I’ve used Fidelity’s Cash Management Account (CMA) as my primary “checking,” “savings,” and “cash management account” for over six years. I recommend this setup to my students. I recommend it to my children. I recommend it to you.

The default CMA setup is already strong. However, I’ve spent years refining it — optimizing for tax treatment, yield, and automation — and the results are worth sharing.

(Yes, I’m the kind of person who optimizes a cash account while losing six figures in equities — we all need hobbies.)

Disclaimer (or lack thereof)

I don’t get paid by Fidelity to shill their products. This blog loses money. I do this for fun.

The Primary Advantages of Fidelity’s CMA

- No fees, no minimum cash holdings, no monthly transaction limits.

- All cash earns competitive interest — automatically.

- Your money is auto-invested in a money market fund (MMF), and shares are auto-liquidated as needed to cover transactions.

- Mortgage payment? ATM withdrawal? Venmo? Covered. That means 100% of your cash is working at all times.

- Get paid one business day earlier.

- My paycheck consistently arrives one business day earlier than it does with a traditional checking account, giving me faster access and earlier investment opportunities.

- Free ATM withdrawals — worldwide.

- All fees reimbursed automatically, typically within 1–2 business days. Even foreign ATMs. I’ve found exchange rates to be favorable too.

- Customizable core MMF.

- The default core position is SPAXX, but you can swap it out via automation with a better MMF of your choosing (more on this below).

The Primary Downsides

- No way to deposit physical cash.

- You’ll still need a local bank account for that. I maintain a $0 balance checking account locally for that purpose.

- No Zelle support.

- Funding holds on incoming transfers if you initiate from Fidelity.

- Rather than pulling from Fidelity, it is much better to push from the other institution. When following this process, funds will be available immediately upon arriving to Fidelity. Thanks to The Finance Buff for teaching me this trick.

- Mobile check deposits can take a while to clear.

- As a result, I deposit checks through US Bank’s mobile app instead. The funds are instantly available for low-dollar checks in my experience. From there, I push to Fidelity and the funds are available the next day.

- Messier transaction log.

- Because MMFs are bought/sold automatically to cover spending, you’ll see extra transactions. Example: if you make a $20 ATM withdrawal and a $1,000 credit card payment, you’ll also see a $1,020 MMF liquidation.

- Not FDIC insured.

- CMA funds are invested in MMFs, not bank accounts. But I personally use a 100% treasury MMF — more on that below — and am comfortable with the risk. “Breaking the buck” is extraordinarily rare.

Want to Set One Up? Here are Some Pointers

1. Open an Account

https://www.fidelity.com/spend-save/fidelity-cash-management-account/overview

2. Set SPAXX as Your Core Position (or Change It Later)

As of Spring 2024, SPAXX is a valid core option. Any unallocated cash in your account will automatically be swept into it.

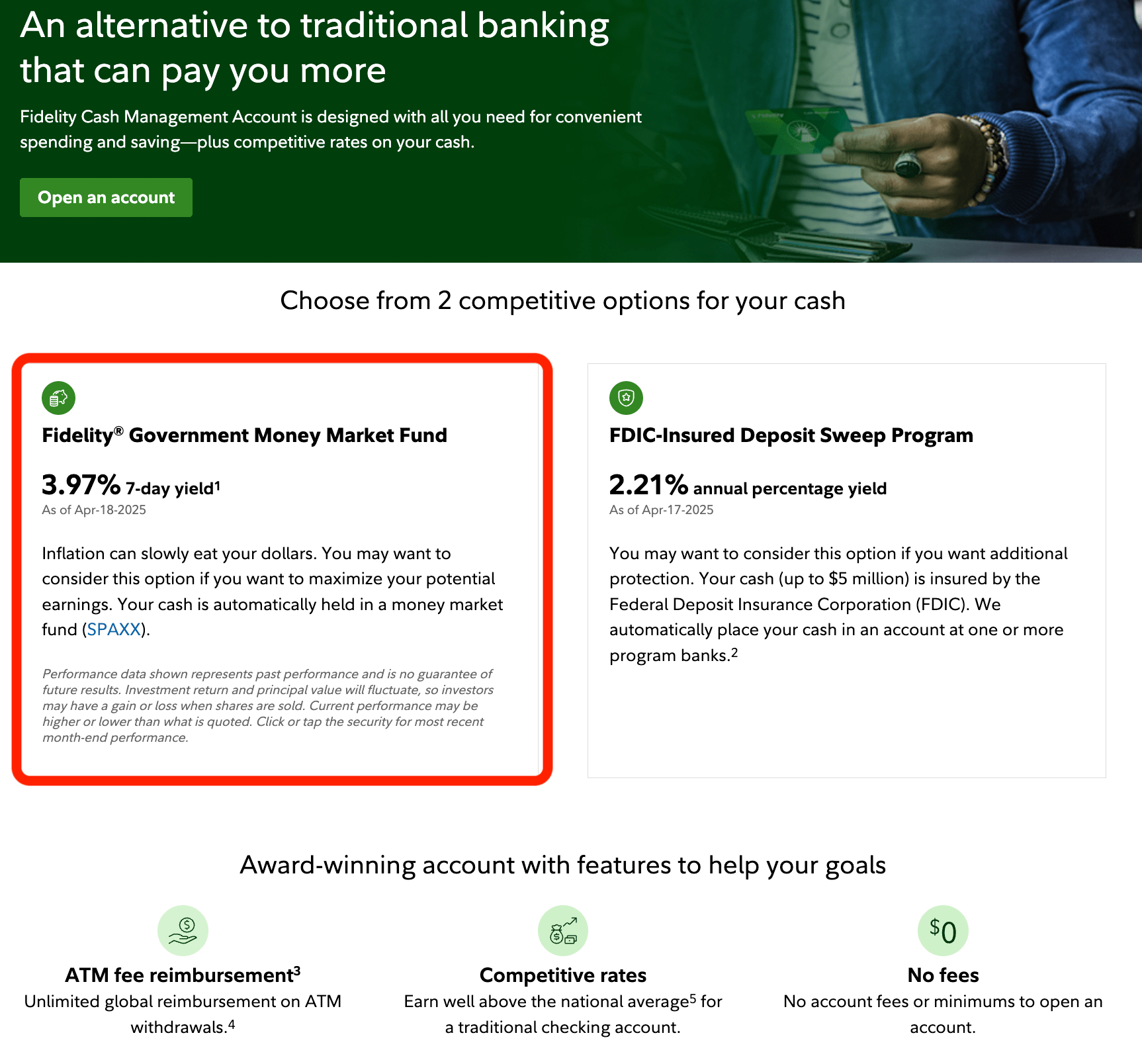

- SPAXX is a money market fund currently yielding 3.97%.

- The FDIC-insured sweep option yields closer to 2.21%.

3. Set Up Firewalls (Optional, for Extra Security)

If you’re risk-conscious, consider opening two CMAs:

- Use your primary CMA for higher-value, lower-risk transactions (e.g. mortgage, credit cards).

- Use your secondary CMA for checks and anything more exposure-prone (e.g. sending a $100 check to the PTA).

That way, if your secondary account is compromised your primary account won’t be.

4. You’ll Have Three Account Numbers (Yes, It’s Weird)

You’ll get:

- A Fidelity-specific account number starting with the letter X

- A 17-digit number starting with 39900000

- Your account number is easily found by clicking on “routing number ⓘ” within the CMA online.

- A 13-digit number printed on your checks

Both the 17-digit and 13-digit account numbers should work fine when setting up ACH transfers at other institutions. Here is an official Fidelity Reddit thread discussing this issue.

5. You Can Do Better Than SPAXX (but it’ll take a bit more effort)

SPAXX has an expense ratio of 0.42%.

There are Fidelity MMFs with expense ratios as low as 0.18% (though they have $10M minimum investments).

A clever workaround is that these $10M minimum investment MMFs are often accessible at other brokerages for much less than the $10M minimum (for example, WellsFargo’s minimum initial purchase amount is $50). Once purchased at the external brokerage, you may transfer the MMFs “in-kind” to Fidelity. Once you have established this holding at Fidelity, it can be purchased indefinitely in the future.

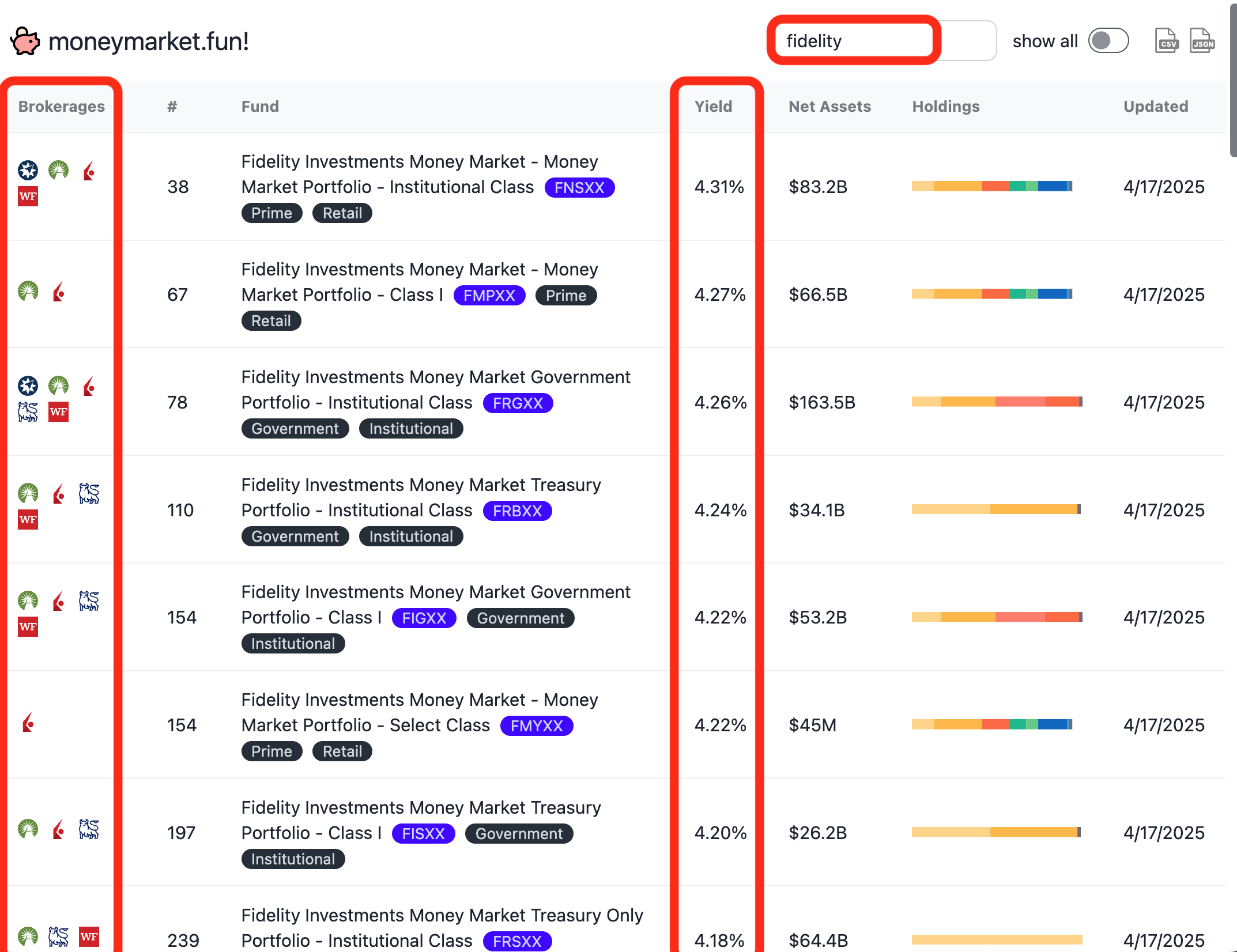

I found this resource helpful in identifying where you can buy each MMF. If you query for “fidelity” in the top right, it should filter only Fidelity MMFs. The third MMF in the table below (FRGXX) can be purchased at Ameriprise, Interactive Brokers, Merrill, and Wells Fargo.

Once purchased externally, you transfer the funds to Fidelity fairly easily. Within Fidelity, click “Transfer”, then “Transfer an account to Fidelity”, then “Investment or retirement accounts”, then “Start Transfer”, then proceed with the directions that follow. Partial transfers are preferred since they leave the other brokerage account open (and avoid account closure fees). One more tip — wait until about a week after purchasing your MMF at an external brokerage before initiating the transfer to Fidelity to ensure that the transaction has settled. Note that you’ll need at least $125 in your WellsTrade account after the transfer (before the transfer, you’ll need >=$125 + the size of the transfer) or Wells will reject your partial account transfer.

6. Transfer MMFs Easily (and Help Your Kids/Friends Optimize)

I have a joint CMA with my 18-year-old daughter to allow for instantaneous transfers from my CMA to hers (a simple alternative to Zelle). One trick I learned recently (thanks to blog reader Peter) is that it is incredibly easy to transfer MMFs “in-kind” across your Fidelity accounts. As a result, I can easily “seed” my daughter’s CMA with the better MMFs.

You can also transfer these MMFs to friends/family through following the instructions on this form. By gifting a MMF “seed” to friends/family, you gift a lifetime of elevated interest on their cash.

7. You can Automate the Better MMF Purchases

Here’s the trick: even if SPAXX is your core, you can still automate recurring purchases of a better MMF like FRSXX.

What I do:

- Get paid monthly. Say $10k.

- Rather than let the $10k sit sub-optimally in SPAXX, I auto-buy $5k of FRSXX twice (two separate scheduled purchases).

Why split the automation of this $10k purchase into two $5k transactions? If I were to contribute $7k to my HSA/401k and my net pay drops to $3k, a single $10k automated purchase would fail. However, two automated purchases of $5k would clear so long as I had a total cash balance of at least $5k.

What’s the downside? Your transaction history will be a bit more cluttered.

Here’s how to access this functionality and how I currently have it configured.

8. Quantifying the Upside of These Shenanigans

Treasuries aren’t taxed at the state level, so you can compute the after-tax yield as:

After-tax yield = Pre-tax yield * (1 – fed marginal rate – state tax rate * (1 – fraction of income from Treasuries) )

Since munis aren’t taxed at the federal level, the fed marginal tax rate goes to zero in the above equation.

As a result, when we apply the above equation (and my tax parameters of 24% fed + 6% state), we get a pretty large difference in after-tax yields across MMFs. For me, FTCXX yields almost 1% more than SPAXX on an after-tax basis. I’m in the process of changing my core position from FRSXX to FTCXX after learning this.

| Ticker | Yield | Treasury % | After-tax Yield | Equivalent Fully-Taxable Yield |

| SPAXX | 3.97% | 55.09% | 2.91% | 4.16% |

| FRSXX | 4.18% | 99.63% | 3.18% | 4.54% |

| FTCXX | 3.89% | 0% | 3.66% | 5.22% |

| FNSXX | 4.29% | 15.84% | 3.04% | 4.35% |

Don’t forget to claim the state tax deduction for treasury income by following these instructions from the Finance Buff.

Rather than replicating the above math with your own tax parameters, you can also reference this excellent Boglehead’s thread and accompanying Google sheet maintained by retiringwhen. Plugging my parameters (24% fed + 6% state) into this excellent tool I see see the following history of after-tax yields for the first three MMFs in my table above:

Final Thoughts

Fidelity’s baseline CMA is good — but with a few mouse clicks, an optimized CMA is even better. I can’t imagine ever going back to a conventional checking or savings account.

Frugal Professor: Thank you for the good work you share with your readership and the world, without compensation. Your writing is always a must read.

I appreciate Fidelity’s Cash Sweep and CMA features.

What I don’t yet understand: How to interpret, and how much to rely upon, the recent published FTCXX 4.03% current yield, which is footnoted by Fidelity (at the FTCXX link you included above) as “The 7-Day Yield is the average income return over the previous seven days, assuming the rate stays the same for one year.”

This 4.03% Yield is a dramatic (+40%) yield increase from FTCXX’s 2.88% 7-day yield published as of three weeks ago on March 31, 2025. Without much movement in price (no “breaking the buck” as referenced above). Could it be that because of the short 7-day income capture period, and some intra-month concentration of income to a few calendar days around mid-month, the yield calculated abnormally high as of 4/20/2025?

Again, thank you for this post and the walk throughs.

Thanks for the thoughtful question. I also noticed the dramatic increase in the 7-day yield from 3/31/25 to 4/20/25 and don’t quite know what to make of it either.

Perhaps someone smarter than the two of us can provide some guidance…

I’ll be keeping an eye on its yield over the coming days. At a minimum, I’d like the option to transition to it if yields remain favorable.

Update: Here’s what ChatGPT said about the increase in FTCXX yields: https://chatgpt.com/share/6806956f-cc14-8001-a42d-f02d74e87b93

Great explanation of how you use this…I am definitely going to take a look. I did have a few things I am confused about. So for #7, why would I not make FRSXX the default and skip having to fund SPAXX first? Also, I am struggling to follow #7 and why it’s all being split up with these $750 purchases and how you can make two $5000 purchases if you have less than $10k in the account?

For the “default”/”sweep” account, you’re stuck with SPAXX or the lower-interest FDIC insured option. Those are your only two options.

Step #7 makes FRSXX (or the MMF of your choice) the defacto sweep.

Why SPAXX rather than FDIC? Why not neither? You have to choose one of the two, so why not the higher interest option.

The trick to realize with #7 is that the automated purchase will clear for a given purchase size so long as your balance is greater than the purchase amount. Only have $6k in cash? The system will process 4 x $5k auto-purchases without incident. Why 4x? To cover a wide range of potential balances. Is there harm in placing redundant purchases? In my experience, other than having a slightly more cluttered transaction list, no.

For me, the $5k transactions at the end of the month are intended to capture my paycheck, and are flexible enough to capture smaller paychecks if I’m front-loading retirement contributions or larger ones where I don’t. The $750 transactions capture misc transfers throughout the month (e.g. cashing out of CC rewards, Venmo receipts, etc). Arguably, the $750 are not adding a lot of incremental interest to me, but it’s not had to implement.

Muni MMF yields regularly fluctuate over the course of the year (although this is the highest I’ve seen it since almost a year ago). There’s a google sheet you can find on bogleheads that pulls the daily yield over the past year if you want to take a look.

Thanks for the heads up. I intended to link that Bogleheads google sheet into my post but forgot to. I’ll update the post now to include it. Thanks for the reminder.

Does FRSXX auto liquidate to cover draws from the account (if there isn’t enough in SPAXX

Yes, FRSXX auto-liquidates. It is glorious.

It has worked with other Fidelity MMFs for me as well (SPRXX, FSIXX, etc). I’m assuming this generalizes to all Fidelity MMFs, but if not hopefully someone can correct me.

Great tips as always. Is there any work around if you don’t want to open a new brokerage at one of these for firms that you mentioned? For example, if I transferred in a Vanguard money market could that work or would that be disallowed? As cool as this is It’s a hard sell having to open yet another brokerage. Maybe there are other money markets at Vanguard, us bank, trade, etrade, etc, that can be transferred in?

It is my understanding (which might be wrong) that Fidelity MMFs are the only ones with the ability to auto-liquidate. As a result, even if you could transfer Vanguard MMFs over, I don’t think you’d be able to replicate that functionality.

If I’m wrong in my understanding, hopefully someone can correct me.

Two things from my recent experience trying to research and execute this strategy:

1. Are you sure your after-tax yield calculation for FTCXX is correct? I couldn’t get it to beat FRSXX under any reasonable tax conditions.

2. Yes you can buy all these Institutional Class funds at Interactive Brokers, but they appear to enforce Fidelity’s minimums. So I couldn’t buy FRSXX without an order of 10 million bucks (which exceeds my excess liquidity by a fair bit!). I already use Interactive Brokers but have no relationship with Wells Fargo, and I’m not sure I’m willing to go through the hassle of opening another brokerage account just for this–unless someone convinces me that it is super easy or definitely worth it.

Thanks for the ideas, though! I still wish I could get that sweet FRSXX yield in my Fidelity CMA!

1.) I just played around with the MMF tool on Bogleheads: https://www.bogleheads.org/forum/viewtopic.php?t=401821

This guy has obviously given a lot more thought to the topic than I have. Using the same tax parameters in my post (24% fed, 6% state), he computes the after-tax yield as:

* SPAXX 2.91% (identical to my calc in the table)

* FRSXX 3.18% (identical to my calc in the table)

* FTCXX 3.66% (less than my calc of 3.79% in the table, but this is entirely driven by changes in the yield of FTCXX between when I published the post and now…the formula is right)

2.) I’ve only had experience buying Fidelity MMFs at Merrill and Wells. Merrill had no minimum (maybe $1) and Wells imposed the $50 minimum. Bummer that IB doesn’t do the same.

If you don’t have a Wells account, I can understand your reluctance to open an account for that purpose.

When plugging in the numbers a bit I looked at two scenarios

7 year trailing vs current for 3 popular MMFs

7 Year Trailing

Fund Name Yield Expense Ratio Effect Fed Tax Rate Effect State Tax Rate % of MM That is in Treasuries After Tax Yield

VMSXX 0.0155 0.11% 0 0.06 0 1.35%

VUSXX 0.0232 0.07% 0.24 0 1 1.71%

SPAXX 0.0195 0.4% 0.24 0.06 0.55 1.14%

Current Conditions

Fund Name Yeild Expense Ratio Effect Fed Tax Rate Effect State Tax Rate % of MM That is in Tresuries After Tax Yeild

VMSXX 0.0411 0.11% 0 0.06 0 3.76%

VUSXX 0.0423 0.07% 0.24 0 1 3.16%

SPAXX 0.0397 0.4% 0.24 0.06 0.55 2.62%

Currently SPAXX is a poor choice, but over longer periods, it is marginally worse. So it depends on how much you want to play the game of switching funds based on which one is yielding the best after tax yield.

Also, its important to take into account the expense ratios of the funds (which only apply to interest and not to principal for MMFs).

I’m relatively new to this MMF optimization game. I hold so little cash that it is laughable that I have even given a minute or two’s thought to the topic (including this post). But I’m a relentless optimizer and I loved the learning process that I went through to generate this post.

Like a OceanView2 says upthread, it seems that these interest rates fluctuate quite a bit, so there is no guarantee that munis will continue to outperform FRSXX. It seems to me that the current interest rate environment (as of a few weeks ago) is favorable to munis. I’m not sure how long this will persist.

I’ve just about given up on trying to get the higher-yielding MMFs into my Fidelity account. Starting from scratch:

(1) I opened a WellsTrade account—I did not have a prior Wells Fargo account so I had to call to make this happen. Couldn’t do it online unless I already have a checking or savings account (which I didn’t want). The representative on the phone was friendly and it was simple to open the account, but it still took more time + effort than I’d have liked.

(2) I pushed $50 from Fidelity to WellsTrade. Fairly easy.

(3) I purchased FNSXX @ WT; also fairly easy.

(4) I’ve tried twice to initiate pulls for the shares @ Fidelity and have been blocked both times. The first time I tried to do a partial account transfer > all shares. I was told this was considered a full account transfer and there’d be a $49-something fee. So I said OK, I’ll try again leaving a single share behind. This was also denied. I called and was quoted the same fee. 🤷

FP–how did you manage to avoid fees when you transfered out of WT?

Bummer.

In my case, I had $250k of Vanguard funds parked at WF while I did these shenanigans. As a result, when I transferred 100% of the MMFs to Fidelity, it was very clearly a partial transfer (since the Vanguard funds stayed).

Can you just have $1 of non-MMF cash sitting at Wells? Then, when you transfer the MMF from Wells to Fidelity, it would be a partial transfer (since the $1 cash is staying put). To simplify things, transfer 100% of your Fidelity MMF holdings.

Edit: on second thought, I remember running into this same issue when I did it! Wells is weird about settlement periods for recently purchased funds. Just wait a week and re-initiate the transfer.

Hmm, I wonder how FTCXX/VMSXX got thrown in the mix…

Sharp Reader Jeremy deserves a lot of credit here. Sorry for the omission.

Interestingly, the chart in “8. Quantifying the Upside of These Shenanigans” seems to imply that the outperformance of FTCXX is going to be transitory. I’ll keep an eye on this relationship over time for the fun of it — not because it will make a big difference to our finances.

Don’t forget NIIT (3.8% over $250k. Munis are free from this too.)

Good point!

If I sell off the MMF I believe the cash goes into the brokerage cash account (separate from the regular brokerage account). The impression I got was that it didn’t matter if it was a full or partial trade; there would always be a fee of $49.95. The fees are slightly ambiguous: https://www.wellsfargo.com/investing/wellstrade-online-brokerage/pricing/

“Outgoing Account Transfer” I take it to mean any transfer to an external account.

My purchase is under a week old, so I’ll give it another go next week and report back. Fingers crossed!

I’ve done a handful of these transfers over the years, and I’ve never gotten charged for a partial transfer. That said, I don’t know that my experience generalizes.

Looks like ML has started to lock this down, tried a couple of funds including and ML says they are ineligible! Bummer, should have done this sooner. Right now rolling the dice with the qualified Municipal MM directly in Fidelity, looks like its 7 day yield fluctuates wildly. As of today gives me an advantage. Does any one know if we can set up alerts if the 7 day SEC yield drops below a value for a specific mutual fund?

Good luck with the transfer!

I don’t know about the alerts, but the Bogleheads google sheet by retiringwhen is fantastic. It auto-updates yields whenever you open the sheet. I plan on looking at it periodically.

Yes, as noted previously, municipal rates are cyclical. I suspect it’s outperforming due to issues with treasuries and the bond market. It just shows you need to regularly monitor rates if you REALLY want to optimize every dollar. For those readers in 0% income tax states, you don’t really need to even look at treasury rates here, may as well as go with FNSXX as it’s a higher yield.

For those in 0% states, I agree that FNSXX is the best.

I’ll keep an eye on the cyclicality of FTCXX for curiosity’s sake. It’s pretty fascinating to observe.

ChatGPT can do the work for you…

Great question — this is where tax-equivalent yield math comes in. You can compare FTCXX (a tax-exempt fund) and FNSXX (a taxable fund) by figuring out the point at which FTCXX’s lower, but federally tax-free, yield beats FNSXX’s higher, but taxable, yield.

—

### 🔍 Tax-Equivalent Yield Formula

To calculate when FTCXX is more favorable, use:

> 📌 **Tax-Equivalent Yield (TEY)** =

> FTCXX Yield ÷ (1 – Marginal Tax Rate)

Set that equal to FNSXX’s yield and solve for your tax rate.

—

### 🧮 Let’s Run the Numbers

Assuming:

– FTCXX yield = 3.99% (federal tax-exempt)

– FNSXX yield = 4.30% (fully taxable)

Set up the equation:

3.99% ÷ (1 – x) = 4.30%

=> (1 – x) = 3.99% ÷ 4.30% ≈ 0.928

=> x ≈ 0.072

👉 So, the breakeven marginal tax rate is about **7.2%**

—

### 🎯 Interpretation

If your federal marginal tax rate is:

– ✅ Above ~7.2% → FTCXX is more favorable on an after-tax basis

– ❌ Below ~7.2% → FNSXX provides more net income

—

### 🧾 Tax Bracket Examples (2025, Individual Filers)

| Federal Bracket | TEY Favorable? | Comments |

|—————–|—————-|———————————-|

| 10% | ✅ FTCXX wins | Modest edge |

| 12% | ✅ FTCXX wins | Slightly better |

| 22%+ | ✅ Strong win | Big benefit from tax exemption |

| 0% | ❌ FNSXX wins | FTCXX provides no tax savings |

—

🧠 Bottom Line: If you’re in the 10% bracket or higher (which is most working adults), FTCXX should outperform FNSXX after taxes.

Want me to plug in your actual bracket or state tax to give you a personalized comparison?

I’m in agreement that FTCXX clearly beats FNSXX based on current yields. Sufficiently so that the breakeven marginal tax rate is low.

FTCXX was off of my radar completely until your first comment last post. Thanks for introducing that to me. I just placed a $50 order at WF today.

I’ve completed the transfer from Wells Fargo and now have $50 of FRSXX and FNSXX in my Fidelity CMA.

When I try to buy more FRSXX (either as a buy or exchange from my FDLXX holdings), I get an error “The quantity you specified is less than the minimum required to buy shares in the mutual fund you selected. The selected mutual fund has a minimum investment requirement of $9,999,999”, i.e. exactly the same error I got before I transferred in the institutional “sourdough starter”.

Any ideas?

For me, it worked flawlessly once I had the funds at Fidelity. Maybe wait a day or two and try again?

(Sorry, wrong post. I meant to post this question to https://frugalprofessor.com/financial-update-mar-2025/ where you originally described the WF transfer trick. Feel free to move or delete and I can repost over there if you prefer.)

For me, it worked flawlessly once I had the funds at Fidelity. Maybe wait a day or two and try again?

Thanks, yes, the transfer only just landed this morning so maybe that’s it. I’ll post back here next week to let you know how I get on.

I think I had to wait a day now that you mention this issue.

When I use Bogleheads google sheet, I get a message saying allowing the email triggers etc, will enable others to access your google account or send messages on your behalf, is it ok to follow instructions and allow access?

The first thing I did with that google sheet was to create my own copy. From there, I didn’t get any email triggers/alerts/warnings. Or maybe I didn’t pay enough attention….

Ok thanks, I did find a website that is is interesting, not sure who runs it. It is called moneymarket.fun , not sure even it was meant for public consumption. But is is very neat and simple. You can easily search your ticker, I searched FTEXX and created a shortcut to that page in my phone. Everyday I just launch it to get the yield. Hope this helps.

It’s a really cool website!

FTCXX – Am I too conserviate to worry about higher default risk for Muni’s?

It seems pretty safe to me, but I’m not putting 6-figures into the fund.

are you sure FTCXX is available at WF without 10mil. minimum?

need to make sure as I have to open new WF acct.

Thanks in advance.

Just bought it on Friday with $50.

Waiting 24 hours worked. Thank you! (And sorry about all the extra comments on the wrong thread!)

Glad it worked! Welcome to the club!

This is a good write-up; thanks for sharing. I’ve been using a Fidelity CMA as my primary checking account for many years. I’ve come to value the following aspects:

1. If you desire using Zelle, you can add your Fidelity CMA debit card to the Zelle mobile app (https://www.zellepay.com/go/zelle).

2. If you obtain a debit card for your Fidelity CMA, it’s worth familiarizing yourself with the “lock” feature (accessible from the Account Features page, by clicking the Manage link next to ATM/Debit Cards; also available from the Fidelity mobile app)

3. If you use a debit card to withdraw cash (gasp), daily withdrawals are limited by both Fidelity and the ATM operator. Though there are different limits involved, your effective daily limit is number of debit cards * daily limit per card => the more debit cards you have, the more cash you can withdraw. You can get a debit card per account per person (in case of jointly owned accounts). I got several, and keep them locked, both physically (all but the one in my wallet are in a safe) and electronically (see point #2)

4. To take advantage of ACH push into a Fidelity CMA, you must add the CMA as an external account to the account from where you’ll push funds. If that account is compromised, your Fidelity CMA can be drained. This is another reason for using a “firewall account” and linking the firewall account. Side note: do not enable overdraft protection on a firewall account

I really appreciate you taking the time to make this insightful comment!

I tried years ago to add Zelle using the debit card, but for some reason I couldn’t get it to work. I’m going to try again on your recommendation.

I’ll be implementing your recommendations on the “lock” feature of the debit card! I should probably implement some better “firewalls” as well.

If I recall it right, you put most into Bank of America + Merrill Edge to get high tier (Preferred Rewards) for higher cash rewards on BofA’s credit cards?

Are you still keep this BofA reward tier after you now transfer to Fido CMAs?

Thanks

Fidelity CMA is my “checking” account.

BoA is for credit cards. Merrill is solely for the 75% boost on credit cards. I transfer assets in-kind to Merrill 1x/year during my premium rewards enrollment window to re-qualify (for the 5.25% rewards), then move the investments in-kind elsewhere once renewed.

If you transfer $300k to Merrill, you can establish the $100k rolling average three-month-balance in one month instead of three.

I’m not sure if this should be addressed here, but since a CMA is a brokerage account, you can invest in BOXX. It does NOT auto-liquidate though.

I don’t know much about BOXX. How do the returns compare to MMFs?

Zelle app is effectively dead.

Good to know; thanks!

Following up from: https://frugalprofessor.com/the-ultimate-guide-to-fidelitys-cash-management-account-cma/#comment-5270

The partial transfer went through, about a week after I put the request in. No charge from WellsTrade. I don’t think I did anything special to make it happen; however, I did try to initiate another transfer this week, and, shortly after I put that request in, the bottommost request from the stack of requests I made last week was processed. I don’t get it; I won’t try to make sense of it; but you were right: wait a week!

I’m now trying to determine what the minimum is to seed any of these MMFs; I sold off all but one share of FNSXX and tried to purchase more and was confronted with the minimum investment requirement error. So maybe $50 is the seed minimum? I’ll report back when/if I figure this one out.

Glad you got it figured out. Waiting seems to solve a lot of problems with this nonsense.

In my experience, $50 is the minimum at Wells.

However, once the “seed” is transported to Fidelity, the minimum “seed” size should be about $1 from which to reinvest. If you’re running into errors, perhaps wait a day or two….? That seems to work for me.

But if you have experience that contradicts the above, let me know.

If I recall correctly, you originally had used the standard Fidelity brokerage account as your “checking” and left $0 in your CMA. When the CMA finally added the automatic sweep option, did you just switch over all ach accounting? Just curious as this is how I set it up years ago (pretty sure with a big assist from your guide at the time).

Many thanks for all the great insights!

You’re right, Fidelity turning on the SPAXX option was the impetus. Plus, I wanted to simplify. I didn’t want to carry around an unused CMA with the sole purpose of ATM withdrawals. I’ve consolidated to a single account now and I like the system quite a bit.

BOXX is an ETF offering box spread returns.

Are the yields competitive with the Fidelity MMF options? I couldn’t quite figure that out.

How to setup CMA as “firewall account”? (need to add CMA as external account)

thanks

I’m suggesting that you offload “risky” functions (such as check writing where your account number is exposed or perhaps an account with ATM card functionality) to a secondary CMA to minimize the risk of your primary CMA being compromised (and thus lead to a world of hurt and risk exposure).

My solution is to write as few checks as possible (preferably credit card or cash when necessary). If you are not writing checks often, then it’s a matter of what activities you consider higher risk that you might want to firewall (as well as how big of a pile of cash you have at risk).

As for us, we hold little cash so I’m less concerned about firewalling beyond basic preventive steps.

The most secure option would seem to be to have two CMAs. Your primary where you hold the most cash. This one would have zero checkwriting ability nor ATM functionality. Your secondary one would have both features enabled. You’d need to manually transfer sufficient funds from your primary CMA to your secondary, but it would be safer than having a single CMA.

Yes

Good to know; thanks!!!

This is a silly idea, but have you considered offering up a stake in your hard-to-acquire munis in exchange for cash? Offer up a paypal, venmo thing, I give you $55, I get $50 of FRSXX, FTCXX etc etc?

Pretty clever idea, but I’ll let another enterprising person do as you propose. The last thing I want to do is get blacklisted by Fidelity (who holds most of my assets) for a couple dollar side hustle.

Update: Muni rates have sunk, you should switch to something else.

Interesting. Thanks!

Great information!

I’ve read a Fidelity response from a Reddit post about using FRSXX in this way stating that “the prospectus also states that you must maintain the minimum balance requirement, or the fund may convert the Institutional Class shares to Class I shares”. And that ” if you are below the minimum requirements, we can’t say how long the shares will remain in the particular class”

https://www.reddit.com/r/fidelityinvestments/comments/1j3nfnv/frsxx_transfer_from_wellstrade_questions/

Don’t want to be negative here, but a bit concerned that this might happen without my knowledge and then my core would not be covered.

This technique has been used for ages by Bogleheads. If they do put the kibosh on it, then I guess it’s back to SPAXX.

I don’t think there is any risk of anything problematic. Worst case, you’re downgraded to SPAXX/SPRXX/etc.

I had used FZDXX with less than 100k for years. It was really only enforced on initial purchase.

BOXX focuses on having no distributions, just net value gain, right now it’s gain is about ~5% over a year.

It is a proxy of the Box option spread strategy, which is a type of option trade that mimics a loan. websites like boxtrader shows whats on offer on things like `SPX`

Good to know. Thanks!

Is there anything at Vanguard or Schwab that would mirror this account?

Neither Schwab nor Vanguard auto-liquidates MMFs, which is why I’m not at Vanguard with their higher-yielding MMFs (due to lower expense ratios).