Last month, I received an email from a reader (shared anonymously with permission):

My wife and I are 53, living in Texas with our two kids. We’ve built up about $1 million in stocks and retirement accounts (we got a late start!). I’m a small business owner, with pre-tax and pre-expense income around $500,000, netting roughly $250,000–$300,000 after taxes and expenses. We contribute $24,000 annually to a self-employed 401(k). Debt free.

Am I optimized as well as I can be? Am I leaving ‘easy’ money on the table I could save with better tax strategies?

It took me about 5 minutes of thinking to find him ~7-figures of tax alpha over his lifetime. Below is what I recommended.

Update a day later — The Lowest-Hanging Fruit: Fully exploit the $70k/year annual pre-tax Solo 401k limit

Reader Craig left an insightful comment on the Solo 401(k) that is substantially better than my initial recommendation:

I’m curious why somebody making $250k+ in net business profit would use a mega backdoor Roth. They should be able to max out the overall contribution limit with a pre-tax Solo 401(k). It seems like that would be a better choice tax-wise at that income level, and also you wouldn’t have to deal with the added administrative burden. I would say the mega backdoor Roth would make more sense for somebody making significantly less than $200k in net profit.

I was wrong in my initial recommendation. For Bob’s situation, pursuing the Mega Backdoor Roth isn’t the best first move. Instead, Bob should fully exploit the $70,000 annual pre-tax Solo 401(k) contribution limit, which will dramatically reduce his federal taxes today.

Since Bob is 53, he can contribute:

- $23,000 employee deferral, plus

- $7,500 catch-up contribution, for a total employee contribution of $30,500.

On top of that, his business can contribute up to 25% of his adjusted net business income as an employer profit-sharing contribution, up to the combined limit of $70,000 in 2025. Given Bob’s $250,000+ net business income, the additional employer contribution needed to reach the limit would be around $39,500, well within the 25% cap.

Relative to what Bob is currently doing, he’s leaving roughly $45,000 per year of pre-tax space on the table. At Bob’s marginal tax rates, this represents a significant tax savings opportunity.

The Mega Backdoor Roth: An Overlooked Tax Savings Miracle

Bob is putting $24K into a Solo 401(k), which is good, but he was unaware of the Mega Backdoor Roth which could allow him to save an additional ~$50K/year in Roth accounts.

Why it matters:

Allocating an extra $50K/year into a Roth that grows tax-free over 20 years could result in over $2M of tax-free funds, avoiding hundreds of thousands in taxes.

How he could implement:

- Many providers (like Fidelity) don’t support Mega Backdoor Roths on Solo 401(k)s.

- Employee Fiduciary often does, with low fees.

- Reader EOG below suggests that MySolo401k is another option. See his comment here.

- Bob could explore opening a Solo 401(k) there to enable this, while keeping current assets at Fidelity if fees are low.

Here’s a guide to the Mega Backdoor Roth at Employee Fiduciary for reference.

Donating to Charity? Use a Donor-Advised Fund (DAF)

Bob donates $120K/year to charity by writing checks directly. While generous, this method misses a significant tax-saving opportunity.

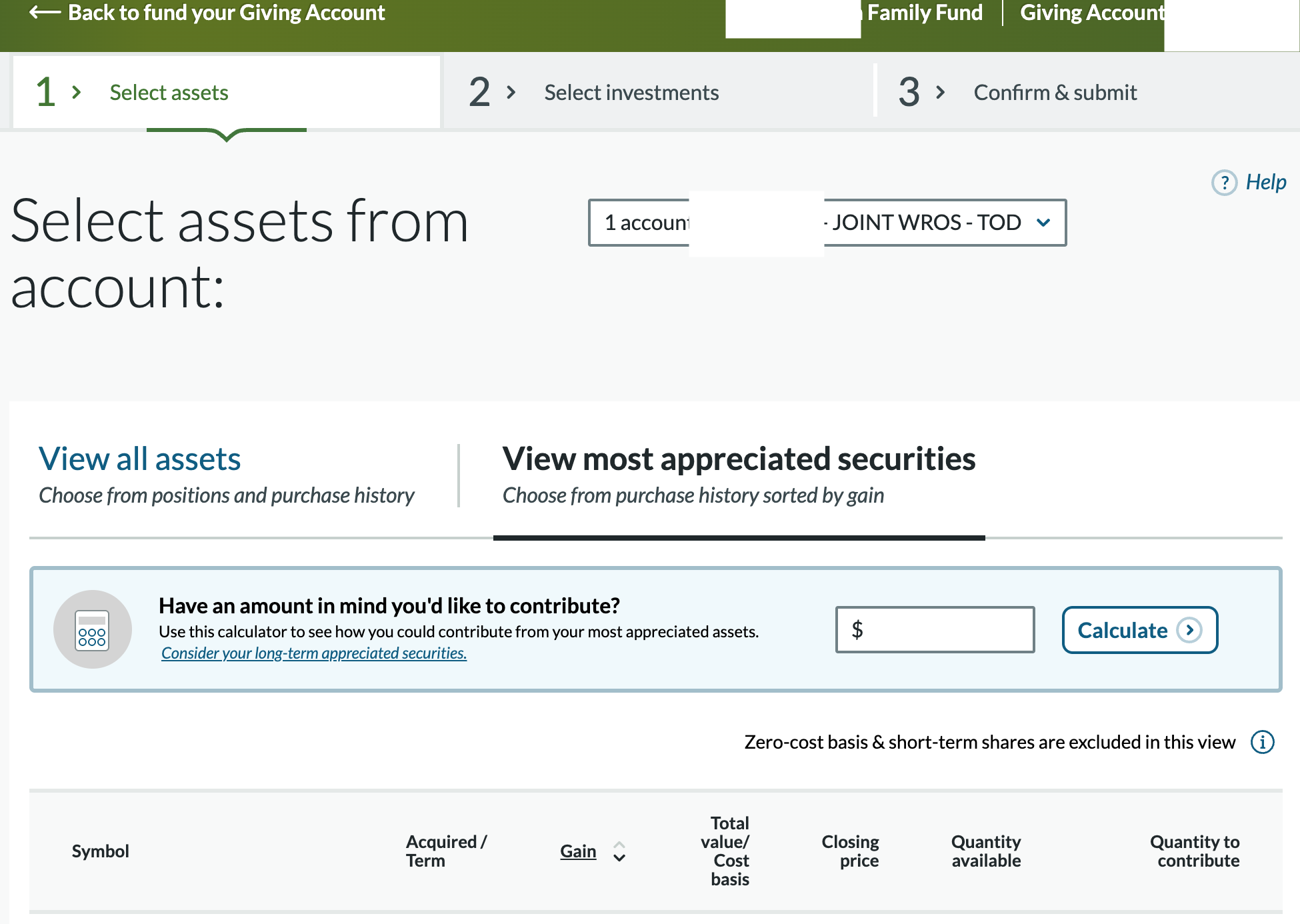

By donating highly appreciated stocks “in kind” to a Donor-Advised Fund (DAF) (e.g., Fidelity Charitable), he can:

- Avoid paying capital gains taxes on appreciation.

- Receive a full charitable deduction for the fair market value.

- Repurchase the same securities with the cash he would have otherwise donated, increasing his cost basis to reduce future capital gains taxes.

- Example: If Bob donates $100K of Apple stock purchased for $30K, he avoids capital gains taxes on $70K (~$10K+ saved) and repurchases the stock at a higher cost basis, lowering future tax drag.

Doing this every year on $120K of donations could save ~$250K+ over 20 years.

Here’s where to open a Fidelity DAF.

Once configured, a Fidelity DAF easily allows you to “transfer-in-kind” highly appreciated securities. Prioritize securities / tax lots with the highest percentage of embedded capital gains (i.e. lowest cost basis as a percentage of current price).

One caveat: Fidelity charges a 0.6% administration fee on DAF funds, so rather than let the funds sit there for a long time incurring fees, it is more prudent to distribute the funds to charities sooner than later.

Backdoor Roth IRAs

Note: It is highly recommended that Bob’s Traditional IRA balance is $0 before messing with Backdoor Roth IRA contributions. If not, consider a Trad=>Roth conversion of Trad IRA balances (and eating the tax cost) before proceeding.

Bob and his wife, both over 50, can contribute $8K each per year ($16K total) to Roth IRAs using the backdoor Roth strategy, ensuring additional tax-free growth.

Over 20 years, this could result in ~$700K growing tax-free, avoiding ~$100K+ in taxes relative to taxable growth.

My video tutorial on how to do this at Fidelity shows how trivially easy this is.

Portfolio Allocation: Should He De-Risk?

Bob’s investments are 100% equities, split roughly 50/50 between individual stocks and index funds. While he enjoys stock-picking, it exposes him to single-company risk, and a 100% equity allocation alongside a business highly correlated with the economy could create a “double whammy” risk in a downturn.

If concerned, Bob could:

- Shift part of the portfolio to bonds to hedge economic risk.

- This is most easily done in his tax-advantaged accounts, where he could reallocate without eating any cap gains taxes.

- Prioritize broad index funds over individual stocks for diversification.

- This can easily be accomplished over time with the help of the Donor Advised Funds:

- Winning stocks can be dumped to the DAF and then given to charity.

- Losing stocks can be sold at a loss (which lowers taxes) and converted to index funds.

- This can easily be accomplished over time with the help of the Donor Advised Funds:

- This adjustment is unlikely to save as much as the tax strategies above but can reduce downside risk, which is worth considering.

Should He Hire a Financial Advisor?

Bob asked if he should hire a financial advisor. Here’s my thoughts:

- Consider a flat-fee, hourly, or one-time fee-only advisor if he wants a sanity check.

- Avoid 1% AUM advisors; the fees are rarely justified.

Most of the value lies in straightforward, high-ROI tax and investment strategies like those above, which many can implement with a bit of education and discipline.

That said, for a small business owner a good CPA is probably worth their weight in gold. MrMoneyMustache wrote about this a decade ago.

Why This Matters: Quantifying the 7-Figure Lifetime Impact

It’s easy to overlook the financial impact of tax optimization, but these strategies can be life-changing. For someone in Bob’s position—a high earner with a long investing runway—implementing tax-efficient strategies like the Mega Backdoor Roth, donating appreciated stocks, and using backdoor Roth IRAs can easily add up to seven figures in tax savings and increased investment gains over a lifetime.

To give a sense of scale:

Mega Backdoor Roth:$50K/year growing tax-free for 20 years could avoid $200K–$300K in future taxes.- Maxing out Solo 401k: This is the most impactful step, by a long shot, easily saving Bob $300k in taxes over his lifetime.

- Donating appreciated stock instead of cash: Avoiding capital gains on $120K/year of donations could save $12K/year, adding up to ~$250K+ over two decades.

- Backdoor Roth IRAs: $16K/year in additional Roth space could save another ~$100K over time.

- Avoiding 1% AUM advisor fees on a $1M+ portfolio could save ~$200K+ over 20 years.

- Additional tax-efficiency from rebalancing and asset location can add tens of thousands more.

The takeaway: A few hours of upfront learning and setup could realistically yield over $1M in lifetime benefits for high earners like Bob.

Conclusion

- Self-employed individuals should max out their pre-tax Solo 401ks if possible (up to $70k/year at time of this writing, including employee + employer contributions)

Self-employed individuals should max out Mega Backdoor Roths if eligible<\s>- So should the rest of us if we are lucky enough to have access to the mega backdoor Roth.

- Donate appreciated stocks via a DAF instead of cash for charitable giving

- High earners should utilize backdoor Roth IRAs annually (ensure $0 Traditional IRA balances beforehand)

- Ensure equity exposure aligns with business and risk tolerance

If you’re a high earner and suspect you’re leaving ‘money under the couch cushions’ like Bob, consider reviewing these steps for your situation. A few hours of learning and action could meaningfully transform your family’s long-term financial trajectory.

If you have any other thoughts, suggestions, or experiences implementing these strategies to share with Bob, please share them in the comments below to help Bob (and others) learn.

If you would like me to critique your situation, email me and I’ll see what I can do. Perhaps we can turn your questions into the next case study to help others optimize their finances.

Very interested in learn more about DAF 101s.

So Bob would sale his Apple stocks, because he puts procedure into DAF, therefore avoid 70K capital gains? or he transfers-in-kind into DAF, and take 70K capital gains deduction from his other income sources?

When in DAF, over years all those yearly dividends and captial gains (if he trades in his DAF account) would not give any tax advantage (couldn’t deduct dividends/gains for other income sources), expect not paying tax over those gains?

Put in DAF doesn’t mean distribution so you’d “distribute” while you’re alive to avoid 0.6% admin. fee?

First time paying attention to DAFs and would like to learn more.

thanks

Bob would transfer the $100,000 of Apple stocks to the donor advised fund without selling. This avoids the capital gain tax on the $70,000 in the example in the blog post.

Once the $100,000 of stocks are in the donor advised fund, Bob could liquidate and distribute the full $100,000.

He gets the full credit for the $100,000 contribution for the purposes of his taxes. He avoids the $70,000 capital gain.

As far as avoiding the administrative fee, the trick there is to minimize the amount of time the assets spend in the donor advice formed. If he sells and distributes the $100k quickly, he can avoid the fee.

In contrast, if Bob decides not to sell the $100,000 of stocks immediately, but instead lets them grow over time then the this growth is not taxed. The downside to this approach is the 60 basis point fee on an annual basis.

Have you heard of Daffy.org? Their DAF is subscription-based and starts at just $3/month (so no % fee).

I hadn’t heard of Daffy, but seems awfully competitive vs Fidelity: https://www.daffy.org/compare

That said, I still think there’s a decent case to go with Fidelity: https://chatgpt.com/share/687c304c-e408-8004-948c-b146c7bf6f2f

Excellent advice, applicable to many!

– MDM

Thanks! I should have run the post past you first!

if Bob’s not doing credit cards, he should. SUBs and what not are going to be worth way more to high income folk than us mere mortals as they are tax free.

At those tax brackets, any tax-free credit card freebies is certainly welcome.

If Bob could invent a time machine, I’d recommend the dead 4% Smartly card (assuming they don’t kill it for the next while).

Just a note, you write “Many providers (like Fidelity) don’t support Mega Backdoor Roths on Solo 401(k)s.” However I think this is just if using Fidelity for the one-stop-shop for the Solo 401k.

There are some firms that allow solo 401k to be held at Fidelity and do a mega back door Roth. e.g. MySolo401k is one, which allows after-tax contributions too and thus mega backdoor Roth. Maybe because they are not a custodian and just help do the setup and do annual tax forms?

No affiliation besides debating if it is worth it for me this year depending on solo income, but at least have seen this site mentioned before on Bogleheads etc. (https://www.mysolo401k.net/solo-401k/solo-401k-faqs/)

I appreciate your correction & suggestion!

The number of firms that offer the elusive mega backdoor roth for the solo 401k seems to be limited, and I appreciate your feedback here. I’ll update the post accordingly.

I wonder if Bob had an “1% advisor”years ago that would have implemented this for him if it’d be worth it. In my experience ideas, like yours in this article, are value but only truly valuable if consistently executed. Maybe worth the fee after all.

Agreed.

Or better yet a fee only advisor years ago.

One comment on trying to avoid the fees on DAF– it may not be the optimal strategy. Over the prior 7 or 8 years, where the SALT deduction was capped and many of us were just taking the standard deduction, I chose to “stuff” my DAF in one year to maximize the contribution and itemize my taxes in just that one year. The remaining years I would use the standard deduction and distribute to charities as I see fit. This means that I’ve got a sizeable balance in the DAF.

I was able to do this in a year that I had a large bonus (high earning year), however one needs to be careful that there is a max of 30% of AGI in doing this. For people that are on the verge of retirement and their income/tax bracket will drop significantly going forward, this may be a smart move.

Excellent analysis and ideas for Bob.

This is a great suggestion for Bob, and one that I considered adding to the post as well. It would be particularly useful if his income is lumpy across time, as yours was, to really mitigate those high marginal rates in the high-income years (thereby allowing Bob to simply take the generous standard deduction in his “off” years).

Thanks again for your comment!

I’m curious why somebody making $250k+ in net business profit would use a mega backdoor Roth. They should be able to max out the overall contribution limit with a pre-tax Solo 401(k). It seems like that would be a better choice tax-wise at that income level, and also you wouldn’t have to deal with the added administrative burden. I would say the mega backdoor Roth would make more sense for somebody making significantly less than $200k in net profit.

You’re spot on. I updated the post accordingly. Thanks for catching that huge error.

I thought the same thing but didn’t have time to respond. Thanks Craig. I guess the advantage of this if your business is variable and you are not always making enough to fill up your solo 401k with employee and employer contributions. The other possibility would be if you have a W2 position and have a 401k through that job, which would prevent you maximizing the solo 401k as well.

Thanks for the input!

If Bob’s wife participates in the business, she’s also eligible for employee contribution, catch-up, and profit sharing. With enough pre-tax contributions, the AGI may drop below the limit for Roth IRA contributions, and it won’t be necessary to mess with backdoor Roth.

I received scarily good answers in two seconds when I posted the quoted question to ChatGPT. I would do that as a first cut and pursue each lead as applicable.

Thanks for the feedback Harry!

I agree that ChatGPT is scarily good…