Another month, another update. A few random comments.

Good Reads/Listens/Watches

- Musk’s biography (link).

- I’m about 1/3 of the way through it. It’s pretty entertaining. A few things I’ve found interesting to far:

- Musk’s reluctance to “take chips off the table,” but rather doubling down on downstream bets. This repeated “doubling down” seemed destined to make him the world’s richest man or broke. Maybe there is still time for him to die broke if he can find a few more Twitter-like acquisitions in the future.

- I really enjoyed his utilization of the “idiot index,” which he defines as the ratio of a product’s final price relative to its raw input materials. The higher the number, the greater the opportunity for disruption. He seemed to have relied on this index extensively in the creation of SpaceX.

- How extremely close Tesla and SpaceX were to bankruptcy around 2008, and the consequences that would have followed — a large delay in the adoption of EVs and the continued stagnation of the space program.

- I’m about 1/3 of the way through it. It’s pretty entertaining. A few things I’ve found interesting to far:

- Kelce (link).

- 2-hr documentary about the less famous of the Kelce brothers, the Eagle’s long-time center Jason.

- 60-minutes segment on 3D printed homes (link).

- A beautiful little corner of the internet called the Costco Subreddit (link).

- Some highlights, where enthusiasts:

- Share their Costco halloween costumes (link1, link2, link3)

- Create histograms of halloween candy bags (link1, link2)

- Scientifically discuss the optimal ratio of cheese/caramel in a bite of Cretors popcorn (link)

- Come up with creative ways of bypassing Costco’s food court cancellation of sauerkraut for hot dogs (link)

- Complain about the injustices of the cessation of the combo pizza (link)

- And, my favorite, eulogize the end of the life of a 3,000 square foot roll of generic KSig saran wrap container (link).

- Between the Bogleheads forum and the Costco subreddit, I have truly found my tribe.

- Some highlights, where enthusiasts:

Life

- As usual, we spent the majority of October chasing around our kids to various activities. The weather was nice, but we are bracing for what’s coming in the next few months.

The start of a cross-country race always reminds me of Braveheart.

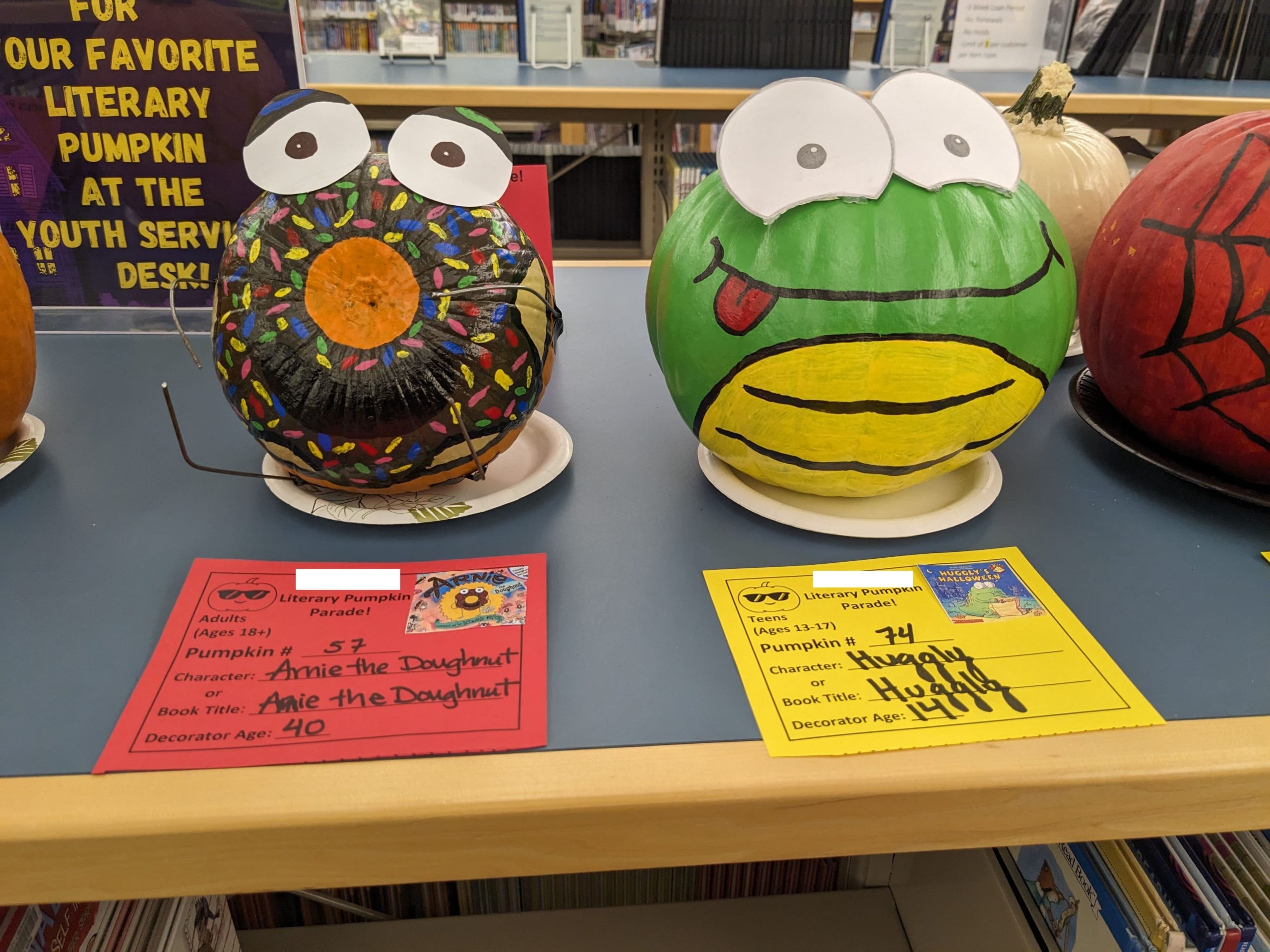

Pumpkin painting contest at the library. My favorite children’s book of all time is Arnie the Doughnut (perhaps followed by George and Martha). Mrs FP painted Arnie. FC2 painted Huggly.

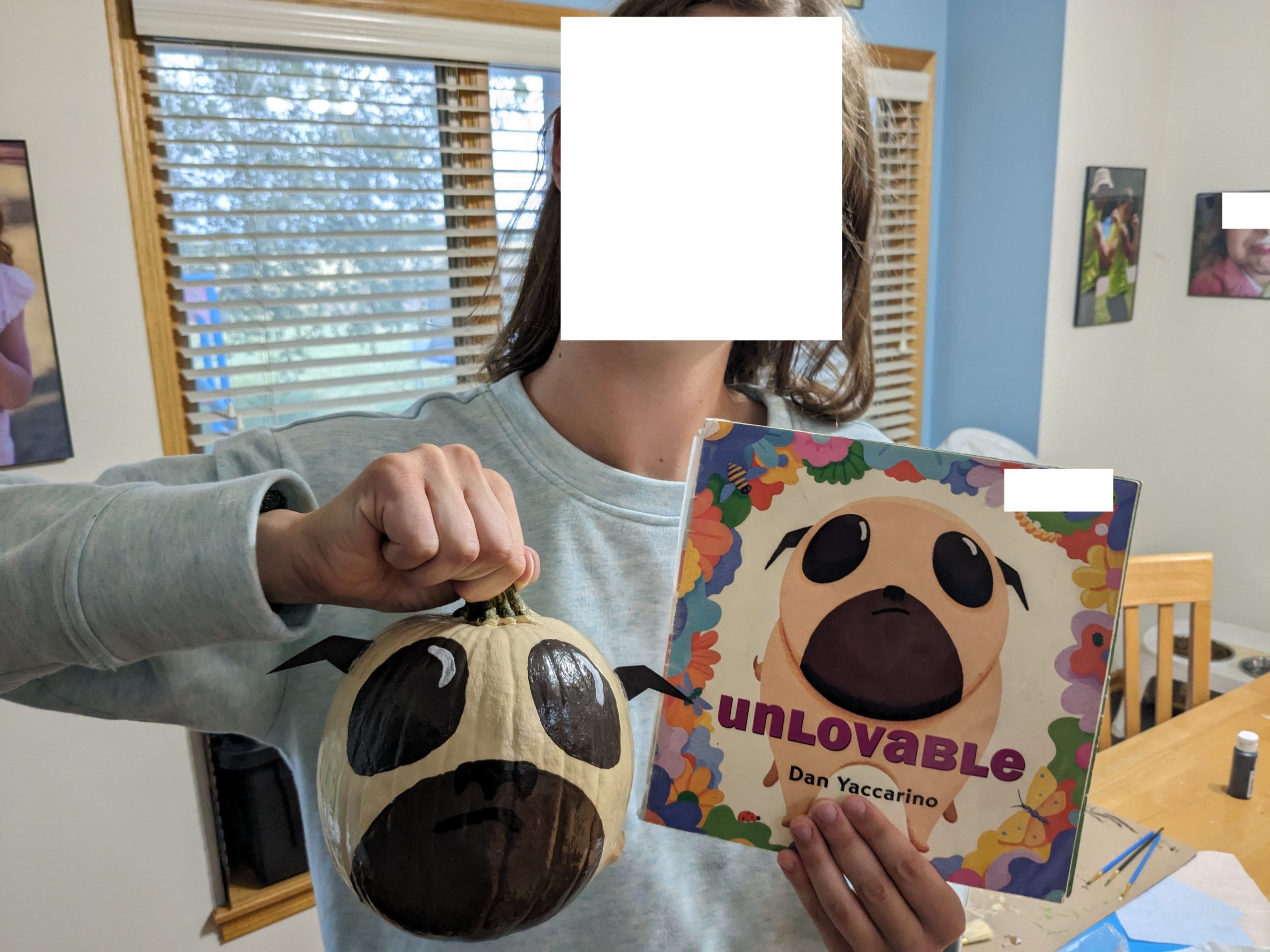

FC1’s entry.

Are you kidding me Costco? Way to tug at my heartstrings!

FC5 at a field trip to visit the prairie. Flyover country can be pretty sometimes.

FC2 somewhere in this mass of marching band kids.

Apple picking at a new-to-us orchard about fifteen minutes from our house. It was a glorious fall day. We should have bought more gold rush apples, which were awesome (as always). Every single time I visit an orchard in town, I wonder why I don’t live on one. They are beautiful.

Beautiful fall commute. I’ll take this over sitting in soul-crushing traffic most days of the year (save a few in Jan/Feb).

This Month’s Finances

For those on the BoA bandwagon, BoA is doing another one of those extra 2% cash back days on Nov 9 (link). If you are planning on making a large purchase/payment anyway, why not time it to coincide with that date? I’ll be doing my monthly $1,500 Costco Cash purchase (+ December’s too?) on that date to eek out another $30+ of rewards. Not life changing money by any means, but I don’t mind picking up proverbial dollar bills from the ground when I find them. The last time I did this, most of my transactions worked as anticipated and got the extra 2% bonus, but a couple small ones did not due to how BoA handled the timing (e.g. medical payment cleared a day after the eligibility date).

- The good:

- Still employed.

- No gas expenses. $10 in EV supercharging costs to get us home on our few >300 mile ventures out to XC meets.

- At-home EV charging expenses round to zero and are now baked into home utilities.

- The bad/abnormal:

- $441 in school fees.

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + cheap investment options (e.g. FZROX, FZILX, FSKAX, etc).

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own, and it’s trivially easy to manage. Further, a DIY portfolio allows one to tax-loss-harvest more easily. Lastly, a DIY portfolio can help avoid the dreaded cap gains distributions caused by a fund-of-funds (e.g. Vanguard Target funds in Dec 2021).

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I hold VTSAX in my taxable brokerage account because its tax efficiency (no cap gains distributions thanks to its patented technique).

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of our 529 money there if not for the state tax deduction we receive in our own state.

- My Collective Investment Trust (CIT) version of Vanguard’s Total Int’l Stock Index has a 0.059% expense ratio, yet produces 0.15% of “tax alpha” due to reduced foreign tax withholdings. Vanguard implemented this change around 2019. Therefore, I report the effective expense ratio of negative 0.091% for this holding (=0.059%-0.15%). The “tax alpha” shows up in the performance differential in the fact sheets here (CIT vs MF) and is more thoroughly explained here. Unfortunately, this 0.15% of “tax alpha” is not available in the mutual fund version.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/.

Always entertaining to read your monthly updates. I’ve got Musk’s biography in my audio queue to listen to.

Hope you enjoy the book!