A few weeks ago I wrote a deflated post in which I questioned the wisdom of keeping this tiny blog alive. Quite a lot of you responded that I should keep it limping along, so I will.

On the topic of what to write about going forward, Ron gave the following suggestion:

As a reader, some of the original articles like credit card rewards, who you bank with, etc. have been great and was what brought me to the site to begin with. I would say my constructive criticism would be there just needs to be new dedicated posts or updates to those topics. For example, the landscape and products available in terms of credit cards/banking have changed over the past year. It would be good to hear your thoughts to some of the new products and whether it has changed your thinking or consideration for your current setup. Or maybe there’s something out there that you’re not using that you find attractive that could fit well for someone else if you were not already entrenched with your current setup.

I appreciate Ron’s feedback. Here’s my attempt to (re)explain why I do what I do. It’s not exactly a very succinct post in terms of focus (running the gamut from credit cards to sunscreen). But here’s a summary of why I do what I do.

Why do I embrace frugality?

- I reject the notion that a single dollar of extra spending will materially improve our happiness.

- Consequently, any dollar not spent today can be invested for my future self’s well being. How much future consumption is that dollar invested today buying me in the future? $1 + interest – inflation – taxes.

- Hopefully interest > (inflation + taxes), though it’s certainly not a guarantee.

- What about “the risk” of over saving?

- I think this is a good “problem” to have. If we over-save, then our kids get some extra money when we’re dead.

- With a pot of money that is too big, one could stop working earlier to solve that “problem”.

- When buying X pounds of food each month to feed my family of seven people (or clothes for them to wear, etc.), why not do so in the most cost-efficient manner?

Once you learn to separate your happiness from excess consumption (above a reasonable standard of living), life becomes pretty simple and enjoyable.

Some life experiences that helped shape my views on frugality:

- Being happy as a poor college student.

- From the age of 19-21, spending two years of my life in South America and viewing how happy people were living on relatively little. Further, this experience taught me to really differentiate “needs” from “wants.” From an outsider’s perspective, many American “needs” are hilariously excessive.

- Making decent money out of undergrad and refusing to succumb to lifestyle creep.

- With $100k in the bank, quitting work for 7 years to go back to grad school (MBA + PhD). Ended up with a net worth of $250k while living below the poverty line.

- Post grad-school, refusing to succumb to lifestyle creep (with varying levels of success).

Who do I bank with and why?

It is a bit ironic/unusual, but I use my Fidelity brokerage account as my primary bank account. I have my direct deposit hit this account and have all AutoPay’s (credit cards / mortgage) linked to this account. What are the advantages of doing this?

- I can hold high-yielding money market funds (e.g. SPRXX or the slightly lower yielding SPAXX) in the account that are auto-liquidated when there is a debit to the account.

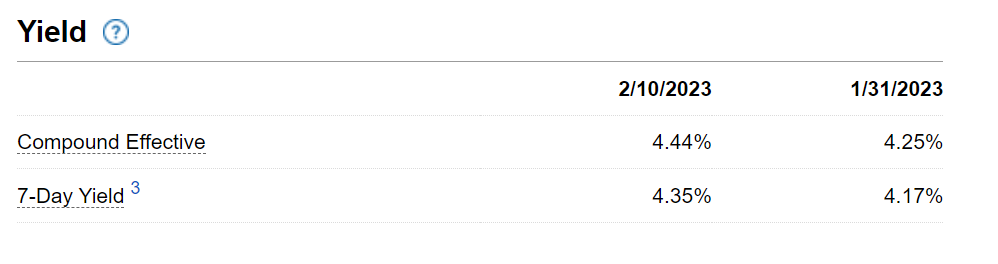

- As of yesterday, SPRXX was yielding 4.44% (annually), which is about 1% higher than Ally bank’s offerings as of the time of this writing.

- I get access to my paycheck 1 day earlier with Fidelity than with a normal bank.

- Unlike Ally, I’m allowed infinite withdrawal transactions per month. Whereas Ally (and other high-yield savings accounts) cap this at 6 debits per month.

- I get ATM fees reimbursed at any ATM in the world. This came in handy during my recent(ish) trip to Peru. Further, the exchange rates are quite favorable with Fidelity ATM transactions.

- Note that free ATM reimbursement is conditional on setting up a CMA account. This process is described in this post.

- Really fast ACH transfers to/from Fidelity.

What are the disadvantages of the above?

- If you need to deposit cash, you’ll obviously need another bank account with a local branch (unless you happen to live by a Fidelity branch).

- Not really a disadvantage, but the interest payments show up as a 1099-B as “ordinary (non-qualified) dividends” rather than a 1099-INT. Since non-qualified dividends are taxed the same as bank interest, it works out to a wash. It’s just a different way of reporting interest on your taxes.

SPRXX yield as of yesterday.

Does the above matter? In the grand scheme of things, hardly at all. Earning a few extra dollars per year in interest does not move the needle for me. Especially when such interest is being taxed at 31% (24% fed + 7% state). Especially when I hold so little in cash to begin with. BUT it’s pretty easy to do and the customer service at Fidelity is second-to-none. So why not earn a couple more dollars and have a good banking experience at the same time?

BTW, the WSJ wrote an article on banking with a brokerage recently (link).

What tax software do I use?

FreeTaxUSA. It is perhaps the least confidence-inspiring name on the planet (their marketing team should be fired), but it’s legit. I learned about them from the Bogleheads forum.

I file my state taxes for free on my state’s free efile system. It takes < 10 minutes and saves me $15. Pretty good return on invested time (~equivalent to $180k/year tax free salary on a per-minute basis).

Where do I turn for financial advice?

Speaking of the Bogleheads forum, I find it the best source of financial knowledge on the internet. Here is the link. The search bar in the top right corner is your friend.

I even turn to it for consumer advice. Want to hear what a bunch of smart people think about electric lawnmowers? Type “electric lawnmower” into the search field and you’ll see many insightful comments from brilliant people.

Admittedly, the site is ugly and doesn’t have good upvoting/organization mechanisms (like Reddit). But it is well moderated so the signal/noise ratio is quite high.

Why do I obsess about Costco?

We shop at Costco for reasons illustrated here and here.

I grew up in the bay area, CA. My love of Costco started at a young age. In middle school, I’d bike 16-miles round trip for the free samples and the $1.50 hot dog + drink + $0.50(?) churro. I’m glad I didn’t get killed biking there; at least I would have died doing something I loved…..

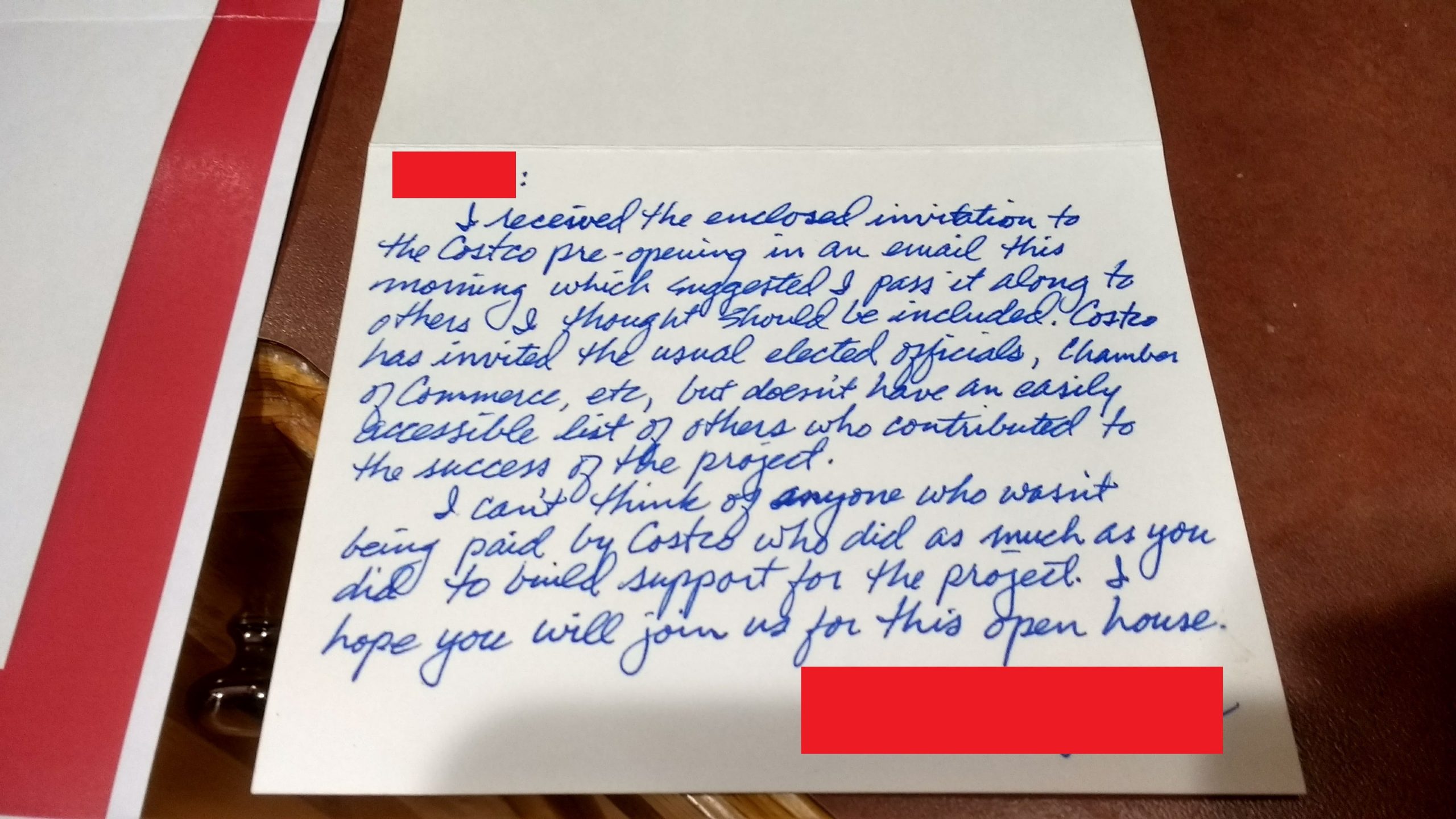

One of the biggest drawbacks to accepting my current job was that there wasn’t a Costco in town when we moved here. However, before moving here I learned through the grapevine that Costco was actively trying to expand to our city. In fact, they were planning on building about 1/3 of a mile (literally, as the crow flies) from the house we ended up buying! Long story short, in my single bout of political activism, I created a petition and collected hundreds of signatures, hosted a city council meeting in my home, and Costco ended up coming to town. I can see actually Costco from my house. It warms my heart every time I see it. I attended the grand opening and got to shake the hand of the CEO. It was a pretty fun experience.

The invitation to the grand opening from Costco’s head of legal counsel. Because cursive is hard to read, I’ll transcribe: “I received the enclosed invitation to the Costco pre-opening in an email this morning which suggested I pass it along to others I thought should be included. Costco has invited the usual elected officials, Chamber of Commerce, etc, but doesn’t have an easily accessible list of others who contributed to the success of the project. I can’t think of anyone who wasn’t being paid by Costco who did as much as you did to build support for the project. I hope you will join us for this open house.”

If you were to ask me on my deathbed what I was most proud of in life, I think that building a Costco in my back yard might rank pretty high up there!

If you haven’t seen this “lunch at Costco” parody, it is one of my favorite things.

We end up getting 7.25% cash back at Costco. 2% Executive + 5.25% CC cash back (see below).

I may have to seek counselling for my unhealthy obsession with that store.

What is my credit card strategy?

Here’s my prior post on the topic for more context/details.

First off, I’d recommend that everyone change their credit card due date across all cards to a date that makes sense. I’m paid at the end of every month so I align my (several) credit cards to have billing due dates on the 1st of every month. Every credit card issuer allows this feature, just google it. “How to change credit card billing cycle at Chase/Citi/Bank of America.”

With a credit card due date on the 1st of every month, this corresponds to a billing cycle end date of the 4th of every month. Guess when I make my big purchases? The 5th of every month (more accurately, the 4th because it takes a day for the transaction to hit the statement). Why do I do this? Because it maximizes credit card float. ~30 days from the first day of the cycle to the end of the cycle + ~30 days from end of cycle to due date = ~60 days of float. I certainly don’t need the float, but if the credit card company is giving it to me, I’ll take it.

With the above out of the way, now we can talk about credit card rewards. A weird oddity with the IRS is that these are considered to be tax-free, which is a big plus.

As I’ve discussed ad-nauseum on the blog, I’ve converged to 100% utilization of Bank of America credit cards. Between my wife and I, we now have six permutations of the Cash Rewards cards. Each one gives us $2,500/quarter of 5.25% rewards in the category of our choice. 6 cards * $2,500 = $15,000/quarter or $60,000/year of enhanced rewards space. We spend less than that, so we’re fully covered.

The most versatile BoA cash rewards category is the “online” category since it is the most flexible. It counts an airline purchase at Southwest.com as an “online” transaction as well as a “travel” transaction. The same is true, I believe, when making food purchases. We’ll occasionally order from Papa Murphy’s online, and it codes both as “online” and “restaurants.” Where this category really gets lucrative is with Walmart and Costco. If you link the credit card to your Walmart app, then any in-store transaction paid for via the “Walmart Pay” feature is coded as “online.”

Relatedly, you can now buy $500 egift cards at Costco.com which are coded as “online”. Every month (on the 4th), I will buy $1500-$2000 of egift cards at Costco.com. They are emailed to me within 15-30 minutes. Once in your inbox, you can redeem via bar code at any register (or self check out). However, my preferred approach is to transfer these to a physical Costco gift card (called the Costco Shop card). I do this at the front counter and it’s a relatively painless process. The max you can transfer to a gift card is $1k/card. If I desire to transfer $2k of digital cards to physical cards, I’ll say “can I please buy two $1k gift cards.” They ring it up, and I pay with my four $500 digital gift cards. It works out relatively painlessly.

I supplement the above BoA “cash rewards” cards with the $95/year annual fee premium rewards card. It gives me 2.625% cash back on every purchase at a minimum + 3.5% on travel/dining. Since we can get 5.25% cash back on travel/dining with “cash rewards” cards, this card is solely our 2.625% cash back card. It’s great when travelling (or ordering from overseas) because there are no foreign transaction fees.

The $95/year annual fee seems bad, but you get $100/year in “travel credits” + a $100 global entry / TSA precheck credit every 4 years. The $100/year in travel credits are described well in this DoC post. In the past, I’ve purchased $100 of American Airlines egift cards and dumped them on Raise.com. However, that opportunity is apparently no longer available. That said, I’m planning on trying a $100 United Travel Bank this year because I actually fly united quite a bit. If this works, then the cost of the card drops to negative $5/year (or more accurately, negative $5 minus $100*3.5% (the cash back earned on the $100 travel credit transaction) minus $100 global entry /4 years = minus $33.5/year).

If you don’t care about foreign transaction fees, or if you don’t travel on United/AA, then this $0 annual fee card (Unlimited Cash Rewards Credit Card) might suit you better than the premium rewards card. It’ll save you the hassle of dealing with the $100/year travel credit.

Am I paid by BoA to share these thoughts? Not a penny. In fact, I lose money on this blog. This BoA setup is what I happen to have in my wallet and I’m happy to continue to pay forward that good advice. I can’t think of a better system than 5.25% cash back on most purchases + 2.625% on everything else. If you have a better system, then please share in the comments.

What if you don’t have $100k of investments laying around to transfer to Merrill? A colleague has the US Bank Altitude Reserve card and says he gets 4.5% cash back at Costco through that card. This post describes the opportunity well. I’m not interested in this card because I dislike the annual fee and the redemption restriction on travel.

If you are looking to play the credit-card-sign-up game, then DoC is your best resource. Like a well-trained animal, I’ll occasionally play this game if the carrot is big enough. $1k seems to be the hurdle to get me excited to pursue an opportunity like that.

Why do I care about taxes?

Put succinctly, your aggregate tax burden over your lifetime is astounding. Especially when viewed in terms of the drag on your compounded wealth accumulation. Learning how the tax code works takes an hour or two of reading and can potentially save you hundreds of thousands of dollars of taxes over your lifetime. I distribute this poorly written PDF to my students every year which attempts to capture the essence of how the tax code works and why you should care about it.

If you care about building wealth, it is probably prudent to invest an hour or two thinking about it. I literally cannot think of a higher return on invested time than that.

Here are some related posts:

- https://frugalprofessor.com/hierarchy-of-savings/

- https://frugalprofessor.com/trad-vs-roth-marginal-vs-marginal-vs-marginal-vs-average-wisdom-from-mdm/

- https://frugalprofessor.com/hierarchy-of-dissavings/

- https://frugalprofessor.com/asset-location/

Unlike optimizing banking or credit cards, which barely move the needle in the grand scheme of things, optimizing for taxes moves the needle by an orders of magnitude more. I can’t emphasize this enough.

I have plenty of friends who’d like to optimize their taxes, but can’t afford to shelter any more money because they are spending too much. Frugality is what enables one enable to shelter money from the tax man and optimize for taxes.

Thoughts on emergency funds?

Do you think Warren Buffet’s has an emergency fund?

I don’t believe in emergency funds. I believe in having a pile of liquid assets (and available credit through credit cards) to handle emergencies.

The math says you’ll come out ahead using my approach, on average. Particularly if that emergency fund is in a tax-advantaged account (e.g. Roth IRA).

Thoughts on insurance?

I reject all forms of insurance where self-insurance is obviously viable (cell phones, extended TV warranty, etc).

More generally, I carry only high deductible insurance. I carry only liability insurance for our two cars (we drive 11-13 year old hoopties so they are easily self-insured). We reject rental car coverage. We carry a $10k deductible on our homeowner’s insurance and are comfortable self-insuring up to that point.

In other words, we are our own insurance company. And we profit — like insurance companies — when we have fewer claims.

Thoughts on cars?

I mostly hate them. They pollute. They kill people — other drivers and pedestrians. That said, they are certainly convenient; particularly when the weather outside is horrendous. Any time I drive mine, I hear MMM’s disapproving voice in my head shaming me. When I do drive, I try to carpool as much as possible. I’m amazed at our collective non-interest in carpooling (birthday parties, school, etc).

Biking is good for the soul. If you are like most Americans, you don’t own a bike. MMM has a post on that.

That said, be smart about it. It doesn’t do you any good to hop on a bike and get killed by a car. 95% of my riding is on dedicated bike trails where the risk of a lethal collision with a vehicle is rather small. Wear high-viz reflective clothing. Helmet. Bike lights at night.

I’d like to bike across the country once in my life. The GDMBR, for example, is on my bucket list. Hopefully I can do it sooner than later given my aging body.

Thoughts on financial advisors?

I think the 1% assets-under-management asset management fee charged by financial advisors is too high. You’d do much better on your own with a low-cost DIY portfolio. Feel free to occasionally utilize fee-only financial advisors who charge $/hr rather than % of assets.

Thoughts on tracking spending?

I think you should do it, even if you are in a comfortable financial position. Having an understanding of what you are spending is truly empowering.

Mint and Personal Capital come to mind as free resources. Mint makes money by trying to cross-sell you credit cards and their tax software. Personal Capital makes money by trying to upsell you into money management. Their financial advice is expensive and horrible, so I’d avoid their advising. But I personally use their free financial tool because it is great. I just block their inbound marketing calls and emails.

Tracking your spending empowers you to see where where your income is going and gives you the opportunity to reflect on whether those outflows align with your values. Until you track your spending, you are essentially relinquishing control of your finances to third parties (like those charging you recurring fees).

Pay particular attention to those charging recurring fees (Netflix, etc). Why? Years can pass with a lingering unused subscription without you realizing it.

If you truly want to geek out, I encourage you to take your expense tracking to the next level and track your income, taxes, and investments each month. I describe how I do so here.

Any frugal hobbies?

- Board Games

- The good ones, like the German ones (Settlers of Catan, etc).

- Disc Golf (more fun than real golf).

- Seriously, give it a try. It’s way better with friends.

- Biking

- Hiking/Backpacking

- Climbing

Any random recommendations?

- Ublock Origin chrome plugin.

- $26 Walmart pants.

Old man rant?

- Take care of your skin. The sun, which ironically gives us life, is simultaneously trying to kill us. Wear a hat/sunscreen.

- Take care of your teeth/gums. You’re not a shark. Your teeth won’t regenerate.

Any closing thoughts?

We’re all hurling around the sun on this rock called Earth at a bajillion miles per hour. At the age of 41, I’m about half dead. Time is flying by (this blog has covered about 17% of my life!). My daughter — who was born yesterday — just turned 16 and will be gone to college (or elsewhere) before I know it.

If you get a few of these financial things right, then your life becomes a lot simpler. No more stressing about money. And you’ll have the financial freedom to do what you want with your life.

Have fun. Pretty soon we’ll all be dead. On your deathbed, I don’t think you’ll wish you had worked more. Similarly, I don’t think you’ll wish you had exerted more of your life energy trying to keep up with the Joneses. I imagine you’ll regret not having lived life to the fullest (travelled the world, biked across the US, better nurtured family/friend relationships).

So why not live a life now that you won’t regret?

Taking ownership of your finances is one seemingly small — but very important — step to get you to this point.

I didn’t see the post questioning the wisdom of keeping the blog alive, but will give a few random thoughts of my own. First, you probably have quite a few passive viewers like myself that enjoy reading your updates, but rarely offer comments. Second, there are some discussions in your blog that don’t apply directly to some of us (don’t live near a Costco, don’t maximize credit card strategies, don’t bike, etc.) so we can’t offer any additional thoughts. Third, this blog will give you a diary and place to reflect sometime down the road. I personally enjoy your financial updates and have found some of your information useful (i.e. using Fidelity as a one-stop shop, money market interest rates). I think you could even open the blog up a little by posting your thoughts about some of the postings from Bogleheads.

Cheers

Tex, thanks for stopping by and for confirming that life is indeed possible without Costco.

Blogging is a weird endeavor. My excitement towards the endeavor ebbs and flows over time. I like making an impact, but the impact is hard to quantify at times. Thanks for the feedback on keeping it going.

Thanks for doing what you do! I agree that you should keep this website up. Every so often I like to hop on here and read what you are upto.

Thanks!

Hi Frugal Prof: thanks for sharing this updated list. Good for all of us to see what you do and then check to make sure we are taking advantage of all the opportunities. I fully agree with your “Any closing thoughts?” section. And at age 76, my agreement comes with a lot of experience under my belt. All the best to you and family.

The years are indeed flying by with every passing year. Thanks for confirming that perspective.

A natural question to ask is what kind of life I will have wanted to live when it’s all over. And I think it’s healthy to work backwards from there.

With banking at Fidelity – do you have any perspective on making accruals toward future spending? Say saving toward car, future property tax bill, etc?

I currently do this at Capital One and keep ~10 different savings accounts that have auto-transfers set up on pay day. It’s a bit of a slog to manage, especially because each few years they’ll “reboot” their high yield savings account and I have to move everything over.

How do you handle this use case?

I’m pretty sure Fidelity will let you up as many brokerage accounts as you want — similar to what you’re doing at Capital One. I’d call and ask.

That said, I’m more of the “single bucket” approach that is a much easier to manage. If your desire is to segment your single pot of money across multiple objectives, why physically separate the accounts when you could digitally/mentally separate then via spreadsheet, for example? Your response will be that it is easier to “cheat” digitally when there isn’t physical separation. I’d push back saying it’s good to exercise your financial discipline muscles.

I’m glad you decided to ‘keep on keeping on’ with the blog. It is one of very few that I subscribe to. Its so informative and I love your general attitude towards money management. This post was incredible… I am currently looking at 13 open links on my browser of things that looked like they worth exploring more. Thanks!

Thanks for the feedback and I’m happy that you found something interesting in the post.

Hi FP:

Thank you very much for the updated recommendations. This is exactly why your blog is so great! I’m glad you’ve decided to keep it alive.

Like the previous comment, I also agree with your closing thoughts. The point is to enjoy our time here. My wife and I are in the beginning of our financial freedom journey and resources like this are encouraging and keep us grounded/realistic.

Thank you.

E.

Thanks for the comment. I’m certainly not the money guru. Just a dude with a weird hobby of being overly transparent with my finances to random strangers on the internet. Hopefully you can learn from my successes/failures and enjoy this strange journey called life the best you can.

Glad you will keep blogging. I share your savings hierarchy post with my students each semester.

Thanks for stopping by. I had a conversation with a frisbee golf buddy about the hierarchy of savings idea. He’d accumulated some extra money by accident and was curious to hear how to best deploy those savings. It’s nice to have a disciplined, tax-optimized approach.

Great update.

Thanks!

I strongly disagree that your obsession with Costco is unhealthy.

Terri, are you guys Costco people? I forgot if I had that in common with you.

With your approval, I’ll skip the therapy sessions.

Thanks for blogging and keeping it going. One question I’ve always had as a fellow over-saver is, when will you retire? Given your current living expenses with 5 kids and your savings + pension, minus whatever you’ll contribute to colleges for the 5, you have maybe 30-40yrs of annual expenses for empty nesters accumulated depending how you draw down? Is there a number or formula you’re following, or is it more than $ factoring in? Apologies if you covered this previously.

This is a really good question. I don’t really know the answer to it, but here are some thoughts:

* Being a professor is the least bad job I can imagine, so I’ll work longer here than I would elsewhere.

* If I were to stop working earlier (e.g. while my kids are young) and watch Netflix all day, I would worry of the poor example I’m setting for my kids.

* I’m unsure what kind of financial obligation I’ll assume with my kids college education. I have friends who are paying big bucks to send their kids to the Ivy’s. I don’t think my kids are headed down that path, so I think I’ll come out substantially cheaper.

* I’m quasi-risk-averse (perhaps a bit ironic given my current 100% equity asset allocation), so I wouldn’t mind a bit of buffer for the unexpected. That said, this kind of mentality could justify working until the age of 120, so I’m not sure how to break out of it.

To summarize, I don’t know when the optimal time to stop work is. Listening to Steve Levitt through the years, however, has taught me one thing. If you are considering a change in your life (moving, career, religion, etc), then it is probably a signal for you to do it. Too much of the time, we let the fear of the unknown or the “status quo bias” paralyze us into inaction — even when taking the leap into the unknown is likely to improve our happiness. Using that framework, if you’re thinking seriously about retirement, it may very well be time to do it (assuming the finances are in order).

Makes sense- I just assumed (hoped?) you had an equation and a magic number that we readers could benefit from. As I’m learning, retiring from your job is one thing, but you need to retire to something – and Netflix isn’t it. I’m not within 5yrs of early retiring, but I have been recently inspired by Bill Perkins’ book Die with Zero- it could help reframe what you describe as your financial risk aversion.

I’m a huge fan of the book Die with Zero. It’s basically the polar opposite of my blog and mentality. I think there are some nuggets of truth in both camps, and I’m certainly loosening the purse strings more than I used to.

It sounds cliché, but there are plenty of people who come to mind that will never retire because they like their jobs so much (e.g. warren buffet, charlie munger). They’ve found a job that energizes them and they don’t view it as a chore. It gives them purpose.

There are certainly aspects of my job I don’t like, but there is a lot to like about it. As a result, it certainly makes me want to pull the retirement trigger later than I would otherwise.

As far as the “magic number” goes, this is where the huge body of work of BigERN comes in. From what I remember about his ~50 posts on the topic, he says something like a 3% SWR is “safe enough.” We’re not at 3% SWR yet, so even if we wanted to, I don’t think we could financially pull it off. But in a few years we’ll likely hit that number.

When that day inevitably comes, I guess I’ll have a decision to make. Keep crunching ahead for “one more year” — aka “one more year syndrome” — or pulling the trigger for some unknown post-retirement pursuit. A colleague of mine just retired this year and he seems to be the happies human I know.

I try not to pretend to possess more wisdom than I actually do. I have no idea what the future holds, but I like the trajectory I’m on and am hopeful that it’ll turn out okay.

Hi FP,

Great post, filled with great advice! The years do fly by, but from what I can tell you are giving your kids a solid foundation on which they will build their lives. Keep up the good work on that, whatever you do blog-wise.

Best regards,

MDM

MDM, thanks for stopping by and for sharing your wisdom with me through the years! I’ve learned more from you about taxes than almost anyone on the planet.

Thanks for the words of encouragement on parenting. It’s amazing how fast the time is flying by.

with so many Bofa Cards, do you have seamless billpay experience at fidelity? i see that for past 1-2 years or so, e-bills setup does not work for BofA cards (if you had already set it up prior to it, e-bill works fine for BofA cards). you have to put in the amount manually and pay. was wondering if you were able to get past the issue.

I don’t use Fidelity’s bill pay functionality. Rather, I authorize third parties (like credit card companies and mortgage companies) to direct debit my Fidelity brokerage account. For my 7 BoA CC’s, I autopay in full on the 1st of every month. It all happens automatically every month and I don’t have to think about it.

Here are some great instructions on how to set up this functionality: https://thefinancebuff.com/autopay-bank-america-credit-card.html

The only time I use Fidelity Bill pay is when I want to send a paper check and save a stamp.

I also enjoy the blog and have only commented once in several years. I am a fellow frugal professor, enjoyed your posts about the 403b changes you worked for…

Frugal professors unite!

Thanks for the note. Hopefully you can find something actionable from my 403b experience to take to your institution as well. As employees, we shouldn’t have to endure poorly implemented retirement plans designed by uninformed administrators (with the help of self-serving “expert” consultants).

Thank you for sharing the pdf Professor. I had made peace with the fact that I won’t see the 401k money for a couple of decades but the Roth IRA conversion information was new and interesting to me. I recently switched employers, so there is my 401k with Empower that I’d love to consolidate with Fidelity. Not being good with math, these conversions frighten me a little. Given we go from 401k at Employer -> rollover into tradtional IRA -> conversion from traditional IRA to Roth IRA, isn’t the tax liability very high at your marginal rate when doing the trad->Roth conversion. You have access to the money/principal sooner but that’s still a fairly large amount of tax.

Also, since you can’t touch the money for 5 years, was it an easy decision for you to make or did you have hesitation setting up the Roth IRA conversion ladder?

Also, isn’t the Roth IRA conversion similar to contributing to a Roth 401k account at your employer instead of traditional 401k? Sorry if these are basic questions, but I often get confused with them.

A $10k Roth conversion is taxable same as $10k of labor income would be. If your AGI is $100k without the Roth conversion, and you do a $10k Roth conversion, then your AGI is now $110k.

I think the benefit of rollover/conversion vs. just making Roth 401k contributions is that the Roth 401k contribution limit is capped per year based off IRS rules, where as conversions of post tax 401k contributions have a much higher IRS contribution limit. And converting previous years of pre-tax contributions in theory is only capped by the balance of that account.

I agree with your logic.

However, for someone who is not FIRE, the Roth conversion is taxed at one’s marginal tax rate (fed + state) on top of one’s existing labor income.

So one would have to be really careful about Roth conversions pre-retirement. To do so optimally, they’d want to ensure that the tax rate on the conversion is lower than their expected tax rate on the downstream withdrawal from a Trad 401k had they not converted (e.g. at the age of 60), after appropriately accounting for any additional sources of income later in life (e.g. pensions, soc sec, other investments, etc). https://frugalprofessor.com/trad-vs-roth-marginal-vs-marginal-vs-marginal-vs-average-wisdom-from-mdm/

Thanks Bill, yes I had totally forgotten about that contribution limits etc.

Your understanding is correct. Old 401k => rollover IRA to Fidelity (rollover) Trad IRA => Convert to Roth IRA and pay for conversion at your marginal tax rate.

There are there reasons why I personally haven’t done the above yet:

* I’m not retired, so I don’t need the liquidity.

* I can’t roll over my workplace retirement plans until I leave my employer.

* My MTR is quite high.

If your objective is to get access to your 401k money earlier, then you’d have to follow this procedure to avoid the 10% penalty.

If I do FIRE some day, I’d unambiguously do it. Given the high standard deduction as of today, one could easily convert ~$26k at 0% tax for MFJ, and an additional $22k at 10%, and so on. All the FIRE bloggers are doing this (GoCurryCracker, RootOfGood, etc).

Thanks Prof. I think I’m going to just leave it as is until I actually need the money which is when a conversion is at least justified else I can’t help but think about the tax rate.

I think that’s the right call.

The only other consideration is the following. If your new employer’s 401k is significantly better (investment costs, administrative costs, fund selection, etc) than your prior employer’s 401k, then it makes sense to consolidate to the newer 401k. In fact, even if the newer 401k is equivalent in terms of costs/etc, I’d still migrate for the sake of consolidation. It’s easier to keep track of and manage assets once consolidated.

Hi Prof, since you use Fidelity for most things banking, you could perhaps try Fidelity Full View to track credit card spending by linking your accounts as opposed to using different services like Mint or Personal Capital. It isn’t the best since some spend is categorized incorrectly and accounts do need a refresh every now and then but there has been a huge improvement over the last couple of years.

I have linked all my credit cards, 401ks and even my Treasury Direct account to get an accurate picture of my net worth. I don’t know how wise this is given all the security breaches but I felt uncomfortable doing that with Mint or Personal Capital and not so much with Fidelity.

I first used Fidelity Full View about 20 years ago. I can’t remember why I migrated away from it, but it was indeed a good tool at the time. I’m glad you’re getting some use out of it.

You’ve had an impact on me and my family. Like yourself, I’m a former engineer that saw the light and went the MBA route. I’ve shamelessly hijacked your expense tracking/net worth uber spreadsheet, and it’s become my prize possession. Literally my roadmap to not just financial freedom, but financial abundance. Thank you, keep it up!

I’m glad you’ve gotten some value out of this silly site.

I cannot believe that you are actually using the net worth tracking spreadsheet! Like you, it has become my North Star. I cannot imagine my life without it. I have follow-on questions. Please email me (my contact info is in the header of the website).

Your blog is very good

Thanks!

Hey FP, Thanks for everything you do. I know the benefits are not monetary for you, but it is the joy of sharing the frugal/optimization techniques. I recently got the Costco membership and I have to tell you, this is the first time I am looking forward to going shopping! There is something about the vibe, the samples etc, that makes you feel you are getting the best stuff for a good price. I used to shop at Aldi and Bj’s and I will be stopping my Bj’s membership from May. I got a Costco membership a bit early due to a promo of 45 dollars cash back for a 60 dollar membership. I am now seriously thinking of upgrading to executive and shifting purchases away from Aldi.

Love your article comparing Aldi Vs Walmart Vs Costco, there is something to be said about the quality of fresh produce, Avocados I purchased from Aldi has to be eaten within a few days of ripening, but I see that both Kiwis and Avocados from Costco are of better quality.

Do you drink coffee? If so, what is your go to bean?

P.S: I should have paid more attention to your site before I got the Citi Costco card, but now I know what I should exactly do :-). I am just going to use the Citi card for just restaurants, which is a good deal even beating BOA cards.

Glad to hear you’ve joined the Costco cult! It truly is a different experience. Next step, upgrade to executive. The breakeven spend is ($120-$60)/0.02 = $3,000/yr, or $250/mo. We’re at $18k/year, so we more than make up for the upgrade cost. Gas + food court excluded. Everything else is included (including my payments at pharmacy (excluding coinsurance, etc)).

It’s blasphemy, but we occasionally shop at Sam’s in town. They give away free memberships almost every year (https://slickdeals.net/newsearch.php?q=sams+club+membership&searcharea=deals&searchin=first&isUserSearch=1), so we sometimes join. But I find myself constantly agitated while shopping in that store. It’s so blatantly inferior in about every single way. But they do carry a few products that Costco doesn’t (e.g. most recently, it was a Nintendo Pro Switch remote that brought us there), so sometimes we succumb.

A dedicated BoA cash rewards card with the category of restaurant selected will yield 5.25%, which is greater than the 3% of the Citi card. But that assumes the $100k at merrill edge.

I don’t know whether another card just for restaurants is worth it given the amount we spend on eating out. I did upgrade to executive.

Good news on executive.

Agreed on the triviality of a dedicated restaurant card. That said, we’ve enjoyed having 6x cash rewards cards (most of which are set to “online”) for the occasional very big expenditure (e.g. major vacations, etc). I’ve also passed the 5.25% savings through to extended family members at times.

Hi Frugal Professor.

Another one of your readers here that comments rarely. I am so glad you are continuing with your blog. I have picked up some great tips from you in the past two or so years that I have been following you and use your Excel spreadsheet to track our family’s net worth religiously. I definitely trust your research more than other financial bloggers out there. Thank you for creating this tool and I hope some day you publish your book!

CindySW,

Thanks for stopping by this obscure corner of the internet. It’s interesting to meet another person tracking their finances religiously. I can’t quite articulate exactly why, but I find it to be a truly empowering activity.

Perhaps I should finish writing that book after all….

Just wanted to chime and say thanks for continuing the blog. You’re up there with MMM and JL Collins in terms of personal impact, for me anyway.

Thanks for stopping by! Glad you’ve found something useful here.

I just used FreeTaxUSA per your recommendation and loved it. I added it to the financial section of my onboarding notes that I provide all of our new college graduate hires so that they’re aware too.

Thanks for all you do!

Glad it worked out for you. I’ll never use TurboTax again!

Brilliant post, professor!

I love your story about Costco activism.

I also have Fidelity CMA set up as my bank account and pretty much happy with it. I will add one more drawback though – no Zelle support. Zelle allows me to instantly transfer money between my bank account and my wife’s. I hope Fidelity will have it some day.

I see you posted this Feb 11. For some reason, your post just showed up in my Feedly yesterday.

Weird about the Feedly delay. Not sure what is going on there.

As far as Fidelity/Zelle goes, I agree it’s another limitation with Fidelity. I prefer Zelle to Venmo/PayPal due to its instantaneous nature. That said, Fidelity’s ACH transfers are as fast as any other institution I’ve dealt with, so I guess it’s a limitation I can live with. It’d be nice if they added that functionality, but discussions on Bogleheads seem to imply that such integration will never happen for a variety of reasons. Not sure if that’s true, but I’m not holding my breath….

Also, about ‘Walmart Pay’ being coded as ‘online’, which normally works fine for me, but I recently went to a different Walmart store, and the Walmart Pay didn’t get coded as ‘online’. I’m not sure if it’s a glitch or just the payment setup at that particular store.

We went there a few days ago and it is still coding as 5.25%. I sure hope they don’t change that policy!

Another data point here. This past Saturday, I paid using the Walmart app, linked to my BoA card. It wasn’t categorized as an online purchase, just a regular grocery purchase.

Weird! Sorry to hear that.

I just checked my recent activity and it appears to be the same at Walmart. At Sam’s, however, (the blasphemy, I know) it is till coding as “online” when using scan and go.

Hi FP,

Just working through your book and you mention that GoCurryCracker avoids taxes in retirement through dividends and capital gains from his taxable brokerage account, up to like 77k. What’s the strategy you have in mind to use up the 77k? Currently, I’m only getting around 4.5k in dividends, so it seems to me I’d need to sell assets in my taxable account every year to get closer to 77k. This tells me I should may be prioritize investing in my taxable account as well? Taxable accounts are always at the bottom of the hierarchy of savings and so I don’t always prioritize it. Either that or there is another way to get up to that 77k that I’m not understanding.

Good question. Google “capital gain harvesting” and read articles like this:

* https://www.gocurrycracker.com/harvesting-massive-capital-gains/

* https://www.madfientist.com/tax-gain-harvesting/

* https://www.schwab.com/learn/story/how-to-save-money-with-tax-gain-harvesting

Thanks!

I love your blog! One thing I would recommend is that you enable sharing of each article entirely in RSS, right now it just shows a snippet with a link to “Read more.” Some others, like Mr. Money Mustache, publish each article in it’s entity in my feed.

Austin,

Thanks for the RSS suggestion. When I started the blog, I indeed had it configured to post the entirety of the text to RSS. However, I ran into a few issues:

* First, post revisions didn’t necessarily propogate/update properly. I write a lot of dumb stuff, so it’s nice to be able to retain revision control.

* Second, and less importantly, I lose the ability to track engagement (e.g. clicks, etc) if the reading happens via RSS.

So I appreciate the feedback, but for now I kind of like the simplicity of the current system. Primarily, the RSS feed is simply a notification of new posts.

How about a future post that dives into the details of all the great deals/products to be found at Costco that you recommend. Any hacks or insider info you have? I just got a membership recently, but feel overwhelmed at times when shopping there.

Here’s a post I wrote a while back on the topic: https://frugalprofessor.com/how-to-shop-at-costco-like-a-boss/

We buy a ton of stuff there. Almost all of our food, clothing, etc.

Hi FP,

FPHN (public health nurse) here. I check your monthly updates but haven’t commented before. I enjoy reading about the intersection of frugality and family life. I’m going to try using your net worth spreadsheet, and looking forward to the book. Thanks for writing!

Thanks for stopping by. Glad you’re getting some use out of these incoherent thoughts.

Good morning, FP. I’m considering opening a Fidelity brokerage as my main bank account. Do you think it’s a good idea to also hold my taxable VTI/VXUS positions in that same account? Thank you.

If it were me, I’d separate my investments from my banking account. I believe I’ve read online that you can open up multiple brokerage account at Fidelity, so separating shouldn’t be an issue.

All of my taxable accounts are elsewhere (VG & ME), so this issues doesn’t currently apply to me.

SPRXX is not an option as a core position now. Do you manually buy its shares or did you get grandfathered in?

SPRXX has never been a core option, though SPAXX is. To get around this, you have one of two options:

1.) Manually buy SPRXX every paycheck, or

2.) Set up an auto-purchase of SPRXX regularly (e.g. weekly, monthly, etc).

I’ve done both methods lately, but have converged on method #2 recently. It seems to be working great. To do so, follow these steps:

* click on your brokerage account

* “More…”

* “Account Features”

* “Payments & Transfers”

* “Automatic Transfers and Investments (View & Add)”

* “Schedule a new transfer”

* “Set up an automatic investment”

* Choose one => “This account’s core position”

* Choose the MF you already own (e.g. SPRXX shows up as “Fidelity Money Market” from drop down menu.

* Select recurring investment amount.

* Select recurring frequency. The most frequent is monthly. To do weekly, you’d need to set up 4 x monthly purchases.

It works really well. Take, for example, the following scenario.

* After getting paid, you have $8k in the core SPAXX and $2k in SPRXX.

* You set up an auto-purchase of $9k of SPRXX.

* It will purchase $9k of SPRXX and liquidate existing balances in the following order: $2k of SPRXX then $7k of SPRXX.

* After purchasing, you’ll have $10k in SPRXX and $0k in SPAXX. No loss in available transactions during this trade.

* If you don’t have sufficient funds to complete the purchase, it will simply not execute. Apparently if it skips 3x in a row, then the automated transfer will be cancelled.

Here’s how I currently have it configured: https://frugalprofessor.com/wp-content/uploads/2023/03/sprxx-automation.png. It seems to be working well.

Frugal Professor, what do you hold at Merrill to maintain Platinum Honors status? I purchased brokered CDs to get me into Platinum Honors at Merrill, but as they mature, I was thinking of purchasing VTI, which has no fees. I’ve only ever held mutual funds, and never had any experience with ETFs. Is the bid-ask spreads the most salient difference between the two? Do you foresee any difficulties if I were to close Merrill in future and transfer my all my VTI holdings to Vanguard? TIA. (Btw, I found your blog last year when I googled whether purchasing Costco cash cards would count as online purchases for my BOA Cash Rewards card. Long live Frugal Professor! )

Ana,

I laughed out loud at the “long live the FP” part of your comment.

I hold VTSAX (MF equivalent of VTI) at ME. I purchased at VG and transferred there. It seems to work okay, though liquidating would trigger a sales commission. Luckily I have no need to liquidate, so I’m fine holding in perpetuity.

If you were concerned about this issue, then you could could simply buy VTI at ME and incur a tiny bid ask spread upon purchasing. If you ever wanted to transfer to VG, that would be a non-issue entirely.

Hi FP,

Glad you are keeping the site around! I check in periodically to see what you are up to and have gained a wealth of knowledge from your blog. It’s always good to learn from someone else who is older and wiser than yourself and has a passion for sharing tips to improve the financial wellbeing of others.

Thank you for all that you do!

Thanks for stopping by!

Does SPRXX come with an expense ratio? If so, do you take this into account when calculating your yield?

It has an expense ratio, but that is already accounted for in the yield.

Love your blog and every few months I check in.

One note, the Fed suspended Reg D that banks used to justify the fees for five or more debits from savings accounts. When Ally hits me with a $10 fee, it is automatically refunded the following day. Consequently, the difference between a Ally MMA (4.15 APY) and a Fidelity CMA is probably de minimis.

I still pay out of the checking account with overdraft protection in $100 increments for safety in case the fees return, but it’s very smooth.

That’s good to know. Thanks for sharing! The transaction limit was always a huge PITA for me back in the day (~20 years ago).

I just discovered your blog, and I think I have many days if not weeks of catching up. Thanks for sharing all this wonderful advice and knowledge!

Hope you find something useful here!

I bought AA GCs for the credit in january as I’ve done the last several years. As far as I know, it’s not dead.

That’s my understanding as well. Glad it worked out for you.