Another month, another update. A few random comments.

Good Reads/Listens/Watches

- I found this YouTube documentary on Malaysian Flight 370 (the Boeing 777 that seemingly disappeared without a trace in 2014) to be fascinating/horrifying (link).

- Vanguard lowers expense ratios on 87 funds (link).

- Tesla is offering a 10% insurance discount for drivers using full self-driving for at least 50% of miles (link).

- I’m not claiming that Tesla’s autopilot is “there” yet (I didn’t even bother to activate it once during my recent FSD trials), but the practice of penalizing human driving vs automated driving is an inevitability. This is the first time I recall seeing it in practice.

Life

- We spent a lot of time chasing our kids to various activities — show choir, swim team, basketball, etc.

- FC1 decides where she’s going to college within the next two weeks. Weird.

- Is anyone accelerating purchases to avoid tariffs?

- I’ve felt the strange compulsion to stockpile TVs, computers, dishwashers, and avocados…

- As a hedge, maybe I need to YOLO everything into Bitcoin/Dogecoin/TrumpCoin/NFTs…

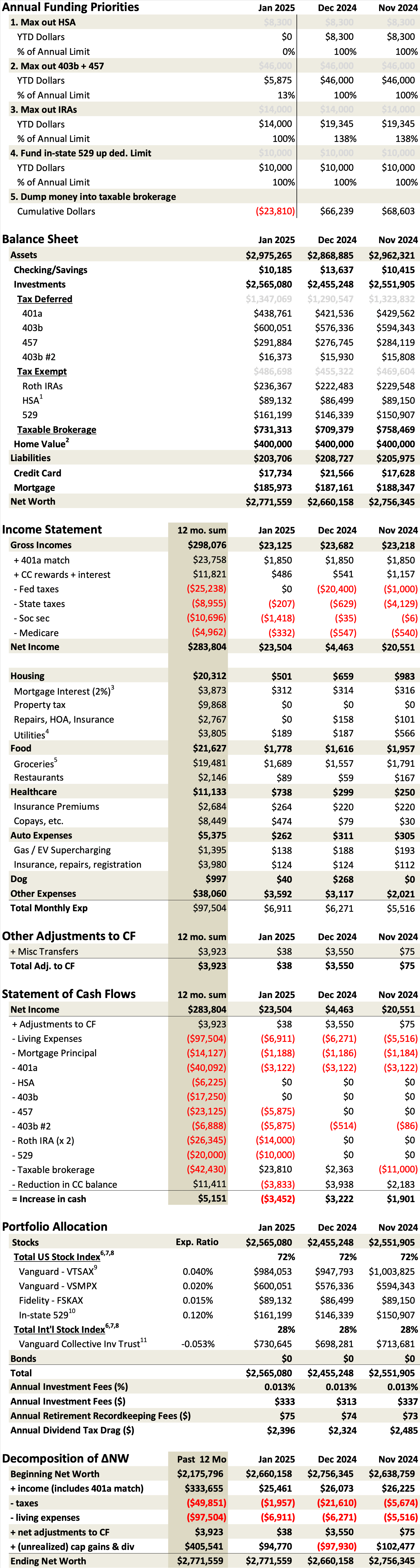

This Month’s Finances

We liquidated $24k of our brokerage (and harvested a small loss in the process) to accelerate the 2025 funding of our 529 (up to $10k state tax deduction limit) and backdoor Roth IRAs ($14k). Why? Because we prefer investments in tax-advantaged accounts over taxable accounts.

We are almost fully booked for our trip to Europe. When booking $650 of Eurostar train tickets, I failed to check the price in other currencies (Euros, Pounds). As a result, I overpaid by ~10% relative to other currencies. We’ll be visiting London, Paris, Amsterdam, Kaiserslautern (to visit Mrs FP’s brother), Innsbruck, and Chamonix.

Our healthcare deductible reset on Jan 1, so our annual tradition of hemorrhaging cash on healthcare resumed on schedule this month.

- The good:

- $2,500 x 2 Wells Fargo brokerage bonuses appear on-track. About two months of hold time left. Then to Merrill for $1k x 2 and to renew the platinum honors status.

- The bad/abnormal:

- ~$3k in travel-related expenses (hotels/trains/theater in Europe, Mrs FP cruise with her parents/sister).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

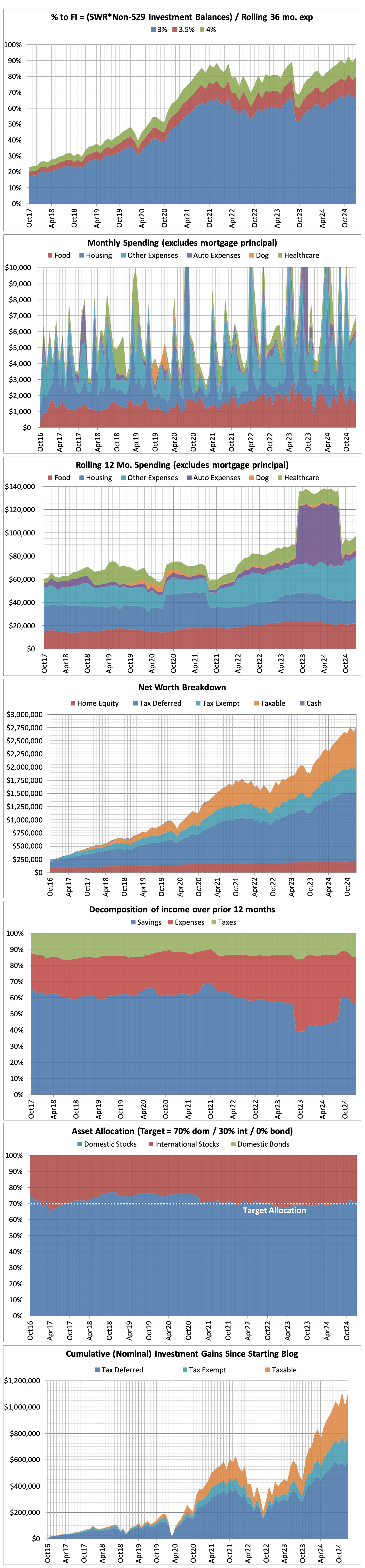

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

“When booking $650 of Eurostar train tickets, I failed to check the price in other currencies (Euros, Pounds). As a result, I overpaid by ~10% relative to other currencies. ”

While abroad if you’re charged in Euros then most cards will use the current exchange rate with no markup (you can check the details of the cards you have). Be wary of stores and hotels in Europe trying to use dynamic currency conversion on you when paying by credit or debit card. They are supposed to ask you (e.g. “do you want to be charged in dollars?”) and if you agree then you get a bad exchange rate and a “convenience” surcharge to boot. Same thing goes if getting cash from an ATM.

Most places will routinely charge in Euros but last year in Sorrento we had a bad experience at a hotel (ironically it was our biggest single purchase on the trip). While checking out the friendly clerk typed in the amount, tapped a few buttons, slid the machine across the counter, tap, done. Well it turns out what he had done was select dynamic conversion. Back home organizing our receipts I saw we were charged a 3% convenience fee for being charged in dollars instead of euros. And printed on the receipt it claimed we were offered a choice of currencies to pay in.

So these days I always smile and ask “Charge in Euros?” Most of the time I get a puzzled look as if to say “well, what else did you expect?” But hopefully it will protect against dynamic conversion being foisted on me.

Thanks for sharing your experience. The lesson learned is to always transaction in the native currency with a no-FTF card. Not sure why I made that blunder with Eurostar. Rookie mistake.

Do you do this liquidation annually since you don’t keep cash on hand year-round? I’ve been doing a backdoor Roth every year, but I usually start saving in Q3-Q4 so I can do it ASAP in the first week of January. Until then, the money just sits in SPAXX.

If I invest it all in VTI in a taxable account instead, any gains are great—I’d just sell, pay the tax, and move it to my Roth. If there’s a small loss, no big deal—I could probably do some TLH. But if it drops, say, 50%… yeah, not sure what I’d do then lol. Does it make sense to then leave it invested and simply move new funds (i.e. payroll, etc.) to Roth? Since performing it this year, I’ve been rethinking this approach and would love your thoughts on further optimization 😀

I used to hoard cash at the end of the year for the purpose of lump summing into backdoor Roths, 529s, etc on Jan 1. Why? I figured I prefer investments in tax-advantaged accounts to taxable so why not. But after doing so 1-2 years, I didn’t like hoarding cash and being out of the market.

What I do instead now is dump money into taxable after tax-advantaged is fully funded. Every single paycheck. Then, come Jan 1, I liquidate to accelerate funding of 529/IRA/Etc ***if*** I can liquidate at a loss. Otherwise, I simply hold onto the unrealized gains and fund the 529/IRA when I have the cash flow to do so (usually in May after accelerating the funding of 403b/457/HSA).

It’s a win win scenario. Stocks go up from Sept-Dec and I’m happy. Stocks go down over this same period and I’m happy because the gov’t eats 31% of my loss (24% fed + 7% state up to $3k/year in losses…with the remainder carried over into the future) and I can lump sum into tax advantaged on Jan 1.

FYI, your “annual funding priorities” chart’s “max out 403b + 457” greyed out max should be $47,000 rather than $46,000. You’re really just barely at 13%.

Its 2025 after all.

Cheers!

Good catch! Thanks!

Do you keep your investments in mutual funds or etfs when you transfer them to various brokerage firms? I have mutual funds at vanguard- should i be converting them to etfs?

Is the cost basis of individual units preserved when trasferring?

I contemplated converting from MF to ETF for the purpose of these transfers, but I’ve left them as MFs because I prefer them. The one exception was Robinhood which doesn’t accept MFs.

When transferring from Vanguard to Merrill to Wells, the cost basis has always transferred for me without incident. Granted, this is a sample size of N=1.

Hi FP,

I’ve read almost every one of your posts and greatly appreciate the content you provide! Question for you regarding Mega Backdoor Roth and retirement plan administration: my wife makes more money than me, and because of that we have a high marginal tax rate and have difficulty making adequate retirement contributions (in terms of proportions to income). She works at a small-ish/new-ish start-up and their benefits are all kind of cookie cutter, generic. Pretty good, but basic. How difficult would it be for her to petition her CEO to have this Mega Backdoor option? Does it cost the company? Why don’t more companies offer this?

Thanks for stopping by.

I’ve been petitioning my university to introduce the mega backdoor Roth since my arrival 9 years ago and have so far been unsuccessful. They are “looking into it” but have been doing so for years now with no luck.

As far as I understand, there are no major costs associated with implementing the mega backdoor Roth. However, there are small administrative costs such as changing payroll systems to facilitate these contributions (and ensuring no over-contributions), integrating with recordkeeper (e.g. Fidelity) to ensure that they can handle the transactions, etc.

The sales pitch that I’ve made repeatedly to my university is that the above are relatively small and one-time costs, while the benefits are hard to overstate to employees who take advantage (leading to a huge retention mechanism). The problem with my university is that not many of us would take advantage of it, so it’s hard to prioritize the effort for such a niche situation. The vast majority of employees don’t max out the accounts available to them (403b & 457 in our case).

Why don’t more employers offer it? Because not many people would take advantage even if offered, and it is slightly more complex to manage.

Hopefully your wife is a better salesperson than me on the idea. I’d encourage her to try — the worst they can say is “no”. Perhaps ask ChatGPT to help draft a convincing argument on why it would be valuable to her and her colleagues.

Hi professor, can you talk about investment in the context of current political scenario? Is sp500 still worth investing in? This year (maybe future too) seems going to be tough. Should I increase the bond holdings?

I’ve been asking myself these same questions, and unfortunately I don’t know that I have a great answer for you. If you are concerned about the US stock market, you could migrate to international stocks, US bonds, or money market funds. Or you could stay the course. Each have plusses and minuses.

Among other things, the sky-high P/E multiples of domestic stocks (i.e. what drove much of the past 15 years of stock market growth) has me concerned with US stocks.

i also joined the wells fargo bandwagon! They charge a $35 transaction fees for Vanguard mutual funds like VTSAX

https://www.wellsfargoadvisors.com/services/online/prices-per-trade-fees.htm

https://www.wellsfargoadvisors.com/research-center/mutual-funds.htm?_gl=1*18zc0mr*_ga*NTYwNjE1MjI2LjE3NDEwMzg3NTY.*_ga_7JXJJ2JF12*MTc0MzE5NjUxNi45LjAuMTc0MzE5NjUxNi42MC4wLjA.

Congrats.

We should get the $5,000 payout in a matter of days now (2 * $2.5k)

I have no intention to transact there. Simply ACATs transfer in kind then back out ASAP.