In my recent FreeTaxUSA post, I announced my retirement from the tax calculator game. However, my retirement was short-lived. Blog reader (and former roommate) Tim convinced me to keep it going.

Download my 2022 model here

========> Download Here <=============

A big thank you to MDM

Reader (and one-time guest interviewee) MDM is a wizard with Excel + the tax code. I had a hard time tracking down a few tax parameters this year (e.g. EITC, CTC) and I relied on his much more robust Excel model (downloadable here) to fill in my missing parameters. All errors in my spreadsheet are my own.

Links to my historical calculators:

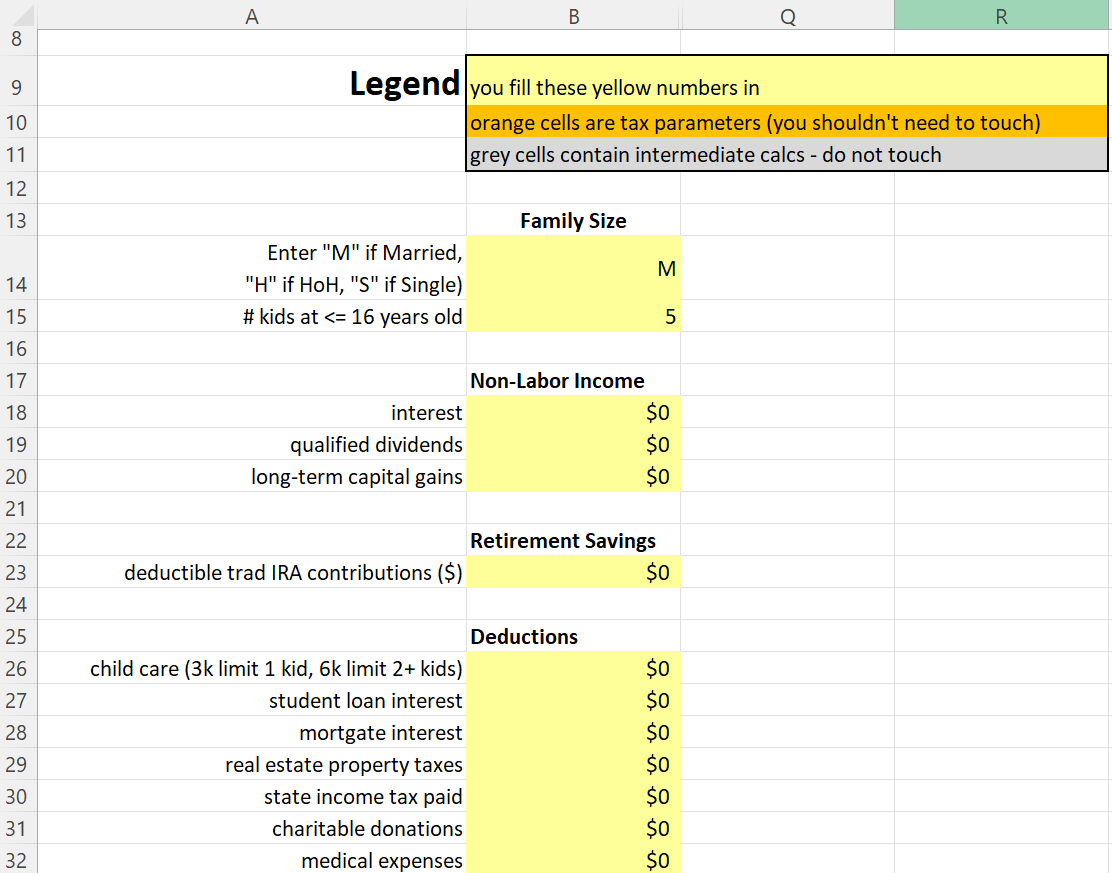

Inputs

Inputs are pretty self explanatory. Notably absent this year is the above-the-line charitable deduction that we’ve enjoyed for the past couple years. The other massive change this year was the reversion to the less generous pre-Covid CTC.

Outputs

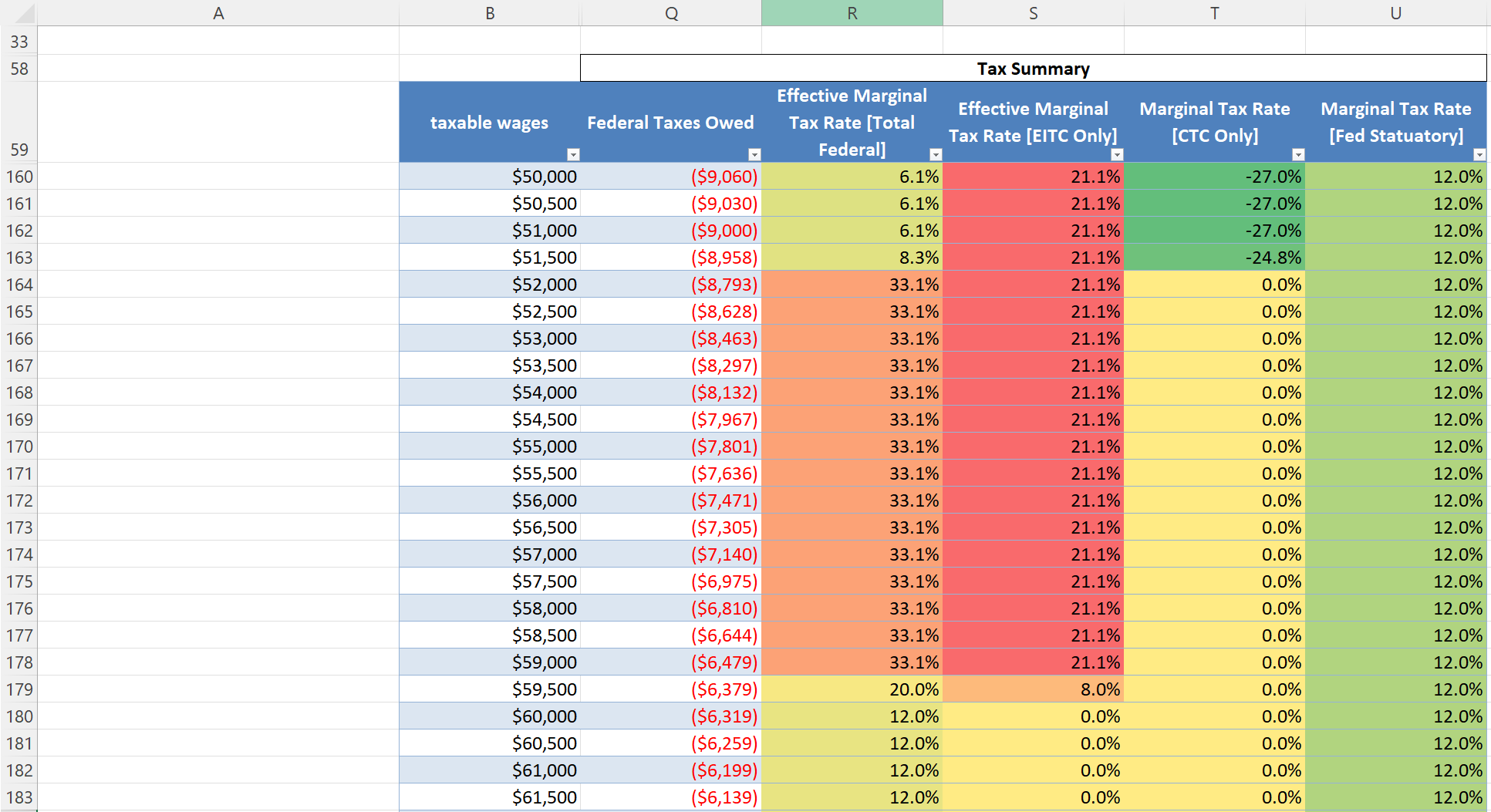

I included a new feature this year — I now decompose the effective marginal tax rate (Column R) into the different sub-components (Columns S-U). As shown below, with 5 kids, I hit a 33.1% effective federal MTR from $52k – $59k of income. This 33.1% is arrived at by adding the 21.1% effective MTR from the EITC + 0% effective MTR from the CTC + the 12% statutory fed tax rate.

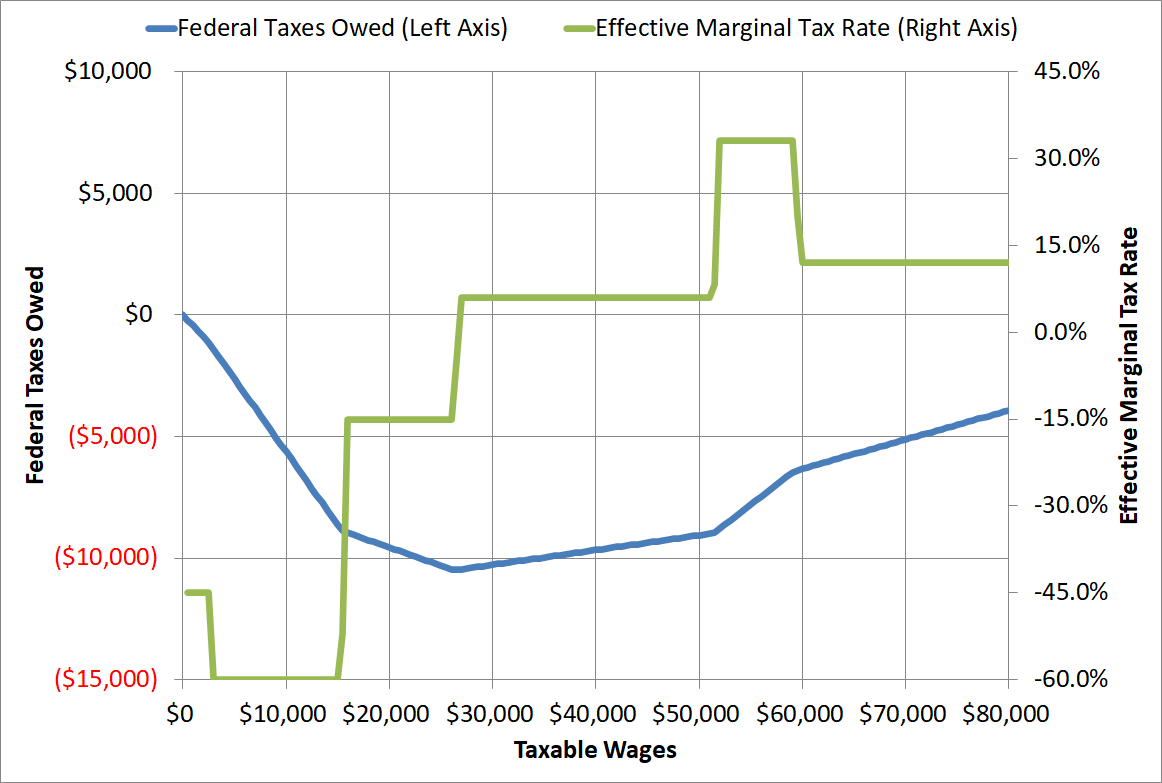

As usual, the output also includes the wonky tax charts showing both federal tax liability (blue line; left axis) and effective marginal tax rate (green line; right axis). The below charts show 5 kids, but this is easily changed in the model.

Conclusion

I’m unsure if this tool is helpful to anyone out there, but I continue to find the wonkiness of the US tax code to be fascinating. My spreadsheet hasn’t been vetted by anyone, so I wouldn’t rely on it for anything important.

If you have any issues with the sheet, let me know and I’ll try to fix it.

I agree that the curve is interesting. Shouldn’t the number of kids be <=17 years of age? Or did that revert as well? Also, what about dependents above 17? I also find the AOTC and LLC phaseouts can lead to a bigger marginal rate.

I’m pretty sure it reverted to < 17, but the tax code is so fluid that I have a hard time keeping up to date with it. I could be wrong in my understanding. I don't believe I've ever tried to model the AOTC in my sheet. Perhaps I should give it a go? Is there a cliff notes summary you can point me to so I can model it easily?

Dependents >=17 (yes, the age limit reverted as well) get the $500 non-refundable credit.

Calculations!Y56:AD67 in the case study spreadsheet (https://forum.mrmoneymustache.com/forum-information-faqs/case-study-spreadsheet-updates/) might be considered a cliff notes summary, or might be too condensed for use….

Nice work decomposing the final marginal rate into its constituent parts!

Side questions:

1) Is there a way to get a preview of one’s reply before posting it?

2) Does the “standard” bulletin board code for linking URLs behind text work here? I guess I’ll find out…: [url=https://forum.mrmoneymustache.com/forum-information-faqs/case-study-spreadsheet-updates/]Case Study Spreadsheet updates[/url]

Thanks,

MDM

Thanks for stopping by and for the feedback!

I’ll have to tweak the sheet to include dependents >=17. Not sure why I thought that was done for.

While I’m at it, I’ll fix the AOTC. Thanks for pointing me in the right direction!

1.) On the preview reply question, I think my caching and/or anti-spam plugin unfortunately has weird implications for comment previews. Sorry about that. Your comment was originally flagged as spam.

2.) It looks like the first URL linked great, but the second didn’t work that great. That’s good to know.

Thanks for updating i definitely find it useful. I use it to optimize my Roth/401k/IRA and Obama care subsidy. I find it much easier that any tax software I have tried

Happy to help!