A colleague of mine recently got a 2% 15Y mortgage from Better. Since I have a 2.25% 15Y mortgage, it piqued my curiosity.

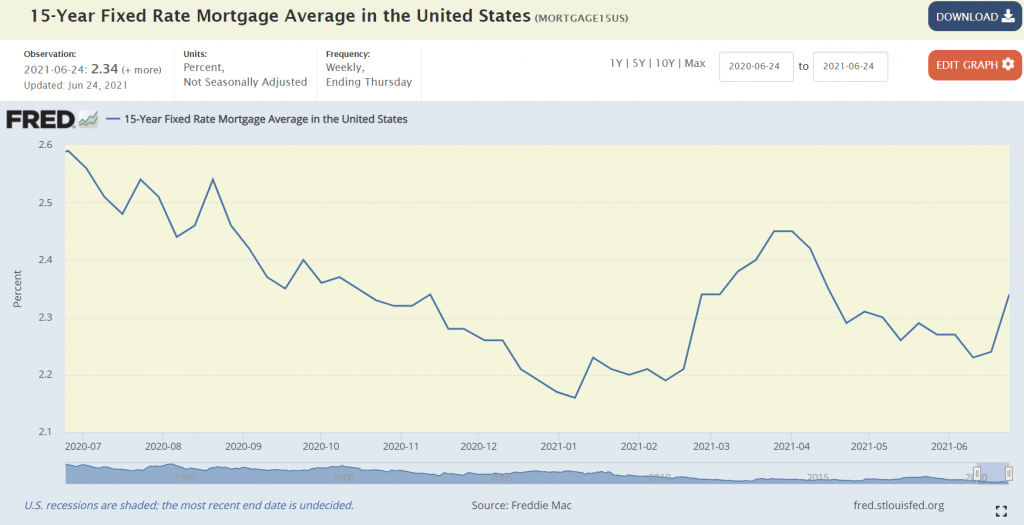

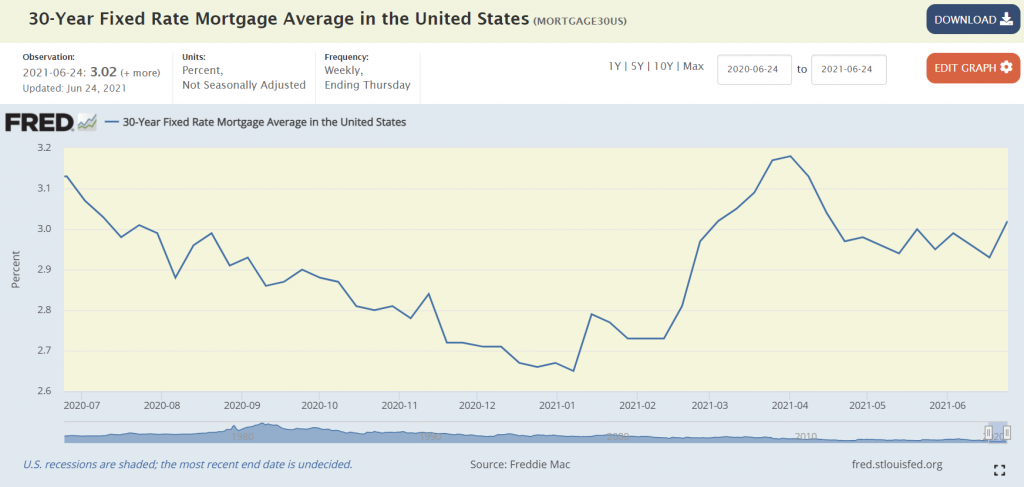

Here’s how interest rates have been behaving lately:

My last refi was about 9 months ago, but I applied last month to Better. Their rates were not competitive relative to my current rate.

A couple weeks back, I learned about a $2k (or $6k for jumbo) promotional Amex/Better credit (link to offer and link to bogleheads thread), which can certainly improve the economics of refinancing. I reapplied this month and was happy to see competitive offers (especially in light of the $2k credit). I was lucky enough to lock before the recent increase in rates.

By refinancing, I’ll be lowering my rate from 2.25% 15Y to 2% 15Y. I’ll also be paid about a grand to do so (after accounting for the Amex credit). I’ll save about $4k in interest over the life of the loan (in present value terms). Combined, I’ll come out about $5k ahead (in today’s dollars).

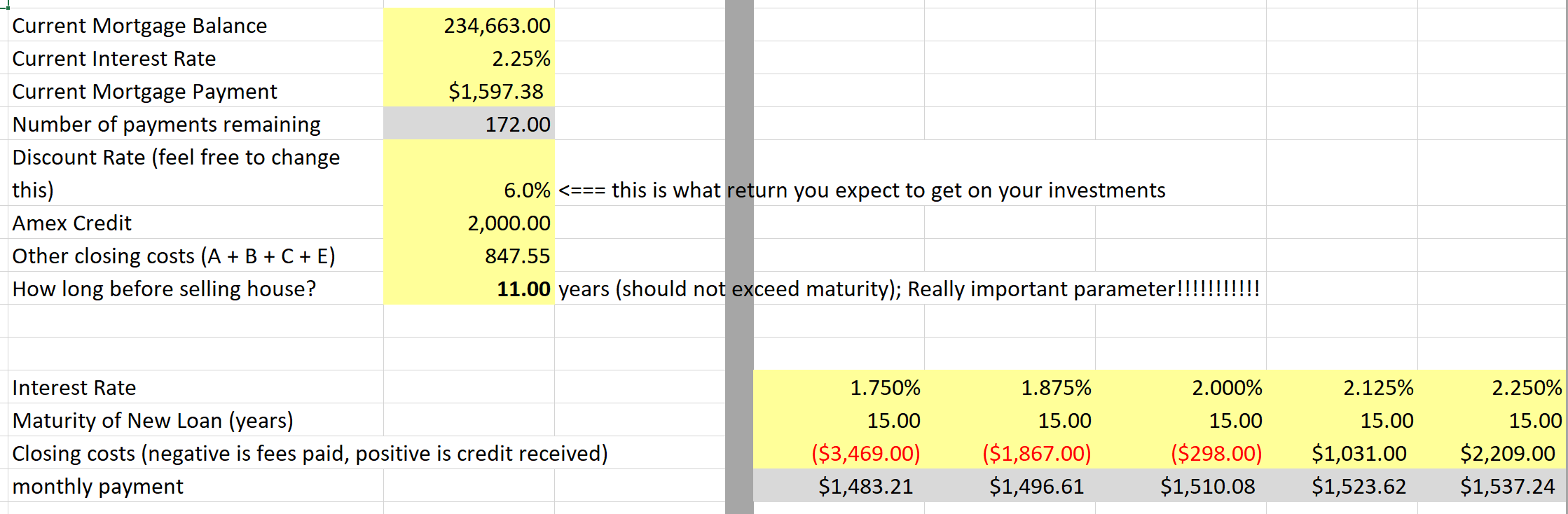

I had a hard time deciding between the different options in my Better rate table (e.g. what is the optimal amount of points to pay), so I naturally built a spreadsheet to help me decide.

========> You can download the model here <============

Relevant model input parameters:

- Everything in yellow. Pretty basic stuff. Grey cells are computed for you. You shouldn’t need to touch them.

- How long until you sell the house is a really important parameter to the model (Cell C9). Obviously, the longer (shorter) you stay in the house, the more (less) sense it makes sense to pay points.

- Another important parameter is the discount rate, meaning the expected return you think you can get on your investments. The higher (lower) the discount rate, the (less) more it makes sense to pay points.

- Cells F12:J15

Relevant model output parameters:

- Row 18:

- Cells F18:J18 tell you, in today’s dollars, the net benefit of refinancing for each of the different options.

- Cells M18:P18 compute the effective return earned (IRR) on dollars invested on points going from one interest rate to the next.

- It obviously makes sense to invest in points to the extent that this IRR exceeds your expected return on investments (cell C6).

Images of the model:

Here’s what the model inputs look like. Excuse the ugly grey line down the middle of the image.

Here’s how much better off you’ll be, in today’s dollars, for each refinancing option.

Here’s where the return on each incremental point is calculated. For example, paying $1,178 (or receiving $1,178 less in credits) to get from 2.25% to 2.125% produces an effective return of 10.9% based on the input parameters. Since 10.9% is a phenomenal guaranteed return, this is a no-brainer for me. Same for the next column over to get to 2%. Before closing, I may convince myself to lock in the 5.6% and 5.1% returns by paying more points.

I think I’ve convinced a few friends to refinance. One of them is coming out $50k ahead on a jumbo refi even though the interest rate change is relatively modest (< 1%).

I still don’t pretend why anyone is willing to loan me money at 2% when inflation is very likely to surpass that. If true, I’ll be borrowing at less than zero in real terms. I could get used to that.

Happy refinancing….?

Edit

Oh yeah, I forgot to mention that if you don’t already have an Amex, you’ll need to get one. I fell into this camp, so I signed up for the $0 annual fee one. There are better cards out there with better offers (like this one), but I didn’t want to deal with cards with $550 annual fees.

Edit #2:

Here is the exact timing of how it worked:

- 6/14: Locked 15Y 2% $233k refi & applied for my first Amex card.

- 7/12: Closed (could have been sooner but was out of town)

- 7/16: Funded

- 7/22: $2k Amex credit hit.

- Called 800 528 4800 to request reimbursement after secure chat failed to help (I don’t plan on using the Amex much at all). The system was unable to send a check for the full $2k, but was finally able to send a check for the $2k minus my current $300 balance, for a check of $1,700. Knowing now what I know, I should have simply requested the $1,700 check as explained here: https://www.americanexpress.com/us/customer-service/faq.credit-balance-refund.html

Cheap money is so tempting but stuff to buy (stocks, real estate) are so expensive that I still don’t want a mortgage. I like the feeling of not owing anybody and am willing to forgo leveraged gains.

If I can borrow for <= 0% real for 15Y, I'll do it. Mortgages paradoxically reduce sequence of returns risk. BigERN has written extensively about this. But I can certainly understand why many people prefer not to have a mortgage at all.

I’m somewhat puzzled by your implicit policy of not cashing out when you refi considering that your investment portfolio is 100% equities. At the same time, the margin rate at IBKR is less than 2%…

I also think I’m being irrational for not cashing out. Cash-out refi’s, however, are costlier. Further, I’m okay with the idea of not having a mortgage some day (through paying down the principal gradually over time).

Regarding IBRK, the margin loan is tempting but I don’t have enough in my taxable account to make it work yet. Fast forward a decade, perhaps that’s a viable option for me.

I paid off my mortgage four years ago and I think the sense of accomplishment is overrated. I have one kid and have been taking the standard deduction, so I would imagine that you have more incentive to keep a mortgage.

Regarding IBKR, isn’t PRO free with just $100k?

I don’t itemize either, but if I did a lump sum charitable contribution, I’d be able to utilize some of the mortgage interest.

I don’t know much about IBKR, but I should look more into it.

How does the 0.5% fee imposed by the Federal Housing Finance Agency as of December 1st, 2020 change the calculation? Is that baked into the points you’re paying?

Also, does your spreadsheet calculate the breakeven point where the total savings from lower monthly interest exceeds the cost of the refinance? In other words, how many months will it take to recover the refinance costs? I suspect it’s a sunk cost, but it also seems painful to frequently pay closing costs without reaching the breakeven point.

Lastly, there’s the wife-acceptance-factor. I suspect mine will strangle me if I ask her to go through another refinance after doing one in March 2020.

The 0.5% fee will be baked into the Better quotes already.

Months to break-even is not computed in my spreadsheet, but is easily computed by hand.

Months to break-even = fixed refi expenses / monthly interest savings

Months to break even = (Section A + B + C + E – Amex Credit) / (mortgage balance * (old interest rate – new interest rate) / 12)

For my 2% loan option with a $298 Section A fee, here’s how the math works out:

Months to break even = (298+64+689.55+94-2000) / (234663*(2.25%-2%)/12) = -17.5 months, which is non-sensical because I’m starting out better on day one.

For my 1.875% loan option, where I pay a net $714.55 on Day 1, here’s now the math works out:

Months to break even = (1867+64+689.55+94-2000) / (234663*(2.25%-2%)/12) = 14.6 months.

For me, the most informative metric on my sheet is the NPV in row 18 as well as the IRR in row 19.

Better.com makes the process as seamless as possible with their slick interface. It took me about an hour to submit everything they wanted (W2, paystubs, brokerage statements, etc.). A friend of mine is less savvy with password management and it will probably take them 100 hours of labor to do so. Thank goodness for LastPass.

I didn’t calculate the wife acceptance factor in the spreadsheet. That is beyond my programming ability. Here’s how it worked with Mrs FP. “Mrs FP, want to drive with me 15 minutes away to get $5k?” She said yes. That was that.

On my last refi, my A+B+C+E was $999+$1,115+$0+794 = $2,908. I didn’t realize that A could/should have been zero but even if I could get the title insurance down to $720, I’m still looking at the government fees. $0+70+$720+$794-$2,000=-$416. I not sure it’s worth it.

How much of an interest rate reduction are you looking at for -$416? I’d do that for a 0.25% reduction.

Great post. Tyvm! Also wanted to take advantage of this $2K offer.

Using your spreadsheet to determine the return on refinancing our home.

Currently a 15 yrs mortgage at 2.75% (refi right before Covid fallout)

We are considering a 30 yrs fixed rate around 2.75%. Reducing monthly mortgage obligations, but plan to continue to make similar monthly prepayment till we can’t. We have some concerns about future incomes because of the current uncertainty.

Lowering the mortgage payment could make our reserve last longer if needed in the future.

Does this thought make sense?

Given the income uncertainty, a 30Y mortgage could make a lot of sense. Best of luck!

tyvm!