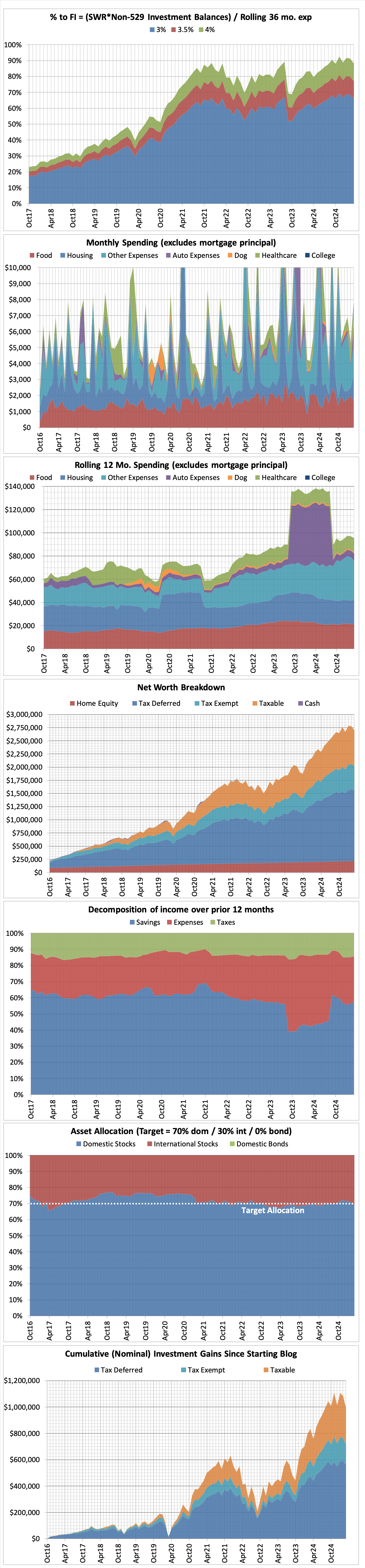

I wrote the majority of this post before markets went to hell on April 3–4. Since then, our portfolio dropped another $250k. We’ll see how this plays out, but I can’t say I’m terribly optimistic about the fallout from what the WSJ called the “dumbest trade war in history.” I wouldn’t be surprised if equities fell 50%+ from their recent highs.

That said, I remain invested because 1.) My investing horizon is hopefully another 40+ years, 2.) I don’t possess a crystal ball, 3.) I have no confidence in my ability to time the market, and 4.) if our portfolio drops by 50%, it won’t materially affect our lives. Then again, I could be making a huge mistake…

Rant aside, back to our regularly scheduled programming. I suppose we’ll learn more over the coming weeks, months, and years.

Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Bogleheads thread on curbing advice addiction (link).

- I aspire to less doomscrolling (now more than ever), but I’m not there yet. Maybe I should take up knitting?

- WSJ video on Costco’s Kirkland Signature brand (link).

Life

- FC1 has been a runner for most of her life, which means we’ve purchased our fair share of running shoes for her (several pairs per year for many years). I loathe paying $160+ for a pair of shoes, so I’ve had to get creative over the years. My favorite place to buy shoes was the now-defunct “Dick’s Warehouse Sale” in Denver (Dick’s outlet store), where we’d regularly buy clearance Brooks & New Balance shoes for ~$50. Since their closure, we’ve tried buying shoes at the following places with mixed success:

- Occasionally shopping sales at Joe’s New Balance Outlet (our last good sale was $50/pair for some high-end models). Sales are posted at SlickDeals with some regularity. However, the return policy is abysmal, which unfortunately affected me when I bought four pairs of shoes that didn’t fit FC1 a while ago. Luckily, they fit FC2.

- Open-box shoes at eBay for ~$50/pair. The return policy is seller dependent, of course, but usually not great.

- This month, I discovered Brooks’ second-hand website called Brooks ReStart, where they sell returned shoes for decent discounts. If they don’t have your size in stock, you can sign up for email alerts pretty easily. They offer a generous free return policy if the shoes don’t fit. I’m overdue for a replacement pair myself and will buy my pair here. I think this will be my preferred strategy going forward.

- With FC1 turning 18 and soon heading to college, I signed her up for Global Entry using my US Bank Altitude Reserve card, which reimbursed the full $120 charge within a couple of days. I’ve had global entry for about 15 years now and it is great, but it is notoriously difficult to sign up for your initial in-person interview (I’ve since renewed online without any incident). Mercifully, FC1 was able to snag an interview at a local satellite travel agency in a few weeks. Almost all of the interviews are conducted at major airports (I did mine during a layover in Philadelphia during grad school).

- Speaking of college-aged children, I set up a Fidelity CMA for FC1 when she turned 18. Since Zelle doesn’t work with Fidelity, I had to come up with another solution to quickly and easily transfer her cash if she needed it. The solution I came up with is to open a joint Fidelity CMA account with her. That way, I can instantaneously transfer money from my CMA to our joint CMA, and she can instantaneously pull money from the joint CMA to her individual CMA. The joint CMA will have a $0 balance when not actively in use for transfers. I thought that was a pretty slick solution that I will surely implement for all of our children.

- I spent spring break replacing 3 toilets and installing 4 new bidets. We bought the toilets at Costco for $140 each. Unfortunately, our new toilet seats were incompatible with the bidets due to a fit issue, so I had to buy $14 replacement seats. We’ve had bidets like this for about 15 years now, and they are arguably the best money I’ve spent in my life. What complicated the toilet replacements was a failed toilet shutoff valve, which made it impossible to replace them without draining water from the entire house. I decided to replace all the toilet shutoff valves, not just the broken one. Since I’m inept at home repairs, a friend helped me with the valve replacements. When I say “help,” I’m being extremely generous with my contribution — I think I may have handed him a wrench once. A week straight of thinking about toilets almost broke me, but I’m happy to report that I’ve mentally recovered since then.

- With tariffs here, is anyone accelerating the purchase of anything in particular before the effects of the tariffs are incorporated into prices?

- Broadly, I think we’ll be deferring/eliminating discretionary purchases for a while.

- I was planning on buying a 15″ Macbook Air M4 for FC1 in the coming months, but I was going to wait for Apple’s annual “back to school” promotion to use in conjunction with their Education pricing discount. However, I don’t know that it’s prudent to wait until June.

- Our already-booked summer trip to Europe is looking increasingly foolish on many dimensions. With the dollar falling, our unpaid expenses are rising by ~10%.

Our Costco has carried Cosmic Crisp apples for the past several months. I think we discovered them years ago during our trip to Hawaii and instantly fell in love with them. Highly recommended if you haven’t tried them yet. Pretty reasonably priced relative to other varieties.

Another Costco favorite for the past many years are these greeting cards. We usually buy them when they’re on clearance for about half this price. They feel like a $7 card. I loathe spending money on greeting cards, but these are a glaring exception. They are usually located in the first few aisles near the office paper.

This Month’s Finances

In the least surprising news of the century, the Smartly 4% card is rumored to be nerfed soon (Reddit thread, Doctor of Credit thread). US Bank was surely losing money hand-over-fist on the card, so this was inevitable. Rumor has it that only checking account balances will count towards the 10k/50k/100k balance requirement, whereas those “grandfathered” in can continue to use their brokerage balances. Further, they will supposedly nerf the elevated rewards on taxes/education/insurance/B2B. Supposedly if you apply in the next week or so you’d inherit the “grandfathered” status, but surely even that will be shut down eventually. Again, these are totally unsubstantiated internet rumors, so take them with a grain of salt. I think the lesson learned here is that US Bank is a bit of a joke, albeit a joke that is currently playing me 4%-4.5% for any swipe I put on their cards.

Motivated by Peter’s comment last month, I bought $50 of both FRSXX and FNSXX (both with $10M minimum initial investments if purchased at Fidelity) at WellsTrade and transferred in-kind to my Fidelity CMA. FRSXX will serve as my core cash position going forward (replacing my prior core position of FSIXX), and I’ll keep a few dollars of FNSXX around for the heck of it in the event that I retire to an income-tax free state some day (until then, FRSXX produces a higher after-tax return to me because of the preferential tax treatment of treasuries at the state level). I have automated the purchasing of FRSXX, and thus mimic the functionality of having it as my true “core” position (similar to what MyMoneyBlog illustrates here). If you are going to replicate, it’s really simple to pull off. My one blunder was initiating the transfer from Wells to Fidelity the day after I purchased FNSXX and FRSXX. Instead, I should have waited about a week after purchasing to initiate the transfer because there was a weird settlement issue that held up the transfer for a few days. I also used this as an excuse to consolidate all of my banking activities from my Fidelity brokerage account (which I used as a quasi-CMA) to my Fidelity CMA. Such a great setup. I’d recommend it to anyone, but remember to use ACH pushes to get money to Fidelity, not pulls. Thanks to the Finance Buff for teaching me that trick.

How big is the carrot? Let’s do some quick math. As of today, the difference in yield between FRSXX and SPAXX is 0.2% if we ignore the tax benefits of FRSXX. If we include the tax benefits, the spread grows to 0.2% + yield * X * (99.6305% – 55.0877%), were X is your marginal state rate. Assuming a yield of 4% and X = 6%, meaning that FRSXX yields 0.31% higher after-tax than SPAXX. If X = 4%, that would shrink to a 0.27% difference. Still not too shabby of a carrot as a rewards over one’s lifetime return of cash as compensation for a few mouse clicks today. If you don’t want to deal with Wells Fargo, you can replicate the above for 0.42% expense ratio with FDLXX (0.24% worse than FRSXX). Remember to follow these instructions from the Finance Buff when filing your taxes to claim the state tax benefits of owning treasuries.

If you live in a state without state income tax, the spread between FNSXX and SPAXX is 0.34%.

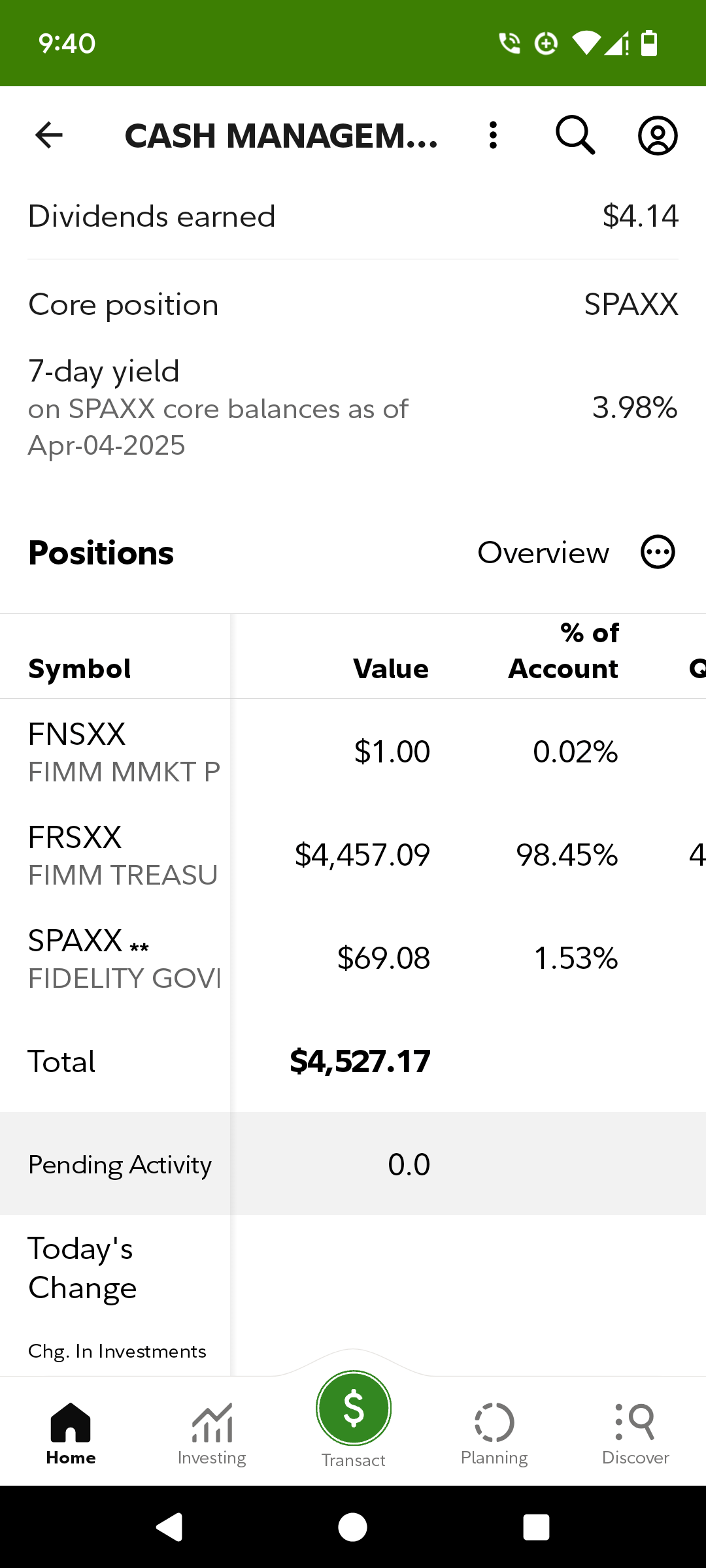

Screenshot of the new Fidelity CMA setup. Almost entirely invested in FRSXX as our automated quasi-core position. SPAXX for cash that hasn’t been auto-invested into FRSXX yet. And a token $1 of FNSXX as a placeholder for if we retire to a 0% income tax state a decade from now.

Screenshot of the new Fidelity CMA setup. Almost entirely invested in FRSXX as our automated quasi-core position. SPAXX for cash that hasn’t been auto-invested into FRSXX yet. And a token $1 of FNSXX as a placeholder for if we retire to a 0% income tax state a decade from now.

When chasing the $2,500 (x 2 with Mrs FP) WF brokerage bonus, we transferred a decent amount above $250k for protection against volatility (close to $300k). The end of our 90-day holding period ended on April 4, the second day of the markets going to hell. Mercifully, we ended with just over the minimum requirement of $250k. Still no payout yet, but DoctorOfCredit users report the payout will come ~2.5 weeks after the 90 days are up (106-107 days from account opening). From here, we’ll head back over to Merrill to renew platinum honors for the year and collect 2 x $1k bonus in the process. If we continue to cycle those two bonuses in perpetuity, that’s $7k/year (=2*($2.5k + $1k)). Not too bad of a return for a couple of mouse clicks. The epiphany I had this year was to split our joint brokerage account 50/50 to double the upside to this nonsense. $250k seems to be the sweet spot for maximizing the yield (2 x $250k transfer bonuses is usually worth more than 1 x $500k transfer bonus). Splitting our joint brokerage account 50/50 into two individual accounts at Vanguard took a simple phone call.

- The good:

- Still employed.

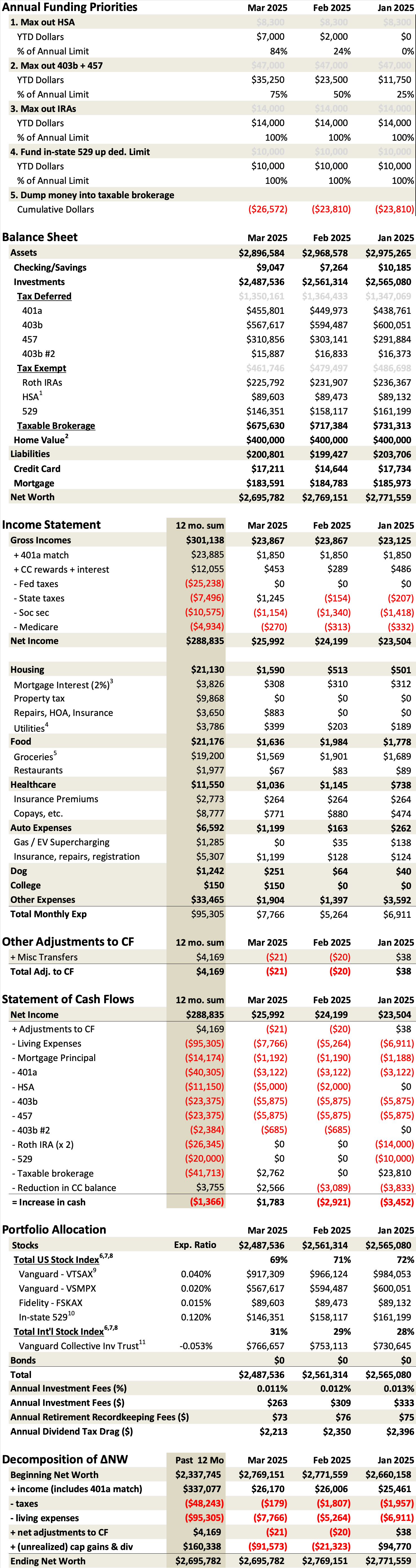

- Continued to front-load tax-advantaged accounts. $5k into HSA this month (84% funded YTD). Another $12k into 403b/457. After we finish front-loading, we’ll resume stuffing our brokerage account.

- The bad/abnormal:

- $150 in college expenses as a housing deposit for FC1. That’s the first time since buying our dog in 2019 that I’ve added a new spending category to the charts.

- Bad month for stocks, but the first few days of April made March’s losses seem like child’s play.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

What the WSJ called the “dumbest trade war in history” preceded the “liberation day” salvo and the revolutionary new tariff formula. The WSJ should have never used the word “dumbest” to challenge Mr. Trump, because He never backed down from a challenge, always ready to prove himself.

You are correct. What the WSJ initially called “the dumbest trade war in history” has devolved into the “dumbest-er” trade war in history (my words).

Rather than blame the WSJ, I place the blame elsewhere.

Oh cool, thanks for the guidance on running shoes! I’ve been running in Altras forever but recently switched to Saucony’s for my hobbit feet, will keep an eye out when it’s time to retire my current pair.

I love our bidet so much that I now travel with a travel bidet. A friend splurged on a Toto Washlet and it’s about the only fancy purchase I’ve envied.

I *did* manage to get a new MacBook Air M4 13″ before the idiocy started. It’s the best computer I’ve owned since my 12″ PowerBook G4.

My climbing friend recommended Altras to me (despite them failing catastrophically on our epic climbing excursion in December, requiring an emergency repair with climbing tape: https://frugalprofessor.com/wp-content/uploads/2025/01/red-rocks-2-scaled.jpg), so I picked up a used pair at REI for $40 or so.

The Altras are fine for walking around town, but I much prefer my Brooks (Glycerine 20s) for running. So much more cushion. I sized up to a 13 and there is plenty of room.

Charging $200 for running shoes is such a scam. Hopefully you can have some good luck going forward.

On the Mac dimension, glad you snagged the Macbook before the world ended. I should probably not drag my feet on this purchase… Our $400 M2 Mac Minis (x 3) a couple of years ago are the best computers I’ve ever owned by a large margin.

You have FRSXX and FNSXX reversed in your write up. FRSXX is the one that is treasuries.

I fixed one instance in which I referred to the wrong ticker. Thanks for the heads up.

As someone who grabs a bag of apples each time I go to Costco… I noticed this weekend that a bag of Envy apples is $2 off – at least at our local Costco.

Shoes are very personal but for an ex-Glycerin runner… I’ve found the Ghost to be better (lighter, still well cushioned and less $). 21% off at Brooks ATM.

I’ve seen the Envy’s on sale as well but haven’t tried them since discovering Cosmic Crisps. How do they compare?

Thanks for the recommendation on the Ghosts. I’ll look into them for my next pair.

Dumbest-er is right. No need to apologize for a rant. Merely observation! 😉

Brings back memories of the formative movie of my childhood – dumb and dumber.

I’m not a serious runner. I’ll jog 1-2 miles a few times a week as a warm up or as part of active recovery from my main exercise, which is climbing. I say that because I just use sneakers I’ve bought from Costco when I jog. All my shoes are from Costco in the $20-30 price range. For example, I paid 19.97 for these sneakers on clearance: https://www.costco.com/puma-men's-rocket-fuel-sneaker.product.4000279146.html

Are these inadequate for legit runners?

When I moved into this house 9 years ago, we met our neighbors who became good friends. She said that the older she gets, the less she cheaps out on 1.) shoes, and 2.) mattresses. As I age, I have increasingly seen the wisdom of that comment from her.

I spent the first 35 years of my life in $20 Costco shoes. For walking around town, they are adequate. But for serious runners (or even casual runners with aging joints), it is a night and day difference running on a $20 pair of shoes vs a $160 pair of shoes. Granted, I refuse to pay $160, but you can snag them for ~$60. I think the $40 premium you pay is well worth it…

What kind of climbing do you do? How long have you been doing it?

I’ve been doing gym climbing for almost 2 years. Your climbing trips look amazing. Maybe some day I’ll take the leap to climbing outside. I’m still on my entry level climbing shoes, but fancy a new pair that will definitely be more than $100.

I’ve also been trying to run more to increase my aerobic capacity. I’m 40 now, so maybe I should upgrade the running shoes and I would feel like running more. Thanks for the tips on cheaper legit running shoes.

Gym climbing is where I started. And given where I live, it’s where I climb 99% of the time. Such a great form of exercise & I love the community aspect of it.

I hate running probably more than most people, but I always feel better about myself after a run. It’s fun tracking my cardio improvement over time on my watch. I feel like I’m in some of the best cardio shape of my life (mid 40s), so I guess there’s something to it…

I’m would not call myself an apple aficionado, but I would call the Envy a close cousin to the Cosmic Crisp. Perhaps a smidge less sweet and less “snappy” or “crisp” when you bite into them. I will readily reach for either, well in advance of a Red Delicious which was a staple when I grew up and now think they are pretty “blech”.

My wife is the apple snob in our family and has given me a proper education through the years. If not for her, I’d probably still be buying red delicious. We’ll have to keep an eye on those Envy’s when the price differential vs Cosmic Crisps is favorable.

Can you explain the benefit of using CMA vs regular fidelity broker account as a checking account? I am currently using a regular broker account for my checking and hold my investment in a separate account. I have premium service so no ATM fee. I seem to be a bit behind, I just managed to transfer in FSIXX, now I read about FRSXX … Thanks for your blog and let me know what I am missing regarding CMA.

Sorry I wasn’t more clear. If you are already “premium,” having a CMA is not value-added relative to your current setup. I’m not “premium” since they don’t count workplace assets, so I benefit from the CMA. The only reason I opened up a brokerage account previously (as a quasi-CMA) was to have SPAXX as my core. About a year back (?) they changed the policy of the CMA to allow SPAXX to be a core, so basically there is no reason for me to have a brokerage account any more.

Are you going to jump through the hoops for the extra 0.04% relative to FSIXX? It’s hardly any work if you have a WellsTrade account open already. The minimum purchase size is only $50.

Thanks for clarifying. I will definitely try to get the extra 4 bps. I was able to transfer FSIXX via Merrill and buying before they reversed it (that worked despite people saying it had been closed). Will try the same as I don’t have Wells.

A few points of clarification:

* With the WellsTrade transfer, I didn’t have the weird reversal issue that I had at Merrill.

* To get the MMF share class that I got (the $10M one), you need to purchase through WellsTrade (not Merrill). Presumably, they have larger assets in these MFs than Merrill to justify the more favorable expense ratios?

I hadn’t noticed this previously, but I want to call attention to it. Everyone drones on about income taxes, and they definitely hurt, but property tax is frequently worse (especially in no income tax states). It’s important to look at the whole picture (income and property taxes, as well as insurance). Many moved to Texas during the pandemic only to discover that combined property tax and insurance wasn’t such a bargain. Idaho has received lots of attention lately, but I don’t see it being so tax favorable. I could spell out (if readers want) states that do appear to be low tax states versus those that may only appear that way. Of course, if you’re at the lower end of the income bracket, then it becomes all about sales tax.

I agree with not letting the tail (state income tax) wag the dog (everything else). If we move in retirement, taxes would be relatively far down the list of reasons why.

That said, it was costless for me to set up the $1 holding as a placeholder for a hypothetical day in which I might take advantage of it. What is the probability of it being useful in the future? Maybe 5% (I like NV and WA and WY). It didn’t require any extra work on my end, and will sit there as a sole $1 for the chance of that future event happening.

Sure, but a state like Arizona is better than many others. Also, in retirement, there are quite a few states that don’t tax social security, pensions, 401k withdrawals, etc. I’m thinking of Illinois, Iowa, Pennsylvania, and Mississippi. I personally wouldn’t really want to retire to those states, but to each their own.

Nevada and Wyoming are great. Washington’s new capital gains tax makes it less favorable. Wyoming is too cold and windy for me. Nevada needs much better medical resources to be a great retirement destination.

I haven’t given a terrible amount of thought to the issue. We have have family in CO and UT, so we’ll probably end up in the mountain west some day. I sure like that area of the country.

I’m glad my FRSXX tip worked for you. If you have more than one Fidelity, account (many people have a regular brokerage account in addition to the CMA), I recommend keeping some FRSXX in both accounts. I transferred money out of my CMA to US Bank to pay off my Smartly Visa, not realizing that my FRSXX position wasn’t large enough to cover it… I had some other money market funds, so the total balance was enough for the transfer. Since there was no FRSXX remaining, it wasn’t possible to buy it again without $10M+. Fortunately, I also have FRSXX in my brokerage account, so I just transferred some shares back to the CMA. You do have to wait until the next day to purchase more shares though.

Also, setting up a joint CMA wasn’t necessary just to transfer cash to FC1. If you go to the function to Link a bank and click the option that it’s an account owned by Someone else, you’ll see that you can add someone else’s Fidelity account. You just need to enter her name, zip code, and account number. Once linked, you can transfer her cash directly, and she wouldn’t need to take the extra step to move it from the joint account.

On the FC1 Fidelity dimension, I appreciate the suggestion. Is your method instantaneous? If so, then my setup would indeed be redundant.

On the other comment, thanks!!! I had no idea you could transfer FRSXX in-kind across Fidelity accounts. I asked ChatGPT and figured it out how to do so. Here are instructions for anyone who might see this:

* Go to the “Accounts & Trade” menu.

* Under “Transfers,” click “Transfer” or go to fidelity.com/transfer-money.

* Choose the option “Between Fidelity accounts.”

* Select the two Fidelity accounts: the From and To.

* If there is cash available, it will default to transferring cash. But near the bottom (or on a later screen), look for “Transfer positions” or “Transfer securities”.

* You should see a list of your positions (e.g., FRSXX). Choose to transfer some or all shares.

Hi Frugal Professor – how do you get the sign up bonus for transferring assets over and over again? Isn’t it for new accounts only? On the Wells Fargo side, are you closing and re-opening accounts each time? And on the BofA side, I don’t think you’re closing because you have all the BofA credit cards. Or maybe you are? I’m interested in hopping on this train so thanks for your help!

On the Merrill side, you can either 1.) call to negotiate a “retention” bonus on an existing brokerage account or 2.) open up a new brokerage account. I’ve only had success with method #2 and it’s easy enough to do. Transferred assets go to the new account. Old brokerage account is closed.

On the WF side, I have no intention to keep a $35/mo checking account open, so I will close it or downgrade to the free tier. I’ll also transfer the assets out of WellsTrade (to Merrill) but leave $1 or so of cash there so they don’t close it down. If/when the promotion is around again in a year, I’ll open up a new checking account & re-transfer assets back to my already established WellsTrade account.

Asset transfer bonuses are tied to the transferring in of “new” assets, but doing the above cycle in perpetuity should work fine.

What running shoes that are easy on knees would you personally recommend? Anything from Asics?

I’m not an expert by any means, but I’ve been really pleased with my Brooks. I was able to try them on at the store before buying to ensure comfort and a good fit.

Buying online is pretty terrible if you don’t know your preferred brand & model & size, but it’s fantastic once you do.

Given Brooks’ extremely generous return policy, I’d probably start there if you want to order online for your first pair. I’d start with the “ReStart” website for the open box pairs at a huge discount.

Will institutional MMFs like FRSXX and FNSXX be liquidated to cover expenses in a CMA, in the same was as the core position and non-instituational funds like FDLXX?

Yes.

Hey for the Merrill account how do you close the account and not loose your bonus for the Bank of America credit cards? Do you wait a certain amount of time before you open the ML account again?

On another topic I don’t think you have ever mentioned purchasing gift cards from GCX https://gcx.raise.com/ I basically use the BOA cash rewards card to purchase 90% of my spend via GCX get 5% back and get discounted cards for amazon 4% Walmart 7-8% and many others

When your annual “preferred rewards” anniversary date comes around each year (mine is in April), they check to see your 90 day rolling balance. If you’re below $100k, they give you a warning saying that you have 90 days to get it back up, or else they’ll drop you to a lower rewards tier. I believe they check a single time after that in 90 days (so mine would be April + 3 months = July). Therefore, if your rolling 90-day average is >= $100k for either April or July, I’m good to go on Platinum honors until the following April. Certainly gameable.

I used to purchase thousands of dollars/year through Raise.com. I stopped because it was a bit of a hassle to manage, but I should look into starting it up again if the discounts are big enough. Have you ever had any issues with fraud? Seems ripe for abuse, of course. If you google it, you’ll come across horror stories. Back when I used them before, I didn’t run into any issues, fortunately.

I also used to use Raise, but nowadays I use an app called “Pepper Rewards”, where Sams Club/Walmart gift cards are frequently available at 10% off. For example, currently there is a promotion that runs till Sunday midnight, but this has been extended a few times so far. The points system is a little confusing, but if it says 10x rewards, it is 10% off. (Walmart/Sams Club is 2x without a promotion). If you wish you can use my referral code (582372) to get additional $20 back for $200 spend within 15 days.

This is in addition to 5.25% online category BoA Premium Rewards so lately my purchases have been 15.25% off at Walmart and Sams Club!

Thanks for sharing!

I was under the impression that, BofA checks 3-months average daily balance and uses that to determine the tier. So if my balance is above 100k in July, but drop to 85k in August, I will be rolled down to a lower tier. Am I missing something here?

Below is the information I found online:

“We’ll review your program balance monthly to see if you’ve reached a higher tier. If so, you’ll receive an automatic tier upgrade.”

They only downgrade if you don’t maintain a $100k 90 day average on your anniversary date or your anniversary date + 3 months (April/July for me).

If you are at risk of being downgraded, they’ll send you a warning letter on your anniversary date saying you have the 3-month grace period to get it back up.

Once you clear that threshold on your anniversary date or the 3 months after, you’re in the clear until the following year.

Thanks for the info on BOA. No issues with Raise/GCX I spend 15-20k a year. Basically I purchase gift cards once a quarter for Walmart and Amazon which are my main spend. Others only for large spend like flights etc. Takes 5 min then I add them to the app. Saves me ~1-1.5k. Yr.

Thanks!

Hi. Why did you decide to go with FRSXX if you can buy TFLO or USFR directly from Fidelity?

Auto liquidation of Fidelity MMFs in my CMA account. I have all of my payments (mortgage, CC, etc) flow through there and I never have to think of liquidating manually.

Where’s the 0.04% from?

Lower expense ratio for the $10M share class (vs FSIXX which I held previously)

So close and open new Merrill.

Keep WF brokerage account open.

Are there any closure fees for either of the investment accounts?

Our $5k from WF arrived today.

Closure fees are easy to avoid. 1.) leave token $1 of cash in account when transferring out securities, 2.) Either leave the token $1 in cash forever or transfer the $1 out after securities are gone.

At Merrill specifically, you could open up a new account for the new bonus, then transfer-in-kind the token $1 from the old to new account, then ask to close the $0 balance account. I think this is what I did before at Merrill without incident. You might want to google/chatgpt that before trying it.

Thanks for the tip on WellsTrade to Fidelity MMAs. I have now updated my primary MMA to the above.

Great!

+1 on the thanks for sharing the WT to Fido tip. Very cool. I had the idea to do something similar a while back (seed a premium fund in a low-value account) but couldn’t find the loophole to do it. Note to self: There’s always a loophole.

How did you transfer the shares over from WellsTrade? Did you use this form or am I overlooking a simpler way to do it through the UI? https://www.wellsfargoadvisors.com/bw/wellstrade/forms/588287.pdf

Once I get the funds over I’m planning to open a separate brokerage or CMA to house the seedlings. Less chance to accidentally sell them off that way. My Fido config is a little atypical as is anyway: I’ve gone with a two-CMA setup for organizational purposes, treating it almost like email: CMA #1 is my Inbox (direct deposits go here); this is my cash on hand, and I have the debit card active for this account. CMA #2 is my Outbox; whenever I schedule a payment I transfer the cash over here so I know that the money is spent. Check-writing goes out of here too. No debit card.

Also, if you haven’t seen it: This thread might be useful to you or other readers looking for the optimal MMF: https://www.bogleheads.org/forum/viewtopic.php?t=401821

I liken the FRSXX and FNSXX to a sourdough starter. All you need is a bit (or “seed” in your terminology) to fund a lifetime of bread. Kind of a fun hack.

Like Jeremy, I PULLED the MMFs from WF to Fidelity. Super easy to do so. Fidelity => Transfer => Transfer an account to Fidelity => “Investment or retirement accounts” => Start a transfer.

That will take you here: https://digital.fidelity.com/ftgw/digital/new-transfer-of-assets/

From there, it’s smooth sailing. Just wait a week after buying at Wells for the transaction to settle before pulling to Fidelity.

Once there, you can buy as much as you want of course. You’re officially in the club. Also, you can transfer “in-kind” from one CMA to another CMA as you suggest. I’ve already shared the MMFs in-kind to my 18 year old, who will now have a lifetime of elevated interest in her Fidelity CMA.

Kind of stupid. Kind of fun.

As far as what MMF is optimal, I like the link you provided, but I’m a simple man who demands auto-liquidation on the little cash we hold so I’m stuck with what Fidelity offers, and this is as good as it gets. If I were sitting on tens/hundreds of thousands of dollars of cash I’d give it more thought, but probably buy treasuries directly through Fidelity.

I did a brokerage transfer of assets from Fidelity (pull).

@FP, I just used the MMA Optimizer from BogleHeads and it’s showing me (which I double checked) that FTCXX beats everything in most circumstances (at Fidelity). Similarly, it shows at Vanguard that VMSXX is the best after-tax yield in almost all tax circumstances.

FTCXX looks really compelling indeed! Have you already purchased it? 100% tax-free at the fed level, right?

Looks like I can purchase at Wells ($50 minimum) but not Merrill. Have you already done so?

Not sure why I didn’t look at this fund previously.

Looking at Fidelity’s MMF screener, there seem to be some alternative options if you live in certain states (perhaps generating additional state tax benefits relative to FTCXX):

* CA: FSBXX

* NJ: FSKXX

* NY: FNKXX

* MA: FMAXX

I can only put text and not images, but using the BH MM Optimizer for Fidelity, FTCXX, at current rates, wins in almost all tax scenarios. It doesn’t win if you’re in the 10% federal tax bracket (Congratulations)! Yes, Fidelity has had the state specific ones, which are almost entirely tax free (as municipal bonds in state aren’t taxable at the federal, state, or local level. The rule of thumb is if you’re in high federal/state brackets, generally those such as FSBXX, are in your best interest (pun intended!) for after-tax yield. For whatever reason, at current rates this isn’t the case. I will add that municipal bonds are more volatile in terms of rate, so you may need to verify/watch closely. In my tax situation (0% income tax state), FTCXX passes the 365-day back-test, but in other ones, the state specific ones might, so you need to think about this carefully. Tax Free Yields are even more important if you’re on Medicare and have to think about IRMAA or want to perform Roth IRA Conversions. I haven’t purchased any yet due to the market being closed on April 18, but I plan to on the 21st.

I’m going to give FTCXX a try as well. Thanks for the suggestion!

I’m really surprised BRK doesn’t have a Midwestern Municipal MMF. Maybe you just need to get Abigail Johnson and Warren Buffet in the same room ;-D

No kidding!

One or thing to note is the cyclical nature of municipal bond yields, so it’s quite likely that treasuries overtake municipals in the future, so you need to keep an eye on it and switch (if you’re obsessed with maximizing after-tax yield).

Great tip!

Hi Frugal Professor,

As your kid is going to college and starts consuming 529 fund, how are you re-allocating the 529 investments? Do you allocation portions to bond fund? Or still 100% in stock fund? What are your thoughts?

Given that we’re maxing out all of our tax-advantaged accounts, I suppose any dollar I withdraw from a 529 today will free up a dollar to redeploy in taxable brokerage. Given that the tax benefits from the contribution have already been accrued, would I rather have $100k in a brokerage or $100k in a 529 today?

Pros to 529:

* Tax-free growth (no div or cap gains taxes)

* With 5 kids, I’m unlikely to have “saved too much”

Cons to 529:

* Higher expense ratios

* No ability to tax loss harvest

* Less flexible than brokerage

Prior to the market tanking, I was fully in the “liquidate as early as possible” camp. Maybe I’m less inclined to do that now and can simply use the 529 with my older kids?

I’ll have to give this more thought!

For $5k WF bonus, can we open 1 joint account with $250k invested and two separate WF checking accounts or do we need to have two WF investment accounts each $250k?

We did it separately. A brokerage and checking account each.

I don’t think what you’re proposing would work for 2 * $2.5k.

Thanks, I thought it would work the same way that BoFA Preferred Rewards status works for joint accounts.

Did you get hit with any fees transferring out of Wells Trade? Did you transfer your entire account or just part?

It was a few months back, but I don’t believe so.

I always do it in a two-step manner. 1.) Transfer majority of assets out in-kind, leaving a trivial amount of cash or cash equivalents so it’s not a full transfer, then. 2.) ACH out the remainder to zero out the account and close.

Hope that helps.