I tend to check out a lot of books from the library. Here’s a list I currently have on my shelf.

I want to love reading books, but I find it hard to finish them because:

- It seems to me that most books could & should be summed up in a couple of bullet points.

- I find books to be less entertaining / informative / varied than podcasts, my preferred method of consuming information.

- Reading books require eyeballs, which means I can’t do it while biking / doing dishes / walking dog.

- I think audiobooks are far inferior to podcasts.

Three of the books on my bookshelf discuss the economics of healthcare. I love thinking about healthcare economics because:

- The US spends 18% of GDP on healthcare (link).

- The US ranks 36th in life expectancy, far below countries that pay significantly less on healthcare than the us (link).

- Overall US life expectancy is 78.9 years, compared to 84.7 for Hong Kong, 84.5 for Japan, 83.8 for Sinagpore, 83.6 for Italy, 83.4 for Spain, and 83.4 for Switzerland.

- For many US citizens, the marginal cost of healthcare is zero (e.g. those on Medicaid, those with super cushy employer plans with low deductibles)

- This creates some wonky economics.

- When economics are wonky, bad things seem to happen (e.g. the mess of the US healthcare system).

- This creates some wonky economics.

- During grad school, many of my friends were docs who complained about people misusing emergency rooms:

- Many people used the ER as their primary care physician.

- Absent a monetary dis-incentive, why not!?!?!?!?!?!?!?!?

- An ambulance ride to the hospital is cheaper than an Uber.

- I wish I were joking.

- It’s open 24/7.

- An ambulance ride to the hospital is cheaper than an Uber.

- Absent a monetary dis-incentive, why not!?!?!?!?!?!?!?!?

- Drug-seeking patients.

- Many people used the ER as their primary care physician.

- My doctor friends complain about spending more time dealing with bureaucracy (charting, dealing with insurance, etc.) than treating patients.

- I find it comically tragic that 18% of GDP is spent on healthcare services that we don’t know the price of until 4 months after the service when we finally receive the bill. No other market functions this way. When you buy a car, you know what price you’re going to pay before signing the dotted line. When you buy a meal, you know what you are paying. When you go to see the doc, you have no idea what in the hell you are signing up for. You just go and hope for the best. It’s absolutely absurd.

- The Surgery Center of Oklahoma, featured on a recent episode of Econtalk, is a glaring counter-example that has revolutionized health transparency to the point that it attracts patients from around the globe. Apparently, the business model is working great and is highly lucrative.

It seems to me that there are few areas that are as dysfunctional as the US medical system. One of the books I’m reading, The Price we Pay, discusses the evolution of the healthcare-sticker-price-inflation game:

- To demonstrate value, insurance companies create preferred “networks” of doctors/hospitals with negotiated discounts.

- Doctors/hospitals, frustrated with low reimbursements, counter by inflating sticker prices.

- Insurance companies counter by further increasing the discounts.

- Rinse, repeat.

- The result is a completely broken down system where prices don’t reflect anything close to reality. If you are a cash paying patient, you’re screwed (unless you pre-negotiate a cash price up front).

Overall, I see prices spiraling out of control and doctors increasingly dissatisfied with their jobs.

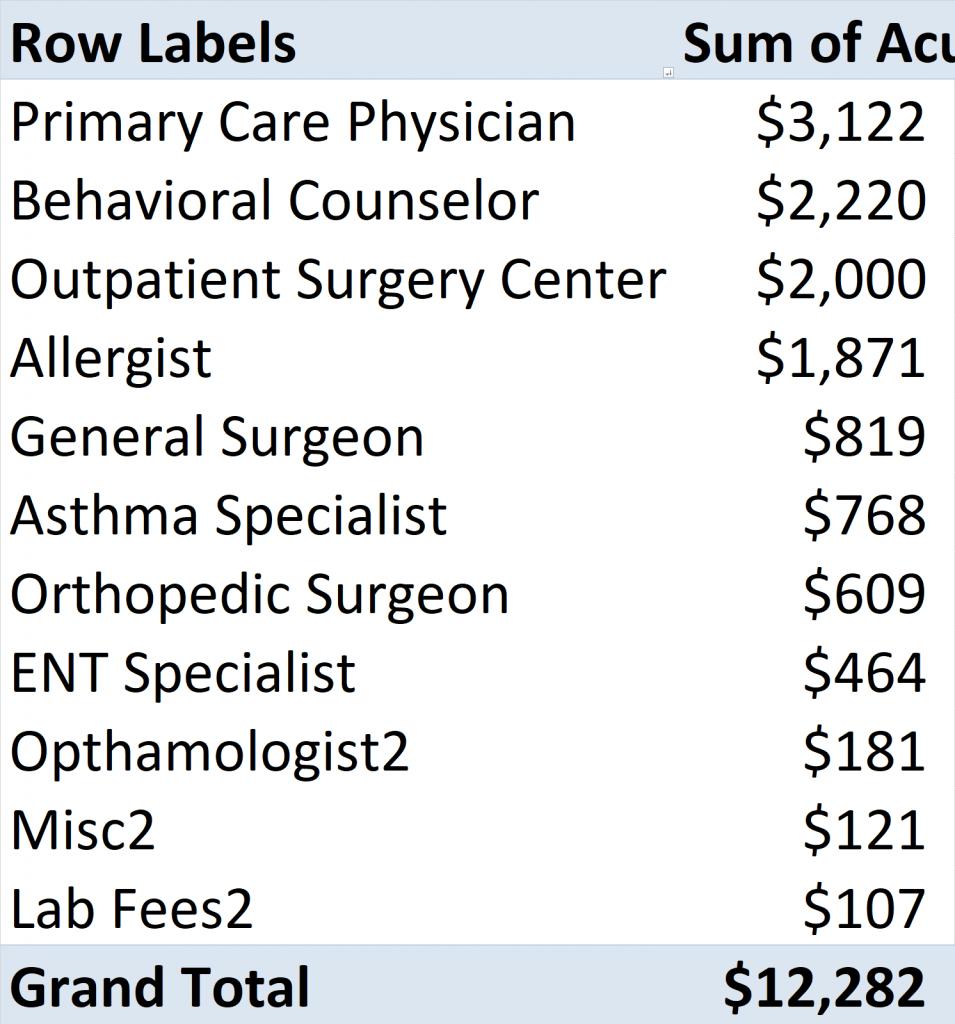

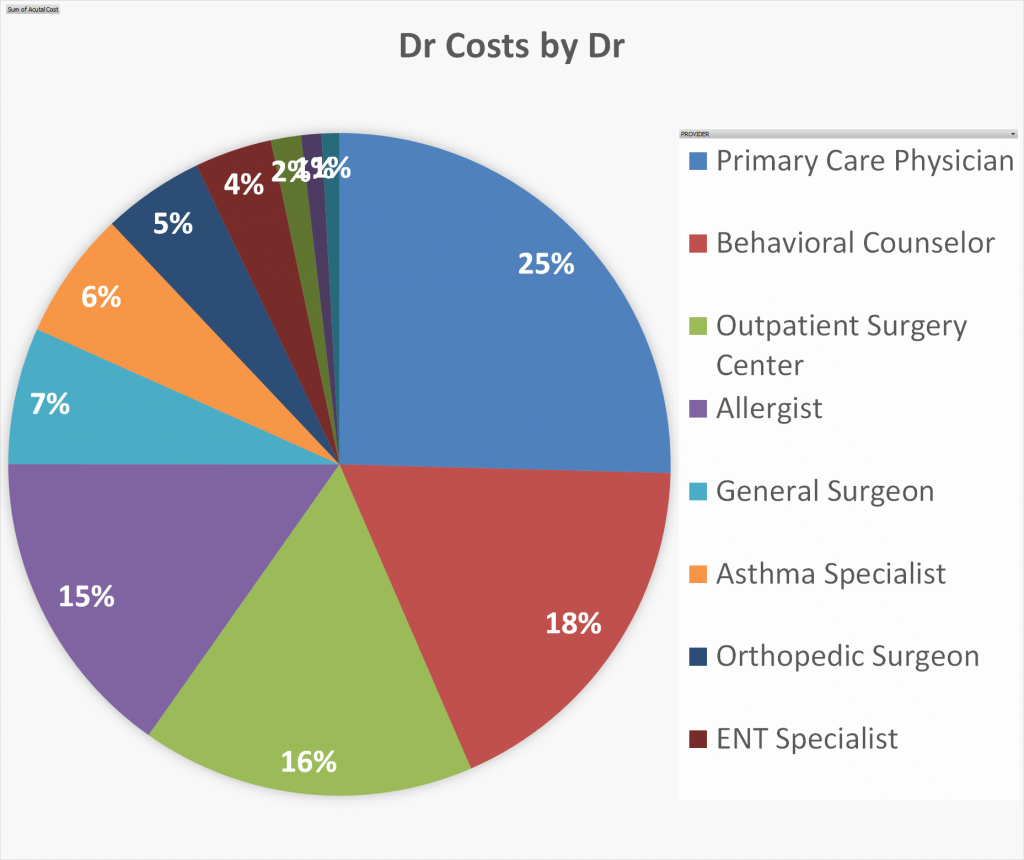

In any regard, the above inspired me to look at our 2020 YTD healthcare spending. This is what I found:

Total YTD Doctor Costs by Doctor

YTD doctor spending by doctor (Dr Charges – Insurance Discounts = What I paid + What my Insurance paid). Here I show either side of that equality.

Total YTD Doctor Costs Only

YTD doctor spending by person (Dr Charges – Insurance Discounts = What I paid + What my Insurance paid). Here I show either side of that equality.

I’m not sure why there’s an extra “2” at the end of each of our names. Thank goodness I don’t have 52 children.

Total YTD Drug Costs Only

YTD drug spending by drug (Drug Charges – Insurance Discounts = What I paid + What my Insurance paid). Here I show either side of that equality.

For the purposes of this analysis, I exclude any benefits from manufacturer’s discounts since they aren’t guaranteed to persist in the future.

Total YTD Drug + Dr Charges

Sum of total doctor + drug costs by FP clan member (Charges – Insurance Discounts = What I paid + What my Insurance paid). Here I show either side of that equality.

Thoughts

- Doctors billed $21,372. Insurance negotiated this down to $12,282, corresponding to an average insurance discount of 43% from the sticker price.

- Again, this completely reinforces the idea that “sticker prices” are completely removed from reality.

- Our primary care physician charges $145/visit, but insurance negotiates this down to $88.50/visit, a discount of 39%.

- I’m more than happy to pay this each visit. I love our primary care physician and he gives us great advice. I love that he rationally considers economics in his giving of advice.

- Our non-MD behavioral counselor with a master’s degree charges $225/hr, but insurance brings this down to $131/hr.

- Our primary care physician recommended behavioral counseling for our ADHD child. It’s a source of active debate in the FP household whether the several thousand dollars per year is well spent. The counselor runs a near-zero-overhead operation with no extra staff.

- I’m a little irked at the $225/hr sticker price. Who ethically charges $450k/year (annualized) to tell kids to hug a teddy bear when they are feeling frustrated? It strikes me as a bit egregious, but perhaps it’s just a part of playing the sticker-price-inflation-game.

- Chronic asthma meds are insanely expensive due to unethical patent shenanigans (link).

- It costs about $2-3k/person/year to manage asthma. There are 3 kids with it in the FP household.

- Given how common asthma is, I’m surprised there isn’t more regulatory pushback on these egregious inhaler prices. Imagine a single parent with a couple asthmatic kids trying to scrounge up a cool $6k/year for asthma inhalers.

- ADHD meds aren’t cheap either:

- Concerta runs $4k/year and it requires a doctor’s office visit quarterly to renew the medicine (another $88.50 x 4 in our case).

- I’m 100% in the general skepticism of excessive healthcare & drug camp. However, this drug is a miracle drug for our child and it’s the best money I spend all year.

- Because we’d already hit our OOP max this year, I went to see an allergist for the heck of it (it was free, so why not!?!?!). I’m allergic to everything, which he confirmed, but it hasn’t bothered me much in my current location. The allergist recommended allergy shots for the next 5 years, which isn’t a cheap proposition, but seemed reasonable enough. A few of our kids are already doing this. He also recommended a daily sinus rinse, which is basically waterboarding yourself. I was shocked to learn, however, that the Xhance prescription he wrote as I left the office costs $500/month (something I learned when first filling it). The generic of this drug, generic Flonase, is available at Costco but doesn’t have a plastic blow tube. Mercifully, there is a manufacturer’s coupon for the drug or I wouldn’t have filled it.

How much do doctor services cost?

- Broken wrist (including xrays, etc)

- Charged $1,017, but insurance discounts brought this down to $612.

- Included a few x-rays, a cast, and a follow-up trip.

- Ganglion cyst removal (including everything)

- Charged $4,624, but insurance discounts brought this down to $2,632.

- Sinus infection treatment by ENT

- Charged $674, but insurance discounts brought this down to $463.

- Seeing the specialist is something our primary care physician recommended after a normal dose of antibiotics didn’t clear the infection.

- Maintenance allergy shots, per year:

- Charged $871, but insurance discounts brought this down to $646.

- My annual physical

- The doctor charged $345, but insurance discounts brought this down to $142. I think my plan is legally required to cover the entirety of this $142.

- Additional lab fees charges were $105, but insurance discounts brought this down to $36. I think I’m usually on the hook for this charge but had already hit my OOP max this year.

- Repairing two broken front teeth

- Dental is another beast entirely with different economics, but I just got the bill so here you go. My child tried a slam dunk on our hoop only to plow his face into the supporting pole.

- Charged $731, insurance negotiated down to $556. Insurance paid $335 and I paid $210.

- Now I now the price of an errant slam dunk.

Is anyone aware of a website that crowdsources the above information? I’m aware that these “negotiated prices” are top secret, but there is nothing preventing consumers from sharing their bills to a communal database. A communal database would solve the information asymmetry issue and empower consumers to make more informed decisions.

What I learned about my insurance plan this year (finally, some actionable advice?!?!?)

- This year, i found out that manufacturer’s coupons counted towards my deductible!!!!!!

- We had a manufacturer coupon for an asthma drug Annuity Ellipta this year. The coupon stated that it’d cost us $10 to fill even though the cost of the drug was $176. The arbitrage is that I got full credit for the entire $176 to count towards my deductible every time I filled the prescription. Since two of my kids qualified for this coupon, every month I filled their prescription, I walked away $332 richer than I had been 5 minutes earlier.

- The above saved us several thousand dollars this year since it artificially lowered our deductible.

- I’m unsure how well this generalizes to other insurance plans & medicines, but I’m hoping for the best next year.

- GoodRx expenditures did not count towards our deductible, but they appear to have counted towards our OOP max. I find this odd, but I’ll recrunch the numbers at the end of the year to reconfirm.

- It’s still my opinion, however, that GoodRx is not worth the bother unless you’re almost certain you won’t hit your deductible in a given year.

Picture of the arbitrage in action.

Picture of the arbitrage in action.

Manufacturer Coupons that I’m aware of for 2021:

- Athsma:

- Digihaler (both rescue & maintenance): https://www.digihaler.com/#savings

- Coupon says as low as $20/inhaler, but you must have insurance

- The maintenance inhalers are incredibly expensive (~$350/mo) without coupon

- Digihaler (both rescue & maintenance): https://www.digihaler.com/#savings

- ADHD

- Concerta: https://www.concerta.net/coupon.html

- Apparently $4/month instead of $348/month

- Concerta: https://www.concerta.net/coupon.html

- Allergy

- Xhance: https://xhancecopay.com/download

- Apparently $50/mo instead of $500/mo

I’d be very curious to hear if anyone has other asthma drug coupons that they are aware of.

To the extent that any of the above manufacturer discounts count towards my deductible in 2021 like they did in 2020, I could potentially hit my deductible having spent practically nothing, bringing my total out of pocket healthcare costs down to almost zero for the year. To the extent that the same arbitrage doesn’t exist next year, at worst I’m saving some cash on drugs I was going to buy anyway.

It’s impossible for doctors to be aware of all drug coupons at all times. Further, some doctors don’t seem to care about costs at all. What I’ve personally found is that “google” + “<drug name> coupon” is a worthwhile endeavor every year. At worst, you’ll waste two minutes of your life. At best, you’ll be thousands of dollars richer thanks to a two minute query.

It’s also been my experience that manufacturer coupons don’t persist year after year. Consequently, to fully exploit the above you’ll have to be willing to switch to a substitute drug across years, if available.

Conclusion

Eat your broccoli, wash your hands, and have strong social connections so you hopefully can avoid needing to see the doctor. If you can’t avoid it, prepare to pay up. If you don’t want to pay up, try rubbing dirt on whatever hurts; it worked okay for me as a kid.

Once you hit your deductible, the rational thing to do is front-load all healthcare and drug costs until the clock strikes midnight and the deductible resets. Doing so is rational for the individual, but when aggregated, is systemically costly and an obvious problem to be solved by someone smarter than me.

Also, drug discounts seem to be an active area for arbitrage, at least under my current plan. Again, I’m unsure how well this generalizes, but perhaps this post will inspire someone to run the numbers.

Until the economics of healthcare are fixed, I don’t see how healthcare costs exit this death spiral.

If I Ruled the World

The below isn’t terribly well thought out…..

- Medicaid:

- Require physicians to disclose prices before any healthcare transaction.

- Give $5k prepaid card to each Medicaid family to be used like a HSA.

- A more sophisticated solution would base it on family size. Perhaps $1k/person.

- Primary care physicians incur $0 copay.

- Generic drugs incur $0 copay.

- ER visits are paid in full with the $5k prepaid card.

- Specialist visits are paid in full with the $5k prepaid card.

- Brand-name drugs are paid in full with the $5k prepaid card.

- Half of unused funds are reimbursable at the end of each year.

- If prepaid card is exhausted, healthcare becomes zero marginal cost.

- I don’t like this, but can’t think of an elegant solution around this short of requiring a modest $5 copay for any subsequent service.

- Private insurance:

- Require physicians to disclose prices before any healthcare transaction.

- Everyone is dumped into high deductible plans.

- Health and drug costs are combined into same deductible/OOP max.

- Deductible starts at $10k. OOP max is $20k. Coinsurance is 50%, implying that you hit your OOP max at $30k (=$10k + ($30k-$10k)*50%)).

- Premiums are cheaper to offset the higher deductibles. Systemic lowering of prices as result of discerning consumers would help too.

- HSA contribution limits rise to $20k/year.

- Generous employers will fund employee HSA’s. Frugal employers will not.

- At the end of each year, up to $10k/year of unused HSA funds can be withdrawn for non-health reasons.

- Once OOP is hit, healthcare becomes zero marginal cost.

- I don’t like this, but can’t think of an elegant solution around this.

- Maybe the solution is that there is no such thing as OOP max, but rather it’s the point at which a 10% coinsurance kicks in (where the insurer is responsible for the remaining 90%).

Further Reading

David at OchoSinCoche did a similar analysis of his (large) family’s 2020 healthcare spending here: https://www.ochosincoche.com/2020/11/06/health/

Yep, that sums up our broken system very well. I have unique situation in that I work at a community health center and take care of a lot of uninsured patients and I can call our pharmacy and know immediately what the price of a drug can be- it’s inconvenient but at least possible to find out. For private insurance the only way to find out the cost is to have the patient run their insurance card at the pharmacy. I have no idea what the labs I order on a daily basis and if I find out it’s still going to be adjusted. Most doctors just wash their hands of it and don’t think about costs to the patient because the system disincentivizes it (ie, wastes time and is often futile), but it’s hard when I see people barely making ends meet and I know I could bankrupt them in one visit by ordering an MRI or referring them to a specialist.

Also, as a primary care doc, I do sometimes get the impression that my services are undervalued. On a regular basis patients will answer phones during visit, etc. clearly these people are not paying or are paying much less than is being charged. Yet, if you increase up front cost of a visit, you increase the chance that care is delayed for some people.

I’ve given up trying to think I could solve these problems, but I enjoy what I do and appreciate that I get paid fairly well to help people who are sick.

Apparently Apple autocorrect likes to take away punctuation . Sorry for sounding illiterate:)

Thanks for the input, and more importantly, thanks for all you do as a physician! Sorry about feeling undervalued. I agree that if patients were paying full freight, they’d show a lot more respect. Unfortunately, I think the culture of cell phone idiocy permeates our entire world, so try not to feel too bad about it.

I appreciate your efforts to consider costs while practicing medicine. I agree with you that the incentives aren’t there. In fact, the incentives tend to go the other direction. Patients tend to demand treatments / tests even when common sense tells them they’d likely be just as well served taking a Tylenol and getting some rest. The “Dr Google” trend must also surely be frustrating for you, in which patients think they know more than you because WebMd made them an expert with a 30 second google query.

In any regard, I’m sorry for your frustrations as a physician. I’m sorry for my frustrations as a patient of healthcare. It seems to me that we need a wholesale reform of the system because the foundation is fundamentally irreparable.

You will be happy to learn that a significant measure of price transparency is coming to health care pricing in the new year. An executive order comes into effect on January 1 requiring hospitals to disclose negotiated rates for a variety of (maybe all?) services.

Executive Order

Department of Health & Human Services press release

Vox analysis

I personally am extremely hopeful that this visibility will make a lot of things a lot better, and I can’t wait to get my hands on the data! Here’s to next year’s Healthcare Analysis post being even better researched.

I appreciate you sharing these links! The Vox analysis was interesting, particularly the skepticism that such disclosure might make things worse. However, it’s hard for me to imagine how it could make this dysfunctional system any worse.

I used this website for information on the cost of a dental crown and it was accurate. It’s by location. https://www.fairhealthconsumer.org/

Looks like a great tool. Thanks for sharing!

In terms of healthcare costs, I found this particularly interesting. I can’t find the article off-hand, but it references here, https://surgerycenterok.com/pricing/ as an model of transparent pricing. I believe they even said doctors benefitted since they no longer have all the bureaucracy of dealing with insurance. The price you see/are quoted is what you get.

The Surgery Center of Oklahoma is certainly leading the way towards lowering costs & price transparency.

Just looked up the price of their ganglion cyst removal and the price was $2,750. It’s pretty incredible how specific they are with their all-in pricing. Who would have thought that this would be such a revolutionary idea!?!?!?

You need to read more fiction! Can’t sum up good fiction in a few bullet points.

There are many lifetimes worth of nonfiction I’d love to read that I find it hard to get excited about fiction. For the same reason, I prefer documentaries to fictional movies.

The rest of my family, however, is very much in the fiction camp.

Thanks for the shout out. I’m constantly amazed at how much my family spends on healthcare and I’m glad to know we aren’t alone! I hope you enjoy the book, “The Healing of America”. I found it so fascinating. I’ve already added some of the other books in your list to my queue. Sadly, it’s usually five books into the queue for every one that I finish.

You are indeed not alone in the hemorrhaging of healthcare money. I keep thinking that “next year” will be the year of low healthcare consumption, but with chronic conditions requiring $3-4k/year/person of medications, it’s unlikely that we won’t hit our OOP in a given year for the foreseeable future.

I haven’t cracked open “The Healing of America” yet but it’s on the bookshelf thanks to your recommendation. Gotta finish the ones I’m halfway through first.

Here’s another random quirk from my experience with healthcare.

In years past I was on expensive oral chemo drugs (list price for full dose over $12k per month). My standard insurance copay was $250 for a four week supply. Expensive, but not a budget breaker. I was able to sign up for a copay assistance card, which dropped my cost down to $10 per script. For the first year or two, I paid $10, but the insurance treated it as if I paid the full $250. So each $250 copay counted to my out of pocket max, even though I was only paying $10 myself.

I figured out that the economics would work of moving to a HDHP with HSA. I would be “charged” the full amount of the drug up to my deductible and OOPM (no more $250 copay), but with the copay card I would still only pay $10 for the drugs. Insurance would show that I paid the full amount. Based on the math, I realized that I would hit that OOPM within two months. So at open enrollment I switched to the new cheaper HDHP. Literally two weeks after open enrollment ended, the insurance company came back and said they were changing things up and that whatever I paid myself would count to the deductible and OOPM. So now I would only show $10 per script going to the max. This broke the economics of the HDHP. Fortunately, HR allowed me to re-do my annual enrollment and I went back to my copay non HSA plan.

Apparently they call this a copay accumulator program and more and more plans are moving that way. Another way we need to be careful out there!

Thanks for sharing your experience! Once you peel back the layers of the health-care-economics-onion, you certainly find some wonky things. I hadn’t heard of the term “copay accumulator program” before, so thanks for teaching it to me.

I’m sorry to hear that they changed the rules on you, but it is great that HR allowed you to change plans as a result.

I’ve found there is zero guidance on the underlying economics for all of this; it’s mostly just trial and error with Excel and deciphering archaic insurance statements.

Paradoxically, of the same arbitrage situation persists in my current plan, I’ll be financially better off with the expensive asthma and ADHD drugs thanks to this oddity.

The root problem is that this is all much too convoluted and arcane for everyone involved. It all distracts from the important business … providing and receiving quality medical care. It’s truly absurd that we’ve created a system where a person receiving chemotherapy has to spend mental energy on these self-imposed (from the perspective of society at large) trivialities.

Agreed that the system is broken.

To really get your blood boiling, read “The Price We Pay.” It is a fantastic book written by an incredibly bright surgeon who highlights the many ways our system is broken.

Your usage is quite high, but you fortunately benefit from hitting your deductible/max OOP and your employer heavily subsidizing your premiums. My usage is significantly lower than yours, but I think I probably pay way more in healthcare costs than you because I get to pay full freight on premiums, and I don’t hit my deductible/max OOP. The ridiculous costs of the current system are really felt when you get to pay $20k/yr in premiums for a HDHP, and then on top of that you get to pay for all the actual expenses out of pocket.

I like most of your ideas for improving the system, but in addition I think we need to get insurance premium prices under control, and I don’t think transparency from service providers is going to cut it. I also feel it’s important that whatever system we have, we provide reasonable insurance options for persons with preexisting conditions. I’m not sure what system can possibly meet these objectives other than a single payer system that puts everyone in the same pool of insureds, and gives the insurer massive power to clamp down on costs.

Perhaps coupling a single payer system with your ideas could provide reasonably priced catastrophic insurance while also incentivizing individuals to use the system wisely. I’m just so sick of dealing with insurance companies, and worrying about costs, and paying ridiculous amounts of money for all of this… there must be something better than what we currently have.

I can only imagine how frustrated you feel paying that much without getting a penny in benefit.

Yes, my family’s healthcare expenditures are out of control. But it’s mostly because of chronic ailments (mainly asthma) and completely unethical patent antics for a drug that would otherwise be generic. They got a patent extension by changing the propellent from CFC’s (which hurt the penguins by creating holes in the ozone) to something else. And the consumer is stuck with a $4k/person/year bill.

When I think about how to solve healthcare, it’s easy to see areas of the healthcare that function just fine. Dental care (including wisdom teeth extraction, etc) costs haven’t skyrocketed. Neither have optometry services or Lasik. I know I’m somewhat comparing apples to oranges here since it’s unlikely that one will face a $1M dental bill in their lifetime yet it’s not impossible to do that on the healthcare front. My biggest gripe with healthcare is that the incentives are all screwed up. Doctors have the incentive to overtreat to: 1.) make more money, and 2.) pacify whiney patients. Patients have the incentive to overconsume because: 1.) it’s mostly if not entirely free, and 2.) there is a widespread belief that more treatment/drugs will lead to better outcomes. I think what I was trying to push forth with my solutions is that once the incentives are aligned, the out-of-control healthcare costs will hopefully be reined in which will eventually be manifest through lower premiums.

To be completely candid, yours truly is part of the problem. I hit my OOP max for the year and said, “what the hell, why not go to a specialist to help me with my very occasionally bothersome sniffles?” There is a reason I went in October when it was “free” — it’s because I didn’t value the services enough to pay full freight. But when it suddenly became “free”, then spending a couple grand at the allergist (literally) became much more attractive. Multiply my experience by hundreds of millions of Americans, and we have healthcare costs spiraling out of control with no end in sight.

I haven’t given much thought to the single payer system, but lots of smart people certainly advocate for it. It’s certainly not without its flaws. Hopefully some of the books on my bookshelf can enlighten me to the arguments for and against it.