Another month, another update. A few random comments.

Good Reads/Listens/Watches

- My frugal brother and parents introduced me to Ted Lasso on Apple TV+. Season 1 was pretty entertaining. Season 2 is currently being released.

- I’ve retold this bad joke before, but it seems pertinent. Some day, there will be a technological solution invented which aggregates disparate channels into a single platform for a single easy monthly payment…

- A few friends had recommended Better Call Saul to me. I finally succumbed. It’s not as good as Breaking Bad, but what show is?

Life

- Our family is continuing to enjoy our Fitbits. I think it has actually inspired us to be more active. I love the automated sleep tracking and heart rate monitoring.

- We bowled once as a family. I’m still not turning pro.

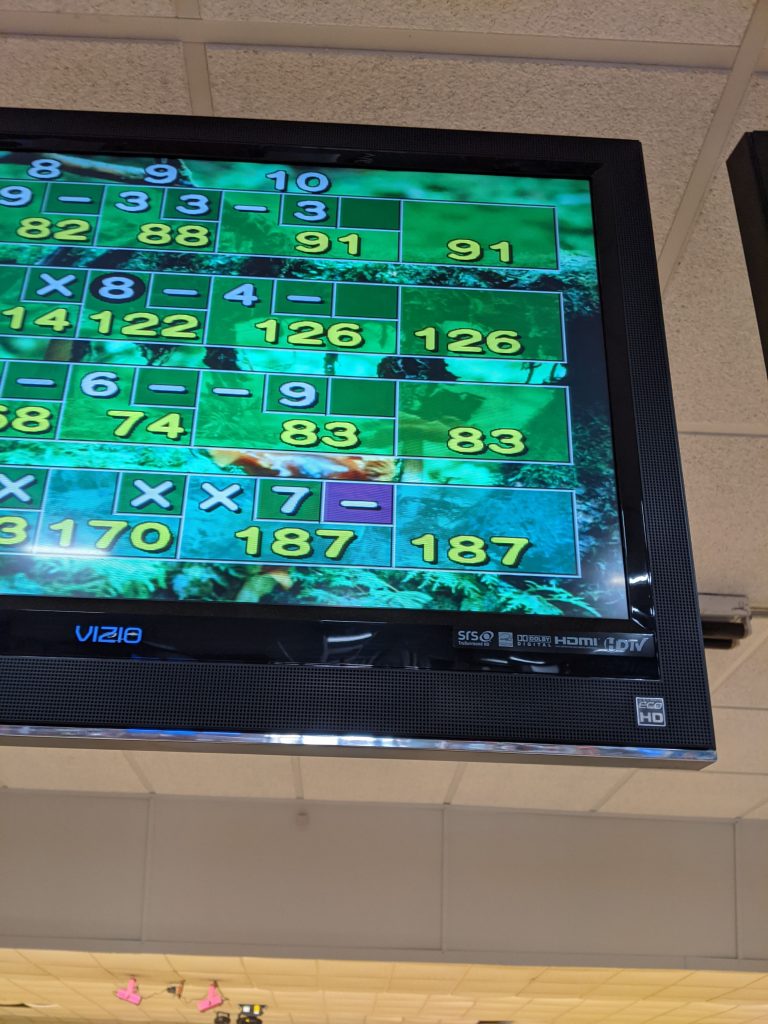

- This month’s scores: 136, 187.

- I hiked Mount Timpanogos with my frugal brother and unfrugal father. It was the fourth time I’ve made it to the top.

- It was not ugly.

- We took the Aspen Grove trail but I’ll try the Timpooneke trail next time.

- The following day, I did the 25 mile Park City Epic mountain bike ride with my frugal brother. We did this last year as well, which is how it earned the nickname “bike ride of doom.”

- Exactly halfway through the ride (on the very top of the mountain), I crashed on a short technical section and broke my rear derailleur. Luckily, my brother jimmy rigged it so that I could still pedal using my easiest gear. With the help of gravity, the remaining 12 miles or so went relatively smoothly.

- We almost got mauled by a moose once we got back to town. It was feeding on the side of the bike trail and we unknowingly startled it.

- Exactly halfway through the ride (on the very top of the mountain), I crashed on a short technical section and broke my rear derailleur. Luckily, my brother jimmy rigged it so that I could still pedal using my easiest gear. With the help of gravity, the remaining 12 miles or so went relatively smoothly.

- FC1, who is 14 years old, started her second year as a detassler.

- It is brutal work in the oppressive heat and humidity. Especially this year with the heat wave.

- Mercifully, a teenage neighbor is also detassling and offered to drive our daughter this year. This saved my wife and I from having to wake up before 5am each day and drive about an hour each day (15 minutes away one-way * 4 legs).

- FC1 will use the income to fund her (Fidelity) Roth IRA. Like last year, I’ll cover her payroll taxes (6.2% Soc Sec + 1.45% Medicare) to ensure she can contribute 100% of her gross income.

- This seems to be a decent strategy if you have the cash flow to do so. Kind of analogous to an employer’s 401k match.

- I get excited thinking about 80 years of tax-free compound interest.

- Speaking of which, I’m continuing to pursue changes to my university’s retirement plan to allow the mega-backdoor Roth. If successful, the tax benefits will be astounding.

FC2 gave me a run for my money for the first half of this game. Luckily I got a turkey to finish her off.

FC2 gave me a run for my money for the first half of this game. Luckily I got a turkey to finish her off.

Sunrise on Timp.

Cascading waterfalls for much of the first half of this hike.

Cascading waterfalls for much of the first half of this hike.

We saw over a dozen mountain goats on the trail.

We saw over a dozen mountain goats on the trail.

Proof we made it up. Provo and Utah Lake in the background. Luckily we hiked on a clear day. The following days were filled with smoke.

At the top of Park City resort, pretty close to where I crashed.

Back in town. I’m glad I didn’t have to outrun the moose on my bike with only my easiest gear available. The max speed on my easiest gear is about 2 mph. The moose doesn’t look very big in the pic because there is a big slope down to where it was. When it crossed the biking trail, it looked mammoth.

One month of sleep data, broken down by sleep stages. I lament not being able to fall back asleep if woken up.

One week of sleep scores. The scores correlate very highly with how refreshed I feel the following day.

One month of “active zone minutes.” You get rewarded with more zone minutes the harder you work (e.g. 1 minute of very hard exercise counts as about 2 minutes of active zone minutes). The first spike on the left is Mount Timpanogos. The second spike is the Park City bike ride of doom. Unfortunately, I take my watch of when I climb so it is missing that data. On days where I don’t bike to campus, my activity score suffers a lot. It really makes me appreciate how integral my daily bike commute is to my overall fitness. I’m really sedentary otherwise.

Resting heart rate computed overnight.

Cardio fitness score. Pretty neat.

Cardio fitness score. Pretty neat.

FC1’s Fitbit GPS tracking for a couple of hours of detassling. On a longer day, she’ll put in over 12 miles over her shift.

This Month’s Finances

- The good:

- Still employed.

- I couldn’t resist signing up for another Chase Sapphire Preferred card for another 120,000 points (100,000 bonus for me + 20,000 referral bonus for my wife). If you have a “player 2” (i.e. a spouse playing the game with you), this is slightly better than the offer we took advantage of last month (since 20,000 points * $0.0125 dollars/point > $95 annual fee + $50 grocery credit).

- I hate dealing with credit card “points” with a passion. Cash back is king. It takes an inordinate amount of time and mental energy to optimize transfers to “transfer partners”, etc.

- Refi #2 was completed successfully (recent blog post, more details here).

- The 0.5% refi penalty was removed a week or two after I locked (link). If you are looking for advice on the optimal time to refinance, it usually ends up being about a month or two after I’ve done mine. Therefore, now would be a pretty good time to start looking.

- I still can’t make sense of interest rates being this low.

- The Bogleheads thread has elucidated a lucrative refinancing strategy:

- Refi at higher-than-market interest rate and harvest ~$5k of lender credits (the opposite of paying points).

- Once you finally grow tired of playing the above game, or suspect that interest rates will rise, refinance a final time at a low interest rate.

- Of course, this strategy works best in periods of declining or stagnant interest rates (e.g. the recent many years). One might obviously regret the strategy if interest rates went up precipitously overnight.

- In hindsight, my prior refi was a mistake. I should have sucked as many credits out of my first refi as possible (given that interest rates have since fallen for my subsequent refi).

- The 0.5% refi penalty was removed a week or two after I locked (link). If you are looking for advice on the optimal time to refinance, it usually ends up being about a month or two after I’ve done mine. Therefore, now would be a pretty good time to start looking.

- The bad/abnormal:

- $400 plane ticket.

- $220 school fees.

- Marching band (bus, etc).

- Yearbook.

- $5 Locker.

- $208 on restaurants

- The second highest month of restaurant spending since starting the blog.

- $100 Global Entry fee.

- I recently learned through Doctor of Credit that Global Entry renewals can be done via Zoom. The Global Entry interviews are notoriously difficult to reserve and complete — especially if you don’t live in a large city. Upon learning this, I eagerly renewed mine with my new Chase card thinking it was an included benefit (a hasty google query seemed to confirm as much). After swiping the card, I realized that the Chase Sapphire Reserve was the card with that benefit, not the Chase Sapphire Preferred. My mistake.

- $31.92 rear derailleur repair.

I balanced my financial statement to the penny again. I’m developing an OCD tendency to do so — however, it is so gratifying when it works out.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

What kind of fitbit do you have? I need a new one. (You have probably included this info in a previous blog post, but I have been working a crap-ton of hours since January and had to give up some luxuries, like reading your blog. But I’m baaaaaack!”

Sorry about the crap-ton of hours. Welcome back.

Fitbit Charge 4. We got 4 of them for the family (two adults + oldest two children). I love that there are no apps vying for my attention on the watch. I’ve turned all notifications off. Zero email, etc. Just a fitness tracker.

Hope you guys are doing well!

If you are patient, they go on sale pretty regularly: https://slickdeals.net/newsearch.php?q=fitbit+charge+4&searcharea=deals&searchin=first

We picked ours up at Sam’s about 6 weeks back.

I have fond memories of growing up under the shadow of Timp. But I’ve never hiked it. Maybe next time I’m in Utah.

It’s incredible. I recommend it.

Thanks(?) to the drought, the snowpack was significantly less than in normal years. Consequently, it was really easy to summit in early July. Most years you have to wait until August/September to do so.

Could you please explain what did you mean :” mega-backdoor Roth” in your post? Do you max out your pre-tax dollars over Trad and Roth IRAs? Thank you

Also, how do you plan/execute the mega backdoor Roth?

https://www.madfientist.com/after-tax-contributions/

https://www.bogleheads.org/wiki/Mega-backdoor_Roth

https://thefinancebuff.com/rollover-after-tax-to-roth.html

Currently, my employer doesn’t allow it. I’m hoping to change that.

Thank you for the references. I am suspecting that my employer doesn’t allow it as well. How are you planning to change it?

I’ve been trying to persuade them for the past 5 years. I think my nagging might be working.

One more question, would you prioritize Trad or Roth IRA contributions?

https://www.dropbox.com/s/lv96xgpfp95d3tk/20180531%20-%20Incomplete%20Rough%20Draft.pdf?dl=1

https://frugalprofessor.com/trad-vs-roth-marginal-vs-marginal-vs-marginal-vs-average-wisdom-from-mdm/

https://frugalprofessor.com/hierarchy-of-savings/

“I’ll cover her payroll taxes (6.2% Soc Sec + 1.45% Medicare) to ensure she can contribute 100% of her gross income.”—-Would you please explain in detail how it works? or if you arleady wrote aobut it please send link for me?

Thanks

If my daughter earns $1k gross, her net paycheck would be for $1k*(1-6.2%-1.45%)=$923.50 after payroll taxes. She has no federal or state tax liability.

However, the gov’t allows her to contribute her full $1k gross income to the Roth. To allow her to better utilize all available Roth space (really valuable for a 14 year old), I’ll contribute $76.50 to her Roth out of my money if she contributes $923.50 of her money for a total contribution equal to her $1k gross.

She has other money in another pot that she could have used to fund the $76.50 shortfall, but I’m more than happy to step in to incentivize her to invest at a young age.

What matters, from the government’s perspective, is that the contribution amount be less than or equal to my child’s gross income (capped at $6k, of course).

I have a buddy worth many million. We’ve talked a lot about kids and money. He has an interesting idea to pay for his children’s taxes as they grow up (into adulthood) as a way of distributing money to them while still incentivizing them to be productive members of society. I’m not sure if he’s actually going to implement the plan (after all, it disproportionately helps high earning kids), but I thought the premise was pretty clever.

Better Call Saul is great, though I have yet to see the latest season. And I need to get on the Ted Lasso train!

Interesting that you are anti credit card rewards. I kind of like the thrill of the Chase, if you will. Though you’re right, cash is king. I had been saving up for a nice first class ticket to Europe but maybe I will just take some cashola at this point.

I watched every season of Better Call Saul available on Netflix. Turns out that is only seasons 1-4. Season 5 is not free on streaming anywhere that I could tell, but I checked my local library and it’s available on DVD. Woot! I know what I’ll be binging this month.

I’m not anti-credit card rewards. I’m just anti letting the tail wag the dog. It seems that once you deviate from cash back, the tail begins to wag the dog at some point. Granted, I’ll gladly take the $2.5k from this current Chase deal…

I think I’ve enjoyed Better Call Saul as much as Breaking Bad, but in a different way that I can’t quite articulate. It’s been a test of patience waiting for each season to come out.

I had no idea that you liked either show. I’m happy we have that in common. They are fantastic.

For future reference, the BOA Premium Rewards Card also includes a Global Entry Fee Credit of $100 every four years.

I appreciate the comment. I’ve used this BoA Premium Rewards benefit in years past but my 4 year clock hadn’t reset by the time mine was up for renewal. I originally used it to get global entry for Mrs FP and our clocks don’t align.

What is the order of allocation of funds for retirement, traditional IRA, then Roth IRA and the employer sponsored if no match?

https://frugalprofessor.com/hierarchy-of-savings/

If no match, then IRA is almost surely better than 401k.

Thank you, I actually have 457b (and 403b).

But the link says to max out remaining 401k over IRAs. So you’d do IRA over 401k (or 457b)?

Also, at what point (income levels) you’d contribute to Traditional over Roth ? The link says “as a mistake here can cost you hundreds of thousands later in life” and the links lead toward Traditional.

It’s complicated with no easy answer. It all depends on how your wealth is currently split between taxable, trad, and roth. And whether you expect to receive a pension going forward. And social security. It’s a bit complicated.

However, if your marginal tax rate today is higher than your expected tax rate in the future, do Trad now. Otherwise do Roth.

Trad now makes a lot of sense if you’re going to FIRE, like go-curry cracker. Relevant posts:

* https://www.gocurrycracker.com/never-pay-taxes-again/

* https://frugalprofessor.com/5-kids-169817-income-0-taxes/

* https://frugalprofessor.com/hierarchy-of-dissavings/

* https://clippingchains.com/2021/02/15/frugal-professor/

If I could contribute 100% of my savings to pre-tax accounts, I’d do so now. My marginal tax rate (27% Fed + 7% State + 2.45% Medicare) this year is 37%. This hurts. I expect my MTR in retirement could be 0%-12% (a la go-curry-cracker).

I only do Roth/Taxable because my Trad buckets are filled up due to IRS regulations. Having 100% of my wealth in a Trad 401k/401a/403b/457/IRA would be a great problem to have (until RMD’s come). You could very strategically convert Trad=>Roth up to certain brackets (e.g. top of the 12% bracket).

Yes, thank you so very much for your detailed explanation. I’m 42, single now, I would expect to receive some pension and SS, but as of today’s date these amounts would be about $300 each Govt + SS. Yes, my “marginal tax rate today is higher than expected tax rate in the future”.

Yes, certainly 37% tax is a big ouch.

And thank you for this tip: “strategically convert Trad=>Roth up to certain brackets (e.g. top of the 12% bracket).”

Happy to help.

FP do you have the PGA Golf cash rewards card by bank of america?

Nope. Hadn’t heard of it before. Just another permutation of the cash rewards card?

Hi Professor,

It’s interesting to see you getting back into the credit card signup game, since your recommended BoA credit card setup is working very well for me.

I agree the ‘point transfer’ game is really time-consuming. Do you plan to optimize and do the point transfer, or just cashing out the sapphire bonus?

Another credit card related question, do you value the credit card benefits, like purchase protections and travel insurance, vs getting the best cash back, when using credit card?

Good questions.

I don’t really have a plan on what to do with the 250k Chase points. A colleague of mine is masterful at redemptions. I’ll probably pick his brain.

On the travel insurance + purchase protection front, I’m pretty naïve to be honest. I don’t really trust these ancillary benefits very much because it seems: 1.) like a pain and 2.) that there is a high likelihood that the credit card company can deny claims.

David at OchoSinCoche blogged a year ago about failing to convince Citi to honor an extended warranty on a Costco purchase. This seems consistent with my intuition, but maybe this single data point does not generalize very well?

If there are obvious benefits I’m overlooking, I’m curious to learn more….

Hey FP – I’m curious how you fund your 403(b) and 457 so early in the year. Do you just sock away entire paychecks in the early part of the year? Maybe I’m just not aware of how those accounts differ from a 401(k). I was under the impression that the only way to get money into a 401(k) was straight out of paychecks. Thanks!

Yes, I basically direct all of my income during the first few months of the year to fund them as quickly as possible. This means that cash flow is tight in the beginning of the year and has to be dealt with strategically.

Hi FP, found your posts on Bogleheads and followed you here, i have been taking inspiration in balancing the balance sheet which i was never able to do.

I have been a long term BofA customer but until the rewards thread did not know we can take advantage of the 5.25% cash back.

Can you tell me what fund/ETF you own in the ME account. I have filled an application to open one recently.

Welcome to the cult of BoA + balance sheet balancing!

I own VTSAX at ME. I just transferred from VG. I never plan on selling to avoid the transaction fees. The downside is that I lose flexibility of tax loss harvesting. If I were to do it again, I would maybe convert from VTSAX to VTI prior to transferring to ME.

OK, great great thanks you.

Hi Professor,

Do you mind talking more about ‘convert from VTSAX to VTI ‘? I wonder if there are some unique features of ETFs?

I don’t understand much, but here’s what I know:

* You can convert from VTSAX to VTI only by calling Vanguard. There are no tax consequences.

* You cannot undo the above conversion. That is, you cannot convert back to VTSAX.

* VTI is 0.01% cheaper to hold than VTSAX and much easier to hold outside of Vanguard (e.g. at Merrill Edge to qualify for platinum honors). To be more clear, I hold VTSAX at Merrill Edge, but I didn’t tax loss harvest in March of 2020 because is more difficult (e.g. costly) to trade VTSAX outside of Vanguard. In many respects, I regret not tax loss harvesting at the time. However, I think TLH is largely overrated: https://frugalprofessor.com/tax-loss-harvesting-is-overrated/