Another month, another update. A few random comments.

Good Reads/Listens/Watches

Due to my lack of bike commuting, I haven’t listened to my usual podcasts this month. Consequently, my recommendation list is quite stingy this month. Also, my lack of bike commuting (and lack of climbing 3 days/week) has turned me into a sedentary individual. I’m slowly atrophying back to my scrawny steady-state being.

- A poignant Daily Podcast (from NYT) episode in which they interviewed the owner of a successful NYC restaurant that is having to close it’s doors (link).

- The pandemic has (obviously) been especially harsh to certain industries. The randomness with which the economic fallout has hit is cruel.

- We watched the SpaceX astronaut launch today. It was incredible. If you haven’t seen it, I’d google it.

- We watched The Last Dance (link).

- I think I’m having (yet another) midlife crisis. Between watching The Last Dance and the SpaceX launch, I’ve declared to my wife that I’m either going to change careers (again) to become an astronaut / rocket scientist / or NBA superstar (I won’t settle for mere NBA star). She was not amused.

Life

- I was feeling antsy while locked down in quarantine so I encouraged the family to go on a bike ride to a nearby park. It went okay until FC2 took a fall near the end of the ride and broke her forearm. About $1k in bills are currently being processed by insurance for two x-rays (through primary care physician) and one cast (30 second consultation with orthopedic doc + 10 minute casting by assistant).

- It’s been interesting observing my university’s response to the pandemic. The message is basically “We can’t financially sustain ourselves without getting students on campus, so we’d better invite them back to campus and figure out the details later.” I hope we can figure it out, but the latest guidance indicates that there isn’t sufficient space in classrooms to facilitate social distancing so we may have to require that half of students attend Tuesday lectures and the other half Thursday lectures (with the non attending students doing online courses). Masks will be required for all students/faculty.

- This begs the really interesting question: are parents going to send their kids to school under these circumstances? On the one hand, the current plan sounds like a sub-optimal college experience. On the other hand, if the alternative is their college-aged kids playing Xbox in their parents’ basement for the next 12 months, perhaps college is the least bad option?

- Here’s a lively bogleheads thread discussing the above: https://www.bogleheads.org/forum/viewtopic.php?f=2&t=310020

- We took a brief (socially distanced) trip out of state to keep from losing our sanity. It was nice to recharge the batteries in the mountains.

- I went mountain biking for the first time in 20 years with my frugal brother. After a brutal 2k foot climb, we stumbled across a flock of about 100 sheep at the top of the mountain. We enjoyed the serenity of the scene for several minutes (first video below) before proceeding with the rest of our ride. When attempting to pass through the sheep (second video below), I was surprised by a pair of Great Pyrenees dogs, which caused me to soil my underpants (another $2.50 down the drain!).

The calm before the storm (30 second video).

The storm. That first little bit was pretty intense; it turns out to be difficult keeping one bike between yourself and two dogs when the two dogs are on opposite sides of you. Also, I was terrified that a third (or more) dog would join the party. I was hoping some rancher would come riding by on a horse to call the dogs off but that didn’t happen. We ended up sorting it out ourselves (by walking slowly around the flock while the dogs continued to harass us).

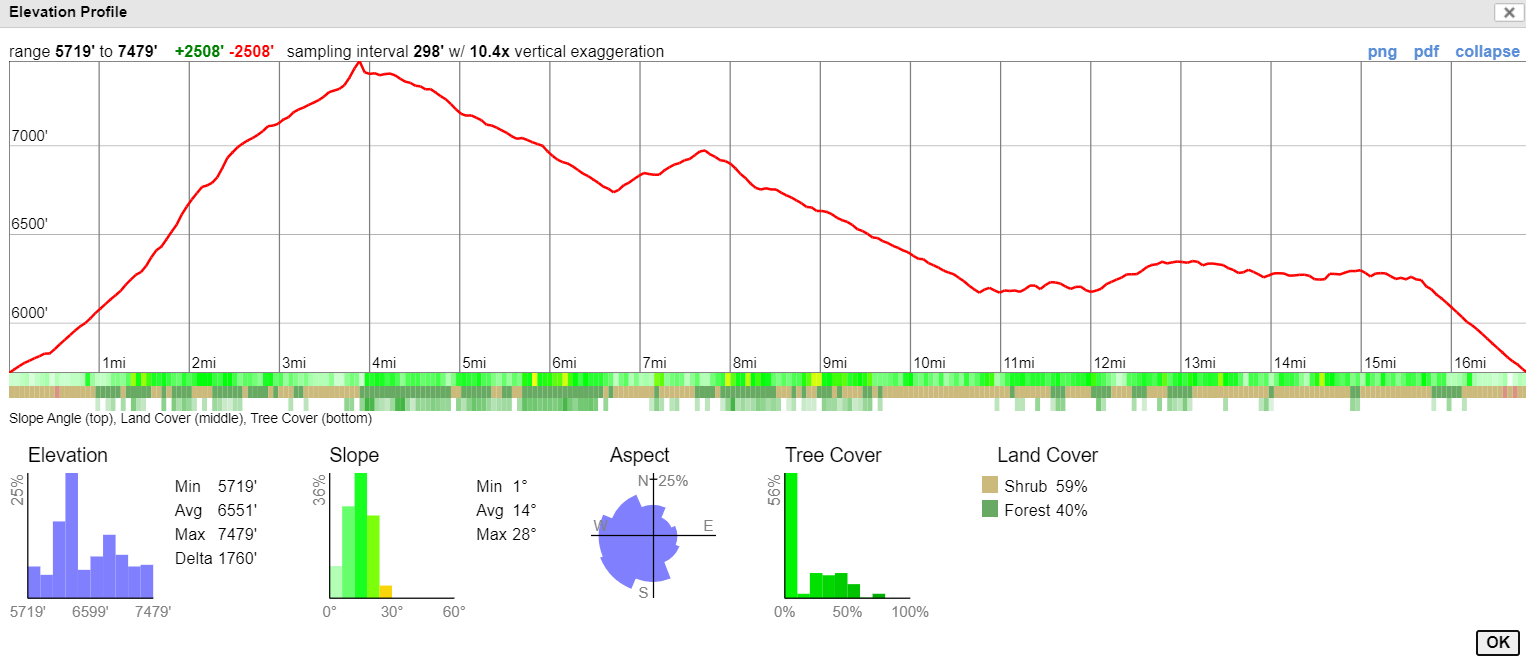

The bike ride was pretty hard. We hit the sheep at the very top of the climb.

The bike ride was pretty hard. We hit the sheep at the very top of the climb.

Mt Timpanogos / Sundance. Stewart Falls in background. Mt Timpanogos / Sundance is one of my favorite places on Earth.

Hiking through an aspen grove on way to Stewart Falls. Utah is not ugly.

Back home, having fun in the creek before FC2’s fateful broken arm.

Back home, having fun in the creek before FC2’s fateful broken arm.

This month’s finances

- The good:

No catastrophes.- Still employed…

- The bad/abnormal:

- $783 annual payment for homeowner’s insurance with Esurance ($10k deductible).

- $317 vet bill for unfrugal dog.

- She got into our trash can and devoured an entire rotisserie chicken carcass.

- The cumulative cost of dog ownership is converging on $5k in less than a year.

- May this be a cautionary tale for those considering buying a dog; the initial purchase price is a drop in the bucket relative to the lifetime costs of owning a dog.

- $160 semi-annual payment for car insurance with Geico.

- $147 annual payment for $1M umbrella insurance policy with Geico.

Full version is downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads as well as the inability to buy partial shares. With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link).

- I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

Wow that dog wasn’t messing around!

You include your home insurance bill in the “Bad”. Our homes are worth about the same and I pay close to $2,500 annually. Something I clearly need to look into. I tried Esurance but they don’t cover my state. I live just less than 2 miles from the ocean and I think that dings me a bit but clearly I am paying too much…

Pretty impressive you’re now 56% to FI on a 4% W/R.

Home insurance definitely isn’t “bad”, but I like to keep track of these transactions individually.

Is the difference between our annual premiums due to differences in deductibles? When we first bought our home I got quotes from a half dozen insurers and Esurance was 75% less than some of the quotes I got.

I need to spend less. The % to FI calc is most easily achieved by lowering expenses rather than increasing wealth.

Hi professor, I’m new to your site from the goodrx piece, and found it a treasure! Thank you for the great (draft) write up 🙂 One thing I’m curious about is your total international stock pick – you didn’t go with VTIAX because of the exp. ratio (0.11%) which totally makes sense. Now between FTIHX and FZILX, it seems that FZILX got a favor as a 0.00% exp. ratio (?). However, FZILX is a little less diversified (2054 stocks vs. 4908 of FTIHX). My question for you if you don’t mind – Will the zero cost weigh in exchange for the less diversified stock holdings?

Welcome to this obscure corner of the internet! I’m glad you found the draft “book” helpful.

Regarding FTIHX vs FZILX decision, I think it’s pretty much a wash. When you look at the data, there is a diminishing benefit from diversification above a certain number of stocks. Given that these indices are market cap weighted, it also means that the stocks that are missed in FZILX are likely to be tiny, and therefore relatively inconsequential in the grand scheme of things.

I love those parts of Utah. I have fond memories of trying to make my way from Midway to a family gathering in American Fork via the Alpine Loop and getting lost. We ended up coming down the mountain on a jeep trail in our Toyota Sienna and ending up around Tibble Fork Reservoir. Didn’t see any sheep dogs or sheep but I can imagine it.

I’ve never done the full Alpine Loop, but I’m sure it’s gorgeous. Thanks to your debacle (and the fact that I’m a fellow Sienna owner), I’ll be sure to avoid it. It’s unbelievably beautiful country though. My appreciation of Utah’s beauty grows with every additional year I spend in the midwest. I took the beauty for granted living there for 7 years. It’s easy to do so when that’s your view every day.

Hello, I enjoy reading your blog. I know in the past you wrote about how you use Fidelity as your one stop shop. Now that interest rates are low, it seems like the High Yield savings accounts have higher interest than Fidelity’s SPRXX. Also, one thing that is preventing me from using Fidelity as my main checking is that their debit card seems to only have a $500 max withdrawal limit at the ATM. Any thoughts? I currently use BofA mainly for Preferred Rewards and the credit card booster. At the same time it’s nice Fidelity has free wire transfers. Seems like every place has their pros and cons.

Ron,

The world has definitely changed since I wrote that post. Interest rates are basically zero (less than zero after inflation; even worse once you account for taxes on interest earned). Consequently, the Fidelity strategy isn’t great these days but I continue to stick with it because: 1.) I like it, and 2.) I hold hardly any cash so there is basically no opportunity cost.

I don’t blame you for jumping ship to a high yield savings account, but I’m thinking that high yield savings accounts will at parity with Fidelity in a month or two, but perhaps I’m wrong.

Regarding the $500 limit, I don’t have much to say. I think I withdraw $500 per decade so I’m not hitting that limit. But I vaguely recall the Bogleheads talking about this issue and perhaps calling Fidelity to alleviate the constraint?

What an amazing hike!

I’ve heard of universities with a space crunch prioritizing certain types of classes for F2F (freshmen/seniors, small classes that can expand into a lecture hall) while others are being pushed to online. Unfortunate for sophomores/juniors, but hopefully it’s just a temporary adjustment (didn’t I say that in March though?).

I hadn’t heard of prioritizing freshmen/seniors before, but that is sensible given the constraints.

Do you have any idea how your teaching will be in the fall? Online/in-person?

Great stuff FP.

FTR, I have chosen DGRO over VTSAX/VTI as offers higher returns at lower volatility. DGRO looks at the top 2000 liquid US stocks, and chooses nearly 500 which are growing their dividends. I like this type of quality screen. It shows profitable companies where management is confident about the future. Similar to VIG, but allcap vs. large cap so DGRO is a better total market replacement.

There are some sector weight differences between DGRO and VTSAX/VTI, but those can be equalized easily. Interestingly, when equalized, DGRO’s outperformance over VTSAX/VTI widens!

Thanks for sharing! I hadn’t heard of DGRO before, but it seems pretty similar to a broad base index fund. 400 firms and expense ratio of 0.08%; not too shabby.

There’s a subset of investors that love dividends. As a long term investor, I hate them because they create a “dividend tax drag” (which you can google for more information). Any $1 of dividends I receive triggers $0.24 of federal taxes and $0.07 of state taxes, leaving only $0.69 to reinvest. If I were retired with low labor income, this wouldn’t be as big of a problem. But as a long term investor with an investing horizon of 50 years or so, this creates a huge tax drag.

When comparing vs VTSAX/VTI in a taxable account, be sure to compare the after-tax returns. Morningstar has a good comparison tool if I’m not mistaken. Or you can do it yourself. The required parameters for Vanguard can be found here: https://personal.vanguard.com/us/insights/taxcenter/qdi/yearend-qualified-dividend-income-2017?Sc=1. 94% of VTSAX dividends are qualified which helps improve its tax efficiency. 100% of Vanguard’s S&P 500 index dividends are qualified, so that’s even better. Non-qualified dividends are taxed at higher rates.

Good points, FP. Thanks for the thoughtful reply.

DGRO is 100% qualified dividends, as the methodology excludes REITs. In terms of tax burden, while the DGRO dividends are higher at 2.5% vs. 1.8% for VTI, Morningstar says VTI’s capital gain exposure is much greater. As a result, the three-year tax burdens are almost identical. A loss of 0.65% per year for DGRO vs. 0.64% for VTI. I believe VTSAX is 0.59%

Additionally, my foreign choice of DNL is significantly more tax efficient than VEU. And my bond choice of AGG is slightly more tax efficient than BND.

FP,

Even if we throw out Morningstar’s tax cost ratios, assume no capital gains and just look at dividends:

DGRO 2.54% dividend at 100% qualified taxed at 15% = 0.38% total tax cost

VTI 1.79% dividend at 94% qualified at 15% = 0.25% tax cost PLUS 1.79% at 6% ordinary income at 24% federal and 7% state = 0.03% tax cost = 0.28% total tax cost

So that’s 0.1% per year in extra taxes for DGRO when DGRO outperforms by 0.4% per year…