Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Skid Row Marathon (link).

- A documentary about a judge helping to lift people out of homelessness through a shared hobby of running. One of the best movies I’ve seen in a while. It made me want to be a better person. (It’s on Amazon Prime).

- Inspired to Ride (link).

- A documentary about an unsupported amateur cross-country bike race that goes from the Oregon coast to Virginia’s coast.

- If not for the (very real) risk of getting killed by a vehicle, it looks like something I’d like to do before dying.

- Universities have begun furloughing staff/faculty (link):

- At the state level, the combination of decreased revenues (income tax, sales tax, and reduced enrollment) and increased expenses (social safety payments like unemployment and Medicaid) has made for the perfect storm for publicly funded universities.

- U Arizona was first to act, cutting faculty pay by up to 20% for 14 months. I would be shocked if my university does not follow suit with similar cuts.

- As of today, our school is planning to open up in-person teaching in the fall. I remain skeptical that this will work out, but I hope I’m wrong.

- Bill Gates on how we get out of this mess (short version, long version).

- Bogleheads discuss:

- Beau Miles (link).

- I’ve spent many hours devouring his Youtube content. He’s an adventurer / filmmaker / kayaker / outdoor recreation professor.

- Planet Money explaining why hospitals are in trouble (link).

- A friend of mine is a radiologist who recently took a pay cut because of the coronavirus. You would think that radiology services would be in high demand during a global pandemic, but the reality is that people are deferring elective procedures. It seems that this phenomenon is occurring across many medical specialties. It’s amazing how far reaching the economic fallout is.

Life

- I started socializing more over Zoom. It’s been great.

- We started weekly lunchtime chats with colleagues. It’s been a great way to stay connected to the group. I think it has kept many of us from losing our sanity.

- We had two game nights with college friends and played Jackbox Party Packs. Those games play very well remotely over Zoom. Preferably, each household would have their TV connected to Zoom via their laptop. One household hosts the Jackbox game and shares their screen. Then each player participates in the game with their phones.

- I accidentally joined a middle-aged man biker gang.

- A neighbor and I started going for 1-2 hour bike rides many weeks ago. A third neighbor joined us a couple weeks ago. A fourth joined us last weekend. On our last ride, we put in almost 20 miles. The oldest in our newly formed biker gang is 63 and the youngest is 38. It’s crazy that it’s taken a pandemic for me to meet and socialize (from at least 6 ft away) with neighbors I didn’t know. I hope the tradition continues post pandemic.

- Our goldendoodle was long overdue for a hair cut. They don’t shed so you have to trim them. Given what a cheapskate I am, I wanted to do it myself to save the $100. I asked friends with doodles if this was a good idea. They unanimously informed me that it was a terrible idea. So what did I do? Naturally, I ignored them and purchased $160 of grooming supplies (clippers + guards). Some how, I convinced Mrs FP to join me. Eight man-hours (and much cursing) later, we did it. It was horrific, but we effectively earned $12.50/hr (tax-free!) through our labor.

- Even if we never groom the dog ourselves again, the $160 + 8 hours will have been well spent because I will never resent spending $100 in grooming fees in the future.

- It was quite the spectacle; neighbors on both sides witnessed the multiple hour debacle and made funny comments to us the following day.

- I sent a package to a friend via USPS for the first time in maybe a decade. Thanks to this Reddit post, I learned that you can use Paypal’s “Ship Now” feature to not only calculate postage but pay for postage and provide a label. If you’ve ever returned something via Amazon, it’s similar to that. It really couldn’t be easier to send a package and leave it for your mail carrier to pick up, provided you have a scale to measure the weight. The tool even accommodates reduced “media mail” shipping rates when applicable.

- Given that teaching is wrapping up, I recorded a 90 minute video for my undergrads giving them life / investing advice. You can watch it below if you’re interested.

- I’m quarantined with 5 kids and an unruly dog so the background noise gets a little out of hand at times.

Spring weather brought outdoor activities like archery in the back yard / field of weeds.

Some of the most fun we had this month was with these nerf guns. The guns are many years old but we bought a 400 pack of off brand replacement darts. The replacement darts were blazing fast (and kind of painful when getting hit). Safety glasses are HIGHLY recommended (speaking from personal experience…).

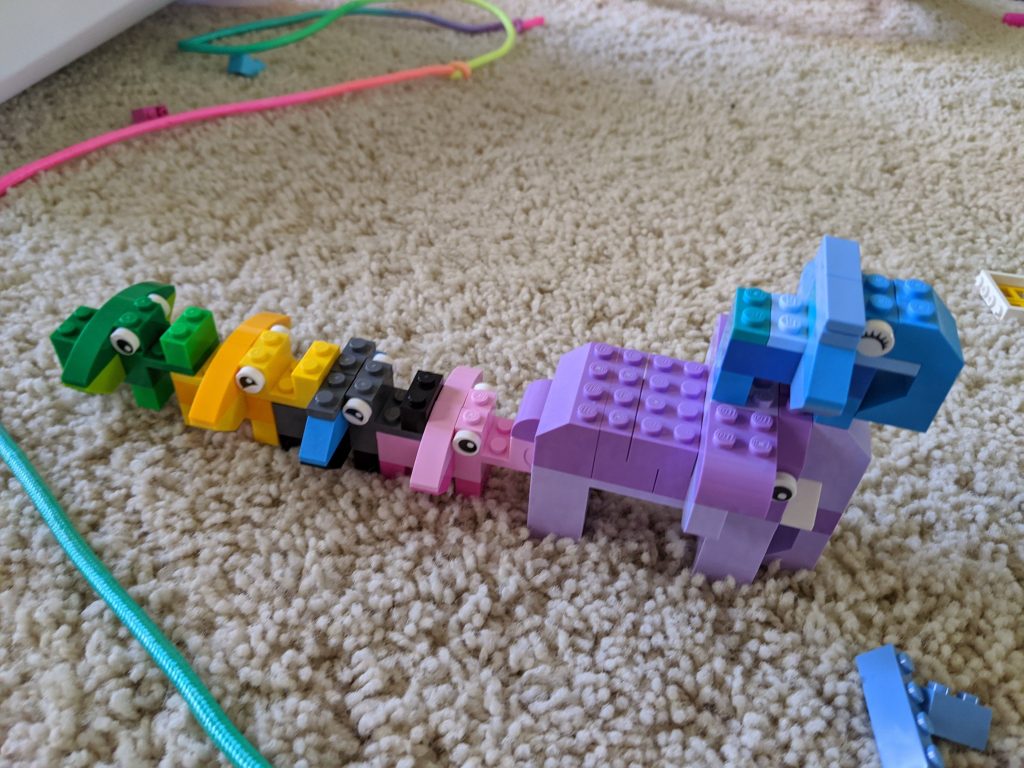

After watching Lego Masters on TV (highly recommended), the kids have been inspired to play with their Legos. We bought a new set at Costco to supplement our old set.

The kids did some backyard camping. It all went well until our dog jumped through the mesh bug screen / window of the tent, destroying the tent in the process. Another $100 to the cost of dog ownership.

It snowed.

Easter egg hunt on the climbing wall.

We wrapped up our “marathon in a month.”

At one point we recreated a Thanksgiving meal thanks to buying a heavily discounted turkey at Costco the day after Thanksgiving. Now that’s my idea of Black Friday shopping!

We had fun during FC5’s birthday party.

We had fun during FC5’s birthday party.

This month’s finances

- The good:

No catastrophes.- Still employed…

- We received $1844 in stimulus money, which we used to top off our annual 529 contribution.

- It was nice of the government to base the payment off of AGI rather than gross income. This rewarded those of us who were already sheltering income in pre-tax vehicles (401k/403b/457/HSA/Trad IRA).

- Since our 2020 income will be lower than our 2019 income, we’ll get about $1700 more stimulus when we file taxes in April of 2021. When the inevitable furlough hits, our stimulus will further offset 5% of the furlough. For those in the phase-out region of the stimulus, you get an extra 5% of “tax alpha” for every dollar you can get your 2020 AGI less than your 2019 AGI through utilization of pre-tax savings vehicles (401k/403b/457/HSA/Trad IRA).

- With the 529 contribution behind us, all tax-advantaged vehicles are now maxed out for 2020 (HSA, 457, 403b, Backdoor IRAx2, 529). From here on out, it’s back to the lowly taxable brokerage account.

- I’m an idiot for not tax loss harvesting while I had the chance. At the trough (which is only recognizable in hindsight), I had several tens of thousands of dollars of unrealized losses. Since most of my taxable assets are at Merrill Edge so it created a logistical challenge to orchestrate the TLH since I’m invested in Vanguard index funds and not ETFs (ideally, I would have transferred assets to Vanguard to avoid transaction fees, tax loss harvest at VG, then transferred assets back to ME). Oh well. I’ll continue to look for opportunities to do so during the remainder of 2020.

- It was nice of the government to base the payment off of AGI rather than gross income. This rewarded those of us who were already sheltering income in pre-tax vehicles (401k/403b/457/HSA/Trad IRA).

- The bad/abnormal:

- $4,221 property tax bill (+$99 CC processing fee) for first half of 2019 property taxes.

- Ouch.

- I continue to enjoy having a 2.625% cash back credit card (at a minimum) to more-than-break-even for credit card swipe fees, giving me 60 days of interest free float given that I time the transaction to occur on the first day of the new cycle.

- If markets return 6% in a given year and we get 45 days of float on our average transaction, I figure this inflates our investment returns by around $45k * 6% * 45/365 = $333/year.

- $907 in copays + drugs. Healthcare is incredibly expensive.

- Without any coupons/discounts, the full price of our kids’ asthma + adhd meds is $8,100/year at CVS (=($175 Arnuity Ellipa * 3 kids + $150 Concerta * 1 kid) * 12 months). We could save 50% by circumventing our insurance and using GoodRx, but if we go down that route none of this spending (around $4,050 after GoodRx discount) counts towards our deductible. It’s infuriating that I have to overpay by 100% to have the charges accumulate towards our deductible.

- Through a miracle, we snagged a manufacturer’s coupon for asthma meds for 2020, dropping the $175/person/month cost to $10/person/month. Even better, our insurance is bizarrely counting $175/person/month to our deductible rather than the $10/person/month we pay. Screenshot below.

- Luckily, we’re getting 10.75% cash back at CVS via:

- 3.5% Raise discount (link) + 2% Rakuten at Raise

- The Raise discount has to be applied to the subsequent Raise purchase. Kind of annoying, but not too bad.

- 5.25% BoA cash back (“Online” category with Raise)

- The above can be implemented with or without GoodRx. Simply buy the CVS gift card at Raise and use in store.

- I admit that it may seem weird to obsess about a few percent saved at CVS, but when you can save 10.75% percent on thousands of dollars of prescription costs per year it adds up.

- 3.5% Raise discount (link) + 2% Rakuten at Raise

- Without any coupons/discounts, the full price of our kids’ asthma + adhd meds is $8,100/year at CVS (=($175 Arnuity Ellipa * 3 kids + $150 Concerta * 1 kid) * 12 months). We could save 50% by circumventing our insurance and using GoodRx, but if we go down that route none of this spending (around $4,050 after GoodRx discount) counts towards our deductible. It’s infuriating that I have to overpay by 100% to have the charges accumulate towards our deductible.

- $416 Unfrugal dog.

- $160 grooming supplies.

- $136 in bulk chew toys (150 cow hooves).

- $60 vet bill for shots.

- Rest on food.

- Tent not billed yet.

- $290 term life insurance premium.

- Not enough in the bank to self insure yet…

- $200 HoA bill.

- $4,221 property tax bill (+$99 CC processing fee) for first half of 2019 property taxes.

Thanks to the 2020 asthma coupons, we’re getting $175.92 of credit towards our deductible for only $10 of spending every time we fill the prescription!!! Too bad this coupon is set to expire at the end of the year!!!!!!! It’s basically $4k of free money this year (since only 2 of my kids are on this particular medication this year).

Full version is downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads as well as the inability to buy partial shares. With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link).

- I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Is that a disc golf basket in your back yard? Terrific frugal hobby.

Looking forward to watching the video this weekend. Thanks for sharing.

Our friends live about 1/4 mile away from us. For some reason, they bought a disc golf basket and installed it in our back yard / field of weeds. It has been here for years. I should probably pay them for it…..

I was introduced to frisbee golf during my undergrad and fell in love with it. There are some pretty good courses by my house.

I didn’t know you had a climbing wall! Ours has saved us so much cabin fever during snow season. I’m watching the will-we-reopen-college-this-fall news anxiously since our town’s economy is centered around the university.

The basement climbing wall has been great for us as well. I’ve been planning on expanding it for 2 years but haven’t done so because I’m an incompetent handyman. I’ll have to wait for my father in law to visit again to finish it.

I really have no idea what to expect regarding school in the fall. We have a faculty meeting this afternoon in which we’ll learn more. The skeptic in me is planning for furloughs + in-person class cancellation, but I hope I’m wrong on both accounts.

FYI, a $60 vet bill for shots is a great deal. Kudos to your vet for not eviscerating their clients. Also, can we get a pic of the results of your grooming escapade?

Terri,

Thanks for the heads up on the shot pricing being fair. I hadn’t priced this out with other vets, but relied on the recommendation of a friend (who is a dog trainer). I guess it worked out.

Pre-trimmed dog is shown in picture captioned “We had fun during FC5’s birthday party.” and also “The kids did some backyard camping”.

Post-trimmed dog is shown in the picture captioned “We wrapped up our “marathon in a month.””

She looks like a completely different animal.

I still can’t believe how expensive dogs are to own. I’m hoping that ours grows out of her destruction phase soon…..

Hope you guys are doing well. It was fun chatting with Russ this past week about Khan Academy.

Hi FP!

In reference to my comment from your March update I have a few additional thank you’s:

1) I adopted your excel spreadsheet. I’ve used Mint and Personal Capital for awhile but I’ve really enjoyed preparing my monthly financial statements using your format. Finally got my cash flow error to zero this month. Woohoo!

2) I have the BoA Premium Rewards card and just used the American Airlines/raise.com hack. My gift card is now for sale. I’ll be interested to see if anyone buys it in the current travel environment.

Thanks again!

Regarding your reply last month: “I’ll only consider my blogging career a success if you’ve also minimized your cell phone expenses to basically zero.”

We haven’t tried your phone plan yet. We are on Ting using the Google Voice hack. The total combined bill for my wife and I (2 lines) ranges from $15 to $21 depending on our data usage for the month.

I also stumbled upon the U Arizona furlough plan. Yikes! My university is “planning” to have in person classes on campus this fall. No word on furloughs or pay cuts yet. I have no idea what will happen with regards to the virus this fall but it does seem that any plan that is not anticipating some sort of second wave is destined to fail. I can only imagine the chaos that will ensue if students/faculty get sick and/or have to quarantine for 14+ days while trying to attend/teach a live class. I just can’t see how that will work.

One silver lining. My school is considering an automatic tenure clock extension. Any chance your university is doing something similar?

Take care!

-Scott

Scott,

Good to hear from you!

Regarding the spreadsheet, congrats! I don’t think I’ve ever zero’d out my statement of cash flows! Last month I got to $3, but there was some gremlin in my sheet this month that blew up my error to $268. I find it to be a huge pain in the ass to maintain the sheet, but it’s a net positive because it is such a good disciplining mechanism. I once had a dream of turning that sheet into a website/app (that automatically does everything for you), but that idea died when I realized I’m inept at coding (and importantly the general public doesn’t care enough about their own finances). Despite first posting that sheet many years ago, you are perhaps the only person I’ve known to actually adopt it (and geek out about zeroing out the statement of cash flows!).

Congrats on getting your cell phone expenses to $15-$21. That’s better than most people, for sure.

Regarding the university conundrum, who knows how this will play out. I agree 100000% about your concern. All of these plans to get back to class are fine and dandy until the first confirmed case hits the university. Good luck contract tracing that….(any restaurants, dorm, classroom, library, etc. that the student had visited in the past 14 days during which they could have been carrying the virus while asymptomatic). From my perspective, a single case kills the university, not to mention the liability if a student get hurt while infected on campus. Admittedly the alternative, shutting down in-person classes, isn’t pretty either. It’s clear to me that the tone of my university’s leadership are erring on the side of survival right now. I can’t say I blame them.

In our most recent meeting, they’re floating around a 10% pay cut. However, we did get a free year added to the tenure clock, so I’m not complaining….

Regarding selling the AA gift card, I’ll say a couple of things. For some reason, the process of selling an AA gift card is really slow on Raise.com. I’ve sold non-AA gift cards and the process is pretty much instantaneous (I think it’s an anti-fraud deterrent for high-risk categories). In today’s environment, you may have to take a decent haircut to sell the gift card. I’d predict you could clear $75 after fees under a worst-case scenario. I typically get $82-$86 under normal market conditions….

I hope the dog is worth it! Frankly, dogs mystify me.

I an in my late 60s and have never had a dog in my life. My mom was deathly afraid of them after a childhood traumatic experience of having been bitten by one as a young child, so my family of origin never had a dog. My late husband had allergies and asthma that precluded having any kind of furry pet. Therefore I have never lived in a household with a dog or cat and have never quite understood why they are so beloved to so many.

I will say that when I go on solitary contemplative walks in my lovely bucolic neighborhood, which has peacefully grazing cows and a Nature Conservancy preserve, my serenity is often disturbed by unattended dogs suddenly charging and barking at me from behind invisible fences in people´s front yards. I know from past experience that these invisible fences do not always work. If families are so devoted to their dogs they should not, in my opinion, leave them unattended in their front yards to terrify unsuspecting passersby. One of these days they will find a senior citizen who has had a heart attack in front of their house from being suddenly startled by their large barking and charging dog.

As for small dogs, my neighborhood listserv reports that there are now lots of hawks roaming around (due to social distancing) and pets under 12 pounds are at risk for being swept up and carried off.

Sorry to be so grouchy in my previous post. I do think that dog owners underestimate the negative externalities associated with their dogs, but at least it is better than it used to be. (Thanks to pooper scooper laws and scial norms.)

On a more positive note thanks for the postage tip!

I can’t say I disagree with your dog rant. I was in the no-dog camp for 38 years of my life and only changed my stance due to some very persuasive children. Despite the obvious negatives, it’s probably been a net benefit for the kids. It has taught them responsibility. It has given them an unconditional friend. A few of our kids struggle with anxiety so the dog has been really good for them.

That said, this dog will be our last.