Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Not much.

Life

- FC1 started college.

- On our drive West, FC1 and I stopped for a 4-day, 45-mile backpacking adventure in WY.

- She seems to be enjoying college so far.

- I was in denial (and probably still am) that she is gone.

- The night before we drove out, we played our favorite game of Ricochet Robots as a family. Just the seven of us. It was a magical moment that I wanted to capture forever in a bottle — I didn’t want it to end. Even though we were supposed to start our drive early the next morning, I almost delayed our departure another day (and thus cut our backpacking trip short a day) just to have one more day together as a family.

- After driving back alone, the first meal together with the remaining six of us hit me pretty hard as well.

- We have been communicating with her via Telegram, which is great for asynchronous audio/video. Its distinguishing features: it is free, 2x playback speed, unlimited storage.

- I have had Ben Rector’s new song Golden Days on a continuous loop in my head over the past few weeks:

I wish you would stop fighting

I wish I got more sleep

I wish there was more time for you mother and me

I miss picking up hobbies

I miss seeing my friends

I miss staying up late

And I miss sleeping in[Chorus]

But one day I’ll miss picking up your (Shh)

One day I’ll wish I could go back here now

But time runs away and things have to change

These are the golden days

[Verse 2]

I still don’t understand it

How it’s so hard to see

All the beauty in something before it leaves

‘Cause I can’t quite find the edges

Or the whole shape of this love

It’s happy and sad and proud and scared and everything all mixеd-up

[Chorus]

But one day I’ll miss moments like this

Onе day I’ll wish I could go back here now

I’ll walk past your room and hum out this tune

Wondering how you’re doing

But time runs away and things have to change

These are the golden days

[Outro]

But one day I’ll miss moments like this

One day I’ll wish I could go back here now

Why does time run away? Why do things have to change?

These are the golden days

- While out West, I took my 94-year-old grandfather for a test drive of a self-driving 2026 Model Y. He has always been a huge fan of cars and it blew his mind.

- For the heck of it, I test drove a Cybertruck and Rivian R1S with my father. My favorite was the Model Y, followed by Cybertruck, then Rivian. I thought I would have liked the Rivian a lot more. Why did they have to make the Cybertruck so hideous looking?

- Our kids are now in 6th, 8th, 9th, 11th, and 13th grades. No more elementary schoolers, which is weird. Two in high school (three next year).

Wyoming Pics

Perhaps my favorite spot on Earth.

We swam in that lake. It was really cold.

Timpanogos Pics

My father (68 years young), Mrs FP, FC1, and I hiked ~15 miles up Timpanogos on the Timpooneke trail. It was my 5th time to the summit but my first time up this trail. I found the trail easier than the Aspen Grove trail, though slightly less scenic.

It rained pretty hard on us during most of our 5-hour ascent. It got bad enough that we stopped hiking to take shelter for about an hour under some trees just before crossing the treeline. Serendipitously, the rain cleared as we reached the summit, producing some incredible views.

Mountain goats galore.

Another perched way up high. It was crazy to see them effortlessly climb the cliffs.

About 15 years ago, my brother and I swam in Emerald lake (pictured below) after summiting Timp. He sliced his big toe upon rapidly exiting the ice cold water, requiring 15 stitches.

Dorm Pics

Not a bad view from FC1’s window. The 22-pitch, 1,900ft climb of that peak four years ago was the hardest physical thing I’ve done in my life (the second hardest was Alaskan Packrafting a year ago).

Refrigerator Pic

My dad and I take a spin in the refrigerator.

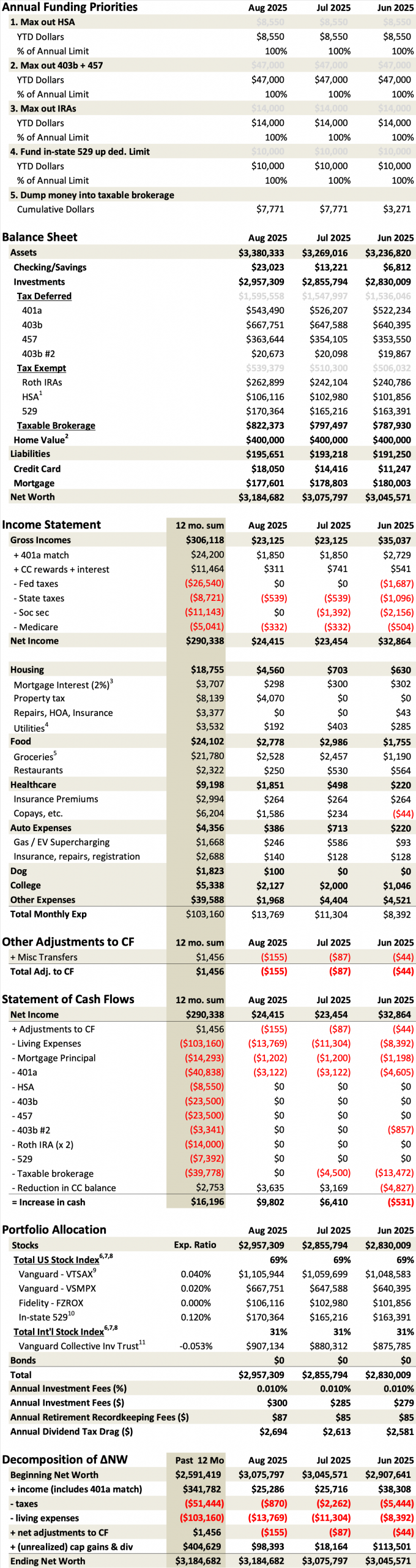

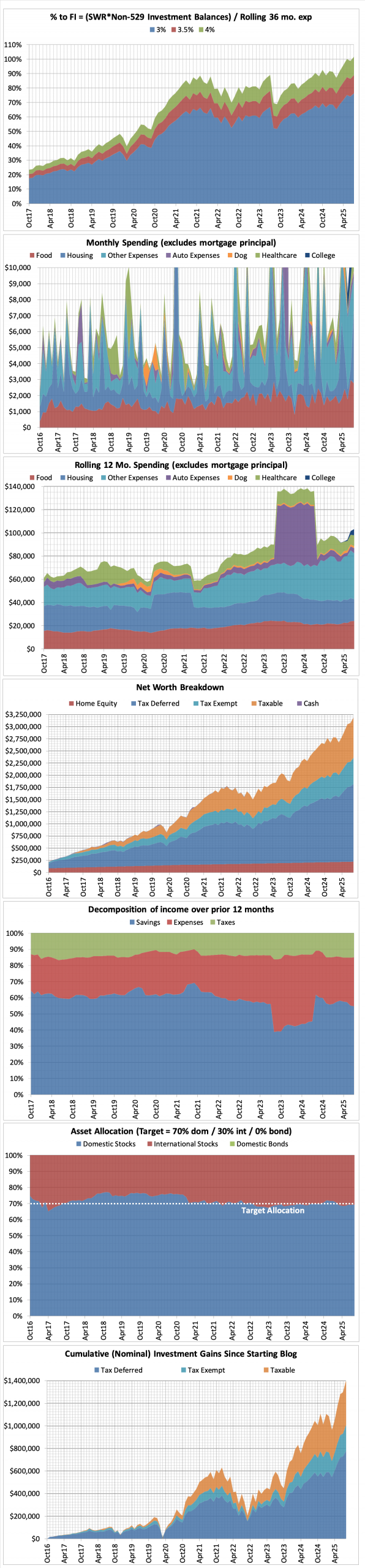

This Month’s Finances

Merrill still hasn’t paid up for the brokerage bonuses. Maybe I should show up on my bike and demand my two (thousand) dollars. Maybe I miscounted the days or screwed it up otherwise. We’ll see if Chase pays out in a few weeks.

Equity valuations are still asinine.

- The good:

- Still employed.

- The bad/abnormal:

- All the money is leaving at a pretty dramatic pace. FC1 in college. FC2 in show choir. FC3 & FC5 in ninja. FC4 in dance.

- $4k property tax payment.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to traditional index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

I have been telling my wife and the one equivalent to the child you speak of here, that “these are the good old days”. It is really true.

Great photos and I like the moniker you have given that stainless steel thing that you and your father were carting around in.

Uncle Russ!

I hope you and the family are doing well!

Congratulations on the first one in college. Having two in right now, and one out, we have done this a few times and it is always bittersweet. What always gets me — even this past week — is that right after drop-off, I always walk by their room and expect them to be in there. Then seeing it empty, I say to myself, “oh, right.”

As the kids go through these milestones, the one thing I remind myself of is a quote, “The only thing worse than them leaving is them staying home.” That of course can be taken a few different ways, but mostly I mean it about their growth, which will be in hyper-drive with new experiences and responsibilities these next few years.

I did just notice your new line for college expenses — that should be fun/painful to watch these next few years. Did you signup for a payment plan?

Enjoyed the hiking pictures! All the best to you and your family.

I’ve thought about your quote often over the past month or two. For many reasons, I’d much rather them leave than stay.

Yes, college expenses will be painful to track over the coming decade. I pay room & board monthly + tuition 1x each semester. FC1’s school is cheap (in the short run), but with some very real strings attached.

I received my first WF bonus on 9/3—thanks for sharing the details in your earlier posts! Now that the bonus has posted, would you recommend downgrading the Premier Checking to Everyday Checking, closing the account entirely, or waiting a few more days before making any changes? As for the investing account, I’m planning to leave a minimal cash balance (maybe $1) and explore options for transferring my holdings to another brokerage that offers a bonus.

Congrats!

A few thoughts:

* This is a good resource: https://www.doctorofcredit.com/best-brokerage-bonuses-earn-up-to-3500/

* The name of the game is 90-day holds.

* Per $250k, the most lucrative thing I’ve figured out is Wells Fargo ($2.5k) => Merrill ($1k) => Chase Private Client ($2k) => Citi self directed ($1k). Each has hold of 90 days and appears churnable annually.

Happy bonus chasing!

Hi FP, Do you face any transfer-out fees when you switch brokerages?

My experience, which I believe generalizes, is:

* Full ACATs are indeed subject to transfer-out fees

* However, partial ACATs are not subject to transfer-out fees

* I’ve always avoided the full ACATs fees by doing the following: 1.) at the receiving brokerage, request a PARTIAL transfer to transfer out the lion’s share of assets, but leave a trivial amount of cash/money market funds in the account (e.g. JPMorgan Chase requires >=$150), then 2.) ACH the remaining cash out a few days later. This technique has not failed me yet over the years.

What are your thoughts on the USBAR changes? Worth keeping? Best alternatives? TIA

It was my favorite card. Now it seems worthless, particularly relative to the 4% Smartly that I received the good nerf for. I downgraded a couple of days ago to recoup the $400 annual fee after harvesting the $325 of travel/dining credits for the next year.

The downgraded card (the altitude connect) has $0 annual fee and 4x priority passes/year. It’ll live in the sock drawer in perpetuity but I’ll gladly use the priority pass benefit.

When my Smartly 4% is eventually nerfed, I’ll go crawling back to BoA’s 2.625% card for my “other” spending. Probably the Premium Rewards card, but maybe the Elite (primarily for the Priority Pass perks & primary rental car coverage).

What are you doing with the USBAR?

I haven’t decided yet. Mine renews in November. I’ll see if I can use the $325 to fund my United Travelbank before the changeover in December.

If they add decent transfer partners, I might stick around. If they don’t, I’ll PC like you and claim an AF refund. I’ll then either try and get the Robinhood 3% card or the BOA Plat Honors setup or the new Alaska Summit card.

Good luck and keep me updated on what you decide….

They allowed you to downgrade? I called like 5 times and told me that I couldn’t. So I cancelled the card.

Still have the good nerf Smartly though and planning to transfer $100k back and start using it again.

The Citi SYW GGR basically rendered the Smartly to be a seldom used card and I picked up a brokerage bonus on the funds.

US Bank allowed me to downgrade to the Connect without any unusual effort on my part. I’m not sure why I was so lucky. It’ll live in the sock drawer permanently but I’ll use it for the 4x/year priority pass & global entry credit every 4 years. Both are nice features for a $0 AF card. A pretty nice consolation prize for the rug pull.

I have the good nerf on Smartly too and am still using it all I can.

Citi SYW continues to treat me well. I’m not in the GGR game, but I’ve been getting some really lucrative offers these past two months. 28% off $1167 of Amazon/Walmart GC’s this month (24% off for Mrs FP) through some stacking offers. Unreal.

Very interesting data you have on your spending. I wish I kept up with mine that well.

It looks like your spending is up >50% in 8 years. Do you think you’ve raised you’re actually buying more things or is it all inflation? I do worry about inflation being understated in the CPI as well as my own lifestyle inflation.

It is fascinating data indeed. I think everyone should do it.

There is a good mix of real vs lifestyle inflation over the past 8 years. Probably 50/50. Larger kids eat more. They have more expensive activities (musical theater vs eating dirt). College costs more than (public) kindergarten. A $20k trip to Europe this summer certainly didn’t help our numbers…

Awesome update. I am one of those folks that had a semi realization of some of the same thing when my boy started elementary school. It did make an impression on me. Many impressions! And I realized how big of a thing it will be when he goes to college!

Nitpick:

8. ETFs are slightly more inconvenient to hold relative to index funds.

The way it’s framed it sounds like ETF are the opposite of index funds, they don’t have to be.

Maybe say mutual funds or even traditional mutual funds instead of index funds there?

So it becomes:

8. ETFs are slightly more inconvenient to hold relative to traditional mutual funds.

Thoughts?

Nitpick accepted.

Enjoy the parenting ride. It goes fast.

Good morning, FP. Have you considered revising your 529 contribution strategy? I understand that contributing $10k a year allows you to grab the low-hanging fruit, but perhaps contributing another $5k to your 529 would be better than contributing the same $5k to a taxable brokerage account? Thanks!

It’s a good question.

It is looking like FP1’s college expenses will be on the order of $15k this year. I’m guessing this will drop as she ditches the meal plan in subsequent years. Extrapolating $15k/year * 4 years * 5 kids = $300k. Current 529 balance = $170k. Expected contributions over the next 10 years = $10k * 10 = $100k.

FC1 is on track to graduate in 3 years instead of 4.

I think I’m reasonably on track to having the “right” amount of savings. I don’t want to be in a situation 10 years from now where I have a large surplus, even with the new IRA rollover implications. I’d rather be short and pay out of pocket from cash flow and/or brokerage.

But for parents who are paying for their kids to attend higher-priced schools, I think the 529 makes a lot more sense than brokerage. It’s just a hard thing to predict with any degree of precision 1-2 decades from now. Will your kid want to go to college? What will the labor market look like? Etc, etc, etc.

Always enjoy reading your monthly updates! That dorm room view looks amazing, makes me want to go back to college.

An unrelated question: I use the BofA setup like you. I’m planning to get another CCR and was wondering about applying for two on the same day. I’ve heard it might only result in one hard pull – have you tried that before or have any insights?

Life as a college student is pretty special indeed.

On the BoA front, I’ve hard similar rumors to you but am not going to be super useful with details. When I applied to my first BoA card almost a decade ago, I was approved for at least 2 the same day. I maybe have applied for a third but forget the outcome of it. I assume it’s a single pull?

Update: Applied for 1 CCR, approved immediately. Experian was pulled. Applied for an affinity CCR after 10 mins, approved immediately as well. No pull for the 2nd one.

Nice!

Hi FP,

Was curious if Chase private client paid out and your experience. I saw your write up in bogleheads. I am wondering how hard it would be to open an account and transfer like 200k there from an old brokerage account that holds some active Mfunds that i have not touched in a long while. I dont want to be stuck with an AUM fee given chase i am sure is trying to get clients in for that version. Also doesnt seem to be too many transfer offers at the moment. DOC lists a bunch but well fargo for example is not active and citi seems convoluted. Already have merrill so cant move any there right now.

Thanks!

Chase Private Client paid out the $2k * 2 a few days ago. I was happy with the process.

They key is to find an advisor willing to open up a JP Morgan full-service (self directed) brokerage account for you. No AUM fees if you go this route. The beauty of opening this account is that it puts the annual Chase PC bonus in play. Upon completion of the bonus, the one piece of advice is to leave $150 or more in cash or other securities, or else Chase will close your account. That ***almost*** happened to me but I luckily intervened in time to stop the closure (which would have put the kibosh on future churning). Lesson learned…

Thats great to hear! So just so I understand, you opened both a Chase private client checking account and a J.P. Morgan Self-Directed Investing account (thats the option i see on their site vs the wealth management advisory account). Did the JP Morgan advisor push you towards an advisory account? And after receiving the bonus I presume you plan to ACAT back to your existing brokerage account. Does that cause the brokerage account to close or do you plan to leave something there too in addition to the 150 in the checking?

The offer is 2K for 250 and 3K for 500. But i imagine you probably split the amount with the spouse which makes more sense as its 4K that way. Cool!

On the same day, I met with a Chase banker & JP Morgan wealth manager. Banker opened up checking, whereas JP Morgan guy opened up full-service, no AUM, self-directed brokerage. It was a bit of a PITA to set up, as these things always are with in-person meetings.

He said he feeds his family on AUM fees, which makes sense. I had no interest. I did not feel compelled to return voicemails.

The brokerage account is the one you’d never want to close, since it makes the churning much more manageable annually. If you can open up this elusive full-service, no AUM, self-directed brokerage, don’t close it. Apparently the $150 is all you need to keep it open after ACATing out.

Our brokerage balance is at $800k, but $100k is at US Bank for the smartly shenanigans, leaving about $700k. The epiphany I had this year was brokerage bonuses are much more lucrative with two players, for only 5% more work. 2x$250k bonus is invariably higher than 1x$500k bonus. 100% was joint before this year, but splitting 50/50 at Vanguard was a triviality.

Pretty fun optimization problem to think through. Wells Fargo ($2.5k*2) + Chase ($2k*2) = $9k YTD. I botched a Merrill bonus by a few days (my mistake entirely), forfeiting another $1k*2. Whoops. At least I renewed platinum honors in the process….

Wow we are practically chatting 🙂

So the 150 was with the brokerage account. Makes sense. The advisors want the AUM so I can see the conversation must have been difficult. Il look into whether there is an advisor here who would agree opening a self directed account. By the way I dont think its possible as you would have otherwise mentioned it here, but Chase also offers cashback for opening a personal checking and savings account ($900 in total). I gather that offer cannot be combined with this one. I attached the link to that one from DOc

https://www.chase.com/personal/offers/checking-savings-900

Hey merrill calls me all the time, I ignore that too. Too bad you missed the Merrill offer this time. I have only done it once in total. I have much to learn from you sir!

I think if Wells had the offer I’d go with them but unfortunately nothing there right now.

Have a good evening, Thanks again.

I called Chase ahead of time to inquire whether the self-directed account was an option. The banker got the JP Morgan advisor on the line who confirmed it was possible. After that, everything was a formality.

I didn’t try to stack the $2k offer with anything else but am somewhat skeptical that it would work. Doesn’t hurt to try, though.

The business model of these institutions is to steer you into high fee products/services. As Bogleheads, we know better so it is not hard to avoid the trap. The calls are somewhat annoying, but easily ignored.

Thanks for the follow up message below (replying to this one since it has a reply option). Sounds a great plan.