Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Podcast interview with Die With Zero author, Bill Perkins (link).

- Perkins’ book, along with the above podcast, has certainly given me a lot of food for thought.

- The podcast made me reflect once again on whether I’m irrationally hoarding/counting/collecting/obsessing about “Chuck E Cheese” tokens. I think the answer is “no,” but it seems healthy to periodically (re)ask myself this.

- If we were worth billions, what would I do differently?

- Maybe move to the mountains (CO/UT/WY/NV) and hike/bike/climb/ski all day every day?

- Even then, I’d probably wait until the kids are out of high school.

- I’m unsure what else…. I like the cadence and quality of family and personal vacations we’ve converged on. I can’t think of any material (or experiential) thing that I’m lacking — in fact, I find myself drowning in clutter (a house full of kids will do that to you). I don’t feel that I’m forfeiting many life-improving experiences, but I’ll certainly be giving this more thought…

- Maybe move to the mountains (CO/UT/WY/NV) and hike/bike/climb/ski all day every day?

- The Daily NYT podcast on 401k’s (link).

- Some interesting history on the birth of the 401k that I didn’t know.

- MyMoneyBlog highlights the Berkshire meeting (link).

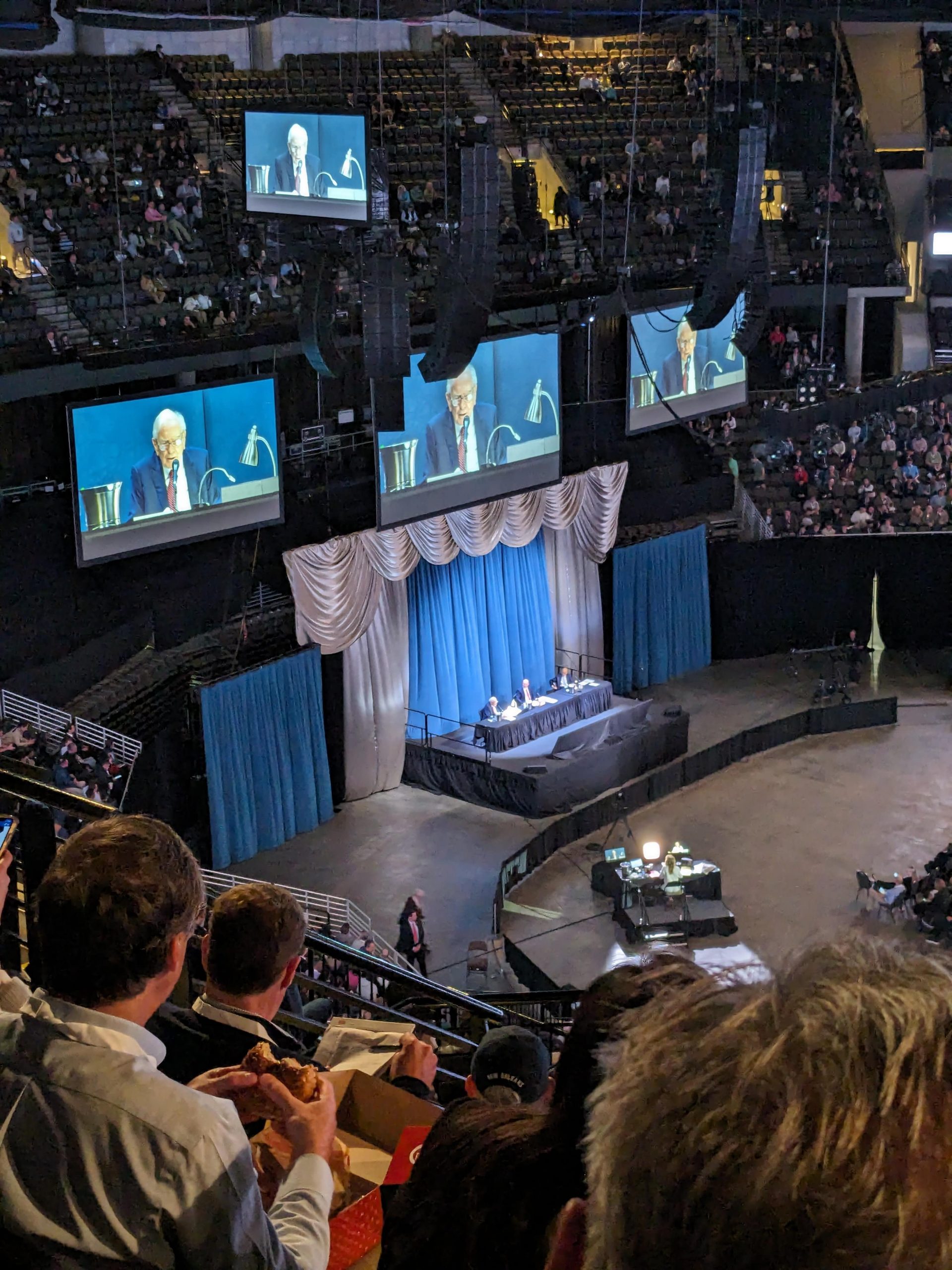

- Once again, I attended this year. It was great to see the tribute to Charlie at the beginning of the meeting. At the very beginning of the Q&A session, Warren deferred a question to Greg Abel but instead said something like “Why don’t you take that one, Charlie?” Warren corrected his mistake immediately, but it was interesting to watch. It elicited a respectful and reflective applause from the audience. Frankly, the meeting was not the same without him. I don’t think I’ll return.

- The Finance Buff on Vanguard’s impending fee changes (link).

- Here’s his related post on migrating from Vanguard (link).

- It seems that Fidelity is certainly leapfrogging Vanguard in the reputation department.

- If I were not interested in the bonus-chasing game, I’d simply stick with Vanguard and the MFs. But with taxable assets of $550k+, I’d easily be forfeiting >$5k/year (before taxes) by not playing the bonus chasing game. It’s a stupid game, but it seems stupid not to play it. This same logic convinced me to move our IRAs to Robinhood. Stupid, but profitable.

- As a result, I’m considering fully migrating from Vanguard before July 1. It would be easy to do, particularly if I converted the MFs to ETFs before leaving (since ETFs are much more portable across brokerages than MFs).

- Is anyone else considering migrating away from Vanguard because of the new fees?

- I prefer MFs to ETFs because I’m a simple man. I like the 1x/day trading, the lack of spreads, the ability to easily invest every penny I want, and the improved liquidity on selling (e.g. hit “sell” on Thursday afternoon and have the cash proceeds hit my Fidelity brokerage/checking account by Friday evening). I also like that I can purchase the MF the day before my paycheck hits my Fidelity account so that I’m fully invested before I’m even paid (since the debit to the funding account occurs the following morning). I also like that I can easily initiate a “sell” or “buy” order outside of market hours, which is more annoying with ETFs.

- Morgan Housel summarizes a lifetime of financial advice to a 10-minute spiel intended for his kids (link).

Life

- Google Domains is ceasing operations, so I transferred my domain registration to PorkBun. They’re a tiny bit cheaper than Google Domains was ($10.37 vs $12 per year). It was easy enough to transfer and I’m happy so far.

- Google Domains now joins the loooong list of products it has killed over the years (link).

- RIP Google Reader and Google OnHub — I really liked both of those products, killed in 2013 and 2023, respectively.

- Google Domains now joins the loooong list of products it has killed over the years (link).

- I visited California and saw several cybertrucks in the wild (though my first was in Omaha after the Berkshire meeting). It’s hard to appreciate how ugly it is until you see it in the flesh — a refrigerator on wheels. If only Tesla had redeployed those resources and R&D energy into something less hideous — the long-awaited refreshed Model Y, a conventional pickup (competitor to Rivian), their long-promised economy vehicle…..

- I survived another academic year.

- Mrs FP took our girls to NYC with her sister, which sounds like the exact opposite of a vacation to me. My boys subsisted on Costco hot dogs on an almost-daily basis in their absence. I took them golfing several times. It was a fun staycation for us.

- On the recommendation of a friend, I paid $20 for the premium version of ChatGPT. I was pretty blown away by its capabilities. I asked it to proofread this post and identify typos, which it hopefully did well (Mrs FP is officially fired). I can see this being such an important productivity tool. I’m excited to explore its many use cases.

Lookout world. There is a successor to the venerable Kirkland Signature Court Classics that were discontinued over a decade ago(?). Initial reddit posts are positive (link 1, link 2). Preliminary reviews from the C.K.C.C.E.G. (Costco Kirkland Court Classics Enthusiasts Group) on Facebook are positive (link). I’m not currently in the market for shoes for myself, but my kids go through shoes constantly. I will be imploring all five of them (plus Mrs FP) to give these shoes serious consideration as their primary shoe in the future. I’m anticipating a bit of pushback, unfortunately. My oldest daughters have recently become mindful of fashion and started to push back on the fact that 100% of their wardrobe was purchased on clearance at Costco throughout their lives. The same is true of me (minus the Walmart Wrangler Pants, of course), but I view that as a badge of honor, not a source of embarrassment.

One tentative thumbs up from this old man based on my one minute test-drive in warehouse. The heel felt a bit odd to me, though, like it lacked stability to prevent you from tipping over backwards. Hard to explain. Size up because they run small.

Berkshire 2024. RIP Munger. You were missed.

Squishmallow pit at the Berkshire meeting. I did not partake, but had I brought my kids they would have had the time of their lives here.

Rainbow on a walk around the neighborhood.

HS soccer team went to state. We went to cheer them on for the second consecutive year. It was a blast. FC4 stayed home.

The boys played 4 times this past month. I was the caddie. Youth On Course for the win. It’s the one activity that my boys love to do and never get sick of (unlike activities I suggest like climbing, biking, etc). I’ve been addicted to On Runnings hats ever since borrowing one from my father (link).

Stanford’s campus is not ugly.

Cybertruck #1 in the wild in the Bay Area.

Cybertruck #2 in the wild in the Bay Area.

California is not ugly. Half Moon Bay golf course (participant in the $5 Youth on Course program). I didn’t play; just visited the coast.

This Month’s Finances

- The good:

- Still employed.

- HSA and Roth IRAs are now fully funded.

- 529 is 30% funded to $10k state deduction limit. Another $7k to go, then we’ll transition to contributions to our brokerage account.

- The bad/abnormal:

- Lumpy expenses hit this month:

- $3,300 in doctors & drug expenses. Mercifully we’ve hit our deductible & are within spitting distance of our OOP max.

- ~$1k in summer camps for kids.

- $785 for annual $1M umbrella policy from Geico.

- Before our teen drivers came on scene, we paid $147/yr for the same coverage.

- Is it crazy to forgo umbrella insurance with teen drivers?

- The price just seems insane to me. If our taxable assets had instead been sheltered from litigation in a mega-backdoor Roth (in employer retirement plans), I would be more inclined to forgo the umbrella insurance. That said, the bulk of our assets are in employer-sponsored retirement plans….

- $744 for 6-mo premium for auto insurance (liability only, 3 vehicles).

- $733 for annual homeowner’s insurance ($30k deductible).

- Lumpy expenses hit this month:

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

“I survived another academic year.” that feels more impressive with each passing semester lol

Ironically, I’m at the beach this week and drove by my first tesla cyber truck in the wild last night .. I sort of thought they were an internet joke until I saw it on the road going the other direction!

The cybertruck will go down as Tesla’s biggest mistake.

My job is great, but “survival” seems an apt word to describe getting through the end of the year…

I’m leaving Vanguard for Fidelity. The closure fee and the fact that they sold their Solo 401k to Ascensus were the two final straws. Also – didn’t realize you were at the Berkshire meeting – I was there too. Definitely not the same without Charlie.

Thanks for the feedback on leaving Vanguard. Did you need to convert any MFs to ETFs before leaving?

Glad you made it to Berkshire. Would have been fun to have a meet up. I didn’t decide to go until the day before.

Hi FP,

Placing a sell order for ETFs after hours should be just as easy as a MF. Just place a good till cancelled order and it will be in effect the next day when the mkt opens. Or is this not available with Vanguard ?

After a discussion with a friend who is an attorney, I am disappointed with how the legal system works with respect to umbrella policies. If you are sued, the person suing can find out the level of assets owned and the umbrella amount, then go after the combined figure. So the umbrella is not truly protecting your assets. That being said, I have one and would definitely have one with teen drivers. The hope being the litigant would not go beyond the umbrella amount. It is a buffer but not a true protector of assets from seizure.

Thanks for the monthly posts.

Thanks for clarifying the mechanics of selling ETFs outside of trading hours. When doing the Robinhood shenanigans, I learned that I couldn’t do so when purchasing ETFs outside of trading hours. I’m extremely inexperienced at trading anything other than MFs.

Thanks for sharing your thoughts on umbrella. I know it’s myopic to consider dropping umbrella precisely when I need it the most. But the size of that premium is really painful, particularly when most of our assets should theoretically be shielded from litigation because they reside in workplace retirement plans…

A possible $100 closure fee in the event of moving investments elsewhere seems innocuous enough, I feel like there is something I am missing in your question. Are you concerned that it’s the first in a series of dominos increasing fees across the board once it’s a little more painful to leave?

I initially came to the same conclusion as you that the $100 fee was trivial. But after thinking about it harder, I came to the conclusion that this is more analogous to your “domino” metaphor.

There is extensive discussion on Bogleheads here on the topic: https://www.bogleheads.org/forum/viewtopic.php?t=430905

I’m still on the fence, but leaning towards migrating out. I guess I’ll have to make that decision in the next few weeks if doing so….

agreed with Derek. To me – looks like the new fees can be easily avoided by either not trading via phone and or by receiving electronic statements.

Frugal Professor – thanks for another monthly update – much appreciated. I enjoy reading every month!

The primary fee that had me annoyed was the $100 fee for partial account transfers. Since re-entering the brokerage bonus chasing game, this becomes an annoying friction that I could easily avoid.

Someone needs to play me the world’s smallest violin for my “predicament”…

$30k deductible? So you’re just insuring against the risk of your house burned to the ground?

Yes. Or tornado.

For an extremely low probability event, I’m happy to self-insure to $30k. That’s like a normal daily fluctuation of our portfolio these days.

Munger had so many great quotes to say about self-insuring. I’m too lazy to paste them here, but I’ve quoted them on the blog before. But everyone should be self-insuring once they have the assets to do so. By doing so, you essentially become an insurance company and are able to invest the “float” like Berkshire does with Geico.

When thinking about insurance, I always think of the following equation:

Insurance premiums = True actuarial cost + insurance company profits + insurance company taxes + insurance company overhead + fraud

By self-insuring, I can just bear the true actuarial cost myself, saving myself the rest of the nonsense. Of course, the downside is that it subjects me to infrequent and large losses, but I’m willing to make that tradeoff. On average, people would be richer (on average) by doing the same, particularly once they have the financial margin to eat their exposure without too much disruption.

$45 for a hat! How great is this hat?

I bought a lightweight cap from Costco for about $15 in store. I like it well enough. https://www.costco.com/adidas-men's-superlite-cap%2C-2-pack.product.4000200462.html

It’s my favorite baseball cap I’ve ever worn. Very cool and super quick drying. Fits my huge noggin well. Bought one for each family member. Unfortunately, we’ve lost a few. I’ll replace them with the exact model.

I got them a bit cheaper a year or two back. Cheapest I see online is $40 now.

I’d love to pay less for a comparable hat. I’d love to try the Costco Adidas hat on in person, but that appears to be an online-only item (and an out-of-stock one at that).

Edit: looks like they have some blue ones for $27. Woot. https://www.on.com/en-us/products/lightweight-cap-301/unisex/niagara-accessories-301.00804

Yes – The Finance Buff has a good article on switching from Vanguard to Fidelity – followed his steps:

https://thefinancebuff.com/steps-before-transfer-from-vanguard.html

Agreed. TFB is the GOAT of personal finance blogging as far as I’m concerned. Thanks for linking; I should update the post to include that.

What specifically motivated you to leave Vanguard? Did you convert MFs to ETFs before leaving?

Would there be a in-the-money FEMA-put in the case of a tornado?

Hadn’t thought of FEMA implications. Is there really potential FEMA money at play?

I don’t know. We have 7 properties and they all have a $5k deductible. For us, the next step would be to forgo insurance all together, at least for those not rented out and without a mortgage, so a $30k deductible policy is interesting to see.

I have a friend worth close to $10M. He has no mortgage on his house. I’m almost positive he self-insures on everything. No homeowners insurance. No comprehensive for his car. No dental. I think he participates in those sketchy faith-based medical things as an alternative to formal health insurance.

I can’t forgo homeowners insurance yet because we still have a mortgage. Nor would I really want to self insure the full home (yet).

If your 7 rental properties were not located in the same city, but rather distributed across the country, I think you could make a compelling argument to self-insure once you’re able to. But self-insuring 7 rental properties in the same neighborhood would probably be less prudent given the high concentration/correlation of risk there.

Is this friend also a finance professor? Wow, it’s like a well-kept secret!

Nope. An information systems dude who worked for Google at the beginning of his career. Then quit his well-paying job to start a bunch of businesses on his own. All of which failed until he listened to his wife’s idea and he struck gold.

Accounting professors are paid better than finance professors. That’s the real secret.

The real question is, would you choose accounting if you could choose again?

Nope. You couldn’t pay me enough.

I contemplated it, though. It’s a lot easier to get a job.

Thanks for the Bill Perkins podcast suggestion; I listened this morning.

Some good food for thought, but I feel like he is missing at least two things, on the podcast at least.

First, he doesn’t seem to account for the hedonic treadmill. If you are always maximizing for supposed fulfillment, you may decrease how well you can handle inevitable bumps in life. One of the beautiful things about intentional frugality is that you open up more room for spikes in enjoyment from the smallest expenditures or good luck and you aren’t as phased by difficulties because you are intentionally choosing to do with less than you could.

Second, I think we may underpredict how much we can enjoy things later in life, which could lead to excessive spending now. For example, in my early 20s, I was pretty sure “fun” would end by my early 40s, and I was quite wrong about that. In fact, I enjoy life more now and have more meaningful things to spend money on now. He also didn’t speak much about the joy of giving, which is something we can do well into retirement.

That said, he does have some good points about memory dividends and doing activities at times in life where we can still enjoy them. The point about spending time with our children and making memories with them while they still want to hang out with us was an excellent reminder.

I agree entirely about him ignoring the hedonic treadmill.

I loved your quote “One of the beautiful things about intentional frugality is that you open up more room for spikes in enjoyment from the smallest expenditures or good luck”

I still consider a Costco hot dog a minor splurge and a Chipotle burrito an extravagant splurge. Every semester I share this fact with my students. In the 8 years I’ve been on campus, I think I can recall a single time I spent money for lunch at a restaurant. It was my first month here and I attended this mandatory department lunch at a pizza place. I was under the impression that my department chair would pay, but I was wrong. I literally cannot think of a single additional penny I’ve spent on food/drinks on campus over the ensuing 8 years. I guess my wife has met me on campus a handful of times for a lunch date, but I guess I count those differently somehow.

I like your Point #2 as well. When I was 20, 40 years seemed incomprehensibly old. But I’m there and it doesn’t seem that old. With a bit of luck, and a bit of continued physical activity along the way, I hope to remain active for another couple of decades at least….

His point on memory dividends is probably the most memorable part of the book for me. I really liked the point.

“the improved liquidity on selling (e.g. hit “sell” on Thursday afternoon and have the cash proceeds hit my Fidelity brokerage/checking account by Friday evening).”

Stocks just moved to T+1 settlement (like MFs) last month, so that’s not really a difference anymore.

Great point! Thanks for the reminder!

Hello Professor,

I’ve been following your blog this year and I’m so glad I found it! I can attest that you’re educating more than your (full-paying) students in your classroom, because I have learned quite a bit here. I’m hopeful that this free education goes along with the frugal theme you’ve created here, so thank you for your efforts.

My portfolio of assets is similar to yours (although my portfolio of children is way less – just two!). My wife does the real work caring for the children, but as we all know, the pay is pretty much zero. Fortunately, I’ve gotten lucky in my career by competently faking competence at my job, and my income level has soared over the past five years.

I noticed that your are contributing to IRAs (x2) every year. I’ve read your hierarchy of saving post (one of the most useful pages on the internet!), but I skipped the Traditional IRA because I thought my income level was too high to contribute. I do Backdoor Roths (again thanks to you – you should really start charging a fee!).

Is you current income beyond the deductible limits of the Traditional IRA? If it is, are you making non-deductible contributions to it?

Thanks again for this great blog, it’s a hidden gem on the internet!

Thanks for stopping by and for the kind words.

First off, if you haven’t read my “book” in the header of the blog, it’ll explain a bit of the mechanics of IRAs, but I’ll summarize it here:

If you make too much money, you can’t contribute to a Roth IRA.

If you make too much money, you can’t contribute to a Trad IRA ***and*** take a tax deduction for it. However, you can make infinite dollars and still contribute to the Trad IRA and ***not*** get a tax deduction for it. This is called a non-deductible Trad IRA contribution. Due to the lack of tax deduction, you’re essentially putting after-tax dollars into a Trad IRA.

What’s the optimal thing to do then? Since the dollars you’re putting in are already after-tax, why not exploit the backdoor Roth? To do so, 1.) first, contribute to a (non-deductible) Trad IRA. 2.) then, convert to a Roth immediately. Ideally, you’d have $0 Trad IRA dollars before executing this two-step process. If not, it might not make sense.

Here’s my YT video explaining the mechanics: https://www.youtube.com/watch?v=To8tg0cufpU

Since you and I are already contributing to backdoor Roths, we can’t also contribute another $7k to Trad IRAs.

To me, one of the most important points in the book was the discussion on inheritances. The fact that most inheritances go to people in their 50s and 60s (parents passing in their 80s), yet its to people at an age where the money really doesn’t make any difference. In contrast, the point that people could most use money the most is from age 25-34. They could pay for a house, or make a risky career move, or go for an extended trip.

To that end, we are working with my mother in law to have her both give money to her grandkids (there are 9 of them), and do it now when she can see it at work. My kids are 24, 20, 19 and a few years of $10k gifts from grandma will really help set them up. Its all in VTI, and helps fund their Roths (up to their earnings). The key is to monitor it so that they’re not blowing it…..so far, so good.

I agree with you there! It’s another point of the book that I think of often (monthly at a minimum) and discuss often with others.

The current system of receiving inheritances at the age of 60-70 is plaid stupid, though I suppose it could fund a retirement at that point if someone has zero in the bank. But if someone has zero in the bank at 60-70, my guess is that they would deplete any inheritance received.

I agree that the ideal age to receive such funds would be around 25-35. Before then, anything received could be easily squandered. After that, the financial trajectory of their lives is already established to some extent. If I received a 7-8 figure inheritance tomorrow, it would change absolutely nothing in my life. But I would have certainly helped 15-20 years ago….

FP, I also have a high home deductible at $32k. I asked my agent to up it to $100k but the insurance company caps the % and I am at that cap. I have contemplated dropping the policy all together since I have no mortgage but cannot seem to pull the trigger. I told my agent he would likely only hear from me if the house burned down.

The same goes for car insurance. I am always surprised at friends and family who have comprehensive coverage on their old cars. When I explain they are spending $600 or $700 per year to protect a $4,000 item they say they never thought of it that way.

Self insurance is the only way to go.

What are your thoughts on self-insuring for umbrella? Do you have teen drivers?

I am married and 60 years old with no children. Our country has become so litigious I would be afraid to drop that umbrella policy. No matter how responsible teens are raised to be, stats indicate their driving skills and decision making at that age are troubling. I considered myself to be a responsible teen back then, but recall several stupid decisions I made when driving like seeing how fast I could get my car to go on an open stretch of highway. All it takes is one accident with an injury requiring hospitalization to run into the hundreds of thousands of dollars. And if multiple cars are involved with your child at fault, seven figures can be reached quickly.

Dropping coverage on a house is different in that you have the potential loss nailed down – the value of the structure and contents. Upper limit on potential liability for teen drivers is unknowable. As much as I despise insurance companies, if I had 2 or more teen drivers I would have at least $2 million in an umbrella policy. I have a $1 million umbrella in case my wife or I cause an accident.

This is a great comment that I needed to hear. Thanks!

It’s also a good reminder of how brain-dead I was as a teenage boy! I was REALLY dumb!

FP, you and I had some emails back and forth discussing the Robinhood 3% match offer and we both ended up taking advantage of the “free” money. I’ll just think of it as Robinhood paying for my insurance out of those funds. Not the most logical of arguments, but whatever works to make my lizard brain happy !

It’s funny you mentioned the RH match.

I had an AC repairman at my house on Friday to fix a unit that their company had installed 4 years ago. They charged me $155 and the repair took about 10 minutes. I felt a bit violated (no warranty coverage on relatively new unit, etc) but my lizard brain rationalized it. by thinking I could easily recoup that with these brokerage bonus shenanigans (e.g. Wells Fargo $2.5k bonus). This is called “mental accounting”. While completely illogical, it actually helps me get less annoyed by things.

I won’t even get into how fast I drove from Clemson to Daytona Beach one year in the mid 1980’s for spring break with a group of friends in the car. If pulled over I have no doubt I would have been arrested. Stupid, stupid, stupid. I am just glad there were no phones/phone cameras/social media back then. The reason your umbrella went up so much is because of the high rate of incidents with teen drivers – I realize I am just stating the obvious. Have you shopped policies? I have had good experience with State Farm.

I have similar stories about speeding through Nevada in college. Got ticketed once. Glad they didn’t catch me at my max speed. More importantly, I’m glad I didn’t kill myself and my friends. The teenage/early 20s brain is indeed dumb.

I’m also glad that social media wasn’t a thing back then. I can’t even imagine my idiocy being cataloged on the internet forever. Kids today have it tough in that regard.

I price out auto insurance occasionally, but Geico always comes back favorably for me. I guess they’ve come to know me pretty well over the past 20+ years. That said, I haven’t jointly priced out umbrella+auto in recent memory, so perhaps I should do that. In reality, I’m sure that’s the going rate for umbrella with teen drivers…

I don’t know I agree on the home insurance front. I filed my first ever claim (10 yrs of ownership). It was for a new roof due to hail. That is something that would required I raid my 457 or sell substantial assets to pay for. I’m glad I paid a few thousand dollars for insurance instead.

Understood, but how many years of a few thousand dollars of extra insurance did you pay for? 5? 10? Would the sum of those extra premiums (+ accumulated interest) have paid for the new roof?

If replacing a roof would represent a problematic liquidity event for someone, as you describe, then insurance could indeed save the day. But, on average, we’re all paying more going this route than through self-insurance. Because the math says it has to. Insurance companies can’t operate at losses in perpetuity.

Have you priced out the cost of mental health these days? You got off cheap.

?

It would help me! I’d get a nanny!

A nanny certainly would have been tempting when the kids were younger!

10 years of premiums was a fraction of the cost, construction costs have exploded since 2020.

That’s great. My colleague is in a similar situation with a recent roof replacement. Their cumulative premiums were less than the cost of the roof replacement.

Our roof replacement in 2016 wasn’t horrific. Maybe $15k. With construction costs extremely inflated over the past several years, I wonder what it would cost to replace again now…. $30k?

“If you are sued, the person suing can find out the level of assets owned and the umbrella amount, then go after the combined figure. So the umbrella is not truly protecting your assets.”

This is one of the reasons I’ve never believed the advice to buy enough umbrella insurance to match your assets. The way I think about it is I want enough umbrella insurance so that their attorney will advise them to accept a settlement covered by the policy instead of waiting years if a lawsuit is filed and they win. And I imagine the legal fees for the plaintiff go up substantially if they have to litigate the case rather than just paying their lawyer for negotiating a settlement; suing for more may not deliver a lot more when all is said and done. If they hire one of the personal injury lawyers that advertises on buses and billboards I’m guessing the business model is to push for a quick settlement.

With no teen drivers in the house, $3 million coverage is affordable and provides peace of mind. I don’t know the ability of local defense lawyers but with that at stake my hope is the insurer does and has motivation to provide a good one. Also the policy includes $1 million in uninsured/underinsured motorist coverage which is valuable since the CA minimums are so low as to be meaningless (assuming the other driver even has insurance).

I agree that umbrella has merit for the reasons you listed. The fact that the insurance company has skin in the game is a big plus. My comment was mainly to inform people that umbrella does not prevent their assets from being at risk. But it is certainly a buffer, and my attorney friend did say that most of the time the suit filer settles for no more than the umbrella amount. Likely for the speed reasons you describe.

Moral of the story for me: don’t be an idiot and drop coverage when I need it the most thanks to my teen drivers.

I appreciate the feedback.

My metal roof was well beyond that.

I believe it!

There is another sticking point here. Most mortgage companies require you have homeowner’s insurance. If you own your home outright, good for you, though most do not. If you purchased a home at the low interest rates, I’d rather keep my low interest rate, tax deduction, and pay for insurance. There are companies that are better than others, though they don’t usually pay Arnold Schwarzenegger to advertise for them.

Agreed

One thing more I’ll add about RobinHood is they are advertising a 3% flat Visa card for those with RobinHood Gold. Unknown date for availability and no sign up bonus for now. You’d have to spend a lot of money on that card for it to be worth it over the Platinum Honors BoA Premium Rewards. Maybe if you are paying business taxes/utilities or something…

$5 monthly RH gold fee * 12 months = $60/yr.

X * (3% – 2.625%) = $60 breakeven

X = $60 / (3%-2.625%)

X = $16k/yr in diverted 2.625% BoA spend to break even relative to PR card.

I spend $10k/year on property taxes on my BoA PR card, so that would mean $500/month left to go to break even. I can hit that pretty easily.

That said, the delta seems small for now. Maybe I’ll take the plunge if they offer a sign up bonus. I’m a bit skeptical that the card will stick around that long. 3% seems unsustainably generous… And I loathe Robinhood….

RH gave me Gold for $50/year, but the point I make here is that the delta is small and unlikely worth the effort. It’s even less likely if you do sign up bonuses or 5.25% CCR , +/- other 5x cards (such as Citi Custom Cash).

Agreed.

At the risk of continuing to ‘sell’ after you’ve already decided to keep buying, your umbrella policy is only 13bps of your checking and taxable accounts. It sounds like a good value to me.

Different question: Please remind me if you have an emergency fund or sinking funds for home improvement (or similar spending items). I don’t know when or what in our house will need fixed during the year, but it’s a safe bet something will.

I hate losing out to inflation (we use HYSAs), but we don’t have a taxable account large enough to cover a home insurance deductible, for example. Needing the money when the market is down 40% would be a problem.

I’ll begrudgingly continue to take my medicine of high umbrella premiums…. I like the framing of normalizing by assets, but normalizing by annual budget paints a different picture; particularly in years we don’t by a car.

I don’t have any emergency fund / sinking fund nor have I found a very compelling need for one. In the event that we’d need to cover a $50k+ expense, here’s how I’d prioritize:

* Credit card float (30-60 days)

* Cash flow from income

* Taxable brokerage (start with highest cost basis first)

* If taxable brokerage is too expensive from a tax standpoint, then I have tens of thousands of dollars of medical expense receipts accrued over the years for tax-free HSA withdrawals.