Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Neurosurgeon becomes disillusioned with job, quits, and now spends his time hiking in the mountains with his dog (link).

- The video has gone quite viral, hitting 10M views in a month. A lot of it resonated with me, including how broken the medical system is (it’s entirely incentivized on treating sickness rather than preventing sickness and promoting wellness), the importance of spending time in nature, the importance of relationships, etc.

Life

- What a chaotic month politically… With roughly 100 days left to election day, Trump avoids death by an inch, Biden drops out of the race leading to mass chaos within the Democratic party, and Harris emerges triumphant days later as the nominee with near universal Democratic support. The election odds implied by betting sites have been gyrating wildly over the past month (link).

- I learned from Reddit that dog medicine (e.g. preventive flea, tick, heartworm, etc) can be purchased for half the price without a prescription from Australia (e.g. Bravecto, Simparica Trio, etc). I’ll be doing this once my current inventory of meds dries up (we’ve been using a combination of prescription Heartgard + over-the-counter Frontline from Costco for years). I wish I had learned of this sooner. For example, a twelve-month supply of Simparica Trio for our large (unfrugal) dog will cost $127 from Australia (shipping included) vs $276 at my local Costco — quite the disparity.

- FC3 followed in FC1’s footsteps and got a job detassling this summer at the age of 13. It’s a pretty lucrative job and he should get $13/hr after bonuses. My favorite part of having the kids get jobs at a young age is that they 1.) learn money doesn’t grow on trees, and 2.) are finally able to equate time and money. That moment where the lightbulb clicks and each expenditure is converted to hours worked is priceless. As far as I know, he’s planning on following in the footsteps of his sister and fully invest 100% of his paycheck into a Roth IRA. As per tradition with FC1, I’ll “match” his payroll taxes of 7.65% to get his contribution to 100% of his gross pay.

- I forgot to mention this last month, but we learned during our tours of UT colleges that UT is very permissive in allowing out-of-state students to change residency after their freshman year if they simply stay in UT over the summer to work, thereby establishing 12 continuous months of residency in the state. Almost every other state will exclude the time spent in school, whereas UT allows it. I started a Bogleheads thread on the topic here.

FC3’s detassling crew. A bit of a change of scenery from Whistler (and Utah and Colorado and Washington) a few weeks prior!!!

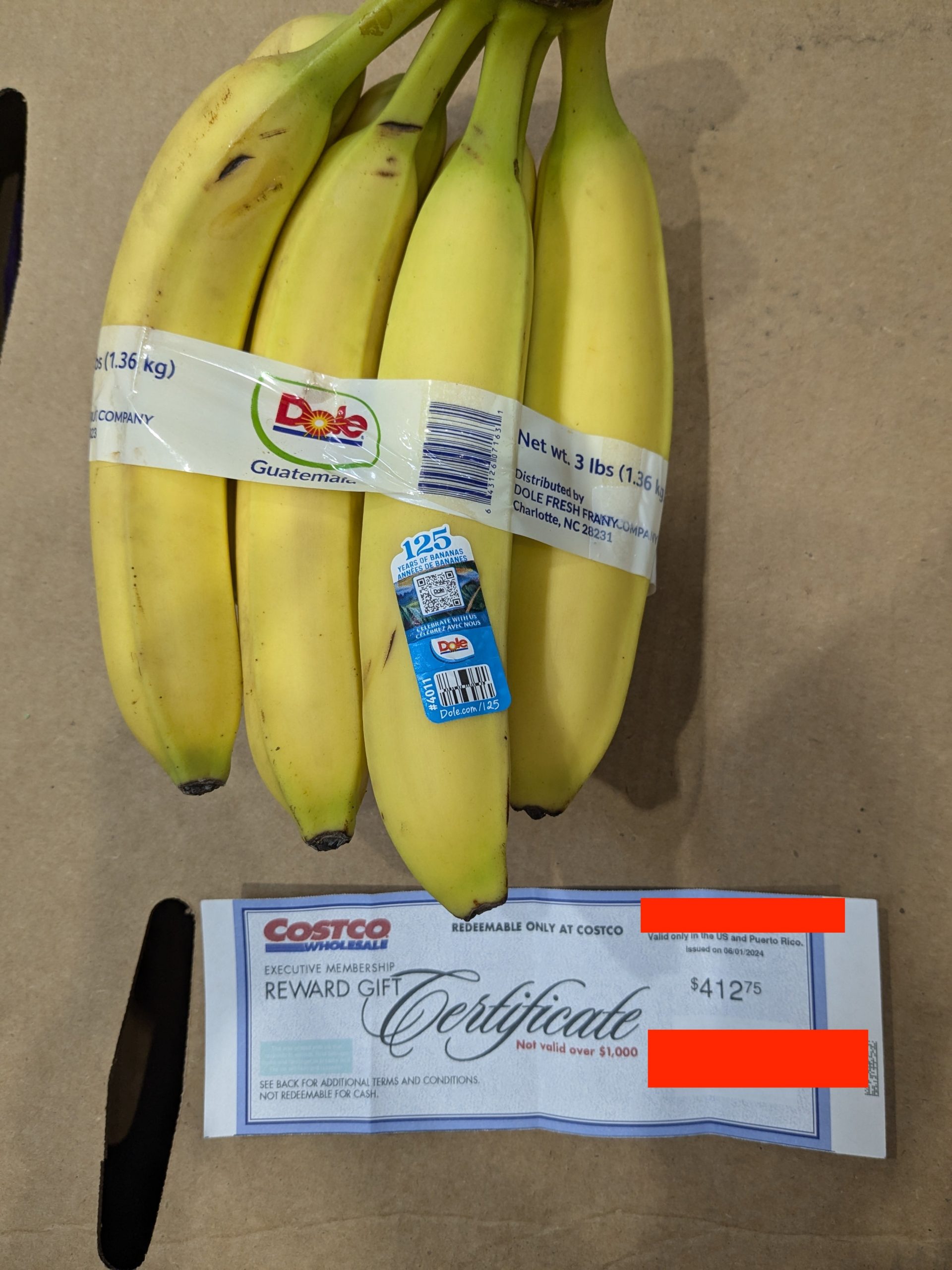

Executive banana rebate arbitrage (use rebate to only buy bananas), producing an extra return of ($412.75 – $1.49)*0.0525 = $21.59 relative to redeeming for a purchase.

We improvised a driving range net for FC3 & FC5.

FC5 has become addicted to diving. We may sign him up for a diving class soon. We were at this pool when a massive thunderstorm ripped through town carrying 80 mph winds. Thunderstorms are nearly a daily occurrence out here, so we’re pretty desensitized to them, but this one was different — it came on suddenly with fierce winds. Our friends – the owners of the pool – weren’t home at the time, so we huddled by an exterior wall for a few minutes while Mrs FP managed to get a garage code and let us in a few minutes later. Several lightning strikes hit easily within a quarter mile. Lots of big trees were downed in the neighborhood. It reminded me of being caught in a derecho on my commute home from grad school 10+ years ago.

A few hours after the storm. If you squint hard enough along the tree line, you can see Costco.

FC4 at a petting zoo exhibit at the county fair.

Chickens for miles at the county fair.

Sheep judging at the county fair. It was this same county fair where our city-slicker kids (FC3, FC4, and FC5) participated in “mutton bustin” 7 and 8 years ago (FC5 is the only kid who did it twice). I think they still have emotional scars from the experience and FC4 may still have a physical scar.

This Month’s Finances

- The good:

- Still employed.

- Dumped another $15k into our brokerage account.

- Our $100k BoA Platinum Honors status renews annually in April. Although our Merrill balance was ~$0 in April, we utilized the three-month grace period to renew our status in July. We transferred $250k to Merrill for 90 days and collected a $750 bonus along the way. Unfortunately, we transferred the funds just days before Merrill increased the bonus amount to $1k. Oh well.

- We now have $640k in a joint brokerage account that is fully deployable to chase brokerage bonuses. As I alluded to in prior posts, we are considering splitting this 50/50 into two individual accounts across my wife and me and start chasing brokerage bonuses with $250k limits (e.g. Wells Fargo, etc).

- The finance buff wrote a blog post saying he’s uninterested in playing such games. I agree that it takes time and adds complexity to one’s life, but these shenanigans can yield a return of a $1-2k per hour of time invested. While stupid and pointless, I can’t think of many uses of my time that yield an easy couple of grand per hour. Again, this game is twice as lucrative with both spouses playing.

- We now have $640k in a joint brokerage account that is fully deployable to chase brokerage bonuses. As I alluded to in prior posts, we are considering splitting this 50/50 into two individual accounts across my wife and me and start chasing brokerage bonuses with $250k limits (e.g. Wells Fargo, etc).

- $412.75 Executive rebate check from Costco, implying $20,638 of annual Costco spend (excluding gas & food court). We dropped a boatload of money at the Costco pharmacy this year, but the majority of it barely missed the cutoff for the executive check this year.

- I never know how to categorize this the redemption of the rebate in my financial statement…is it “interest” or is it a rebate against grocery spend? This month, I arbitrarily classified it as a rebate against grocery spend.

- The bad/abnormal:

- Not much.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Care to share a link for the pet meds?

There are many options, of course. We’ll likely do the first link for the triple combo: flea, tick, heartworm.

https://www.pets-megastore.com.au/zoetis-pet-products/simparica-trio-green

https://www.pets-megastore.com.au/msd-pet-products/bravecto-blue-large-2

Can you speak about the brokerage bonuses? I have lazily kept a balance with Merrill.

Once you renew your platinum honors status every year, there is no incentive to keep the $ at Merrill until the next renewal period twelve months later. What’s the strategy? Slosh the money from broker to broker, collect a few bonuses along the way, including on the round trip to Merrill at your next renewal period, where you could collect another grand (or two if your spouse is playing). A bit of a hassle, but it frees up your investments to chase brokerage bonuses.

According to this comment, you can churn the Merrill bonus 2x/year: https://www.bogleheads.org/forum/viewtopic.php?p=7978501#p7978501

Slosh those investments around (by transferring in-kind) from broker to broker and let them pay you a few grand per transfer in the process.

Also relevant: https://www.doctorofcredit.com/best-brokerage-bonuses-earn-up-to-3500/

It’s a stupid game, but lucrative, particularly when both spouses can play.

Thanks for the tip on dog medicine! My wife sometimes scoffs at various bargains as “not worth the effort” but she was a little shocked by the potential savings here. As for the banana arbitrage to maximize your Costco rebate, do you have to buy something with your Executive rebate certificate? I’m no longer Executive, but I’ve always just gone to the counter to cash in the rebate certificate from our Costco credit card and I believe I was able to do the same with my Executive rebate in past years.

US consumers pay exorbitant drug prices relative to the rest of the world. It was nice to learn this month of the drug arbitrage for dogs, which I will certainly be exploiting. I am hopeful that others do the same. For human drugs, I’ve considered retiring to a border city (e.g. Bellingham) to exploit the drug pricing disparity in retirement. Drug pricing is asinine.

Maybe 5+ years ago, like you, I would simply bring my Executive rebate check to customer service and they would cash it out. But ~5 years ago, they changed their policy to require a purchase. Bananas are almost always the cheapest item in the store, so they are the logical purchase to maximize the reward. It has turned into a fun and silly tradition each June/July.

After achieving Platinum Honors, do you transfer funds out of the Merrill Edge account and close it? Allowing you to reopen the account in a year, regaining the status and earning another sign-up bonus? I do see on the ME offer link you posted it does mention “new account”.

I am new to ME and thought of keeping 100k worth etfs just for the status but I don’t mind a little hassle for $750-1k every year.

You’re right that the bonus is for “new” accounts, but you can have multiple brokerage accounts at ME just like you can at Fidelity. So the order of operations in your situation would be: 1.) move the $100k to collect bonus at Broker B, leaving your ME account empty or near empty, 2.) collect broker B bonus after minimum holding period, 3.) sign up for new ME account and transfer back to collect $1k bonus (or twice that if married and both spouses are playing). Hopefully step 3 aligns with the platinum honors anniversary date (or +3 month grace period…since either will work). With a $300k balance, you’d hit the three-month moving average at ME after a month. Plus $250k seems to be the threshold for generous brokerage bonuses. So sloshing around $300k across brokers every few months seems to be particularly lucrative. Wells Fargo is paying $2.5k for $250k right now….

A few more clicks of a mouse can easily get you $5k/year or so, especially if both spouses are playing the game and there are sufficient assets to slosh around. Stupid game, but lucrative.

The offers are certainly lucrative, and I actually enjoy the work involved—it’s oddly satisfying. My main concern, however, is the potential ‘loss’ of cost basis information. I recently experienced cost basis issues when transferring assets from ETrade to Robinhood earlier this year, which required follow-ups, escalations, and many complaints to resolve. This negative experience has made me hesitant about moving taxable assets between brokers again.

I’ve been fortunate enough to not have had that cost basis problem, but it sounds like an absolute disaster. I just transferred our Roths to Robinhood, so mercifully cost basis doesn’t matter there. Good luck if you decide to go down this path. All I can say is that I haven’t had any issues sloshing around VTSAX from Vanguard to Merrill Edge.

Hmm, so you pay 7.65% of payroll taxes and the kids pay the other 7.65%? Do they have to pay any state or local city income taxes?

Assume my kid makes $100 gross. Kid pays $7.65 in FICA. Kid’s employer pays $7.65 in FICA. Kid’s net is $92.35. Absent dad “match”, kid can only contribute $92.35 to Roth because that’s how much cash they net. With my “match”, however, I top them off to their gross of $100. I’m happy to subsidize my kids’ Roth contributions in this manner. It replicates a far less generous employer match that they’ll see later in life and carries with it huge benefits. My 17 year old daughter, for example, started her Roth with her detassling money at the age of 13. Think of the experience that she’s gained by staying invested over the covid crisis. I hope this lesson will serve her well later in life (not to mention her Roth can pay for whatever she wants down the road, like a house, car, etc).

So far, kids’ income is low enough that there is no federal/state liability. No local/city income tax either.

So tax-free money is going into a Roth where it will grow for an undetermined amount of time. At withdrawal, it’ll be tax free. Sounds like a winning proposition to me.

Ah I see. So they are on a W2. Not a 1099 or self-employed. That’s nice. My kids do some referring and those are considered self-employment. It kind of stinks cos you have to report taxes and pay the full 15.3% FICA taxes once above the $400 threshold. I wish they would revisit this low threshold soon.

What a coincidence! FC1 quit her current job and is about to ref as a 1099 employee. Pretty big hourly pay bump for her, but it comes at the cost of paying both sides of the FICA tax.

Check out this comment for how much of the 1099 income can be contributed to a Roth. As before, I’ll match 7.65% of her payroll, but not the full 15.3%. https://www.bogleheads.org/forum/viewtopic.php?p=7947140#p7947140

Oh another question, do you mind sharing what are your college plans for FC1? I assume she would get free / discounted tuition if she goes to where you work, but seems like she’s touring other options. Does your work provide equivalent tuition benefits if she attends other schools?

In state tuition at my university is $10k. My job provides a 50% discount. If FC1 went there, she would live on campus which would obviously drive up the price. Campus is a 7 miles from our house.

Mrs FP and I went to college 1,000 miles from our home and I think we benefited tremendously from doing so. I think FC1 wants to get out of state, and we’ll pay a bit of a penalty for it, though the UT residency arbitrage will soften that blow considerably if she chooses that route. Scholarships will also soften the blow.

I think leaving one’s home town and going across the country to study is underrated for undergrad. There is a lot of growth in leaving the nest, while it is admittedly not the cheapest option for us.

Got it — I should have realized that you never would have wasted 7.8 cents! ($1.49 x 0.0525) 🙂

The horror!

Be sure to look at private colleges as well as public universities. Even though the “sticker price” of a public university is often much lower than the “sticker price” of a private college, in my experience (putting four kids through college without loans for them or us) private colleges are much more generous with merit scholarships. Fortunately, our oldest was a good standardized test taker as well as inherently competitive, so she put in the work to get an ACT score that earned her full tuition plus some expenses at a nice liberal arts college. We learned from our experience with her applications to focus on getting as much merit aid as possible for her siblings.

Great advice! Thanks for sharing!