Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Bikepacker “Dan Cycles the World” kayaks the Darien Gap (link).

- His channel is probably the most inspiring/entertaining thing I’ve watched in a long time.

Life

- FC1 seems to be enjoying college. While it was a weird adjustment period, we’re adjusting to the new normal of her absence. Life goes on for both parties.

- Manchild FC3 is reluctantly following FC1’s footsteps by doing cross country in high school. He absolutely loathes it, but has stuck with it so far. High School cross country meets are pretty special.

- In the first time that I can recall, we’re observing a Monarch butterfly migration. It is pretty incredible to see right in our back yard. I literally cannot go for a run without running into several.

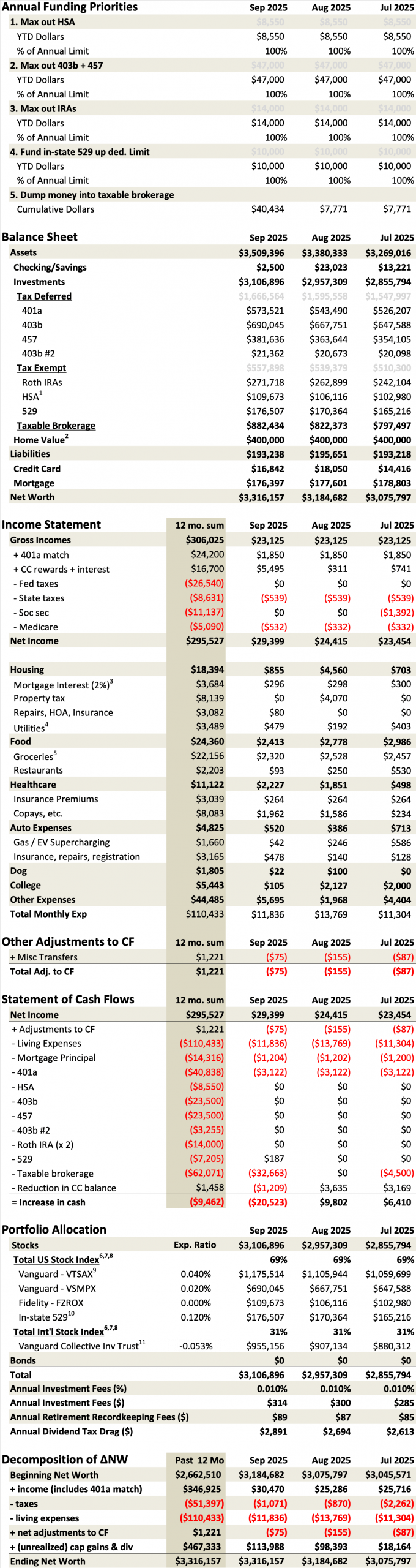

This Month’s Finances

Our 2*$2k JP Morgan Chase bonuses hit this month. It was relatively quick and painless. Tip for those playing the game: leave at least $150 in cash/securities when ACATing out of JP Morgan or they will close your account (even when requesting a partial account transfer). Given the PITA that it is to find the elusive no-fee full-service self-directed brokerage account with JP Morgan Chase, it is advisable to leave it open to churn annually.

I called Merrill to inquire why our 2*$1k bonuses didn’t hit. It turns out I made a blunder — I incorrectly assumed the holding period was 90-days from account opening (like WF and JP Morgan Chase). With Merrill, it is 90-days from account funding. Whoops. A $2k mistake for not reading the fine print better.

All-in, we’re at $9k in transfer bonuses YTD. Was it worth the hassle? It translates to a pre-tax hourly rate of about $500/hr. I make far less than that at my day job, so it seems like it was worth it.

My US Bank Smartly 4% statement just closed and I’m still earning the 4% on most purchases (insurance & education seem to be excluded). Any bets on how much longer that will last? My guess is end of year at longest, but I hope I’m wrong.

Speaking of US Bank, I downgraded my Altitude Reserve card last month to the no-annual fee Altitude Connect which will permanently live in the “sock drawer.” But I’ll keep it open for the 4x/year priority pass visits + global entry credit. Mercifully, US Bank refunded the full $400 annual fee even after I utilized most of the coming year’s $325 travel/dining credits.

After downgrading the USBAR, for the first time in a decade all of combined credit card fees is zero (despite earning 4%-5.25% on almost every swipe). It is nice not having the mental overhead of having to recoup a single annual fee.

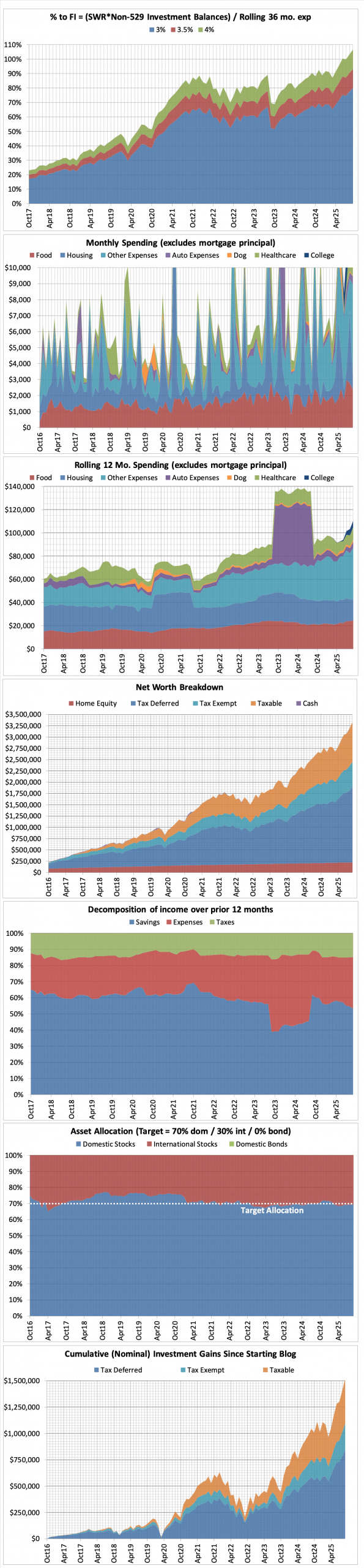

Equity valuations remain stupidly high. It seems inevitable that they will come crashing back to Earth, but I’ve been saying that for 15 years now. I’ll be right one of these decades. Until then, I’ve learned to not hold my breath.

- The good:

- Still employed.

- The bad/abnormal:

- $3k in furniture.

- $2k in healthcare.

- $1.3k in cell phone shenanigans:

- 6 x $96 annual plans

- 2 x $340 for Pixel 9

- $555 in “ninja” fees.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to traditional index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Congrats on reaching FI! I like your graphs I am trying to build that into my own tracker, excels graphs are annoying to me to use, but I’ll figure it out. Thanks for the update

Best of luck. It seems to me that tracking is an incredibly important step in this process.

I never thought much about it- are you using a tool to pull diff accounts in a single place, or is it manually done

There are many “financial aggregators” out there, but I use Personal Capital.

Over the past 25 years, I’ve used a number of them. Fidelity Full View, Mint, Yodlee Moneycenter.

As of today, Personal Capital is probably the least bad.

But you will get solicitations from them to manage your money unless you block their phone number.

Here’s how I transform PC to my spreadsheet: https://frugalprofessor.com/my-updated-net-worth-and-more-tracking-spreadsheet/

I’m planning to do the same with my USBAR — use the $325 once the fee posts this month, then downgrade. Did you cash out your points before you downgraded, or carry them to the Connect?

The $325 of credits became available before my annual fee hit, which I was not expecting. Probably 30 days prior?

I zeroed out my accrued points with a flight. If you don’t have immediate travel coming, book any flight, redeem RTR, then cancel within 24 hours. Works every time. The trick is to find the right priced flight to zero out the points. You get the true 1.5x redemption if you go this route.

Just want to say I’m so glad I found your website. We just had a newborn and was looking into 529 plans since I live in a no income tax state (WA). It was great to know CA had a such low expense US equity fund.

Happy to help!

I’m curious, what do you do if your credit cards don’t sync? The Citi SYW card doesn’t work for me in Empower/formerly Personal Capital. 🙁

I have the same problem occasionally. Citi SYW is one of the worst offenders.

However, when I click “update connection” and re-enter my username/password, it will often fix itself.

Our two SYW cards are updating fine as of today.