Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Jason Zweig reflects on the life of Charlie Munger on a WSJ podcast (link).

- Relatedly, Poor Charlie’s Almanac is a good read (old edition, new edition).

- Beau Miles embarks on a 3-day pumpkin-fueled journey (link).

- Two cyclists have been biking from the very top of Alaska to the bottom of Argentina. They are currently halfway through their journey in Mexico. Pretty amazing to follow. Here’s an abbreviated summary of their trip to date (link).

- The latest “Reel Rock” film is now available for free on Red Bull’s website (link).

- Honnold is a maniac.

- Pretty entertaining test drive of the Cybertruck (link).

- I’ve been re-watching the original Wonder Years with my kids and have been having a great time (link).

- Nostalgia for Fred Savage prompted me to show my kids The Wizard.

- The movie brought back fond memories of countless hours of callous-inducing gaming on the original NES console.

- Unlike other movies I’ve shared with my kids from my childhood like the Never Ending Story, Flight of the Navigator, and Willow, they didn’t hate this one. How could my kids not love Willow!?!?

- Nostalgia for Fred Savage prompted me to show my kids The Wizard.

Life

- A friend shared a gmail hack with me that I thought was pretty clever. Create a filter for the word “unsubscribe” and automatically send all of such emails to junk (or just skip the inbox). Not sure why I didn’t think of that myself.

- We continued to spend inordinate amounts of time attending kid activities (sporting events, band/choir performances, etc).

- Mrs FP introduced me to the NYT game “Connections” (link).

- Super fun. One new game per day. We are pretty competitive with each other. Mrs FP almost always wins.

- It is a lot like Codenames, an excellent board game. Best with 6+ players (link).

A modest pile of leaves, thanks to the removal of our four giant ash trees four years ago (stupid emerald ash borer). We planted a red oak to replace them (pictured above), and I think it has grown a couple of inches in the ensuing four years. At this rate, it will be 10 feet tall when I’m dead, assuming I live a long time.

A modest pile of leaves, thanks to the removal of our four giant ash trees four years ago (stupid emerald ash borer). We planted a red oak to replace them (pictured above), and I think it has grown a couple of inches in the ensuing four years. At this rate, it will be 10 feet tall when I’m dead, assuming I live a long time.

Mrs FP dragged us (and the dog) on a Thanksgiving morning turkey trot at a middle school track. FC1 beat me in the mile by a few seconds, which pained my soul. So did the 5,750 ft of elevation and freezing temps (and, if I’m being honest, my aging body). 13-year-old FC3 has grown many inches over the past few years and has now surpassed everyone but me. I’m sure my days are numbered before he passes me up. Weird.

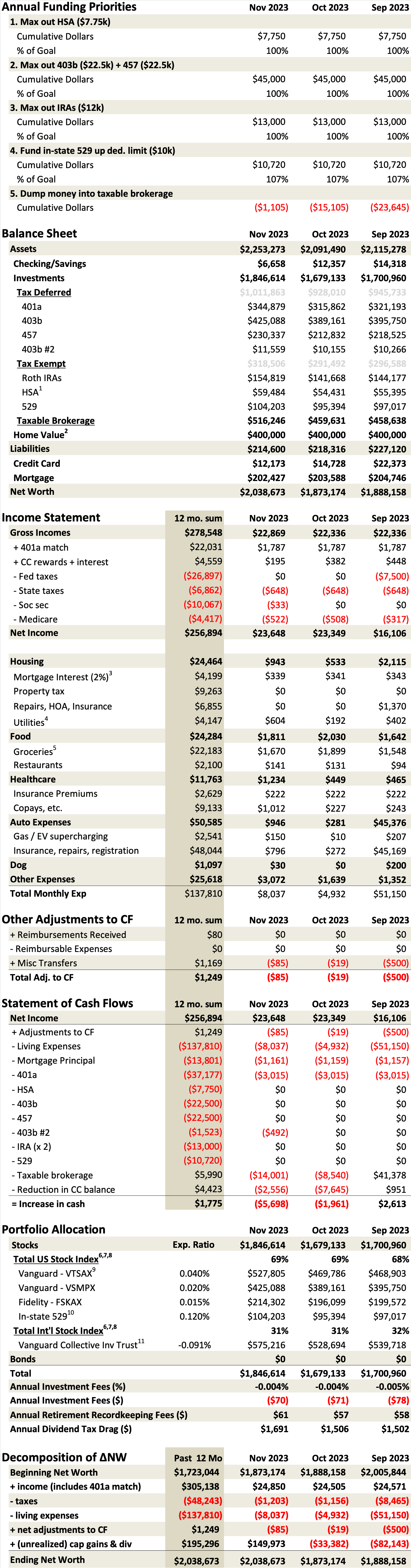

This Month’s Finances

An accounting professor found my blog and a fun email thread ensued. When I asked him about the usefulness of my financial report, he said it doesn’t have enough accruals and he disliked the % to FI chart. I don’t want to mess with accruals, but I did fix my % to FI chart by using a rolling 3-yr annualized spend rather than a rolling 1-yr spend. This will help smooth out lumpy transactions like roof replacements and car purchases and give a more stable snapshot of out financial progress. Further, I stripped out our 529 savings from the SWR computations. I like the changes.

YTD, we’ve contributed approximately $0 to our taxable brokerage accounts. The purchase of the new car didn’t help, nor did our increase in general spending. Prior annual taxable brokerage contributions: 2022:$62k, 2021:$88k, 2020:$52k, 2019:$53k, 2018:$57k, 2017:$47k.

The brutal honesty of these reports/charts is pretty humbling. In my mind, I’m a lot more frugal than the data shows. We’ve started loosening up the purse strings a bit on kids activities (die with zero). The three youngest love “ninja” class/lessons more than anything, so we’re spending $250/mo to put them in a 1x/week class. It all adds up.

Every time I look at the dividend tax drag computation for our taxable brokerage account in the financial update, three thoughts go through my head. 1.) Ouch, 2.) Why doesn’t my employer offer a mega backdoor Roth?, and 3.) Why didn’t I invest in Berkshire in my brokerage account to avoid dividend taxes? The preferential tax treatment of share repurchases (and thus, deferred capital gains) over dividends will never cease to baffle me.

- The good:

- Still employed.

- The bad/abnormal:

- $1,012 in orthodontia/dental expenses. Prepaid an extra month of $200/mo Invisalign payments due to BoA’s 2% bonus day. $374 night guard. $239 normal dental stuff.

- $796 in auto insurance premiums.

- $604 in utility payments. I prepaid an extra month due to BoA’s 2% bonus day.

- A couple grand on misc “other” (upgraded two 10-year-old computer monitors, 7 pairs of shoes for growing kids, seven tickets to see off-broadway musical, random Christmas presents/gifts, $88 to take my boys to a college football game (we predictably lost a heartbreaker on the last drive by a few points, like every game for the past 8 years)).

- We filled up multiple tanks of gas. An increasingly rare action.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Do you include your HSA in your SWR calculation? I’ve been thinking about leaving it out lately because it’s a 20% penalty for anything other than healthcare expenses before age 65. Also, non-medical withdrawals after age 65 are taxed.

I do count the HSA in the SWR calculation. My justifications:

1.) I have a boatload of healthcare receipts to “turn in” to withdraw tens of thousands of dollars tax and penalty free today. Probably the majority of our current HSA balance.

2.) Even if I didn’t, I’m comfortable waiting until 65 and using it just like a Trad 401k/403b/457/IRA.

Thanks for the update Frugal Prof! I always look forward to reading your updates, especially the comments at the beginning. I ended up buying a Pixel 3a for my wife a few years back due to you mentioning the sale.

Cherish the Pixel 3a, as it is the last Pixel with the free photos. Even after you upgrade (like we did somewhat recently), you can transfer photos to the old phone for continued free photos. A bit confusing to set up since you have to disable backup on the new phone. But we’ve been doing this for about two years now with great success. We use the “Syncthing” app. There are YT tutorials on how to configure it.

Fun update! Get used to your kids exceeding you. I’m not shorter than two of my six and there’s a good chance at least one more will surpass me. To add insult to injury, I’ve actually shrunk a little!

It is wild having children grow up so fast. The years are flying by. Hope you and the fam are doing well!

“In my mind, I’m a lot more frugal than the data shows.” Oh man, I can relate. We only have our kids with us a few more years, so we’ve opened up a bit too. Our rolling real spend graph has quite a positive slope.

Positive slope of doom! I know the feeling indeed.

Better to spend on them now than regret being a miser down the road, I suppose.

Ouch – that’s rough that they don’t like Willow or Flight of the Navigator!!! Maybe they would appreciate the wonders of “Mr. Boogedy”? I just recently watched it on Disney+. I was scared silly when this first came to TV in 1986 🙂 Classic!

Willow and Flight of the Navigator are such great movies. It’s too bad my kids don’t like them. The NeverEnding Story, it turns out, is not such a great movie in 2023 despite my memories of it being good.

I hadn’t ever heard of Mr Boogedy, but the trailer was…interesting. I don’t know that I’ll be traumatizing my kids with that one any time soon….

Thanks prof for sharing. You mentioned about dividend drag & megabackdoor roth. Why not setup a backdoor roth ?

Good question. We do backdoor Roths as well, but have extra savings each year that have to go into something other than tax-advantaged space because we’ve already filled that up: https://frugalprofessor.com/hierarchy-of-savings/

I enjoy these. Question on your taxes – do you make quarterly estimated payments and then withhold $0 from your paychecks? If so, is this to ensure you don’t over-withhold and/or to earn interest on the excess money until you pay your estimated taxes? It looks like that’s what you are doing from the fed taxes under your income statement. What do you do to accrue cash for tax liabilities beyond withholdings, if anything?

My tax withholding situation is weird. Because I withhold close to 100% of my paycheck in tax deferred accounts for the first few months of the year, there are very little taxes withheld during that time. Some years my taxable income is near zero through April.

I run the numbers and ensure that I settle up by the end of the year on my W-4.

This year was wonky because we bought an EV and qualified for the $7500 tax credit, dramatically reducing the amount of taxes I needed to withhold during the year.

Hey Prof , thanks for your advice on moving to Fidelity. I used to have my payroll hit Bofa and then trigger transfers, but now ive moved everything to Fidelity. It’s the most user friendly experience. I even enjoyed the free atm withdrawls feature recently on my trip to Peru!

I had one question- Ive setup Roth IRA and plan to invest in VTSAX. but i realized that there may be commissions associated with buying Vanguard funds in Fidelity. Whats your workflow like here?

Glad the setup is working for you! The free ATMs worked great for me in Peru as well.

For Roth IRAs, you have a few options:

1. VTSAX in Vanguard Roth IRA.

2. VTI (ETF equivalent to VTSAX) at Fidelity Roth IRA.

3. FSKAX or FZROX (both of which are VTSAX clones) with Fidelity Roth IRA.

I’ve done a combination of options #1 and #3 in my life. Currently doing option #3 but sometimes I regret not sticking with option #1.

Congrats on becoming a multi-millionaire!

Thanks! Who knows how long it’ll last…

Mr(Ms) Market can be quite fickle.