Update 4/14/25:

On 4/14/25, U.S. Bank essentially neutered this card for new applicants. The $100k balance must now be held in a checking account rather than a brokerage account (and thus incurring a ~$4k/year opportunity cost for new applicants). Further, there is a list of exempted categories (taxes, education, etc).

Given this, I’d now strongly recommend against this card. Yes, Peyton Manning is misleading you. If you have $100k laying around, then the 2.625% – 5.25% BoA game is pretty profitable.

That said, original applicants like myself are supposedly grandfathered in to the initial terms ($100k in brokerage is okay + no exempted categories). We’ll see how long it lasts.

I asked ChatGPT to Eulogize the card (much like I did for the nerfed US Bank Altitude Reserve card). Here is the result:

Smartly, Briefly: A Cashback Eulogy

Oh Smartly, sweet and short-lived flame,

You came, you gleamed, you lost the game.

Launched with fanfare, bold and brash—

“Four percent!”—a dopamine splash.But five short months—you barely breathed!

Then bankers gasped and quickly sheathed

The sword they forged in marketing,

When someone checked the spreadsheet thing.Who thought it wise (or long to last)

To hand out cash both free and fast—

If only you’d just transfer in

A hundred K to let it begin?A brokerage bribe, dressed up in gloss,

That screamed “We didn’t count the cost!”

No clawbacks, traps, or long-term strings—

Just, “Here’s some yield. Enjoy, my kings.”We did enjoy. And then, the axe:

No taxes, tuition, or gift card hacks.

And now to earn that shrinking bone,

You must park cash in a checking zone.A hundred grand at zero yield—

The least efficient cashback field.

Four thousand lost per annum’s pace,

For what? A card that’s lost its face.No longer “Smartly,” just a name,

A neutered shell, a cashback shame.

From fintech glory to fiscal joke,

It died the day the bankers woke.So here’s our toast: to flash and crash,

To dreams made real, then turned to ash.

You soared too bright, you burned too fast,

Farewell, dear card. You couldn’t last.

Disclosures:

This blog isn’t profit-driven — I don’t receive money from credit card referrals, and there are no affiliate links here. This review reflects my genuine and unbiased opinions.

Summary:

If you can transfer $100k of assets to US Bank (including their brokerage platform), then the Smartly 4% card is the best single-card setup available, earning a no-nonsense 4% cash back on every transaction. The caveat is that US Bank’s brokerage is as bad as I’ve seen, but this is arguably tolerable for buy-and-hold investors who don’t transact and can therefore tolerate an inferior brokerage experience.

If you don’t have $100k to transfer, you can earn:

- 3% cash back with $50k, or

- 2.5% cash back with $5k

Background:

I’ve been enjoying the 5.25% Bank of America gravy train for many years now, but there were always some nuisances with this setup:

- The 5.25% cash back was capped at $2,500 per quarter per card, requiring juggling of cards to optimize.

- The “non-category” spend only earned 2.625% with the BoA Premium Rewards card.

US Bank’s 4% card overcomes those two problems by offering an unlimited 4% on every transaction.

I’ve already downgraded my Premium Rewards card (to our 8th CCR…one with the superpower of no FTF) and will shift all non-category spend to the Smartly 4% card. However, given that I’ve already incurred the fixed cost of setting up the BoA ecosystem, I see no reason to ditch the 5.25% gravy train yet for “category” spend. That said, the 1.25% premium I’m earning from maintaining the BoA ecosystem feels increasingly trivial as I seek to simplify my life.

How to Get the 4% Cash Back at US Bank:

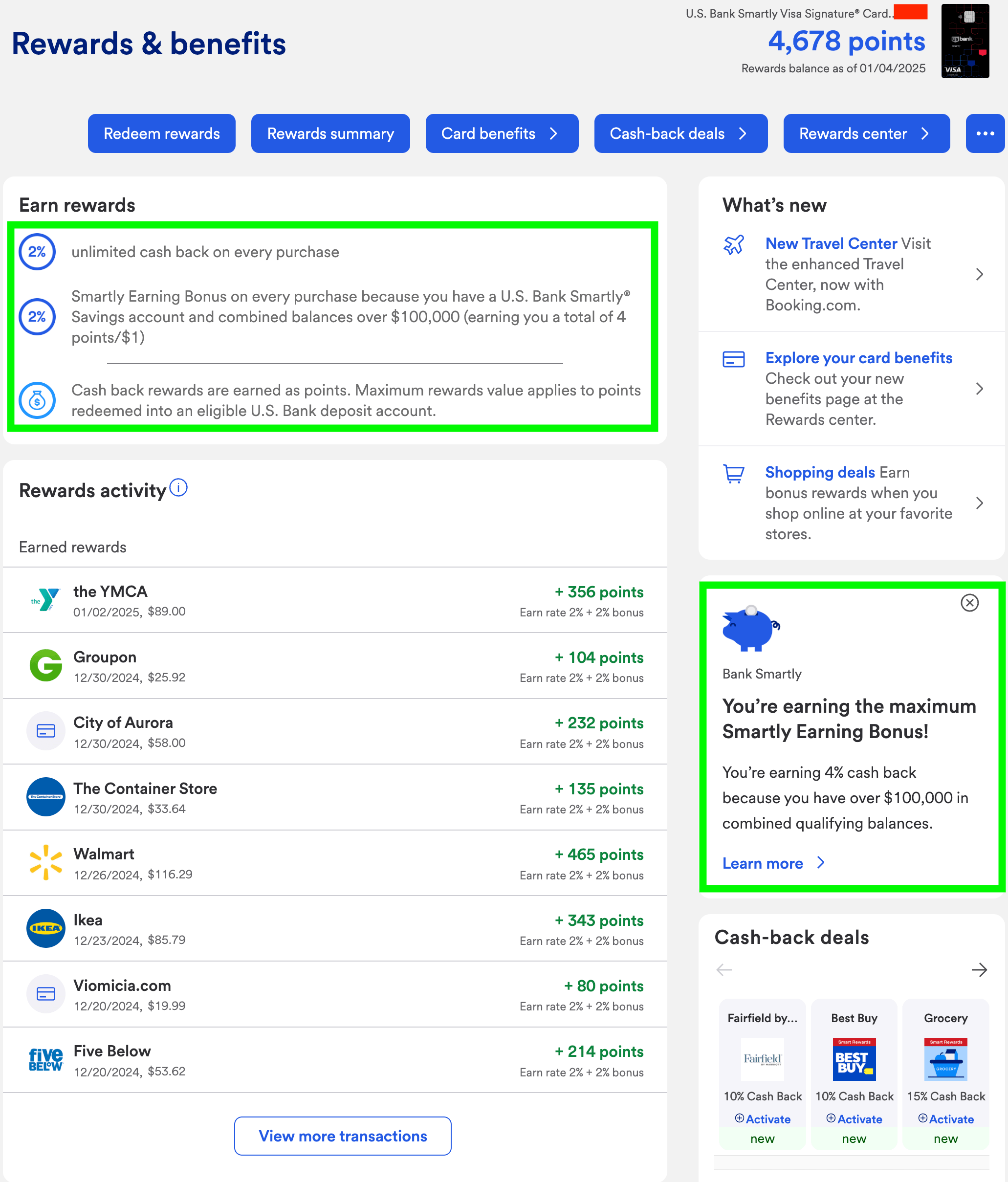

Similar to the BoA/Merrill setup, the elevated rewards on the Smartly credit card are conditional on maintaining >$100k of assets at US Bank. Importantly, you can transfer $100k of investments to their brokerage account (or IRA) to meet this requirement. Unlike BoA/Merrill which computes the $100k balance requirement using a 3-month moving average, the US Bank balance was updated for me about 5 days after transferring the assets over. Once you do so, it’ll look like this:

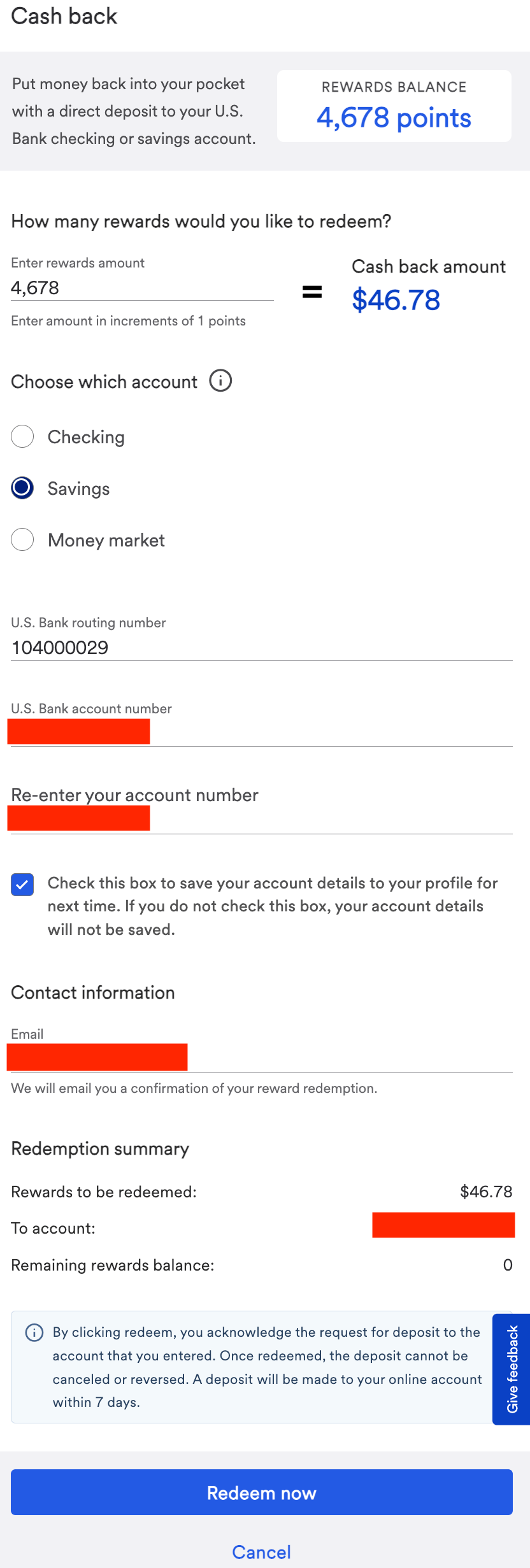

Point Redemption is Straightforward

Points are redeemed at full value as cash. There is a $25 minimum distribution (like the Fidelity 2% card), but that is easily hit with $625/mo of spend (=$25/.04). There doesn’t appear to be an auto-redemption option (I’ll update this if that’s wrong — I’m still learning).

Why US Bank’s Brokerage Account is Terrible:

Presumably the whole reason US Bank is offering this generous card is to attract the assets of high net-worth individuals. Given this, it is laughable how bad US Bank’s brokerage account is. Some examples:

- Dividend reinvestment elections cannot be made online. You must call them.

- This is inconvenient for people like me who adjust dividend reinvestment elections throughout the year for tax loss harvesting purposes.

- Beneficiary elections cannot be made online. You must call them.

- The interface looks like something from the 90s and makes (the mediocre) Merrill Edge look advanced in comparison.

- They encourage emailing of sensitive data over unsecured email.

- I was on a two-hour phone call with customer service to try to configure my dividends to distribute to an external account (at Fidelity), but after bouncing around to different agents, they told me this was not possible.

- While inconvenient, I can manually sweep dividends once a quarter.

Arguably, the above should be tolerable for a buy-and-hold investor who isn’t going to transact in this brokerage account. However, I can understand if these issues are deal-breakers for you — it’s not exactly confidence inspiring.

As an aside, the “default” handling of dividends on my Vanguard MFs was to reinvest dividends. I had to call to opt out.

One More Technicality:

You’ll also need to open a US Smartly Savings account, which has no monthly fee if you get the credit card. This is similar to BoA, which requires a checking account for their program (even one with zero balance suffices for me there).

For some reason, they couldn’t verify my identify when trying to open the savings account online, but a trip to the branch around the corner from my house resolved this issue. It would have been a huge hassle had I not been able to resolve this in person.

I also opened up the optional checking account because they paid me $450 to do so.

Limitations of the Card:

- 3% Foreign Transaction Fee

- No primary car rental insurance

- No travel insurance

- No TSA PreCheck/Global entry

- Etc

If you want the above, you’ll need another card (like the Fidelity 2% card or the defunct US Bank Altitude Reserve) to fill in these gaps.

Summary of Fees:

- No fee for credit card.

- No fee for savings account if you have a credit card.

- No fee for brokerage account if you have >$100k there (per customer service).

Conclusion:

Despite the abysmal brokerage platform, I’m giving this card a try. Four percent cash back on every purchase is just too big of a carrot to pass up. With my eldest child soon to go to college (and her four siblings following shortly thereafter), I am anticipating funneling some big expenses through this card over the coming years.

My biggest concern is that the benefits are almost surely too generous to last, begging the question whether this is all worth it.

Going forward, my setup will be:

- BoA’s BoA’s 5.25% card: online, travel, gas, and restaurants.

- US Bank Altitude Reserve for primary car rental insurance, foreign transactions, and Global Entry/TSA PreCheck.

- Fidelity’s 2% is another alternative with Global Entry credit and no FTF, but it offers only secondary car rental insurance (thanks RV for correcting my misunderstanding).

- US Bank’s 4% for all else.

I’m assuming that the BofA CCR also has no travel insurance, so doesn’t sound like it’s much of a concern…?

Merrill Edge didn’t allow me to reinvest dividends on my ETF (AVGE), so I’ll be interested to see if US Bank does.

I won’t have enough $$ at Merrill to maintain the Platinum Honors as I moved them to US Bank, so I’ll have to see if i have funds available in December 2025 when it does it’s next annual check.

Is there a reason you didn’t convert your Premium Rewards to another CCR ?

CCR & Travel insurance: You’re right. But USBAR vs Smartly there’s a difference.

I should have added to the review that the “default” was to reinvest dividends on my Vanguard MFs.

I did convert the Premium Rewards to our 8th CCR. Supposedly this card will have the superpower of no FTFs, which I’m excited about.

Hey there Prof.

Thanks for the write up I find it very intriguing.

I understand that the brokerage leaves a lot to be desired but I would appreciate if you could clarify one thing.

Do they support reinvest dividends, lol?

If they do, that might be good enough for me.

Thanks

For Vanguard MFs, they do. Reinvestment is the “default” election. I can’t speak to ETFs, but if others have experience I’ll update the post.

Are you operating with the assumption that $100k balance will waive the annual account fee despite mentions of $250k on their website.

Customer service told me multiple times that there was no fee for brokerage balances > $100k, but I’ll update the post if that is proven wrong.

Always great insights. I am curious on your current setup with USBAR and not using it for apple pay daily expenses. Are the return from global entry and no foreign transaction fee sufficient? Thank you

I find the USBAR travel redemption to be a nuisance.

Also, I get 5.25% through BoA on Travel, so it seems silly to put travel on the USBAR which earns an inferior 4.5%. Plus, there’s the hassle that you need the full amount to redeem (if you have $450 of travel benefits accrued for a $475 flight, you’re out of luck).

The way to redeem USBAR points and still utilize the 5.25% BoA is through manufactured travel & cancellation. I can confirm that it works just fine, but it’s a bit of a nuisance.

Relative to the new 4% card, I find the USBAR to be rather uncompelling. From an annual fee perspective, you’d need to spend $75/(4.5%-4%)=$15k/yr via USBARs tap-to-pay to justify the fee (assuming you don’t value primary car rental insurance, Global Entry, Priority Pass, travel insurance, no FTF and importantly that you don’t hate the travel redemption restriction). But the revamped Fidelity 2% card does much of that (including primary rental car insurance) for $0 AF. That card has lived in my “sock drawer” since 2005 but will likely be promoted to wallet when traveling abroad (or domestic car rentals) if I cancel the USBAR.

Glad to hear that! I’ve done the same, so fingers crossed.

For the checking + savings accounts, what balance are you keeping? I’ve kept the opening $25 deposit, but I’m wondering if I can take it down to $0.01 safely. I read that $0 balance accounts can be automatically closed, so I don’t want to go that low.

I have no idea on the checking & savings balances.

Given that I’ve already pocketed the $450, I”m unsure what benefit (or harm) there is in keeping the checking account open. There’s a branch around the corner from my house, so perhaps I’ll keep a token dollar in so they don’t close the account.

The primary account I don’t want them to close is the savings account, since this is the one that makes the 4% magic happen. Like you, I’ve maintained the opening $25 in there. Like you, I’ve wondered if I can drop to $1. I probably will.

I have maintained $1 balances at accounts for over a decade with several old banks, so I’m hoping that the same will work here?

Let me know if you learn otherwise.

Can you have the Smartly card pull money from other banks to pay it off in full every month? If so, how easy is it to set this up?

Yes. It’s trivially easy to do.

Thanks for sharing…had a few questions you may already know.

If you moved money from a Roth IRA say at Vanguard to US Bank for this, do you have to sell your shares then transfer over and re-purchase or can the shares transfer without being sold?

Also, can a spouse be added to credit card as an authorized user, or would they need to open their own account with own separate $100,000 transfer.

Lastly, any idea what would happen if $100,000 initial balance were to dip temporarily below $100,000 due to market? Do you just lose the 4% cash back during that specific time period? Seems like balances could potentially move all over the place unless you transfer more than $100k to overcome.

* You shouldn’t need to liquidate to transfer assets when utilizing the transfer “in kind” feature like I did from Vanguard. This is especially important to not screw up when transferring assets in taxable accounts, since inadvertent sales would have adverse tax consequences. My Vanguard MFs transferred over “in-kind” just fine.

* The card allows up to 7 authorized users at no cost — perfect for my family of 5 kids. Each will be getting their own card in time.

* I’m unsure the exact mechanics of the dipping below the $100k threshold, but I transferred over $115k to create some margin of safety. If markets drop more than that, I’ll transfer more assets over. It’s a pretty simple request online to do so.

Really nice to see some data points (Reddit, DOC, yours) regarding the no fee by keeping 100k and not 250k at the brokerage. Pretty much destroys BofA’s 2.62%. It’ll be nice to see if BofA adds a 4% card or USB adds a 5.25% “online” card – both highly unlikely so will have to juggle both banks and brokerages.

Saw your other comment of giving cards to kids, unfortunate that USBank is one of the banks which do not provide any segregation (online or statement) by authorized users. I used to have Cap1 and Amex which provided those features and it was very handy, especially if you have more than 1 authorized users.

The “no fee” for $100k datapoint is certainly provisional, but I’m hopeful that what CS has told me is true.

Glad to see I’m not the only one juggling both the BoA + USBank relationships. The rational part of me questions whether it’s worth the small amount of work for the 1.25% spread over the 4%.

I agree that the lack of segregation on authorized users is kind of annoying, but I guess I’m used to it my now. BoA doesn’t either, right? My kids don’t spend much but it’s nice for them to have a card in a pinch.

Once BofA nerfs my platinum honors due to the assets I moved away, all 5 of my BofA cards get sock drawered unless I find some more funds to park there and they give me another bonus. The extra 1.25% doesn’t seem worth the hassle vs a “good enough” 4% on everything plus a foreign card. Which card that will be, I’m not sure. I also have the Fidelity 2% which I haven’t used in years, a Capital one Venture X (but the travel portal isn’t ideal, so may cancel after first year), and USBAR.

With the recent improvements to the Fidelity card (and not-recent improvements like no FTF), it is a pretty compelling foreign/car rental card.

Congrats for being at peace with the “good enough” 4%. Time will tell if it’s worth the small hassle to maintain the BoA relationship for the extra 1.25%. The other thing keeping me with BoA/Merrill is the $1k Merrill bonus every year (x2 with spouse) from sloshing the assets around 1x/year.

Could you please explain “The other thing keeping me with BoA/Merrill is the $1k Merrill bonus every year (x2 with spouse) from sloshing the assets around 1x/year.”??

This is a relevant DoC comment: https://www.doctorofcredit.com/robinhood-hood-week-10-16-10-27-2-brokerage-bonus-3-ira-match/#comment-1929972

Basically, with brokerages offering transfer bonuses it encourages disloyalty.

Using the example from Brian in the DoC comment, you can churn the Merrill Edge & Wells Fargo bonuses annually for $1k and 2.5k, respectively. Double that if married and your spouse is willing to play. Merrill’s bonus pays out after 3 months or so. Same for WF. This makes it churnable annually.

Excluding our US Bank brokerage assets, we now have $650k remaining in a joint brokerage account. My plan is to divide that into two individual accounts ($325k/each), then cycle between ME and WF bonuses for $3.5k*2=$7k/year in perpetuity. Taxed at our marginal rate of ~30%, that’s about $5k/year after tax for a few hours of work. Doing the above will have the added benefit of maintaining platinum honors status with BoA.

As far as I know Fidelity 2% card is having secondary rental car coverage in USA and not the primary, can you please let me know if I am incorrect?

Here is the documentation from Fidelity:

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/fidelity/Fidelity-Visa-Signature-Card-Guide-to-Benefits.pdf

AUTO RENTAL COLLISION DAMAGE WAIVER

The Auto Rental Collision Damage Waiver benefit provides reimbursement for damages caused by theft or collision

up to seventy-five thousand ($75,000.00) dollars. The Auto Rental Collision Damage Waiver is secondary coverage,

which means it supplements, and applies in excess of, any valid and collectible insurance or reimbursement from

any source. T

You’re right. I was mistaken. I’ll update the post accordingly. Thanks for catching my error and fixing my (mis)understanding.

No worries, I like your posts and just thought of sharing this minor issue. Thanks.

Looking into this for purchases that aren’t GGR but for those I’m still loving my Shop Your Way 15% for the year!

Yeah, that SYW card is unreal…

What money market funds are available through US Bank?

The Bogleheads look to be buying GABXX: https://www.bogleheads.org/forum/search.php?keywords=GABXX&t=438760&sf=msgonly

These two upcoming Vanguard ETFs would look perfect as well: https://corporate.vanguard.com/content/corporatesite/us/en/corp/who-we-are/pressroom/press-release-vanguard-to-offer-new-options-for-meeting-investors-short-term-liquidity-needs-112224.html

As far as myself, I’m keeping Vanguard equity MFs and never transacting. Given how awful the US Bank brokerage is, the less transacting I do, the better.

I read on their policy that, to waive the Annual account fee of $50 of the brokerage account, “Annual account/IRA fees may be waived for clients with a statement household balance > $250k”. Otherwise I basically pay $50/year for the 4% card.

That was my understanding as well until customer service told me otherwise on the phone. They told me $0 in fees for >$100k of brokerage assets.

I guess time will tell whether customer service or their stated policies are correct.

My understanding was that 100k was for no fee on IRAs, but 250k was for brokerages.

That was my understanding as well until customer service told me otherwise on the phone. They told me $0 in fees for >$100k of brokerage assets.

I guess time will tell whether customer service or their stated policies are correct.

My Fidelity card was sock-drawered after obtaining the BoA Premium Rewards. Eventually, Fidelity/Elan closed my account.

After not having used the card in a decade, they sent me a letter last month saying to use the card or it would be closed. I bought a $1.50 Costco hot dog to keep it alive. It is my second-oldest card (~20 years) so I don’t want it closed. Plus, I can see myself transitioning some spend to this card if I close the USBAR.

I can’t recall if I received that letter or not, but suffice it to say that it was closed.

For the transfer to US Bank Investment account, did you get US Bank to reimburse the transfer fee?

Unless I’m mistaken, Vanguard didn’t charge a fee for the partial transfer out.

FP,

I just applied for the card but am waiting for approval. Do I need the card before I open a brokerage account. I’m not a customer of this bank yet and am having trouble opening the brokerage. The only link I can find is:

https://onboarding.usbank.com/consumer/brokerage/application?prodCode=SDB&prodSubCode=INV

and this seems like you have to be an existing customer. Should I just wait to see if I am approved first and then I can log in with the same credentials as I would use for the CC? I think I am missing something simple. I have read your entire post which was very helpful and I am going to just get this card purely for paying my taxes in a HCOL area.

I’d wait for CC approval then open the brokerage account. That’s what I did and it worked out well

Do I miss it? Not really. The Bank of America Premium Rewards card is a better card (with Platinum Honors) pretty much all around.

thanks, what kind of credit limit did you get?

Smartly: $20k

Altitude Reserve: $25k

Not as high as I’d like, but not too shabby.

Did you get any more SYW offers? Still playing that game?

I got this offer for each month in 2025:

* $50 credit on $500 Gas/Grocery/Restaurant spend

* $100 credit on $1000 Gas/Grocery/Restaurant spend

I also have another:

$ 50 credit for $500 online spend

All offers are in addition to base rewards.

I’ll do the $500 online through a Costco gift card. Easy 10% back.

On the gas/grocery/restaurant dimension, I really don’t spend much on gas (thanks to tesla), grocery (thanks to Costco), and restaurants (thanks to legendary cheapness). If I could simply swipe a $500 transaction in Walmart gift cards every other month, that would be helpful but I’m not sure if that would work. Any idea? DoctorOfCredit seemed mixed on Walmart gift cards / Walmart Pay.

I missed the Altitude Reserve, but will apply for Smartly. I am currently using the BofA system. I moved 100k to US bank broker first in the hope of getting a higher credit limit, maybe that was not necessary. I think I would be willing to forgo the extra 1.25% in saving for the simplicity of having only 1 card. Maybe I can get another US bank card and move the credit limit to the Smartly card (this is what I did at BofA for Prem reserve for 37k limit, but BofA messed up once when I was trying that, I ended up just with a lower limit on the CCR and a no increase on reserve). Lets see how it goes. Thanks for you blog!

What helped me with my smartly credit limit is calling reconsideration the day I applied and begging for a higher limit. Good luck!

I’m convinced that simplicity of the single 4% card is worth ditching BoA, but for some reason I haven’t let myself do that yet and forfeit the 1.25%. It’s a mental illness.

I presume US Bank allows an account owner to designate a citizen of a foreign country to be a primary or contingent beneficiary of any bank account type. But does US Bank allow the same beneficiary designations of a foreign citizen for brokerage accounts (regular investment or a Roth IRA or a taxable IRA)? We have no children and my spouse, whom is likely to outlive me, is from Latin America and her entire extended family resides in Latin America.

I had to set mine up on the phone. I’m not sure about your questions about foreign citizens.

This may have been the form they filled out for me? https://www.usbank.com/dam/documents/pdf/wealth-management/tod.pdf

Hi frugalprofessor, I was wondering how you ‘calling reconsideration the day I applied and begging for a higher limit’ ? Did you call them after you submitted the application online? Also, I assume you had other US bank products before opening this card. Did you log onto your existing US bank account first and then did application? Did you need to enter your income information during the application process? Thanks.

I’m sorry if I’m fuzzy on the details; this was a couple of months ago.

With both the Altitude Reserve and the Smartly card, I applied online and got the generic “we’ll let you know in a week” email. Not satisfied with that response, I called the reconsideration line to see if they needed else anything from me (for identification purposes, etc). After addressing those issues, I asked for a reconsideration of the credit limit during the same call.

Seems to have worked out reasonably well. $25k limit on altitude reserve. $20k on smartly.

Here’s a bogleheads post where I go into a bit more detail: https://www.bogleheads.org/forum/viewtopic.php?p=8114354#p8114354

Very informative thanks. I’m thinking of rolling over a decade’s old 401(k) from an old employer into US Bank’s Traditional IRA for this. I’m new to this and a little worried there might be “gotchas” that I don’t know about. Are there things I should be paying close attention to to make sure the process goes smoothly, or are there common mistakes to avoid? Does US Bank have good low fee “set it and forget it options” since I don’t want to actively manage the investments? Thanks again.

Given how lousy the US Bank brokerage is, I wouldn’t roll over any more than is required to hit the 4% bonus. I personally transferred $110k to have some margin for volatility. If the market drops more than that, I’ll transfer more.

If I were you I’d roll over the rest to a reputable broker like Fidelity/Schwab/Vanguard. Fidelity is my personal preference.

As far as order of operations, I’d probably roll over 100% of employer money to Fidelity rollover IRA, then $110k (or whatever you choose) from Fidelity to US Bank.

Professor,

I’d be interested in your thoughts on a portfolio of closed end funds. It’d be more for those with a retirement view (either in or close to retirement). But the draw is that you can easily get 8%-10% from your portfolio. You’d spend 6% and reinvest 2%. Avoids all the drama of safe withdrawal rates.

I don’t understand how closed-end funds would help you to avoid investment risk. On asset allocation, here’s what I’ve personally done: https://frugalprofessor.com/1m-in-investment-gains-a-finance-professors-diy-two-fund-portfolio/

One of my favorite investing quotes is from Bogle: https://www.bogleheads.org/wiki/Cost_matters_hypothesis

30 years from now, I don’t think you’ll regret keeping your costs (including tax costs) low and your portfolio simple and easy to manage.

Hello FP,

Could you confirm that after PC the Premium Rewards card to CCR, there is no FTF? I’m thinking of changing my BOA Travel card to CCR is the FTF trick is true. Thanks!

I just logged in to my BoA account and it turns out they don’t provide the Card Account Agreement online. I requested a paper copy and will let you know.

Multiple redditors/bogleheads/youtubers have confirmed the no FTF to be true, so I don’t know why it wouldn’t work for me too but I can’t personally confirm yet.

One oddity with my PC is that they kept my same credit card number (and expiration date and code). I wasn’t expecting that.

Credit card agreement posted digitally today. Can confirm no FTF on the converted PR card. I am happy about that.

Do you know if USB will accept and HSA account to meet the cash requirement of $100K?

No idea. Sorry. Without googling, I’m skeptical but hope I’m wrong for your sake.

I’ve switched from BOA to Smartly/USBank for the simplicity of a mostly one card set up. Not needing to figure out which card we are near/at the quarterly limit. Also, it will be better for my wife, only having 1 card to rule them all. My kids are almost 12 and 10 but are doing more stuff on their own. Do you know if there is a minimum age to add as them as an authorized users?

Congrats.

Looks like minimum AU age is 13: https://www.usbank.com/customer-service/personal-banking/credit-cards.html

How do I add an authorized user to my credit card?

To add an authorized user, the request needs to come from an account owner. Up to seven authorized users can be on the account at the same time. Authorized users must be at least 13 years of age. All that’s needed to add them is their first and last name, date of birth, and Social Security number. Adding a middle initial is optional.

Three of my kids are already AU, but surely the remaining two will join eventually.

First off, I just signed up for your site. I love your input and candidness. I am like you in that I’m not ready to give up totally on BOA because I’m not sure how long the 4% will last. It does seem too good to be true. I got a ridiculously low credit limit on the Smartly Visa (800+ plus well established bank accounts)and was not going to pursue it any further thinking it was a “bait and switch.” I called the recon line because I had already set up the savings acct (and cc) and had nothing to loose. I’m not sure that US Bank is really ready for prime time though because I knew more about the card/process than he did. I called back a second time and asked to speak to a manager. Then I get two letters stating that my credit score is 576 (NOT) and that they couldn’t possibly increase my credit limit, along with another letter saying congratulations on a huge increase. My question is, are you certain that authorized users would get the 4% too, I thought I read somewhere that they were ineligible for the 4% and would only get the 2%

I’m not sure what to make of US bank either. I’ve been a fan of their credit cards so far, but not a fan of their processes nor their brokerage. But I suppose I’ll stick with them until they stop paying me 4%+ on every transaction.

Regarding authorized users, I have a wife and 3 kids as AUs and they are earning the 4%. We all share the same credit card number.

So far, I only got the online spending offer. Mid Dec to Mid Jan was 200k points for $750 online spend. I bought Amazon gift cards, but it’ll take me a while to use it up.

For Mid Jan to Mid Feb is 250k points for $750 online spend. Not sure I can organically spend that and I don’t need more Amazon – so I’m thinking about buying Sams Club gift card on Pepper, selling it to Cardcash . I’d basically be spending $127 for $250 in points that I could redeem for a visa to load into google wallet.

Were you able to confirm if HSA qualifies?

I personally can’t confirm either way. Does US Bank even offer an HSA? I couldn’t even find that online.

Website does state $50 AF is waived only at $250,000 but I was able to request it be waived at $100,000.

The $100k waiver seems to be working for most of us, thank goodness.

I had added my 14 year old as an AU to my Double Cash, then my Savor for food. Neither asked for his SSN. I just added him as an AU to my Smartly and USB did ask for his SSN! So, now he is actually starting to establish his own credit history. 🙂

My kids are AU on several of my cards (Fidelity, BoA, US Bank). I forget which have/haven’t asked for SSN. Some have been AU from birth. My oldest turns 18 soon and I’m very curious to learn their credit score.

I got the Smartly card (along with the checking and savings) a month or two ago. About 2 weeks ago, I got my 100,000th dollar transferred in to USB. For now it’s just sitting in the Smartly Savings. You talked about the self-directed option but I have been very interested in the auto/robo-investing. 0.24% fee but it’s cheaper than the wealth management 1 – 1.2% fee and seems to offer some nice features (investing based on your inputs, rebalancing, tax harvesting, etc.). Do you think this is worth me trying? Or should I choose self-directed and just plop the money into some reliable ETFs? Thanks!

Congrats. Hope you enjoy the 4% gravy train (until they inevitably revoke it).

I’m extremely skeptical of the value-add of robo advisors, even at a relatively low 0.24% fee. A Vanguard Target Date Fund would do so for 0.08%, but even that is not a panacea (see the capital gains debacle a couple of years back and the massive fallout: https://www.sec.gov/newsroom/press-releases/2025-21).

I much prefer the simplicity, low-fees, predictability (e.g. no cap gains debacle), and tax efficiency of a three-fund portfolio: https://www.bogleheads.org/wiki/Three-fund_portfolio, or in my case the two-fund variant sans bonds.

Our $700k brokerage account is entirely US index funds (Vanguard). Super tax efficient. We get international exposure through superior (tax efficiency, lower expense ratio) CIT fund offerings in our 401a/457b, but acknowledge most don’t have that option. Our 403b, HSA, and IRAs are entirely domestic. Trivially easy to manage DIY for a combined blended expense ratio of 0.01%, or about $100 per million per year.

Fees matter (even small ones), particularly when compounded over a many-decade investing horizon.

Thanks fp!!!!

Nice! Keep us updated!

Did you transfer the the $100k into a brokerage account? If so, how does their APY compare? My assets are at Vanguard which is earning 4.3% as of today.

$100k is in Vanguard mutual funds (VTSAX), which earns the same interest regardless of custodian.

There’s an explanation of the “Combined Qualifying Balance” in the footnotes of the signup page: https://www.usbank.com/bank-accounts/savings-accounts.html

> First, at the end of each month an average Combined Qualifying Balance is calculated. The balance is based on a 90-day average balance for all qualifying accounts and is calculated by adding together the end of day ledger combined balances for every day in the last 90 days and dividing the total by (i) 90 calendar days, or (ii) the number of days since opening an initial qualified account […]

It’s calculated at the end of month, meaning you wouldn’t be immediately demoted to the 3% tier (in most scenarios) if you temporarily dipped below $100K.

This was meant to be in reply to Thomas (December 9, 2024 at 11:00 am) above.

I’m considering doing something similar to you, Keith. I have my Trad IRA @ Fidelity—I’m currently holding mutual funds (FSKAX and FTIHX) but would convert them to ETFs (VTI and VSUX) before transferring the shares over. You get can 100 free ETF trades per year @ Bancorp (to trade mutual funds would incur transaction fees; I’d like to have the option to change my investments without yielding USB a dollar): https://www.usbank.com/investing/online-investing/self-directed-investing/brokerage-fees.html

Thanks for the write-up, FP. Count me as another intrigued reader seeking a single CC to rule them all.

Thanks for the feedback. Hope the card/setup works out for you.

From this doc: https://www.usbank.com/dam/documents/pdf/deposits/consumer-pricing-information/deposit-products.pdf

> Accounts opened through online, mobile or phone banking must have an opening deposit or the account will close after 30 days. Once the opening deposit has been made, to keep an account open it must have a positive balance or deposit/withdrawal activity. An account will automatically close if it has a zero balance and no deposit/withdrawal activity for four consecutive months.

As long as you stay above $0 the account will stay open.

(In reply to December 8, 2024 at 9:23 pm; my nested replies aren’t nesting. Alas!)

This is great! Thank you so much for confirming!

Rumor says that the USB smartly CC is likely to be discontinued soon. I’m wondering whether I should get this card.

I’ve seen the rumors as well. While I was skeptical of the longevity of the card, I cannot fathom them nerfing it a few months after release.

Even though they’ve nerfed the USBAR, it’s still going strong for existing card holders like me. I wonder if they’ll do something similar with the Smartly card.

I’d frankly be content if they dropped the Smartly card to 3%. I’d still prefer that to the 2.625% that BoA offers.

RobinHood offers a 3% Visa card (no categories) to Gold members ($50/yr). Gold comes with other benefits too. However, I’ve seen reports that RobinHood will close the card if you use it too much. If cash is your thing, the Bank of America Premium Rewards has been sustained with a long track record. It also provides 3.5% on travel/dining. Now that Southwest is charging for bags, I think getting your $100 airline credit should be easy to do. BoA also offers the elite, but to me, the math doesn’t make sense. I much rather just have the Capital One Venture X card for lounge access.

We’ll see how this Smartly debacle unwinds. If it implodes, I’ll probably go crawling back to the BoA Premium Rewards / Elite card. I don’t trust RobinHood and try to minimize my interactions with them.

Hi Professor, I searched Chase Sapphire at your website and wanted to see you reviews but no information. Is there any reason you don’t use Chase products? The Sapphire preferred/reserve seem to have tempting sigh up bonus.

100k points isn’t too shabby: https://www.doctorofcredit.com/rumor-chase-sapphire-preferred-100000-point-offer-in-branch-starts-3-23-25/

That said, I guess I don’t get too excited for these offers any more, particularly if I don’t see a use case for the card long term. For me, the CSR seems inferior to my 5.25% BoA + 4%-4.5% US Bank setup.

These days, I’m more inclined to ACATS transfer a few hundred grand of investments across brokers for bigger bonuses, albeit taxable. Seems like less work to me.

How did you get the direct deposits up to 8K? Would ACHs from Vanguard or something work? Because I really dont want to change over DD from employers temporarily like that if I can avoid.

2 x $4k ACH push from Fidelity to US Bank worked for me.

Same

Looks like US Bank is nerfing this. Signups after April 14 will no longer count brokerage balances towards requirements. In addition, education, taxes, and insurance will only receive 2%.

I saw that too. Bummer, but not surprising.

Well I put in a last-minute application April 10th and got approved, hope this gravy train lasts. I’ve had probably… 7 nerfed cards at this point and some of my best cards are grandfathered ones I’ve had for so many years I think the banks probably forgot about them. I bet this lasts at least a year, maybe longer.

Congrats on sneaking in before the deadline!

I’m hoping the gravy train lasts a while, but I guess we’ll see!

And now you’ve added Chase to the mix. Mad respect. 😀