Well, that happened pretty fast.

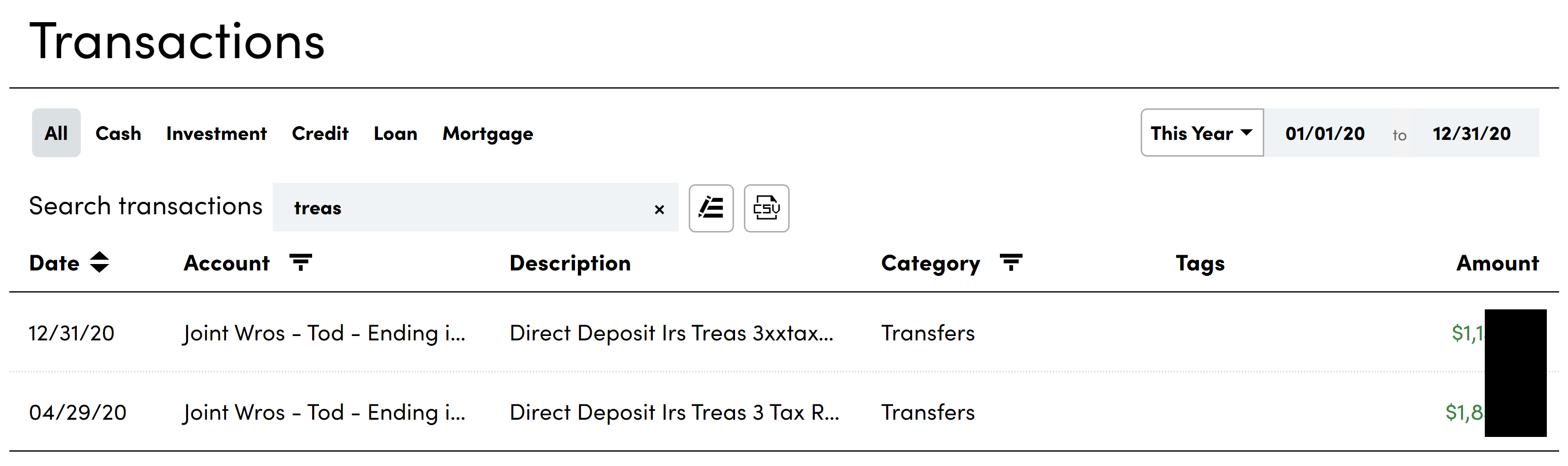

My Coronavirus Stimulus 2.0 hit my Fidelity (which has lightening fast ACH processing times) account this morning. If you don’t bank with Fidelity, presumably this will hit your account tomorrow?

Here’s what I understand about the new stimulus:

- $600/adult + $600/kid if aged 16 or younger.

- 5% phase out above $150k 2019 AGI for MFJ and $75k 2019 AGI for single.

- The formula to determine the size of payment is below:

Stimulus size = # people aged 16 or younger * $600 – 0.05 * (2019 AGI – 150k)

If single, replace $150k above with $75k. If income is below the phase-out region, ignore anything past # people aged 16 or younger * $600.

I confirmed the above and my stimulus payment matched the above to the penny.

With the first round of stimulus, the phase out region was recoverable when filing 2020 taxes in April of 2021 if 2020 AGI < 2019 AGI. I’ve personally confirmed this with FreeTasUSA’s currently available 2020 software.

I’ve yet to read anything indicating that the second round of stimulus is also refundable/recoverable in the phase-out region, but reason seems to indicate that it should also be recoverable. If anyone has information either way on this, please let me know.

This IRS link seems to indicate that round 2 of the stimulus is also recoverable (link):

Eligible individuals who did not receive an Economic Impact Payment this year – either the first or the second payment – will be able to claim it when they file their 2020 taxes in 2021. The IRS urges taxpayers who didn’t receive a payment this year to review the eligibility criteria when they file their 2020 taxes; many people, including recent college graduates, may be eligible to claim it. People will see the Economic Impact Payments (EIP) referred to as the Recovery Rebate Credit (RRC) on Form 1040 or Form 1040-SR since the EIPs are an advance payment of the RRC.

If the second round is indeed recoverable for those with 2020 AGI < 2019 AGI, this creates an additional implicit 5% marginal tax rate on income earned this year which is particularly relevant for those making Roth conversion and “Roth vs Trad” decisions. If true, it amplifies one’s implicit marginal tax rate by 10% relative to existing federal + state rates.

Mine landed in my Fidelity account as well.

Glad to hear.

I’d certainly seen the headlines but I didn’t have any idea that was coming this soon.

I thank my unborn (great) grandchildren for their generosity in paying for the stimulus. I’ll try to pay it forward to them by investing it wisely and leaving it to subsequent generations.

Do you have to pay taxes on it? Thanks, for the info! Have a happy New Year!

Nope. Tax free.

Looking at your monthly updates from 2019, you earned over 200k. So how did you qualify for the stimulus?

Maxed out 401a, 403b, 457, HSA. And I have five kids so the stimulus is larger and the resultant phase out region is much longer.

I feel like I am doing something wrong when doing my taxes! My household income is similar to yours ~$240K and we maximize two 401k accounts and HSA for total of 44K. My 2019 tax return is showing AGI of 211K after adding dividends. Does this sound okay to you? Thank you in advance.

2x$19,500 – 1x$7,100 = $46,100

$240,000 – $46,100 = $193,900

From my calcs, your AGI should be $193.9k, not $211k. Are both of your 401k’s Traditional? If you are inadvertently contributing to a Roth 401k, that might be the reason for the large disparity.

While I don’t have access to a spouse’s 401k, I have access to my 401a, 403b, and 457. It really adds up since all are pre-tax Traditional accounts.

For some reason HSA contribution is not substracted from W2 box 1. Seems like this is a costly mistake. I always assumed HSA contribution was deducted from my income, and hence did not do pay attention. I am nervously searching the internet for answers!

My previous message was a false alarm. My wife or I did not know what her gross salary was! Her W2 does not report gross salary anywhere. It appears that whatever number reported in box 1 is (gross salary – 401k -HSA). So our gross income is close to $250K. I am relieved now. Thank you for your time.

Happy to help. I wish I had the problem of having a larger-than-anticipated salary! That’s a great problem to have!

Mine hit Fidelity on the 31st as well, I was impressed with the speed!

These payments initially make me uncomfortable but then I get used to it and usually let my wife know cash hit our account. Then make some joke about buying cruise stocks, unless it is 2008 then I talk about buying Ford.

I never actually buy anything, though.

Max

I used ours to fund our 529 since I’d already set aside a pile of cash to fund our IRAs on Jan 1.

My unborn grandkids will pay for the stimulus, so I figure I’ll invest it wisely for them.