Another month, another update. A few random comments.

Good Reads/Listens/Watches

- We are enjoying Season 4 of Welcome to Wrexam (link).

- Ben Rector dropped a new album. It is great (link).

- Some new favorite YouTube channels:

Life

- In the ultimate gesture of betrayal/blasphemy, we joined Sam’s after taking advantage of a $50 off with an educators promo. After discount, the net cost of the “Plus” membership was $60 (=$110-$50). They sell a handful of staples that our Costco does not (dry black beans, milled flaxseed, steel cut oats, prego, grape nuts, egg pasta, diced tomatoes w/ green chilies, etc). Unlike Costco/Instacart, they don’t impose a surcharge on delivered items (provided you hit the $50 minimum order size). Member’s Mark is sometimes cheaper than Kirkland Signature, but worse. Whereas Sam’s Member’s Mark offers mostly non-organic options, Costco’s KSig is mostly organic. They offer decent gift cards, including this 15% off restaurant card we used this month.

- The great Portuguese contact lens arbitrage was successfully completed, saving us ~30% from Costco’s competitive pricing. Oddly, Interlenses provided no email or online updates on the order over the 7-week period between order and delivery (the lenses are custom-made in the UK which explains much of the long lead time…even when ordering from the US it’ll take 5-6 weeks). So far, I’m batting 100% with these international arbitrages and I don’t foresee buying contacts domestically for FC1 again. I got 5.25% cash back and avoided FTFs with the converted BoA PR => CCR card.

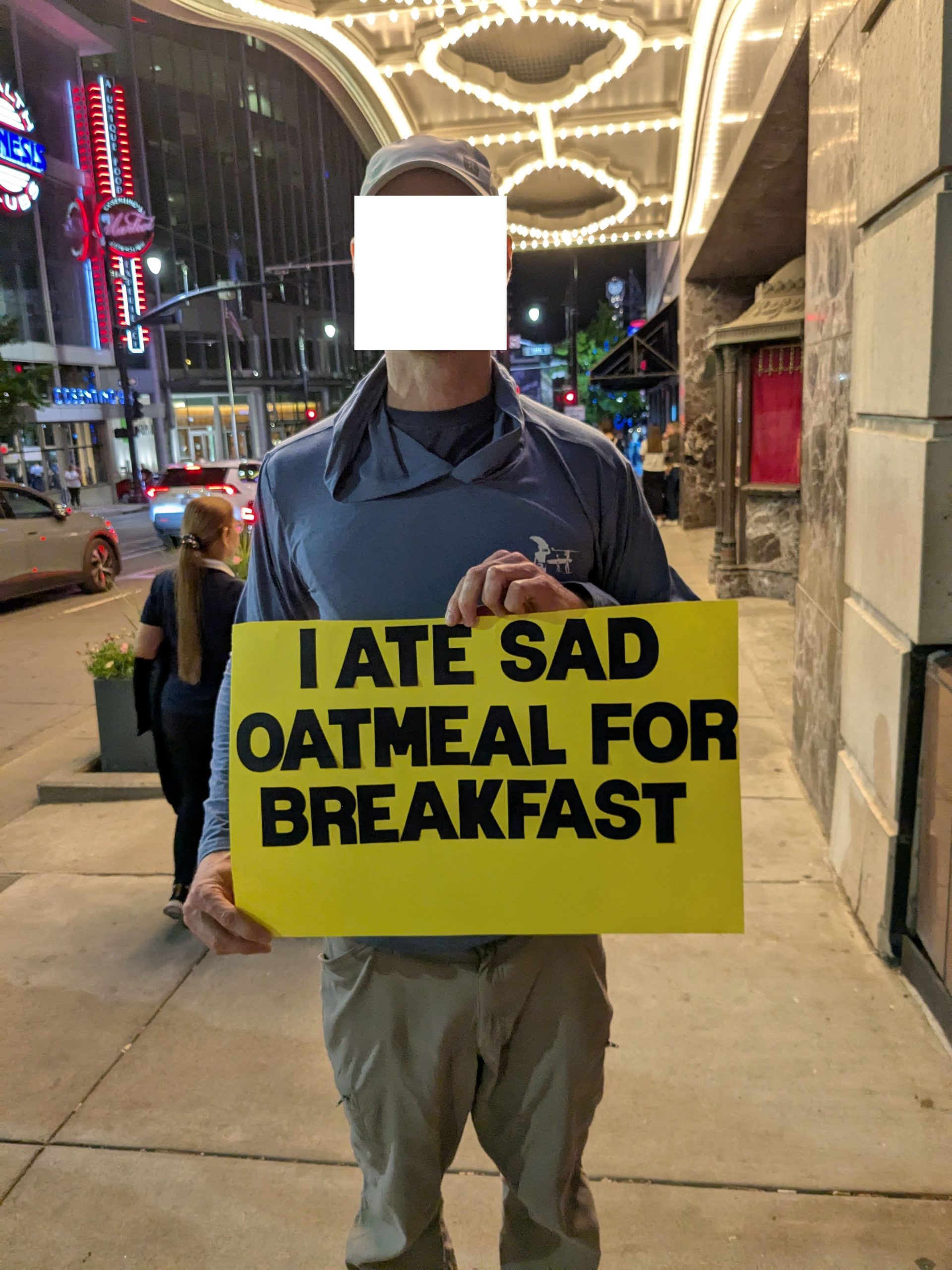

- On a whim, I bought the family same-day tickets to a Ben Rector concert and drove 6 hours round-trip in a single day to see him. We were in the twelfth row. It was fantastic. The opening group, the National Parks, was underwhelming. It was my third time seeing him in concert over the last few years but my first time seeing him headline a show. He released a high quality recording of our live show here. I asked Mrs FP to make a sign for me that said “I ate sad oatmeal for breakfast,” which he saw and briefly responded to. Apparently, he has aspirations to make a podcast about what people eat for breakfast. We’re best friends now.

- Seeing the band perform made me reflect on my world-class mediocrity…being quasi functional in a few areas of life but not excelling in any.

- FC1 graduated high school. Apparently, in our neck of the woods, there are a few traditions that are completely foreign to me. First, graduation announcements are sent out. This requires a new set of pictures (and cards) that are separate from the “senior photos” that were taken a few months prior. Whereas I was deemed to be an inadequate photographer for the “senior photos,” I was promoted to photographer for the “graduation photo.” Second, a graduation party is thrown. Mrs FP cooked home-made “Cafe Rio” burritos for ~75 guests that funneled through our home. It was a bit chaotic, but we survived. FC1 pocketed some cash, which means nothing more to me than a moral obligation to give all of it back to the givers’ children. I’d prefer simply forgoing the exchanging of cash.

- Our kids are now in 13th, 11th, 9th, 8th, and 6th grade. No more elementary schoolers. Weird.

- It was a bad month for small kitchen appliances in the FP household. I broke our 15-year-old rice cooker while cleaning up exploded quinoa out of it. Unfortunately, our 8-year-old instant pot also died of natural causes. The upside is that after spending an embarrassing amount of hours researching rice cookers, I arrived at this model which we’re now using 1-2 times a day for overnight steel cut oats, quinoa, and rice. This strainer helps cut down the foam of the quinoa to prevent future catastrophes. We have used instant pots (and their predecessors) almost daily for about 15 years for dry beans, some pasta dishes, some stews, meats, etc. We settled on this model for a replacement, which is a notable upgrade from our prior one (we bought when it was on sale for $123). Many times per semester, I tell my students that the best investing advice they’ll ever receive is to buy an instant pot and learn how to use it, since that will free up non-trivial amounts of cash to invest over their entire lives.

- Black bean recipe: 4 cups dry black beans, 10 cups water, 2 tsp salt. Cook at pressure for 30 min, then natural release. Strain without rinsing.

- Steel cut oats recipe: 1 cup steel cut oats, 2.5 cups water (or double both). Cook on porridge setting in rice cooker.

- I helped sign FC1 up for a no-fee (until she turns 25) checking account with Wells Fargo. They offered her a $125 bonus. I figured it couldn’t hurt her to have a brick-and-mortar bank to accompany her Fidelity CMA, if only for the sole purpose of depositing cash then instantaneously transferring it out. FC1 also opened the Fidelity 2% credit card which is probably the best first card a teen could have. Too bad she missed out on the original 4% Smartly card.

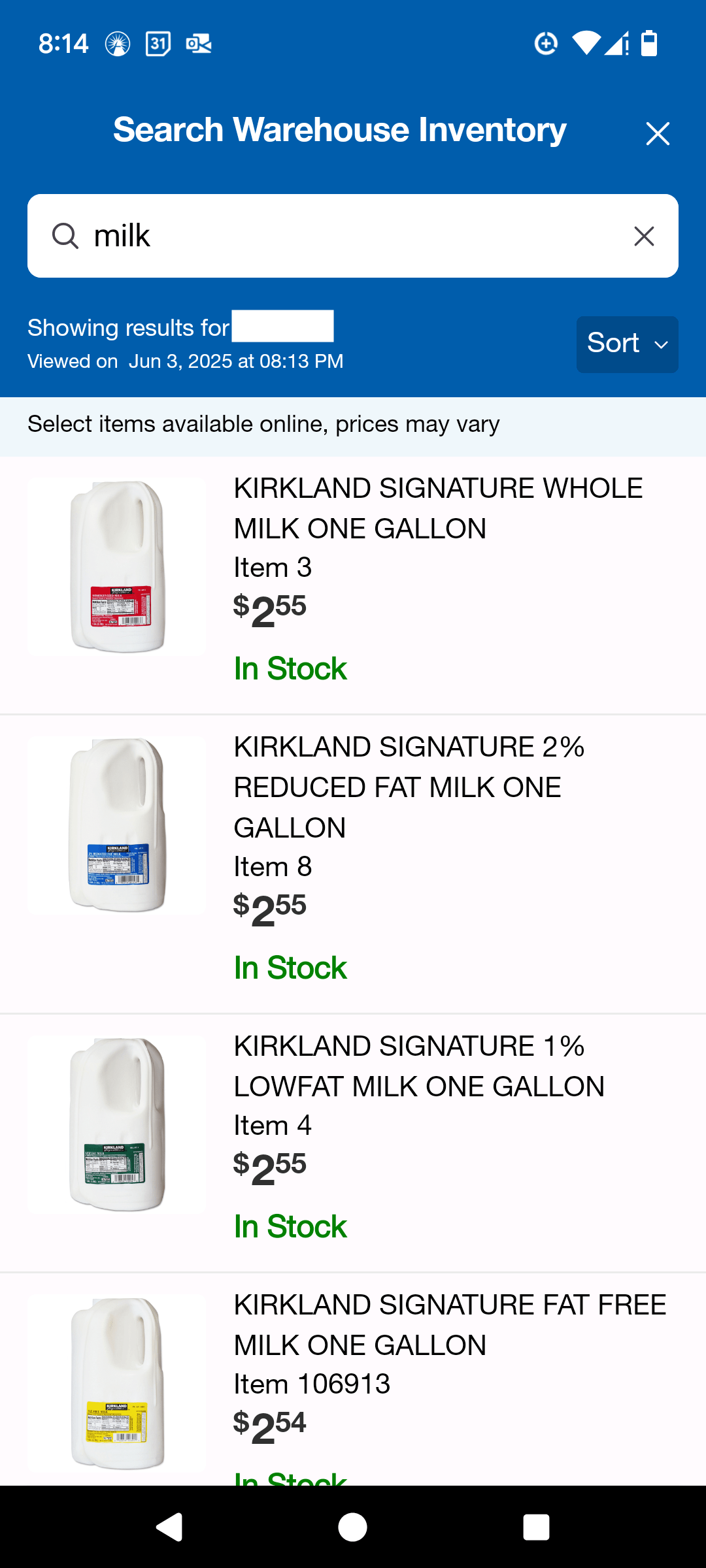

- I learned of a new Costco local warehouse inventory & price checking feature within the Costco app. Open app => click “warehouse” button on bottom of screen => select your warehouse => query where it says “Search Warehouse Inventory.” Fancy.

Local inventory & price checking feature in action. Fantastic.

Executive Dog bundle is back. Too rich for my blood, but will probably buy if they go on sale. The prior version was the most robust dog toys we’ve ever purchased.

Proof of the betrayal. Cheaper (non-organic) Sam’s greek yogurt to make my sad oatmeal slightly less sad. Maybe I’ll keel over dead from the non-organicness.

The man, the myth, the legend.

I’ve recently declared war with squirrels on my roof. I’m close to losing count of how many I’ve caught.

My roommate from college swears by man-purses (murses). If you are in the market, Costco has a nice one for $4.97 (check the app for local pricing/inventory!). However, I’m not comfortable enough with my masculinity to pull it off. FC4 bought one though.

I don’t feel old enough to have a kid graduating HS.

These people are growing up!

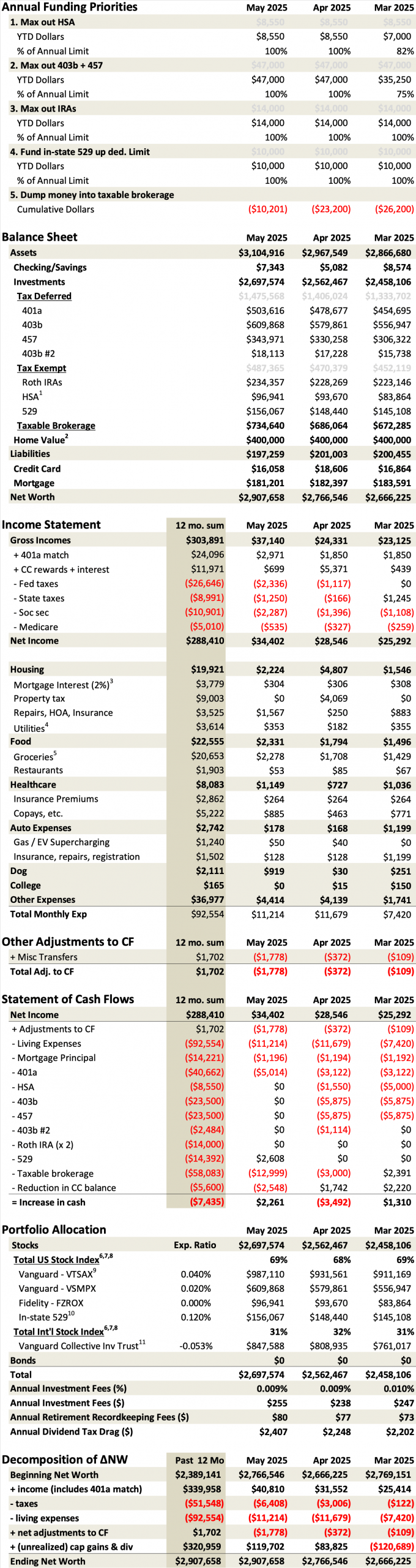

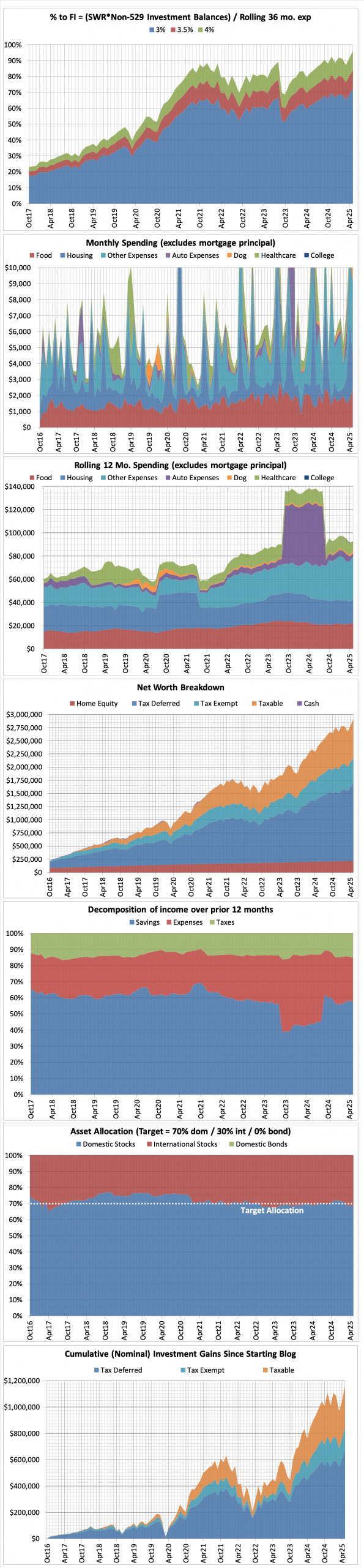

This Month’s Finances

I zeroed out a few small 529s that we had accumulated over the years. I’m still undecided how much liquidation of 529s I’ll do over the near vs far term, but I think I’m leaning towards zeroing them out sooner than later.

My university told us that we are not getting raises this coming year. It seems that doom and gloom is on the horizon, but what else is new?

Several readers (Jeremy and Rwaltr) commented on using BOXX in lieu of money market funds to hold cash. Why? To defer accrued interest just like you would a stock. Pretty clever and tax-efficient if you’re looking to maximize your after-tax returns on cash. Here is a lengthy Bogleheads thread on the topic for those interested. As for us, we hold near zero cash so the little we hold I’d prefer to be able to auto-liquidate through Fidelity MMFs.

- The good:

- Still employed.

- The bad/abnormal:

- We hemorrhaged a bit of cash this month.

- $786 in home insurance premiums (a 7% increase from last year).

- $800 in eyeglasses. 6 pairs purchased.

- $600 in home repairs.

- $500 in airplane tickets for Mrs FP and I to drop FC1 off to college.

- $360 in kitchen appliances.

- $294 in annual premiums for $1M term policy. I started the 15Y year term policy back in grad school, but our financial picture has evolved from those days of relative poverty. I was very tempted to let the policy lapse and self-insure from here on out, but ChatGPT convinced me that the pricing was actuarially a good deal since my probability death over the next year is > 0.03% (=$294 /$1M). Even though it feels wrong to not self-insure from here on out, I couldn’t refute the math.

- $287 in Ben Rector tickets. Money very well spent.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

A couple months ago I made the move to your net worth tracking template. I use Simplifi to track my spend and had a basic Excel file tracking account balances once a month. Your template is 1000x better than my old one… but for the life of me, I cannot figure out how to get the Statement of Cashflows to balance out. And we’re not talking a couple bucks – it’s hundreds.

Do you have any tips to making this work?

For example – and this might seem really obvious – it took me awhile to realize I need to capture account balances on the first of the month if I was going to use the previous month’s expenses so that the spend start/end lined up with the capturing of account balances.

Welcome to my spreadsheet cult!

After creating the spreadsheet, it literally took me years to get it to zero out. Some lessons learned:

* Updating the sheet more frequently will help you identify errors quicker.

* The timing of reporting can be a bit problematic. Say you paid a credit card recently (and the funds have left your checking) but it hasn’t been credited to your card yet. This timing issue can cause the sheet to be off temporarily.

* To get it to balance perfectly, you have to be moderately OCD. While fun, it’s arguably a waste of time. However, once balanced, it is a very satisfying feeling.

Since posting that sheet, I’ve made a few changes to it. I now do some pivot tables that make the sheet easier to produce and more informative. I will post an updated sheet eventually.

Recommendation from Tennessee mountain boy, squirrels are tasty and cheap!,

I’ll take your word for it!

I’ve seen my fair share of squirrels consumed on the TV show Alone: https://www.imdb.com/title/tt4803766/

We also got into Sam’s last month, for the $20 membership though. Appreciate the Wells Fargo account tip!

If you like Sam’s, the Plus upgrade is worthy of consideration. Free delivery, curbside pickup, extended hours, 2% back. It would pay for itself pretty quick.

I’m splitting the Plus membership with my brother this year. It was worth the $30/person (total) this year.

Enjoy the blog. Thanks for all the tips. I ordered the heartworm pills for my pup from the Australian company you recommended. Saved me quite a bit!

Every time I walk past the dog meds at Costco, I feel a moral obligation to put a sticky note referring people to the Australian pet med site. Unbelievably cheap/easy/slick. But I think they’d revoke my Costco membership if I did. The next best thing I can think of is by posting it on this tiny corner of the internet.

I’ve told a few of my friends (with dogs) about the hack, but they look at me like I’m crazy. Like, why in the hell am I ranting about Australian pet meds during a disc golf round.

Hence the blog. It’s my release valve.

😂

I bought that man purse (black) a while back. My wife hates it of course but lucky for her, I only use it when traveling by plane. Easy access to all passports, boarding passes (some airlines still print em), headphones, gum and to stuff everything I got in my pockets when I reach the TSA checkpoint.

Funny enough we also upgraded our Sams Club membership to Plus this past weekend. Our local store has a few items that we never find at Costco.

Where do you buy glasses? My kid lost her first pair…so I got a quote at Sams (~$220 – ouch) and then Costco which has special pricing for youth glasses ($130)…so we went with Costco, but I bet something will happen to the new pair…

A murse owner in the wild!!!! This put a smile on my face. My roommate from college says that his murse is the best thing that has ever happened to him. I’ll keep it in mind for travel, but I still don’t think I’m comfortable enough with my masculinity to pull it off.

Regarding glasses, we’ve converged on the following:

* Exclusively Costco.

* We pay out of pocket. We always buy 2 pairs/person because Costco gives a $50 discount on the second pair when ordering two pairs.

* We submit reimbursement to Eyemed insurance for $63 off the first pair.

All-in, it works out to roughly a net $100/pair for us (depending on options). Not bad. Free adjustments/repairs. Good service. It’s nice having a backup pair. Some of our kids do transitions on one pair and not transitions on the second. Mrs FP just got one normal pair and a second Rx sunglass pair. I get two pairs: one for home and one for work.

In the past, we’ve gone cheapo with Zenni optical, but nothing really beats Costco for quality/convenience.

First, freakish coincidence: I am wearing palazzo pants from Costco and thought to myself, “Self, I wonder if Costco still has these. I’m going to live in them this summer.” So I get on my computer to see if I can figure it out, but I saw your blog post, and decided to read it first. And lo-and-behold, you tell me exactly how to find product in my local warehouse. Weird!

Second: Russ has a murse, but he calls it a satchel.

Third: YOU don’t feel old enough to have a high school graduate?! I’m 60 with a new high school graduate, and I don’t feel old enough for that.

Fourth: Speaking of HS grad, about 9 months ago, after she’d been working for a few months, I took her to Kemba (our credit union) to open and account for her and get a debit card. They just happened to be offering $800 for new money market accounts! I just can’t wrap my head around that.

Finally, what is the name of the Australian company?

Thanks!

1.) I’m glad the stars aligned and that the Costco hack was useful.

2.) I cannot envision Russ wearing a murse. Please tease him for me.

3.) Aging is relentless. It’s weird.

4.) $800 is asinine for a new account bonus! Too bad we missed out.

5.) This is the link to the Simarica Trio. Different links for different dog weights. Combines flea, tick, and heartworm for ~$10/mo. No Rx required. Couldn’t recommend it more. If you have a credit card without foreign transaction fees, use it. 12 month supply (or more) is the best deal given the fixed shipping cost. https://www.pets-megastore.com.au/index.php?route=product/search&search=Simparica%20Trio

Hope all is well with the Hessler clan. We miss you guys!

Quick question about the Fidelity 2% card for a young person (teen, college, etc.). So they don’t care about the low income level? Our kid has a good credit score because we did an authorized user trick but low income level. Thanks in advance!

FC1 applied for the Fidelity card several months back and was denied. I never followed up on why.

This time around, I called ahead of time to explain our situation (student w/o current income, great credit score, family financial support) and they guided us through the application. For housing expenses, I put $0, and for income I put the expected annual contribution I’ll make for her college expenses. There wasn’t an option for “parental support” but customer service said that “trust fund” was the most appropriate field. She was approved for a $7,500 credit limit.

Right now I am having a wild tax year, Fidelity MMF has been great as a checking account replacement. But I’ll be testing out BOXX to hold my tax reserves until payment.

Wild to see you go to Sam’s Club after all this time. Looking forward to hearing if having both memberships is worth it over time 🙂

Wild tax year seems exciting, in a good way.

Best of luck with BOXX. To be clear, I know nothing about the ETF other than it has come up on Bogleheads and mentioned in the comment section here.

I’m also curious to see if I’ll renew Sam’s next year. It helps sharing the cost with my brother. It seems somewhat complementary to a Costco membership.

Many thanks. This is very helpful. Excellent advice.

Was your $786 insurance premium for a full year or was it a semi-annual payment? If it was the former, would be you willing to share your provider (and the deductible for the policy)? We’re paying considerably more for coverage from Travelers/Geico. I console myself with the idea that at least we’re helping the bottom line of Berkshire Hathaway (we own some B shares), but I think we’re truly paying too much for home coverage.

$786 was the annual premium. Here are the details:

* Esurance (I shopped this out across a dozen insurers when we moved here 9 years ago and have yet to find anything remotely competitive despite shopping it out often-ish)

* We live in the midwest – tornado alley

* Dwelling protection: $656k

* Other structure: $33k

* Personal property: $262k

* Family liability: $100k (required by umbrella)

* Wind and hail deductible: $33k

* All other peril deductible: $33k

* Auto/Umbrella with State Farm because it’s way cheaper (particularly with kids) so there are no bundling discounts

*** For Auto, we have liability only on all three cars, even our 1 year old Tesla that we all (including the teens) drive daily.

I loathe insurance and prefer to self insure whenever possible. My current coverage is as cheap as I could find. I’d arguably self-insure my home if I didn’t carry a mortgage. I’m comfortable with managing that risk. That said, my sphincter tightens a bit every time I hear hail hit my roof.

Charlie Munger said it best: https://finance.yahoo.com/news/billionaire-charlie-munger-said-dropped-000009686.html?guccounter=1

A number of good ideas. Could you expand on this “I tell my students that the best investing advice they’ll ever receive is to buy an instant pot and learn how to use it, since that will free up non-trivial amounts of cash to invest over their entire lives.”

I’ve been buying cans of beans for around $1/can and making black bean, onion, corn, and rice soup. How much more efficient could it be buying dry beans and using an instant pot?

It’s funny you should ask. I actually did the math this past week on the cost of dry vs canned beans and came to the conclusion that canned beans are 4.2x the cost of dry.

We consume a truckload of black beans each week (purchased in bulk from Sam’s). Cooking our own black beans saves us on the order of $40/mo (~$500/yr). Not life changing, but not nothing. A great healthy snack for the kids to have any time they want.

Here’s the math. Assume 12 cans/week consumed at $1.04/can (Costco’s pricing). That’s $646/yr. Cost to cook own is 1/4.2 of that, or $154. Annual savings is $493, or $41/mo. Actual prep/clean up time is comparable to opening up cans and the difference rounds to zero. I think homemade taste better.

In a perfect world, the kids would join me in my sad oatmeal crusade, but alas they have yet to see the vision.

I look forward to reading your insights every month! Thank you for continuing to share with your readers!

Happy to help!

Thanks for that! Our renewal is coming up this fall and I always put off researching better options and end up staying put. And paying more each year. 🙁

We no longer have a mortgage so self insurance is an option, though I’m not quite comfortable with that.

Insurance is one of those things that is so easy to let renew without seeking out quotes.

Ironically, most of the times it has been unfruitful for me. That said, when we switch from Geico to State Farm for auto+umbrella, we saved $1k/year for equivalent coverage. Mercifully, State Farm really didn’t penalize us too much for teen drivers.

Can you share your black beans recipe?I am curious how you make a snack out of it. If you go to an Indian grocery store, you can get a variety of dry beans- Chickpeas, Kidney beans etc.

I don’t know why we’ve converged on black beans over the past 15+ years, but our whole family enjoys them quite a bit. Our base recipe is simple:

* 4 cups dry beans, 10 cups water, 2 tsp salt, 1 tsp cumin (if you like it…our kids don’t but I do). Cook at pressure for 30 min, slow pressure release. Strain, don’t rinse.

On occasion, we make a fancier version but I don’t know the recipe by memory.

Thanks for the indian store recommendation!

Sam’s club is light years ahead of Costco in terms of checkout – try their Scan and Go button in the app. I am really enjoying it.

I tried the scan and go app last week. It was pretty slick, but I’m not convinced it’s that much more convenient than self checkout or even a traditional checkout.

I’m sure there is a reason that Costco hasn’t adopted this technology yet — I’m sure it’s to minimize “shrink.” At our particular Costco, checkout lines are a breeze. I realize that we’re anomalous relative to other areas.

But if you’re in a high-traffic area, I can see the appeal. Particularly for a small cart where the burden of taking out your phone for each item is relatively small.

Professor, thanks so much for your valuable contributions. Do you have views on disability insurance? My wife and I have elementary school aged kids and both work. We have ample investments though I’m curious of your considerations either for or against?

My life philosophy is to only insure against things I can’t afford to self-insure. If you already have ample investments, to the point of financial independence, I cannot imagine disability insurance to be a winning strategy.

The governing formula for insurance is:

insurance premiums = true actuarial cost + insurance company profits + insurance company taxes + insurance company overhead + fraud

There is non-trivial fraud with disability insurance.

I’d rather just bear the true actuarial cost myself (and cut out the insurance company profits + insurance company taxes + fraud), particularly if I can afford it. In other words, I don’t mind being my own insurance company — it’s kind of fun, and I like investing the “float” a la geico.

Thank you! Do you just eat this straight? or does it go into another dish you are cooking? You can try this

https://youtu.be/8IOZ7-32Q3Y?si=tGklnqsGOnjKlgsf and adjust spice levels as needed..

Thanks for the link.

We eat black beans a bunch of different ways:

* Plain (usually with a bit of cheese or salsa)

* In burritos/quesadillas

* In soups

I’ve brought it up. I have EF in MMAs at Fidelity and the backup EF in BOXX. It winds up being about 50/50. I have the backup for some upcoming expenses I’m expecting. Good news: I’ve held BOXX over 1 year.

Sounds like a good system!

One more thing: there’s a new credit card that has been amazing for me at least. There’s a referral bonus (for me and the referee) on it, it has no annual fee and gets ~3% on many categories that aren’t previously covered such as property taxes, home repair, insurance, home improvement stores, and daycare. Let me know if there’s interest

Interesting.

Seems inferior to those of us with the (defunct) 4% smartly card.

What card is it?

3x transferrable points vs 4%. Also, new users can’t get the previous version of the Smartly card. I wouldn’t be surprised if US Bank applies the new rules to the first holders after a year (Card Act rules).

I’d be glad to give out referrals to those interested. We both benefit.

Let me think about it…

I forgot to mention about BOXX. The main reason you want to hold BOXX is to convert your interest/dividends into long-term capital gains upon sale. So, not only can you defer interest/dividends until it is a better time to do so, but you can also convert it from income taxes to capital gains. This is somewhat controversial in finance circles as it’s thought the IRS may decide this violates some rules. To date though, it has seemed to work. The best possible case is if you are in the 35% income tax bracket and the 15% LTCG bracket saving 20% on taxes! I think this situation only happens to those filing single though. However, many can see an 8-10% tax improvement. States generally don’t offer capital gains though, so you lose the benefit of not paying state taxes you receive with treasuries. Obviously, this is situation is most beneficial to those in no income tax states.

Pretty slick! Thanks for sharing!