable annuities from TIAA. Just the TIAA Traditional.

- What I dislike about their plan:

- Why split US stocks into two funds?

- What I like about their plan:

- Carnegie Mellon

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 2 fixed income funds

- Vanguard Total US Bond

- Vanguard TIPS

- 5 stock funds

- Vanguard S&P 500

- Vanguard Mid Cap

- Vanguard Small Cap

- Vanguard Developed Markets

- Vanguard Emerging Markets

- 1 real estate fund:

- Vanguard REIT

- 2 fixed income funds

- They charge a modest fixed $/head recordkeeping expense.

- They offer a self-directed brokerage plan for those wanting more complexity

- No variable annuities from TIAA. Just the TIAA Traditional.

- What I dislike about their plan:

- Why split US stocks into three funds?

- What I like about their plan:

- Nebraska

- What I like about their plan:

- 100% passive.

- Aside from Target Date Funds, they offer a handful of index funds:

- 1 fixed income fund

- Vanguard Total US Bond

- 2 stock funds

- Vanguard Total US Stock

- Vanguard Total Int’l Bond

- 1 fixed income fund

- They charge a modest fixed $/head recordkeeping expense.

- They offer a self-directed brokerage plan for those wanting more complexity

- No variable annuities from TIAA. Just the TIAA Traditional.

- What I dislike about their plan:

- Not much.

- What I like about their plan:

Honorable mention

Excluded from the “exemplary” plan list above due to the inclusion of one or more active funds.

- U California

- Notre Dame

- Penn

- Virginia

- U Virginia offers two sets of target-date-funds. One is active and the other is passive.

Other interesting info:

- Only two universities allow the mega backdoor Roth:

- A small, yet growing, number of universities offer in-plan Roth conversions.

- Only a handful utilize lower-cost Collective Investment Trusts.

- This is driven by the regulatory constraint that CITs cannot be held in 403b (until laws change).

- Only 401a & 457b plans can hold CITs.

- The other obvious constraint is that the barrier to entry into CITs is large….a plan needs > 1B in assets to qualify (I’m unsure of exact threshold).

- This is driven by the regulatory constraint that CITs cannot be held in 403b (until laws change).

So, what can you do if your retirement plan is lousy?

- Contact HR and educate them on why their plan is so bad. Perhaps this post can be one resource. Continue bugging HR until they improve your plan.

- Perhaps remind them that retirement plan litigation is extremely common and expensive, particularly among private institutions. Just google “retirement plan lawsuits” to see how common it is. Jerome Schlichter is behind most university lawsuits. Just google “Schlichter university lawsuit” for many examples. Here is an incomplete list of recent settlements:

- MIT: $18.1M

- Emory: $16.75M

- Vanderbilt: $14.5M

- Johns Hopkins: $14M

- U Penn: $13M

- Columbia: $13M

- Duke: $10.65M

- Chicago: $6.5M

- Brown: $4M

What are some additional resources to share with HR?

- This 176-page publication put out from the CFA institute entitled Defined Contribution Plans – Challenges and Opportunities for Plan Sponsors is pure gold (free PDF link).

- Chapter 5, in particular, is incredibly helpful.

- If you work for a very small firm, I’ve heard many good things about Employee Fiduciary for recordkeeping (fees here).

- I helped a local friend set up a 401k through this company and it was a great experience.

- You can search the retirement plan holdings of almost any institution in the country (excluding non-profits and public universities) through the department of labor’s 5500 site:

- https://www.efast.dol.gov/5500search/

- To find Stanford’s defined contribution holdings, for example, type “Stanford” into the search field.

- Then sort by assets.

- Download file for given year (in this case, 2021 is most recent).

- The good stuff is usually in the last couple pages.

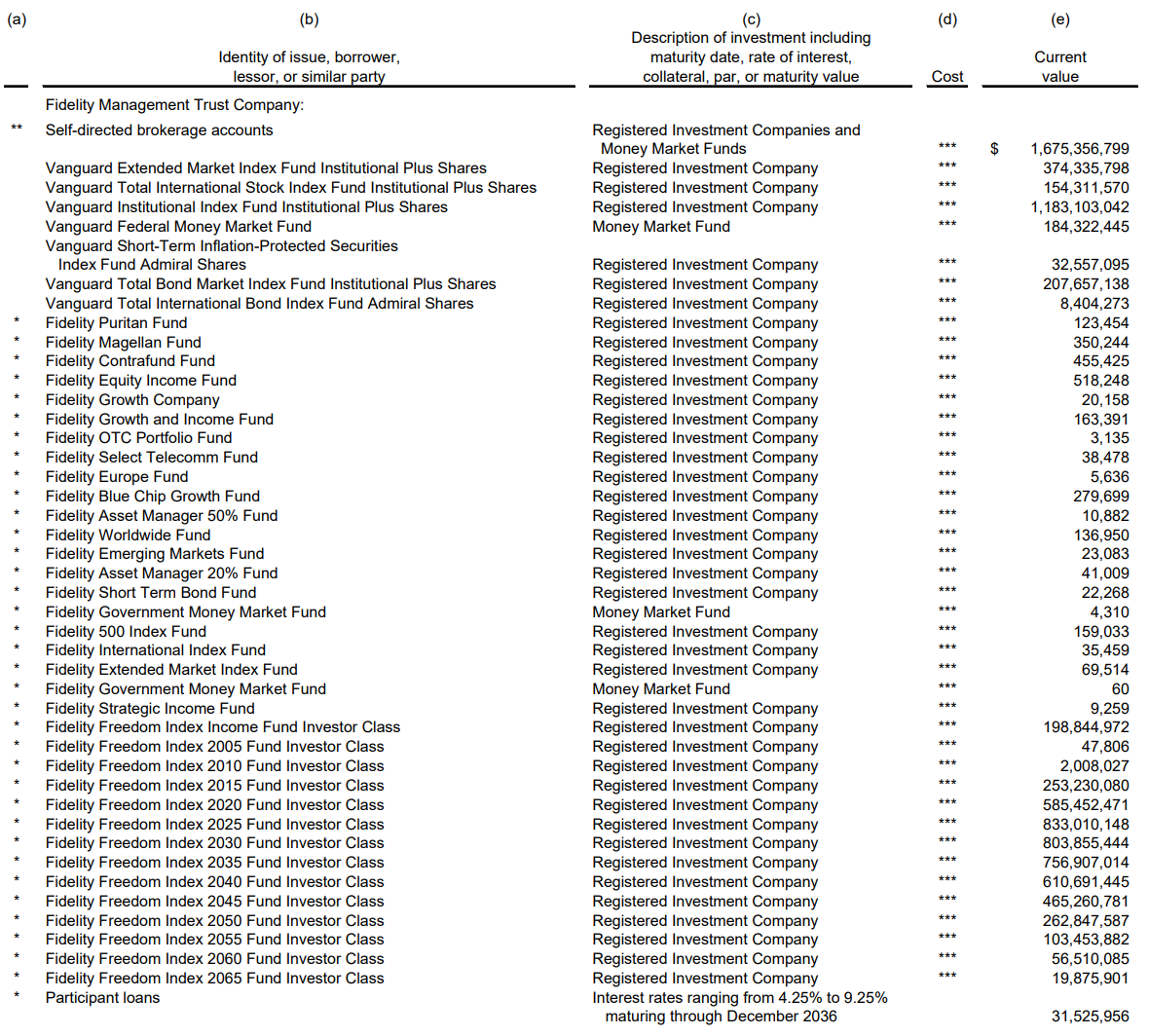

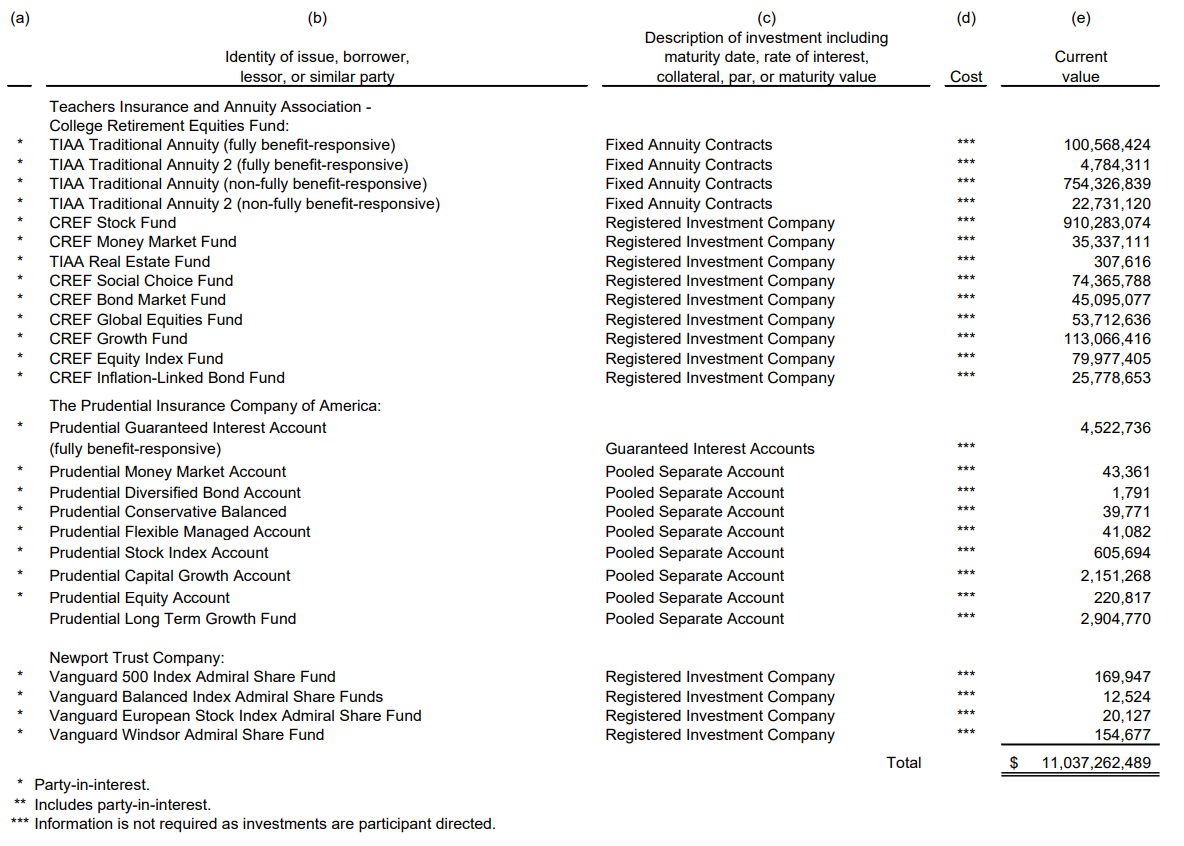

- Some interesting observations about Stanford’s plan:

- Even though their menu has been streamlined to a few index funds + TIAA traditional annuity, they still have a large amount of holdings in legacy assets (those that used to be offered, but are no longer, such as Fidelity mutual funds + CREF variable annuities).

- They recently transitioned from Vanguard Target Date Funds to Fidelity Target Date Funds to save 0.02% in ER. This is a testament to how well governed the plan is.

- 15% of their assets are held in the brokerage window (=$1,675M/$11,037M).

- Only 0.08% of plan assets are in the Total Int’l Bond Fund.

- There are 6.3X more assets in the Vanguard Total Bond Fund vs the Vanguard TIPS fund ($208M vs $33M).

Conclusion:

If your plan is already well-designed, then this post is obviously not going to help you much.

However, if you are among the >95% of the population with lousy retirement plans, perhaps this post can be a resource in lobbying for a better workplace retirement plan. There is no excuse to have a poorly designed workplace retirement plan.

Good luck.

Nice job sharing your learnings. And in such a way that others can take advantage of these learnings, and do it with less investment of time than you had to put in. And lots of good suggestions and then specific examples. That is usually very convincing. plus the cost of a lawsuit if the old plan is not up to snuff.

Thanks for the comment. I certainly wish I’d had this resource two years ago when I started this process. I certainly hope that lousy retirement plans become obsolete in the not-too-distant future. That said, it will be easier said than done to overcome the enormous conflicts of interest in this space so I’m not holding my breath.

High value, educational post. Thank you Frugal Professor.

Glad you found it useful.

Startups can be tough: small number or participants, small total balance (which generally means a record keeping fee around 1%) and not a lot of interest in improving it (i.e. “if we get big enough, the rewards will far outweigh the dinky 401k fee”). My philosophy is to contribute for the tax benefit and immediately roll it into my self-employed 401k when I leave. This way only a few years worth of contributions are exposed at any given time. It sucks, but I’m not sure what else is better.

At least there are pretty low fees on the investment options. I had everything in VTSAX but they recently swapped it out for FSKAX, for who knows why.

I’d take a long, hard look at Employee Fiduciary: https://www.employeefiduciary.com/401k-plan-pricing

Pricing as low as 0.08%/head w/ access to Vanguard funds. So, all in for VTSAX is 0.12%. Not too bad at all for a startup.

For my wife to invest in VTSAX, she’s looking at 0.32% due to the 0.28% recordkeeping expense. It infuriates me and I’m continuing to lobby for a better plan with with her employer (the local school district).

Excellent post, as a fellow frugal professor, I’m curious if you have ever compared % match between institutions in higher education?

I think variation in % match is interesting but I haven’t done extensive benchmarking on this dimension. I am personally much more interested in the appropriateness of a plan menu and recordkeeping fees than how generous or not an employer’s match is.

Why? Because having a low retirement match is not illegal, but having a poorly constructed plan is a breach of fiduciary duty and can lead to 9-figure legal settlements (Walgreens alone settled for $300M this past year: https://www.benefitspro.com/2022/01/25/the-10-biggest-erisa-class-action-settlements-of-2021/?slreturn=20221014140855). I also find this issue so fascinating because the problem of poor plan design is so easily remedied with just a little bit of common sense.

Curious if on your research you have found a company or university that allows a fixed dollar amount to be deposited into their 401k, similar to HSA and dependent care spending accounts. You provide what you want to give for the whole year and divides by paycheck. much to my annoyance, I have only seen 401k as a % salary resulting and changes through the year

At our university, we have a 401a, 403b, and 457. The 401a is designated as a % of salary, while the 403b and 457 are designated as $ contributions.

I can imagine that it would be annoying when trying to hit the 401k limits (but not exceeding them and forfeiting 401k match, for example) when specifying % rather than $.

Very insightful post. I would be very interested in becoming part of the committee at my institution to institute these changes. How did you get on your committee? Any advice on where to start?

I pointed out deficiencies in our retirement plan to the head of HR for years, suggested improvements, and have phd in finance (part of my dissertation studied retirement plans). Eventually they listened.