Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Nothing comes to mind.

Life

- We took a three-week trip to Europe. It was great. The all-in cost for the seven of us was ~$20k. I’ll elaborate in another post.

- A teenager in our climbing gym was working on muscle-ups. After a few days of trying, I was able to (sort of) accomplish my first (ugly, belly-flop style) muscle up at age 43.

This Month’s Finances

As I’ve written about previously, I’ve stepped up my bonus transfer game this year. Earlier in the year, we did Wells Fargo for 2 x $2,500. Then, we moved to Merrill for 2 x $1,000, which also renewed our platinum honors status for the next 12 months. This month, we each opened up a Chase accounts for 2 x $2,000. Across those three brokerages, we’ll pocket $11k on a pre-tax basis. A tiny bit of hassle, but worth it in my opinion. I elaborate on some details here. Perhaps I’ll write a dedicated post at some point. Given that the funding deadline for these transfers is 45 days from account opening and the holding period is 90 days from account opening, the true holding period is ~45 days for these bonuses. I’m hoping to churn these annually in perpetuity. If anyone has any suggestions for high-value, short holding-period bonus (preferably ~90 days) to add to the rotation, I’m all ears.

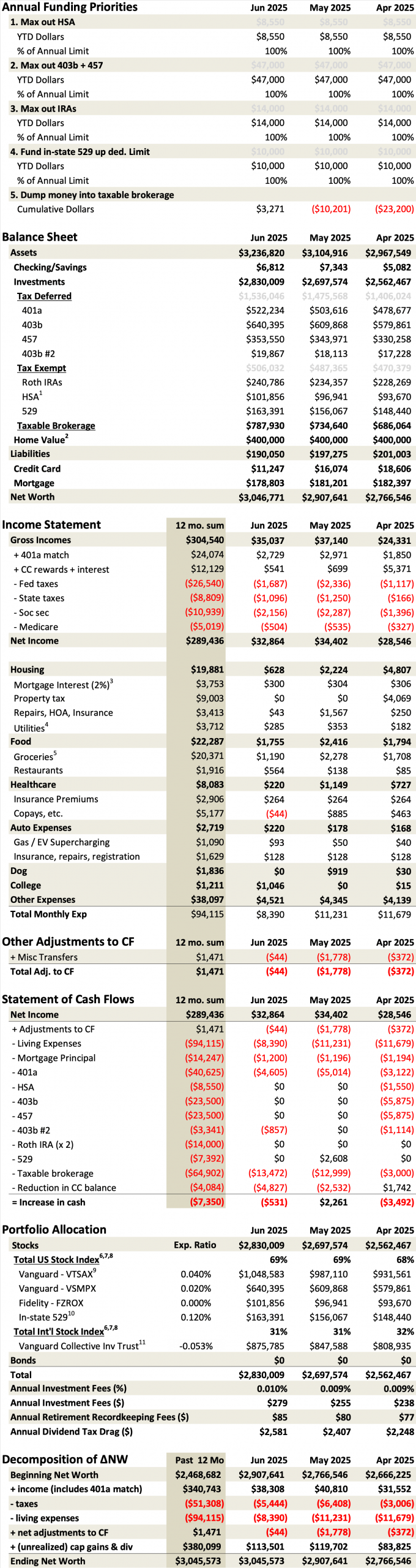

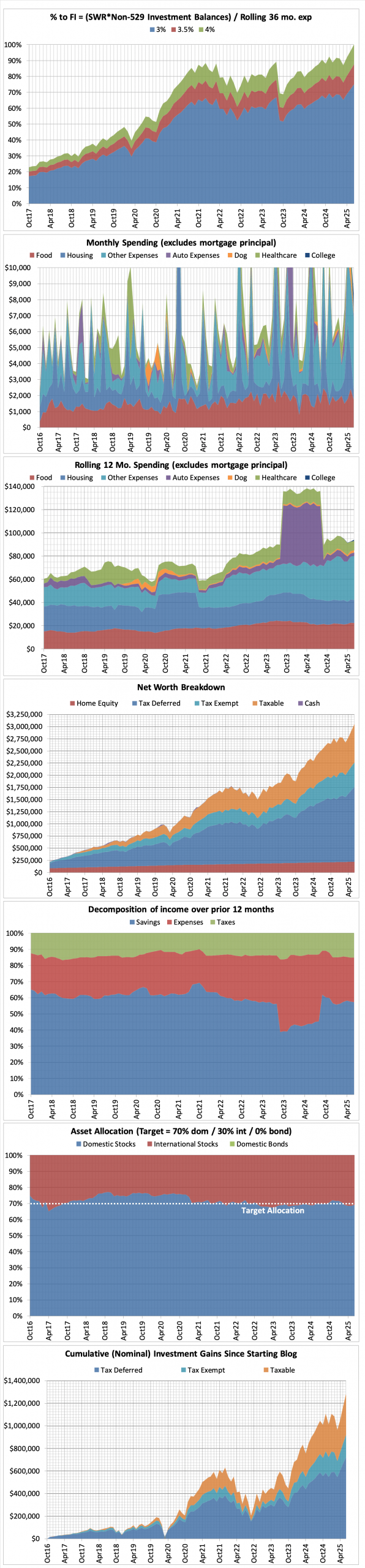

We crossed $3M of net worth this month. Our first million took us 39 years. Our second took us another three. The third took us another two. It is fun to see compounding in action, although I don’t believe that the stupidly high P/E ratios of US stocks can persist. Relatedly, after a decade+ of underperformance, our international stocks are finally helping us out, outperforming domestic stocks by >10% YTD. If I were a betting man over the next 1-2 decades — which I’m absolutely not — I would bet that: 1.) Longer maturity US bonds are in for a rough ride as yields inevitably rise (causing bond prices to fall), 2.) US stocks have to fall back to reality from their asinine P/E ratios, and 3.) International stocks are probably the least bad investment vs US bonds & stocks. That said, I’ve been wrong about investing for most of the past 20 years so my predictions are surely no more useful than those from a Magic 8 Ball.

- The good:

- Still employed.

- The bad/abnormal:

- Europe was expensive — about $20k all-in.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Have you thought about parking $200k into Citi Self Invest for the yearly $200 subscription rebate on Costco, Amazon, or Spotify? Now that I think about it, what music service do you use? Is there a frugal option?

I didn’t know about that rebate; pretty cool!

That said, $200/yr seems like rather small potatoes relative to moving $200k from brokerage to brokerage to brokerage within a year, which is earning us roughly $5.5k/year per person on $300k.

For music services, I used the free Pandora plan for about 15+ years (with uBlock origin on Chrome). I liked it a lot and thought their algorithm was fantastic. I was recently invited to join an Apple One family plan, so that’s nice too (but a worse algorithm & interface than Pandora’s in my opinion). Individual Apple One account is $20/mo, but only $26/mo to add 5 more people (so marginal cost is ~$1/person/month for unlimited music & TV).

Muscle up at any age is great!

Btw, Costco finally is out of the stone age: https://www.doctorofcredit.com/costco-shop-cards-can-now-be-loaded-to-your-costco-account-app-similar-to-amazon/

This makes the whole gift cards via BoFA CCR game so much easier to use.

I noticed that in the app as well this week! I already added my gift card to my account but haven’t checked out with it yet. Seems pretty slick!

That said, there are a few limitations that I can see:

* Doesn’t work at pharmacy or food court (we shop at both quite a bit)

* Not shareable with a spouse. Would have been really nice to pool across the household.

* Merchandise returns would go back to the account as opposed to the flexibility of returning to other payment methods (like Costco citi visa which provides a 5.25% arbitrage).

Not sure what I’ll converge on going forward, but it’s a nice option to have. What I really want is to be able to add funds to the physical card online. That would be the best of all worlds for my use case.

Looks like Chase’s self directing brokerage accounts that has no annual fee are not eligible for the promotion. Could you please confirm if you are able to get their https://www.chase.com/personal/investments/advisor/pricing account without any AUM fees?

If you read the Bogleheads thread I linked to and/or the Doctor of Credit page, you’ll see mention of the elusive “full-service brokerage account” that an advisor must open. This account has no AUM fees and is eligible for the Chase PC bonus. It is the holy grail to find, but many advisors are reluctant to open it for you due to lack of AUM fees. I may have gotten lucky. Others report failing to find a cooperative advisor.

Once it’s open, apparently you’re set for life and can churn the checking bonus.

Looks like US Bank is killing the 4% cashback card by requring the 100k in a checking/savings account?

https://frugalprofessor.com/us-bank-smartly-credit-card-bait-and-switch-smartlier-solutions-from-a-finance-professor/

I met with another local bank advisor and assured that he can open a full-service brokerage account that is eligible for this bonus and there will be NO fees if I just do in-kind transfer stocks/funds from another account and just park them without any trades.

Is there any place in the docu sign page that I need to double check about this? I checked commission schedule section where it was mentioned below:

STOCKS AND EXCHANGE-TRADED FUNDS 1% of principal.

Minimum commission of $25 may apply to stock and ETF trades.

‘STOCKS AND ETFS VIA CHASE.COM $0.00’

That’s a good question. I don’t recall the details, but I trusted them (probably naively) when they said the account would have no fees.