Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Ben Rector dropped three new songs, which made my month (link).

- I particularly like the song The Richest Man in the World.

Life

- I took a climbing trip to Vegas where a friend and did a ~1,500 ft classic climb called “Solar Slab.” When we tried it 5 years ago, we had to turn back before the summit because we ran out of daylight. This year, we reached the top. It took us 14 hours car-to-car. Rather than taking the basic rappel route back down, we opted for the more adventurous walk-off/rappel into the adjacent gully (by the Rainbow Wall). It was a long and hard day, somewhat reminiscent of the sufferfest of Alaska a few months ago. When suffering on these trips, I often repeat to myself “I’m on vacation” to remind myself my “past self” thought it would be a good idea to be there.

- Honnold climbed Solar Slab as part of his asinine free-solo Red Rocks traverse a few years ago (part 1, part 2).

- (A new season of Reel Rock just dropped on RedBull’s site).

- Honnold did an 11-pitch 5.13b and a 12-pitch 5.12d in a single day on the Rainbow Wall a few days after our trip (link).

- Showoff.

- Honnold climbed Solar Slab as part of his asinine free-solo Red Rocks traverse a few years ago (part 1, part 2).

- I bought myself a Garmin over black Friday and have been enjoying it. I particularly like the “Garmin Coach” feature which looks at my current health and caters a training plan accordingly. I’ve enjoyed the mix of recovery runs, interval training, and tempo runs. During these runs, it lets me know whether I’m going too fast/slow. It basically gamifies your health, which I find pretty fun/rewarding. It seems to me that Apple Watches are like having a phone on your wrist, whereas Garmin Watches are like having a personal trainer on your wrist.

- Garmin sleep tracking is vastly inferior to the Fitbit I had 5 years ago. After tossing and turning with ~4 hours of insomnia one night, I got a perfect 100 sleep score. In contrast, my old Fitbit always captured my insomnia well.

- Our contraband dog meds from Australia arrived last month (link).

- Currently priced at $116/yr (including shipping) — 58% less than my local Costco. No Rx needed. A single chew for fleas & heart-worm each month. Cannot recommend the site highly enough. No foreign transaction fees & BoA gave me 5.25% cash back for the online purchase.

- I replaced a radon mitigation fan in our attic without dying or burning the house down, saving myself $300 or so in the process.

- A funny thing happened a month or two back but I forgot to write it down. I was biking home from work (on my hardtail mountain bike) one day when I heard someone behind me. I don’t like to be passed on the bike trail, so I picked up my pace a bit to avoid the humiliation of being passed, yet the sound persisted. When I eventually turned around to see what it was, I was horrified to find an incredibly fit rollerblader (decked out with speed skates and lycra). He looked down at his watch and congratulated me, saying we were going 21mph. He drafted behind me for about 2 miles before passing me and leaving me in the dust. I was simultaneously amazed and humiliated.

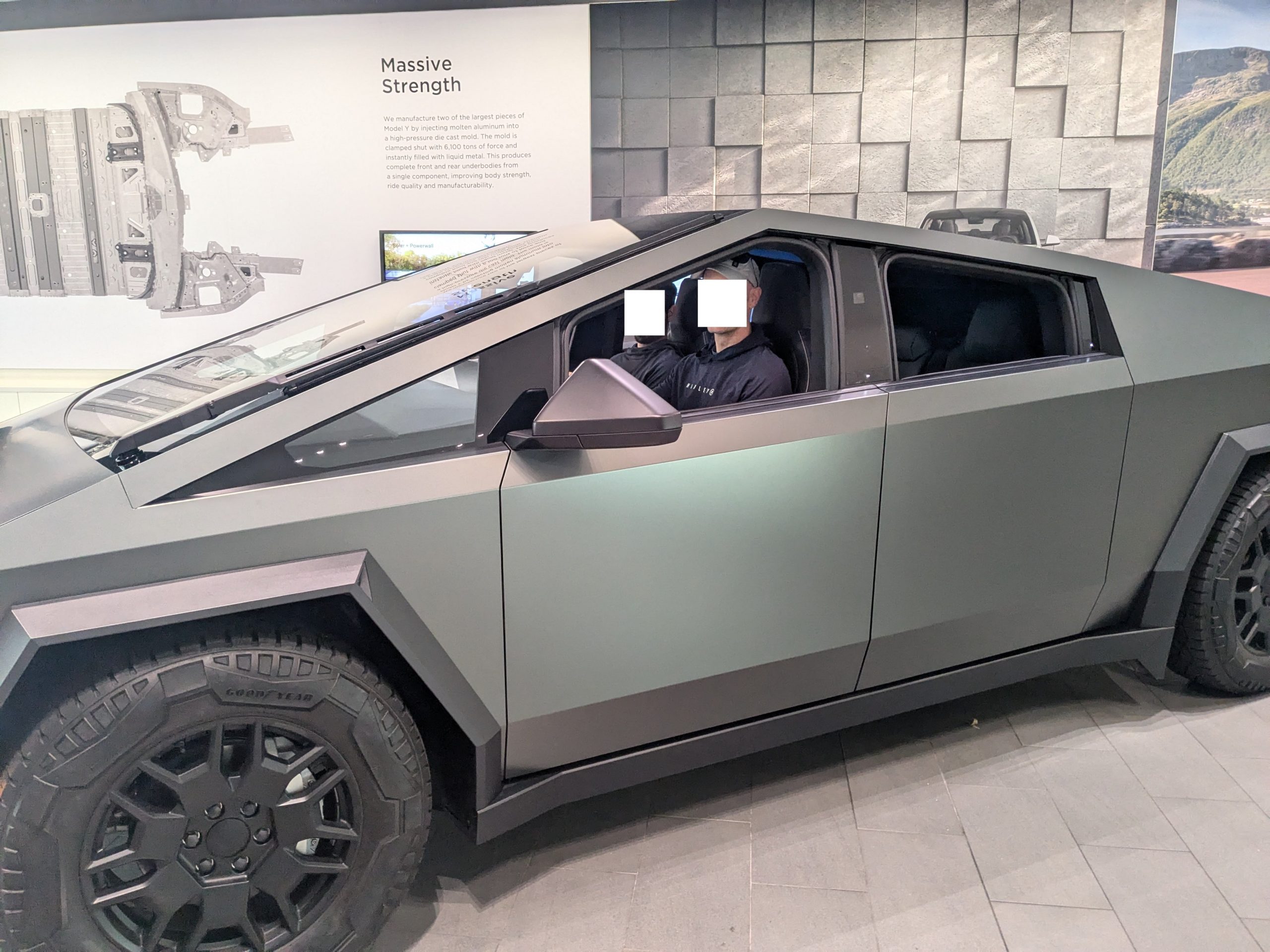

I sat in a Cybertruck in Santana Row. I think they were test driving them but my dad/brother had no interest. They wrapped the one in the showroom which I found ironic.

I sat in a Cybertruck in Santana Row. I think they were test driving them but my dad/brother had no interest. They wrapped the one in the showroom which I found ironic.

Cybercab. I don’t see the vision. In contrast, an affordable Model 2 would surely be a hit?

Cybercab. I don’t see the vision. In contrast, an affordable Model 2 would surely be a hit?

Pre-climb gear check during which I realized that I’d left my harness at home and needed to make an emergency $80 visit to REI. Stupid mistake caused by my desire to never pay a carryon bag fee in my life (I left it behind in one of my many bag-repacking attempts). Through a miracle, I avoided the carry-on fee on Allegiant this trip even though my bag was huge.

Pre-climb gear check during which I realized that I’d left my harness at home and needed to make an emergency $80 visit to REI. Stupid mistake caused by my desire to never pay a carryon bag fee in my life (I left it behind in one of my many bag-repacking attempts). Through a miracle, I avoided the carry-on fee on Allegiant this trip even though my bag was huge.

We hiked in the moonlight to the base of the climb.

We hiked in the moonlight to the base of the climb.

My friend’s tennis shoe separated from its sole at the beginning of our descent. We performed surgery using climbing tape, which did the trick for the difficult descent. He received some weird looks during our celebratory In-and-Out meal afterwards.

My friend’s tennis shoe separated from its sole at the beginning of our descent. We performed surgery using climbing tape, which did the trick for the difficult descent. He received some weird looks during our celebratory In-and-Out meal afterwards.

Calico basin — Honnold’s literal backyard.

After our family trip to Vegas almost two years ago, Google Photos thought that the third-from-the-left Thunder from Down Under dude was me. I never let my wife forget that fact.

After our family trip to Vegas almost two years ago, Google Photos thought that the third-from-the-left Thunder from Down Under dude was me. I never let my wife forget that fact.

Christmas eve ultimate frisbee with grandpa.

Christmas eve ultimate frisbee with grandpa.

Christmas is a holiday where perfectly good and useful money is transformed into items doomed for the landfill after a few minutes of usage. Nonetheless, Mrs FP assures me that me that this norm is customary and cheaper than therapy for our children.

Christmas is a holiday where perfectly good and useful money is transformed into items doomed for the landfill after a few minutes of usage. Nonetheless, Mrs FP assures me that me that this norm is customary and cheaper than therapy for our children.

Mini golf in Denver thanks to Groupon, bringing the price to <$4/person.

Mini golf in Denver thanks to Groupon, bringing the price to <$4/person.

For the uninitiated, this is what show choir looks like. Those dresses are literally 15 pounds. Mrs FP volunteered to help out this year (measuring clothing, purchasing clothing, and feeding during performances) and it has turned into an unpaid full-time job for her.

For the uninitiated, this is what show choir looks like. Those dresses are literally 15 pounds. Mrs FP volunteered to help out this year (measuring clothing, purchasing clothing, and feeding during performances) and it has turned into an unpaid full-time job for her.

I love the gamification of one’s health. VO2 tracking is a pretty good proxy for cardio health and a fun thing to monitor.

Fun chart on max/min heart rate per day. Easily shows sedentary days (like the one I spent driving 9 hours).

Since getting the watch, it identified two days as particularly stressful. The 14-hour climbing/rappelling day scored highest. It looks like my stress spiked for each pitch of climbing, and there was a bit of stress on the descent. My second-highest stress day was driving in a snowstorm from UT to CO, which was not fun.

The 14-hour hike/climb shows up as an anomalous calorie expenditure day.

My recommended workout for today — an easy jog for 3.6 miles. It’s nice that it’s not asking my to push so hard on every run (how I used to run).

This Month’s Finances

Mrs FP and I are jumping on the $2,500 Wells Fargo promotion (promo link, DoctorOfCredit discussion). During our required in-person appointments, there was an unfortunate glitch in their system that rejected our legitimate promo codes. Assuming the glitch is resolved, we’ll transfer $250k each to WellsTrade and pocket $2.5k each after a ~45 day hold. Not a bad 1% 45-day alpha to capture, though unfortunately it’s taxable. Once this is complete, we’ll move to Merrill for another ~45 days to capture another $1k each and renew our platinum honors status with BoA. I plan on rinsing and repeating annually for $7k/yr (=2*($2.5k+$1k)) until I find something better or until they stop giving me free money. Assuming that sloshing around investments takes 5 hours/year, that’s a pretty good hourly rate. Having two players involved in the game makes it particularly lucrative.

- The good:

- Still employed.

- The bad/abnormal:

- Not much.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more inconvenient to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces ~0.11% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.053% for this holding (=0.059%-0.11%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this ~0.11% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Happy New year. Another great informative and helpful year.Thanks for what you do in this blog

Happy new year to you too!

FP I always enjoy reading your posts. There is a current thread on boglehead about hiking with kids I’d love to hear your response on as I like reading your family related travel posts. We are not really a camping family but love the outdoors. Struggling to find hikes for all parties involved 10,,8,3. I’m likely making this more complicated than necessary! Looking to do a bigger trip with the family coming from the east coast.

Which thread are you referring to? This one? https://www.bogleheads.org/forum/viewtopic.php?t=433466

I don’t know that I have great advice for hiking with kids. One of mine professes to hate it, while the other four seem to tolerate it (one or two might actually enjoy it). We’re not particularly geographically endowed where we live, so we usually hike while on vacation. We dragged the kids on a bunch of hikes in Whistler last summer which was fun (https://frugalprofessor.com/financial-update-june-2024/). The summer prior was the disastrous (because of mosquitos) backpacking trip to Wind Rivers, WY (https://frugalprofessor.com/financial-update-july-2023/). Prior to that many years ago we dragged our kids on many hikes in the Tetons & Glacier (https://frugalprofessor.com/grand-teton-yellowstone-and-glacier/).

That trip to Yellowstone/Glacier was 5.5 years ago. Our youngest would have been 5 then. We carried him for much of the Grinnell Glacier hike.

As far as the mechanics go, I’ve learned that kids innately love to be outside and are often their best versions of themselves then. During the WY backpacking trip of doom, I didn’t once hear my kids complain despite the horror show. It may be my favorite memory with them. Backpacking is just so special. However, this creates some logistical hurdles since backpacking is a bit more involved than day-hikes (and higher consequences if you screw up). But when kids are young, day hikes are a great way to experience nature. Be prepared with the normal stuff (layers, snacks) and bring water purification so you don’t have to lug infinite water. My preferred solution is this for hiking/backpacking is the Platypus gravityworks water filter system. I have the 6L variant which is awesome. Tennis shoes are fine. Hiking boots are overrated. My favorite hiking/adventure shoe is the Solomon Speedcross. We bought the whole family a pair for WY. That’s what I do all of my adventures in (Alaska, backpacking, climbing approaches).

Happy New Year! Nice update and was curious about your new Garmin….I clicked through and saw that you got the Epix2. Have you been happy with the battery life? Also, was wondering if you could use it to give directions on a bike instead of a mounted unit.

Thanks for the update……

I’ve been really pleased with the battery life on the Epix2. It lasts about 2 weeks for me (I think) when using gps daily for my runs.

I don’t have experience with bike (or hiking) navigation on the watch, but here’s what ChatGPT says: https://chatgpt.com/share/677968c2-9860-8001-abfa-7046a9c88984

What does it mean “they wrapped the one in the showroom”?

Vinyl wrap.

The stainless steel was marketed as a durable + ingenious + cost effective exterior material. However, in practice, it is prone to smudging and it generally looks terrible.

The solution many have come up with is a $7,000 vinyl wrap, which largely defeats many of the stated objectives of the stainless steel. After market vinyl is expensive and not terribly durable.

Do you have your work withholdings set to $0 and pay all estimated taxes in December?

I aggressively front-load my retirement/HSA contributions each year, which drives down taxable income (and thus withholdings) until mid-year. My taxable income & fed withholdings rise in mid-year and I settle-up in November/December via precise W4 withholdings after confirming what I owe in FreeTaxUSA each October when it is released.

I loathe tax refunds. People bad at math/finance love them. I enjoy owing a little (under the underpayment limit, of course).

Totally agree on the Christmas landfill sentiment but well my wife agrees with Mrs FP too lol. Wishing you a happy new year! Congrats on reaching 500 subscribers – a great milestone. It’s interesting how our brains are wired to appreciate rounded numbers, 498 to 502 is literally < 1% change but 500 somehow is more satisfying to the human eye.

Thanks for stopping by.

My grad school professor subscribed to my blog this past month. Maybe he was lucky 500? Perhaps I’ll use this as inspiration to start saying something useful/intelligent going forward. Easier said than done…

FP Thanks for all the hiking info! It has inspired me to start planning a future trip whether it be this year or next……On the financial side reading this post you mentioned not wanting to get a refund on your taxes which makes sense. Hopefully we have ten years left to work to collect pensions from our teaching jobs. This year I have decided to max our Roth 457 plan instead of the traditional version. I am anticipating our taxes will go up this year due to this. How do I know how to adjust things so that we don’t get an “underpayment penalty” as mentioned in an above comment.

Good luck with the hike!

On the tax dimension, this article might be helpful: https://www.hrblock.com/tax-center/irs/tax-responsibilities/avoiding-underpayment-tax-penalty/. Usually the FreeTaxUSA software I pre-fill every October spits out an underpayment withholding threshold, but this year I don’t think the functionality was built in time so I just did my best to estimate.

On the Roth vs Trad standpoint, by choosing Roth over Trad you’re taxes will go up by the contribution amount * (marginal fed rate + marginal state rate). The benefit is that you should never pay taxes again (unless congress reneges in the future). The cost is the forgone potential tax arbitrage in the future if you were to do something like GCC is doing: https://www.gocurrycracker.com/never-pay-taxes-again/, https://frugalprofessor.com/5-kids-169817-income-0-taxes/.

I tell my students to do Roth if their fed marginal tax rate is <= 12% and do Trad if it's >= 22%. I follow that rule myself.

Just some food for thought….

I have seen and studied that gocurrycracker post before….although I have neve seen yours….I have also seen something similar at Millionaire Educators. For some reason my brain can never quite compute and make sense of these posts. I’ve been “bogleheading” for 10 years now and am grateful for that site but I need to really dig into your post and try and make sense of it. I just always assume that we would have a high income in retirement via the pensions. so it would be better to fill up the roth now. Or I guess my plan is just to have a mix of traditional, roth, and taxable to keep all bases covered. My taxable is my “mistake” account in which I have a bunch of blue chip stocks that I purchased ages ago that would cause a huge tax hit to sell. I need to dive into those posts right now.

also….is that post by you as if you were “retired” or currently working……To me it looks like an example as if you are retired and how you would generate income to spend if you had no job……Thanks!!

If you have a pension coming, then that certainly changes the math. Particularly if it’s a generous pension. Most of us (myself included) aren’t so lucky and are going to be 100% reliant on any 401a/401k/403b/457b/IRA/brokerage/HSA savings.

Given your pension, I think you are thinking about things correctly unless your fed + state taxes drastically lower in the future. This frankly seems unlikely at the federal level, though at the state level (for me) lowering my state rate by 7% is as easy as renting a uhaul and moving across state lines to WY, WA, TX, NV, NH, TN, AK, FL, SD.

Having large gains in a brokerage account is a good problem to have, particularly when LTCG can be realized at 0% (under current tax law) if not working.

Not sure if that is helpful, but the draft “book” pdf in my header might help your understanding of these shenanigans and opportunities/pitfalls that might arise.

For most of us without pensions, the standard deduction would make the first $30k of the 401a/401k/403b/457b distribution taxed at 0% (fed), with remaining chunks taxed at 10%, then 12%, and so on. The obvious caveat is that we don’t know future tax rates so it’s kind of an exercise in futility to get too scientific about it. But for most of us without pensions, there is a whole lot of optionality and opportunity by having a mix of Roth/Trad/taxable savings.

Fp….thanks for the reply! I am going into look into this even more…..Multiple posters have always recommended Roth to me on bogleheads due to the pensions…….I am just grateful to that site, yours, gocurry, as I literally was clueless on the fees involved with all this stuff. I recently had the Roth option added to my job. Surprisingly it took just one email and it got added! Btw I gave chatgpt a link to one of your hiking posts to create an itinerary for me and my family but staying in hotels instead of camping. I also asked for driving times as that intimidates me a little bit with our 3 year old. I might plan for 2026 summer….We are planning NY Finger lakes this summer and going the state park route. Here is the itinerary chatgpt gave me based on a link from your blog.

Day 1: Arrive in Jackson, Wyoming

Activity: Explore Jackson, including Jackson Town Square and Snow King Mountain, where kids can enjoy a scenic chairlift ride or the alpine slide.

Accommodation: Holiday Inn Express & Suites Jackson Hole (IHG).

Day 2: Grand Teton National Park

Activity: Hike the Schwabacher’s Landing Trail (easy, ~1 mile round trip), offering incredible views of the Tetons and opportunities to spot wildlife. Spend time at Jenny Lake and consider a short boat ride followed by the Hidden Falls Trail (1 mile round trip).

Accommodation: Continue at the Holiday Inn Express & Suites Jackson Hole (IHG).

Driving: 20–30 minutes from Jackson to Grand Teton trails.

Day 3: Grand Teton to Yellowstone National Park

Activity: Stop at Mormon Row for iconic photo opportunities and explore West Thumb Geyser Basin upon entering Yellowstone.

Accommodation: Holiday Inn West Yellowstone (IHG), located near the park entrance.

Driving: 2–3 hours, depending on stops.

Day 4: Yellowstone National Park – Old Faithful and Geysers

Activity: Visit the Old Faithful Geyser and stroll the Upper Geyser Basin boardwalks (~1 mile, flat and great for kids). Don’t miss Biscuit Basin, another easy boardwalk trail.

Accommodation: Holiday Inn West Yellowstone (IHG).

Driving: 1 hour from West Yellowstone to Old Faithful.

Day 5: Yellowstone National Park – Grand Canyon of the Yellowstone

Activity: Explore the Artist Point Viewpoint and take the Brink of the Lower Falls Trail (~0.8 miles round trip) for incredible views. Both are kid-friendly.

Accommodation: Continue at Holiday Inn West Yellowstone (IHG).

Driving: 1–1.5 hours from Old Faithful to the Grand Canyon of Yellowstone.

Day 6: Yellowstone to Glacier National Park

Activity: Drive north to Glacier, stopping in Missoula for lunch and a break.

Accommodation: Hilton Garden Inn Kalispell (Hilton).

Driving: 8–9 hours total (split with stops in Missoula and other towns).

Day 7: Glacier National Park – Many Glacier Area

Activity: Hike the Swiftcurrent Lake Nature Trail (~2.6 miles round trip, easy), with stunning views of the lake and surrounding peaks.

Accommodation: Continue at Hilton Garden Inn Kalispell (Hilton), as Many Glacier Hotel doesn’t align with your preference for Hilton/IHG properties.

Driving: ~2 hours from Kalispell to Many Glacier trailhead.

Day 8: Glacier National Park – Going-to-the-Sun Road

Activity: Drive the iconic Going-to-the-Sun Road, stopping at Logan Pass. Consider the Trail of the Cedars (~1 mile loop, flat and shaded, perfect for kids) and a short walk to Hidden Lake Overlook (~2.8 miles round trip).

Accommodation: Continue at Hilton Garden Inn Kalispell (Hilton).

Driving: ~2 hours from Many Glacier to Logan Pass and Lake McDonald.

Day 9: Glacier National Park – Lake McDonald

Activity: Enjoy activities at Lake McDonald, including a boat tour, paddleboarding, or the Avalanche Lake Trail (4.5 miles round trip, moderate but doable with older kids).

Accommodation: Continue at Hilton Garden Inn Kalispell (Hilton).

Driving: ~1 hour within the park, depending on activities.

Day 10: Depart from Kalispell, Montana

Activity: Drive to Kalispell and visit any final attractions before your flight.

Accommodation: If necessary, stay at Hilton Garden Inn Kalispell (Hilton).

Driving: ~30 minutes from Lake McDonald to Kalispell.

Key Modifications

Shorter, kid-friendly hikes such as Schwabacher’s Landing, Trail of the Cedars, and Swiftcurrent Lake Nature Trail were prioritized.

Lodging at IHG or Hilton properties was included where available, ensuring comfort and loyalty points.

This version balances exploration with manageable activities for children. Let me know if you’d like further refinements!

I like the itinerary, but there is not enough suffering in it to scratch my itch.

The Grinnel Glacier trail is probably the favorite hike I’ve ever done with my kids. I’d get a good kid carrier backpack (and very importantly the water purification to save on weight) and have a go at it. It is one of my favorite memories in life.

The logistics in Glacier are a bit challenging. It is crowded. Reservations are often required. Shuttles are required because there is no parking. You have to plan well in advance. But we managed to do the walk-in and it worked out okay. ChatGPT could probably help fill in the missing details.

Good luck!!!

Hi, a question on the 401a. I assume that’s the employer contribution match? How is it that under gross income, 401a match is $23,695. But under statement of cashflows, it becomes $39,986?

In the income statement, the 401a match is my employer’s contribution. In the statement of cash flows, it is the sum of my contributions + employer contributions.

Ah! so you get to contribute to 401a on top of the 403b + 457?

I am trying to figure out how do you get your federal taxes to be so low… for a similar gross income, we are paying close to $38k for taxes… 🙁

Public sector employees often have access to 401a & 403b & 457b (+ HSA). So I’m quadruple dipping. When I worked for the private sector, it was only the 401k for me. It makes no sense whatsoever to have public/private sector employees play by different rules.

The 5 kids also help with fed taxes. $2k/kid tax credit for kids <= 16, so that has historically lowered our fed tax burden by $10k. That said, it was reduced by $1.5k to $8.5k this year b/c our oldest turned 17.

Thank you for agreeing that the rules do not make sense. It made me feel less aggrieved. Out of spite, I actually started looking at job listing at public universities that has 401a & 403b and 457b. Haha.

We have three kids and one is turning 17 this year too. And they are very unfrugal for being involved in competitive sports. In our case, this is our “cheaper than therapy” self-consolation. 😣

Hi – do you have a newer version of your tracking spreadsheet that can be shared for customization? And/or an update to the methodology on how you input values if that has changed (Personal Capital now Empower, etc)? I you posted one in 2017 but I see from these screenshots you have tweaked some of your charts (e.g. the % to FI graph has different title) so perhaps you made other under-the-hood fixes along the way? Thanks! ps – Congrats on your progress growing your net worth since back then.

I posted an updated sheet three years ago here: https://frugalprofessor.com/my-updated-net-worth-and-more-tracking-spreadsheet/

My process has stayed the same for the last almost decade. Pretty great system. Takes a few minutes/month to update. Provides greater clarity on my finances than any tool I can think of. I still use personal capital for the importing because it’s free and adequate.

I haven’t updated the sheet to reflect the % to FI chart, but I will eventually. The numerator is the hypothetical income our portfolio could produce sustainably at the 3%, 3.5%, and 4% withdrawal rates. The denominator is our average annual spending over the last 3 years, computed on a rolling basis. It’s not a perfect measure by any means, but I like the intent of the chart, which compares our actual portfolio balance to our actual spending.

Hi,

I was recently made aware of Buffered ETFs. What are your thoughts on them?

I’d never heard of them. However, I’m skeptical after googling them. Just another way to introduce unnecessary fees to your portfolio. You mitigate risk in your portfolio with appropriate asset allocation, not expensive products like these.

Financial instruments like these are almost always created to enrich the sellers of the product at the expense of the buyers who the product is purported to “help”.

A belated Happy New Year! I know that you’re probably not looking for an affordable apartment in California, but when I saw this WSJ article about living on top of a Costco, I immediately thought of you:

https://www.wsj.com/real-estate/is-living-on-top-of-a-costco-the-answer-to-the-affordable-housing-crisis-ed3e8bf3?st=vBFZAz&reflink=desktopwebshare_permalink

Ha! I saw that article as well and it’s basically my dream!!! Though my current gig of living 1/4 mile away isn’t bad either…