Another month, another update. A few random comments.

Good Reads/Listens/Watches

- A fascinating 45-minute BBC documentary on the doomed Titan submarine, filmed many months prior to the recent disaster (link).

- The amount of red flags documented within the first 5 minutes of this documentary is astounding.

- For example, during the filmed expedition one of the thrusters was apparently installed backwards causing the sub to spin out of control. This anomaly was discovered at the time of launch, yet the mission was not aborted.

- The amount of red flags documented within the first 5 minutes of this documentary is astounding.

- Ramit Sethi interviews Mr 1500 (Carl) and his wife (link).

- Here’s Carl’s follow-up blog post (link).

- I certainly have some of Carl’s mentality in me. I’m working on changing my mindset.

- Ken Ilgunas, one of my favorite authors/bloggers, auditions for the TV show Alone and writes about his experience (link).

- Mrs FP and I watched the Tour De France Unchained on Netflix (link).

- It was pretty good. Not near as good as Drive to Survive, but still enjoyable.

Life

- June flew by. I’m not sure where it went.

- I’m continuing to enjoy my new M2 Mac Mini quite a bit. That said, I loathe the neutered Excel on the device. Other than that, it has been great. If you buy it from Apple’s Educational store, you now get a $100 Apple gift card, effectively reducing the price to $500-$100=$400 (link). It is unbelievable now much computing power can be purchased for ~$400.

- Continued to settle into the old-man physical routine of disc golf, climbing, pickleball, and biking. My aging body is enjoying these relatively low-impact activities. It’s nice that they are also rather frugal and social activities.

$529.19 Costco Executive rebate, implying $26,459.50 of Costco spend over my 12-month membership period. This was a big increase from last year’s $369 rebate check. This past year I shifted all of our pharmacy spend to Costco, which explains some of the differential. Not counted in our Costco spend is our gas & food court expenditures. We buy a bunch of Costco pizzas — at least one per week. It is basically our personal inflation hedge. As per tradition, I purchased a single bunch of bananas with the $529.19 executive check, so that I could get the remainder distributed back as cash (and thus continue to maximize the 5.25% rewards). These shenanigans augment the rebate check by about $28 dollars (=5.25%*($529.19-bananas)).

FC5 golfing at a local par 3 course.

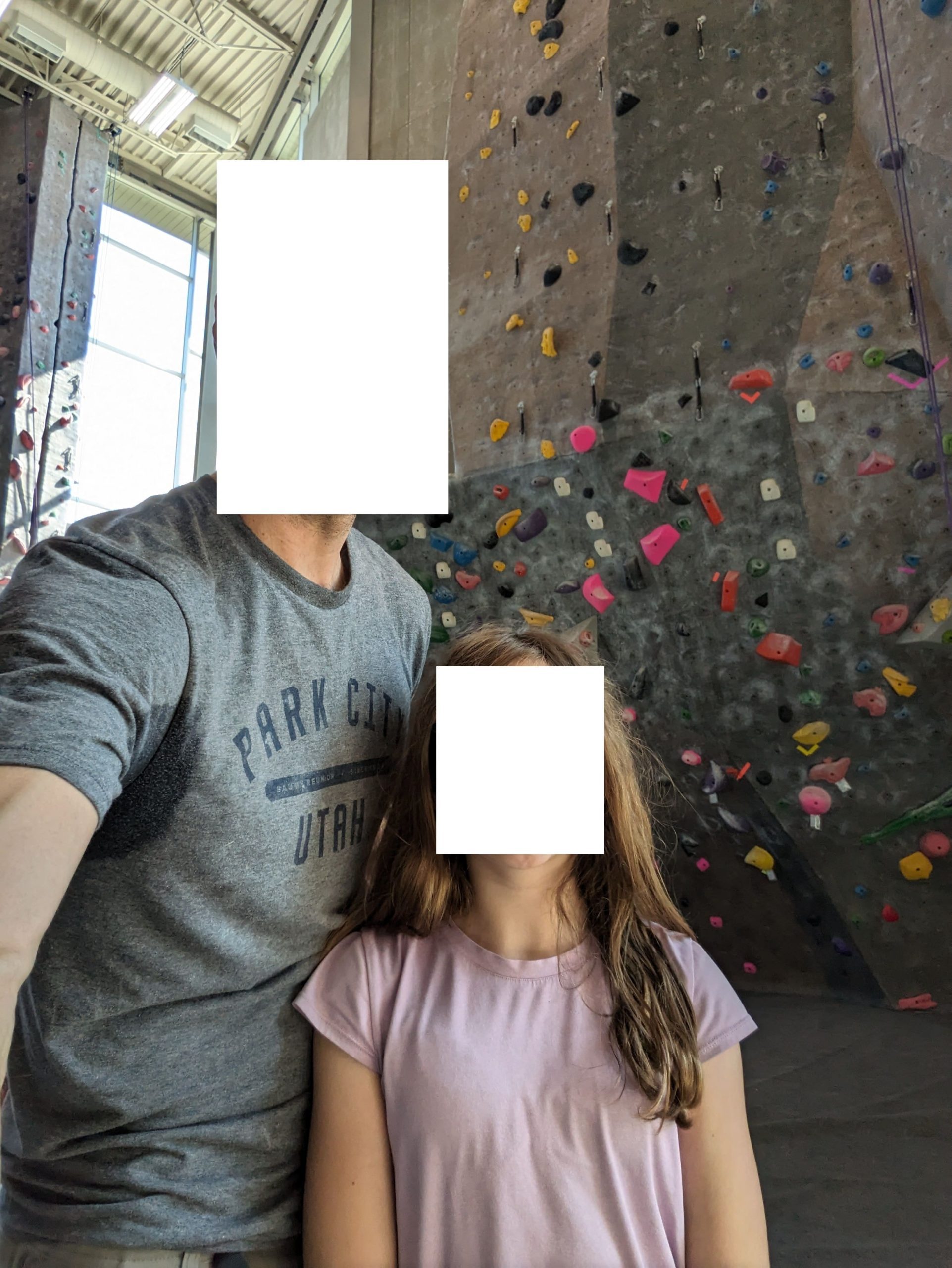

Most of my kids largely loathe climbing. Somehow I convinced FC4 to join me once on the campus gym.

I’ve started regularly playing pickleball with some guys from work. The median age of pickleball players is about 65. It has been fun.

I’ve started regularly playing pickleball with some guys from work. The median age of pickleball players is about 65. It has been fun.

FC3 leaping in a state track championship.

FC3 leaping in a state track championship.

This Month’s Finances

- The good:

- Still employed.

- The bad/abnormal:

- Not much bad. Pretty good month.

- With 2023 tax-advantaged space now full, we’re transitioning once again back to taxable brokerage accounts. That said, there is a chance that my employer will enable the elusive “mega backdoor Roth,” which would be a game-changer. As shown in the below financial report, our annual dividend tax drag is roughly $1,600/yr. This dividend tax drag (+ eventual capital gain tax) could have been eliminated entirely if I’d had the Mega Backdoor Roth option from the beginning of my employment. While it might not seem like a big number, the cumulative effects of dividend + cap gains taxes are not trivial over a many-decade holding period.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Frugal Professor: Thanks as always for the monthly update. Thanks for mentioning Ramit Sethi’s interview with Mr and Mrs 1500. This was my first encounter with Ramit Sethi. I was initially bothered the video and what seemed to me like psychological shaming. I paused it a few times to do other things but eventually came back to finish it. Thankful, because it was valuable to me and more importantly I’m guessing valuable to Carl and Mindy. Hopefully it will be of some value to their following. Impressed with the humility and openness of Carl and Mindy. Impressed with their past accomplishments, and hopeful for their future. Hat tip to you, FP, for stating that you’re working to change your mindset about some of your money view/values. I wish you all the best as you continue that path, as any positive changes should accrue to your family, as well as to you. Again, thank you.

Carl and Mindy are fantastic. I’ve met them a few times in person at those Berkshire meetings, and they are as nice of people as I’ve ever met.

I don’t know too much about Ramit, but I like what I see.

There is a surprisingly fine line between prudent saving and irrational hoarding. I’m learning to more fully embrace spending on experiences. More to come in the July financial update. Life is short. We’ll be dead soon, and in my case, my kids are shortly out of the house. I’m going to try to be better about spending money on memories.

Thanks FP. Your spend at Cosco is impressive and I like the bananas tradition.

Your tax drag comment and line item reminded me of how much I dislike dividends. At least your Berkshire share(s) do not distribute them. I suspect that you are getting close to these being subject to the Medicare surcharge as well…. 🙁

I loathe dividends and their accompanying tax drag, which is exasperated by the fact that I live in a high tax state (~7%). I sometimes wonder if I should have gone 100% BRK to avoid dividend taxes, but this would have presumed Berkshire’s continued no-dividend policy, which is obviously not guaranteed.

Luckily, VTSAX is pretty tax efficient. I could have done much worse in setting up my portfolio.

Fp thanks I enjoy reading your blog. Have you read about the “Shop your way credit card” on bogleheads? Think it actually beats the preferred rewards set up that I copied from you.

I have read about the “shop your way credit card,” but when I google it to learn more, I leave more confused than when I started. Do you have any personal experience with the card? I’d definitely be open to switching to something better, but what I read on Boglehheads implied that it was conditional on receiving unreliable promotional offers. Sounds kind of like a pain.

Fp. I felt the same. I basically opened the card and got no offers. Then they started rolling in. Since March I’ve had 15% off gas grocery restaurants. Also a online offer worth 200k thank you points. The offers come straight to email and are simple.

Thanks for the info! Maybe I’ll give it a try!

Does it make sense to time the application during a promotional period? Or is today as good as any to apply?