*** Edit 2025 ***

I wrote a better and more comprehensive guide here: https://frugalprofessor.com/the-ultimate-guide-to-fidelitys-cash-management-account-cma/

As a result, feel free to ignore the post below and instead rely on the guide above.

*** Edit 2024 ***

Fidelity has updated their Cash Management Account to now allow SPAXX as a core position (if you opt into it). This negates any need to hold cash in a brokerage account as I describe below, so from 2024 and beyond, just use a CMA. https://www.mymoneyblog.com/fidelity-cash-management-account-new-core-money-market-fund-option.html.

Also, you probably want to read this before opening up a Fidelity CMA:

- Due to widespread mobile check fraud, some users are having accounts frozen: https://www.bogleheads.org/forum/viewtopic.php?t=439500

- Solution: Deposit checks at non-Fidelity bank then push (don’t pull) money to Fidelity: https://thefinancebuff.com/ach-push-avoid-account-restricted-closed.html

- This is also worth reading: https://www.mymoneyblog.com/fidelity-atm-debit-card-warning-fraudulent-transactions.html

That said, I’m quite happy with my Fidelity CMA setup that I’ve been using for 5+ years. I like getting access to my paychecks 1 business day earlier, I like earning >5% on cash, and I like free worldwide ATM withdrawals.

Also, you’d do better holding large chunks of cash at Vanguard because of the lower fees: https://investor.vanguard.com/investment-products/money-markets. The disadvantage of Vanguard is that they don’t auto-liquidate MM funds, meaning it can’t replace the functionality of a checking account easily like the Fidelity setup.

*** Original Post ***

Thoughts on cash

I don’t like physical cash very much.

Why? It is dirty, can be stolen/lost, and erodes in value over time. Coins are even worse. Their sole purpose is to find their way into the crevasses of my sofa cushions and cars.

We usually have about $25 or so of the green stuff in our house at any given point in time. I find $1 bills to be the most practical for tooth fairy duty (it turns out that 5 kids lose lots of teeth). It comes in handy for tips while traveling.

Digital cash solves many of the problems of physical cash: it’s not dirty, it can’t easily be stolen/lost (especially if you’re following proper protocol using a password manager + 2 factor authentication on banking sites), and will erode less in value if you keep it stored properly in a money market account.

My new banking setup

Over a decade ago, when I was in my mid 20s I thought I was clever by earning 5% in my Ally checking/savings account with check writing ability. I maintained this setup for almost a decade (though interest rates shortly plummeted to close to 0% for a while). It worked great, with one limitation: I could only make six withdrawals per month (and no more than 3 of them could be checks). I went over this limit a few times, was penalized with fees, but negotiated them to zero by calling up customer service. Despite the decade of no fees (after haggling), it was a pain and I lived in fear of going over the 6 transaction/month limit.

A few months ago I stumbled on this Bogleheads thread which convinced me to transition 100% of my checking/savings to Fidelity. The Bogleheads thread is a bit unruly, so let me summarize what I find to be the best banking setup in the country. Again, the Bogleheads deserve credit for this system; I shamelessly adopted it on their recommendation a few months ago. After a few months of trying it out, I fully recommend it. I’ll never go back to clunky money market accounts again.

To do so, I opened 2 accounts: Fidelity Cash Management Account (CMA) & Fidelity Brokerage. There are pros and cons of each:

- Fidelity CMA:

- Fidelity brokerage

- Pros:

- Can set default “sweep account” to a money market fund (i.e. SPAXX).

- Cons:

- ATM fees are not reimbursed.

- Pros:

- Either of the above:

- Pros:

- Debit & ATM cards.

- Free paper checks (saving me about $13.18/lifetime in Costco boxed checks!).

- Unlimited transactions.

- Earn up to 5% as of today in SPRXX.

- Automatically liquidate money market holdings upon withdrawing money (i.e. no need to explicitly sell).

- Offer ability to instantly fund Fidelity investment accounts.

- Great bill-pay capabilities.

- Pros:

In summary, the Fidelity CMA and the Fidelity brokerage are both very capable checking/savings accounts. However, as shown above, each of them in isolation has a limitation. However, if used together (as I do), you can overcome these small shortcomings. Specifically, I do the following:

- Dump direct deposits (& paypal transfers, etc) into my Fidelity brokerage account.

- This cash is immediately swept into SPAXX (currently yielding 5%).

- If you are a relentless optimizer like myself, you can actively purchase SPRXX which currently yields 2.23%, if you remember to do so.

- This technically negates the SPAXX benefit of the brokerage account since I eventually purchase SPRXX manually anyway.

- If you are a relentless optimizer like myself, you can actively purchase SPRXX which currently yields 2.23%, if you remember to do so.

- I make ATM withdrawals through CMA for free.

- I hold $0 in cash in CMA, but I self-fund overdrafts from my Fidelity brokerage account.

- I write checks & autopay credit cards + utilities from my CMA but there isn’t a particularly good reason to do it through the CMA rather than the brokerage account.

With the above we’ve accomplished the following:

- 5% (automatic) – 5.1% (with a couple clicks) checking account.

- Unlimited transactions/month (unlike the 6/month through Ally).

- Free unlimited ATM withdrawals world wide.

- Since direct deposits are directed to Fidelity, investments in IRAs and HSAs can now be accomplished instantaneously. On the day of my payday, I can be fully invested in their 0% ER funds in my HSA or backdoor Roth (which takes 30 seconds to accomplish).

- I maintain my taxable brokerage at Vanguard due to the superior tax efficiency of VTSAX.

Thoughts on emergency funds

Ironically, even though I earn 5.1% on digital cash, I still loathe holding it. Why? I pay taxes (24% federal + 7% state) on the 5.1% of interest, bringing my after-tax return on cash to be less than the rate of inflation. On average, you’ll do better on investments (stocks & bonds), particularly if you shelter those assets in tax-advantaged accounts.

Many people argue that cash should be held for emergency funds, but credit cards do a great job for emergencies while providing me 2.625%-5.25% cash back as well as 30-60 days of 0% interest float. Alternatively, liquidating assets works pretty well for emergencies. I’ve found the best protection against emergencies (i.e. 80mph deer collision, $7k appendectomy, etc) is not to hold $20k of cash, but instead to consistently live below my means for decades, accruing a stockpile of liquid assets in the process.

In other words, I echo BigERN’s thoughts on emergency funds; they are for chumps.

How I minimize my cash holdings

Since I don’t particularly like holding digital cash, I get rid of it as soon as possible. I’m paid on the last day of the month. On the first of the month, all of my credit cards autopay in full, helping me to get rid of this nuisance cash. After those bills are paid, I transfer every dollar except for ($500 + $1,500) to investments on the first of the month. The $1,500 is my mortgage payment which I autopay in full on the 15th of the month (this is the last possible day to do so without incurring interest penalties). After the mortgage is autopaid, I’m left with $500 in my account. This pays for piano lessons, a water bill that doesn’t accept credit cards, and whatever random school PTA events that require checks.

It’s a pretty good setup. I recommend it. Despite my lifelong desire to optimize my finances I only began to align my credit card due date with my paychecks within the past 5 years. I didn’t realize I could do so until then. Once CC bills are paid in full, it is obvious how much cash can be transferred immediately to investments (on the 2nd of the month in my case).

Wrapping it up

Cash is overrated. Money market funds are underrated. Either Fidelity CMA or Fidelity brokerage would make a great primary checking account, though both used together is the best. Emergency funds are overrated. Liquid assets are underrated. Aligning your credit card billing cycle to align with a monthly paycheck is underrated.

A few screenshots for the curious

Personal Capital screenshot of CC bills due. BoA, Citi, and (not shown) Fidelity credit cards are all due on 1st. BoA requires a phone call to set this up (slightly annoying). Simply ask for due date of credit card to fall on 1st. I recall that Citi & Fidelity can be done online.

Screenshot of my Fidelity CMA + brokerage setup in action.

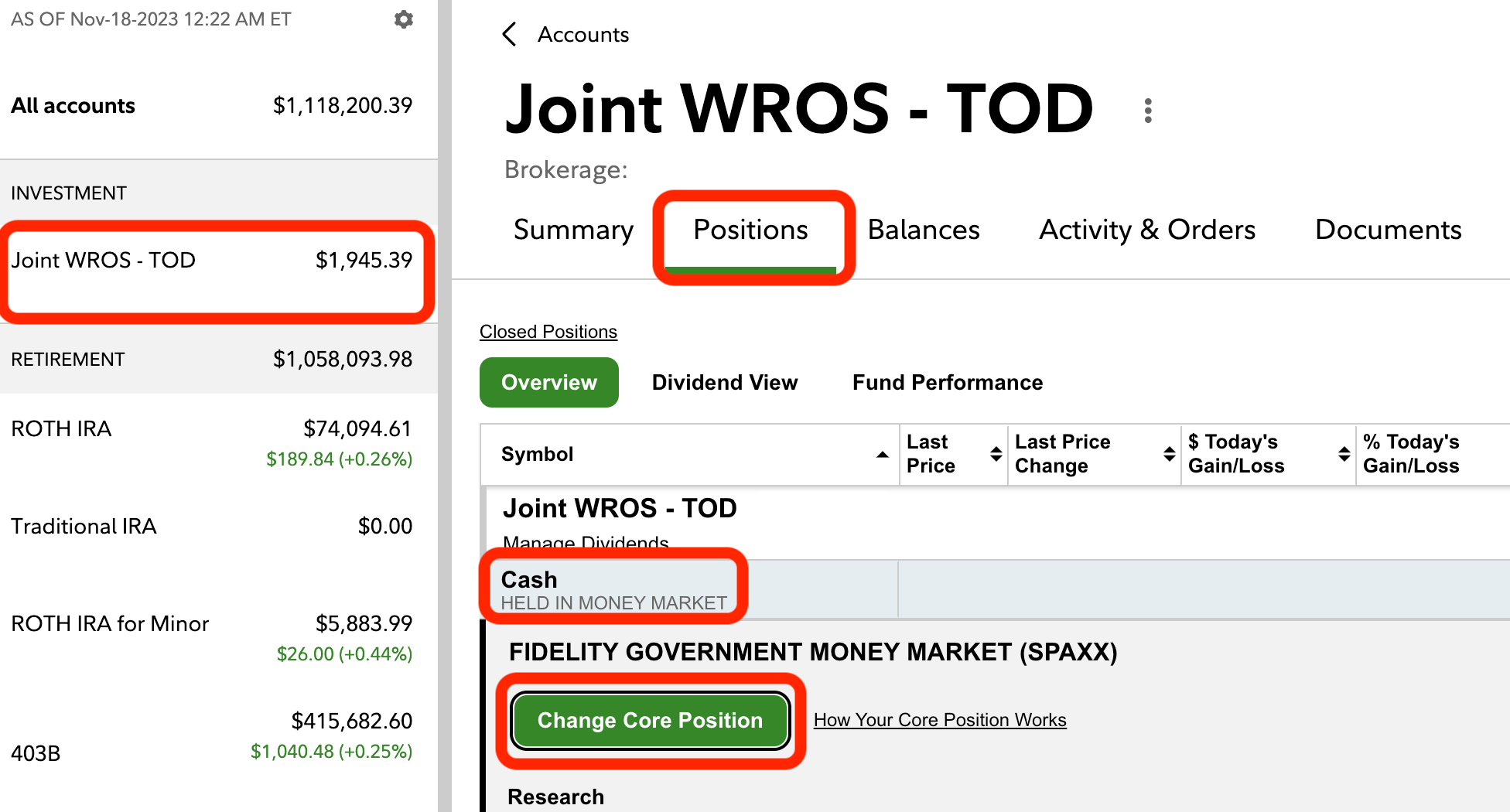

To change the default sweep account in your brokerage account to SPAXX, currently yielding 5%, click on your brokerage account from your account overview => “Positions” => “Cash” => “Change Core Position”

If you use CMA + brokerage, the following 4 screenshots illustrate how to set up the self-funded overdraft. As a reminder, I store $0 in the CMA so any debit to that account will be funded by the brokerage account.

Setting up this overdraft protection is not intuitive (i.e. PITA without a guide). Hopefully the following 4 screenshots will help.

Step 1: Account overview => “More” => “Manage Cash”

Step 2: Click on CMA (not Brokerage) on left => “Account Services” => “Cash Manager Tool”

Step 3: Turn on self-funded OD protection within the CMA. Set target balances to $0.

Step 4: Select the Fidelity Brokerage as the source of the self-funding OD account. Congrats; you’re done.

This is what it looks like in my $0 balance CMA account. 3 credit cards autopaid on 6/3. 1 credit card autopaid on 6/4. There is a single OD transfer inflow from my brokerage account to account for the three transactions ($12,706.63 = $9.80 + $1,949.52 + $10,747.31).

On the brokerage side, here’s what the corresponding transaction looks like. One auto-redemption of my money market funds (SPAXX or SPRXX) for $12,706.63. Then the corresponding transfer-out to the CMA.

One last hint. If you want to link your CMA/brokerage account to other financial institutions (PayPal, Vanguard, local bank, etc), you must click the “routing number” link to reveal the appropriate account & routing number.

I wish Schwab had their checking/brokerage setup to do this. I use the brokerage account as savings with most funds in a money market fund and some in the CA Muni fund.

The Fidelity setup is great. Too bad Schwab doesn’t do this.

My problem is I need a way to deposit cash into the account.

I have a checking account at a local credit union for this purpose. I keep a $0 balance there.

Because you manually purchase SPRXX anyway, you can just have one account (the CMA), without the overdraft setup. Also, once you get to the Premium level, ATM fees are also reimbursed for the debit card on the regular brokerage account. That’s another way of having just one account. When you have only $1,000 in the cash account because you lined up your bill payments and transfers to investments, it hardly matters whether that $1,000 earns 2.35% or 0.37%. So if you forget to purchase SPRXX in the CMA, it still works out just fine.

TFB! Thanks for stopping by!

I fully acknowledge that the manual purchasing of SPRXX negates the whole point of the 2-account system.

I fully acknowledge that the difference in yield between SPRXX and SPAXX is negligible.

I fully acknowledge that the interest earned on $1k+2,185.20 of cash for a few days is negligible, which begs the question why in the hell I’m even messing with this in the first place.

But I have fun optimizing anyway; even though it’s not rational. It’s a weird hobby.

Before your comment, I was ignorant of Fidelity Premium level. Do retirement assets through work count? If so, google tells me I’m there. If so, I guess I’d be justified in closing the CMA and simplifying the setup. Thanks for the heads up!

I’m not sure whether workplace retirement plan accounts count or not. You can see your current service level on the top right when you click on All Accounts on the top left.

I just contacted Fidelity and my workplace plans don’t qualify. Thanks for the heads up though!

This is a great set-up Prof! Do you know if there is a Vanguard equivalent?

I have workplace retirement assets at Vanguard, 2 Roth IRAs (him and hers), and a taxable brokerage account. Would love to have my banking there as well for simplicity, but not sure how feasible that is.

Thanks for sharing. Maybe it would still be worth it to have the brokerage account at Fidelity and transfer my brokerage over there. But then I would have to deal with Vanguard + Fidelity. Any insight would be appreciated.

It looks like Vanguard used have a competing product but has shut it down: https://www.bogleheads.org/forum/viewtopic.php?f=10&t=274303

Bummer about Vanguard closing their cash management product. I’m starting to value simplicity more and more. Perhaps I should open up a Fidelity account for the CMA account as well as the Visa credit card of 2% back. Then I can roll over the Roth IRAs and brokerage account there as well. Would only leave the work sponsored 401k at Vanguard (not much I can do about that).

In the meantime, I’ll slim down the # of bank accounts as well as shifting all credit card auto-payments to the first of the month. That would be pretty simplifying and maybe get me 80% of the way there.

I have really valued the simplicity of having most of my wealth at Fidelity in 0% ER funds.

I had the 2% fidelity visa for a decade and loved it.

Ally bank is a great alternative to this CMA nonsense if you don’t have too many transactions in a given month. Over time, I’ve been able to keep the debits under 6/month so I’m really content with the new CMA setup. It may appear complex, but in reality is great. It will hopefully be much simpler to set up thanks to this guide.

I actually came to your site for the sole purpose to ask you a question about the CMA setup, since I recalled you mentioning it in the past few monthly reviews, so great timing on the post!

I do have a few questions as I am looking to make a similar move and consolidate my Checking/Savings/Vanguard IRA accounts into a single location at Fidelity if possible. I moved my HSA in January, so this would be a great simplification!

1) Are you holding your full taxable brokerage at Merrill Edge? with monthly sweeps of additional funds there? I have enough in Vanguard Mutual funds to qualify for the Platinum Honors, but can I just keep holding the Vanguard funds there? or do you still have a portion at Vanguard? If so I may pull the trigger on

2) Any other oddities you would mention versus a “Traditional” bank setup? Have you been pleased with the billpay? fund transfers to external accounts/holds on deposits? I am also at Ally, and rarely have cash deposits, so that’s not a problem.

Thanks again for being one step ahead of me!

I currently have $103k of VTSAX at Merrill Edge and $10k of VTSAX at Vanguard. I prefer keeping VTSAX at Vanguard b/c I can tax loss harvest better there, but the $100k at ME gives me the 75% CC bonuses. If I were to do it again, I’d probably convert VTSAX to VTI at Vanguard before transferring to ME since ETFs work better there. To sell VTSAX at ME is a costly endeavor, whereas selling VTI there is free. Even though I already have $100k of VTSAX at ME, I may still do this: 1.) transfer everything to VG, 2.) convert to ETF, 3.) transfer back to ME. There are zero tax implications for doing so.

All new brokerage money will go to Vanguard. As ME assets grow well above $100k, I transfer some of them back to Vanguard.

I’ve been really happy with the CMA, despite the oddity that you either have to manually purchase SPRXX or set up the two-account setup like I show above. I don’t think there are any real downsides to the setup. I maintain a local credit union account for the occasional cash deposit, but they are pretty rare.

https://investor.vanguard.com/etf/faqs

Do you have any other secrets to get the Cash Manager to work? I set it up as displayed, but when an ACH draft for greater than the CMA balance hit today it only took the cash available. I asked Fidelity why and they said “check tomorrow, it should move from brokerage tonight” but this is worrisome if it was a bill…

The only thing I can think of is my does not show “Cash manager Status” as “Active” (no matter if i select and resubmit) Also when selecting the funding source I selected the brokerage for funding source, but the CMA is not listed on the right like (selected account) in your image, its the brokerage again. I don’t have the option to select the CMA there.

Any thoughts would be appreciated, but in the meantime guess I might need to move fund manually just to make sure bills pay properly tomorrow.

Realize you aren’t tech support, but any help is appreciated!

I agree it’s unsettling for this to happen in a delayed manner. I store $0 in my CMA. Let’s say that I have a $100 CC bill autopaid on the 1st and another $50 CC bill autopaid on the 1st. It has been my experience that the evening of the 1st, there would be an automatic “sell” order placed in my brokerage account for $150 of SPRXX or SPAXX to cover the $150 shortfall in the CMA. As a result, you won’t see the transaction as completed until later that evening (9pm EST or so).

When the transaction clears, please stop by to confirm your experience. I’m sure other people would benefit from your experience.

Update:

So the issue I ran into was due to the fact that the distribution in question was part of the Auto Withdrawal Service. I setup a monthly distribution at Fidelity to transfer funds from the CMA to an external bank (USAA) to meet a deposit requirement for higher cash back on a credit card.

So while bill pay was able to overdraft successfully from the brokerage without issue, this recurring transfer out will only transfer what is currently in the CMA, and wont overdraft to the remainder. In my situation this resulted in only $50 of a $1000 transfer being completed.

I assume this may have been buried in some e-document I accepted when setting up the transfer, but certainly a surprise. Fortunately a non-essential transfer that I can re-initiate myself. I’ll work on an alternate way to get this done automatically as I don’t want to have to manually transfer cash to CMA or remember to make the transfer to/from the external bank either.

Thanks for the update. I’ve never had such issues. Every autopaid bill pay (utilities, mortgage, credit cards)+ checks that flow through the $0 CMA have performed flawlessly.

In light of your issues, perhaps the CMA only route is the best path for you, with the caveat that you spend 15 seconds per pay period purchasing SPRXX?

So looks like most of my issue was/is related to the “Auto transfer service” from Fidelity to external account – that for some reason will not overdraft from the brokerage. I have cancelled it, but not before it was able to send an additional $0.01 to the same external account when interest was paid in the CMA at month end…

Further complication – In talking with Fidelity reps to get to the bottom of this transfer they told me the overdraft will NOT work for auto debits from external sources (such as CC or Mortgage auto pay’s, or even external bank accts pulling via ACH) and will only work for checks, billpay and debit/atm transactions.

I realize this is contradictory to your experience, so guess more testing will be needed to see how it actually performs. For the time being I would prefer to have the dual brokerage/CMA setup with the overdraft for “simplicity” but it may get to the point that the 15 seconds bi-weekly is less of a hassle…its just that I know it should be possible to get it to work!

I think the Fidelity reps are wrong. I updated my post to show screenshots of the overdraft protection in action on a recent CC payment (the 2nd and 3rd to last images now). All of this happens automatically automatic (CC’s are autopaid, OD transfers are automatic, liquidation of money market funds at end of day is automatic). I’m not sure why the Fidelity reps would be misinformed; they’ve usually been quite helpful to me.

Do you have joint account with your yr wife for cma and brokerage? I want to keep it simple for our family. Can you fund your individual 401k from your joint bank account?

Thanks professor

Yes, the brokerage and cma are both joint. We use both to fund our IRAs. My employer sponsored 401k is funded through my employer. I’ve never funded a solo-401k because I’ve never been self employed. I would assume that a solo 401k would be easily funded from the joint cma or joint brokerage account without problem.

I’m very tempted to setup both a CMA with $0 balance and Brokerage acc which I deposit all funds to, however i’m a bit wary to keep the majority of my funds in a brokerage acc and treat it like checking.

Is there any fraud concern by setting up CMA overdraft to automatically pull from the brokerage acc? Correct me if i’m wrong, but I thought MMF’s were not FDIC insured. Does that mean if someone were to get the Debit card connected to my CMA account and try pulling cash (which in turn would auto sell from my MMF to cover the overdraft) it would not be insured? Or am I still protected since the CMA itself is FDIC insured? Just confused what would happen in that scenario.

Thanks for the great writeup though!

John,

I sympathize with your concerns. One solution is to have two brokerage accounts (in addition to the CMA). One brokerage account as your savings account holding SPRXX/SPAXX and the other as you investment account. Since I do taxable investing at Vanguard, this isn’t a concern for me at the moment.

If constant overdrafting is a concern, how about a simpler setup with Fidelity Brokerage Account as the main account for payroll, deposits, bill pay, writing checks, etc? It could be set up with auto sweep to SPAXX, with possible further optimization to purchase SPRXX whenever you feel like it. The only missing feature is free worldwide ATM transactions. This can be fixed by having a Fidelity CMA account that is overdraft protected by the main Fidelity Brokerage Account. You would get debit cards from the CMA account. The CMA account is really just for debit/ATM cards and can keep a minimum or even zero balance.

Since writing this article, I’ve transitioned almost to what you suggest:

CMA:

$0 balance

Only purpose is free ATM cards; Debit cards are irrelevant

Brokerage:

Receives direct deposit

Autopays all bills

Write check from

Transfer to investments (Vanguard, Fidelity)

It’s a slight improvement to what I was initially doing because it simplifies things. Rather than writing a check from a $0 balance CMA and having it funded by overdraft, I simply write the check from the brokerage account. This simplifies the number of transactions that the check creates. With the check coming from the $0 CMA, this would create 1) the initial check, 2) the liquidation of SPRXX, 3.) the transfer from brokerage to CMA. With the check coming from the brokerage, I now have 1) the check, and 2) the liquidation of SPRXX. It seems cleaner and reduces the number of transactions I see in personal capital.

You can’t keep a zero balance. Fidelity closed my CMA after some amount of years of non-usage.

That’s good to know. I use it every time I use an ATM, which is maybe once or twice a year. They haven’t closed it yet.

I’m wanting to emulate your setup, but I’ve noticed that SPAXX and SPRXX have a lower yield than my current Marcus account and lower than VMFXX and VMMXX. Do you have any concerns with leaving money on the table? I suppose my situation is somewhat different in that I am building saving for a down payment on a house and I keep a 6 month emergency fund. If you were in my position would you use Fidelity solely as a checking account and keep savings at Vanguard?

After my credit cards are paid on the 1st of the month I invest the rest (except for $500 cash reserves and my $2,185 mortgage payment). Therefore I actually earn very little interest in a given month (a handful of dollars). Nonetheless, I love that I’m optimizing.

I dislike the fact that cash savings are taxed at my marginal rate of about 30%. Since I’m taking home only 70% of the interest after tax, I don’t get terribly worked up over slight differences in rates across banks.

Interest rates aside, Fidelity is fantastic to bank with. Their ACA transfers are quicker than any other bank I’ve dealt with. My paycheck becomes available a day before any other bank I’ve dealt with. They are an absolute pleasure.

In your case, if you’ve got $100k in money market funds for a down payment, these small differences in interest rates could add up. If the interest rate differential were 1%, then this would result in (1-0.3)*(0.01/12)*100k=$58.33 more after-tax interest per month at the higher yielding bank. Assuming the difference in interest rates is smaller (say 0.1%), then the after-tax difference in interest would be $5.83. Is that enough to get you to move banks? I’m not sure. It depends on how much hassle / convenience $5.83 is worth. But you’re doing the right thing of not investing the down payment in stocks.

Thank you Professor! I started my account with Fidelity. I don’t see any reason to move my Roth IRA over from Vanguard, so I’ll keep that, a taxable account, and my down payment with them. I’ll use Fidelity primarily for banking, but I will use their commission free trades to buy BRK.B, so that I can attend the shareholders meeting. Do you think you’ll be coming in 2020?

I moved over my IRAs from VG to Fidelity to get access to there zero expense ratio mutual funds (https://www.fidelity.com/mutual-funds/investing-ideas/index-funds). Saving 0.04% relative to VTSAX is relatively trivial in the grand scheme of things, but I decided to do that anyway. The only money I keep at VG is my taxable brokerage these days due to the superior tax efficiency of VTSAX.

I’ll be at Berkshire this coming year. It’d be fun to meet up. Email me a week or two before so we can arrange a meetup (contact info in the menu of the website).

Follow up question regarding the IRA transfer.

Did you transfer in-kind, liquidate, and then buy the Fidelity funds? I’m asking to understand if I will be out of the market for a couple of days to complete this transition. I know in the grand scheme of things it probably doesn’t matter, but it is a concern to me.

Is there anyway to just exchange for Fidelity funds without exiting?

When I transferred my Roth IRA from VG to Merrill Edge to satisfy the $100k platinum honors status, it all was transferred in-kind with no subsequent liquidation. However, once I had enough in taxable accounts, I simply moved those to ME and moved my IRA back to VG. When Fidelity came out with their zero funds, I forget what I did. Likely transfer-in-kind, liquidate, then buy fidelity funds. I’m with you in not wanting to be out of the market. I think I saw a bogleheads thread on the Fidelity/VG fund exchange in the last couple of days illustrating exactly how to do it without being out of the market. I’d search bogleheads for details.

Hi, new here. To net this out, a fidelity CMA is only useful if you don’t have a premium / private client brokerage account. Otherwise, there is no reason to get the CMA. Per fidelity’s website “2.For Fidelity Cash Management Account owners or Fidelity Account® owners coded Premium, Private Client Group, Wealth Management, or with household annual trading activity of 120 or more stock, bond, or options trades, your account will automatically be reimbursed for all ATM fees charged by other institutions while using the Fidelity® Debit Card at any ATM displaying the Visa®, Plus® or Star® logos. The reimbursement will be credited to the account the same day the ATM fee is debited. Please note there may be a foreign transaction fee of 1% included in the amount charged to your account.”

FWIW, since taxes are such a big issue for me (especially in CA), I use FSPXX to store my cash and get a decent tax free return.

Thanks for stopping by. I agree that the premium / private client negates the need for the CMA. The Finance Buff made that point as well. Unfortunately they don’t count retirement assets so I don’t qualify since my brokerage stuff is with VG.

Thanks for the heads up on FSPXX. I’ll look into this some more.

What exactly is the advantage to paying your credit cards on the first of the month? Wouldn’t it more to your advantage to put your credit card pay date as far back in the month as allowable like your mortgage, and then hold the required funds you need to pay your credit card throughout the month, accruing interest?

The expected return of stocks is higher than the expected return of money market funds. Therefore, I hold as little cash as humanly possible, hold as many investments as possible, and I maximize credit card float.

I’m paid on the 31st of every month. I autopay in full on the last day possible (the 1st). Rather than paying my mortgage on the 1st, I hold onto the cash and pay it on the last possible day (the 15th), earning $2185.20*(1.5%/24) extra interest by deferring payment. I invest the remainder and hold basically no cash (other than a token grand).

On the 4th of every month, I begin the new credit card cycle and time any large payments to coincide with the start of the cycle (doctors payments, $4.5k property tax, etc), thereby maximizing float since these purchases won’t be paid off for 60 days (30 days to next close + 30 days until payment is due). This earns me $X*(R%*2/12) in extra investment market returns where X is the size of the purchase and R is the realized stock market return. Add 5.25% cash back earned on most purchases, and credit card utilization becomes a fun game to play.

I think my issue is understanding how credit cards work. To make sure I fully understand the benefits of your strategy:

Your credit card company allows you to define your own billing cycle. What day the billing cycle falls on is arbitrary, as whatever day your cycle falls on, you will have 30 days per cycle where charges accumulate, and then 30 days to pay the card. Subsequently, by aligning your credit card billing cycle with your payment date, you don’t hold cash at all because as soon as you’re paid, you can dump it to pay your credit cards. Further, by being cognizant of when you make large purchases in the cycle, you’re able to get some additional float by pushing your payments back roughly 60 days instead of 30.

Your mortgage payments are different because your mortgage doesn’t have a cycle, you just pay the same amount monthly. Subsequently, it’s to your benefit to pay your mortgage on the last day possible, which you do (15th).

As a note, it also seems to your advantage in terms of aligning your billing cycle because you’re paid monthly. If you’re paid bi-weekly (like myself), my pay dates can be at different times of the month, meaning that I won’t be always able to sync them up perfectly. Although the added benefit is that I get paid earlier, which has some TVM value to it too.

I agree with 100% of what you said.

FYI, all credit companies I’ve dealt with (Fidelity, Citi, BoA) allow you to change your billing due date. But I also agree that it’s a moot point if you are paid bi-monthly. Being paid bi-monthly has slightly positive NPV implications but being paid monthly has its convenience implications. I love the simplicity of being paid on the 31st, then dumping (balance – $2,185.20 mortgage payment – $1,000 desired cash buffer) into investments on the 1st. Given that I’m always paid at the end of the month, there is no question that I’ll have the money to cover the autopaid credit cards the next day.

And yes, timing large purchases is a nice way of extending the 30 day float of credit cards to 60 days.

As I understand it, FDIC insurance is used to protect depositors in the event of a bank failure. It does not cover fraudulent transactions at the consumer level, as described in the above scenario. Just wanted to clear that up. BTW, this entire thread has been very educational for me as a new Fidelity client. Thank you!!

Thanks for the feedback.

Any thoughts on Robinhood (or Betterment) cash management accounts vs above Fidelity setup?

They offer direct deposit, credit card payments, ACH, ATM withdraw and decent interest (~1.80 APY at the time of writing).

I think Robinhood is a gimmick. Why not use a brokerage that’s been a round for decades? This smells to me like Zecco, Sharebuilder, and other brokerages that are no longer around.

I loathe Betterment’s AUM fees.

I earned $100 in interest in 2019. I just filed my taxes. After tax, this was $69. If I could have eeked out another 0.2% in interest on my idle cash, I wouldn’t change my system given how little cash I hold. If you hold tens/hundreds of thousands in cash, however, then fractions of a percent would make a difference.

Thanks for the reply.

Sorry if it is a novice question, is there any difference in taxes – Interest from savings account (Robinhood, Betterment or any Savings account, etc.) vs Interest from SPAXX (money market from above Fidelity setup)?

As per my understanding, I get 1099-INT for interest earned from banks and 1099-DIV for interest earned from SPAXX.

Which one is better for us?

I just filed my taxes. Fidelity CMA/brokerage income on SPRXX / SPAXX was reported on the 1099-DIV as ordinary dividends which is taxed as ordinary income. At other banks (Ally, etc), interest income shows up on the 1099-INT as interest income. Since interest income is taxed the same as ordinary dividends (i.e. non-qualified), there is no difference in tax treatment.

Hello,

The Bogleheads thread confused me and this simplified things a lot, so thank you so much.

Just a question, my Vanguard account is linked to my CMA. So, when I wanted to buy more VTSAX when the market is down, I previously kept money in my CMA only to cover transfers from Vanguard. Now, if my CMA has $0, will the same setup work? As in a buy order on Vanguard to fund from a $0 CMA will trigger the overdraft from Brokerage and fulfill the request?

Glad the post helped.

Since writing this post, I’ve transitioned all non-ATM transactions to the brokerage account rather than the CMA. This reduces the need for overdraft protection and reduces the number of transactions that occur every time you transact on your account.

However, when I first started, everything pulled from a $0 balance CMA and the overdraft was covered automatically. So I see no downside to your proposal of pulling from $0 Fidelity CMA from Vanguard.

Dumb question…SPAXX has an expense ratio of 0.42% right? How is that better than a plain old high yield savings account which has no costs and yields about 1.5%?

Not a dumb question.

The yield is the relevant metric. At the time I wrote this post, Fidelity’s yield was comparable to a high yield savings account (~2%). Since I wrote the post, the world ended and yields have collapsed to near zero. As of today, the yield on SPRXX is 0.31% which is far less than Ally which is currently yielding 1.25%.

In a world in which the yields are comparable, the Fidelity setup is better in my opinion (no 6/month transaction limit, super fast ACH transfers, really easy integration with investment accounts). However, in a world in which Fidelity is underperforming online savings accounts by 1% or more, I don’t know that it makes much sense to bank with Fidelity.

That said, I’m not sure what I’ll do going forward. I usually hold about $1k in cash at any given point, so a 1% difference in yields translates to $10 less interest at Fidelity (pre-tax) or $7 less interest at Fidelity (post-tax). $7 is probably not enough to get me to switch back to Ally (or equivalent high yield savings account). But if I were consistently sitting on $100k in cash, I’d definitely change my strategy.

Makes sense and thanks for the quick response. If not SPAXX where do you hold your emergency funds. If not Fidelity would you recommend Merrill as a One Stop shop as I already bank with BofA. I am a sucker for technology and good looking websites and I hate how Merrill looks and feels UI wise :-).

I’m not a huge fan of BoA/Merrill Edge for banking. I just keep $100k in VTSAX there to qualify for platinum honors for 5.25% cash back on CC.

The Bogleheads have discussed Schwab as a one stop shop here: https://www.bogleheads.org/forum/viewtopic.php?t=287311. I don’t think I’ve seen an equivalent Merrill thread.

I don’t have an emergency fund. If I did in today’s near-zero interest rate environment, I’d probably store it at Ally or something similar.

Right now I have a CMA and Brokerage account, unlinked for overdraft protection right now. Could I just use CMA as my personal bank(direct deposit, credit card bills, debit card, etc) and have my brokerage account as a regular taxable investing account I use to invent is FSKAX? I am a minimalist by nature and think this is a sufficient setup. Do you agree?

Also, once I open a Roth IRA when I start working (I’m a college student), can I use the funds from my CMA to start automatic investing to my Roth IRA?

Yes, it’s super simple to transfer from a CMA/brokerage account to a Roth IRA at Fidelity. That’s what I do personally.

What you lose with the CMA as a bank is the auto-sweep into SPAXX. In today’s interest rate environment, that’s not a big deal at all since interest rates are zero.

An alternative is to do as I do for cash management (CMA + Brokerage). Then open a second brokerage account (in addition to your first brokerage account used for banking + your CMA). This second brokerage account would be used for investing and, given the separation from your banking brokerage account. The separation of brokerage accounts would act as somewhat of a firewall, preventing a fraudulent ATM transaction, for example, from affecting your investing holdings. I think the Bogleheads forum thread discussed this strategy.

I see what you are saying. Would it be sufficient though to just manually purchase SPRXX and just use CMA with no overdraft protection and have a separate brokerage for personal investing?

Yes, that would certainly be sufficient. Much simpler setup , but you’d have to remember to buy money market funds each paycheck.

Thank you for your help!

Do you know if this app has the tax harvesting feature?

What app are you talking about? I’m talking about a brokerage (Fidelity) in this article.

Sorry I meant for the Fidelity IOS app. I have the Fidelity cash mgmt account and was wondering if the app facilitated tax loss harvesting like a robo-advisor app would (like Betterment or Wealthfront).

Outside of the roboadvisors, TLH would be a manual process. At Fidelity, it could be accomplished with a couple mouse clicks. Sell total stock market index, buy S&P index. 30 seconds of work per year does not justify Roboadvisor’s high fees.

You can read my rant about it in the comment section of this page: https://www.mrmoneymustache.com/2017/02/01/betterment-cranks-up-features-and-costs-is-it-still-worthwhile/

Haha, thank you sir. I will.

Now that SPAXX is basically yielding 0%, any second thoughts about this setup? I used to use Schwab Bank and kept my Ally account lying around. I’ve switched back to Ally. I keep some in checking, but “pay myself” into my savings. Then a few times a month (before my BofA autopay hits) I’ll transfer funds to checking. Overdraft always bails me out too.

Good question.

I have access to a 2% grandfathered checking account from a local credit union through my affiliation with the university. I spent about an hour thinking about whether it’d be worth the time to switch everything (all autopays, etc). I hold about $1k in cash at any given time. $1k in cash * 0.02 = $20. After taxes that’s $14, or $1.17/month.

I like the Fidelity setup enough to forgo $1.17/month in interest.

If I hoarded cash like many people do, I suppose it would be a different story.

But I really do like the Fidelity setup. The primary disadvantage I’ve found is the lack of check images on the brokerages/CMA statements for remote deposits. It’s a small enough disadvantage that I’ve decided to stick with it despite the 0% interest rates.

FP, came across this post last week while searching the interweb for others’ experience with Fidelity CMA. Been hooked on your entire blog and approach to personal finance ever since. I’m mid 30s married with three kids and have always considered myself thrifty and good with my finances. Always saved aggressively for retirement (or so I thought) and always lived below my means. Suffice it to say, my mind has been blown. I’ve had a financial advisor for over 10 yrs who’s “looked after my portfolio”, but…… yeah, that’s gonna change. After pouring over your blog and other material you’ve linked to, I feel like a baby learning to walk again. But, here’s to a new day.

Thanks for the note! Stories like yours are the reason that I maintain this tiny and inconsequential blog. Feel free to reach out if you need any guidance along the way. The comment section is the most logical section to do so because it allows others to contribute to your response as well.

Congrats again on taking ownership of your investments and financial future. Your future self will be hundreds of thousands of dollars richer as you increase your after-fee returns by 1-2% per year (by avoiding fees). It’s even better once you account for the enormous tax savings if you’re not already optimizing on that dimension.

The tax savings topic has been an eye opener for me. I’ve always just contributed up to my employer match on 401k, then max out Roths, then been working toward 401k max. Your posts on tax arbitrage and savings hierarchy have been most enlightening. I will definitely re-prioritize based on this newly acquired knowledge. I’m trying hard not to dwell on what could have been had I realized all this before now!

Glad to see that you have come to appreciate the power of tax optimization. If you haven’t read the PDF that I wrote, you would probably enjoy that. You can access it using the draft book link in the header.

I finished reading it (in big gulps) and did indeed enjoy it – especially the section on taxes. I had to do some trust but verify checking against the IRS website, but wow, didn’t realize how stupid easy it is to calculate one’s tax burden. I never took the time to understand a progressive tax system until now, but your book helped me in a big way. Anyway, I digress as related to the content of the original post, but keep up the good stuff. I’ve now made the jump to managing my own assets and it’s completely changed the way I view my (now much more potentially early) retirement.

Congrats and best of luck to you on your journey!

FP,

In the current interest rate environment, it makes more sense to use an online savings account or T-Mobile money.

I agree with you. I have access to a 2% checking account currently and have concluded that it’s not worth the hassle for me to switch banks to get a couple more bucks in interest per year given that I hold close to $0 in cash.

Hello,

Other than the $1K in your brokerage account at Fidelity, do you keep anything in cash/savings for expenses like vacations, major repairs, etc or everything goes into the taxable account at Vanguard and you pull from there as needed?

I keep nothing outside of $1k cash. The rest goes into retirement + taxable brokerage. We do cheap vacations (near $0 expense). We hit a deer at 80mph a few years back that cost us $5k or so. We put it on a credit card to get the rewards and had plenty of time (~45 days) to figure out how to pay for it (mainly by decreasing savings contributions as a result of the increased credit card bill). This past month we paid $11.5k replacing VHAC systems for our home. We did the same this time around. Put it on a card to get the 2.625% cash back + 45 days of float. I’m going to drop investing contributions to $0 for the coming pay cycles to pay for it. If that were not sufficient to cover the expense, I’d liquidate some of my taxable brokerage (and preferably harvest any tax losses along the way to lower my tax burden).

I had opened a Fidelity Brokerage and CMA maybe 10 years ago, it looks like Fidelity has closed the CMA at some point. The only reason I know that is by looking at your screenshot which shows the category of Investment Account and Savings,Checking etc. So, theoretically, I could use my Fidelity’s bill pay service with my brokerage account ? I’ve been using Alliant as primary for about a decade, but I wonder if Fidelity would be more convenient.

When was Ally ever paying 5% ?!?!

Ally paid 5% back in 2005/2006 when I was wrapping up my undergrad: https://www.firstrepublic.com/finmkts/historical-interest-rates

Rates haven’t always been 0%, even though it sure seems like it.

I didn’t know Ally was even around that long ago. I thought it was rebranded from General Motors after the financial crisis.

Now that you mentioned that, I definitely joined them while they were still GMAC, so I was surely around during the whole rebranding effort. I’d forgotten about that until your comment.

It looks like I have a choice of FDRXX or a FDIC bank for my core position in my HSA. There’s rarely ever much money in there since it auto-purchases FZROX, but which would be the optimal choice?

I don’t know that it makes one iota of a difference in a zero interest rate environment.

Thanks so much for your write-up, FP. I’m considering switching to this setup, and have a question for you.

I already have two Fidelity brokerage accounts—one for investing and another as an IRA. I am planning on adding SPAXX to the investing account as the core position, and linking that account with the CMA as described here.

Or should I open a third brokerage account independent of investments and IRA to serve as my checking/savings?

When I say “brokerage” account in this article, I’m referring to a taxable brokerage account. Not an IRA.

If I were you, I’d open up a new brokerage account (if they let you) to keep your checking/savings separate from your investing. I don’t like the idea of comingling those.

If they don’t let you do this, then you can do your checking/savings with the CMA account with some tiny nuisances described above.

Thanks, I appreciate that, and that’s what I’ve done.

Firstly thanks for this, and all of the other info you provide.

With the gains by holding cash in the Fidelity CMA have dropped to nearly zero, have you looked into M1 Finance at all? I’m curious about using them as a nearly one-stop-shop. Like you I don’t put much in a true savings account, I prefer to invest anything I’m not going to need in the short term. With that said the balance on my checking generally sets pretty high because, like you again, I direct every bit of spending possible through credit cards for the cash back and I hold the payments until the due dates.

With their M1 Plus ($125 a year) you gain 1% APY on their Spend account and a few other bells and whistles on their investing side. Their investing platform is interesting because it’s somewhere between a robo-investor and a traditional brokerage. They’re options seem more limited, but it seems dead simple to setup a “pie” as they call it with VTI/VXUS/BND or similar and define the allocations and they automatically maintain the ratios. I think they mostly handle the balancing by adjusting how much goes where with your deposits versus doing a lot of actual re-balancing by trading amongst the investments.

Matt,

Thanks for stopping by!

The truth is that I ditched Fidelity for a 1.5% rewards checking account offered through an affiliation with my university when yields dropped to zero. I strive to keep about $1k in cash at any time. By ditching Fidelity, the 1.5% yield on $1k is $15/year pre-tax, or $10 after-tax. Suffice it to say, it was not worth the effort to change my autopay to the rewards checking account.

It seems that $125/year is not a bad fee for what you describe at M1. It certainly beats a 1% AUM model. I love the simplicity of my system so much that I don’t think I’ll ever deviate from it: 1.) retirement & IRA & HSA at Fidelity. 2.) taxable in VTSAX at vanguard. All-in weighted avg expense ratio on $1,335,000 is 0.032% or $400/year. Given the simplicity and the ease of tax loss harvesting (since VTSAX is tracking a different index than FZROX, for example), I can’t every see deviating from it.

I just came across this thread. I actually prefer & use BOA for Bill Pay. Main reason is that it allows you to link external other bank accounts to use for Bill Pay. I simply point it to my Fidelity CMA or Reward Checking Account or whatever checking account I am using primarily. Right now it is pointing to T-Mobile Money to pay bills. This way I don’t have to setup my credit card accounts (which is too many depending on which bonuses I go after) & other payees in different Bill Pay services if I switch my checking account. BOA has the usual e-bills, auto-pay and other services too.

I’m glad you have had a positive experience with BoA’s Bill Pay.

Every time I log onto that god-forsaken site, my life expectancy is shortened by a month because the frustration elevates my blood pressure to unhealthy levels.

I can’t seem to find that SPAXX yields 2.05%. I am seeing 0.01% 1yrs, 0.65% 3yrs, 0.48% 5yrs, 0.24% 10yrs and 1.67% after taxes and distributions. Thanks for your guidance.

*1.67% Life

The yields in the article are stale thanks to the plummeting of rates to zero these days.

Thanks for the post, quite interesting approach. Could this be done with something other than SPAXX or using a MMA? Could it be done using FXAIX instead of SPAXX?

Here are your options: https://www.fidelity.com/trading/faqs-about-account#faq_about2

Thanks for the info!

The funds listed, SPAXX, FZFXX, and FCASH are not that good. I found interesting that the footnote says:

“Generally speaking, these are the options available to you at the time you open your account. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose.”

The one part I need to find more information about are what other options are available for the core position once the account has been established.

Happy to help.

That is a cryptic footnote. My experience is that SPAXX, FZFXX, and FCASH are my only options.

A year or two back interest rates were pretty good. Now they are miserable.

so you don’t use fidelity brokerage for checking no more?

Once interest rates dropped, I converted back to a local credit union paying me 1.5% for checking. It’s a deal for local faculty.

I’d happily go back to Fidelity once interest rates increase. I miss the lightning fast ACH transfers.

(In the grand scheme of things, I think I’ll earn a couple dozen dollars of interest as a result of changing. It probably wasn’t worth my time to switch over my autopays given how little cash I hold.)

Stumbled upon your site here researching SPRXX and have started to research how I can use this as a core position in my fidelity TOD account. For some reason when I click “Change Core Position” it says there are no new core positions to select, so reached out to Fidelity to see if they can help. SPRXX shows a 7-day yield of 2.96% as of this writing which I would love to be getting in that account.

SPRXX can’t be “core”, but SPAXX can. Once a month (payday) I manually buy SPRXX.

You can also experiment with auto-purchases within the account. Once a month on the 1st of the month, buy $X of SPRXX. If you don’t have enough $, the auto-purchase doesn’t fill. If you set this up creatively, you can create your own auto-sweep feature.

Also, the 7-day yield is 3.10% as of 3/11. You need to dig deeper on the site to find the more current yield: https://fundresearch.fidelity.com/mutual-funds/view-all/31617H201

Thanks for letting me know that core position can’t be SPRXX and has to be purchased manually. Since this is a mutual fund, do you use this fund as a temp savings account and move money in / out as needed between SPRXX and SPAXX? Also, can’t remember but does Fidelity restrict movement out of mutual funds – or can you move it out as often as needed?

It is indeed my savings account. I hold only SPRXX, since I’m paid monthly and it’s easy enough to place a buy order 1x/month. There aren’t any restrictions on moving money out of the MF’s. It automatically liquidates when you pull, as I describe in this post.

Great advice! I’m going to start today moving all of my cash in my IRA’s and cash management account in Fidelity from SPAXX over to SPRXX and set up scheduled automatic transfers so that any additional can earn at the higher rate – had no idea that I could be earning a little more this way.

Thanks much for this post! I’m finally getting off my backside and getting things moved over to fidelity now that interest rates are back up… I really like your blog and I hope you’ll continue posting. One comment, LastPass has been breached really badly so I think it would be worth removing that recommendation from this post.

Fair point on Lastpass. I’ll update the post.

👍

Hello, thanks so much for taking the time to explain this setup. Thanks to you I am going to optimize my setup the same way. Quick question : when setting up ACH from other financial institutions, they typically ask if the account is a checking or saving – sometimes brokerage is not an option. When asked I indicate “checking” although the fidelity account targeted is a brokerage one. Did you ever get an issue with that ?

Thanks again, your blog is fantastic!

Good question, and I’ve been similarly confused on how to answer it when asked. I think most of the time I choose “savings”, but I’m sure I’ve also answered “checking” at times. I’ve never had an issue with either.

One thing about the routing number. There are two variations of the routing & number for the same account. One shows up on your checks. The other shows up when you click on the three dots on the top of your brokerage/CMA account at Fidelity.com. When setting up ACH linkages to other firms, I always try to use the longer account number (should start with 3990000) & the accompanying routing as shown on the website.

A weird quirk, but it has never failed me. The numbers on the check should also work too.

Here’s a reddit post on the topic: https://www.reddit.com/r/fidelityinvestments/comments/t0dnqm/how_to_determine_correct_account_for_dir_dep_from/

Thanks!

Im a recent fan of this blog. Ive setup fidelity brokerage & CMA. Im trying to setup autopay of my bank of america credit card, but im lost. Did you set it up in BoFA or Fidelity?

Set it up at BoA. Same as before using their Bill Pay interface. Just update the “from” account to your Fidelity account.

First of all, thanks! This post was one of the things that persuaded me to use Fidelity for my normal personal banking, as described here, which has worked great for me for the past few years. I’ve recommended it to a few others as well, and always give them a link to this post when I do.

There was a short while where I tried to use Interactive Brokers as my main account (direct deposit into it, and autopay out of it) because their margin rates were so low that I could invest everything immediately and not worry about needing to have cash on hand to cover expenses because it would just come out of portfolio margin, so things like credit card auto-pay would always clear regardless of whether the account contained any uninvested cash at the time. However, that became less attractive once rates rose again (where idle cash does yield somewhere approaching expected market returns, and any returns from investments made on portfolio margin would be negatively offset by the cost of borrowing the money in the first place), so, despite still having an account there, I never went through with fully migrating. Perhaps I’ll reconsider if/when rates drop again. In the mean time, re-reading this has reminded me about aligning my credit card due dates to something useful, and now that I have the funds to qualify for BoA Preferred Rewards as well as the credit score to qualify for the BoA cards, it’s probably time to give that a try too. I had forgotten that both these great systems had come from the same blog 🙂

Now for what made me leave a comment in the first place: The Fidelity interface has changed since the screenshots in this post were taken, so the way to get to the part where you set up self-funded overdrafts isn’t clear anymore. I took new screenshots to send to friends & family who were trying to replicate the setup of this post, but it doesn’t seem possible to include images in comments here. I hate to ask you to do more work, but, I bet new folks would appreciate it if you would update the screenshots in this post. It’s otherwise great, and much appreciated!

Thanks for stopping by!!!!

Glad that you’re joining the BoA + Fidelity club. I remain a pretty happy camper with them several years into the experiment. The credit goes to the Bogleheads, my source of all useful financial knowledge.

On the topic of updating screenshots, thanks for the suggestion! I’ll do that in the next few days when I’m not feeling so lazy. I had no idea that the interface had changed, so thanks for the heads up.

Hi, I’ve been working on this setup since the rates seem good. I’m a little confused on the purpose of purchasing SPRXX when the brokerage account sweeps into SPAXX? What does it change?

As of today, SPRXX (5.04%) is yielding about 0.1% higher interest vs SPAXX (4.96%).

Because I hold SPRXX, I’ll be a few pennies wealthier than had I held SPAXX.

In many states, it’s more beneficial to hold T-bills and/or FDLXX (Fidelity Treasury MMA) due to the tax savings.

The MM Optimizer from BogleHeads does a great job showing your which MMA is in your best interest. Just an FYI: For the last 2 years, nothing has beat 4 week T-bills, though VUSXX and VMRXX have been quite good. At Fidelity, it’s usually the regular accounts unless you’re in a very high tax bracket (ie 37%+ and NY/NJ/CA top tax brackets). In those cases, T-bills still win with the top MMAs usually be Muni(Fed and/or state).

Thanks for the suggestions. I hold very little cash, so chasing after tens of basis points doesn’t matter to me personally, but if I were to hold 6-figures plus in cash, I’d surely be a lot more strategic about it. Thanks for the resource in case I ever change my no-cash policy.

In the lower interest rate environment, I held less in cash, but I was fearful of the market not performing well (during COVID, d’oh!) ,and I needed the cash for other expenses, so getting 5%+ is welcome.

5%+ is indeed >>> 0%. I’m a fan of higher interest rates, but that increase in rates was terrible for bond investors over the past 2-3 years. Luckily I had the foresight to not buy into bonds at 1% yields…

I liquidated bonds when they fed rate hit 0 last time. Nowhere to go but down (unless you’re buying into the G fund).

Smart man. We just lived in a period of a prolonged bond bubble.

Perhaps in a year’s time I’ll be making the same comment about equities as well…. Bubbles are a lot easier to identify after the fact.

Thinking of doing this too but is it correct to assume that SPAXX future returns is the guiding principle on this and if interest rates go down in the future, then making this change from another bank won’t yield much? For e.g. would it have made sense moving all cash to Fidelity CMA in 2010? Perhaps not right?

The Fidelity Money Market setup is as good as it comes for a cash management account. MM yields are slightly higher with Vanguard money market funds, but you lose a ton of functionality (auto-liquidation, atm reimbursements, etc).

You’re correct that in a zero interest rate environment there is not much upside to the Fidelity CMA setup, since MM yields of 0% would approximately equal checking account interest of zero. Even then, however, there are advantages to Fidelity’s CMA: worldwide ATM fee reimbursements, super fast ACH transfers (I get paid a day early because of this), free checks, “one stop shop”, etc. That said, there are some minor disadvantages: a bit more complexity, arguably harder to get support if you run into issues (e.g. theft), etc.

We hold so little cash (~$1k) that it frankly wouldn’t matter where we bank, but I find enough upsides to stick with Fidelity because I like the setup.

Apparently on the 20th, you can change the settlement fund on the CMA to FDRXX. I’d point out Robinhood, M1, and others are now competitive.

Great news!

Channeling crystal ball to win lottery AND use options in Roth to challenge Thiel.

I would not complain about a seven figure Roth balance…

Peter Thiel has a 9 figure Roth IRA.

I recently landed a tt position that offers 403b and 457b. I’m wondering if you would suggest doing Roth for both 403 and 457? I have maxed out Roth IRA and employer match, and plan to make additional contributions to 403 and 457. Should I use tax-deferred plan or Roth for additional contributions? Thanks for your insight.

Congrats on the job!

A few thoughts:

* I’d prioritize the 457 over the 403b, but maxing out both is even better.

* My rule of thumb for Roth/Trad is as follows: If your federal marginal tax rate >= 22%, then do pre-tax Traditional. If your federal marginal tax rate is <= 12%, then do post-tax Roth. If your income straddles that threshold, then do both (Trad to bottom of 22%, then Roth for anything under). Obvious disclaimers apply: * It's hard to make an informed decision today when future tax rates are unknown. * If the government/debt level is going to hell, perhaps Roth is more prudent now with the obvious caveat that the gov't could renege on the tax-free nature of these assets. * Etc. Good luck! As for us, we're in the 100% Trad camp by following the logic above.

Thank you so much for your reply. I have another scenario in my head. Assuming I get tenure and will work till 70 before retiring, I will make at least 20k/year from 35 to 70 and start to withdraw retirement funds after 70. Would you think Trad plan is still better than Roth in this case given the time the assets have to grow?

To put it another way, will the capital gains based on deferred tax outweighs the tax saved through a Roth plan over 35 years?

I still find this complicated. My IRA is Roth and employer match is Trad. I wish someone can come up with a magical formula that allows me to calculate lol.

The only thing that matters when deciding Roth vs Trad is your tax rate on the contributions now vs the tax rate on the withdrawals in retirement.

Let X be the amount of pre-tax income contributed to either a Roth or Trad now. Let R be the rate of return. Let N be the number of years in the future. Let T_now be your marginal tax rate now. Let T_later be your marginal tax rate on the withdrawal

Future Value of Roth:

X*(1-T_now)*(1+R)^N

Future Value of Trad:

(X*(1+R)^N)*(1-T_later)

If you’re trying to compare which will be bigger

FV of Roth vs FV of Trad:

X*(1-T_now)*(1+R)^N vs (X*(1+R)^N)*(1-T_later)

Simplify by dividing both sides by X*(1+R)^N

(1-T_now) vs (1-T_later)

In other words, all that matters is your marginal rate now vs your marginal rate on the withdrawal.

Here’s a blog post: https://frugalprofessor.com/trad-vs-roth-marginal-vs-marginal-vs-marginal-vs-average-wisdom-from-mdm/

Also check out the PDF of my “book” in the header of my blog.

My rule of thumb is a good one, I think. Trad if MTR >=22%. Roth if MTR <=12%. Both if your income straddles the cutoff.

I think there’s another reason that doing trad 457/403 + roth ira is beneficial. I notice that the tax brackets increase every year. For now, dollars above 100k are taxed at 24% (which is my case, single). However, 35 years later, it’s possible that dollars above 150k get taxed at 24% and 100k taxed at 22%. So I can pay a 22% tax in the future on what I am taxed at 24% today. With that, roth ira can help further lower the tax rate.

This is helpful. I just changed my 457 to 100% Trad. I’m not able to max out 403 at the moment tho.

I think that having a good mix of Trad/Roth/Taxable is a great scenario to find yourself in in retirement because it creates optionality. See this post: https://frugalprofessor.com/5-kids-169817-income-0-taxes/

I can easily foresee paying $0 in taxes on >$100k/year of withdrawals in retirement.

@FP, are you going to update this to add the FNSXX/FRSXX information?

I was thinking of rewriting this post entirely with the knowledge I’ve gained over the past 5 years.