I’ve been doing a bit of benchmarking retirement plans lately. The vast majority of universities have made their menu structure publicly available, so it’s a pretty easy exercise. Rather having it sit unused on my hard drive, I thought I’d post it to the internet in a dedicated post. If you are interested for some incomprehensible reason, you can download it here.

If you work for a 15-employee small business, then surely this post is going to be less relevant to you. The nice thing about working for a large institution is that economies of scale can be leveraged pretty easily. An employer has a lot more leverage in constructing a better plan menu when it has billions of retirement assets.

Here’s what I learned through my benchmarking study:

- There is an incredible amount of heterogeneity in retirement plan quality across institutions.

- There is an incredible amount of litigation in this space.

- U Penn settled a $13M lawsuit last week for excessive 403b fees (link).

- Other university settlements include MIT ($18.1M), Emory ($16.75M), Vanderbilt ($14.5M), Johns Hopkins ($14M), Duke ($10.65M), Chicago ($6.5M), Brown ($4M), etc. Most of these settlements are described here (link). The law firm Schlichter Bogard & Denton is behind most of these lawsuits (if not all of them).

- There are tons of firms in the private sector that are also getting sued. Just google “401k lawsuit” for infinite examples.

- It seems to me that being a lawyer in this space is a pretty good way of making a living for the coming decades. It kind of reeks of ambulance chasing to me, but if it results in a better outcome for employees, I suppose it’s justified?

- There is a trend away from opaquely baking recordkeeping fees in the underlying expense ratios of the funds. Instead, the trend is to charge a transparent and explicit recordkeeping fee (either $/head/year or %/head/year).

- There is a fairness issue with either of the above recordkeeping models:

- $/head is good for people with large balances but bad for people with small balances.

- %/head is bad for people with large balances but good for people with small balances.

- From what I can tell, top institutions are much more likely to choose $/head. I think this matches the underlying economics quite well. It costs just as much to send out a prospectus to a household with a $10k balance as it does to send it out to a household with a $10M balance. The same is true for website maintenance, etc.

- To avoid lawsuits, it seems that the only logical conclusion is for employers to:

- Simplify the menu to an index-only menu.

- Set the “default” fund as a passive target-date fund.

- Stanford, Harvard, CMU, the US gov’ts Thrift Savings Plan, University of California, Notre Dame, and (the post-lawsuit) U Penn have best-in-class menus.

- However, the plans differ on a few minor dimensions. For example, U Penn offers the most complex menu with 14 funds (ignoring the money market fund but counting the target-date fund as a single fund). The complexity of Penn’s menu comes from stratifying the US equity market several ways (growth, value, large, mid, small) as well as international equity markets (total international, developed international, emerging markets). Harvard does none of this and simply offers a total domestic stock + total international stock fund. However, Harvard offers a socially responsible investing index and Penn does not.

- With the exception of the US gov’ts TSP, each university charges a fixed $/head:

- Harvard: $28/year

- Stanford: $36/year

- CMU: $48/year

- UC: $33/year

- ND: $60/year

- U Penn: TBD; they are redesigning their plan as we speak

- Stanford and the University of California allow non-Roth after-tax contributions to a 403b with in-plan Roth conversions, opening up the door for the lucrative (and elusive) Mega Backdoor Roth:

- Stanford (link).

- UC (link).

- I didn’t find evidence of other universities offering this option. If you know of any others, please let me know. I know this is relatively common among private firms.

- The lifetime tax savings from maxing out a Mega Backdoor Roth over one’s career are astounding. I’m hoping I can convince my university to allow this option.

- All universities except the UC’s offer annuities. Some offer a single annuity (Stanford offers TIAA traditional), whereas most offer around 3 TIAA annuities (TIAA traditional + 2 more).

- Despite being almost completely passive, the following universities offer a couple actively managed funds:

- UC: 1 US equity fund charging 0.35% and 1 international equity fund charging 0.48%.

- Notre Dame: 1 global (US + international) stock fund charging 0.62% and 1 bond fund charging 0.67%.

- U Penn: 1 bond fund charging 0.44%.

- All universities in my sheet allow for the BrokerageLink option, giving investors have access to thousands of unvetted mutual funds after employees sign a waiver absolving the university from any liability.

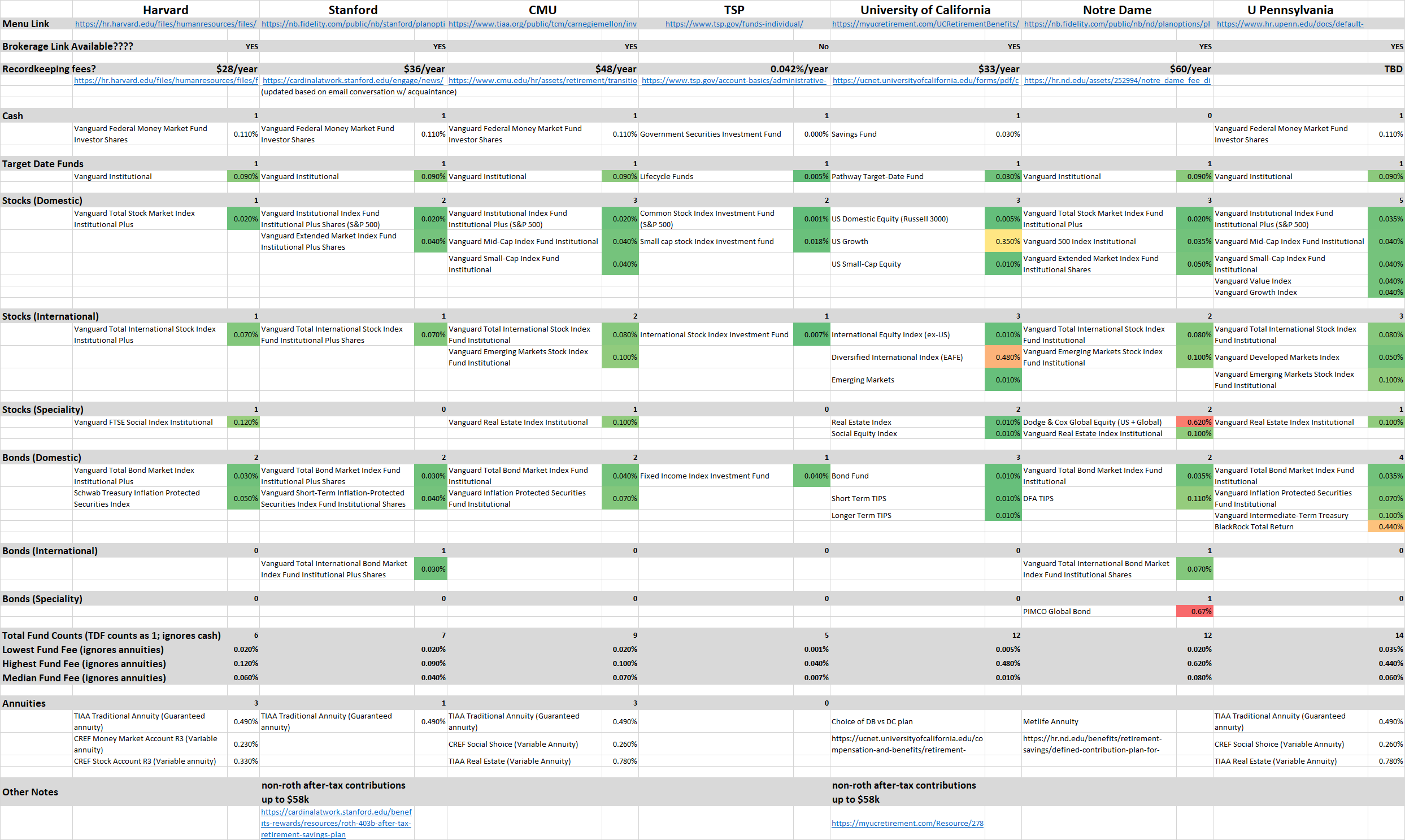

My spreadsheet contains the links to these menus in Row 3, the links to the recordkeeping fees in Row 7, and the fund menu for each of the institutions as well as the cost of the underlying funds. I color coded the expense ratios to facilitate the reading of the fees.

It’s my understanding that nobel-prize winner William Sharpe spearheaded Stanford’s retirement plan redesign committee.

If you have a crummy plan, perhaps you can share my spreadsheet with your HR department and demand a better menu. It’s not rocket science. Construct a simple, low-cost menu and implement a fair recordkeeping fee structure. It’s my experience that HR departments, the ones making decisions influencing billions of invested dollars, aren’t well versed in investing. It’s also my experience that “expert” retirement plan consultants who advise HR departments give pretty bad investing advice. I remain unsure why their investing advice is so bad. Perhaps asserting the ability to choose which actively managed funds will beat the market is how they justify their high fees? Imagine paying a consultant a few hundred thousand dollars to have them print off a 6-7 fund passive menu like Harvard’s/Stanford’s.

Here’s an image of the sheet for those not wanting to download the spreadsheet. Of course, you’ll need to download the sheet to get access to the hyperlinks for the underlying sources.

Addendum 1/23/2021:

The initial post didn’t adequately why I thought the above plans are exemplary. I fully admit that most retirement plans offer index funds. From that perspective, the above plans are not unique. However, what is unique about the above plans is the absence of actively managed funds (with a couple exceptions) from the menu. Importantly, the default investing option is a passive TDF.

From what I’ve seen in my review of plans across the US, the above is indeed unique. Most plans are littered with high-cost actively managed funds.

Makes me feel good about my benefits from VCU:

Fidelity® 500 Index Fund (FXAIX) 0.015%

Fidelity® Extended Market Index Fund (FSMAX) 0.036%

and our VA Defined Contribution Plan is even better:

US Stock fund (Blackrocks Equity Index Fund F) 0.01%

SMall/Mid-Cap stock fund (BlackRock Russell 2500 Index Fund F) 0.03%

But for some reason I can only send my main 403b contributions to Fidelity or TIAA and put my 401/457 and University cash match into the DCP. My better half works in the VA Community College system is able to send everything to the DCP, not that she has any clue about anything in there (likely not even a rough idea of her balance…)

You indeed have some good options!

What I failed to communicate in the original post is what I find unique and exemplary about these plans is: 1.) a great low-cost TDF as the default, and 2.) a simple menu of passive-only funds.

A sophisticated investor can easily navigate a 177 fund Fidelity menu like I currently have and easily pick the lowest cost funds. However, the median investor cannot. A simpler passive-only menu offers great protection for those investors.

My current plan indeed has 0.015% ER funds which I invest in. I also receive revenue credits, so my net investing cost is negative 0.03% ER or so. This is a bizarre cross-subsidy where I don’t pay any recordkeeping fees and I’m the recipient of a wealth transfer from my colleagues invested in higher cost funds. This is a regressive tax on investor stupidity.

From a selfish perspective, the status quo is better for me than any of the plans mentioned in the post. However, from the perspective of the proverbial “benevolent social planner”, I think the Harvard/Stanford/CMU/TSP/etc models are much more appropriate for investors in aggregate.

Great post! Now I’m trying to figure out how to use it to bully my HR into improving our 401(k) plan. We’re now at 200+ employees, but we’re still probably too small to get a better deal. We have nearly 40 different options, most of which are active managed garbage. And I like the idea of $/head. It totally makes more sense than a %/head.

Thanks again for sharing.

Happy to share. Not sure how useful it is, but it’s crazy to me that plans are uniformly garbage across the US. Even at $100-$150/person/year in fixed fees, one could easily be better off if it opened the doors to previously available index funds.

What I’m trying to convey to my university is that the fixed $/head + passive-only menu is the only way to go. Hopefully they listen. If not, I guess I’ll continue to be the beneficiary of the bizarre cross-subsidization in which I pay negative several hundred dollars/year in net investing fees. I just feel bad for the uninformed investors in high cost funds on the other side of that arrangement.

Absolutely most plans are filled with garbage options that just confuse the matter. Fidelity in particular charges surprisingly high management fees, though I don’t know how they compare to other providers for a plan the size of my company. Guess I’ll just keep having to bug HR!

Agreed entirely. If you are employed by a large employer, hopefully you could use my spreadsheet to petition change for the better. The problem, of course, is that these universities are huge so they are better able to leverage economics of scale to achieve lower pricing.