Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Rational Reminder Podcast interviews Burton Malkiel (link).

- Malkiel is the author of A Random Walk Down Wall Street, one of my favorite investing books.

- Since recently discovering this podcast, I’m going through many of their archived episodes. Some of my favorites so far:

- GoCurryCracker gives a Ted talk (link).

- My favorite quote (@9:45): “If you are willing to live a slightly less affluent lifestyle — in one of the wealthiest countries on the planet — for a short period of time, you could reduce your working years by 20, 30, or 40 years. It seems like I reasonable tradeoff…..If there is a non-glamorous way to describe our story, we did nothing more than live like college students for a few years longer than is socially acceptable.”

- Amen.

- Jonathan at MyMoneyBlog summarizes nicely the 2023 Berkshire Hathaway meeting, which I attended this year (link).

- Mr 1500 was kind enough to save a seat for me. Mr 1500 is pretty much the only blogger I’ve met in real life and he couldn’t be a nicer guy.

- Statistically, it is unlikely that both Charlie (99) and Warren (92) will both be alive for much longer, so this is perhaps the last time I had to see them together in action. But they have proven me wrong on that dimension time and time again.

- Like Jonathan, I remain in awe of their mental capabilities well into 90s. If I’m 10% as coherent as them at that age (or even if I’m above ground), I’ll consider it a victory.

- Speaking of Jonathan at MyMoneyBlog, here are some other recent posts I’ve read of his that I’ve enjoyed:

- Investment Asset Classes: What do You Really Need (link).

- Consumer reports concludes (quite obviously, of course) that Costco reigns supreme (link).

- Charlie Munger or I could have told you that….

- When I began my investing career as an engineering undergrad around 2005, I remember his blog was of the trustworthy investing resources on the internet at the time. Almost 20 years later, I continue to learn from him.

- Speaking of favorite blogs, the Finance Buff is an invaluable resource. Harry does an incredible job explaining practical investing topics.

- This past month, a colleague and I were talking about the proliferation of AI, including voice spoofing. Concerned, I removed voice authentication from my Fidelity and Vanguard accounts. I’ve replaced them instead by gibberish responses to the standard verification questions. What is your mother’s maiden name? pg!%i2vvgB#Z, as a hypothetical (stored in a password manager). It’s weird, but I have verified my account on the phone several times using this method and I feel much more comfortable with this approach to voice verification.

- In beefing up my online security hygiene, I found this post by the Finance Buff to be excellent. I’m considering adding a hardware key (Yubikey) to my accounts as a result of this article. Perhaps the only thing stopping me from full-on adoption is my love affair with account aggregators (e.g. Personal Capital, Mint, etc).

- I ditched LastPass for BitWarden and couldn’t be happier.

- The migration took me about 10 minutes thanks to this guide (link).

- This past month, a colleague and I were talking about the proliferation of AI, including voice spoofing. Concerned, I removed voice authentication from my Fidelity and Vanguard accounts. I’ve replaced them instead by gibberish responses to the standard verification questions. What is your mother’s maiden name? pg!%i2vvgB#Z, as a hypothetical (stored in a password manager). It’s weird, but I have verified my account on the phone several times using this method and I feel much more comfortable with this approach to voice verification.

- Bogleheads Live Podcast interviews Mr Money Mustache (Apple, Spotify).

- Not much new here, but I like listening to MMM.

- When I first stumbled across his blog over a decade ago during grad school, I marveled at how our similarly our brains worked.

- On a recent flight, I binged How to Get Rich, with Ramit Sethi. I thought it was well done, but I geek out about personal finance.

- I’m not sure if others would find it enjoyable. It is various permutations of people spending more than they earn in predictably idiotic ways.

- TLDW: you get rich by regularly spending less than you earn (or alternatively stated by earning more than you spend).

- The funniest YouTube video I’ve seen in a while, which perfectly summarizes my guilty love affair with Reddit (link).

- I created a YouTube video on the BoA cash back ecosystem (link).

- Since I’d never used iMovie (or any video editor) before, it was a bit of a pain to learn. But I think I sort of figured it out. I even amazed myself by making a clickbaity thumbnail in PowerPoint using a random looking template with a swoosh on it. How hip am I?

- If you want to “like and subscribe” and comment or whatever, maybe I’ll make a few more videos. Some other topics that come to mind:

- Dumb simple investment stuff.

- Dumb simple tax stuff.

- How to operationalize a backdoor Roth contribution.

- Not sure what else. Please feel free to suggest something. you might find useful.

Life

- Another academic year is behind me. As an undergrad, an academic year seemed to last an eternity. Now, they fly by like exit signs on the freeway. The cycle is predictable. The summer lull is abruptly interrupted by a frenzy of activity. Students move in. Then comes the bustle (and inevitable disappointment) of the college football season. Then winter comes followed by the mercy of spring. You blink twice, then graduation comes and students move out, leaving campus a ghost town once again. You blink a few more times, and a decade or two has passed and then you start googling terms like “colonoscopy.” Time is weird.

- I took a trip back to my home town to visit my folks.

- I hiked 7-10 miles each morning while there, putting in just shy of 50 miles for the week.

- While living in CA has its perks, I don’t know how the masses of every day people afford to live there. The solution (of leaving) seems obvious but inertia and family ties create an insurmountable obstacle for most.

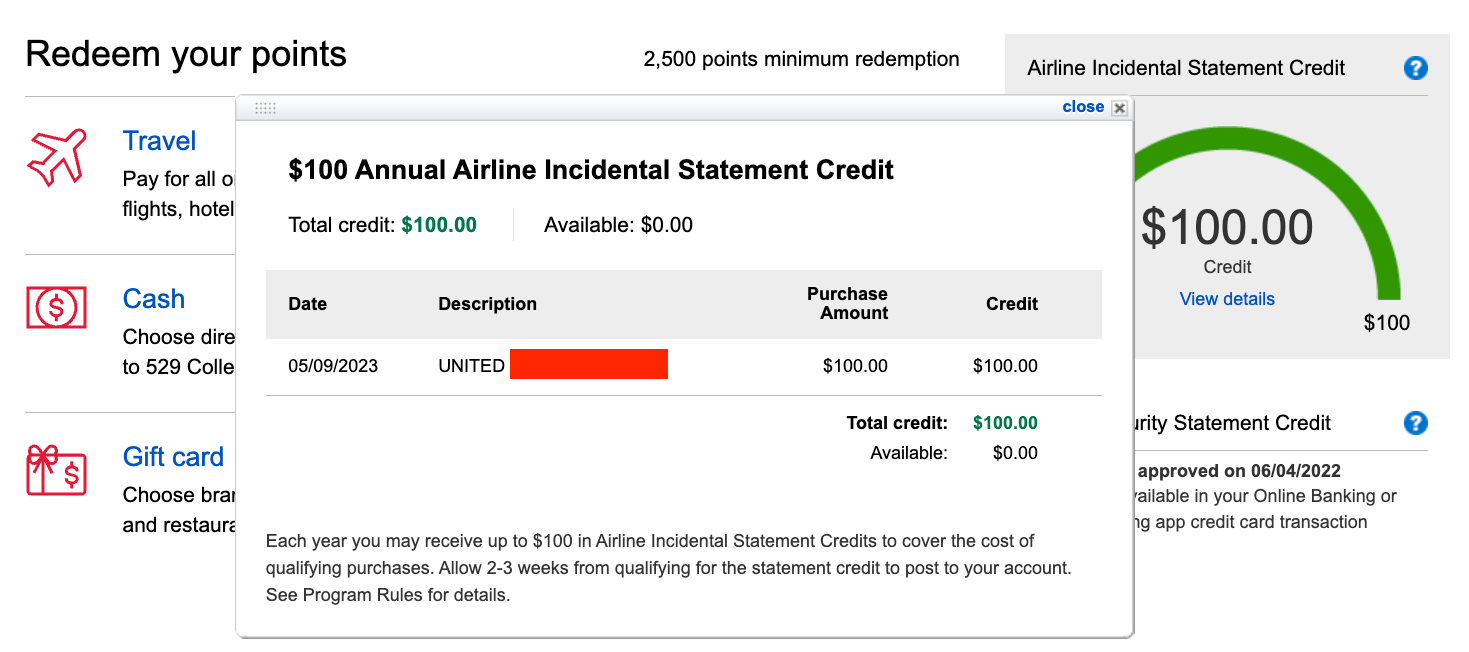

- Relatedly, I tried the United Travel Bank for the first time using my BoA premium rewards card and I indeed got the $100 reimbursement credit a few days later. I fly United so this is a great way of easily bringing the effective annual cost of that card to less than zero ($95 annual fee – $100 travel credit – $3.5 cash back from $100 United Travel Bank purchase – $100 global entry fee / 4 years – $3.5 cash back from global entry / 4 years = negative $34/yr effective cost).

- In years past, I would purchase AA gift cards and sell them online. Since I don’t fly AA, I will continue to use the United Travel Bank going forward.

- DoC discussion here.

BoA reimbursement of $100 United Travel Bank purchase.

BoA reimbursement of $100 United Travel Bank purchase.

Berkshire 2023.

As per tradition, I parked in Iowa and jogged to Nebraska. Why waste $10 in parking fees when you can enjoy scenery like this?

Our jerk best-ish friends had the nerve to buy a cool house, finish building a custom pool this month, invite us over to swim in a pool-christening ceremony, then move to Utah. The above was taken at their goodbye party. FC5 spent an ungodly amount of time trying to make that shot (hours?), which was a lot harder than it looks. He finally made it long after I’d stopped shagging balls for him. He took inspiration from Dude Perfect’s most recent video, which is actually pretty amazing (link).

Our jerk best-ish friends had the nerve to buy a cool house, finish building a custom pool this month, invite us over to swim in a pool-christening ceremony, then move to Utah. The above was taken at their goodbye party. FC5 spent an ungodly amount of time trying to make that shot (hours?), which was a lot harder than it looks. He finally made it long after I’d stopped shagging balls for him. He took inspiration from Dude Perfect’s most recent video, which is actually pretty amazing (link).

Spring arrived, leading to some nice bike rides. Unfortunately my crank disintegrated while riding due to a failed bolt. It is sort of repaired, but not very well. I need to figure it out.

If I die in a fiery t-bone car crash with some idiot in a raised pickup, I will haunt the person forever from my grave. How is this even legal? How did we converge on an arms race where we drive increasingly large vehicles for “safety”?

Silicon Valley as viewed from Rancho San Antonio. If you squint, you can see the UFO headquarters of Apple in the distance (circled in red).

For those feeling charitably inclined, the Koi fish in Saratoga are $3M short of their pond renovation target. To think that there are jerks out there prioritizing retirement savings and/or college savings. What about the Koi in Saratoga?

For those feeling charitably inclined, the Koi fish in Saratoga are $3M short of their pond renovation target. To think that there are jerks out there prioritizing retirement savings and/or college savings. What about the Koi in Saratoga?

This was literally a blast from the past. One of my first jobs in my life was to work on a temporary basis for a gun range. I was probably 13 at the time? One of my best friends worked there and they would occasionally need extra help during shotgun tournaments. My job was to sit on a range like the above pictured and listen carefully for the shooter to utter some permutation of the word “pull,” after which I’d press a button to release the clay pigeon (if you squint hard you can see the neon green one above the green shack). I’d then observe whether the target was hit and tally the scores. While this seems simple enough, it was actually quite challenging. Why? Because I was wearing earplugs which made it hard to hear the muddled “pull” call among the orchestra of gunshots across the range. Further, there were shooters in adjacent stations simultaneously calling “pull.” Suffice it to say, I may have messed up once or twice, upsetting the participants in the process. I was a bit intimidated to upset armed men in a high-stakes tournament. Spoiler alert: I wasn’t shot dead. I was paid $6/hr under-the-table and gleefully ride my bike home after a 10-hr shift with $60 of cold-hard cash in my pocket. I felt like the richest person on the planet.

This Month’s Finances

Spending this month was an unmitigated disaster, but much of that was driven by predictably large recurring expenses (e.g. insurance premiums, summer camps, doctors, etc).

- The good:

- Still employed.

- The bad/abnormal:

- This month, we felt the pain of insuring a teen driver for the first time:

- 6-mo car insurance premium before (~$240) vs after ($541).

- 12-mo umbrella insurance premium before ($147) vs after ($557).

- Overall, that’s a ~$900/yr increase in insurance premiums as a result of adding a single teenage driver.

- Since we drive beaters, I finally got around to dropping the comprehensive coverage of our minivan (which we bought new during grad school). I probably should have done that a few years ago.

- Over $2k for a bunch of doctors bills (orthopedic, primary care, dermatology, dentist, optometrist, etc).

- Roughly $1k on summer camps (more to come next month).

- Musical theater is expensive.

- ~$600 in travel for Mrs FP.

- $689 annual homeowner’s insurance bill. I’ve raised our deductibles substantially so we’re essentially self-insuring, but we still carry the insurance for liability purposes.

- $561 for two bikes for our kids who have outgrown their old ones.

- “Food” (e.g. Costco) expenses were much higher than normal, but I don’t recall eating more oatmeal than normal.

- This month, we felt the pain of insuring a teen driver for the first time:

Through a combination of boredom and curiosity, I added a new chart to the financial report. The last chart now computes our cumulative investment gains since I started the blog (basically post-grad school), ignoring any gains prior to that since I didn’t track it this well before then.

During the early stages of Covid, the entirety of our investing gains were wiped away. During 2022, $400k of gains vanished. I think it’s a pretty interesting way of visualizing the roller coaster of emotions that a long-term investor is bound to face over their investing life. It’s truly amazing how quickly gains come and go. The chart ignores inflation, and thus fails to account for any erosion of purchasing power of the portfolio over time. Perhaps I’ll refine the chart someday to include that.

I’d be a lot better investor with the benefit of hindsight. If I could summon my inner Doc and Marty McFly, I’d drive my DeLorean back to 2016 to coach my former self to time the market perfectly, to avoid international stocks like the plague that they’ve been, and to lever up to my eyeballs to buy as much real estate in UT, ID, and MT that I could get my hands on. Over the past 7 years, those investing strategies would have made me at least an order of magnitude wealthier. But that’s obviously not how this thing works. I made the best decisions I could given my imperfect information.

The challenge of investing, of course, is to make prudent decisions today based on uncertain future events (wars, asteroids, pandemics, recessions, tax policies, etc.). I certainly don’t know what the future holds, but I’m optimistic that our decades-long habit of spending less than we earn and investing what is left over in a tax-efficient manner in low-cost index funds will lead to positive outcomes down the road. I’m thankful to my former self for the various decisions that he made (health, investing, education, etc) to put my current self in a position to thrive. I’m similarly hopeful that my future self will be thankful for the decisions of my current self.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

This is probably more for your readers, since you keep very good track of spending on your BoA Cash Rewards cards. It’s a bit easier to go to Accounts -> Spending & Budgeting. From there select your card and then you can see the actual amount spend for the entire month. Just add up the months for that quarter. It’s a lot easier then trying to sift through the data through the actual card account’s transactions page.

Thanks for the suggestion! I had never visited that part of the website before. But with 6 BoA cards x 3 months, that’s potentially 18 queries and summations to perform. I find it easier much easier to do a pivot table, but I can understand why others would find your approach to be superior.

Thanks for another post of great information! I did not realize you had a YouTube channel [now subscribed].

Whenever I visit my parents in NJ, I always ask if we can go to Costco so I can smooch off their Costco membership card. As a family of two and living in a one bedroom condo in DC, we can’t utilize buying too big of a bulk, but Costco comes in so handy for EVOO, avocado oil, coffee, croutons, tortilla chips, toilet paper, granola, and almonds.

My vote is to pony up the $60 and turn your Costco hauls into furniture. Put a tablecloth over the giant package of toilet paper, and you have yourself an ottoman! Or shove stuff under your bed.

Joking aside, there is so much value in a Costco membership that my wife and I were members in undergrad before we were married (technically I was the member but added her to my membership post-marriage — a historically significant landmark in our relationship). At the time, each of us lived in tiny apartments with 5 other roommates (6 people per apartment). It can certainly be done, and the financial benefits are hard to refute.

@Meighan one thing you might want to do is give your parents $50 or so in $10 bills to buy a few Costco gift certificates. Anyone can show a gift certificate to enter Costco even if they’re not a member, then at checkout you use any credit card or cash to pay the remaining balance. If a Costco membership doesn’t make sense this is a way to still make a few visits.

Great post! What prompted you to leave LastPass for BitWarden? I have my wife and another family member setup on a LastPass family plan so I’m hesitant to change up everyone’s routine.

I’d love to see a YouTube video walking through doing a back door Roth contribution step by step! Even better if it’d be on Vanguard. It’ll be my first time doing that later this year.

Thanks!

I left LastPass for two primary reasons:

* Their history of security breaches, though admittedly they have been benign thus far.

* Their limitation of browser OR phone app unless you pony up the money. BitWarden allows for both functions simultaneously for free across a bunch of devices. My wife and I have it configured on all of our computers + phones. Plus, there’s some nice added functionality (cheapish Yubico integration if I ever get around to it, the option for a pin/biometric unlock after you’ve already authenticated a device with the master password). It is just like LastPass, but better. That migration tutorial I linked to made the transition absolutely seamless.

Thanks for the video suggestion. We’ve already maxed our both backdoors (on Jan 1) this year, but I’ll record the process next time we do it.

Curious what are your thoughts on international vs domestic. My inner Bogle says that if during the last 10 years VTI returned 10% nominal and VXUS 2% nominal, it is time to buy international. P to E favors international as well.

Relative to domestic stocks, international PE ratios have been favorable for years. One would think that the US outperformance would eventually stop at some point, but I have no idea when that might occur. I feel pretty good about my international allocation right now, but who knows what the future holds.

Thank you for the shoutout! Yubikey also works at Bank of America.

Harry,

Thanks for stopping by!

Stupid question that I think I know the answer to. Assuming I enable Yubikey with BoA, I’d completely lose the ability to monitor BoA accounts in an aggregator like Personal Capital, right? Because the whole point of a Yubikey is limiting access to the account to someone possessing the physical key….

While I’d like more security in my life, I also love the functionality of aggregators so much…..

Some aggregators are approved by the financial institution as a trusted party for view-only access through a special channel. They don’t go through the same website that you and I use. Having Yubikey on the customer side won’t block aggregators in that special channel.

I use Fidelity’s Full View (eMoney). It gets information from Vanguard and B of A just fine while I have Yubikey enabled for both. I don’t know whether it’s the same for Personal Capital. You can always try it. If it breaks the aggregator, turn off YubiKey.

Thanks for the feedback Harry!

What I care most about securing are my investment accounts, so I should enable Yubikey on those. I’ve read that Fidelity might be working Yubikey integration. But I wish all brokers would enable the ACAT freezing that Fidelity does (https://www.mymoneyblog.com/fidelity-money-transfer-lockdown-block-fraudulent-acat-transfer-brokerage-scams.html).

You’re net worth has increased by over $1.4M in 6 years!!!! And that includes a couple of pretty bad years for investments, although there have been a few good ones in there too. Amazing stuff!

Thanks!

The small (and big) things add up. Living below your means, optimizing for taxes, keeping investment costs low, and staying the course.

Wait you gross 272 but net 260? How is that possible

That gross does not include the generous 401a match, which certainly allows us to “net” a high percentage of our gross. If gross were recomputed to include 401a match, the sting of taxes would be much more pronounced.

That said, to lower our taxable income I max out all available pre-tax space:

* 13.5% of my gross goes to 401a (that’s my contribution + employer match)

* $22.5k 403b

* $22.5k 457b

* $7.3k HSA

* Pre-tax contributions for work (e.g. medical/dental/vision insurance premiums, parking, etc)

Credit card rewards are tax-free.

100% of Mrs FP’s modest salary goes pre-tax to her 403b, to avoid the 24% federal and 7% state marginal tax rates.

~$27.7k MFJ standard deduction (e.g. the 0% bracket).

Child tax credit for 5 kids shaves off $10k of federal taxes. If you have enough kids, you can almost always get your tax liability to below zero, though I wouldn’t recommend that as a positive NPV strategy.

The progressive tax code is very kind to moderate incomes. With enough pre-tax deductions, our income is taxed very favorably.

I wrote everything I know about the US Tax code in this “book” linked in the header of the blog: https://www.dropbox.com/s/lv96xgpfp95d3tk/20180531%20-%20Incomplete%20Rough%20Draft.pdf?dl=1. Perhaps you’ll find some of it interesting?

Thanks for the link. I max out every possible pretax option as I am in a high earner but can’t get even close on a percentage basis to you. Very frustrating

Death and taxes….

One note with respect to the verification questions, I’ve heard it is better to use random words than a typical password generator output. One social engineering tactic to bypass the verification on the phone would be to say “Oh I don’t know what it is, I just entered something random.” I’m not sure how valid that is, but I use the random word based password generation in 1password for my verification questions to prevent that.

This is a great suggestion. Thanks for sharing!!!