**** I updated some technical stuff (Ubuntu / PHP) on my host server and accidentally crippled the comment functionality of the blog. Thanks for your patience while the world’s worst webmaster (me) tries to sort this out ****

Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Not much.

Life

- For various reasons, my group of college buddies broke our approximately decade-long tradition of backpacking this summer. These trips — including adventures in Alaska and Peru — are some of my favorite memories. Nonetheless, we managed to salvage a weekend climbing trip to Vegas this month. Notably, my college buddies are not climbers, but they let me drag them out anyway. It was a blast.

- My friends did not bat an eye at spending $30/meal (after taxes/tip) at restaurants. This is about 3X the cost of what I perceive to be an indulgent $10 Chipotle meal, but I gather that I’m in the minority on this issue.

- Speaking of indulgent Chipotle meals, there are a few BOGO deals coming up this Saturday and next.

- My friends did not bat an eye at spending $30/meal (after taxes/tip) at restaurants. This is about 3X the cost of what I perceive to be an indulgent $10 Chipotle meal, but I gather that I’m in the minority on this issue.

- We drove to Denver to spend Thanksgiving with my in-laws. FC1, who we hadn’t seen since August, flew out from UT to meet us there.

- A week before taking the SAT, FC2 started doing some prep. It has been fun doing practice tests with her, though they hurt my brain.

- A friend tipped me off that Darn Tough Socks are ~30% off at Govx, a discount site for federal/state/local gov’t employees.

- As a public university employee, I was able to register pretty easily by uploading a photo of my work ID.

- Gemini mercifully (and patiently) helped this dinosaur update the blog’s Ubuntu/PHP/plugin configuration that was about a decade stale, though I kind of broke the blog in the process. Hopefully I fix it soon.

I hadn’t climbed outside for over a year. It felt great.

I hadn’t climbed outside for over a year. It felt great.

We took one day off of climbing to hike.

We took one day off of climbing to hike.

We [were] not in Kansas any more.

We [were] not in Kansas any more.

The Formula 1 stands blocked the main view of the Bellagio fountains (boo!), so we were forced to view them from behind.

The Formula 1 stands blocked the main view of the Bellagio fountains (boo!), so we were forced to view them from behind.

The seven of us reunited for the first time in three months. The kids are growing up fast. I’ve been taking family photos with a tripod for as long as I can remember.

The seven of us reunited for the first time in three months. The kids are growing up fast. I’ve been taking family photos with a tripod for as long as I can remember.

I was convinced that FC3 was just barely taller than me. Mrs FP and FC3 corrected my misunderstanding — it is not even close. Unrelatedly, sun hoodies are one my favorite discoveries over the past couple of years — a perfect layer almost year round. One of my biggest regrets in life is not buying twenty of these $10 Hurley ones from Costco three years back. I’ve scoured the Earth to replicate this shirt, including buying an inferior Hurley from Sam’s a year ago, but have yet to find anything comparable in terms of comfort, breathability, and durability. If anyone has a (preferably cheap) sun hoody suggestion, please share.

I was convinced that FC3 was just barely taller than me. Mrs FP and FC3 corrected my misunderstanding — it is not even close. Unrelatedly, sun hoodies are one my favorite discoveries over the past couple of years — a perfect layer almost year round. One of my biggest regrets in life is not buying twenty of these $10 Hurley ones from Costco three years back. I’ve scoured the Earth to replicate this shirt, including buying an inferior Hurley from Sam’s a year ago, but have yet to find anything comparable in terms of comfort, breathability, and durability. If anyone has a (preferably cheap) sun hoody suggestion, please share.

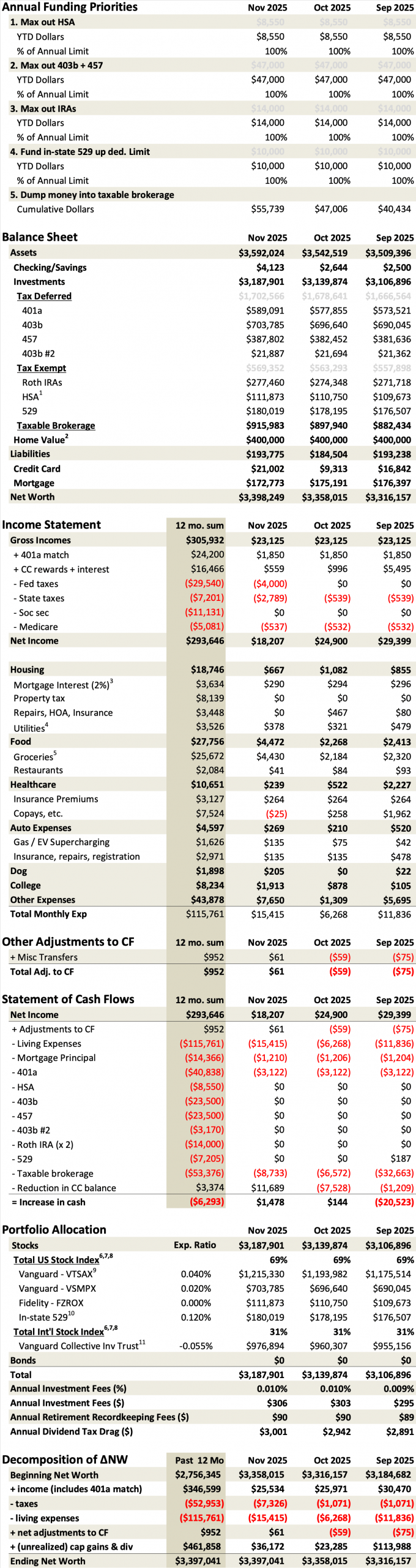

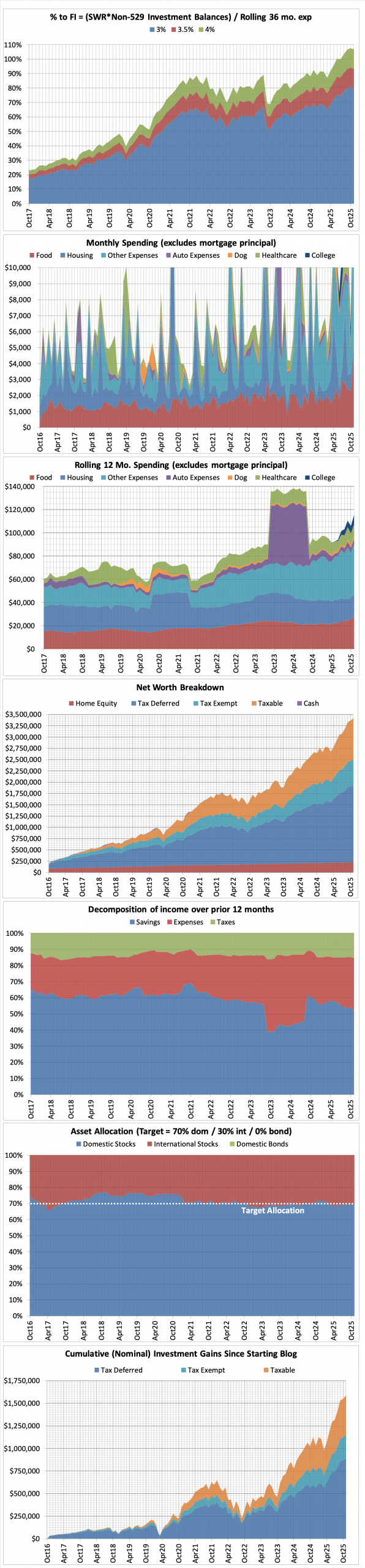

This Month’s Finances

Last month’s comment section had some gems:

- Phillip mentioned this 2% Webull promo, capped at $40k for a $2M transfer. 13 month hold. Doctor of Credit discussion here.

- I was tempted to pull the trigger, but couldn’t quite convince myself to do it, primarily for liquidity reasons. Not a bad “alpha” to get on up to $2M!

- Peter shared his positive experiences with the BoA Premium Rewards Elite card. I ended up pulling the trigger in early December. I’m now up to 5xCCR + 1xPRE myself, and Mrs PF has 3xCCR. I’ve long since reached the point where BoA refuses to offer me new credit, so they just reallocated credit from another card (which I’m totally fine with).

- I’m attempting the “triple dip,” harvesting $450 worth of credits in 2025, 2026, and 2027. If successful, the card will produce a net benefit to me of 3*$450 (credits) + $750 (sign up bonus) – $550 (annual fee) = $1,550.

- I don’t value the $450 of credits at full value, but the $150 lifestyle credit should organically offset gym fees for us and we’ll utilize the United Travel Bank hack to recoup the $300.

- It comes with a few other perks like 20% discount on flights when redeeming points through portal/concierge, primary rental car insurance, decent travel insurance, no FTF, 3.5% (travel/dining) / 2.625% (non-category), 4x priority pass memberships with unlimited visits + restaurant/guest privileges.

- If BoA product conversions were always granted (which isn’t always the case), I devised a scheme to maintain this card in perpetuity for “free” if both spouses participate:

- June of given year, spouse 1 converts customized cash rewards card to elite. Harvests the $450 of credits in the current year and the following. Pays $550 annual fee. Net fee is therefore $550 – 2*$450 = negative $350. At end of that year, downgrade back to CCR card.

- After downgrading, other spouse does the same as above. Rinse and repeat.

- One nice side effect of this strategy is that each downgraded CCR card should be no FTF. After enough cycles of this, one could accumulate many no-FTF CCRs.

- The only limitation is if customer service denies a conversion.

- I realize that this scheme forfeits the $750 sign-up bonus, but it seems like a reasonable compromise for the simplicity.

- I’m attempting the “triple dip,” harvesting $450 worth of credits in 2025, 2026, and 2027. If successful, the card will produce a net benefit to me of 3*$450 (credits) + $750 (sign up bonus) – $550 (annual fee) = $1,550.

With December around the corner, I have a decision to make on my 529 account — to raid the 529 piggy bank or let it grow. Since our state gives us a tax deduction on up to $10k/year of contributions, we’ve been contributing the full $10k/year since starting my job a decade ago. The 529 is currently worth ~$180k. Interestingly, with the lowering of our state’s marginal rate from ~7% to ~4% over the next few years, the value of this subsidy has almost halved from ~$700/yr to ~$400/yr. With 5 kids I’m not terribly concerned about having too much left in a 529 when our last kid is done with school. Nonetheless, with our eldest in college currently, I think it is prudent to start withdrawing these 529 funds now (~$15k for her first academic year). I’d rather zero it out sooner than later. Since money is fungible, and since we’re maxing out all other tax-advantaged accounts, these distributions will have a 1:1 effect on how much we can contribute to our brokerage account going forward. That is, a $15k withdrawal from our 529 will increase our brokerage balance by $15k.

Since the vast majority of our 529 contributions were made under the 7% regime, it is a pretty obvious manifestation of tax arbitrage at play. We’re getting a 7% discount on college through simple tax arbitrage (not to mention the sizable accumulated interest and federal tax breaks). We also saved 4% through the Smartly card for a few months before they knocked that down to 2%. FC1’s room and board does not charge a credit card surcharge, which is nice (though surely it’s baked into the price already). Her tuition carries a 2.5% credit card surcharge.

It is kind of an interesting moment of reflection. We’ve dutifully saved in tax-efficient vehicles for our entire adult lives, starting by maxing out our Roth IRAs in our early 20s, and we are finally seeing the fruits of these decisions in real time. Surely there are more tax arbitrage fruits to be harvested in the coming decades.

- The good:

- Still employed.

- We completed our second dog med order from Australia, saving us a boatload vs anything domestic (including Costco).

- Last year we paid 202 AUD => $137.63 USD.

- This year we paid 250 AUD (including a new 32 AUD tariff) => $162 USD.

- The bad/abnormal:

- Our seemingly inconsequential vague promise to let each of our Seniors choose an international family vacation destination is coming back to bite me. FC2 is a Junior this year but wants to take her Senior trip this coming summer. She decided on northern Italy. We bought 7 tickets at $629/ticket for a total of $4.4k. Ouch.

- Aside from hemorrhaging money on airfare, we had a wonky spending month:

- We bought $1k-2k of Christmas presents.

- We took advantage of BoA’s extra 2% day to purchase several grand of Costco gift cards at 7.25% off (=CCR 5.25% + extra 2%).

- As a result, our “grocery” spend was artificially inflated by several grand this month but should be near zero for the next 1-2 months.

- That extra 2% day is turning into a nice perk for BoA cardholders. They capped it at $2.5k spending per card but people with multiple cards were able to go hog wild.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$8/mo cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.08% to 1%. I can achieve a much lower expense ratio on my own, and it is a triviality to manage with a two- or three-fund portfolio. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded capital gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to traditional index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account for its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.050% expense ratio, yet produces ~0.095% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.045% for this holding (=0.050%-0.095%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.095% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Good thing you didn’t buy meals on the Strip while in Vegas. My wife’s coffee and plain croissant for $25 is crazy. Good thing her company is paying for meals, but still. We ate every meal off-strip except for that one.

The strip is indeed a rip off!

The WeBull promo also has a concurrent large referral bonus, which could add another 1%-2% to the referrer depending on the transfer amount…seems too good??

What do you think of the Tradier 2% promo (up to $3000) for 6 month hold? Seems to include IRAs…

I’m in analysis paralysis mode on these brokerage bonuses — still trying to figure out what I’m doing.

At a minimum, I’ll do Merrill, WF, and JP Morgan over the next year. Each has hold times of 45-90 days. I just need to figure out if there is enough time to squeeze in another one but kill my liquidity with longer lockups.

Citi has the transfer bonus too and if you’re CitiGold you $200 in credits for Costco membership, Amazon Prime, and some others. You also get a discount on a few cards with annual fees. Using their system is terrible, but if it’s just hold funds, it’s free money to put into your cycle.

This one, right? https://www.doctorofcredit.com/citi-wealth-management-up-to-3500-bonus/

Not too shabby. I’ve been considering adding this to the annual WF, Merrill Edge, JP Morgan cycle…

That’s the one! Now you have the 4 for throughout the year. Congratulations on your continued success.

For northern Italy let me suggest taking a look at the Dolomites for part of the trip. Amazing views and hikes on the largest alpine meadow in Europe, Alpe di Siusi. We stayed in Ortisei the Fall of 2024 and had a blast. Extensive bus network as well so you can get by without a car, with passes often included from your lodging.

Thanks for the suggestion! We hope to spend a lot of time in the Dolomites/Alps. Hopefully, doing a lot of via ferratas like last summer.

The webull promo seems solid. Too bad I work at a FINRA regulated firm and opening new brokerages is a PITA. I pulled some teeth to get them to allow the USB Savings and Brokerage accounts for the Smartly card.

On sun hoodies, the Patagonia capeline sun hoodie is nice. You have to be careful about them treating the material. Many companies achieve desired UPF by spraying chemicals onto the clothes. I discovered sun hoodies in Joshua tree when my climbing buddy was wearing a “hoodie” in the hot sun and I was intrigued. I also wear a comfort colors hooded t-shirt, which is 100% cotton, and is great for around town or out on the weekends, since its softer and nicer on the skin than polyester and in cooler temps you don’t sweat into it. I picked one up for $10. The UPF is lower and not rated, but I’d estimate a dark color to be around 15-20ish UPF which is still pretty good. Also if you want premium, Voler merino sun hoodie is 100% merino and no chemicals, but it’s pricey. Haven’t tried it but I imagine would be great for travel and multi day wear.

I guess I should consider myself lucky to not work at a FINRA regulated firm. Sounds like a PITA indeed!

On sun hoodies, thanks for the suggestions! I’ve been a man on a mission to find the perfect sun hoodie. I’m getting desperate enough that I might pony up some real money (> $10) to buy a fancy one or two.