The 2023 version of FreeTaxUSA is now live: https://www.freetaxusa.com/

Usual disclaimer: the website’s name makes it sounds like a horrible scam. But it is my favorite tax filing site, found through my favorite resource on the planet for all things personal finance: the Bogleheads forum.

How do I use FreeTaxUSA?

- In November, I take 30 minutes to extrapolate my YTD income to arrive at projected W2s + 1099s, and thus my projected tax refund/shortfall:

- I’m salaried with no uncertain bonuses coming, so I can estimate to the penny my 2023 income. Combined with my YTD + future withholdings (fed + Soc Sec + Medicare), I can perfectly estimate my official 2023 W2 in mid-November.

- I created a template if you want to see the gist of what I do. It’s not terribly sophisticated, but it works flawlessly every year given my predictable income stream: W2-Estimator

- For interest income (e.g. 1099-INT), I estimate it as YTD interest (through Oct) * 12/10.

- I use Personal Capital to easily observe my YTD interest through a simple transaction query.

- Be sure to include bank bonuses here. They are easy to forget.

- For dividends (e.g. 1099-D), I can estimate this as YTD dividends (through Oct) * 4/3, since I’ve already received three of the four quarterly VTSAX dividends from Vanguard (Mar, Jun, Sep). Historically, 95% of these dividends are qualified (with 5% non-qualified). That is going to certainly get me close enough.

- I use Personal Capital to easily observe my YTD dividends through a simple transaction query.

- For cap gains (e.g. 1099-B), generate a YTD report from your brokerage and try to extrapolate what that will look like at the end of the year.

- At Vanguard, this is accessible through the Show=>Realized Cap Gains/Losses drop-down menu within a brokerage account.

- Include any deductions you need to. In my case, I claimed the EV tax credit for a $7,500 reduction in my federal tax liability. I, like most people, simply take the standard deduction (thanks to the $10k SALT cap) so I don’t worry about any of the itemized stuff (e.g. mortgage interest, prop tax, state income tax, etc).

- I’m salaried with no uncertain bonuses coming, so I can estimate to the penny my 2023 income. Combined with my YTD + future withholdings (fed + Soc Sec + Medicare), I can perfectly estimate my official 2023 W2 in mid-November.

- In February once our official W2s and 1099s are received, I update my estimates at FreeTaxUSA and file my federal taxes for free. Filing state is fairly cheap ($15), but I prefer to file on my state’s free eFile website.

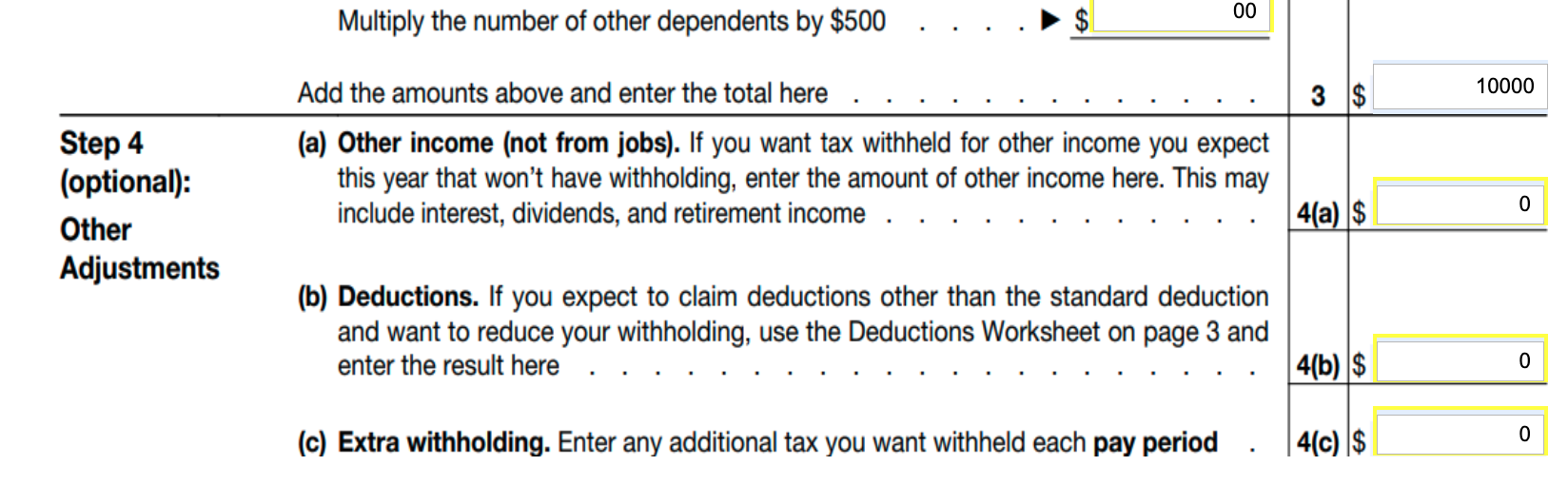

If you estimate your W2 and 1099s today and find that you owe money, you can simply adjust your W4 withholdings by putting your projected federal tax deficit into cell 4(c) below. Just be sure to turn this back to $0 after the desired “extra” withholding occurs. If you want to split your shortfall across two paychecks, then put $/N into 4(c).

On the other hand, if you project to have a refund, that’s a bit more difficult of a problem to solve because the W4 doesn’t have an explicit “withhold $X less/paycheck” feature. You can sort of get there with 4(b), but it is not at all clear what you’d put in there to reduce your withholdings by $3k, particularly over the 1-2 remaining paychecks in 2023. This is a bummer

The median federal tax refund is ~$3k because there is inherent conservatism built into the W4 withholdings. It drives me crazy, but I guess you can’t blame the government for erring on the side of over-withholding (to reduce non-payment risk). But it is certainly not in the our best interest to give the federal government an interest-free loan every year by overwithholding. Particularly when interest rates are greater than zero.

I have a weird hobby of trying to get my refund/payment to as close to zero as possible each year. Last year I was off by ~$50. Hopefully I can get it to single digits this time. It’s pretty easy to do so with about 30 minutes of planning. Perhaps you will join me in this weird endeavor.

I used to accomplish the above tax estimation using math and tax tables (e.g. https://frugalprofessor.com/2022-tax-calculator/), but I’ve found that using FreeTaxUSA ahead of time with projected W2s/1099s is much easier (and more accurate) than trying to use my to decipher the ever-evolving mess of the US tax code. For those wanting to geek out to that level of detail, please see MDM’s excellent case-study spreadsheet which is far more sophisticated than my dinky little spreadsheet ever was.

FreeTaxUSA worked great for my wife and I last year. Thank you for the recommendation! I shared it with coworkers as well.

Glad it’s worked out for you! It’s a great service.

I understand your “weird hobby” of getting the withholding exactly right, but it is clearly not optimal. I do the extreme and try to get the maximum “free loan” from the government that avoids any penalties/interest – the lessor of 90% of your current liability or 110%* of last year’s liability. In 2024, for 2023, I will owe an additional ~$18k to the Feds. Nice ~9 month interest free loan in a high rate environment. Why don’t you do the same?

Your point is well taken, and it’s something I’ve been considering for a while now. When interest rates were zero, there was very little upside to intentionally underwithholding within the penalty-free region. Since interest rates aren’t zero any more, I’ll give your strategy some more thought.

The TaxCaster App (found in App Store for free) by Intuit was just updated a few days ago for 2023 as well. This is an easy and accurate tool I have used for years to estimate my taxes due. Check it out if you have not heard of it. It’s nice because you don’t have to enter any personal information or even create a user name/account to use it.

I’m a huge fan of taxcaster and recommend it to my students all of the time. The MDM spreadsheet is basically taxcaster on steroids.

How do the two (FreeTaxUSA and taxcaster) compare? Also, what about CashApp tax, which includes free state filing?

FreeTaxUSA is the real deal. Comparable to TurboTax but free. Taxcaster is just a tool for estimation. Have never heard of CashApp tax before.

Every year I read your post about freetaxusa and think that – wow – it would be nice to save about $150, but I just can’t stomach uploading my data online to a private company. If only they had a downloadable edition!

I’d recommend it if you ever change your mind. It is an excellent product.

Inspired by Median Build’s comment, I adjusted my W-4 to greatly reduce withholdings for the rest of the year, so instead of a refund on my tax return I will owe close to the max allowable amount.

You can use ADP’s paycheck calculator, https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx, to model what your paycheck will be based on different W-4 entries. On the “Federal Taxes” tab, there are fields that map to the W-4 field 3 and fields 4a through 4c. I increased the number in “dependent amount” (field 3) until my tax withheld was reduced to the desired amount.

Thanks for sharing the ADP calculator! Looks really useful!

I was also inspired by Median Build’s comment and am going to try to be a bit more strategic this year (by owing a small amount in April).

I’m glad to be an inspiration. But just a word of caution based on experience and behavioral finance. Even though it is the mathematically correct choice, be prepared for the disdain of writing the government a big check in April when you are used to the opposite. I still don’t like it even though I “know” it’s the appropriate decision.

That’s pretty hilarious. Thanks for the warning.

Another advantage of owing money is you could pay the tax with credit card.

Taxes can be paid by credit card with a fee of 1.85%, and BOA platinum honors members can get 2.625% back.

So, paying the 18k via credit card could net $148 plus an extra month to float the money. Not much, but maybe this could make the payment experience less painful?

I think I have an unhealthy compulsion over-optimizing this stuff.

“I think I have an unhealthy compulsion over-optimizing this stuff.”

You might not be alone in that regard….