Edit November 11, 2024

The card appears to have been nerfed with the introduction of the new Smartly 4% card on Nov 11, 2024. Existing users can still use the card, but it seems to be closed to new users. RIP. I asked ChatGPT to eulogize it. Here’s what it came up with:

Disclaimer

Usual disclaimer. This blog loses money. I don’t get money from credit card referrals. YTD, I’ve earned $15.42 in Amazon affiliate income and incurred $64.37 in web hosting/domain costs. There are no affiliate links in this post. The thoughts below are my sincere thoughts unclouded by profit motives.

Background

About six weeks ago, I stumbled across this Bogleheads thread on the BoA Premium Rewards Elite card. Due to this post, I ironically ended up getting the US Bank Altitude Reserve card instead.

Summary

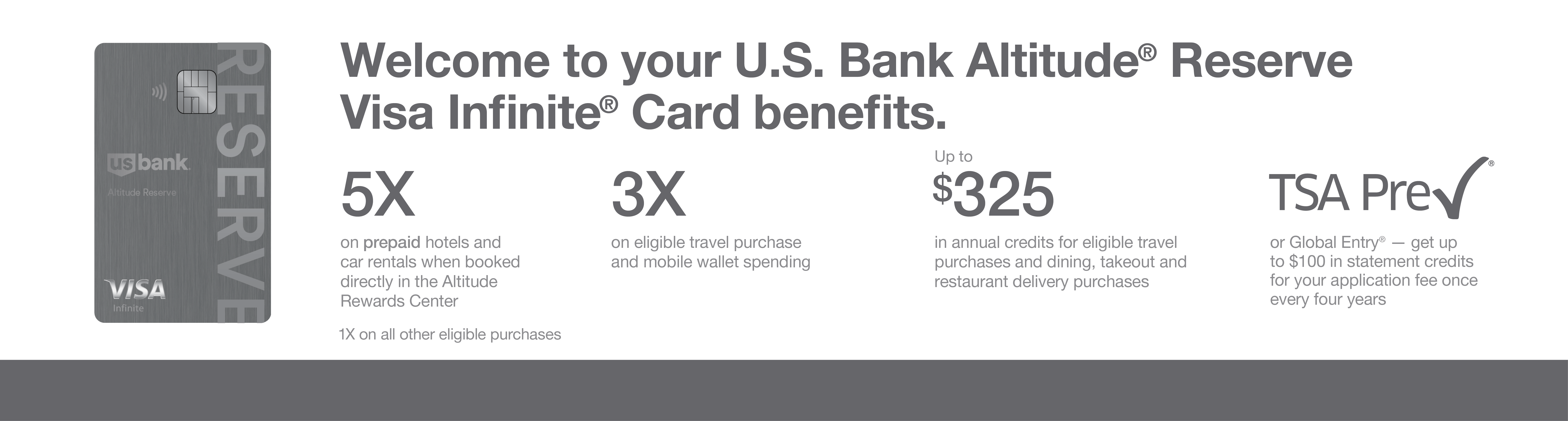

To put it succinctly, I think one could argue that the US Bank Altitude Reserve card (USBAR) is the best card out there right now, particularly for a simple one-card setup. I’m kind of embarrassed I hadn’t considered it until now given that my colleague first mentioned it to me about 5 years ago. It earns 4.5% cash back on most purchases (assuming that you can use “tap to pay” or Apple/Google Pay on most purchases).

Caveat

US Bank’s upcoming 4% cash back card on all spending is so competitive that it might be a better choice than the USBAR.

USBAR Pros/Cons

Reasons to get the USBAR card:

- 4.5% cash/travel back on the following categories:

- Travel booked directly (no Expedia, etc).

- Mobile wallet spend through Apple/Google wallets (acceptable at any merchant with a tap-to-pay reader that doesn’t require you to insert a credit card).

- Online purchases using Apple/Google Pay (Costco.com accepts these, for example).

- 8 Priority Passes per year, allowing access to airport lounges OR $28 vouchers at participating restaurants

- $100 Global Entry / TSA PreCheck credit every 4 years

- Primary rental car coverage

- Trip delay reimbursement (up to $500/ticket for a delay of 6 hours or more)

- No foreign transaction fees

Reasons not to get USBAR card:

- Your credit score isn’t good enough; apparently US Bank is more stringent than other issuers.

- You are unable to take advantage of 4.5% category in the following situations:

- Online tax payments

- Amazon, etc

- At the few physical merchants that haven’t migrated to tap-to-pay terminals yet

- You don’t travel and therefore can’t enjoy the modest travel perks

- You don’t spend enough to justify the net $75 annual fee:

- For example, if you already have a 2.625% cash back card, you’d need to spend $4,000 per year to justify the $75 annual fee difference (=$75/(4.5%-2.625%)).

- Of course, if you value some of the benefits mentioned above (like Global Entry, Priority Passes, etc) then the numerator in the above calculation would be reduced commensurately. I think I would easily pay $50/year for primary rental car coverage, Global Entry credit, and 8 Priority Passes, so my particular break-even is computed as $25/(4.5%-2.625%) = $1,333/year.

$400 Annual Fee!?!?

You might be thinking that only a fool would pay $400/year for the privilege to carry a credit card when there are so many free alternatives out there — that’s what I thought before my eyes were opened to this crazy world six weeks ago.

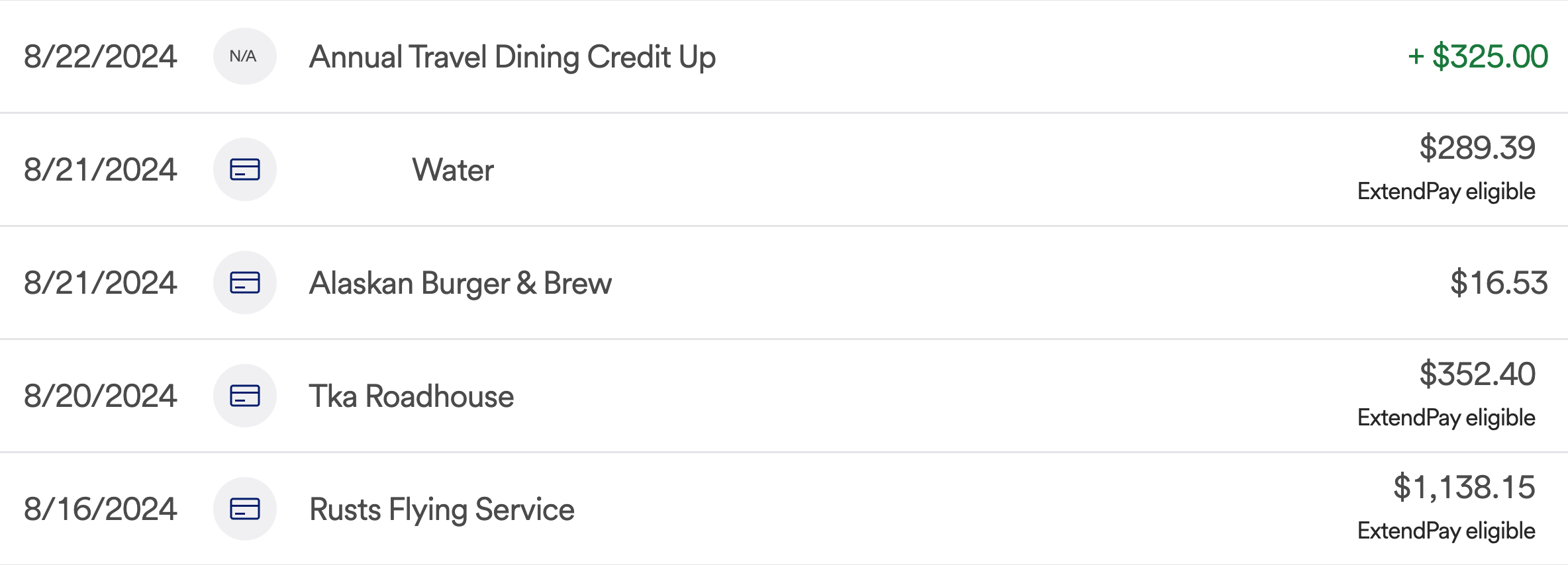

However, the USBAR offers a $325/year credit for travel/dining which easily offsets most of the $400 annual fee. I can think of very few people I know that don’t spend $325/year on travel/dining. If this describes you, congratulations, you are more frugal than the Frugal Professor!!!

Assuming you are a normal human being, you’ll reach this without any effort. Probably in a month or two. I hit this in a couple of days.

The very first transaction I made on this card was a $1,138.15 payment to a float plane operator in Anchorage on my recent trip to Alaska. Oddly, this transaction didn’t count as “travel”, but the second transaction — a bed and breakfast in Talkeetna — did. The $325 credit automatically hit my statement two days later. No action required on my part, so the USBAR turns into a $75/year annual fee card with essentially no effort whatsoever.

My Experience Earning Points

The first step in earning 4.5% cash/travel back on each purchase is to spend in the following categories:

- Travel

- Mobile Wallet (tap to pay at physical merchants using phone wallet app)

- Apple Pay/Google Pay (can do online).

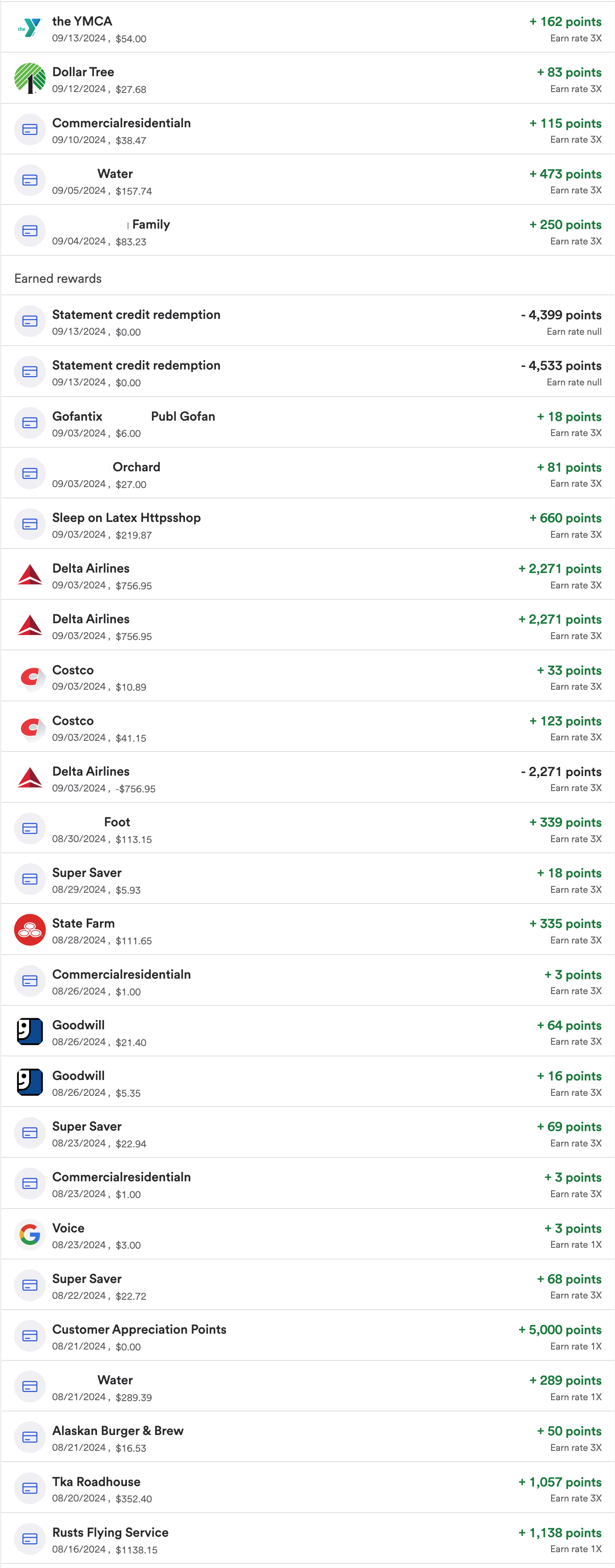

Technically, you earn 3% points then redeem at a 1.5X multiplier when redeemed on travel, but let’s ignore that detail for another minute or two. Anything earning 3X in the screenshot below is effectively earning 4.5%.

Here’s what I’ve learned a month into using this card:

- Apple Pay, even for online transactions, always earns the full 4.5%.

- I don’t own an iPhone but I own an iPad which gives me access to Apple Pay. With a State Farm app downloaded on the device, I can make insurance payments through Apple Pay to get 4.5% cash back on $1,340/year of auto/umbrella insurance.

- If I pull up my water bill on my iPad, it allows me to pay via Apple Pay for 4.5% cash back. However, if I use Google Pay to pay my water bill through an Android device, I only get 1.5% cash back.

- Our natural gas company allows me to save Apple Pay as a payment method, so it’s easy to use Apple Pay via any Chrome browser for 4.5% back.

- We’ve earned 4.5% at a bunch of merchants when using the tap-to-pay mobile wallets, including doctors, gyms, retailers, Costco, airlines, etc.

- I was a bit surprised that the float plane transaction (the very first on the card) didn’t code as Travel. BoA’s Travel category is much more inclusive and even includes things like bowling alleys, mini golf, go karting, and museums. When I called US Bank to inquire why I hadn’t been awarded the full 4.5%, they apologized and gave me 5,000 points (worth $75), which I appreciated.

My Experience Redeeming Points

The most gimmicky part of the card is that you can only unlock the true 4.5% potential of this card if you redeem these points on travel. To do so, the travel must be booked directly with the airline/hotel/rental car company (no Expedia, etc).

Immediately after booking the travel, you’ll get a “Real-Time Rewards” text asking if you want to redeem at the 4.5%. You simply respond “redeem” and the points are redeemed at the 4.5%.

Here’s how it looks on the statement. Interestingly, the credits are applied immediately (even before the travel transactions clear).

How to enroll in Real-Time Rewards (RTR)?

Click “Sign up for Real-Time Rewards”, then configure the RTR to only text you for transactions that take advantage of the full 4.5% (i.e. travel transactions).

One small nuisance with RTR is that you need enough points to cover the entire transaction amount, otherwise it won’t trigger the RTR. Say you have $500 of rewards accrued but your flight is $550, you won’t be able to redeem points on this transaction. It would have been nice for them to allow the partial redemption here, but that’s not how it works.

What if you don’t travel enough organically to redeem accrued rewards?

Some Redditors report booking refundable flights, getting the credit, then cancelling. I don’t see why that wouldn’t work, but I think we travel enough that this won’t be an issue.

Is there a sign-up bonus?

For reasons that I think are irrational, people get really excited about credit card bonuses. To me, getting a new credit card is hardly ever worth the hassle of the sign-up bonus. I’d rather just get good cards and keep them for life. The USBAR is a good card independent of sign-up bonuses.

Nonetheless, this card offers $750 of travel upon spending $4.5k in 90 days.

Do I need to carry the physical card?

Ironically, it doesn’t make sense to carry the physical card since you’d do better with even a simple 2% card if a merchant isn’t equipped with tap-to-pay readers (or Apple/Google Pay online). That makes the physical wallet simpler.

How do I set up Priority Pass?

https://prioritypass.com/usbankaltitudereserve

What about the upcoming US Bank 4% Card?

Good question. There is a new US Bank card on the horizon that will get 4% on every transaction and carry no annual fee. However, this new card reportedly won’t have a sign-up bonus.

If you are interested in the upcoming 4% card, then perhaps the logical route would be to get the USBAR, get the bonus, then convert to the 4% card.

Although the USBAR has relatively few hoops to jump through, I think one could make the strong argument that they are not worth the 0.5% spread (4.5% vs 4%) on upcoming this catch-all card. If you don’t value the USBR travel perks, then break-even spending differential between the two cards is $75/(4.5%-4%)=$15k/year.

Does this change my thoughts on the BoA setup?

Yes. A relatively hassle-free 4.5% on any tap-to-pay purchase is fantastic and clearly outperforms BoA’s 2.625%. For those craving simplicity, they should go with the USBAR or the upcoming 4% card.

That said, I’m addicted to 5.25% cash back for online purchases (including Costco gift cards), 5.25% at restaurants, and 5.25% on gas, even if the spread is only a modest 0.75% relative to the USBAR. Free money is free money, and I’ll happily swipe the combination of cards that maximizes this, provided it isn’t too big of a hassle.

What about the fancy BoA Elite Card?

BoA offers an Elite card, but I view this to be largely inferior to the US Bank offerings. So why would someone choose this card? Put simply, to pay a net $100 annual fee for four Priority Pass memberships, each of which has guest privileges, and all of which have dining privileges. So each time my family of 7 visits an airport, that’s $28*7 = $196 in dining credits per airport. How about a meal before/after landing?

You can gift these PP memberships to people living outside of your household if you want.

So what’s the “catch” with the BoA Elite card? There is a $550 annual fee, but you get $300/yr travel credits (can do United Travel Bank or American Airlines gift card hacks) and $150/yr lifestyle credit (gyms, streaming, food delivery, etc), bringing the net annual fee to $100.

Otherwise, the card is largely similar to the cheap premium rewards card: 3.5% travel/dining, 2.625% on all else.

Users of this card tout the value of 20% off travel when booked through the portal (otherwise framed as a 1.25X multiple on spending). When booked through the portal, then the effective cash back is 3.5%*1.25=4.375% on travel/dining and 2.625%*1.25 = 3.28% on all else.

Note that 4.375% and 3.28% are both less than the 4.5% that the USBAR offers for mobile wallet/travel purchases. Further, the above calculations ignore the fact that the travel redemption itself does not earn points itself, which makes the card even less compelling.

In summary, aside from infinite free food while traveling, I don’t find the BoA Elite card to be a very compelling card relative to the USBAR.

I contrast the USBAR and Elite card in more detail here: https://www.bogleheads.org/forum/viewtopic.php?p=7988041#p7988041

What will be my setup going forward?

The USBAR’s 4.5% cash back has already replaced my BoA Premium Reward’s 2.625% catch-all category for merchants that accept mobile wallets. That said, I view the USBAR to be a nice complement to BoA’s offerings, rather than a substitute.

However, the newly announced US Bank 4% card introduces a wrench into my system. As does my discovery of the practicality of Priority Pass memberships this past month.

My biggest decision at BoA going forward will whether to:

- Keep the Premium Rewards card,

- Convert my existing Premium Rewards card to a Cash Rewards card, or

- Try to convert it to an Elite card (with the net $100 annual fee)

My biggest decision at US Bank going forward will be whether to:

- Keep the USBAR, or

- Convert the USBAR to the new 4% card, or

- Get both cards

Before I make any decisions, I’ll wait for the details of the new 4% card. In the meantime, here’s a table I created to compare my options—perhaps it will help you as well. Open in a new tab to make bigger.

Thoughts?

Anyone else jumping on the US Bank bandwagon?

Are there other cards you’d recommend looking into?

Some readers have recommended the Sears Shop Your Way Mastercard to me, which I got a few months ago, but 1.) the unspoken rule of this card is to not acknowledge its existence, 2.) the generosity of the card is dependent on receiving “offers” via email that may or may not come, and 3.) I have yet to formalize an opinion on the card other than to think that it is really weird.

So I don’t own any Apple products (I mean, I have a work iPhone, but that doesn’t count.)

Is there a way for me to use Apple pay in a Chrome browser? That would be a game changer. How would I accomplish this? I might have created an Apple account for a free trial of the Apple TV streaming service, do I somehow link my credit card to that?

I think I’ve read that it’s hit or miss to have success with Google Pay in a browser. I am working on the SUB for this card – but most of my mobile pay transactions so far have been restaurants and gas stations, which I can do better on BofA.

But the bonus + travel/dining credit vs the annual fee is a no brainer.

For my gas bill, I set up Apple Pay through a chrome browser. I don’t believe I had to set up on an Apple device (I could be wrong here). But that method is forever saved as an option, so no problem from here on out.

For my water bill, I have to open the statement on an Apple device to see the Apple Pay option. I have no ability to save this and pay on Chrome.

For my electric bill, I don’t have an Apple/Google pay option.

On Costco.com, Apple Pay is an option, but I believe it’s only the case on Apple devices. I just checked on Chrome on a Mac and even that is not available, but it is available through Safari on a Mac. Weird.

For State Farm, I had to download the app on an ipad to see the Apple Pay option. I don’t have the option of a recurring Apple Pay option, but it takes 30 seconds to do manually and I have a normal credit card on backup.

In other words, it’s a kind of janky/fragmented system. It’s bummer that Google Pay is not as reliably coded as 4.5% as Apple Pay, since I’m primarily an Android guy.

If you were a big Costco spender, for example, you could probably justify picking up a used $100 ipad/iphone to use Apple Pay on. For example, assuming you didn’t want to haul this old device around with you, you could purchase Costco gift cards on it using Apple pay, then redeem them using whatever means you wanted (e.g. your normal phone).

Hope that helps,

FP

what does it mean when you write, “the travel must be booked directly” ? Is this through a US bank Travel portal ? Or are you booking the flight directly with the airline, and using the US Bank Card to pay for it? I assume hotels work for travel category but what about car rentals?

Sorry about the ambiguity in writing.

You pay for travel directly with airline, hotel, car rental company to get the 4.5% (I don’t believe you earn the full points if you book through portals like Expedia, etc).

To redeem points, you do the same. Book travel directly with airline, hotel, car rental company. This will trigger the redemption text, which you respond to with “redeem.”

At no point are you required to book travel through the portals. That said, I suppose you could theoretically get 5% * 1.5 = 7.5% cash back on hotels/car rentals through their portal. That doesn’t really sound too appealing to me though…

I jumped on the US BAR bandwagon and signed up on the waitlist for the 4% offering.

Regarding the SYW card, the card alone I think is not worth it. You can only redeem for gift cards (targeted offers are usually for statement credit) which I believe dilutes the benefit. For example, if I redeem for Amazon gift cards, I lose out on the 5% I would otherwise get with the Amazon Prime card. For simplicity of the example, it cuts the SYW 5% benefit in half. Additionally, the targeted offers I have gotten seem to be a hassle to monitor and manage. YMMV.

Fingers crossed the new 4% card works out.

Thanks for sharing your feedback on the SYW card. I’m withholding final judgement on the card until I’ve had it for a year or so. I can see how it would be very lucrative for some, while simultaneously seeing how it would be not worth it for others. I’m unsure where on this spectrum I’ll find myself, but if you forced me to answer today, my thoughts largely mirror yours.

*** Update ***

After writing the above comment, I got a special offer to my inbox like manna from heaven. 20,000 points (worth ~$200 to me) on $750 of online spend. I’ll happily buy another $750 of Costco gift cards for an effective cash back of ~27%.

Maybe this card is starting to grow on me after all….

Mr E, It doesn’t drop the 5% benefit in half, it reduces the benefit by 5%. So, You spend $50 in gas using your SYW card. You get 5%, or $2.50 back in points. You eventually use your saved up points to fund your amazon account. You check out at amazon and use your new funds. You aren’t getting 5% CB with your prime card since you are using gift card balance. So that $2.50 in points prevented you from earning $0.125 (5%). That makes the SYW card a .95*5.0% = 4.75% cash back card for gas. And a 2.85% cash back card for grocery/dining. But the beauty of this card is all of the endless bonus offers – most of which are true cash back (statement credits). And the double and triple dipping that can be done is amazing (I’ve stacked ‘online’, ‘utility’, and ‘make 5 $75+ purchases’ by making 5 online utility payments). This is by far my most lucrative card ever.

I agree with Josh. It is a stupidly good card. No way it is sustainable if a bunch of us hop on it and get 20% cash back. Not sure how it has gone on so long other than the credit profile of this card is the lowest of any in the country.

I briefly looked at the US Bank 4% cash back card today but was disappointed the further I got into the details.

It appears that you have to have a US Bank savings account set up to get any additional bonus and the savings account has to have a minimum of $100K to get the full 4% cash back.

From what I’ve read so far, it will be somewhat comparable to the $100k BoA/Merrill thing. While annoying, it’s a hoop I jump through for 5.25% cash back.

For those wanting to avoid this asset hurdle, the 4.5% of the USBAR is hard to beat.

I don’t believe there was a requirement to have a $100k savings account – it was clear that a US Bank brokerage account is an option.

That’s my understanding as well, but I suppose we’ll learn more over the next month or two.

I still enjoy the Fido 2% on everything card. It’s automatically deposited into a Roth IRA. I don’t do ANYTHING, but use it, and pay the bill. That $ will grow until I take it out, and ….. importantly, I will never pay taxes on it, nor the growth. I’m sure I could MAYBE leverage another card to gain a bit more, but it cannot get simpler than this. They’ve been excellent for customer service as well. My 2c…. thanks for the blog. Read it every time.

The Fido 2% card is great, but I’m a sucker for tax-free free money so I introduce a bit more complexity to my life to eek out a little over double the 2%. To me, it’s a fun game.

I’m going to be paying $10k for an upcoming cross country move, might look into getting this card for the bonus. I need to determine if the transport company will take Apple Pay… probably not though.

I don’t travel often, so I think I would need to do the book and refund hack to reap the most benefit from this card. When the Smartly card comes out I think I will try to do a product change.

Sounds like a solid plan.

I think you’ll be surprised to learn how many merchants except Apple pay.

I was eating my words after writing this. I got an offer for 250k points ($250) on $1k of online spend. If Costco wasn’t a trek for our shopping, I probably would get a Costco gift card. There are reports that reloading amazon gift card works, but Citi denied the charge. Other than buying Costco gift cards, trying to navigate what counts is a bit frustrating (inconsistent data points on the Doctor of Credit comments). I just might have to have a date night at Costco to utilize the gift card.

In consideration of the above, I won’t include the card in my daily spend but I will hold onto it for capitalizing on these bonus offers if they make sense. Initially, I received the same utilities one as you and the juice wasn’t worth the squeeze…until this one.

The Costco gift card worked perfectly for me during the last “Online” offer.

$250 for $1k spend is a crazy promo. That’s slightly better than the one I was offered ($200 for $750). I’m thinking that these SYW evangelists are onto something… Perhaps Mrs FP will get one too so we can double dip.

Ignoring sales tax, $1k of Costco cash can pay for 333.33 date nights of 2 x Costco hot dogs (=1000/(2*1.50))!!! If that doesn’t spice up the relationship, I don’t know what will.

Since I don’t travel much, and travel mostly means hotel for my spending, it looks like the biggest overhead for me is to redeem 4.5% for Travel and the $75 net annual fee, besides the little uncertainty of Apple Pay/Google Pay. BTW, do we still earn points for the travel that we are redeeming 4.5% ?

I’m still thinking about USBAR vs the new 4% card.

There will be more hoops to get on the 4% card, opening checking/savings/brokerage, moving brokerage assets. And still trying to figure out if there are brokerage fees for IRA accounts.

It’s basically 0.5% vs $75 fee (or minus any brokerage fee), regardless of all other hoops.

There are also some cases where I can use the catch-all 4%, but not the 4.5%.

Yes, you earn points on the travel purchased during the redemption which is awesome.

I think the easiest way for non-travelers to redeem points book any flight (refundable or nonrefundable) and cancel within the 24 hour window.

I don’t mind a few more hoops for the 4% card. I opened up a checking account this month which has a $450 bonus. I’ll get the checking account next, then brokerage, assuming the 4% card comes to market.

I’m probably leaning towards converting this card to the 4% card in a month or two, but for now the travel parks have been really nice and I like the 4.5%. Just today, my wife paid $600 of my kids’ student fees with tap to pay on her phone for 4.5%. It required her to pay in person, but she was at the school anyway so the time cost was very low.

I was eating my own words after making this post. I received the 250k points for $1k in online spending. Costco gift cards are reported to work for this but I opted for Amazon. Reports that reloading works.

I think I’m coming around to the card as well, not for an EDC, but hip pocket for these offers should be fun.

Agreed!

Sorry for all the posts. I thought my original was not going through. In other news, looks like the 4% smartly card may come out October 21st as I gather you might have seen on DoC.

My comment system is pretty janky, so it’s not your fault.

It’ll be interesting to see the actual card details on Oct 21! Should be fun.

I remember from my renting days, most landlords/portals used to charge around 3% fees if you used a credit card. USBank 4% is a game changer if someone rents (I know there’s Bilt but I think it’s not very straightforward and has many “monthly” requirements to meet).

I wonder if there’s some way to pay my mortgage using the 4 / 4.5% card? If there’s some legit workaround for this, it’ll be amazing!

The 4.5% reward is almost surely higher than most fees passed through to consumers. For property taxes, I currently pay a 2.2% swipe fee which is a decent amount below the 2.625% I get from my BoA PR card (plus I get the 60 days of free float). I hope to use this card for large expenditures in the future (college expenses for my kids, etc).

As far as using the card to pay for a mortgage, I don’t know how one would do that…. Perhaps someone smarter than me can chime in?

But at Merill I can invest it.

My understanding is that you can do the same with a US Bank brokerage, but we’ll learn more next month.

What about the opportunity cost of keeping the $100k in a savings account paying less interest, since that might be a lot more than the rewards you would get from other similar accounts? Even if it’s 1% APY less than another account now you have to make up $1k in lost interest.

The difference from BoA that I can see is that at least in Merrill your money is in relatively high performing investments.

For the USBAR I’ve been following your thoughts on this – but you need to have enough spend that isn’t covered by other categories to make it work. For example I already get 5% on restaurants, 5% on gas, 5% on groceries, 5% on Amazon, and that’s the vast majority of my spending. Then for catch-all spend a lot of my other spending is not eligible for Apple Pay, eg doctors.

So the amount of spend required is a lot more than it seems. If I could pay my federal/state taxes with Apple Pay it might be worth it.

My understanding is that the US Bank setup will be analogous to BoA/Merrill through US Bank’s brokerage channel, meaning you can invest the $100k, meaning there is no opportunity cost.

I get 5.25% on most of my spend too, however there is a good chunk in non-category spend where the USBAR really shines at 4.5%: doctors, property tax, insurance, utilities, and soon college costs (tuition/housing/food/transportation) for 5 kids. It will be a non-trivial amount we funnel through that 4.5% category.

This is gold!

Happy to help.

Fp,

Do you think buying a Walmart gift card from the app will code as online? Doing the same strategy as you did with Costco on the SYW card.

It worked for me on two different offers with gift cards at Costco.com.

My guess is that it would also work at Walmart. I think there is a doctor of credit thread on the topic if you wanted to confirm.

FP,

I tried a 35$ purchase of a gift card at walmart.com and then I checked my recent activity on my account and it showed up as “MERCHANDISE DISCOUNT STORE”…….I am thinking that it did not work as online. Am I missing something. I checked DOC and couldn’t find any good info.

If we’re still talking about the SYW mastercard, I’m not sure what to say about it. Their tracking mechanism is really cryptic so I’m unsure how you’d even track the status of the card. I only found out that Costco.com gift cards worked when my bonus was triggered about 3 days after purchasing the gift cards, which is consistent with what DOC users reported as well.

Relevant DOC post: https://www.doctorofcredit.com/what-works-eligible-categories-for-the-citi-sears-card/

Thanks. Went for it today, I’ll take 200$ for spending 750$ that I was going to spend anyway on groceries.

Good luck!

Relatedly, I got a $150 statement offer today for $150 statement credit on $1k/month of grocery/gas/restaurant spend, which is pretty enticing. However, I only spend at Costco so I don’t think I can hit the $1k requirement without creating a headache on my end.

I’ll add one more ability to get a good return at Costco (besides BoA CCR online Costco Cash cards) or the USBAR, that would be taking advantage of the OfficeDepot/Staples gift card deals with Chase Ink. You are limited to $25,000/year and have to manage the gift cards, but on the plus side, you don’t have to just use them at Costco. You can use it anywhere, medical, insurance, etc.

Sounds interesting, but a bit of a hassle. I’ll ponder it some more….

The hassle factor is similar to CCR with Costco Cash, probably a little more (said in Trump voice, because this is his style of interjection), but you’re not limited to just Costco.

I appreciate the feedback!

If you use their travel portal get 5% on it and then redeem the points for travel does it result in 7.5% back? Thanks for your blog. Very helpful.

For hotels & car rentals through their portal, you pay with dollars and get 5% in points back, which are transformed to 7.5% back when redeemed on future travel. That said, you might be able to do better outside of the portal with Rakuten/etc for rental/hotel discounts.

For flights, you are better off booking direct since it doesn’t cost you anything in terms of points vs booking through their portal. Plus, booking through third parties is a terrible idea for flights. For flights, you’d simply earn the plain vanilla 3% * 1.5 = 4.5%. That said, you might be able to do better with discounted gift cards (Southwest airlines at Costco, etc).

I mostly ignore the portal gimmick and treat the card as a 4.5% cash back card (on travel or tap-to-pay or apple pay online) with the caveat that the cash back must be redeemed on organic travel or “manufactured” travel (e.g. book refundable flight and cancel).

So, Tap-to-pay is always 4.5% (apple-pay, samsung-pay, google-pay), On Desktop/Browser (and in iPhone/Android apps): Apple Pay is always 4.5%, and google-pay is sometimes 4.5%? Do I have it right?

That has been my experience so far:

* 100% success rate with tap-to-pay on android phone.

* 100% success rate on web through apple pay on ipad.

* ~50% success rate on web through google pay (the number of data points is very low since I stopped trying after the failed attempts).

Thanks for the reply. Too bad they don’t let you pay with points in the portal.

They do let you pay with points in the portal. Sorry if I wasn’t clear about that.

However, I think it’s superior to pay with cash so that you can ensure the earning of the points on the redemption itself.

Ah, so I take it portal buy is not included in RTR. (?)

My speculation is that RTR is only triggered upon spending cash (not points). I could be wrong here…

In practice, spending cash is the way to go then redeem points via RTR. Couldn’t be easier. I’m assuming this is just as true inside of the portal as outside of it.

DP: Rumor that this card will be discontinued soon.

Interesting. Source?

So far, speculation from one YouTuber which DoC and random Reddit threads have ran with.

Leave it to me to get a card a month or two before it’s nerfed!

I guess the rumor is that I’ll be grandfathered in with the USBAR?

I still think the 4% card is the more compelling offering….

To me the 4.5% / 4% cards are complementary and need not be compared to each other I could potentially go to just those two cards. I wouldn’t need to mess with Bank of America anymore, those two would be “good enough”. I guess I’d need a backup card to take out of the country for non-tap transactions.

I’m with you on the two cards being complements. That said, the break-even on the net $75 annual fee is $75/(0.045-0.04)=$15k/year of annual spend. I know there are ancillary perks to the USBAR (priority pass x 8, rental car insurance, travel insurance) but it comes at a cost of the hassle of RTR travel redemptions.

I’m very likely to try to product change the altitude reserve into the 4% card…

After reading your posts I was inspired to get the US Bank Altitude Reserve Visa Infinite Card (while I was inspired in early November I put off completing the application)…Just yesterday I received confirmation that I was approved and should receive the card in the next 7 days…I came here today to reread the review and make sure when it arrives I am using it properly to optimize the utility and was surprised to see the eulogy…but based on my experience it may not be completely dead yet…or maybe this was just a fluke.

I never saw the appeal of this card. $75 AF. You have to pay with mobile wallet (I tried a mobile wallet once and it forced me to put a password on my phone which I prefer not to do). And you have to redeem for travel (we don’t travel much). And this is getting a little petty, lol, but you’re spending $325 on dining at 4.5% whereas I like to get at least 5% CB on dining (sometimes more with SYW or 5.55% with citi CC) (yes, I know it’s only $1.63+, lol). But, perhaps more of a concern, you have to pay for (at least some of) your travel with this card to get your maximum redemption – well, what if using another travel card would provide better than 4.5%? And/or what if buying non-direct travel was cheaper?

The appeal of the card is 4.5% on non-category spend (assuming you can tap-to-pay).

The $75 annual fee is recouped, relative to a 2.625% BoA PR card, with $75/(0.045-0.02625)=$4k/year of spend. I’m about to send my daughter to college. If we can tap-to-pay tuition, room and board, etc that would certainly add up. You’d be surprised how much spend can get funneled through the card. It is rare for merchants to not allow tap-to-pay.

Plus it has no FTF, primary rental car insurance, priority pass, and free global entry.

I got the card before the 4% US Bank card was announced. The break-even relative to that card is $75/(0.045-0.04)=$15k/year which is a much higher hurdle. But this calculation assumes I don’t value the primary rental car insurance, priority pass, global entry, and lack of FTF. I do. Maybe I value those at $50/year, so my break-even becomes $25/(0.045-0.04)=$5k/year, which is a much more reasonable hurdle.

I agree with you on the limitation of redemption on travel. However, it’s easily defeated by “manufacturing” travel with refundable flights that are cancelled. But this takes a minute or two more than a simple redemption.

In summary, relative to the BoA PR card, it is great. Relative to the new 4% card, it is more marginal. I’m not sure what I’ll do when the card is up for renewal…

Well, the good thing is we can calculate how much you need to spend to make the extra 0.5% “worth it.” 75/.5% which is $15K. This sounds terrible, but many websites, doctors’ offices, universities, tax offices, etc accept mobile payments online or in-person. With the upcoming changes to the Smartly 4% card, this may be better than you think.

Agreed!