I’ve been a member of the BoA cult for the better part of a decade now, happily earning 5.25% on “category” purchases with the Customized Cash Rewards card and 2.625% on “non-category” purchases with my BoA Premium Rewards card.

However, I recently jumped on the US Bank 4% Smartly card bandwagon for my “non-category” spend, and so far it’s going well. Well enough, in fact, that my BoA Premium Rewards card has become obsolete (since 2.625% << 4%). Especially since I also have the defunct US Bank 4.5% Altitude Reserve card.

If I were a rational man, I’d drop Bank of America entirely and put all my spend on the 4% card. But I am not a rational man. I suffer from a mental illness called overoptimize-itis.

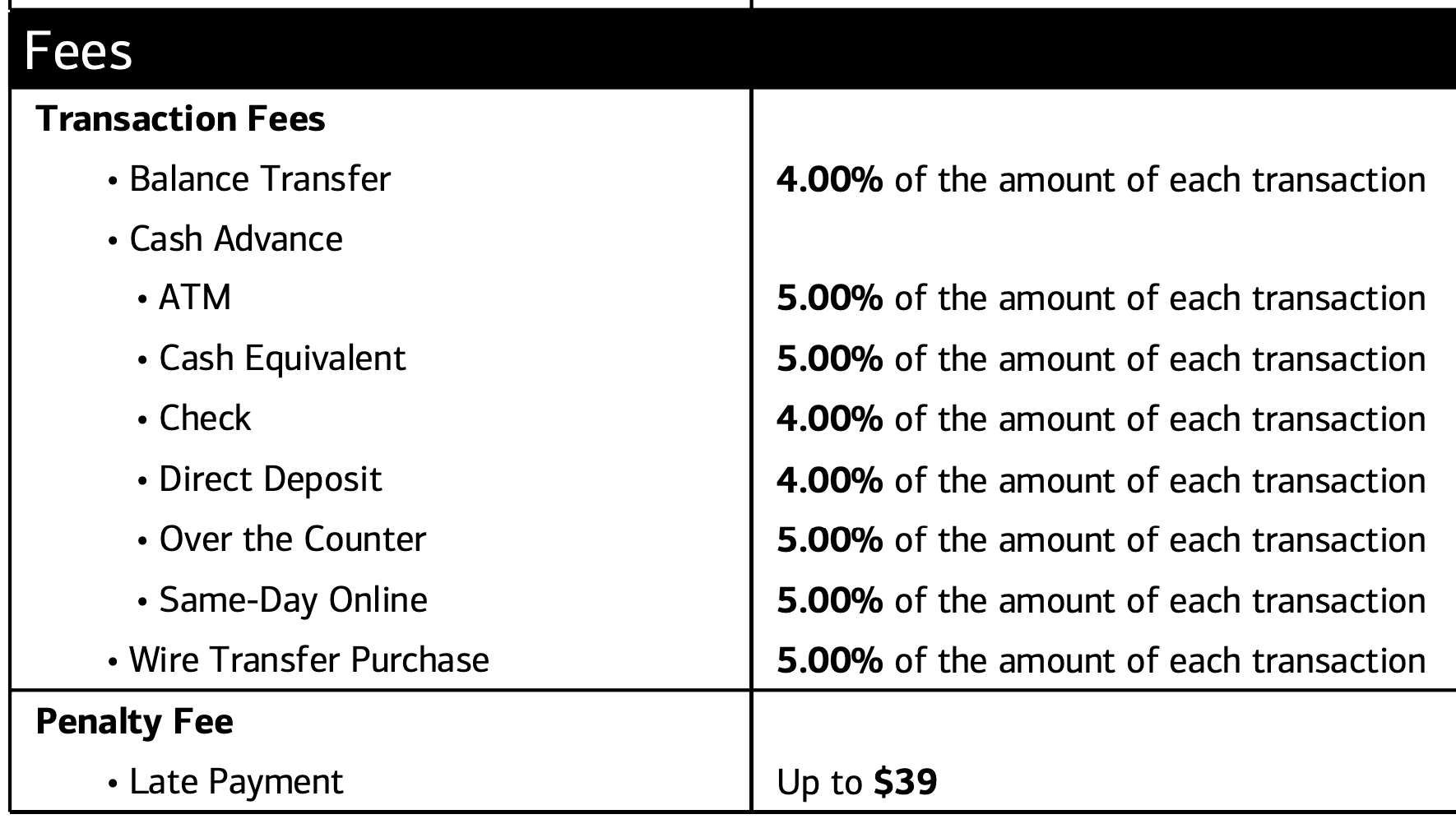

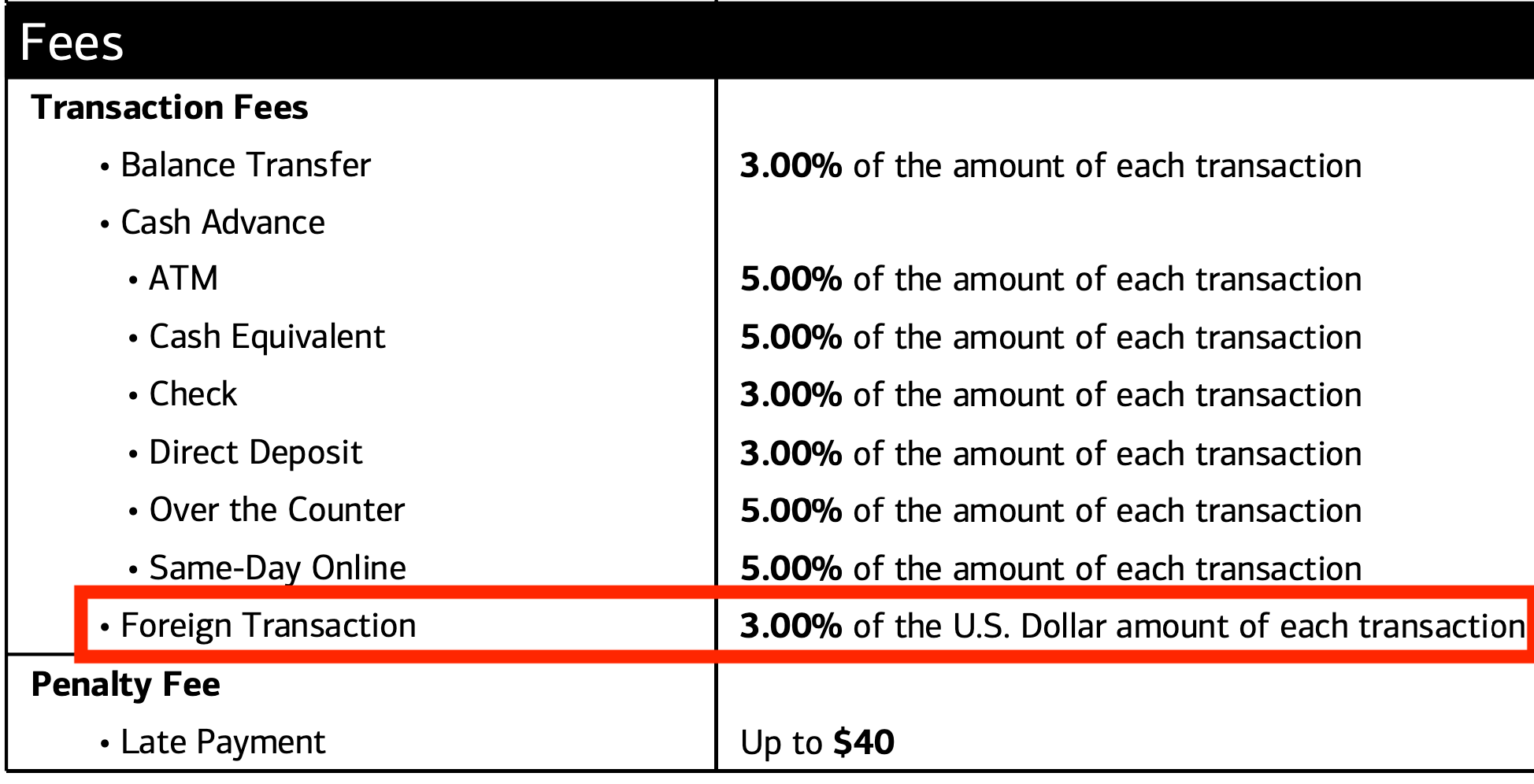

A few months back, I called up BoA to “downgrade” my 2.625% Premium Rewards card to my fifth (or eighth, including Mrs. FP) 5.25% Customized Cash Rewards card. However, this “downgraded” Customized Cash Rewards card has the superpower of no FTF—a property it inherited from the Premium Rewards card. I’ve confirmed this in the terms of the credit card, as well as through foreign transactions. Screenshots below. Hat tip to YouTuber Stan the Frog, who first shared this unconfirmed rumor many months ago. The Bogleheads have also discussed it recently in the forums (but I’m too lazy to find the references).

No 3% FTF on the converted PR => CCR card.

No 3% FTF on the converted PR => CCR card.

3% FTF on the organic CCR card.

3% FTF on the organic CCR card.

No FTF. Awesome.

Getting the full 5.25% on “category” spend. Awesome.

A Few Concluding Thoughts:

- Redeem all accumulated Premium Rewards points before downgrading, since they’ll disappear otherwise.

- The order of operations would be: 1) wait for the statement to close, 2) lock the card to prevent accidental usage, 3) zero out accrued rewards, 4) call to convert.

- You’ll have to call them to downgrade.

- It takes a while for the conversion to go through—several weeks in my case.

- I downgraded right after my $95 annual fee was charged (I tried to downgrade earlier, but doing so would have caused me to lose accrued points). Luckily, they refunded the $95 annual fee.

- They kept the same card number, which I wasn’t expecting. I would have preferred a new number.

End of rant. Hopefully this helps someone.

Did you get the $100 airfare credit before you downgraded?

I didn’t want to risk them not refunding the $95 annual fee, so I didn’t try.

>>It takes a while for the conversion to go through—several weeks in my case.

Do you mean by the process to convert Premium Rewards to CCR took a while to complete? I heard that some people got denied. Did you face any issues when you call them to convert?

No issues when calling to convert, other than the “oops” moment realizing I didn’t want to sacrifice accrued rewards so I had to call back again after the statement closed and I zeroed out the account.

Glad they didn’t deny me. Not sure I would have done in that case…cancel the card?

It seems the BofA premium rewards provides better travel protection, e.g., Trip Cancellation, Trip Delay Reimbursement etc. I used those 2 times in the past to get refund when getting sick (when I had CSR) and find it quite valuable, certainly willing to give up up 0.5% or even 1.15%.

I think this is a valid point. That said, my USBAR card has even better travel protections than the PR card. But for those without the USBAR, I think your point is a good one.

In case this helps others who are trying to change their cards, I have tried and been rejected multiple times for a product change from B of A, but then I found through a Doctor of Credit comment threads the phone number for their Advanced Client Solutions team 866-866-2059. From that thread, where some people can get PC’ed through normal channels no problem and some people can get it eventually by hanging up and calling again, others like me never could get it to work. Where the regular customer service reps through the contact numbers on the back of the card or the website might say it needs to be an option for them to click through and isn’t available or that it isn’t something they allow at all (which is just a bald faced lie), when I called that number the person jumped right in to filling out the form and getting it submitted for me. That is what I needed to do to make a similar PC off the Unlimited Cash Rewards (the no annual fee version of the Premium Rewards) to another CCR after I got the Smartly card.

This is a fantastic comment. Thanks for sharing. To be honest, I’m not sure what number I called…the regular or special one.