A few weeks back I indicated that it was a good time to refinance because:

- Rates are historically low, and

- For refi’s funded on/after December 1, there will be a 0.5% one-time surcharge to refinance which will make refinancing less appealing from that arbitrary date.

Here’s what I ended up doing. I think it worked out pretty well:

- I got an initial online quote from LenderFi.com

- Consistent with the Bogleheads thread, I called LenderFI and they lowered the closing costs by about $1,000. I collected a written loan estimate.

- I provided the LenderFi loan estimate to LoanDepot, who beat the closing costs by $100. I collected a written loan estimate.

- I could have repeated the above process more times, but decided against it.

- I took the LoanDepot loan estimate to Better.com, who beat the closing costs by $100. I collected a written loan estimate.

- However, the Better.com loan estimate had a $550 appraisal which was almost immediately waived (due to sufficiently low LTV of 50%). Therefore, my closing costs were now ($550+$100) less than LoanDepot.

- However, the Better.com loan estimate had a really inflated $1,320 title fee. I took 20 minutes to call some local title companies and got the fee down to about $720, saving me another $600 in closing costs. Therefore, my closing costs were now ($550 + $100 +$600) less than LoanDepot.

- Those 20 minutes yielded a pretty good return on time invested (a tax-free $1,800/hr).

- The variability of pricing from local title companies was pretty amazing, ranging from $720 – $1,350.

Here’s how the timing worked with Better.com:

- Sept 14: Rate Lock

- After rate lock, uploading of required docs to the Better.com website was really slick. Any “tasks” required by me were clearly communicated. My “team” of agents was really responsive.

- Sept 29 (Lock + 15 days): Signed paperwork at local title company.

- Oct 5 (Lock + 21 days): Loan funded and sold to The Money Source.

- I remain slightly confused at why it took a week to fund after closing. I understand that there is a 3-day rescission period after signing the paperwork, but I thought funding would occur immediately after. I was wrong.

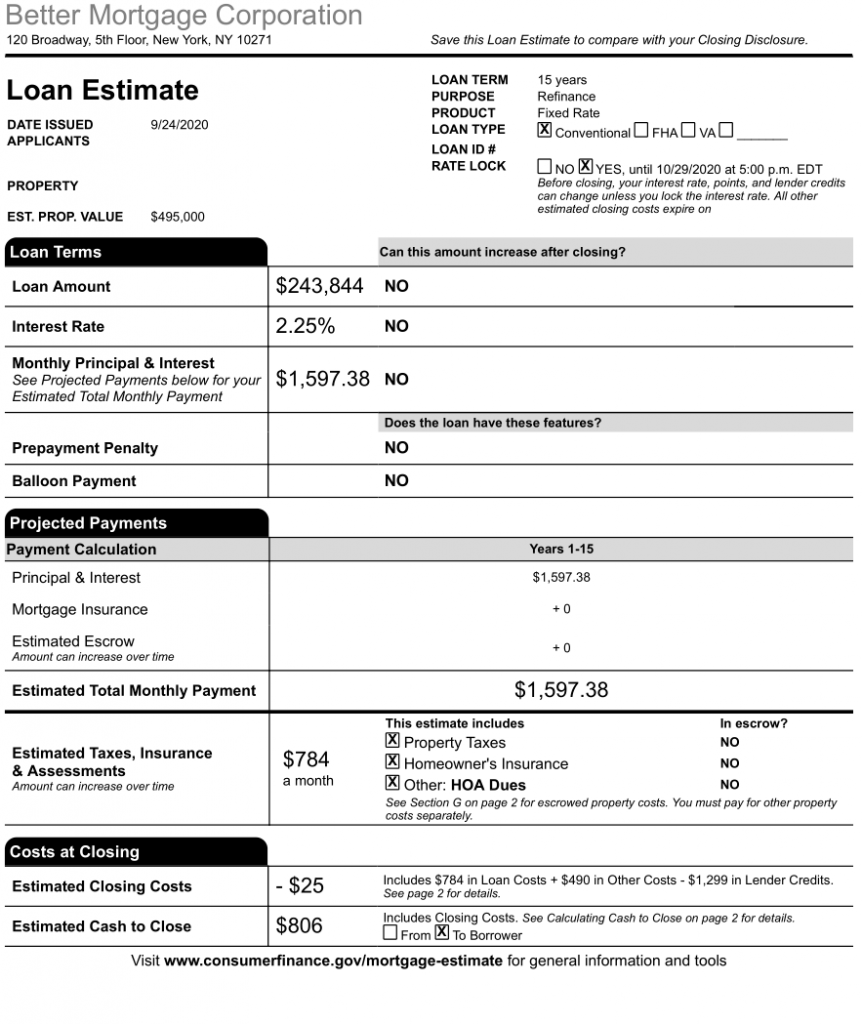

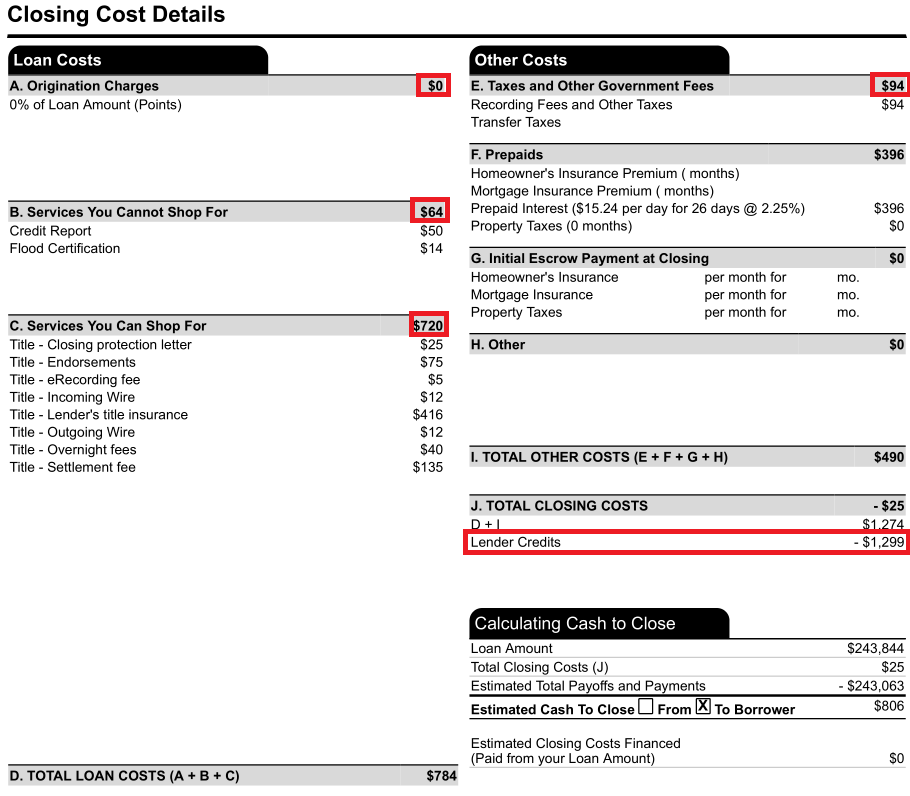

How to interpret your Loan Estimate

Below are some screenshots of my Loan Estimate. This is standardized across lenders, but several sections are economically irrelevant (the CFPB has failed consumers by creating such a confusing document). To understand your true closing costs, sum:

- Section A

- By the way, this should be $0 at reputable lenders, unless you’re paying down points to get a lower interest rate

- Section B

- Credit report, etc

- Section C

- Title closing fees

- Section E

- Gov’t transfer fees/taxes

- Section J

- Lender credits to offset the above.

The true closing costs are A + B + C + E – Lender Credits. In my case, it came out to ($0 + $64 + $720 + $94 – $1299) = NEGATIVE $421 in closing costs, meaning I walked away with money after considering the closing costs.

Ignore the rest of the numbers when comparing different loan estimates.

Closing thoughts from my first refi:

- It was a lot easier than I’d feared. I probably spent 6 hours of “work” on the process and it was pretty enjoyable; particularly because I’d never gone through the process before so I was learning a lot.

- Better.com was a fantastic company to work with. However, I’d definitely recommend leveraging competing offers with them.

- Even though my interest rate only went from 2.875% to 2.25%, I think it was worth the 6 hours of “work”. Initially, I’m saving roughly $1,524/year (or $127/mo), computed as ($243,844*(2.875%-2.25%)), though this is obviously an over-simplification of the math because it ignores the amortization.

- I love the fact that these savings are tax-free. The government doesn’t tax the $1 coupon you use at the grocery store when you pay your income taxes. Similarly, the government doesn’t tax any wealth created by saving $1 of interest. It’s pure profit.

- Going through the refi process, I’m reminded how much I hate the idea of escrow. I’m glad that my lenders have deemed it appropriate to treat me as an adult who is capable of making a $300/year HoA payment, a $700/year insurance payment, and a $9k/year property tax payment. If this transaction had included escrow, it would have slightly complicated the closing process and the loan estimate.

- More broadly, I don’t like the idea of trusting an escrow company to do it’s job properly and remit the payments on time; I love retaining control of those (very important) payments.

- I slightly regret putting $12k of air conditioning replacement costs (and $4.5k of property tax payments) on a credit card 60 days ago, causing my credit score to drop from ~840 to ~790 precisely when I applied for the refinance. I worry that this temporary drop in credit score may have cost me a better refi rate.

- I cannot wrap my head around the fact that interest rates are this low. It’s surely propping up real estate asset prices, which is great for existing homeowners like myself that get to benefit from the appreciation bubble. But it’s a bummer for those first entering the market now.

- It feels nice to finally be a homeowner and be somewhat hedged from the whims of real estate markets. I remember how painful it felt to be missing out on the real estate “gold rush” boom of 2006-2008 while a renter (and how relieved it felt to be watching from the sidelines as a renter during the subsequent crash). Since I finally own real estate, I’m pretty indifferent on which direction prices go; prices could go up 300% or down 50% and I’d be pretty indifferent.

- About a week before closing, I asked for my new loan amount to be equal to my existing loan balance. Since I’d made a mortgage payment between the time of my initial application and closing, I’d paid down another ~$1,500 of principal. Given that I’m completely naïve at how this process worked, I thought my refi would automatically update to reflect this reduction in principal. I was wrong. Apparently I requested that the balance be changed too late into the process, so I inadvertently took $1,500 of equity out of my home through this process. I could obviously use that $1,500 to pay down my new mortgage, but that wouldn’t lower the monthly payment amount as I was hoping to accomplish with a lower initial loan balance.

- With rates this low, perhaps I should have more seriously considered a 30Y mortgage. I think it’s reasonable to expect investments to out-perform ~2.5% (the going rate on a 30Y mortgage) on an after-tax basis over a 30Y horizon, so it is reasonable to conclude that any acceleration of mortgage repayment (like choosing a 15Y loan over a 30Y loan, for example) will likely decrease long-term wealth. I guess I was slightly irrational in that regard. Oh well.

Parting advice:

- Since we’re barreling down on the Dec 1 deadline, I’ve read that many lenders are already starting to bake in the 0.5% refi fee into their pricing. However, I’ve read on the Bogleheads forum that Better.com will refund that 0.5% fee if you close by Dec 1. I specifically asked Better if this would apply to my situation, but they assured me that I wasn’t charged the 0.5% fee in the first place. No matter who you go through, it would be worth 2 minutes of your time to ask your loan officer whether you might qualify for that 0.5% fee refund if you close in time.

I’m jealous of your “Taxes and Government Fees” (item E) of $94. When I refinance back in March, my locality fees were $794 (recording fee $56, local transfer tax $184.50, VA transfer tax $553.50). Bummer.

Glad things worked well with refinancing with Better.com

$794 >>> $94. My condolences. It’s the first time in my life I’ve found myself happy to live in my state from a tax standpoint.

Very impressive indeed. It has been almost 20 years since my husband and I paid off our mortgage, and even longer since we last refinanced. Our last refinance was some point in early 1990s. Financial institutions did not use email or internet then. Technology and laws have changed a lot since then.

I am struck by how much technology and improved disclosure laws have facilitated smart comparison shopping, not just for lenders but also for service providers (title processing, etc.)

And yes, indeed, refinance frictional costs certainly reduced by your state/local government mortgage transfer laws. In NYC, your mortgage recording tax would have been over 2% of your principal, almost $5K in your case. Still worth doing, but less obviously so.

https://a836-acris.nyc.gov/CP/CoverPage/CalculateTaxes

I definitely agree your time was very well spent.

Also, even though I no longer have a mortgage, I empathize with your regret for having put your AC and property tax on your credit card bill.

I also put a major HVAC (replace AC and hot water heater plus upgrade ventillation/filtration) charge on my credit card in late July, causing a brief but dramatic hit to my credit card score in August.

I did not think anything of it at the time, since I was not planning to apply for credit. However, my annual homeowners/auto/umbrella policy renews in October and August was likely when my insurance carrier was preparing my renewal. According to state law, they are not allowed to *raise* your renewal premium based on score, but they are allowed to take your score into account in calculating any discounts they may choose to give.

I can’t help thinking my annual insurance premium would likely have been lower if I had immediately paid off the card balance after incurring it.

Credit scores are indeed a bit of an oddity. 99% of the time they don’t matter (since you’re not applying for credit), but 1% of the time they do matter. It was slightly unfortunate that the AC went out precisely when I decided to refi (the timing was a function of low interest rates + this arbitrary Dec 1 fee date).

I can’t really complain in the grand scheme of things…..

Thanks for letting me know about 0.5% refinance fee, I totally missed from the news.

Any thoughts about zero cost refinancing?

There was a recent WSJ article on it, but it hasn’t been very widely reported: https://www.wsj.com/articles/adverse-market-refinance-fee-11600864469

I don’t really know what zero-cost refinancing means. Does that mean lender credits = A + B + C + E?

Generally, there is a tradeoff between closing costs and interest rates. The higher the closing costs, generally, the lower the interest rate. Without doing the math, it’s impossible to intelligently state whether a zero-cost refi is a good decision (i.e. relative to what alternative?).

Wow! I am impressed. How did you get them to give you a lender’s credit of $1200? I feel like an idiot for thinking I did great reducing my closing costs from an initial quote of $5K plus plus down to $2K. 🙁 And I did get rates from Better and Loan Depot too 🙁

Not sure if my experience was atypical, but it certainly took a couple hours of “work” to negotiate that down. The Bogleheads thread was quite helpful in benchmarking to me the types of deals others were getting.

Thanks. I wish I knew about the bogleheads thread earlier. I am wondering if I should try to refinance again. We just closed in August 🙁 at 3.125% for 15 years. If I could get it to 2.25% at $0 like you, it might be worth it. But I am not sure I can get it done before the 1 Dec dateline.

A 15Y 3.125% mortgage, unless a jumbo mortgage, strikes me as non-competitive given today’s interest rate environment.

https://fred.stlouisfed.org/series/MORTGAGE15US

I’d apply and see what happens. If you follow the exact sequence I recommend (including calling LenderFI), perhaps you’ll get lucky like I did. I’ve helped a few people follow that exact process.

Regardless whether or not you hit the Dec 1 deadline, I’d imagine you can do better.

Just out of curiosity. How has your experience been with the money source servicing? I’ve been reading a bunch of reviews on them and they’ve been awful to a point where I’m actually worried about refinancing with better.

I was at TMS for about a month before my loan was moved to Mr Cooper. Both were fine, though I think I had a slight preference for TMS. Once autopay is set up, I never deal with my servicer anyway. Both seem competent enough, though getting dumped around from servicer to servicer isn’t fun.