Another month, another update. A few random comments.

Good Reads/Listens/Watches

- The Finance Buff:

- On securities-based lending (link).

- On the (likely?) downfall of the (mega) backdoor Roth (link).

- Actionable steps?

- Complete (mega) backdoor Roths before Jan 1 2022 as a hedge.

- Bummer; I was getting closer every to convincing my university to allow this.

- Goodbye $40k/year (+ $6k*2) in Roth contributions, regardless of income level.

- Actionable steps?

- Reflecting on adverse market timing in the real estate market (link).

- Entertaining ClippingChains podcast interview with a climbing CPA (link).

- This would be a great resource to share with others. I’ll probably share it with my students going forward.

- Bogleheads on Investing episode with the manager of Vanguard’s $1.3T Total Stock Market Index (link).

- GoCurryCracker:

Life

- Fall has arrived (sort of). The weather vacillated between hot, cold, and everywhere in between.

- Family life is busy.

- I continue to have fun working on my university’s retirement committee. I had separate Zoom meetings with Stanford, University of California, and University of Delaware this past week. It was informative picking their brains on how their committees arrived at their respective menus. Stanford and UC allow for the mega-backdoor Roth. I’m not aware of any other university that does. They both report that it is easy to administer (Fidelity does the heavy lifting) and that employees are happy. I learned that it is not uncommon for a university to disregard the advice of a consultant pushing actively managed funds. With any luck, my university’s retirement plan will join the ranks of the best-managed plans in the country.

- I learned that the mutual fund holdings of any private university (or company) are easily searchable here: https://www.efast.dol.gov/5500search/

- For example, type in “Stanford” to the search box, sort on asset size, and download the respective 5500 report for Stanford. The informative stuff is in the “attachment” file.

- It would seem that an enterprising lawyer could spend a few hours doing the above, find egregious allocations to high-cost funds, and sue the pants off of any private institution in the country with high-cost funds on the menu.

- This guy out of St Louis has succeeded in $450M (and counting) of university retirement plan settlements to date (link).

- To date, he has targeted prestigious private universities.

- He’s basically the white-class version of an ambulance chaser. However, to the extent that he has scared universities into cleaning up their menus and better managing their retirement plans, I applaud that. It is amazing how quickly tens of millions of dollars of excessive fees can occur annually through the poor management of a multi-billion dollar retirement plan within a single institution.

- Lesson learned (I think): if you own a business or administer a 401k, the 401k ought to be well managed, have low recordkeeping fees, and be devoid of high-fee funds.

- If these statements aren’t true of your retirement plan, then Jerry Schlichter is coming for you. You should fear him (or his equivalent in the corporate world) and his $20M settlements.

- This guy out of St Louis has succeeded in $450M (and counting) of university retirement plan settlements to date (link).

- I learned that the mutual fund holdings of any private university (or company) are easily searchable here: https://www.efast.dol.gov/5500search/

- Somewhat relatedly, a friend of mine owns a local trash company with 38 employees. He was interested in setting up a 401k for his employees. I searched the Bogleheads and found this company: https://www.employeefiduciary.com/401k-plan-pricing

- I was really impressed by their pricing and their professionalism over the phone. I think my friend will end up using them.

- Some Bogleheads report using them for solo 401k’s and they apparently can handle the mega-backdoor Roth pretty easily. However, they don’t allow for mega-backdoor Roths within conventional 401k plans.

- Their CEO has written a bunch of great blog posts, including this one which recommends emulating the (excellent) Thrift Savings Plan menu (link).

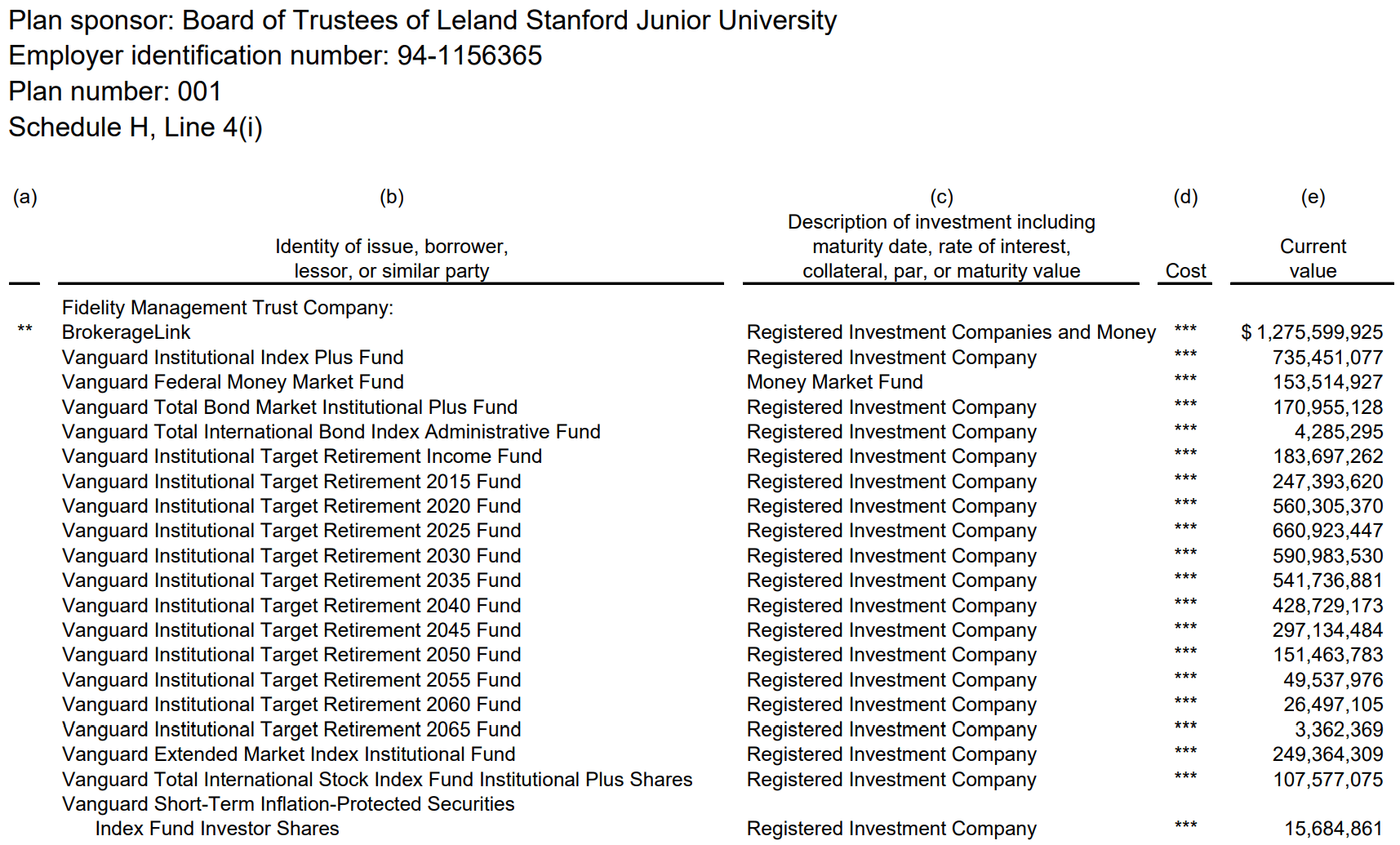

Distribution of Stanford’s on-menu holdings per their 5500 filing as of 12/31/2019. In addition to target-date funds, their menu is comprised of: 1.) S&P 500 Index, 2.) Extended Market Index, 3.) Total US Bond Index, 4.) TIPS, 5.) Total Int’l Stock Index, and 6.) Total Int’l Bond Index. The TIPS and Total Int’l Bond Index were added somewhat recently to their menu. This menu is quite similar to the ~$1T TSP (link).

FC2 on Mrs FP’s shoulder’s trying to get the good apples.

FC2 on Mrs FP’s shoulder’s trying to get the good apples.

This was harder than it looked.

We attempted to make 3.5 gallons of applesauce, but we lost half a gallon when a jar cracked. Bummer. Making applesauce is a lot of work. Our record is about 40 gallons in 2013. That was a nightmare; it prompted me to write the following song almost a decade ago (to the tune of Peaches by The Presidents of the United States of America):

We attempted to make 3.5 gallons of applesauce, but we lost half a gallon when a jar cracked. Bummer. Making applesauce is a lot of work. Our record is about 40 gallons in 2013. That was a nightmare; it prompted me to write the following song almost a decade ago (to the tune of Peaches by The Presidents of the United States of America):

Millions of applesauce. Applesauce for me. Millions of applesauce. Applesauce for two grand.

Applesauce comes from a man. It was put there by me. In a factory in my kitchen.

If I had my little way, I’d eat applesauce every day.

But I wouldn’t spend two grand to do so or burn 10 fingers in the process.

Cereal went on sale at Costco. We bought twice the amount pictured above but I forgot to take an updated picture. Also, our beloved Kirkland Signature peanut butter has been out of stock for a few months. I hope they didn’t get rid of it forever.

Cereal went on sale at Costco. We bought twice the amount pictured above but I forgot to take an updated picture. Also, our beloved Kirkland Signature peanut butter has been out of stock for a few months. I hope they didn’t get rid of it forever.

FC3 continuing to rock his sister’s hand-me-down pink cleats without complaining. It has been very enjoyable not coaching this year. Photo credit our friend.

FC5 loves golf. I detest it. Luckily, the local nine hole course is only $10.

One of the manliest things I’ve done in my life. I cut a couple of pieces of PVC pipe with a hand saw to make a nunchuck obstacle for FC3. Lest anyone think I’m handy enough to construct the climbing wall, my father-in-law built it.

Evening stroll with the dog. Fall is great.

Evening stroll with the dog. Fall is great.

Made Me Smile

- WSJ article: Taylor Heinicke Was Solving Differential Equations. Then the NFL Called (link).

- Gender reveal gone wrong (link):

- The comment section is pretty hilarious

- Looks more like an IQ reveal party.

- The comment section is pretty hilarious

- A colleague shared the following with me. It is great.

This Month’s Finances

- The good:

- Still employed.

- I made my first post-second-refi mortgage payment.

- This second refi saved me another ~$50/month in interest. I’m a happy camper. I still cannot believe I’m paying borrowing at a negative real rate.

- The bad/abnormal:

- Several expenditures for upcoming Disney cruise. Disney is my eternal adversary.

- $1k in Disney World tickets.

- $446 for flights to Orlando ($74/person non-stop round trip).

- It’s with Spirit Airlines. It’s almost too good to be true. I’m worried that they will cancel the flight and I’ll be left shelling out $3k to get my family to Orlando in time for the cruise.

- High school is more expensive than the previous grades. Extrapolating to college, this will surely get worse.

- $500 deposit (of $2k total expense) for summer band trip to Orlando.

- $65 cross-country bus fee.

- Several expenditures for upcoming Disney cruise. Disney is my eternal adversary.

Full version downloadable here (link).

Footnotes:

- Fidelity unambiguously has the best HSA on the market. $0 admin fees + $0 expense ratio funds.

- I lazily approximate home value as my historical purchase price.

- I have a 15Y mortgage which results in much larger principal payments than a 30Y mortgage. Since principal payments are simply transfers from one pocket (assets) to another (debt reduction), I treat such cash flows as savings.

- ~$0 cell phones described here.

- All expenditures at Costco & Walmart are classified as “Food at home” for simplicity (even if it’s laundry detergent, clothing, medicine, toys, etc).

- Nobody knows the perfect asset allocation. Just pick one and run with it. Use a target date retirement fund as a benchmark if you want some guidance (link). If you prefer to DIY (as I do), then a three-fund portfolio is great (link).

- My low portfolio expense ratio is the primary reason why I don’t hold target-date funds, which have expense ratios anywhere from 0.16% to 1%. I can achieve a much lower expense ratio on my own due to Admiral shares, etc. And it’s not hard. Plus, a DIY portfolio allows one to tax-loss-harvest more easily.

- ETF’s are slightly more annoying to hold relative to index funds. With ETF’s, you must deal with bid-ask spreads

as well as the inability to buy partial shares(Fidelity now offers fractional shares). With a simple index fund, you don’t have to deal with either of these issues. Bogleheads discussion here (link). - I continue to own VTSAX rather than FZROX and in my taxable brokerage account because it is more tax efficient due to lower capital gains distributions. Bogleheads discussion here (link).

- The one blight in my expense ratio analysis is my 529 plan. The underlying Vanguard fund is almost free to hold (0.02%), but the high administrative fees bring the total cost of holding the fund to 0.29%. I abhor fees and would likely avoid 529 plans if I didn’t get to deduct up to $10k of contributions per year on my state return, saving myself $700/year in state income taxes.

- CA’s 529 plan has the lowest expense ratio US equity index fund of any in the US (link). I’d have 100% of my money here if not for the state tax deduction I receive in my own state.

- I own one share of Berkshire Hathaway (B Class) for the sole purpose of getting 4 free tickets/year to Berkshire’s annual meeting.

- I bought 100 shares MoviePass for $0.0127/share to be able to tell my students that I held a stock that went to zero. So far, the stock price stubbornly remains above zero.

Disclaimer: This site is for entertainment purposes only, as disclosed here: https://frugalprofessor.com/disclaimers/

It’s been a tough month for equities… Did your Boeing boss mention how to cope with calendar years where investment losses would outpace labor income?

He didn’t give advice on that specifically.

But the past 20 years of equity investing have taught me how to cope — I try to keep a long term perspective. I’m probably dead in 50 years. That’s an incredible amount of time to let compound interest do its thing.

The alternative is to invest in less risky assets that more susceptible to the ravages of inflation. This seems particularly relevant today.

That’s what makes being an investor today is so hard. There is nowhere to run. Either take on a bunch of risk in equities, knowing full well that expected (future) returns are subdued. Or dial down the risk and earn zero/negative real returns.

I admire you for having a 50-year horizon. I’m in my late 30s and want to FIRE in five years. I’m thinking about refinancing and paying off a chunk of my mortgage, thereby getting a guaranteed return.

Having a long-term horizon helps me to maintain the appropriate perspective. Otherwise, I’d lose my mind with the market’s daily/monthly/annual gyrations.

Best of luck with the refi. Not sure if Better’s Amex promo is still going on, but it was good for me a couple of months ago.

I am thinking of doing opposite of what Michael is thinking with refinance; I recently refinanced to 2.125%/15years, but had option of 2.5%/30 years. Now I am thinking that 30 years would have been better option considering high inflation. May refinance again if I can get 2.5%/30 years.

It seems to me that there are advantages and disadvantages to carrying a mortgage into retirement:

Pros to paying off mortgage before retirement:

* lower cash flow obligation post-retirement.

* psychological benefit of less debt

Cons to paying off mortgage before retirement:

* forfeit ability to borrow at zero/negative real for 15-30 years

* the paying off of the mortgage itself (e.g. with a lump sum payment) paradoxically increases sequence of returns risk.

If you can borrow at zero/negative real for 15-30 years, I probably think it more prudent to retain the mortgage. Who can possible argue against the rationality of borrowing at zero/negative real?

I’m a fan and subscribe for these monthly updates …one question and it pertains to how I earn my living: what do you and your family spend on clothing and how is it sourced? (I see you mention Costco a lot). Your kids tend to have t-shirts with slogans and such indicating that it’s new and trendy. Do you ever buy second hand? Or is Costco that cheap? Admittedly I don’t know how their clothing is priced but I assume it’s very cheap. It’s likely on par with “fast” fashion which for my values doesn’t equate. That aside, I’m curious what your approach is! My business is this http://www.outdoorinventory.co

Thanks and I learn a lot from you!

Craig Randall

We spend next to nothing on clothing.

Costco clearance ($X.00) + thrift shops + reusing clothing across children + inheriting hand-me-downs from friends/family + craigslist (back in the day) + not caring about current trends + wearing stuff until it falls apart = near $0 clothing expenditures for our family. I’ve found Costco clearance ($X.97 or, even better $X.00) is cheaper than thrift shops. Costco practically gives their going-out-of-season clothing away for free.

When our kids outgrow their clothing (and assuming that it isn’t trashed), we donate to the local thrift shop.

I checked our your website. Looks like a cool business model!

You better believe college is going to be more expensive than high school!

That’s an impressive stack of cold cereal. I’m guessing it was purchased in batches? If not, did you get the inevitable “you running a preschool?” or something like that?

Thanks for confirming the obvious — that my financial future is doomed because of the college expenses of my five children. Heaven help you and me both.

We purchased 40 boxes of cereal over the past month or two 10 boxes at a time. That is usually the limit. With 5 kids hanging off of our cart at Costco, I don’t think people worry about us running a daycare.

There was a time in our lives, in the not too distant past, that cold cereal (nicknamed “treat cereal” in our house) was considered a rare delicacy. Then life got busy and we have been feeding it regularly to the kids. Laziness is easier than non-laziness. Maybe we’ll break the habit some day. The pictured amount of cereal is probably a month’s supply given the rate at which my kids devour the stuff.

Apparently Costco has “temporarily discontinued” Kirkland Signature peanut butter, but it should be back in November or December. It was a sad day when I went to stock up this past week and it was nowhere to be found.

https://www.mashed.com/471510/bad-news-for-fans-of-costcos-organic-peanut-butter/

Thanks for sharing that article!!

A month or two back, my wife had astutely noticed the asterisk on the K-Sig PB price tag, which denotes that the product will not be re-ordered. That prompted my wife to stock up. Luckily we hoarded enough to get us by to November/December.