Unless you have been sleeping under a rock for the past decade or two, you may have noticed that interest rates have fallen quite a bit. This is manifest in a few obvious places: the interest rates available to investors (e.g. bond yields) and the rates at which borrowers can borrow (e.g. mortgage rates).

Below are a few relevant charts.

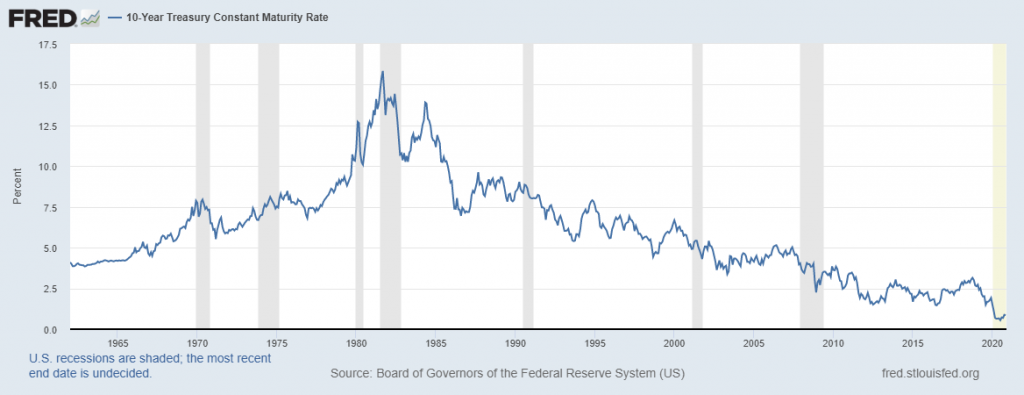

Historical 10Y treasury yields (link). If you account for inflation, real yields are now negative!!!!

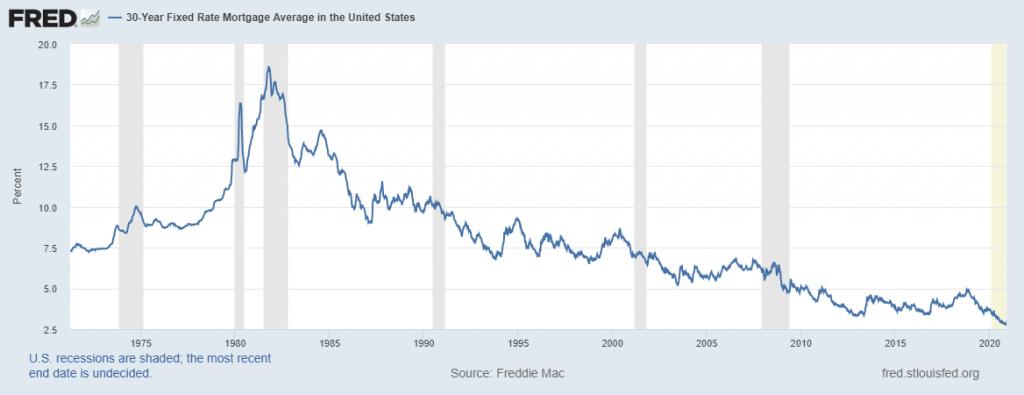

Historical 30Y mortgage rates (link).

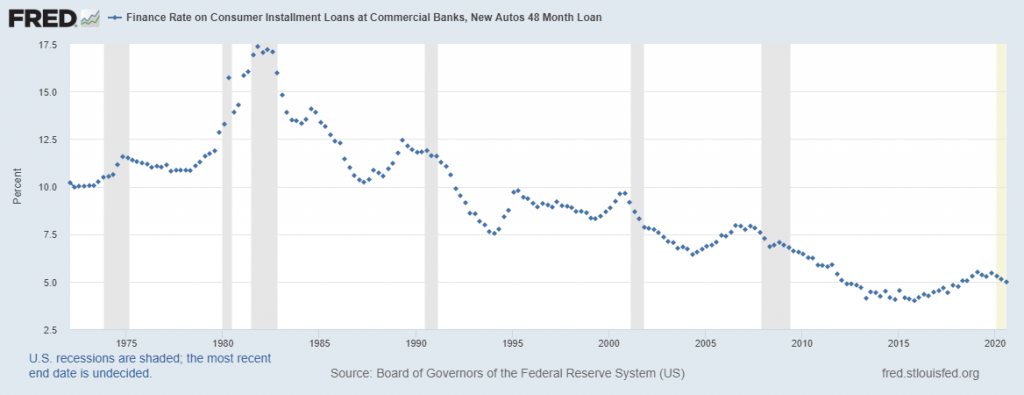

Historical auto loan rates (link).

When interest rates fall, it’s good for the following groups:

- Existing owners of fixed income investments (e.g. bonds), thanks to the inverse relationship between interest rates and bond prices.

- Existing owners of stocks who benefit from inflated asset prices as investors “reach for yield.” Given the currently unappealing fixed-income investment alternatives, stocks become relatively more appealing in a low-interest rate environment.

- Existing owners of real estate who benefit from the asset bubble fueled by cheap money.

- Further, existing homeowners with a mortgage can refinance their mortgages to benefit from the lower interest rates. Yours truly did just that a month or two back, saving about $127/mo in interest.

- I’m less convinced that falling interest rates are good for new home buyers because of the offsetting effect of increased home prices.

Some pictures to illustrate:

Case Schiller home price index (link).

Growth of $1 invested in total stock & bond market indices since 2001. Dividend reinvestment is included but taxes are excluded. Source: Yahoo finance.

Growth of $1 invested in total stock & bond market indices since 2001. Dividend reinvestment is included but taxes are excluded. Source: Yahoo finance.

(I realize that interest rates are not set in a vacuum, of course, but are rather a result of complex interactions of the supply and the demand for credit.)

That said, it seems to me that the collapse of interest rates seems to have substantially exasperated wealth inequality. Owners of assets (stocks, bonds, real estate) have seen huge increases in wealth. This sounds great until you consider the other side of the equation — that those without assets are now living in a world with elevated asset prices and the associated baggage (lower expected returns & higher home prices).

So what’s the point of this doom and gloom post?

I’m not really sure, other than to point out a few key obvious points that I haven’t seen covered very much in the press:

- Those who have assets are doing relatively well. Those that don’t have assets are likely to be doing substantially less well. This is particularly true as we think about the implications of the current interest-rate-exasperated wealth divide compounded over the coming decades.

- Investors today face huge headwinds in a zero-interest-rate environment and should adjust their expectations for future returns accordingly.

- Riding a bike into a 20-25 mph headwind is something I do on an almost daily basis. It’s pretty miserable. Similarly, investing in a zero-interest rate environment is not going to be pleasant going forward, though the ride to zero has certainly been enjoyable for those of us with existing assets.

- When biking into a massive headwind, you 1.) downshift, 2.) pedal harder, and 3.) go slower. Analogous changes will be required for investors going forward. We’ll have to 1.) spend less, 2.) save more, and 3.) expect lower investment returns. I realize that recommending that one spend less and save more is easier said than done during a pandemic/recession.

- The 12.8% annualized return of the US Stock Market Index over the past 10Y (link) certainly isn’t sustainable going forward. Nor is the 3.5% annualized return of the US Bond Marked index over the past 10Y (link).

- For an investor with a multi-decade investing horizon (which should be a lot of us), I’d give a lot of thought about the appropriate role of bonds in your portfolio going forward. I don’t think the historical rules of thumb (e.g. “age in bonds”) necessarily apply in a zero-interest rate environment. Absent further drops in interest rates, those buying bonds today are locking in ~1% returns for the next decade or two.

- That said, going 100% stocks is certainly not a panacea. Due to elevated asset prices, stock holders have to get used to lower expected returns than they have historically been used to achieving. I don’t think it’s unreasonable to think that stocks returns could be in the neighborhood of 4-6%/year for the next decade+. Obviously, since stocks are risky, one has to be prepared to lose 50% of one’s portfolio tomorrow if one chooses the 100% equity path — not too dissimilar to what we saw in March of 2020.

- If a zero interest rate environment doesn’t bring investing costs to the forefront of investor’s minds, I don’t know what will. It’s one thing for advisors / mutual funds to skim 1-2%/year off the top of a 12.8% return for the past decade, but I think it’s an entirely different proposition to do so in an environment with 4-5% returns going forward. A 1% AUM fee + 1% actively managed mutual fund ER could potentially eat up 50% of the nominal return for investors in a given year, or 100% of an investor’s real return. Compounded over an many-decade investing lifetime, these fees are especially catastrophic in a low interest rate regime.

- I haven’t seen anything in the news indicating that AUM / mutual fund fees are the subject of increased scrutiny. I’m unsure why this is the case, but investor inattention never ceases to amaze me.

- It’ll be interesting to see if this is the death of the 1% ER actively managed bond fund industry. It’s hard to believe that such high expenses can be sustained in a zero-ish interest rate environment.

Reader Poll

Am I being too melodramatic? How are you dealing with this zero interest rate world? Do you similarly find the thought of holding 1% yielding bonds for the next several decades repulsive?

Thanks… I nice summary. I would also enjoy reading your thoughts about how this scenario unwinds (.i.e rates starting returning to a more normal ranged).

That’s a great question!!!! Unfortunately, I haven’t the slightest clue how this thing unwinds!!!!!!

Excellent assessment, coming from an Economics Major. You hit the nail on the head. There always seem to be some sort of weird anomaly in our capitalistic system that we have “never encountered before”.

We’ll see how this plays out in the next 10-15 years, but I agree, lower equity returns and tiny bond returns (possibly negative) that probably won’t reward you for taking the outsized risk of buying bonds at historic low rates.. I guess they could always go negative. At there coupon rates, US government bonds will probably not keep up with inflation. This record bond bull market is over. I’m a fan of moving bond allocations to fixed instruments in retirement accounts (like those inside non-profit 403b annuities that guarantee 3% or so if one has access to sure an instrument.)

Thanks for stopping by!

I have colleagues who are transferring assets to annuities at TIAA. I haven’t looked seriously into this, but your comment has reminded me to look into it some day.

Riding a bike into a 20mph headwind isn’t very fun. At least I got to enjoy a few years of the 20mph tailwind…..

I guess the abysmal interest rates highlight the importance of increasing one’s wages going forward.

Great post, thanks for sharing your thoughts. Any thoughts on the G Fund for feds/military?

I’m currently at 20% fixed income- all G Fund. Considering going to 100% equity. Current net worth at about 20x annual spending and considering transitioning to part-time/seasonal work. Making that transition would be easier emotionally if there was just a little buffer in the asset allocation, but fixed income seems kinda worthless.

I’m not a TSP expert, but this link tells me the G fund is 100% short term treasuries: https://www.tsp.gov/funds-individual/g-fund/

Short term treasuries are basically yielding nothing; closer to negative 2% after inflation.

Like the rest of us, you don’t have great investing options: 1.) invest in bonds and realize a negative after-inflation return, or 2.) invest in inflated stocks (with low expected returns) with a ton of downside risk.

I can’t tell you want to do for obvious reasons, but given that my investing horizon is about 50 more years (I’m almost 40) I’m personally betting on the side of equities right now. Doing so, I fully acknowledge that there is a lot of risk with this strategy; particularly at inflated valuation levels. I’m prepared to lose $500k tomorrow. If this happens, of course I’ll be kicking myself for not accepting a negative real yield today.

The dividend yield on many equity indices is about 2%, which is higher than the yield of bond funds even if stock prices don’t go up. The downside, of course, is that prices can collapse at any moment. And there is no guarantee that dividend yields will persist.

I think what’s hard about it isn’t necessarily just bonds, but rather, as you point out, that EVERY asset seems like an uninspiring option right now. Your ‘headwind’ analogy is a good one. We talk about staying the course through dips and crashes all the time, but we rarely talk about having to stay the course through a time like this. That, I think, is the thing to do now though. Whatever stock/bond/real estate split was right for people before is probably what is still right for them now, just with knowledge of a ‘headwind’ for the time being. Personally, I’m not changing anything in my strategy.

Sorry I didn’t approve this comment until now. It was sent to spam for some reason.

I agree that every asset class is inflated. I’m unsure that the headwind analogy will be short-lived. I think we’re in it for the long haul of the next decade or so. I’m not looking forward to it.

Great thoughts. For the AUM/fee questions, I would put it down definitely to investor inattention. And it doesn’t help when the financial industry works overtime to hide and obfuscate the fees. Expect those shenanigans to increase.

Regarding the insanity of AUM/fees, I read this article yesterday: https://www.financial-planning.com/opinion/the-7-biggest-shockers-from-my-four-decades-of-financial-planning

In it, it shows how the CFP designation and associated “fiduciary duty” is a complete scam. There is no guarantee that an advisor with a fiduciary obligation to you will not rob you blindly. The financial advice business seems structurally flawed; advisors are paid by extracting wealth from clients and preying on their stupidity.

This is probably my favorite blog to read. Reading about the optimization of one’s portfolio satisfies my need to “tinker” with my sleepy 60/40 portfolio. I’m sure I can do better but I’m also sure I could do far worse! The low fees I pay through Vanguard and my 403b/457 are all I concern my self with. Whenever I want to tinker I just think of those AUM fees people pay and figure my sleepy portfolio is certainly outperforming those. I continue to invest listening to my “nobody knows nothing” motto.

Thanks for the kind words.

Are you implying that I’m excessively tinkering with my portfolio and this is preventing you from deviating from a sleepy 60/40 portfolio? If so, I’m happy to fill that role for you. If I’m not, who is doing the excessive optimization that you are referring to?

In any regard, it’s unambiguously the case that low investing fees are even more important in a zero interest rate environment. I’m happy to hear that you’re on the low-fee bandwagon like most of the rest of us. Fees add up; particularly when compounded over a many decade horizon.

FP you are certainly not excessively tinkering….You are purely just discussing a current environment. What I was trying to say but failed is I enjoy reading about your tax optimization strategies which somehow satisfy my urge to tinker with my portfolio. I also am a fan of the monthly recommendations! Loved The Octupus Teacher!

Great feedback.

My Octopus Teacher was indeed fantastic! What a great film.