Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Mrs FP and I (+ the two oldest kids) are officially obsessed with Neflix’s Drive to Survive series (link).

- Prior to this show, we couldn’t have cared less about car racing. But this show is so well produced that it is impossible to not be captivated by the sport.

- The WSJ put together a pretty useful and comprehensive tax guide (link).

- No paywall on this one.

- NYT podcast on the new Bing AI chatbot:

- First, they released a glowing review of the Bing AI search engine (link).

- Shortly after, they released an episode on dark side of Bing’s AI chatbot (link).

- This episode is hilarious/dark/funny/disturbing.

- Both are worth listening to.

- This evolution of these recent AI technologies is truly mind-blowing. It seems that our lives are about to change in a pretty major way, but I’m not exactly sure how. I haven’t felt this way for a long time (> 25 years?).

- MyMoneyBlog discusses Charlie Munger’s recent words of wisdom (link).

- Holy bajolie he’s 99 years old!!!!!

- In this clip, in addition to attributing his longevity to eating copious amounts of See’s peanut brittle, he also attributes his longevity to having never intentionally exercised a day in his life.

- I liked his thoughts on insurance. They mimic my own. Transcription from MyMoneyBlog:

- In my own life, I’m a big self-insured and so is Warren. It’s ridiculous for me to carry fire insurance on my house because I could easily rebuild a house if burned down. So why would I want to bother fooling around with the claims process and all kinds of things.

- So if insurance — you should insure against things you can’t afford to pay for yourself. But if you can afford to take the bumps, so unusual expense coming along doesn’t really hurt you that much. Why would you want to fool around with some insurance company. If your house burned down, I would just write a check and rebuild it. And all intelligent people do that way. I don’t say all, but — maybe I should say, all intelligent people should do it my way.

- There should be way more self-insurance in life. There’s a lot of waste. You’re paying when you buy insurance for the other fellows frauds, and there’s a lot of fraud in life. And you can afford to take the risk yourself and not fool around with claims and this and that and commissions and time. Of course, you self insure, it’s simpler and so forth.

- Think of what I’ve saved in my life. I narrowed it. I don’t care. I never carried — never. I think once — but with one exception, I never carried collision insurance on a car. And once I got rich, I stopped carrying fire insurance on houses. I just self insure.

- I liked his thoughts on the optimality of a passive-only 401k plan. They mimic my own. Transcription from MyMoneyBlog:

- …look at the Daily Journal Corporation. We just put in a 401(k) plan. What are the investment options for the people at work? Zero. It’s all index funds.

- What percentage of American 401(k)s have our plan, index funds required? About zero. Am I right or am I wrong? Of course, I’m right. It’s a logical thing to do.

- 23:48 Charlie’s thoughts on the business environment in CA vs other states.

- 29:00 Charlie’s thoughts on ChatGPT / AI.

- 59:32 Charlie’s thoughts on Costco. He loves it….a lot.

- 1:00:49 Charlie’s thoughts on Biden’s proposed tax increase on share buybacks.

- Holy bajolie he’s 99 years old!!!!!

- A former Google employee who famously lived in a U-haul in a Google parking lot has finally become domesticated and recently celebrated 1Y post U-haul (link).

Life

- February flew by. I’m not sure where it went.

- The weather varied from glorious to horrendous. It was bad enough for the university to be cancelled one day.

- FC1 is officially a driver now. Having an extra driver in the house has been pretty life changing.

- It was a bit painful adding her to our Geico policy, but I softened the impact by removing collision coverage on our minivan. I should have done that years ago.

FC5 likes sharks.

FC5 likes sharks.

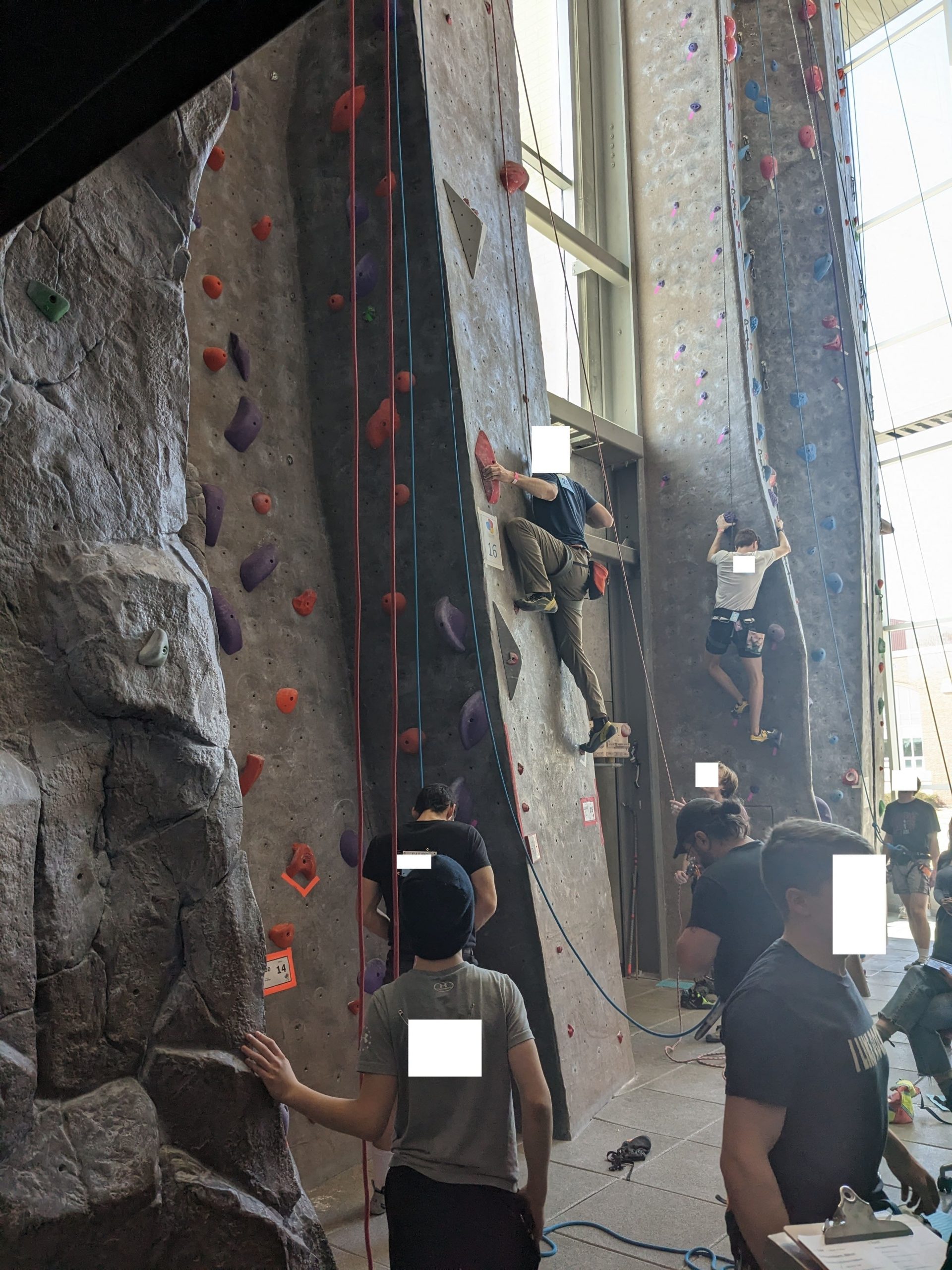

Climbing comp. This slab route was hell. I couldn’t get past that move.

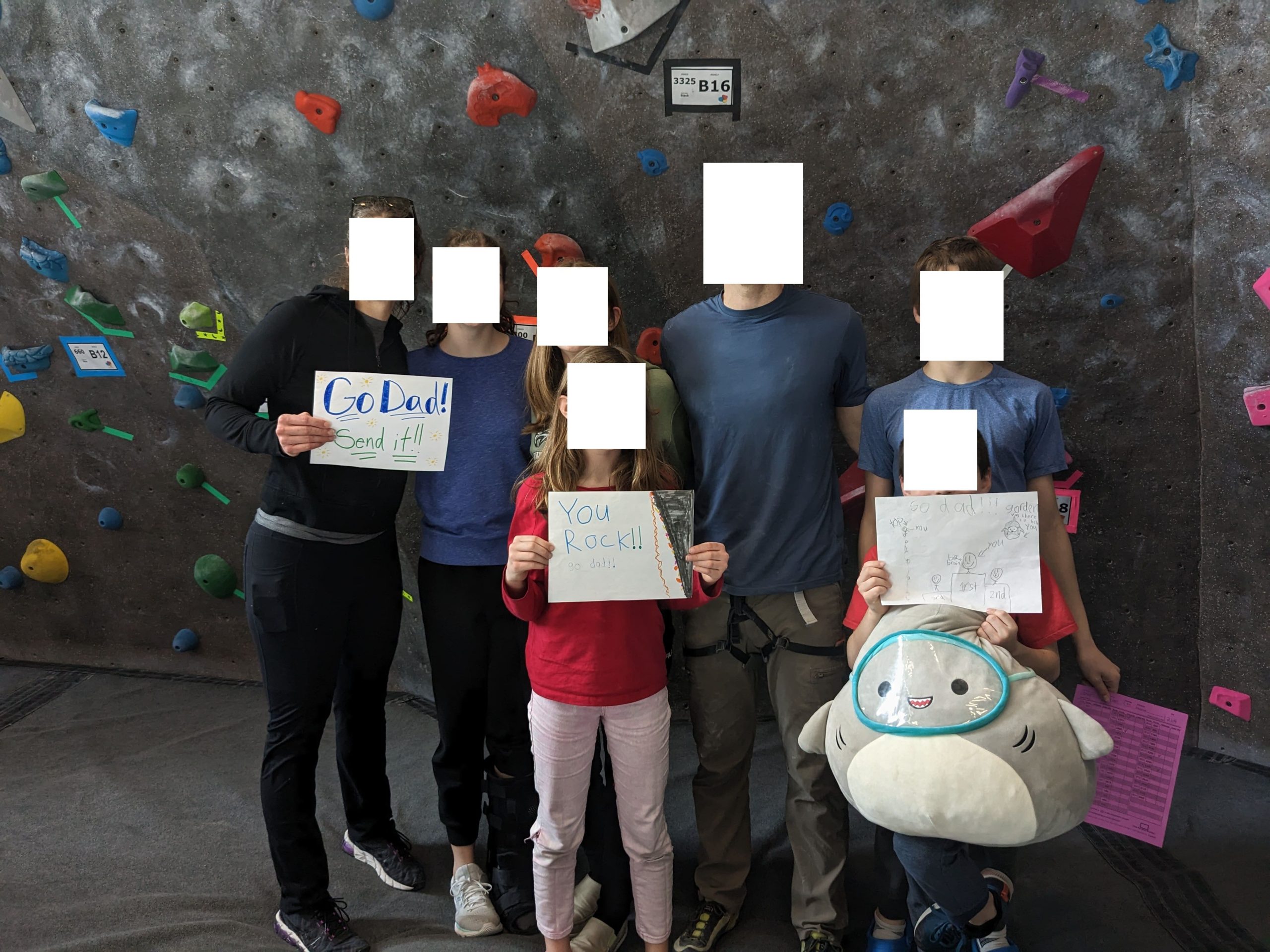

The fam came to cheer me on. It was pretty fun having them there.

We tried sledding a few days after it snowed. It turned out to be a bad idea.

We salvaged the sledding outing by making a really big snowman.

A cats came in a 6-player game of sequence. I’d never seen it before. I hope to never see it again.

The maiden voyage of our new driver. It was fun/weird/terrifying watching her drive away, especially with several of her siblings in the car. She stopped by Costco on her way back from dropping a sibling off and got herself a treat at the food court. Have I mentioned I love that store?

Roller basketball.

This Month’s Finances

- The good:

- Still employed.

- The bad/abnormal:

- We haven’t hit our healthcare deductible yet, so we’ll continue to hemorrhage money on drugs until then.

- Our 12-month rolling spending chart is trending dangerously high; I might have to rescale the cart.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Hello. Another interesting update. its nice to see your NW essentially return to prior peak so quickly. Its a tribute to your high savings rate.

Looking at your rolling twelve month spending for the full 5 years, especially food and housing, is interesting. How do you think inflation vs. family dynamics (older kids eat more, etc.) vs. lifestyle inflation is breaking out for your family vs. the nationally reported numbers?

Housing expenses have been relatively stable over time. The refi’s helped lower those expenses, but property taxes inevitably drive those expenses up. I’m pretty content with that category of spending.

“Food” expenses have definitely gone up, but I broadly classify spending at Costco/Walmart as “Food” (even when purchasing clothing, etc). I can’t think of much going on in that category in terms of lifestyle inflation, but it seems that larger kids eat more food, so perhaps that’s driving some of the increase (in addition to actual inflation as well).

Where lifestyle inflation has really surfaced in our spending is the “other expenses” category, which captures essentially all discretionary spend. Travel expenses show up here. Kid expenses (e.g. summer camps, sports, etc) show up here. We’ve intentionally loosened the purse strings in this category, so I’d attribute much of the growth of this category to lifestyle inflation vs real inflation.

The chart is indeed interesting to look at. It’s kind of a neat way to summarize one’s financial life. Every penny spent will forever be archived in the chart. And time trends are easily observed.

Glad to see that you’re still chugging along with the blog. I personally have found a lot of value in your posts over the years, and I thank you for taking the time and effort sharing it with everyone.

The discussions above from both you and Charlie Munger regarding insurance has me a bit curious. My homeowners has ballooned to about $2.5k/yr in the past few years (no claims) and it seems to me a time for a rethink of how I’m approaching this. I know you’ve mentioned in the past (perhaps recently) that you keep a high deductible. If you don’t mind sharing, I’m curious where you have your insurance and how often you shop around…and perhaps any other thoughts you may have on the subject.

Good question on insurance. I’ll write a dedicated blog post on this topic in a day or two and give more details on our insurance strategy.

Gustav,

The blog post is drafted, but I lost steam so I didn’t publish it yet. Quick summary:

* Esurance for homeowner’s insurance. I pay ~$650/yr for a $25k deductible plan. I shop around every year but never change.

* Geico for cars. We get all the discounts. It used to be < $200 for two cars total before FC1 turned 16. Now it's a bit higher, as is expected. I don't shop this around because I'm confident I'm getting a great rate. I've been with Geico continuously since 2003 or so. * $1M Umbrella with Geico for ~$150/yr. Happy camper here. I don't shop this out every year.

That WSJ book is a great resource. Thanks for sharing!

Glad you liked it!

Hi! I have been a lurker for a while and just started to look into 529 now that we have a bit more cash flow.

Is your 529 with California 529? And do you only contribute $10k a year for all kids? Aren’t you expecting their college expenses to be much higher than that?

My 529 is through my state because I get a $10k/year deduction (worth $700). Absent this incentive, I’d be 100% in CA’s 529 since it is the lowest cost.

I’m anticipating college expenses in excess of my 529 balance, or more accurately stated, than the future balance of my 529 balance. I’ll cover the shortfall with cash flow, cost sharing with my kids, and maybe scholarships. My employer, for example, picks up 50% tuition if my kids go to school here.

Ah I see. Wondering if you have done the detailed math… is it possible that the projected federal and state tax-free compound growth in the CA529 might exceed the $700 savings per year, if you contribute more than that $10000 limit instead to the CA529?

The relevant tradeoff is as follows. Since my kids’ college expenses will exceed my in-state 529 balance, I’ll have to come up with the shortfall through some other manner. To arrive at the tradeoff you’re discussing then it’d be the following:

* Invest any shortfall (e.g. the difference between total college expenses and my 529 balance) into a 529 plan (like CA’s). Why? Because the gains are exempt from fed & state taxation.

* Alternatively, I could invest this same shortfall into a taxable brokerage account. The disadvantage of this approach is cap gains & dividend taxes. However, the advantage of this approach is I don’t run the risk of “over saving” in a 529 account and dealing with the consequences (e.g. 10% penalty + taxes on gains).

By maxing out the available $10k/year of contributions (based on my state’s rules), I’m ensuring at least a 7% discount on all college expenses funneled through the 529 (based on my state’s tax rates). It’s actually more than that when I account for the dividend & cap gains savings, which I have never computed personally.

But I think you have a point. If I could magically forecast to the penny what my kids’ future college expenses were (and future investment returns), then I could calculate to the penny what I’d need to contribute today to “superfund” any shortfalls in a 529 plan. The advantage of this approach is I’d save on dividend taxes + cap gains taxes relative to a taxable brokerage account. The disadvantage, in reality, is that there are many unknowns, and over saving in a 529 plan is not costless (e.g. 10% penalty).

good to see unfrugal dog enjoying/chilling in snow

Surveying her territory with pride….

I’m glad you’re still chugging along with this blog. You’ve inspired me to create my own Blance sheet. It took me about a month, but I could only go back 6 years since the data gets spotty with some information being updated only every 3 months, rather then monthly. But, it’s all good. I did notice however when totaling my federal taxes and FICA for last year that it was substantially higher then yours, even though our incomes are very similar. Are you able to give insight on that? Mabe it’s just becuase me and my spouse are DINKs.

In 2022 we sheltered $35k in a 401a, $20.5k in a 403b, $20.5k in a 457, $6.4k in another 403b (Mrs FP’s), and $7.3k in a HSA. All of that is pre-tax. It adds up. Every dollar of contributions saves us about 31 cents in taxes across federal and state. It pays to be a university employee with access to multiple retirement accounts.

Also, the $10k child tax credit doesn’t hurt either.