Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Zooming into iPhone chip kind of blew my mind (link).

- Beau Miles completes his Seinfeld recycling arbitrage (part 1, part 2).

- Another month, another massive data breach in which our personal info is permanently exposed to the world. If you aren’t already operating under the assumption that your name, address, social, birthday, and phone are publicly available, you should probably reconsider.

- Every single adult should freeze their credit at all three credit bureaus (link).

- I’ve been doing this for at least a decade and can’t think of a single good reason not to do so. Unfreezing/thawing credit at all three takes me about four minutes total (thanks largely to Bitwarden for helping me keep track of my passwords).

- Further, consider using a Google Voice number in lieu of a cell phone at important financial institutions, with your google account secured by 2FA (link).

- I’ve been doing this for several years now and sleep better at night because of it.

- Every single adult should freeze their credit at all three credit bureaus (link).

Life

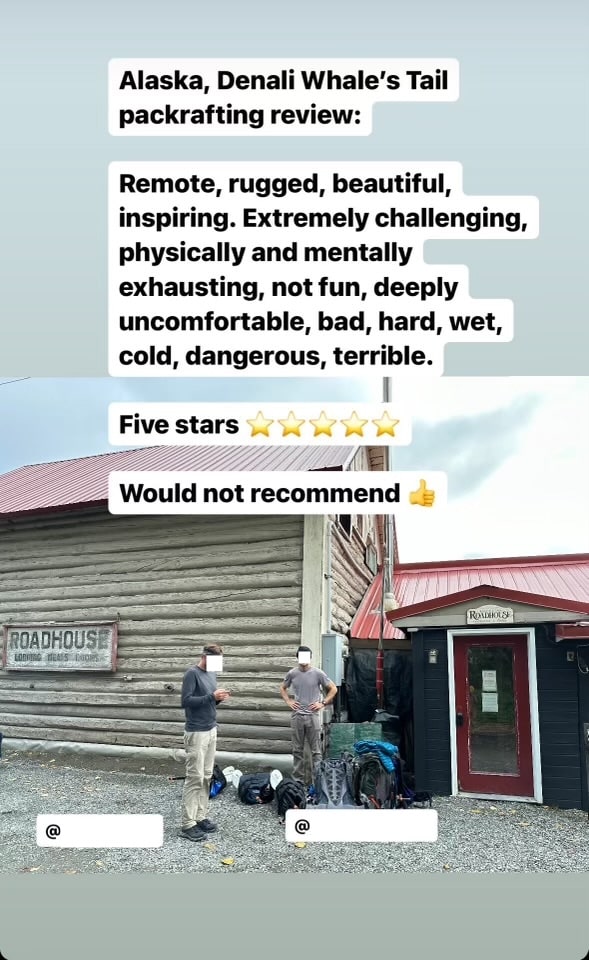

- I went backpacking/packrafting in Denali National Park for 4 days. The day prior, we took a one-day packrafting course to try to learn how to not kill ourselves on the river. Apparently it worked. My pack started off at a dainty 42.5 lbs (with food/water), but surely gained several pounds of water weight as it rained/drizzled continuously on us for the four days (starting about 2 hours after getting dropped off by our float plane). We saw infinite signs of bears (scat, trails, prints) but luckily no bears. In fact, we sought out bear trails through the dense vegetation (like 8 foot tall fields of ferns). Thanks in large part to 13 hours of hellish bushwhacking through dense alder trees (plus the continuously demoralizing weather), it ranks among the hardest trips I’ve done (the title of hardest thing I’ve ever done still goes to a few of my climbing trips, but particularly this 22-pitch, 1900 ft climb in Provo which I did back in 2021). Because I’m a glutton for punishment, I loved every minute of the suffering. Upon returning, the transition back to the comforts of suburbia has been a bit jarring/disorienting. Being in that wild environment really puts the trivialities of our modern inconveniences into proper context. Interestingly, my appetite was insatiable for several days upon returning — I had never experienced anything like it. I suppose it was my body’s way of compensating for the massive calorie deficit incurred over the trip.

- There were quite a few hot days (110°F heat index) in which I would run the dog in the morning before the sun came out and wouldn’t leave my home again for the rest of the day. With our warming planet, is this the new normal? Is our species going to become nocturnal during summer months? Or are we all migrating North to Alaska/Canada?

- Another school year has arrived. The kids are busy, meaning the kids’ parents are busy schlepping them around town.

The combination of Boeing 737-MAX + Alaskan Airlines was perhaps the least confidence inducing way of starting the trip…

The combination of Boeing 737-MAX + Alaskan Airlines was perhaps the least confidence inducing way of starting the trip…

The Costco in Anchorage shared a parking lot with the “Costco Home Showroom.” Pretty cool! I wish we had one of these locally. It’s too hard buying furniture at Costco.com sight unseen.

The Costco in Anchorage shared a parking lot with the “Costco Home Showroom.” Pretty cool! I wish we had one of these locally. It’s too hard buying furniture at Costco.com sight unseen.

My buddy’s instagram post summarizing our trip. We stayed at the Talkeetna Roadhouse on the way home, which was great. There are funny stories to be told about our stay here, but that will have to wait for the dedicated trip report.

My buddy’s instagram post summarizing our trip. We stayed at the Talkeetna Roadhouse on the way home, which was great. There are funny stories to be told about our stay here, but that will have to wait for the dedicated trip report.

The only time we saw the sun/sky over our 4-day adventure was the two hours after getting off our float plane. The Ruth Glacier in the background.

The only time we saw the sun/sky over our 4-day adventure was the two hours after getting off our float plane. The Ruth Glacier in the background.

My first airport lounge visit in my life (thanks to the new credit card mentioned below). On my return flight, I had a 3-hour layover from 6am-9am. While certainly not fancy, it was a welcome place to relax and shove my face for a few hours and get away from the peasants. They even had a shower but I was too tired to partake.

After sharing this photo with my Alaska buddies, they mocked me for having “sad oatmeal” in a continental breakfast with many less-sad options. I guess I’m a creature of habit….

A polished Cybertruck at the local Costco. I can’t say that it achieved the desired objective of making it any less hideous. Croc loafers with darn tough quarter-length socks shown in the reflection. It must have been too hot for the Walmart wrangler pants.

I visited Staples for the first time in over a decade for an Amazon return. I was relieved to find their inventory of $9,999.99 gift cards to be fully stocked. Thank goodness!!!

The urinals at our local par 3 golf course are as awkwardly spaced as I’ve seen in my life (reminiscent of the dubious double toilet from October 2022). This is unambiguously a situation in which the proper etiquette would be to wait your turn (or use the adjacent toilet) rather than cozy on next to the person already there, which clearly makes the second urinal redundant. What makes it more comical is that they could have spaced them further apart (and even included the all-important divider), but didn’t.

While searching my Google Photos for the prior image, this two year old photo taken at a bowling alley showed up. I’m unsure the circumstances which led to this situation.

While searching my Google Photos for the prior image, this two year old photo taken at a bowling alley showed up. I’m unsure the circumstances which led to this situation.

This Month’s Finances

Insurance update

I switched auto and umbrella insurance from Geico to State Farm, and in the process I saved $931/year (or 41% of our old rate). I don’t know if this is a teaser rate but I’m a happy camper for now. It’s hard to believe that I could save almost 50% for equivalent coverage, particularly since I’d been been with Geico for over 20 years. Oddly, it didn’t make sense to bundle homeowner’s insurance with State Farm — Esurance is still cheapest for me.

- Old (Geico)

- Auto: $1487/yr

- Umbrella: $785/yr

- Total of above: $2,272/yr

- New (State Farm)

- Auto: $1024/yr

- Umbrella: $316/yr

- Total of above: $1,340/yr (41% less)

For the record, I also got an umbrella quote at RLI for $456/yr and would have switched to them if I hadn’t gone with State Farm. I learned about RLI from Bogleheads.

Lesson learned: actively shop insurance providers with some regularity, particularly once teen drivers come onto the scene.

Credit card update

I got the US Bank Altitude Reserve card for reasons mentioned here (link 1 and link 2). Basically a net $75 annual fee card that produces 4.5% travel/cash back on any purchase made with a tap to pay through a mobile wallet. For the $75, you get free global entry every 4 years, primary rental car insurance, 8 Priority Pass visits/yr, etc. I can funnel a bunch of our major expenditures through tap to pay mobile wallets (google/apple pay), including my $10k/year of property taxes. The required break-even spend relative to my BoA premium rewards card is $75/(0.045-0.02625) = $4k/year, which I’ll easily exceed without even trying. I think one could make an argument that the ultimate simple credit card setup would be the USBAR + BoA Premium Rewards card for 4.5% on tap to pay through USBAR, 4.5% on travel through USBAR, 3.5% through dining with BoA PR if tap to pay is not an option, and 2.625% on all other expenditures where tap-to-pay is not an option. After having the card for a few months, I’ll write a review on it. So far, I’m a pretty big fan of the card and kind of kicking myself for not getting it sooner. My colleague first told me about the card 4 years ago, but I dismissed it because I thought it was asinine to pay $400/yr for a card when I was getting 5.25% for free with BoA. Now here I am eating those words and happily utilizing both.

This was my first month using “mobile wallets.” I think they are pretty gimmicky (what’s so onerous about pulling a card out of a wallet?), but if US Bank is paying me 4.5% to use them, I’ll play the game and jump through that hoop. Easy enough, it seems. I don’t even need to turn on data.

Somewhat relatedly, there is supposedly a 4% US Bank card on the horizon (reddit, doctor of credit). It’s hard to believe that it will be sustainable. Hat tip to TJ on Bogglheads.

Fidelity Money Market Hack

I followed a hack found on Bogleheads (thanks anon_investor!) to qualify for the $1M share class of money market fund FSIXX, which has a yield of ~0.23% higher than the normal retail version, FDLXX. Bogleheads thread here (link). The trick also worked for FIGXX, which is better for those living in states without state income tax. Steps: 1.) buy MM fund at Merrill Edge, 2.) pull the MM fund from Merrill Edge to Fidelity, 3.) buy more of the fund upon arrival to Fidelity before the transaction is reversed in 1-2 business days, 4.) auto-purchase FSIXX/FIGXX at whatever frequency you want for about a 0.23% improvement in yield on your cash in perpetuity. Note to self, remember to enter this properly into FreeTaxUSA so I can get the appropriate deduction at the state tax level (link 1, link 2). This hack makes the one-stop strategy at Fidelity even more lucrative than before, particularly for those with large cash balances.

- The good:

- Still employed.

- The bad/abnormal:

- Not much.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETFs are slightly more annoying to hold relative to index funds. With ETFs, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Is there anything included in USBAR travel besides flights, hotels, and rental cars? Trying to understand if those rewards are a good fit for our spending.

For the USBAR to work most efficiently, one would have to have “organic” travel expenditures in the following categories:

* Airlines

* Car rentals

* Hotels

* Other travel (cruises, uber/lyft)

Oddly, my float plan trip in Alaska did not code as “travel” with US Bank. In my limited experience, they are substantially more limited than BoA in their definition of “travel.”

The “real time redemptions” on transactions in the categories above are what make the USBAR remotely competitive. It transforms the 3% mobile wallet & travel spend into a 4.5% redemption. And you still earn points on the purchase itself that you’re reimbursing yourself for.

For me, the math is pretty simple. Say we put $25k/year on the card, with a 4.5% reward yielding $1125/yr in travel reimbursements. We easily spend many multiples of that in a year in travel, so there is no concern that I can’t meet this. Funneling work travel through a personal card is pretty much the perfect use case for this card.

If you don’t have sufficient “organic” travel to meet the redemption needs, then reddit users report you can “manufacture” travel by buying reimbursable plane tickets, getting reimbursed, then cancel for a full refund. Not sure if US Bank would eventually cancel the card for abuse, but it’s something redditors are claiming works.

Looks like an awesome trip!

When you switched car insurance was there any leg work involved ? I slightly remember having to go to an auto shop to get something briefly checked out. It was quick but annoying. I think I used Gabi which scanned my current car insurance and gave me cheaper quotes. This is in ny.

I’ve read on bogleheads about using a independent agent to find better rates but have always unsure how to find independent agent

Switching car insurance entailed:

* Getting quotes online

* I engaged an independent agent (recommended by a colleague) but they couldn’t beat state farm

* Engaging a state farm agent (after filling out a form online) since they don’t do online quotes without talking to a human being

* Cancelling Geico

Pretty simple. A bit time consuming, but I’m hoping to harvest $1k/year in savings for the foreseeable future. I think it was a productive use of my time.

FP, I had to laugh at the urinal and toilet photos. As a freshman at Clemson in 1983, my dorm was an old military barracks. Each floor had a large open square room with shower heads lining all walls. The room next to it had a row of toilets directly facing a second row of toilets with no partitions at all. Nothing like sitting face to face doing your business. When I hear young people complain about having an apartment at college with roommates vs living alone, I tell them they do not realize how good they have it.

That is hilarious. I’ve had my share of bathroom trauma over the years, but none that rivals yours!!! I’ll have to bookmark your comment for when my kids inevitably complain about their dorm experiences in the coming years!

I did not even get into the small rectangular postage stamp dorm room with 2 dressers, 2 tiny single beds, 2 corner desks, and 1 small window. No fridge, sink, or kitchen of any kind. But I have to say it builds character. I appreciate the luxuries we enjoy now so much more. After eating powdered eggs in the cafeteria every day, Waffle House is like a Michelin star restaurant.

The secret to happiness is having low expectations!!! The $1.50 Costco hot dog remains a big splurge for me on occasion.

I doubt your kids will need this motivation, but when my father dropped me off at college, he told me I have 3 options. I can do the right thing and succeed in college, join the military, or live on the street. There is no coming back home. Sink or swim. I knew there was no quitting despite majoring in Chemical Engineering, the hardest major on campus. Tough love works.

That is tough love indeed!

I don’t think any of my kids are at risk of being boomerang children at the moment, but we’ll see…

Thanks Professor for another monthly update. It was nice to read about your Alaska adventure as well. Regarding new US bank card, I received an email from US bank that with a balance of 100k in any IRA Taxable etc. the user will qualify for 4% cash back on any purchase. This is for $0 annual fees. It looks very attractive for now. It will eventually trump BoFA

That’s a pretty exciting sounding card! There is a lot of interesting discussion on reddit/bogleheads/doctorofcredit on the topic. I hope to get it.

Do you think boa will have a rebuttal for this us bank card if it loses customers.

Also have you got any shop your way offers yet?

I have no idea what BoA will do, but a straight 4% back on all purchases for parking $100k or $250k in investments at US Bank would be pretty competitive with BoA’s offerings. I think they are complementary offerings. Primarily BoA for online/dining/travel @ 5.25% and US Bank @ 4% for all else. But I suppose one could reasonably argue that the difference between 5.25% and 4% might not be worth the mental overhead and that a convergence towards a straight 4% card would be good enough.

On the SYW front, I’ve gotten a few offers. One utility offer which I activated then decided wasn’t worth my time (5% on utilities, but only conditional on hitting >= $400 in a given month). The second offer was $50 statement credit on a $750 online purchase (6.67% statement credit + 1% gift card back), which was marginally better than my 5.25% setup but I bit the bullet on a Costco gift card purchased online. Not life changing yet, but I wouldn’t be opposed to getting the stacked offers I read about online if I continue to play the game…

I’m much more interested in systems that are predictable and not reliant on random offers showing up.

You should get a game changer offer soon on grocery a dining a gas I’m forgetting exactly but maybe 15% month for a year.

That would be pretty impressive and certainly worth the hassle!

A common one is $75 back when spending $750/month on groceries, dining, and gas, or $150 back when spending $1500/month on those categories.

Haven’t seen this offer yet but I’ll keep my eyes out.

The “problem” with our spending is that my grocery, gas, and restaurant spend is close to zero because we shop primarily at costco for food, own an EV and thus spend very little on gas, and are too cheap to go out to eat. But if I were a more normal person, I can see how the grocery gas and restaurant promotions would be very lucrative.

I have a question on the travel redemption piece – more on the mechanics. First some background – Have had a Chase Sapphire Preferred card for several years. Early on we had planned a weekend getaway, and booked the hotel through their portal (effectively Expedia on the back end). We get to the airport and a very early season, freak snowstorm shut down Denver Airport. By the time we got to the Southwest counter, next flight out was on a Tuesday.

It was a bit of a pain (hours on the phone) to cancel the hotel (called the hotel – they wouldn’t do it w/o Expedia. Expedia wouldn’t do it without the hotel folks on the phone). Very frustrating – so we now always book directly with the airline or hotel.

What’s the mechanism to redeem points for travel? I’m hoping you’ll say it’s just a statement credit. If it’s something along the lines of logging into their portal, identifying the travel related purchases and paying for with points after the fact, I’m sold. If it’s having to convert points to travel purchases via their portal, I’m back in analysis paralysis mode. I was contemplating the BoA option per your post and youtube video, but I’ve waffled for several months due to having to tie up 100K.

If it’s statement credits, I think this very well could be our second card replacing the CSP.

And of course follow-on Qs… Is there an extra cost for a secondary card holder (spouse)?

I assume the annual, 8 Priority Pass lounge visits would be per account as opposed to card holders. Is that correct? Also, If you and your wife were traveling, could you both hop in the lounge for 2 of the 8 passes, or are you limited to one a day, and would have to pay the $35 for the other person?

I’ve had the card for about a month now. It is incredible. I’d highly recommend it. To answer your questions:

* You book travel direct. No need to use portals (and you shouldn’t for reasons you mention).

* Mechanism to redeem points is 1.) enroll in Real Time Redemptions (RTR). 2.) Configure RTR to only text you for travel redemptions (true 4.5%). 3.) Once you book travel (air, hotel, rental car, rideshare, cruise, etc), you’ll immediately get a text asking if you want to redeem. You respond “redeem” and you’re good to go. Couldn’t be easier.

* It’s my understanding that the 8 priority pass memberships can be shared. If you bring a spouse to a lounge, then you’re down two passes for the day. This is where the BoA Elite card really shines in contrast.

Hope that helps. It is an unbelievably good card so long as you limit spending on it to the true 4.5% categories of travel and mobile tap to pay (which can be anything, of course, provided you can pay with a tap on your phone OR apple/google pay online).

One question about the Fidelity Money Market hack. You say that this “makes the one-stop strategy at Fidelity even more lucrative than before, particularly for those with large cash balances,” but so far as I can tell you don’t have much of a cash balance at all. Is this a hedge against possible future changes in investing strategy or am I missing something? (p.s. I appreciate your blog a lot!)

Astute observation!

I indeed hold hardly any cash, but I did the hack anyway because it:

* only took a few minutes of my time,

* was fun,

* scratches my (arguably irrational) optimization itch, and

* gives me optionality (for the rest of my life) if I choose to change my strategy on cash at Fidelity.

That said, if I were to hold a large amount in cash, I think Vanguard is probably the place to do so because of their lower MM fees (and thus higher yields): https://investor.vanguard.com/investment-products/money-markets

However, the Vanguard MM funds don’t auto-liquidate like the Fidelity funds so there are some tradeoffs there…

Thanks for the tip related to $1M share class of money market funds.

Any thoughts on FZDXX ?

Also, any money market fund recommendations for WA state residents where there is no state income tax.

I did the trick with both FIGXX and FSIXX. I think FIGXX would have slightly higher yields for a WA state resident. Maybe 3-4 basis points.

I don’t have an opinion on FZDXX, but at a quick glance it seems that the yields are even higher than FIGXX for a WA state resident. Not sure if the “trick” would work with that fund since I haven’t tried it. If you do it, please return and report.

Hi,

How was your airport lounge experience? Which airports did you get to enjoy it? I have read disappointing stories about airport lounges; overcrowded, long waitlists, or denied entry when busy, etc. How would you value the priority pass perk on the credit card? Is it just hyped as a luxury perk?

Given the lack of sleep on my backpacking trip and the sleepless night on my redeye the night before, I’d rate the lounge visit in Seattle at a 8/10. I got a warm meal, a toilet (quite the luxury after several excruciatingly difficult days in Alaska), and a place to relax during my 3-hour layover.

Had I arrived to the airport well rested and well fed, I think I would have rated it a 5/10.

I stayed in the lounge from 6-8am, so there was no overcrowding.

Priority Pass consistently ranks as the crummiest lounge network on reddit. I don’t disagree. However, the nice thing about the USBAR (& BoA’s Elite) Priority Pass is that it also has the $28/visit restaurant voucher as an alternative to lounges at many airports. I think this is a much bigger selling point than mediocre lounge access.

I tried this recently and Merrill Edge is blocking transfers out of most MMA now. Even if the brokerage will accept it, Merrill is now stating you must sell and transfer cash or transfer securities (non-MMA securities).

Bummer. They wisened up. Thanks for the update.